By: Mark Glennon*

A different and more heartbreaking way to look at the Illinois pension fiasco is contained in a report just issued by the National Council on Teacher Quality, Doing the Math on Teacher Pensions. They calculated unfunded teacher pension liabilities on a per pupil basis for each state. That’s appropriate because today’s students will be paying much of the bill, and it’s direct spending on their educations that is reduced by pension costs.

Illinois, no surprise, is worst in the nation, with $27,000 per pupil (page 78). For our neighbors, Wisconsin is $30; Indiana, $11,000; Iowa, $7,000; and Michigan, $15,000. The report is based on state-reported numbers, so real ones are probably worse (and are unquestionably much worse for Illinois). The teachers’ pension represents about 60% of Illinois’ unfunded state level pension liability.

That sadness should turn to anger when you consider how public unions in Illinois propose to address teacher pension debt, as well as all other state pension debt (aside from raising taxes). The only proposal they’ve embraced is from the labor-funded Center for Tax and Budget Accountability. You’ve probably heard countless times from the CTBA and other pension reform opponents that the cause of the problem is underfunding by the state. That’s their mantra, and it should be self-evident — if the pensions had been fully funding we wouldn’t have a problem.

Well, guess what their solution is? Less annual funding from the state, but string it out for a longer period — all the way until 2060! They call it “re-amortization.”

“Re-amortization” in fact is nothing more than deeper underfunding — kicking the can down the road harder than ever. CTBA’s Executive Director, Ralph Martire, has been peddling “re-amortiztion” for several years. You’ve probably seen him on television with reporters who act intrigued when he says “re-amortization” solves the problem, but never ask what it means.

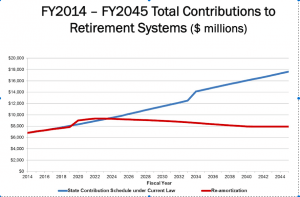

Here’s the CTBA’s own chart that they used in legislative testimony, comparing annual Illinois pension funding under current law to the lower, strung-out contributions they propose in red. They cut it off at 2045, though their extended contributions would last until 2060:

Come to think of it, maybe the CTBA has a point. Their plan would lower per-pupil pension liabilities. Never mind that the pupils’ kids would be passed part of the bill and that spending for their educations, too, will be reduced to pay pensions. Public unions love it.

*Mark Glennon is founder of WirePoints

Hopefully, all media will get the message, in Illinois, too.

Hopefully, all media will get the message, in Illinois, too. Ted joined Tom Miller of WJPF to talk about Illinois’ highest-in-the-nation property taxes, why lawmakers don’t want to touch the tax’s cost drivers, just how much Illinoisans’ tax burden has grown over the decades, why Gov. Pritzker failed to meet his promise to reform property taxes, and more.

Ted joined Tom Miller of WJPF to talk about Illinois’ highest-in-the-nation property taxes, why lawmakers don’t want to touch the tax’s cost drivers, just how much Illinoisans’ tax burden has grown over the decades, why Gov. Pritzker failed to meet his promise to reform property taxes, and more.

Ted joined Dan and Amy to talk about the free speech controversy brewing in Wilmette due to the city’s refusal to fly a religious freedom flag, the city’s left-wing excesses and the growing culture war, the latest money spent on the illegal immigrant crisis, and more.

Ted joined Dan and Amy to talk about the free speech controversy brewing in Wilmette due to the city’s refusal to fly a religious freedom flag, the city’s left-wing excesses and the growing culture war, the latest money spent on the illegal immigrant crisis, and more.

The Center for Tax and Budget Accountability (CTBA) proposal to re-amortize pension debt: 1) only includes 5 of the 18 pension funds in the Illinois Pension Code (the 5 pension funds to which the state makes an annual contribution) 2) After 30 years, in 2045, those 5 “state” pensions would be 72% funded. Pensions are designed to be 100% funded and yet at the end of 30 years 5 of the 18 pensions would be 72% funded with the Ralph Martire plan. The five “state” pension funds: – General Assembly Retirement System (GARS) – Judges’ Retirement System (JRS) – State… Read more »

The teachers who are near retirement better go for it now. The money is just not there for future retirees. Any amount of jiggling the numbers comes up “The Moneys Not There”.