College students should think twice before the next Trump rally protest – American Thinker

March 14, 2016

No Comments

53% of the tuition paid at the University of Illinois, Circle Campus, where the protest occurred, goes to college public pensions. Tuition at that campus protest site has rise 74% in the last ten years, and almost all of that extra tuition cost went straight to pay public university administrators’ and professors’ pensions. For twenty years, many will have to work and pay student loan payments. Comment: “Think twice”? They should think once.

Government debt is the new subprime – Opinion – MarketWatch

March 14, 2016

No Comments

In the U.S., federal, state and local governments have very large unfunded pension liabilities that will have worsened with the recent falls in equities and other risk assets. Disputes between Chicago teachers and the governor of Illinois have resulted in a surge in borrowing and in the interest rate paid on new debt.

You paid to build them, now you pay to lease them – Chicago Sun-Times

March 14, 2016

No Comments

Under Mayor Richard M. Daley, the city of Chicago chipped in $19 million to build Sky55, a 40-story apartment building that was part of City Hall’s plan to redevelop the South Loop neighborhood where Daley lived. Now, the city’s taxpayers are paying to help fill the privately owned building.

What Happens When Pension Money Runs Out? When Does it Run Out? – Stump

March 13, 2016

2 Comments

Lack of Illinois budget means furloughs, lay offs for Illinois universities – WQAD

March 13, 2016

No Comments

Comment: Reminder that half of state money for higher education goes to pensions.

Statehouse Insider: Maybe Rauner spoke too soon – State Journal-Register

March 13, 2016

No Comments

Polling in fact shows strong support for his agenda.

Rauner pushes for increase in performance-based higher education funding – nwitimes

March 13, 2016

No Comments

Hate-Baiting and Race-Baiting Turned Surreal in Chicago on Friday Night – WP Original

March 12, 2016

5 Comments

By: Mark Glennon* I was at the Illinois GOP event at the Palmer House in Chicago Friday night, which was the other target of protesters along with Donald Trump’s cancelled event at UIC. Before going, I read an email from my U.S. Congresswoman, Jan Schakowky, calling for protests at both events. It read: Donald Trump, Bruce Rauner, and Ted Cruz are going to descend on Chicago to spread their message of intolerance, racism, and hate. We need to stand up to their disgusting rhetoric and remind them that Chicago won’t tolerate the garbage they are spewing. I saw plenty of

New year brings sales tax hike on North Avenue in Elmwood Park – Elm Leaves

March 12, 2016

4 Comments

It brings the effective sales tax rate from 9 percent to 11 percent in part of the village. Madness.

Growing Illinois workforce struggles to find jobs – Illinois Policy

March 12, 2016

No Comments

While new state numbers painted a rosier picture of 2015, Illinoisans are still struggling in a poor economic climate.

llinois Weekend Watch: Round and Round While We Wait for a Strike – Stump

March 12, 2016

No Comments

Author Mary Pat Campbell is an actuary who writes about pensions.

Chicago State University students: Blame CSU administration for your troubles – Illinois Policy

March 11, 2016

No Comments

The bloated administration at CSU has pushed up the administrative cost per student to more than $3,600 per student, by far the highest of all Illinois’ public colleges and universities. By comparison, the average MAP grant at CSU is $2,600 per student.

Illinois now home to the highest sales taxes in the Midwest – Illinois Policy

March 11, 2016

1 Comment

Chicago has the highest percentage of female entrepreneurs in the world at 30%, well above the average of 18% – Chicago Inno

March 11, 2016

No Comments

A Comprehensive List of Women Founders In Chicago Tech

The chickens have come home to roost in Illinois – The Southern

March 11, 2016

No Comments

During the past eight years, while there has been a 22.5 percent increase in tax revenue in Illinois, the budget deficit has more than doubled from $3 billion to $7 billion and the pension deficit has increased from $48 billion to $110 billion.

Higher ed officials paint grim picture – Illinois News Network

March 10, 2016

No Comments

Of about $4.1 billion appropriated for higher education in fiscal 2015, more than half went to pensions.

Northeastern Illinois University announces furlough days – Chicago Tribune

March 10, 2016

No Comments

Wiener’s Circle in Chicago Sells ‘Trump Footlong’ Hot Dogs – DNAinfo

March 10, 2016

No Comments

Huge, Blind Reliance on State Exposed by Illinois Fiscal Crisis – WP Original

March 10, 2016

5 Comments

By: Mark Glennon* Did you know Catholic Charities is Illinois’ largest social service provider and gets 70% of its funding from the state? I didn’t. Perhaps the most surprising aspect of Illinois’ financial crisis is the depth of its impact on social services commonly thought to be privately funded or otherwise not heavily reliant on state money. Same, to some extent, for higher education. Was the plight most of them face today foreseeable? Definitely. Avoidable? Not so clear. Major cutbacks loom for groups like Catholic Charities, or have been made already. Catholic Charities, with a budget

Successful at tech, Ferro sets out to save Tribune Publishing, journalism industry – Chicago Tribune

March 10, 2016

No Comments

CPS files $65M lawsuit against former CEO Byrd-Bennett, others – Chicago Sun-Times

March 10, 2016

No Comments

Illinois budget impasse creates bigger need for food assistance – WPSD

March 10, 2016

No Comments

The Murphysboro Food Pantry feeds 37,000 people every year, 850 families each month. But with jobs lost from the Illinois budget impasse and a drop in funding from outside sources, the food pantry is now in need of help.

Chicago Hands China $1.3 Billion Order for New Urban Train Cars – Bloomberg

March 10, 2016

No Comments

Taxicab industry on the ‘verge of collapse,’ aldermen told – Chicago Sun-Times

March 10, 2016

No Comments

Retired teachers call on Illinois to pay up with pensions – WQAD

March 10, 2016

1 Comment

Bill giving governor budget powers unpopular all around – The Southern

March 10, 2016

No Comments

Chicago Teachers Union Vows To ‘Shut the City Down’ During One-Day Strike – DNAinfo

March 10, 2016

No Comments

They basically called for a general strike, asking “all concerned Chicago citizens” to skip work and boycott classrooms.

Anne Dias sells Reboot Illinois, site to expand under AFK Media – POLITICO

March 9, 2016

No Comments

Chicago Public Schools tells principals to watch spending – Chicago Tribune

March 9, 2016

No Comments

Chicago Public Schools officials told principals on Wednesday that the district is “short the necessary cash for the remainder of the school year” in part because it faces another massive pension payment this summer.

A Mosaic Artist’s Quest to Bring Fine Art to Chicago’s Potholes – CityLab

March 9, 2016

No Comments

State Bankruptcy Would Change Life for Public Pensioners, Bond Holders – ABC News

March 9, 2016

14 Comments

Under existing law, a state cannot go bankrupt. That’s not because the action is forbidden. Not the U.S. Constitution nor any other piece of paper says a state cannot. The bankruptcy code simply does not address the possibility. Now lawyers, politicians and other ingenious folk are looking for a way around that problem — a fact that should come as no surprise, given the perilous financial health of California, Illinois and other states encumbered with crushing debts.

Chicago Watch: What’s the Leverage When There’s No Money? – Stump

March 9, 2016

No Comments

New study: Illinois still second worst for property taxes – Chicago Tribune

March 9, 2016

3 Comments

Though property taxes vary from county to county across the state, the average effective rate in Illinois — the proportion of the value of a home that a homeowner must pay each year in taxes — was 2.25 percent, just a hair below the New Jersey rate of 2.29 percent.

Cook County: State must pay millions owed to fund child support collection program – Cook County Record

March 9, 2016

No Comments

Cook County State’s Attorney Anita Alvarez and lawyers acting on behalf of parents owed child support have asked the federal courts to step in to force the state of Illinois to pay up what it owes to cover the costs of enforcing the collection of child support, saying the state’s failure to pass a budget to fund the program has cost Cook County millions, harms the parents and their children and threatens the future viability of the program.

Rauner wants action on school funding, Cullerton wants numbers – The Southern

March 9, 2016

No Comments

Vise Tightens on Chicago Schools – The Bond Buyer

March 9, 2016

No Comments

From a threatened teacher strike to an escalating state-level attack on its governance and borrowing powers, the barrage of bad news has not let up since junk-rated Chicago Public Schools sold $725 million of debt at a punishing 8.5% rate.

Taxpayers need way to claw back excessive state-funded pensions – Daily Southtown

March 9, 2016

No Comments

Because SURS has bigger pensions, it’s no small feat that for the moment TRS is grabbing headlines for more egregious abuses of taxpayer money.

Undocumented students fight for funding amidst state education crisis – Medill Reports

March 8, 2016

No Comments

Experts weigh implications of immigration in Chicago and U.S. – Medill Reports Chicago

March 8, 2016

No Comments

Why Taxing the Wealthy Can Be Trouble for States – Pew Charitable Trusts

March 8, 2016

No Comments

The wealthy are an unstable source because their income fluctuates with markets.

