By: Mark Glennon*

This one was so easy to see coming we can only say, “Duh,” instead of our usual “Told you so.”

Last year, Chicago lawmakers wanted a way to soften the blow of the city’s recent property tax increases, or at least make it look softer. Singling out the city wasn’t workable, so they got Springfield to pass increases in the homeowners and senior exemptions for all of Cook County.

The Chicago Tribune last week detailed the actual results. The broadened exemptions merely shifted the tax burden to to other properties. Many properties were taken off the tax rolls entirely, leaving the remainder to pay the bills. The levy — total taxes raised — didn’t drop. The consequence has been a “perfect storm,” the Tribune says, for many communities already in a property tax catastrophe.

We weren’t the only ones who saw that coming. The Daily Herald and Illinois News Network, among others, wrote about it. We said it was a wonderful illustration of rampant idiocy in the Illinois General Assembly.

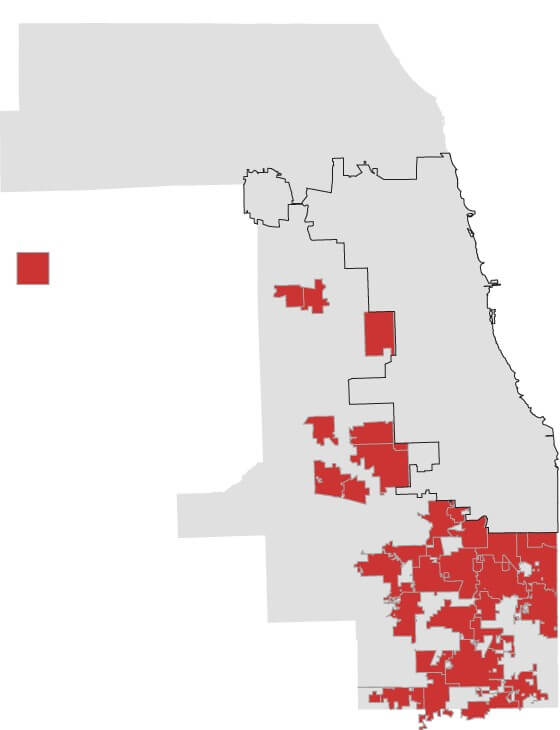

The actual effect of the stunt has been particularly pronounced in Chicago’s south suburbs, which are largely working class and African-American. The map of Cook County on the right is from the Tribune article. Communities shown in red lost more than 5% of their equalized assessed value, which is basically their property tax base.

Their situation was already beyond impossible. We wrote here three years ago about its average property tax rates in the south suburbs — which then already exceeded 5% — robbing hundreds of thousands of families of their home equity.

For commercial properties it’s even worse — far beyond absurd. Commercial rates in Cook County generally are 2.5X the residential rates. In some south suburbs, as the Tribune reported, commercial property owners end up paying the same amount in taxes over seven years as they did for the property itself.

The Tribune profiled one business owner, Tony Sanchez, who owns a paving company. “The Markham property he’s owned for decades has an assessed value of about $511,000. This year, his tax bill topped $86,000 — more than three times as much as he would be paying for a Chicago business property worth the same amount.”

The anointed champions of Illinois’ working class and minorities are anything but.

*Mark Glennon is founder and executive editor of Wirepoints.

A set of state lawmakers want to extend CPS’ current school closing moratorium to February 1, 2027 – the same year CPS is set to transition to a fully-elected school board. That means schools like Manley High School, with capacity for more than 1,000 students but enrollment of just 78, can’t be closed for anther three years. The school spends $45,000 per student, but just 2.4% of students read at grade level.

A set of state lawmakers want to extend CPS’ current school closing moratorium to February 1, 2027 – the same year CPS is set to transition to a fully-elected school board. That means schools like Manley High School, with capacity for more than 1,000 students but enrollment of just 78, can’t be closed for anther three years. The school spends $45,000 per student, but just 2.4% of students read at grade level.

Hopefully, all media will get the message, in Illinois, too.

Hopefully, all media will get the message, in Illinois, too. Ted joined Tom Miller of WJPF to talk about Illinois’ highest-in-the-nation property taxes, why lawmakers don’t want to touch the tax’s cost drivers, just how much Illinoisans’ tax burden has grown over the decades, why Gov. Pritzker failed to meet his promise to reform property taxes, and more.

Ted joined Tom Miller of WJPF to talk about Illinois’ highest-in-the-nation property taxes, why lawmakers don’t want to touch the tax’s cost drivers, just how much Illinoisans’ tax burden has grown over the decades, why Gov. Pritzker failed to meet his promise to reform property taxes, and more.

“Legalized” robbery. Chicago’s gentrification and soaring property values are coming at the direct expense of Cook County suburbs. The metro area is a zero-sum game… unlike Los Angeles, San Francisco, New York and others, there is little real growth happening here, largely due to heavy and unfair taxation.

Almost $14,000 property tax for a house in country club hills? You gotta be kidding, a house whose value is decreasing in a town that is deteriorating. Time to sell it, but who would buy it with those taxes?

Yet, the “frogs” in the south suburbs are being boiled alive and either don’t know or don’t care. Could it be that the school districts, which levy about 70% of property taxes, are holding parents of students and students for hostage, that any rebuke of their spending/pensions/pension short-fall, will result in shaming and even student failure? Or could it be nobody much cares if they are renting from the local governments? Who knows anymore?

Happening in Proviso and Leyden west suburbs as well…