By: Mark Glennon*

Look, maybe it would be reasonable to argue that solving only part of our pension crisis is the best we can possibly do.

But it’s another thing entirely to start the discussion simply by defining away a large percentage of the problem. Unbelievably, that’s routine.

The latest culprit is an important reporter, Karen Pierog, who covers pensions for Reuters. Her columns are widely reprinted. Yesterday, in an article about the portion of an Illinois pension’s liability that’s funded, she said it’s “still far below the 80 percent level considered healthy.”

No, 80% is not considered healthy. That’s an often-repeated myth propagated by politicians who want to cover up the mess they made and sloppy, uncritical reporters.

The American Academy of Actuaries says just that — the 80% funding standard is a “myth.” It’s not complicated. You don’t need to be an actuary to understand this. Pensions either have what they need or they don’t. That’s why 100% funding is the measurement for a healthy pension, the Academy says (though actuaries and accountants in practice don’t follow that).

Ninety percent isn’t enough, either. You either have enough gas to make it home or you don’t. And that’s where actuaries and accountants, in practice, play tricks, among other places. Virtually all calculations of the “ARC” target only a 90% funding level. It’s now common to compare what a government is paying into its pensions to the ARC — the Actuarially Required Contribution. For example, you now sometimes see it reported that Chicago has been funding only about 1/4 of the required ARC. But that, too, actually understates the shortfall because even paying 100% of the ARC wouldn’t clean up the problem.

Politicians, reporters, accountants and actuaries are simply defining away part of the problem.

They commit this sin almost universally. Even the Better Government Association made this error. It’s one reason why former Illinois Governor Jim Edgar is in the “Hall of Shame” kept by Mary Pat Campbell, an honest actuary who writes about pensions. All financial reporting for state and local pensions in Illinois, when they include an ARC, use a 90% target.

Why does this matter, since Illinois’ pensions are only about 40% funded — half of even the mythical target?

Because this trick is just one of many used, together, to grossly understate the scope of our pension crisis. An honest actuary who I talk to often, Mitch Serota, has an ongoing debate with me. I say pensions are like peeling a rotten onion — each layer reeks with its distinct stench. He says, no, it’s Whac-a-Mole. Whatever. You get the point. Whether it’s outdated mortality tables, silly investment return expectations, ignored healthcare liabilities, the target funding level or any of many other assumptions that go into pension accounting, the numbers get manipulated.

Solving our pension crisis requires, first, an honest, agreed measurement of how big a problem we face. Uncritical reporting of perverted numbers isn’t getting us there.

*Mark Glennon is founder of Wirepoints. Opinions expressed are his own.

If you’re frustrated with Illinois’ educational results, you may want to follow the money from teachers unions. In the last four years alone, Illinois lawmakers and political candidates have taken nearly $30 million in contributions from teachers unions and their national affiliates.

If you’re frustrated with Illinois’ educational results, you may want to follow the money from teachers unions. In the last four years alone, Illinois lawmakers and political candidates have taken nearly $30 million in contributions from teachers unions and their national affiliates.

Wirepoints President Ted Dabrowski testified on April 10, 2024 to members of the House Revenue and Finance Committee at the invitation of Rep. Joe Sosnowski. Ted told lawmakers that the state’s property tax burden has become dire for countless Illinoisans.

Wirepoints President Ted Dabrowski testified on April 10, 2024 to members of the House Revenue and Finance Committee at the invitation of Rep. Joe Sosnowski. Ted told lawmakers that the state’s property tax burden has become dire for countless Illinoisans. Ted joined WLS 890’s PM Chicago Show to discuss Chicago’s worsening pension crisis, why the city’s crisis makes it such an outlier nationally, its negative impact on residents, government workers and retirees alike, and what Mayor Brandon Johnson should do about it.