New Illinois Innovation Index highlights growth of university-driven startups in Illinois

March 8, 2016

No Comments

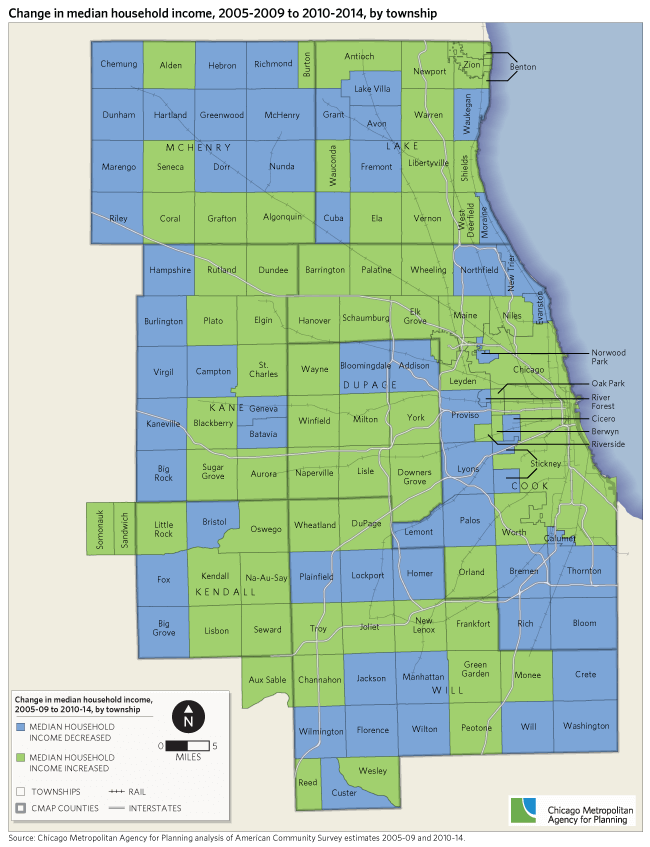

Chicago remains a segregated city by race and income – and government deserves much of the blame – Illinois Policy

March 8, 2016

No Comments

City zoning policies serve to keep many neighborhoods segregated. These rules also keep lower-income residents of all races out of popular areas, allowing city officials to shape who can live where and making housing more expensive.

No, Valerie Jarrett is not Why Illinois Pensions Are in Trouble – Stump

March 8, 2016

No Comments

IL Commission on Government Forecasting & Accountability March Report

March 8, 2016

No Comments

HBO’s John Oliver is Rauner’s unlikely ally in fight against Illinois special taxing districts – Reboot

March 8, 2016

No Comments

Comment: Oliver’s video is actually a rather thorough look at the overuse of special taxing districts across the country.

Pensions and insurance may be undone by negative rates – Reuters

March 8, 2016

No Comments

Comment: In Illinois, of course, they’re long past being “undone.” Negative rates would just scatter the ashes.

Lewis to CPS parents: April 1 CTU action ‘like an extra holiday’ – Chicago Sun-Times

March 8, 2016

No Comments

St. Louis offers free land for spy agency headquarters; Illinois also offering incentives – A.P.

March 8, 2016

No Comments

BGA To CHA: House People, Don’t Horde Cash – Better Government Association

March 8, 2016

No Comments

Legislators Weigh Pension Buyouts – WUIS

March 8, 2016

No Comments

Comment: Waste of time unless they pay a small fraction of the pension claim and figure out a way to exclude the sick, which is probably impossible.

Chicago’s War With its Teachers Union Is the Sign of a Bigger Problem – Fortune

March 8, 2016

1 Comment

New Illinois Poll – Chicago Tribune

March 8, 2016

No Comments

Trump had the support of 32 percent, followed by Texas Sen. Ted Cruz with 22 percent, Florida Sen. Marco Rubio with 21 percent and Ohio Gov. John Kasich with 18 percent. An additional 7 percent were undecided. The poll of 600 registered voters likely to cast a ballot in the Republican primary has an error margin of 4.1 percentage points.

Kicking off the 2016 Eighty Percent Funding Watch – Stump

March 7, 2016

No Comments

The author is an actuary who writes about pensions. Here, she adds Reboot, Ralph Martire and the Center for Tax and Budget Accountability to her “Wall of Shame” for repeating a pension myth.

Illinois House candidate alleges assault outside campaign office – Chicago Sun-Times

March 7, 2016

No Comments

Comment: The alleged assault victim is a primary challenger to an incumbent Democratic House member. Hmm. Let’s wait for more details.

Advantages of pooling pension funds – Pensions & Investments

March 7, 2016

4 Comments

Such proposals have a long history. “On Jan. 8, 1919, Gov. Frank O. Lowden (of Illinois) delivered a message to the General Assembly recommending “a consolidation’ of pension fund assets in the state under a central state supervising board.”

Special prosecutor requested to look into McHenry County Board IMRF allegations – Northwest Herald

March 6, 2016

No Comments

State Rep. Jack Franks officially asked McHenry County State’s Attorney Lou Bianchi for a special prosecutor to investigate whether County Board members are working the 1,000 hours a year required to qualify for Illinois Municipal Retirement Fund pensions.

Chicago runs risk of becoming a one-paper town — and that’s very bad news – MarketWatch

March 6, 2016

No Comments

Public Pensions and Fiscal Incompetence – The American Interest

March 6, 2016

No Comments

America’s ongoing—and underreported—public sector pension crisis — the role played by institutional greed and fecklessness—greed by public sector unions that have turned so many state and local governments into ATM machines, and fecklessness by politicians who were willing to keep wildly over-promising to keep their campaign contributions flowing.

US public pension deficits squeeze city and state budgets – Financial Times

March 6, 2016

No Comments

Nice to see the FT wake up to the pension crisis, which they’ve been overlooking.

Illinois budget battle explained through ugly math of a dysfunctional state – Herald-Whig

March 6, 2016

No Comments

Chicago High Schoolers Compete In Magnetar Financial Literacy Event – CBS Chicago

March 5, 2016

No Comments

Teens from 44 Chicago-area high schools competed Saturday at Soldier Field, but not in an athletic event. Instead, it was a test of teamwork and financial literacy.

Study: Illinois drivers dinged hard on insurance after getting ticketed – KMOV

March 5, 2016

No Comments

Illinois House votes overwhelmingly for Chicago school board shake-up – Reuters

March 5, 2016

No Comments

About 1,600 Illinois jobs targeted by companies closing, cutting back

March 5, 2016

No Comments

My, What a Foolish Comment by the Chicago Tribune’s Chairman – WP Original

March 5, 2016

8 Comments

By: Mark Glennon* Michael Ferro is the Chairman and largest shareholder of Tribune Publishing, owner of the Chicago Tribune. This week, he said: I now understand how important it is to have real journalism in the world and we’re starting here with our properties around the country. Bloggers can’t be the ones deciding public opinion, deciding presidential races. As for the first part of his comment, let’s just say it’s good he “now” understands the importance, whatever that indicates. But as for the rest, there’s evidently much he doesn’t understand: • Journalists aren’t the

CPS, CTU Back Off Threats – WTTW

March 4, 2016

No Comments

The Chicago Public Schools and the Chicago Teachers Union seem to be engaged in a game of “chicken,” where the both sides continue to decelerate before collision.

How Rahm Emanuel Is Failing Chicago – The Progressive

March 4, 2016

1 Comment

Left, Right — nobody likes him.

Facebook, Google Photo Tags at the Heart of Data Privacy Lawsuits – Chicago Inno

March 4, 2016

No Comments

Illinois is one of only two states nationwide (the other is Texas) that has a law regulating the use of biometric data, such as retina scans, fingerprints, and facial structure.

McPier bets financial future on optimistic plan for hotel, DePaul arena – Chicago Tribune

March 4, 2016

No Comments

The Tribune found that McPier’s formula for success is based on a series of optimistic and risky predictions.

Chapter 9 Five Proposals for Meaningful Reform – The Bond Buyer

March 4, 2016

4 Comments

Comment: In a sane world, we’d be debating how Chapter 9 can be amended to make it a more efficient means to give zombie municipalities a fresh start. The suggestions in this article mostly would give bondholders a windfall and therefore should be suspect, but that’s a topic for a different day, and some of these suggestions are sensible. One change to Chapter 9 that definitely should be made would be to allow discretion to make pension cuts progressive — protecting the smaller pensioners more than the gluttons. In any event, let’s hope bondholders’ lobbyists don’t hijack Washington to rewrite

Chicago Named Nation’s “Top Metro” for New and Expanding Companies for Third Year in a Row – World Business Chicago

March 4, 2016

No Comments

“While there is debate in some circles about the economic impact of corporate headquarters, in Chicago there is no denying their power,” says Adam Bruns, managing editor of Site Selection.

