By: Ted Dabrowski

Wall Street’s best predictor of a recession has reared its ugly head and Illinois is nowhere near ready for a slowdown. In fact, Illinois is the nation’s least-prepared state for an economic downturn. When that recession finally comes, Illinoisans should expect to get hit hard.

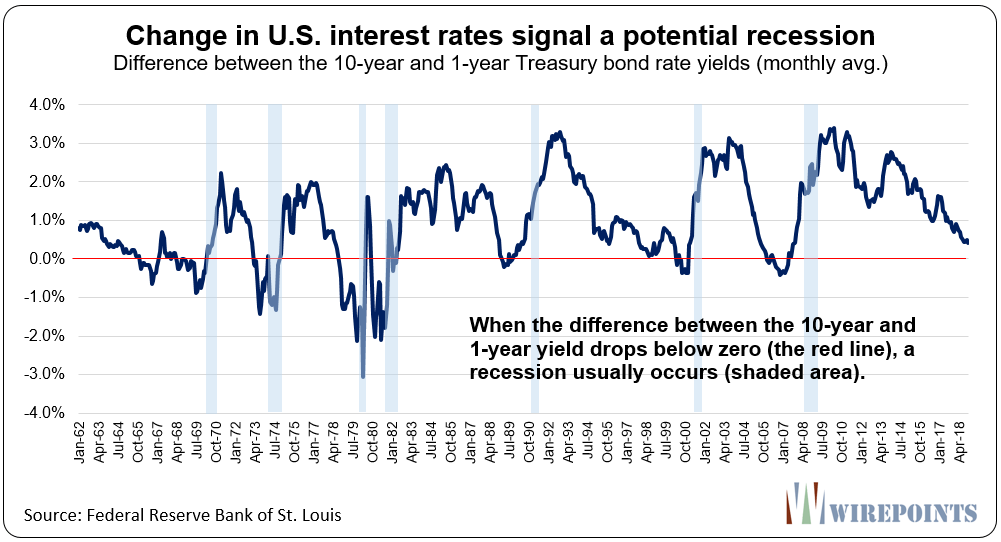

The predictor of that next recession is the U.S. interest rate curve. It’s somewhat technical, but all you need to know is that when long-term interest rates fall to levels below short-term interest rates – called a yield-curve inversion – a recession typically follows within 21 months. And those interest rates have started to invert.*

The last time U.S. interest rates predicted a downturn? It was 2007, right before the Great Recession.

Of course, there’s no guarantee of when the next recession will come. It may take time since many parts of the national economy are still humming. We also don’t know how deep the next recession will be. Most recessions are short, but it’s the long ones that do real damage.

Nevertheless, the market signal should serve as a stark warning to Illinoisans. An economic downturn is inevitable and their politicians are doing nothing to prepare the state for it.

Unprepared

Most well-run states are prepared for when the national economy tanks. They have rainy-day funds and slack in their budgets,which allows them to prioritize what must be spent and what can be delayed.

Illinois has none of that. Quite the contrary.

Moody’s, for example, rates Illinois’ finances and governance the worst in the nation, just one notch above junk. The U.S. News and World Report places Illinois dead last in fiscal stability nationwide and next to last when looking just at short-term indicators. Only New Jersey was worse. And the Mercatus Center also finds Illinois worst in terms of fiscal stability nationwide.

The next recession will hit Illinoisans particularly hard

Many Illinoisans have yet to recover from the Great Recession. Statistics from manufacturing to black unemployment to underwater homes show Illinois has continued to underperform since 2009. And Illinois is shrinking after losing population four years in a row, a distinction shared nationally only with West Virginia.

But what makes the situation even more worrisome today is the state’s finances. They’ve deteriorated significantly since the Great Recession. Already, the state has a stack of $7 billion in bills it can’t pay, billions in future budget deficits and debt it can’t handle. With a $250 billion state pension shortfall and $73 billion in retiree health insurance debts, Illinois has the worst retirement crisis in the nation.

For Illinoisans, that mess means they’ll pay for the next recession more dearly. It’s hard to predict how it will all playout, but Illinoisans should brace themselves for an oversized hit to their wages, job prospects and home values.