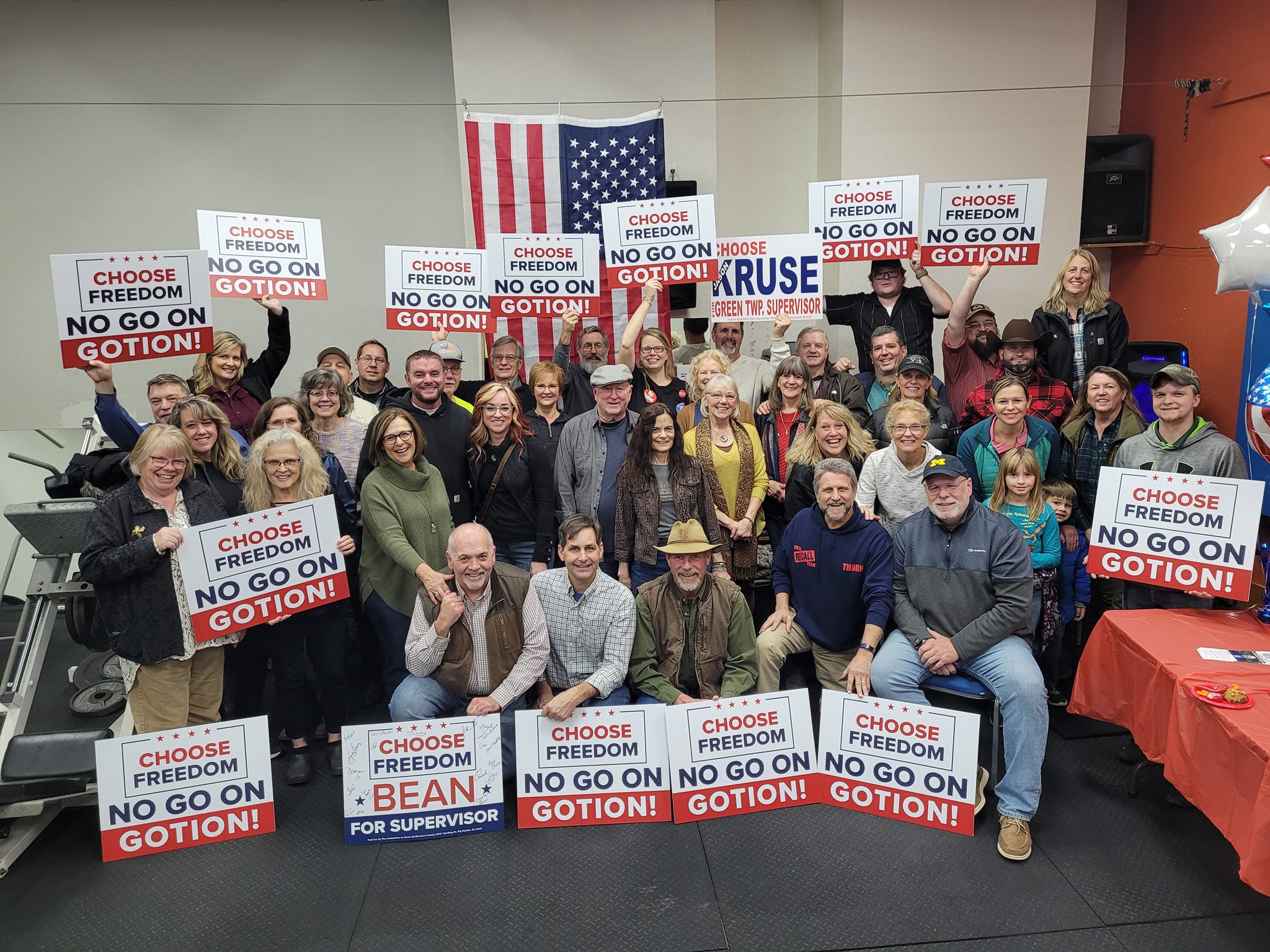

Ted joined WLS 890’s PM Chicago Show to discuss Chicago’s worsening pension crisis, why the city’s crisis makes it such an outlier nationally, its negative impact on residents, government workers and retirees alike, and what Mayor Brandon Johnson should do about it. When has any company persisted with a project in the face of stronger local, statewide and national opposition? When have taxpayers subsidized a more harebrained project?