Illinois Expects To Pull The Plug On Internet Lottery Sales – WUIS

March 4, 2016

No Comments

Pension Problems Hit Madison and St. Claire Counties – Taxpayers United of America

March 4, 2016

No Comments

“There are about 300 area government retirees collecting pensions of at least $100,000 annually, while 17.6% of St. Claire County residents live below the poverty level, along with 14% of Madison County residents. Across 6 state pension funds, there are 12,154 government pensioners collecting six-figure pensions and 85,893 pensioners collecting more than $50,000 annually, where the state debt per capita is $24,959.”

Dems advance latest higher ed bill, take another stab at union measure – Chicago Tribune

March 4, 2016

No Comments

Democrats once again sought to bolster their election-year campaign attack fodder against Republicans on Thursday, voting for the latest plan to fund higher education and another union-backed measure to prevent a worker lockout or strike following earlier vetoes by Gov. Bruce Rauner.

The Suddenly Poor Life: Millions Will Lose Their Pensions – The Trumpet

March 4, 2016

No Comments

Tens of millions of Americans are not going to get the benefits they are planning on! This is an underappreciated trend that will have a profound effect on America’s economy. Consider this: In Chicago, a recent report found that the city’s unfunded pension liabilities totaled 10 times the entire city’s revenues. According to analysts, this means that the city will soon be paying 50 percent of its revenue just to cover pension costs. Comment: As we’ve been saying repeatedly, only SOME face genuine hardship. There are haves and have nots, which is why pension reform must include means testing or

Illinois Democrats Approve Bill Requiring Union Contract Arbitration – WNIJ and WNIU

March 4, 2016

No Comments

Illinois House votes overwhelmingly for elected Chicago school board – Reuters

March 3, 2016

1 Comment

BUT NOTE THIS: A concurrent bill provides for dedication of part of property tax levy to pensions only! No surprise that reporter Dave McKinney would ignore that, but the Chicago Teachers Union is sure grateful and called that out. See their statement linked here.

Chicago schools fast running out of cash as standoff with Illinois governor worsens – Reuters

March 3, 2016

No Comments

Comment: The premise of this story is that the standoff with Rauner impairs CPS’s ability to borrow. That’s false. Its ability to borrow is already shot, and borrowing wouldn’t solve the problems.

House Fails To Override Rauner’s MAP Funding Veto – A.P.

March 2, 2016

No Comments

House Republicans’ side of the story is linked here.

Chicago, area counties team up to attract foreign direct investment to region – West Cook News

March 2, 2016

No Comments

Illinois voters to consider 120 Illinois property tax questions – Reboot

March 2, 2016

No Comments

Tribune chair Ferro donates Sun-Times stake to charitable trust – Chicago Sun-Times

March 2, 2016

No Comments

In a written statement issued Wednesday, Sandra Martin, chief financial officer of Tribune Publishing, said Ferro’s “divestiture will create a very clear separation of ownership and avoid perceived conflicts of interest, while also providing millions of dollars for community programs and other charitable causes.”

11 things you need to know about Chicago teacher pensions – Illinois Policy

March 2, 2016

1 Comment

17 Illinoisans on Forbes’ billionaires list – Chicago Sun-Times

March 2, 2016

No Comments

U.S. top court rejects union challenge to New Jersey pension reforms – Reuters

March 2, 2016

No Comments

The United States Supreme Court declined to hear an appeal from a New Jersey decision challenging pension underfunding under the Contracts Clause of the U.S. Constitution. A Bond Buyer article on the same story is linked here. Comment: If Illinois was to amend its constitution to allow pension cuts, unions say they would still challenge any cuts as a violation of the U.S Contracts Clause. This case appears to indicate the Supreme Court’s reluctance to hear such a challenge.

How the Tax System Favors Government Workers and Punishes Independent Contractors – Union Watch

March 2, 2016

No Comments

Experts: Mortality data, if faulty, may be the least of Detroit’s pension problems – Crain’s Detroit Business

March 2, 2016

No Comments

Comment: See our recent story about the implications of this Detroit chapter for Illinois.

Poverty up, services diminished in Chicago’s black neighborhoods – study – Reuters

March 2, 2016

No Comments

Senate Hearing Examines Rare Retirement Topic: Cuts to [private] Pension Checks – WSJ

March 2, 2016

No Comments

Insiders hoping to land Midway food concession deal – Chicago Sun-Times

March 1, 2016

No Comments

“Hoping”?

Charter schools CPS wanted closed could reopen next school year – Chicago Sun-Times

March 1, 2016

No Comments

Rauner’s budget caps state support for pensions in education – INN

March 1, 2016

No Comments

Legislative analysts predict Illinois revenue will grow only by $200 million this year – less than 1 percent – A.P.

March 1, 2016

1 Comment

Full COGFA report is linked here.

CPS budget breakdown: Where has the money gone? Illinois Policy

March 1, 2016

1 Comment

Unaffordable salaries and pension benefits on top of a structurally unstable retirement system have pushed CPS to the brink of insolvency despite record tax revenues.

Allstate moves 400 tech workers to downtown Chicago – Crain’s

March 1, 2016

No Comments

Allstate is opening an innovation center in the Merchandise Mart that will bring 400 technology jobs downtown. The Northbrook-based insurer is just the latest in a growing conga line of suburban employers that have either set up satellite offices or moved their entire operations downtown in search of fresh talent.

Why Chicago’s Loop Will Survive Property Tax Increases – Huffington Post

March 1, 2016

No Comments

Present without comment, except to say the Loop and Near North are quite unique.

The City of Chicago – A “zombie bank” about to be unmasked? Truth in Accounting

March 1, 2016

No Comments

Under-the-radar attempts at changing Illinois government – Reboot

March 1, 2016

No Comments

Comment: They’re “undercover” only because reporters ignore them, focusing, instead, on Madigan-Cullerton stunt government.

CTU Threatens to Strike as Early as April 1 if Pension Subsidy Cancelled – NBC5

February 29, 2016

No Comments

Rauner says Madigan prolonging Illinois’ higher education funding crisis for political gain – A.P.

February 29, 2016

No Comments

Chicago’s Massive Lakeside Development Dead After U.S. Steel and McCaffery Interests Split – DNAinfo

February 29, 2016

No Comments

CPS announces $85 million in cuts; 62 employees to get pink slips Monday – Chicago Sun-Times

February 29, 2016

No Comments

State Crisis Management Team Prepping For CSU Shutdown – WUIS

February 29, 2016

No Comments

Chicago PMI at 47.6 in Feb vs 54.0 reading expected – CNBC

February 29, 2016

No Comments

Ugly. Below 50 indicates contraction.

University of Chicago’s New Venture Challenge turns 20 – In Other News – Crain’s Chicago Business

February 29, 2016

No Comments

Comment: Huge salute to U of C Professors Steve Kaplan and Ellen Rudnick for their work on this. First rate scholars who are also grounded in real world practice who made this work.

Editorial: Pull back curtain on Ald. Burke’s workers comp fiefdom – Sun-Times

February 29, 2016

No Comments

Pension ‘lump sum’ proposals get first hearing – Gatehouse Media

February 29, 2016

No Comments

Under consideration will be plans that would allow workers at retirement to take pension benefits as a lump-sum cash payment and give up guaranteed pension payments for life. Comment: Don’t get your hopes up. Tiny lump sums would have to be offered to make this work and there wouldn’t be many takers.

CTA Pension Giveaway Costs Riders, Taxpayers $100 Million – Better Government Association

February 29, 2016

No Comments

“Lawmakers have no excuse for letting the abuse continue.”

Pension funding is Quincy’s most pressing issue – Herald-Whig

February 29, 2016

No Comments

Leap Day Pensions (and Finance) Watch: Detroit, Chicago, and California – Stump

February 29, 2016

No Comments

Pension Lawsuits and the Blame Game: Detroit is Harbinger of the Inevitable – WP Original

February 28, 2016

20 Comments

By: Mark Glennon* Detroit last week gave us a glimpse of what to expect on a much larger scale in Chicago and across the country as the sheets are gradually pulled off on public pensions. Reality ultimately invalidates wrong assumptions. In the public pension world, that means taxpayer liabilities eventually will spike. Scapegoats will be found, fairly or not. Lawsuits will come. Heads must roll as anger erupts — all financial meltdowns are that way. Officeholders and voters bear primary responsibility, but that won’t matter. Detroit’s mayor announced the startling (to some) conclusion that the city’s

Budget issues cause Illinois ‘brain-drain’ – Editorial – Herald Review

February 28, 2016

No Comments

Wealthy Foreigners Invest in Chicago for Green Cards While Others Wait Turn – NBC Chicago

February 28, 2016

2 Comments

What Accrual Accounting Would’ve Exposed — Medium

February 28, 2016

No Comments

Comment: This is fundamental to why widely-reported state and local budget and spending numbers are bunk. Losses are hidden, among other ways, by underfunding pensions, and ever-worsening unfunded pension liabilities aren’t in budgets.

