By: John Klingner

The Illinois Commission on Government Forecasting and Accountability (COGFA) has released its latest report on the state of Illinois’ pensions. The numbers confirm what taxpayers already know and what Illinois politicians continue to ignore: Illinois needs massive pension reforms.

COGFA says that the state’s pension debt remained virtually unchanged from last year despite massive stock market gains and billions more in taxpayer contributions.

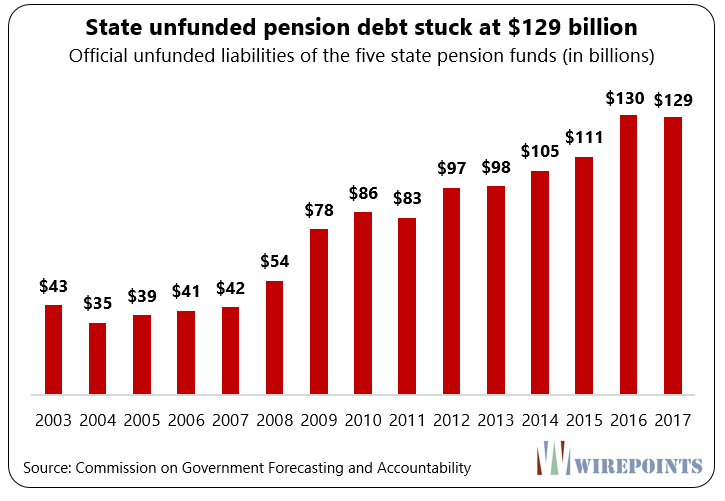

The total shortfall for the Illinois’ five state-run pension funds – for teachers, state workers, university employees, judges and lawmakers – totaled $129.1 billion in 2017, a touch under last year’s $129.8 billion.

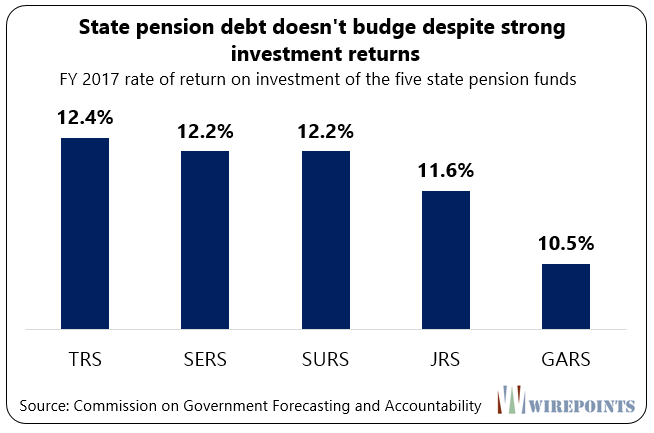

The state’s shortfall failed to improve despite sizable investment returns earned by the pension funds. The teachers’ fund earned 12.4 percent on its investments compared to a 7 percent expectation. Both the state employee and university employee funds also earned above 12 percent returns.

Taxpayers also poured more contributions into the pension funds than ever before.

Illinoisans contributed $7.9 billion dollars to the pension funds in 2017, six times what they contributed just 10 years ago.

It just shows how bad a state pensions are in. Billions in taxpayers contributions and high investment returns can’t even make a dent in Illinois’ accumulated pension debt.

Insolvent

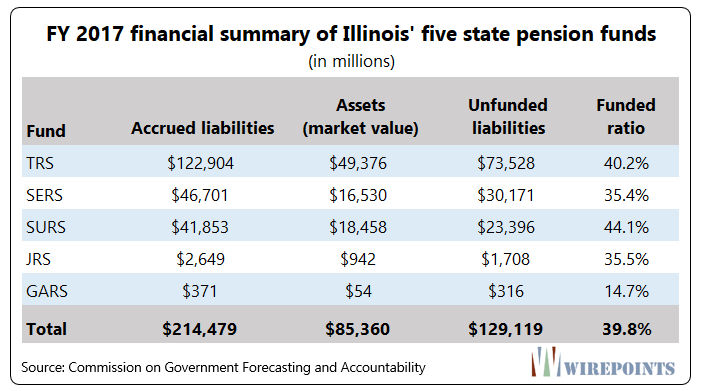

Collectively, the five pension systems have just 39.8 percent of the funds they need today to be able to meet their obligations in the future, up from 37.6 percent they year before. The university employee fund, SURS, is the best funded with just 44.1 percent of its liabilities covered.