When has any company persisted with a project in the face of stronger local, statewide and national opposition? When have taxpayers subsidized a more harebrained project?

http://www.nasra.org/files/Topical%20Reports/Funding%20Policies/80_percent_funding_threshold.pdf

https://www.actuary.org/files/80_Percent_Funding_IB_071912.pdf

This also clarifies that your interpretation is in error……….

You’re worried about an 80% funding level not being enough? Isn’t the actual money set aside for Social Security at 0%?

Checking my notes here:

https://docs.google.com/spreadsheets/d/1Id7VUMJwR5vSNONZc-5AT2wkliojghrMlAXXrxFu6Ik/edit#gid=0

Karen Pierog has made this mistake twice before:

April: http://www.reuters.com/article/2015/04/08/us-usa-chicago-finances-factbox-idUSKBN0MZ2BS20150408

May: http://www.reuters.com/article/2015/05/10/us-usa-illinois-pension-constitution-ana-idUSKBN0NV0QN20150510

Looking at my notes, she is one of the people who appear multiple times as I have no good way of contacting her… which is the same problem I had with her Reuters colleague Hilary Russ. I try to comment on stories directly, but I can’t do that with Reuters. Oh well.

I expect this third time ain’t a charm, and she’s just going to keep using the bogus 80%.

I heard a great comment a few years ago about Chicago’s pensions. ” Deals were cut with the unions, but the money moved to the suburbs”. If it was not for the residency requirement for city workers, the bottom would have fell out a long time ago. This has forced the city, over the last 30 years, to short pensions, excessively borrow, mislead investors, and sell assets, in order to maintain a semi-functioning government. Now that “new” money is slowing trickling back into the city, I don’t think that they want to be on the hook for past services performed.

There has been a concerted effort for decades to make public sector retirement benefits seem less expensive than they truly are. And besides all the tricks Mark mentioned, their fallback has been to underfund the pensions. Imagine the conversations that would have occurred decades ago if we funded the pensions up to 100%. Imagine the corresponding tax hikes that would have been required. Wouldn’t that have sparked serious discussions on the level of benefits being offered? Don’t you think things would be different today? Here’s an inconvenient truth most public sector folks never mention. If we funded pensions properly over… Read more »

The cost of their wages can be found via the city website at http://www.cityofchicago.org/city/en/depts/dhr/dataset/current_employeenamessalariesandpositiontitles.html. You can download it as an excel file from the link. Looking at the wages brings up serious questions, not only about the fact we have 32, 181 employees but a payroll of 2.54 billion dollars as well. Is a city ASE certified mechanic at 92K per year twice as good as an ASE certified mechanic in the metro area whose average salary is 47K per year? My downstairs neighbor is a good example. He’s a supervisor in Streets and San who makes about $44 per… Read more »

Excellent observations, nixit. I have been saying the same things from my perch for years. There simply are no adults left in the room.

Reboot Illinois, made the 80% shame list http://stump.marypat.org/article/230/80-percent-funding-hall-of-awesome-experts-say

Anonymous, that’s a good point about actuaries. I know what they are, but have no idea how they come up with the numbers they do or how accurate they are. I’ve wondered about the math used to draw their conclusions, but they don’t make the data sets available for dissection/peer review. A little too liberal assumption on rates of return on investments can mask problems and make funds appear healthier than they are.

Mark– two other things you overlook. How many taxpayers– and politicians for that matter– understand any of this– what an actuary does, how big these numbers are, where the assumptions on returns. life expectancy, etc come from? Almost nobody who comments publicly on this has a clue what they are talking about. Privately, it is a different story. And the second point– actuaries are paid by the pension funds- the directors and trustees of which are appointed or hired by the politicians. They arent going to speak publicly. In private they joke about how dumb or deceptive their clients are.… Read more »

Same with rating agencies. Paid by the issuers.

Mark, the only flaw in your piece is that you neglect to implicate Ms. Pierog’s editor, Matthew Lewis, who shares responsibility for failing to correct the obvious 80% blunder in the Reuters article.