Government-worker pensions take away funding meant for students- Illinois Policy

February 28, 2016

No Comments

Illinois’ growing pension costs – not the state budget gridlock – are taking away funding for essential government services, such as education.

Pension funds lost millions on deals with Daley nephew, Obama pal – Sun-TImes

February 27, 2016

3 Comments

A real estate venture created by President Barack Obama’s onetime boss and a nephew of former Mayor Richard M. Daley squandered $68 million it was given to invest on behalf of pension plans for Chicago teachers, cops, city employees and transit workers, a Chicago Sun-Times investigation has found.

Rauner’s new appointments include two TRS trustees – Press Release

February 27, 2016

No Comments

Rauner Announces Tom Cross as New Higher Ed. Board Chairman – WNIJ and WNIU

February 27, 2016

No Comments

A Chicago towing company that has for angered motorists for decades may be close to the end of the road – A.P.

February 27, 2016

No Comments

Chicago State University sends layoff notices to all employees amid Illinois budget battle – The Washington Post

February 27, 2016

No Comments

Comment: The many headlines about layoff “notices are a bit misleading. Despite the notices — including to the president — university spokesman Tom Wogan said that does not mean the 900 people working at Chicago State all will lose their jobs. He said the school is still trying to determine how many layoffs are needed to offset the loss of funding. “It means that every employee of the university, from the president on down, is susceptible to a layoff.” Wogan said the university has no plans to close, but said it needs the flexibility to make staff reductions to remain

CSU president: ‘Everything’s on the table’ when looking for money to keep school open – WFLD

February 27, 2016

No Comments

Chicago State University sends layoff notices to all 900 employees – Chicago Tribune

February 26, 2016

No Comments

Pension Penalty Amendment Stripped From ESSA – Illinois Issues

February 26, 2016

No Comments

The issue is diversion of Federal money into pensions — money that’s supposed to be helping school districts with large numbers of underprivileged students. Congressman Bob Dold got a fix passed in the House but the Senate stripped it out.

Number Of Illinois Residents With Health Insurance Continues To Grow – WNIJ and WNIU

February 26, 2016

No Comments

About 380-thousand of them signed up for private plans. But the majority are people on the government’s Medicaid program — who were previously ineligible or chose not to sign up.

‘Blame it on Rauner’ is Dems’ mantra for 2016 – Nadig Newspapers

February 26, 2016

No Comments

And Rauner is letting them get away with it.

Bernie Sanders in Chicago: Need ‘political revolution’ against wealthy status quo – Chicago Tribune

February 26, 2016

No Comments

Top GOP Pollster: Young Americans Are Terrifyingly Liberal

February 25, 2016

No Comments

According to new polling by right-wing political consultant Frank Luntz, Americans 18 to 26 are extremely liberal — so liberal that “the hostility of young Americans to the underpinnings of the American economy and the American government” should “frighten every business and political leader.”

Public Unions ARE the Political “Establishment” | Union Watch

February 25, 2016

No Comments

Rauner supports ‘special funds’ proposal for state universities – ABC7

February 25, 2016

1 Comment

Illinois Pension Watch: This is Why Your Pensions are in Trouble – Stump

February 25, 2016

No Comments

Mary Pat Campbell, the author, is an actuary who writes about pensions. Next time you hear a politician say Illinois is making “full pension contributions” or “what the actuaries require” tell them they’re lying. Same for almost all local pensions.

Detroit mayor eyes legal action over pension shortfall – Reuters

February 24, 2016

1 Comment

Detroit may sue some of the consultants who worked on its bankruptcy over a $490 million pension funding shortfall that will result in bigger-than-expected city payments. The mayor blamed the projected deficit on outdated mortality tables used by the consultants that assume retirees will not live as long. Sound familiar, WirePoints regulars?

Chicago Teachers Union enlisting Lake County support in Springfield – Lake County Gazette

February 24, 2016

No Comments

Cook County spends $166 million per year on secretaries – Lake County Gazette

February 24, 2016

No Comments

Amid declining enrollment, 21 charter campuses seek to open in CPS – Chicago Sun-Times

February 24, 2016

No Comments

Federal jury convicts Block 37 developer – Chicago Sun-Times

February 24, 2016

No Comments

Illinois Colleges Downgraded by Moody’s Over State Budget Battle – Bloomberg

February 24, 2016

No Comments

One Illinois public university had its credit ratings lowered to junk, and two others had their debt downgraded by Moody’s Investors Service because the state’s record budget impasse has wrecked havoc on college finances.

Madigan hints he’ll block the Fair Maps redistricting effort – Illinois Review

February 24, 2016

No Comments

Ill. Pension Woes Destabilizing Teaching Profession, Analysis Says – Education Week

February 24, 2016

No Comments

Nearly a quarter of newly hired teachers will never vest in the state’s Teacher Retirement System, a new analysis says. What’s more, three quarters won’t even make back what they pay into the system. (That’s for new, Tier 2 teachers only.)

Madigan Plans Probe Of Rauner’s New Public/Private Economic Development Entity WJO

February 24, 2016

No Comments

Standard trouble-making grandstanding.

Congressman Bob Dold To Introduce Bill Giving State Grants To Increase Access To Heroin Antidote – CBS Chicago

February 24, 2016

No Comments

Why Illinois Democrats should want to streamline ‘The Government State’ – Chicago Tribune

February 24, 2016

No Comments

Why the Chicago Cloud Tax is Destined to Fail – Chicago Inno

February 24, 2016

No Comments

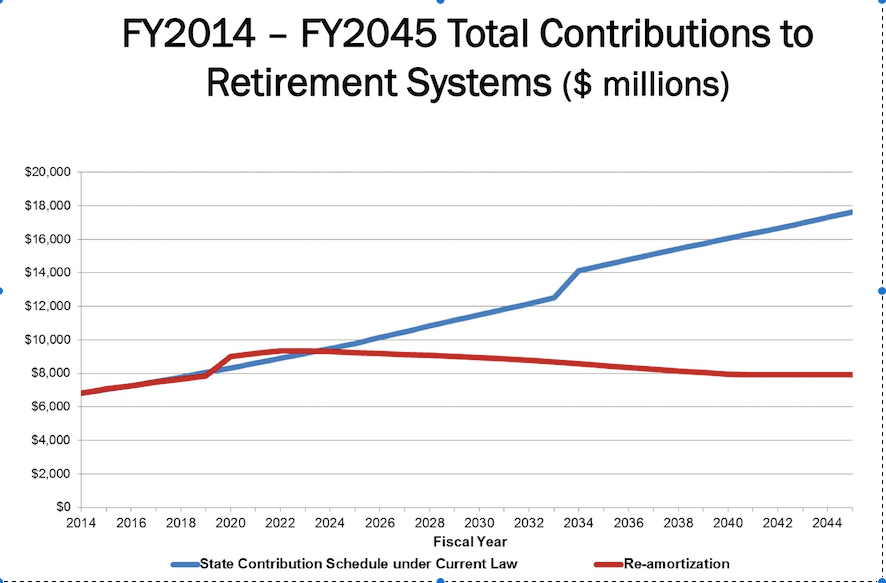

Rauner-backed bill leaves pension payments in play – A.P.

February 24, 2016

No Comments

One of the budget options Gov. Bruce Rauner presented to lawmakers last week could clear the way for the state to once again short or skip contributions to its beleaguered pension funds. Comment: Wake up, media. We already are shorting contributions. The state makes the contributions required by statute which are far short of what is required to prevent unfunded liabilities from worsening.

Ald. Burke accused of hiring ‘political hacks’ to run $100M-a-year workers’ comp program – Sun-Times

February 24, 2016

No Comments

Comment and prediction on this story: Just the tip of the iceberg on this topic. Much more to come.

Chicago State University To End School Year Early to Save Money – A.P.

February 23, 2016

No Comments

Cities want automatic payments, expanded home rule from legislature – State Journal-Register

February 23, 2016

No Comments

Latest Case Shiller Index: Chicago Home Prices Gaining Steam But Still Slower Than Other Metros – ChicagoNow

February 23, 2016

No Comments

The average Chicago area home is still worth significantly less than it was at the September 2006 peak. Single family homes are still down 23.0% and condos are down 17.5%.

Former Education Secretary Arne Duncan on the State of Education – WTTW

February 23, 2016

No Comments

Bang for the buck in education? – McHenry Times

February 23, 2016

No Comments

Does more money equal a better education? There’s perhaps no better way to examine that question than the real-life experiment known as the Chicago Public Schools (CPS), where over the past 10 years, enrollment has fallen and spending has soared.