Most notable is the funding ratio for the state legislator pension fund. It is just 15 percent funded. Any way you measure it, it’s broke. Only a yearly bailout by taxpayers is keeping it afloat.

Uncontrolled benefits

Lawmakers typically blame the current pension crisis on a lack of taxpayer dollars. But the pension funds are crisis today due to over 30 years of uncontrolled benefit growth, not a lack of funds.

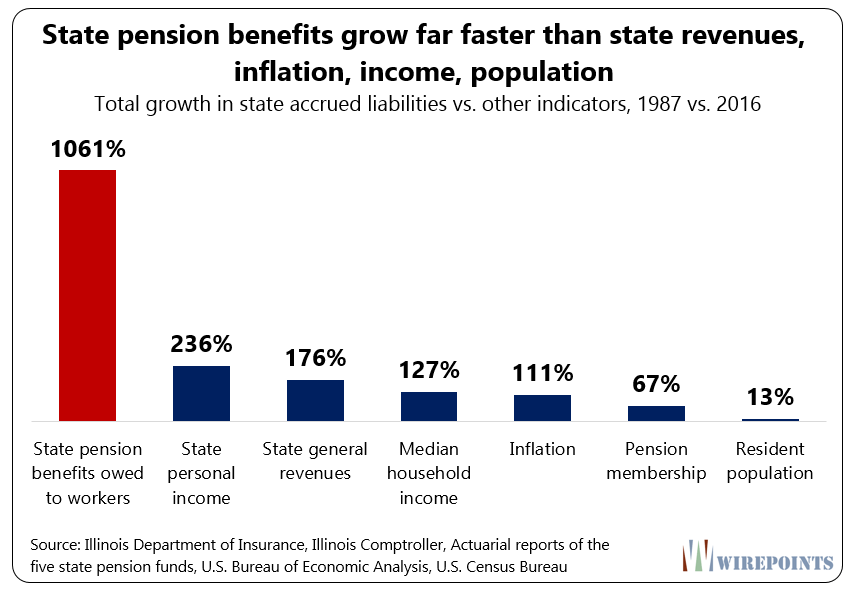

What COGFA’s report fails to mention – and what the media has failed to report on – is that total pension benefits owed to state workers grew 1,061 percent between 1987 and 2016, swamping the state’s economy and taxpayers ability to pay for them.

Benefits have grown eight times more than household incomes (127 percent) and nearly ten times more than inflation (111 percent) over the period.

That growth in benefits has made it impossible for the state to escape the pension crisis.

Stellar investment returns and growing taxpayer contributions aren’t enough to fix things so long as politicians refuse to do anything about the growth in pension benefits.

A period of collapse

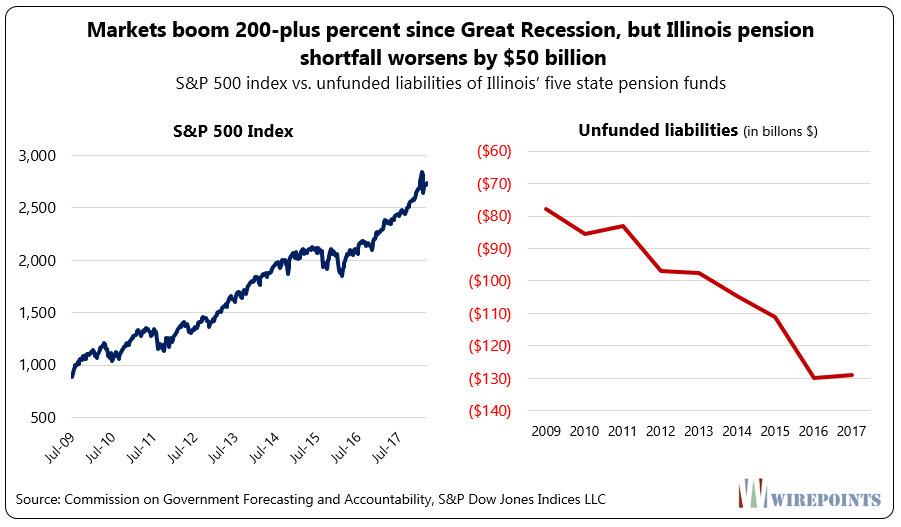

Illinois’ pension funds have collapsed – putting both state workers and taxpayers at risk – during one of the longest bull markets in history.

