By: Mark Glennon*

A research report recently published by JP Morgan looks at pension obligations for Illinois and other states from several particularly useful and interesting perspectives. It’s the best attempt we’ve seen to quantify how much of state budgets would be required to fix their pensions. Highlights are below, but if you really want to roll up your sleeves on public pensions, read all 26 pages, linked here.

The primary author is Michael Cembalest, who is known for seeing through the Madoff fraud and refusing to do business with Madoff while his firm did. He now chairs JP Morgan’s Market & Investment Strategy group. And he’s apparently no pension-chopping enemy of the public sector, highlighting in the report his view that pensioners earned their pensions and have every right to expect them to be paid.

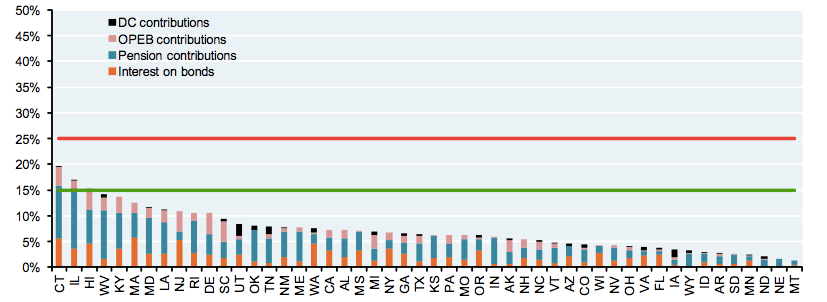

First, the report adds up each state’s pension contributions and expenses, healthcare costs for state retirees (OPEBs), and interest on its bonds. It looks at those totals as a percentage of tax revenue brought in by the state. The point is to get a sense, on a cash basis, of total yearly cost of pensions, related healthcare, and debt, and the extent to which other services are being crowded out by those costs.

Based on what Illinois is currently paying into its pensions, it’s bad — Illinois is second worst in the country — paying about 16% of its revenue on those expenses. Here is how Illinois compares to other states:

Note that it’s pension contributions, not interest on bonds, where the bulk of the problem is for Illinois.

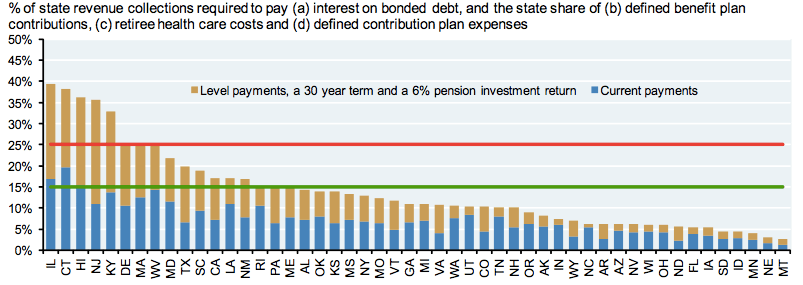

It gets much more interesting, however, as the report goes through a series of adjustments to look at what states should be paying on their pensions if they are to be fixed. The report corrects for unreasonable and inconsistent assumptions, and compares states on an apples-to-apples basis. Those adjustments include eliminating how some states back-load their ARC (which is the schedule of future payments required to fix a pension) and using consistent return assumptions (the report uses six percent, which is not terribly low or unreasonable).

Make those adjustments and the ratio for Illinois zooms from 16% to almost 40%. That is, to fix the state pensions, a full forty percent of Illinois taxes would go towards those fixed payments using reasonable, consistently applied assumptions. Making those same adjustments to other states, here’s how Illinois compares:

Note how big the difference is for Illinois between what it’s currently paying, shown in blue, and the additional amount it should properly be paying to fix the pensions, shown in brown.

The report is full of other important observations and calculations. For example:

– Most states have a manageable problem — an adjusted ratio of 15% or less, according to the report.

– Reducing COLA increases by one percent, capping OPEB benefits at the 80th percentile, and increasing employee contributions by two percent (say, from 5% to 7%) do not have a very big impact, even if done together, which is contrary to the prevailing claims of most would-be pension reformers in Springfield.

– Rules and assumptions imposed on corporate pensions in the private sector are much stricter than the adjusted assumptions used in the report.

– Even using Illinois’ own published assumptions, it is only paying about 76% of what it should be paying each year to hit its ARC.

The report covers only state pensions, of which there are six in Illinois. As for the other 650-plus Illinois city and local pensions, nobody has done an analysis like this, though most are in horrible shape. Doing this kind of analysis for them would require “exponentially more time and analysis,” the report says. In other words, nobody really has a full handle on the extent of the local pension crisis.

*Mark Glennon is founder of WirePoints

A set of state lawmakers want to extend CPS’ current school closing moratorium to February 1, 2027 – the same year CPS is set to transition to a fully-elected school board. That means schools like Manley High School, with capacity for more than 1,000 students but enrollment of just 78, can’t be closed for anther three years. The school spends $45,000 per student, but just 2.4% of students read at grade level.

A set of state lawmakers want to extend CPS’ current school closing moratorium to February 1, 2027 – the same year CPS is set to transition to a fully-elected school board. That means schools like Manley High School, with capacity for more than 1,000 students but enrollment of just 78, can’t be closed for anther three years. The school spends $45,000 per student, but just 2.4% of students read at grade level.

Hopefully, all media will get the message, in Illinois, too.

Hopefully, all media will get the message, in Illinois, too. Ted joined Tom Miller of WJPF to talk about Illinois’ highest-in-the-nation property taxes, why lawmakers don’t want to touch the tax’s cost drivers, just how much Illinoisans’ tax burden has grown over the decades, why Gov. Pritzker failed to meet his promise to reform property taxes, and more.

Ted joined Tom Miller of WJPF to talk about Illinois’ highest-in-the-nation property taxes, why lawmakers don’t want to touch the tax’s cost drivers, just how much Illinoisans’ tax burden has grown over the decades, why Gov. Pritzker failed to meet his promise to reform property taxes, and more.

If a similar analysis were done for Social Security and Medicare at the Federal level, I wonder what the results would show? Even on a pay-as-you-go basis, benefits paid out by these two programs are projected to consume well over 40% of Federal revenues in 15-20 years. If you were to fully fund them over the next 30 years, like you are assuming state pensions need to be, that would probably require close to 100% of Federal revenues.

That really is a good research piece to read and understand. Politicians and reporters should be required to read it, and they should justify any numbers they claim that are more optimistic than what’s in it.