Chicago Teachers Union enlisting west suburban support in Springfield – West Cook News

February 23, 2016

1 Comment

Illinois’ $58 Billion Teacher Pension Problem – TeacherPensions.org

February 23, 2016

No Comments

“Illinois’ teacher retirement plan is doing a poor job of serving the majority of its teachers.”

DuPage group says pension system is broken – The Doings Oak Brook

February 23, 2016

No Comments

Illinois budget impasse may be broken with workers comp compromise – INN

February 23, 2016

No Comments

Comment: Don’t get your hopes up, and don’t think that passing a budget means that painful cuts can be eliminated. They won’t be.

Cook County Jail Inmates Eating Jail Parts – CBS Chicago

February 23, 2016

No Comments

It’s “very expensive proposition,” says Cook County Sheriff Tom Dart.

North Shore school district’s $198M referendum causing ‘a civil war in Highland Park’ – Chicago Tribune

February 23, 2016

1 Comment

Owner of Old Main Post Office in Chicago says he won’t just let the city take it over – A.P.

February 23, 2016

No Comments

An Illinois County Clerk Unilaterally Levies Millions Of Dollars In Extra Property Taxes – Forbes

February 23, 2016

No Comments

Why Corporate Headquarters Matter to Chicago – World Business Chicago

February 23, 2016

No Comments

A rebuttal to a recent Crain’s article arguing that corporate headquarters have little impact.

Peoples Gas’ new owners have a new foe: the utility’s union – Crain’s

February 23, 2016

No Comments

The union is urging the Illinois Commerce Commission, which regulates utilities, to order WEC Energy to hire more full-time personnel. The commission has the power to do that under a state law enacted in 2008. The union is pushing for a workforce of 1,300, up 36 percent from today’s levels. Peoples’ unionized workforce numbers 954, up from a low-water mark of 872 a decade ago.

Judge: Red-light, speed-cam tickets ‘void’; city violated due process – Sun-Times

February 23, 2016

No Comments

Homicides in Chicago now double same period last year – Chicago Tribune

February 23, 2016

No Comments

Are Budget Sweeps Coming? – INN

February 23, 2016

No Comments

The Unbalanced Budget Response Act would allow the governor to make cuts and sweep special funds in the upcoming fiscal year. And while Democrat leaders have said the governor could use his line-item veto authority, Governor Bruce Rauner said Monday that won’t solve the state’s problems.

$88.8 billion: The state economic impact of Illinois hospitals and health systems – BCR News

February 22, 2016

No Comments

Illinois’ more than 200 hospitals and nearly 50 health systems generate a total impact of $88.8 billion annually on the state’s economy, according to a new report, “Illinois Hospitals and Health Systems $88.8 Billion State Economic Impact” releases recently by the Illinois Health and Hospital Association (IHA).

Illinois governor eyes blocking Chicago school debt – Reuters

February 22, 2016

No Comments

Teamster Central States Pension Fund to cut retiree benefit checks in half – Illinois Review

February 22, 2016

No Comments

4 unions sue Lincolnshire over right-to-work ordinance – Daily Herald

February 22, 2016

No Comments

As expected. Likely to go up on appeal however the trial court rules. Fortunately, it’s in Federal courts where it belongs.

Illinois Temporarily Suspends Certification of Targeted Employment Areas for EB-5 Visas

February 22, 2016

No Comments

Taxpayers’ advocate says under-funded Judicial Retirement System rife with conflicts of interest – Madison County Record

February 22, 2016

No Comments

“Not only do these judges benefit from the redistribution of taxpayer wealth, they also rule in their own favor to protect the Illinois pension cabal when practical, necessary reforms are challenged in the courts.”

Dold pushes to expand availability of heroin overdose antidote – Daily Herald

February 22, 2016

No Comments

Comment: The real focus has to be on ending the heroin epidemic. It’s not just a humanitarian crisis but an economic one, at the core of gang violence and soaking up social service spending. Chicago is the distribution center for heroin coming out of Mexico and that’s another reason why the border must be enforced.

Illinois lost 56 manufacturing jobs per workday in 2015 – Illinois Policy

February 22, 2016

No Comments

Though neighboring and Great Lakes states added a combined 200 factory jobs per workday on net in 2015, an average of 56 Illinois manufacturing workers, on net, received pink slips each workday during the same time.

Rauner: State board can block CPS bond deals – Chicago Sun-Times

February 22, 2016

No Comments

“We have a duty to evaluate what’s going on in that school district, learn the facts and then decide what’s appropriate action to take,” said Rauner.

Republicans push plan to save money on schools, Democrats push back – INN

February 22, 2016

No Comments

A nice summary of Ch. 9 municipal bankruptcy – Orrick

February 22, 2016

No Comments

Comment: Orrick is a leading California law firm. Municipal bankruptcies are not yet authorized for Illinois, but, if that happens, most of this would apply.

Graduation Numbers Inflated At Nearly All CPS High Schools – WBEZ

February 22, 2016

No Comments

Mayor Rahm Emanuel touted improving graduation rates as he campaigned for re-election last year. But an investigation by WBEZ and the BGA found that graduation rates were inflated, because many principals were regularly labeling students as transfers out of the district when they should have been classified as dropouts. In response, CPS went back and scrutinized who had been counted as a transfer in the past.

Why does charity suffer when governments are broke? – Truth in Accounting

February 22, 2016

1 Comment

You might be surprised to learn that about 70% of the budget for Catholic Charities of Chicago comes from government funds, which are derived in turn from taxes. The developing fiscal crisis in Illinois may illustrate some of the risks in relying on government money for charity.

The New $9.50 Garbage Collection Fee Will Be on Your April Water/Sewer Bill – DNAinfo

February 22, 2016

No Comments

Doctors form their own angel funds for health care startups – Crain’s

February 22, 2016

No Comments

The Chicago “doctorpreneur” has assembled a group of about 30 physicians to fund health care-related startups at the earliest stages. His pitch is simple: Doctors generally have capital and need to diversify their finances beyond their own practices and the stock market. Meanwhile, one of the biggest barriers for health care entrepreneurs is finding investors comfortable enough with the sector.

Education funding could be next front in Illinois budget battle – QC Times

February 22, 2016

No Comments

Coming rebirth of Children’s Memorial Hospital site brings relief to Lincoln Park – Chicago Sun-Times

February 22, 2016

No Comments

Pension plan a wedge issue in race to replace State Sen. Duffy

February 22, 2016

No Comments

Comment: This is about Batnick’s plan to give retirees the option to immediately receive 75 percent of what the state expects they’d earn through their pension over the rest of their lives — which is too high to work.

Municipal Bankruptcy Brings Joy to Taxpayers – WP Guest

February 22, 2016

8 Comments

By: Joe Mathewson* Chicago Public Schools’ desperate and very costly quest for buyers of its recent $725-million bond issue (cut from $875 million) is a harbinger of peril ahead, not only for CPS but for the City of Chicago and other Illinois local governments and special districts relying fatuously on borrowing to pay current expenses. If the Illinois legislature finally passes a pending bill permitting municipalities and special districts to seek relief in U.S. Bankruptcy Court, there might be a parade of them knocking on that door. They’d be well received, for Chapter 9 of the Bankruptcy

A Long Journey on the Red Line

February 21, 2016

1 Comment

For Fred Long, Chicago’s youth-focused nonprofit UCAN has been a ticket to a world that he never even knew existed growing up on the city’s South Side. Comment: If you think you don’t need a reminder about the conditions some kids face, think again and read this story. “As a little kid, my mom would be off doing drugs, and all of us would be left alone at home, hungry and without food,” he recalled. “We’d sit there looking down the street for her — that’s called ‘Window Pain.’ Or sometimes she’d take us on drug runs, where she’d go inside a

Cleversafe: An Interview with IMSA Alumni – IMSA360

February 21, 2016

No Comments

IMSA, the Illinois Math and Science Academy, is breeding ground for some of best tech talent in the nation. This article looks at its role in Cleversafe, a hugely successful Illinois data storage company recently acquired by IBM.

Illinois will receive $114 million to help homeowners still struggling from the 2008 recession – A.P.

February 21, 2016

No Comments

The startup growing 30 times more produce per acre on New York, Chicago rooftops – MarketWatch

February 21, 2016

No Comments

Valerie Jarrett is the poster girl for our pension crisis – American Thinker

February 21, 2016

No Comments

Education funding could be next front in Illinois budget battle – QC Times

February 21, 2016

No Comments

Democrats, it’s time to stand up in Illinois budget mess [by embracing the Civic Federatons wacky proposal!] – Editorial – Crain’s

February 20, 2016

No Comments

Comment: No surprise that the innumerate goofballs at Crain’s would go for the the Civic Federation’s recent budget proposal. For the facts on that proposal, see the Illinois policy article linked here and our earlier one linked here. They want $9 billion in new taxes per year just at the state level, and assumption of liability by Illinois taxpayers of the $10 billion -plus unfunded Chicago teacher pension liability.