Since the end of the Great Recession, the S&P 500 index has recovered and grown by more than 200 percent to reach record highs.

At the same time, Illinois’ pension shortfall worsened by 65 percent, to reach $129.1 billion. In 2009, it was $78 billion.

Some of the growth in debt was due to the pension funds changing their actuarial assumptions, including a drop in assumed rates of return in 2016. Regardless, the systems’ overall downward trend is clear.

And the warning this trend provides is even more stark: if the state’s pension debts continue to worsen during a period of remarkable market returns, imagine how those funds will collapse when the next recession inevitably hits.

Not only will state workers’ retirement security be put at greater risk, but taxpayers will be forced to pour billions of extra dollars into the pension funds when they can least afford it. And those most dependent on government services will only experience further pain.

Illinois needs comprehensive reforms more than ever

What’s important to note is that the reported $129 billion in debt is the rosy scenario for Illinois.

The state’s actuaries are still calculating the pension shortfalls assuming investment return rates of around 7 percent on average.

When more realistic rates are used – those that can be guaranteed – the shortfall increases to more than $250 billion for the five state funds.

Add to that all pension shortfalls in municipalities, plus the state’s $57 billion in unfunded health care obligations, and taxpayers’ burden becomes unbearable.

That means Illinois’ pension crisis is only going to get worse. And that’s bad news for everyone.

The only way lawmakers can fix things is by passing a set of comprehensive reforms:

Pass a constitutional amendment to help slow the growth in owed pension benefits. In addition, they should give local governments the option to declare bankruptcy and work with federal officials to negotiate a federal bankruptcy law for states.

Enroll all new state workers should be in a 401(k)-style plan based on the State Universities Retirement System’s existing 401(k) plan. The SURS plan has been operating for nearly 20 years and is the preferred choice of over 20,000 university members.

Require teachers to pay their fair share toward their own pensions. Many school districts pay each teacher’s required pension contribution, called a “pick-up,” as a fringe benefit, costing school districts $380 million per year. As a result, teachers in over half of Illinois school districts pay nothing toward their own pensions.

Stop giving unions the right to strike or go to arbitration whenever they don’t get their way. Illinois is the only state among its neighbors to enshrine a union’s ability to strike. Forced arbitration for public safety unions is also too one-sided. Both give unions too much power over the very people that pay for their services.

Consolidate school district administrations, starting with combining all elementary and high school districts into unit districts. That alone will cut the administrations of over 300 school districts.

The state’s massive pension debts aren’t shrinking even though the market is booming and taxpayers are pouring more funds in than ever before.

Illinois cannot grow its way out of its pension crisis. It needs comprehensive reforms. And it needs its lawmakers to actually talk about them.

Ted joined Tom Miller of WJPF to talk about Illinois’ highest-in-the-nation property taxes, why lawmakers don’t want to touch the tax’s cost drivers, just how much Illinoisans’ tax burden has grown over the decades, why Gov. Pritzker failed to meet his promise to reform property taxes, and more.

Ted joined Tom Miller of WJPF to talk about Illinois’ highest-in-the-nation property taxes, why lawmakers don’t want to touch the tax’s cost drivers, just how much Illinoisans’ tax burden has grown over the decades, why Gov. Pritzker failed to meet his promise to reform property taxes, and more.

Ted joined Dan and Amy to talk about the free speech controversy brewing in Wilmette due to the city’s refusal to fly a religious freedom flag, the city’s left-wing excesses and the growing culture war, the latest money spent on the illegal immigrant crisis, and more.

Ted joined Dan and Amy to talk about the free speech controversy brewing in Wilmette due to the city’s refusal to fly a religious freedom flag, the city’s left-wing excesses and the growing culture war, the latest money spent on the illegal immigrant crisis, and more.