Depressing

Yes, the above message is depressing. Politicians have made a mess of Illinois. The hurt felt by many ordinary Illinoisans is the doing of their politicians.

But until Illinoisans are ready – and willing– to mount a populist reform movement that brings about the structural reforms Illinois needs, it behooves individuals to look out for themselves. After all, their politicians certainly aren’t.

********************

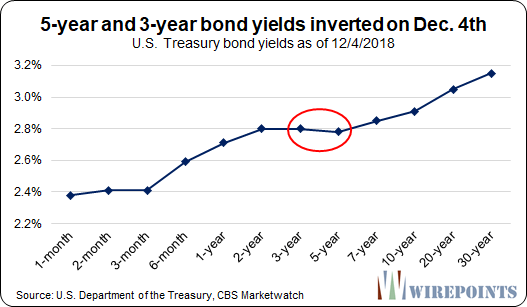

* A full inversion of the curve is when 10-year rates fall below 2-year rates. So far, that has yet to happen this cycle.

The curve did invert partially, however, on December 4, 2018. That’s when 5-year rates fell below 3-year rates.

A set of state lawmakers want to extend CPS’ current school closing moratorium to February 1, 2027 – the same year CPS is set to transition to a fully-elected school board. That means schools like Manley High School, with capacity for more than 1,000 students but enrollment of just 78, can’t be closed for anther three years. The school spends $45,000 per student, but just 2.4% of students read at grade level.

A set of state lawmakers want to extend CPS’ current school closing moratorium to February 1, 2027 – the same year CPS is set to transition to a fully-elected school board. That means schools like Manley High School, with capacity for more than 1,000 students but enrollment of just 78, can’t be closed for anther three years. The school spends $45,000 per student, but just 2.4% of students read at grade level.

Hopefully, all media will get the message, in Illinois, too.

Hopefully, all media will get the message, in Illinois, too. Ted joined Tom Miller of WJPF to talk about Illinois’ highest-in-the-nation property taxes, why lawmakers don’t want to touch the tax’s cost drivers, just how much Illinoisans’ tax burden has grown over the decades, why Gov. Pritzker failed to meet his promise to reform property taxes, and more.

Ted joined Tom Miller of WJPF to talk about Illinois’ highest-in-the-nation property taxes, why lawmakers don’t want to touch the tax’s cost drivers, just how much Illinoisans’ tax burden has grown over the decades, why Gov. Pritzker failed to meet his promise to reform property taxes, and more.

I have an opinion shared by many and rejected by many. As rauner announced yesterday, he tried to buy off others to run for gov, not of course Jeanne Ives because rauner is a dem who ran as a repub. So, am I brokenhearted that pritz the criminal tax-evader won? No. The only event that can save illinois is total and complete collapse. pritz will bring this collapse much faster than the life-support we have been on for years. So this is good news. As they raise taxes-state income, state real estate, gasoline, text tax, this will also help. It… Read more »

I can’t believe the stories about how the pillars of the stock market appear to be made of cardboard. IBM bought Red Hat out of desperation, FANG stocks are in trouble, and Verizon just took a $5 billion writedown on its acquisition of Yahoo and AOL. AT and T has $400B assets and $300B debts. Maybe I’ll buy some AT and T because it has a dividend yield of 6.5%.

https://www.businessinsider.com/verizon-will-write-down-46-billion-in-value-of-oath-2018-12

Until Illinois is rid of despicable career politicians like Michael Madigan, NOTHING is going to change and things will get much, much worse. The same pocket-lining, self-serving people that got the state into the unfixable mess it is in are STILL in office decades later. What do voters expect when you continue to vote for the same old song and dance election after election after election? I know I am already planning on moving out of this state that is the armpit of the country.

Obama bussed in the last group of illegals straight to Chicago to get more of those democratic votes. We people who live in the surrounding counties have seen an influx of Chicago poor coming out and moving into the section 8 housing. They also have that Democratic entitlement mentality that thinks these politicians are bringing in the free stuff they got back in chicago. So we are being hit by Democrat votes in Chicago and now out in our surrounding areas. This creates more Mike Madigan political cronies just squeezing the life out of the middle class that is shrinking… Read more »