Rahm Moves to Seize Old Main Post Office Property Using Eminent Domain, Choose New Developer – DNAinfo

February 20, 2016

No Comments

The Most Trusted State Governments Are Red – The American Interest

February 20, 2016

No Comments

And you know who is the least trusted.

Interest rate swaps class action vs big banks could draw in ‘tens of thousands’ of public bodies with billions at stake – Cook County Record

February 20, 2016

No Comments

Two Mississippi and Alabama hospitals and the county that includes the cities of Biloxi and Gulfport, Miss., have squared off in Chicago federal court with many of the country’s biggest financial institutions over so-called interest rate swaps — an issue now impacting governments and other public bodies throughout the country, including Chicago’s public schools system.

Gov. Rauner: First, fix the school funding formula – Chicago Tribune Editorial

February 20, 2016

No Comments

The formula is broken. The whole system, actually, is broken. Roughly half of the money many schools receive doesn’t get squeezed through the formula anymore. Grants have increasingly been sent to school districts as lump sums, in some cases outpacing what districts receive through the means-tested formula.

Rauner creates cabinet to deal with children’s issues – FOX2

February 20, 2016

No Comments

State gets $114 million for ‘hardest hit’ by housing collapse – Chicago Sun-Times

February 20, 2016

No Comments

Treasury Department officials on Friday released $114 million to Illinois agencies to aid homeowners and neighborhoods still struggling due to the 2008 financial meltdown.

Tired of waiting, Emanuel moves to acquire, redevelop old Main Post Office – Sun-Times

February 20, 2016

No Comments

Civic Federation’s Island – Eric Allie Cartoon

February 20, 2016

No Comments

Comment: Good to see others going after The Civic Federation, which has gone off the deep end is now seems more like the union-funded CTBA of Ralph Martire. Illinois policy did a great piece linked here on The Civic Federation, and our own earlier one is linked here.

An outstanding interview with a former IL legislator and voice for manufacturing – Video

February 19, 2016

1 Comment

Former State Senator and current President and CEO of the Technology and Manufacturing Association (TMAIllinois.org) Steve Rauschenberger gives a detailed, blunt interview not just on manufacturing but on his own Republican party’s failings.

Speaker Madigan promotes map amendment opponent – INN

February 19, 2016

No Comments

Comment: Seems like the only opponents on the planet to fair map reforms are Madigan and his friends.

Illinois next to last in post-recession personal income growth – Pew

February 19, 2016

No Comments

The Governments (plural) of Chicago -Truth in Accounting

February 19, 2016

No Comments

The average Chicago citizen is walking around on real estate with a number of different, overlapping governmental jurisdictions, each of which poses financial implications for any single taxpayer. Calculating the full ‘Taxpayer Burden’ for a Chicago citizen requires analysis and assessment of his or her exposure to the multiple layers of government that are borrowing money, with future tax implications. Comment: That’s the key. Any one jurisdiction may look fixable in isolation, but in aggregate they are not.

Why a “balanced” Illinois budget won’t actually be balanced – Reboot

February 19, 2016

No Comments

A great reminder why government “budgets” mean little.

As Illinois universities await funding, some students look out of state – The Southern

February 19, 2016

No Comments

Right-sizing Illinois state government’s payrolls – Illinois Policy

February 19, 2016

No Comments

This analysis found that Illinois’ operating deficit, which has led to more than $6.9 billion in outstanding bills, would not exist if, since 2000, state government had simply paid its employees at a rate relative to what other state governments pay their workers.

5 tech transplants explain why they moved to Chicago – Built In Chicago

February 18, 2016

No Comments

State board rules against teacher ‘steps and lanes’ raises – Sun-Times

February 18, 2016

No Comments

A state board that oversees school labor disputes ruled against immediately reinstating raises for education and experience to members of the Chicago Teachers Union, but could reconsider the teachers’ request at a later trial.

State Board of Ed launches financial probe of CPS – Sun-Times

February 18, 2016

3 Comments

This will get mighty interesting.

Ricketts’ vision for Wrigley Field plaza: ‘a town in Europe’

February 18, 2016

No Comments

State-worker pensions, health care crowd out spending on education, public safety, human services – Illinois Policy

February 18, 2016

No Comments

Illinois state government now pays more for pensions and health care for state workers than it spends on K-12 education, public safety or human services.

Governor’s Budget Proposal Looks Past Current Crisis – IL Issues

February 18, 2016

1 Comment

Comment: Balanced summary of Rauner’s budget address, drawing the right distinction between the short and long term. Includes an important reminder that one year ago Rauner’s reform agenda had 40 items and he already compromised it down to 5.

Old Expenses Rattle New Illinois Auditor General – Better Government Association

February 18, 2016

No Comments

New standards for digital access to the Chicago Tribune

February 18, 2016

No Comments

A new “metered” approach that will give nonsubscribers access to up to 10 articles each month before being asked to subscribe.

Emanuel: Charge downtown developers more, spend money in struggling neighborhoods – Chicago Tribune

February 18, 2016

No Comments

Chicago city council advances bill for E15 gas, with more ethanol – Crain’s

February 17, 2016

No Comments

Aim gun at working class, pull trigger. And you may recall that this measure resurfaced after its main sponsor, Alderman Ed Burke, got a $20,000 contribution from corn grower ADM.

Chicago taxpayers’ money funneled to capital markets, professional advisers, according to ‘Bond Girl’ – Illinois Policy

February 17, 2016

No Comments

US taxpayers, too, are subsidizing the financial contortions of the doomed Chicago Public School District.

The definition of insanity: Repeating the 2011 income-tax hike is the road to continued fiscal disaster – Illinois Policy

February 17, 2016

No Comments

The Civic Federation is pushing a $30 billion tax hike in Illinois, following the same mistaken path that got Illinois in today’s fiscal crisis.

Madigan and Cullerton: Eight months. Time’s up. Their choice – Editorial – Chicago Tribune

February 17, 2016

No Comments

Hinsdale police chief will collect pension, still work full-time – The Doings Hinsdale

February 17, 2016

3 Comments

$120,000 a year for the new full-time position, plus a pension of $113,000 per year. Age 56. And by Illinois pension laws, Bloom’s pension will grow by 3 percent of that amount each year. Comment: “Madness” is the only word for allowing this to go on and on and on.

Arizona Pension Overhaul Huge Win for Workers, Taxpayers – Retirement Security Initiative

February 17, 2016

No Comments

Comment: As states with comparatively small pension problems make reforms, Illinois will be rendered still less competitive.

Lawmakers seek probe of Chinese investors’ buy of Chicago exchange – Reuters

February 17, 2016

No Comments

Lucas museum officials considering other cities for project – Chicago Tribune

February 17, 2016

No Comments

Officials behind “Star Wars” creator George Lucas’ bid to build a museum along Chicago’s lakefront are considering other cities and sites for the project, a city of Chicago lawyer told a federal judge Wednesday, indicating the lawsuit filed to block the proposal has put the project in jeopardy.

Illinois Senate Democrats reactions to Rauner budget speech

February 17, 2016

No Comments

Comment: Not one suggests his own plan. Put up or shut up.

Hillary Clinton blasts Gov. Rauner, Illinois Republicans at Chicago rally – WGN

February 17, 2016

No Comments

She forgot to mention that she got $280,000 for one speech to GTCR, Rauner’s old firm!

Illinois Dems pass union arbitration bill, but can they override a veto? – INN

February 17, 2016

No Comments

Chicago Tribune names Bruce Dold as new editor; Gerould Kern to retire – Chicago Tribune

February 17, 2016

No Comments

Comment: Separately, Dold said he wants to “cover the hell” out of politics. Let’s hope Dold recognizes how poorly the fiscal crisis is covered.Political reporters just don’t understand fiscal issues well enough to cover them.

Illinois governor seeks power to balance state budget – Reuters

February 17, 2016

No Comments

Business groups respond to Governor’s budget address – Illinois Review

February 17, 2016

No Comments

Full Text of Governor Rauner’s Budget Address

February 17, 2016

No Comments

I stand before you today with respect for our co-equal branches of government – acknowledgment of our shared responsibility for the future – and a deeply-rooted desire to work with each and every one of you to right our ship of state. Although we succeeded last year in eliminating an inherited $1.6 billion budget hole without a tax hike, we are now in our 8th month without a state budget – and court orders are forcing us to spend beyond our means. Shocking, yes. Acceptable, not even close. For more than two decades, we’ve had unsustainable unbalanced budgets, undisciplined spending,

Madigan’s law: Politicians prosper as Illinoisans feel pain Illinois Policy

February 17, 2016

No Comments

State lawmakers have effectively exempted themselves from the consequences of budget gridlock.