I have an idea: Let’s also stop giving them ridiculous pay increases. How does an elementary teacher’s salary (k-4) go from $84,000 to $115,000 in the last 6 years ($12,000 raise from 2015 to 2016), given the backdrop of this crisis? Who allows this? This particular employee is approaching retirement. Seems clear to me that there is collusion to set the bar as high as possible for pension benefits.

Because the teacher contract (most likely) states that retiring teachers are entitled to 6% pay increases every year for 4-6 years after notice is given and local school districts are still under the false impression that offering early retirement incentives such as this has value.

Does anyone have the total dollar amount of retired pension recipients vs the total numbers of recipients and compare that to dollars coming in. What is the average pension check? Seems to me many only have $100-140K in pension contributions and will start collecting 50-75% of that amount growing at 3% compounding for life. If I had 100K in the bank I could only get 1% maybe or $1,000 /yr without any risk. Just trying to learn more. I hope the many astute commenters here have an answer. Thanks

According to an article published several years ago by IL Policy Institute, the average pensioner only pays in 4% of their expected lifetime pension benefits. It did not break it down to city, county or state levels.

Freddy, that’s an important question but tricky. You can’t do it as simply as you suggest because those “averages” that you would get would include part-timers and those who worked less than a full career for their pension, meaning they have a separate pension or retirement benefit for their other years. One thing you can easily get is average starting pension for a full-career person retiring now. That’s in actuarial reports. The most recent TRS report says the average initial pension for somebody now retiring with full career (35-40 years of service) at TRS is now up to $79k, big… Read more »

Thank You Mark and Bob. Would total income earned divided by years of service be a better way to calculate pensions rather than the highest 3 or 4 earning years. Or does that fall under the Diminish or Impair Clause? P.S. when the 3% compounding was enacted the prime rate was 7% so you could get 6% in a money market account but the 3% was never indexed to CPI or any inflation metric.

The pension calculation in your example would be considered a diminishment and impairment, just as adding 1 year to the minimum retirement age or 1% to the employee pension contribution would be considered diminishments and impairments.

Most among the general public who comment here seem to hate the 3% automatic annual increase (AAI) which the IL public pension systems use each year rather than the year-by-year ever-changing COLA they seem to want to have the pension systems use. Well, yes, for this year and the last several years that 3% AAI has exceeded the COLA figures published for those years. But, Freddy hinted at why that choice of making annual pension payment increases happened. Basically, as I understand it, when inflation was raging even well above 12% for many months some 40-45 years ago the public… Read more »

40-45 years ago, AAI was calculated using 2% simple interest. In fact, the original AAI deal was 0.5% employee contribution for 1.5% simple interest. The problem was the Legislature gave away AAI increases but couldn’t take them back due to the state constitution. The Legislature should’ve countered with an increase to the employee contribution rate each time it was increased. For 3% compounded COLA today, the employee AAI contribution should be 2%, not 0.5%. The payback period would be less than a dozen years. Still a pretty good deal. And when inflation does return at some point and maybe even… Read more »

The worst enemy of the taxpayers are the corrupt bond rating agencies. As long as there are buyers for this debt the problem will continue. For these agencies to continue to deny a problem exists and reward the Illinois bond market with acceptable ratings is the real fiduciary crime. They are like heroine dealers, the state is hooked, and Moody’s sits back and enables the whole thing for a market profiting from misery.

As was pointed out in The Big Short. Sellers shop rating agencies until they find one that gives them a good rating.

Great article JK ! I looked at the Report and it took 5 mins to see the disaster-in-action: To keep the Unfunded of $130B at 6/30/17 from getting worse up to 6/30/18, this would have to happen: Cash contribs would have to be at least Normal Cost $3.6B, plus 7.0% interest on $130B unfunded, equals 3.6B + 9.1B = 12.7B, AND net investment return on the $85B assets will have to be at least 7.0% net of all expenses paid from assets. But it appears cash contribs will be $8B. Thus the plans are almost certainly doomed. To put the… Read more »

Thanks Steve for sharing, the sooner the better, but the corrupt democrats will go down the scorched earth path, pressuring judges and politicians to bail out the pensions. What bankruptcy judge will actually let the pensions get on pennies on the dollar when the funds go broke? It’s better for them to see it go broke and scream cry and complain than get a 40% cut now.