University of Chicago to Get $50 Million From Venture Capitalist – The New York Times

February 17, 2016

No Comments

Rep. Ives: Don’t be duped by DuPage consolidation claims – Reboot

February 17, 2016

No Comments

42% of Illinoisans would like to move to another state, Gallup poll shows – Illinois Policy

February 17, 2016

No Comments

A recent Gallup poll found residents in states with higher tax burdens are more likely to want to move. Illinoisans are the third-most-likely to say they would prefer to move permanently to another state.

A group of House Democrats are proposing President Barack Obama’s birthday become the next state holiday – A.P.

February 17, 2016

No Comments

Bill sponsor Rep. Andre Thapedi says President Obama’s distinctions as a Nobel Peace Prize winner and first black president of the United States are reasons to honor him.

Illinois governor’s new budget aims to keep schools funded – Reuters

February 17, 2016

No Comments

Rauner union dues order among pending U.S. Supreme Court cases – Daily Herald

February 17, 2016

No Comments

A U.S. Supreme Court case that could affect Gov. Bruce Rauner’s move to do away with unions’ so-called “fair share” payments is among those thrown into question by the death of Justice Antonin Scalia.

Illinoisans see 2nd-worst income growth in the nation since recession – Illinois Policy

February 16, 2016

No Comments

While Illinoisans’ incomes have flatlined since the recession, state tax revenue has grown by more than that in almost every state in the nation.

Extra cost of CTA pension express: $2.7M in fees [Part 3 of series] – Sun-Times

February 16, 2016

1 Comment

The fees are on top of the pensions paid in 2014 to 19 CTA board retirees, including top White House aide Valerie Jarrett, who made $11,132 in payroll deductions into the board’s pension fund and began drawing a $35,660-a-year pension at age 50. Jarrett, now 59, has been paid more than $306,000 stemming from the nearly eight years she served as the CTA’s part-time board chair, records show.

What’s Behind That Crop of Chapter 9 Petitions in Nebraska? – Bloomberg Briefs

February 16, 2016

No Comments

“One of the reasons Nebraska has more of these than anywhere else is because of the sheer volume of municipal entities formed.” Comment: Sound familiar? Illinois has more units of government by far than any other state.

Effects of the Budget Stalemate on Revenue and Spending at the Midpoint of Fiscal Year 2016 – U of I Inst of Government & Public Aff.

February 16, 2016

No Comments

“It will take more than a handshake, a vote and a signature to restore spending in FY16 to FY15 levels. There is a $6.6 billion deficit to deal with. Already over seven months into FY16, it is hard to imagine any new sources of sustainable revenue that could be adopted and cover a gap of this magnitude.”

Union-backed bill Rauner says would cost taxpayers billions is resurrected – Illinois News Network

February 16, 2016

No Comments

House Bill 580 is similar to Senate Bill 1229 that failed to overcome Rauner’s veto by only a few House votes. If passed, it would treat the members of the American Federation of State, County and Municipal Employees Council 31 like law enforcement or firefighters in that they would not be off the job in the event of an impasse in contract negotiations.

Companies across the U.S. are flocking to the University of Illinois Research Park – Crain’s

February 16, 2016

No Comments

About 150 miles south of Chicago, past open fields and small-town water towers like pushpins on the Illinois map, you’ll find a surprising corporate outcropping. Twenty-five big-name businesses—from Dow Chemical to Yahoo—have set up shop in a cluster of buildings at the University of Illinois Research Park in Champaign.

School of Debt: How to Bankrupt Public Education, Chicago-Style – Bloomberg

February 16, 2016

No Comments

“Nowhere else in American public education have local mismanagement and Wall Street engineering collided so spectacularly.”

Clout-heavy contractor to extend 26-year grip on city towing business – Chicago Sun-Times

February 16, 2016

No Comments

The Principal’s Principles: CPS principal speaks out about pension crisis – WGN

February 16, 2016

No Comments

The Civic Federation Has Lost Its Way – WP Original

February 15, 2016

24 Comments

By: Mark Glennon* The Civic Federation had a long, proud history providing an important check on state and local financial management. It sounded the alarm loudly long ago about Illinois’ problems: “Doomsday is here,” said its President, Laurence Msall, six years ago. No more. A noticeable change occurred about three or four years ago. Since then, the alarms have softened. Critical issues are overlooked or given lip service. Limp pension reform proposals dominate. Dire implications of its own research pass without comment. Now, it has worsened. The Civic Federation has become part of the problem. Last

Math Ain’t Magic: Playing With Numbers Doesn’t Make Pensions Cheaper – Stump

February 15, 2016

No Comments

CAT CEO’s warnings 4 years later: Illinois on downward slide as predicted – Illinois Policy

February 15, 2016

No Comments

Illinois politicians ignored Caterpillar CEO Doug Oberhelman’s 2012 plea for pro-growth reforms, and Illinois is the only state in the region to have lost manufacturing jobs on net over the last four years.

In U.S., State Tax Burden Linked to Desire to Leave State – Gallup Polling

February 15, 2016

No Comments

Residents living in states with the highest aggregated state tax burden are the most likely to report they would like to leave their state if they had the opportunity. Connecticut and New Jersey lead in the percentage of residents who would like to leave their state.

Can telehealth keep nursing-home patients out of hospitals?- Blue Sky Chicago

February 15, 2016

No Comments

Comment: Yes, and Illinois should be all over this.

Chicago and Mexico City explore new paths for economic growth – Brookings Institution

February 15, 2016

No Comments

Comment: Not very clear what concrete results emerged.

2 Investigators: How The CPS Pensions Turned Into A Budget Mess – CBS Chicago

February 15, 2016

1 Comment

Comment: If we had a buck for every article wasted on the history of our fiscal mess, the problem might be solved. The history matters little. The solution is the issue.

Kumbaya Won’t Fix Illinois – WP Original

February 14, 2016

9 Comments

By: Mark Glennon* “Politicians, do your jobs.” “Compromise.” “Can’t we all get along?” In the endless repetition of calls like that, the underlying thought is that “passing a budget” means spending cuts now painfully felt will go away. They won’t. They can’t. It doesn’t matter whether one or the other side caves completely or they split the difference — for a number of years, that is, until longer term solutions hopefully can pass and take hold. As Comptroller Leslie Munger recently pointed out, if we tried to cover current operations from an income tax increase, the

Higher education funding: time to play offense – Opinion – The Southern

February 14, 2016

1 Comment

They should have added that 50% of state higher education money is going to pensions.

Chuck Sweeny: State money isn’t coming back, agencies – Journal Standard

February 14, 2016

No Comments

The money that social service agencies, state colleges and universities are owed by the state is not likely to show up, and new money is not likely to flow to them, either. This is the new normal.

Jim Nowlan: The complicated, exasperating matter of school funding – The Daily Journal

February 13, 2016

No Comments

“Speaker of the House Mike Madigan has scheduled Soviet-style show hearings on the topic.”

CTA execs ride the pension express – Sun-Times

February 13, 2016

No Comments

The Chicago Transit Authority has spent nearly $94 million over 15 years on a retirement program that has allowed former CTA executives to start collecting lucrative pensions in their late 40s and early 50s while also getting paychecks from other government jobs, a Chicago Sun-Times and Better Government Association investigation has found.

Emanuel tries to resurrect O’Hare express train plan – Chicago Tribune

February 13, 2016

No Comments

Aviation Commissioner Ginger Evans said Friday the city will look for a private company to cover construction costs and operate the system, but it’s likely public money would go into building stations at the airport and downtown if the project moves ahead.

Illinois Democrats revive union arbitration legislation that would cut Rauner out of contract negotiations – Illinois Policy

February 13, 2016

No Comments

Through House Bill 580, Democrats in the General Assembly take a second run at removing Gov. Bruce Rauner from contract negotiations with AFSCME.

S&P downgrades College of DuPage credit rating – Chicago Tribune

February 13, 2016

No Comments

Intricacies of Chicago Landlord Tenant Ordinance sparking rash of lawsuits over technical violations – Cook County Record

February 13, 2016

No Comments

A rash of lawsuits against landlords under the Chicago Residential Landlord Tenant Ordinance has led to questions over whether the ordinance, which governs relations between apartment dwellers and their landlords in the city of Chicago, may need reform. “For a long time I’ve been advising my landlords who don’t want to be professional landlords to sell their properties and get out of Chicago,” said a landlord/tenant lawyer.

Politicians Love Lincoln, but Maybe Not Enough to Pay for Lincoln Scholarship – NYT

February 13, 2016

No Comments

Record number of new downtown apartments – Crain’s

February 12, 2016

No Comments

Developers will complete a record 4,000 apartments downtown this year and almost 5,000 in 2017, a nearly 28 percent increase in supply, according to Appraisal Research Counselors.

Energy experts at SIU warn federal regulations could devastate Southern Illinois’ economy – WSIL

February 12, 2016

No Comments

Comment: Illinois stands alone in not even measuring the cost of various clean energy alternatives. Inexcusable. See our earlier article linked here.

Private donations to renovate governor’s mansion total over $1 million – A.P.

February 12, 2016

No Comments

Chicago Sun-Times Chairman Sagan works to keep the newspaper “viable” – Crain’s

February 12, 2016

No Comments

Sun-Times Holdings Chairman Bruce Sagan said he isn’t focused on whether the Chicago Sun-Times will ultimately fold into its larger rival, Chicago Tribune, now that the two papers have owners in common. Instead, he’s all about keeping the Sun-Times “viable,” in the face of shrinking industry revenue and circulation.

CPS students walk out of class to protest budget cuts – WGN

February 12, 2016

3 Comments

Sorry, kids. Gotta pay the pensions.

Be wary of who circles in the CPS desperate hours – Kristi Culpepper – Crain’s

February 12, 2016

No Comments

“It is not an accident that bond market professionals are willing to escort governments with significant structural problems down this path. Short time horizons and desperation are a lucrative business for advisory and law firms. Their fees are typically financed through the bond issue in question and, for large borrowers like Chicago, can run into tens of millions of dollars.” Comment: Culpepper is a diamond in the rough — somebody who knows the muni bond industry but has the courage to speak up. We link to her stuff about Illinois whenever we see it. Perhaps her best line here is

SIU small business center to close due to no Illinois budget – Wand

February 12, 2016

No Comments

They ‘take the cake’: Some assumptions in Chicago Firefighters’ pension – Truth in Accounting

February 12, 2016

No Comments

There are a number of remarkable expectations in these projections, including a six-fold increase in plan assets, which are projected to reach $6.8 billion in 2041 (up from $1.0 billion in 2014). And the ‘statutory contribution’ is projected to rise from $109 million annually (about twice as high as employee contributions) to about $470 million annually (about six times as high as employee contributions).

A huge coal miners’ pension plan is on the brink of failure. One senator is blocking a fix. – The Washington Post

February 12, 2016

1 Comment

“The mineworkers’ pension funds are not the only one in danger of foundering. The Labor Department has placed hundreds in other industries on its list of funds in such poor condition that benefits may be reduced.” Comment: Just a reminder that severe problems with defined benefit pensions aren’t limited to the public sector.

Rally Held at Northern Illinois University to Support a State Budget – MyStateLine

February 11, 2016

No Comments

Comment: The misunderstanding reflected here, which is epidemic, is that passing “a budget” means the painful cuts will be restored. They won’t be. We’re running a $6.2 billion annualized excess of expenses over revenue, even with the cuts in place, and excluding the massive pension underfunding. “Compromise” to get a budget won’t help much and nobody wants a tax increase big enough to cover it all.

IL congressional delegation push for $1.6 billion defense facility in Southern IL – A.P.

February 11, 2016

No Comments

Why Is Illinois Struggling, Anyway? – Chicago magazine

February 11, 2016

No Comments

Comment: The article certainly isn’t true to the headline.

Chicagoans paying 50% tax rate on raw price of gas – Illinois Policy

February 11, 2016

No Comments

While gas prices have dropped to a 12-year low in Illinois, Chicagoans pay $0.32 more per gallon than the state average due to multiple layers of city, county and state taxation.

Police, fire pensions still a thorn for Alton – The Telegraph

February 11, 2016

No Comments

Comment: With a ratio of inactives to actives of almost 2:1, unfunded actuarial accrued liability of $45,173,850 — a 30% funded ratio, yes, you can call that a “thorn.” Alston is hardly unusual. Illinois is a thorn garden.

Pennies on the Dollar: How Illinois Shortchanges Its Teachers’ Retirement – TeacherPensions.org

February 11, 2016

No Comments

Great study showing how the system is rigged for gluttony at the top and hardship at the bottom. See our own article about the study linked here.

New Study Details Illinois Pension Excess at the Top, Hardship Below – WP Original

February 11, 2016

13 Comments

By: Mark Glennon* Public union leaders forever pound their chests about wealth inequality and how our pension system protects the middle class. In fact, Illinois public pensions may be the worst tale of two cities. The gluttony bankrupting us is at the top, which includes union leadership, but it’s very a very different story for the rest. A great new research piece on Teacherspensions.org, a project of Bellweather Education Partners, looks at it for Illinois teachers. Remember from earlier stories that the average member of the state’s teacher retirement system retiring now after working 33 years for

Editorial: Hey, Governor, it ain’t workin’ – Chicago Sun-Times

February 11, 2016

4 Comments

Comment: “The only road forward is through compromise,” the article says. Compromise will will speed the spiral down. The opposite it true. The list of radical reforms needed immediately must be expanded — bankruptcy for many municpalities, pay cuts, layoffs, slashed pension payments. The crisis is now spinning out of control and a state of emergency should be recognized by all.

Chicago City Council passes weakened oversight ordinance at Burke’s bidding – Illinois Policy

February 11, 2016

No Comments

Walgreens to sell heroin OD remedy Naloxone over the counter – abc7chicago

February 11, 2016

No Comments

Comment: Just another indication of the severity of the heroin crisis, which, as a primary cause of crime and gang activity, is helping undermine the entire economy.

Council OKs weakened inspector general ordinance – Chicago Sun-Times

February 10, 2016

2 Comments

Disgraceful.

Chicagoan Valerie Jarrett reviews nine years ago today – Illinois Review

February 10, 2016

No Comments

Comment: TR, especially, would especially love this one: “He has protected more natural resources than any previous president.”

Overprescribing opioids: Illinois’ workers’ compensation system puts doctors’ and patients’ interests at odds – Illinois Policy

February 10, 2016

No Comments

Illinois’ workers’ compensation system’s physician medication-dispensing rules provide incentives for physicians to overprescribe opioid pain medication to workers’ compensation patients.

President Carter’s speech nearly 40 years ago touched on themes being discussed today – INN

February 10, 2016

No Comments

Chicago area companies, such as McDonald’s and United, predict falling 2016 revenue – Crain’s

February 10, 2016

No Comments

Financial forecasts for 2016 predict another year of falling sales at most of the largest companies based here, from McDonald’s to United Airlines to Mondelez and even Boeing.

Rauner to Dems: Work with me or pass tax hike – Madison County Record

February 10, 2016

No Comments

Illinois Fire and Police Pension Actuary Facing Actuarial Discipline – WP Exclusive

February 9, 2016

10 Comments

By: Mark Glennon* WirePoints has learned that the Actuarial Board of Counseling and Discipline (the ABCD) recently recommended that Timothy Sharpe, actuary to dozens of troubled Illinois fire and police pension funds, be expelled from membership in the American Academy of Actuaries. If the Academy implements the recommendation, it will be very unusual since only 11 actuaries have been expelled from the Academy since 1975 and only 20 have been otherwise publicly disciplined (http://actuary.org/content/public-discipline). The recommendation is the result of separate complaints by two actuaries, one by actuary Tia Goss Sawhney. Those complaints followed three prior complaints,

Supreme Court Deals Setback to Obama’s Power Plant Regulations – The New York Times

February 9, 2016

No Comments

The Supreme Court on Tuesday temporarily blocked the Obama administration’s effort to combat climate change by regulating emissions from coal-fired power plants. The brief order was not the last word on the case, which is most likely to return to the Supreme Court after an appeals court considers an expedited challenge from 29 states and dozens of corporations and industry groups. Comment: Pertinent to Illinois’ pending clean energy bills — a multi-billion dollar issue for Illinois consumers.

Wrath of Khan: The Sequel — Ex-Council IG blasts aldermen

February 9, 2016

1 Comment

What the council is doing here is completely tying his hands to make sure no one can look at what they’re doing. Menu money and worker’s comp programs are exactly the type of programs that an IG needs to look at. That’s where the fraud and waste comes from whether intentional or not. By refusing the IG, the City Council is thumbing its nose at the taxpayers and saying they will do whatever they want. The bottom line fact is that the City Council doesn’t want oversight.”

Total student-loan debt in Illinois is approaching $50 billion – Illinois Policy

February 9, 2016

2 Comments

Fight or Flight? – WP Original

February 9, 2016

4 Comments

By: Mark Glennon* Boy, do I get emails here. A regular one in particular makes me squirm. It’s not any of the insults like “vulture capitalist” or “pension thief.” Those are fine. Have at it. It’s when I’m asked by Illinoisans, usually young ones, whether they should leave. I’m uncomfortable playing career planner, especially when financial interests have to be balanced against personal issues like leaving one’s home and family. Most importantly, there’s no single answer. But I can’t escape the question, especially when asked what I am doing. Let’s take the economic self-interest matter first

The Incredible Shrinking Illinois – Chicago Magazine

February 9, 2016

No Comments

“Counties with colleges are growing, but the rest of the state is losing population—and it could prove costly.” “Could” prove costly?

Chicago Teachers Union Responds to Gov. Rauner’s Attempt at State Control of Chicago Public Schools

February 9, 2016

No Comments