By: Ted Dabrowski and John Klingner

Illinois state pensions are getting all the attention as a result of Gov. J.B. Pritzker’s budget speech, but don’t forget Chicago pensions. Believe it or not, they’re in even worse shape than the state pension plans.

Moody’s has just released a warning of sorts to governments with the worst-funded public pension plans, especially those relying on riskier-than-usual strategies to meet their investment targets. In “Market volatility underscores risk of high pension investment return targets,” Moody’s worries that major stock market drops, like the kind seen late last year, will damage what little liquidity those funds have, and eventually, the credit rating of their sponsor governments.

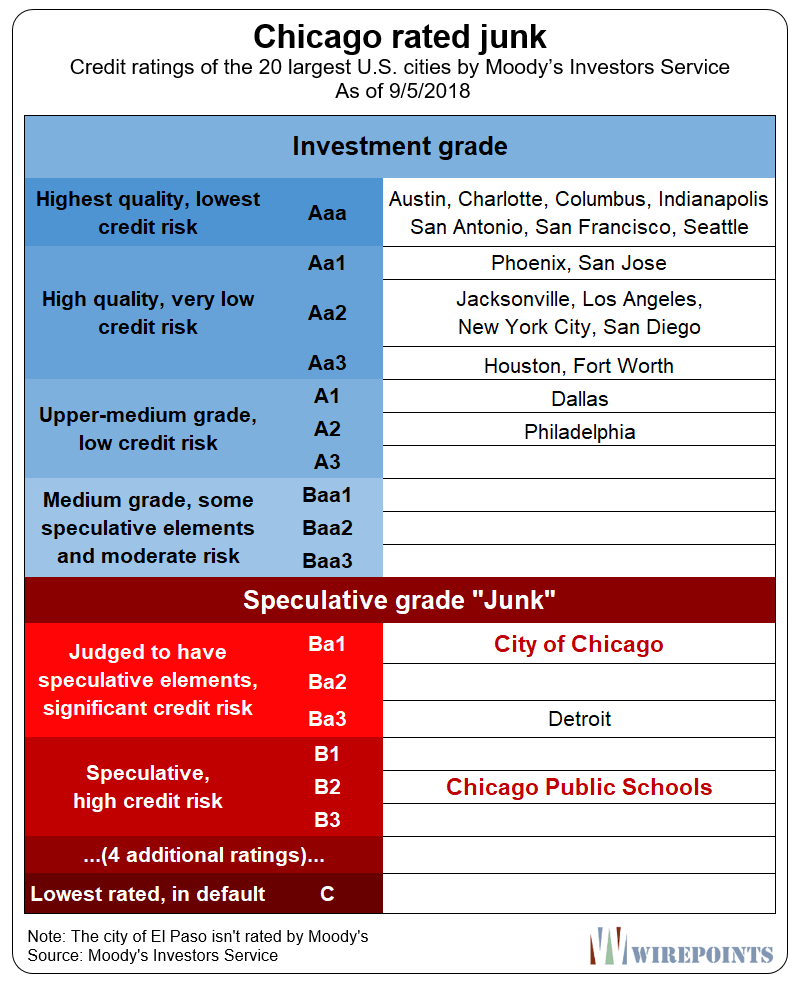

Chicagoans will want to heed Moody’s pension warning. The city is already junk-rated by Moody’s and the situation in the Chicago Public Schools is far more dire: the district is five notches deep into junk territory (see chart in the appendix). Any major stock market drop that creates a cash crunch for the city will send politicians scrambling to plug the pension plans with billions in additional taxpayer dollars.

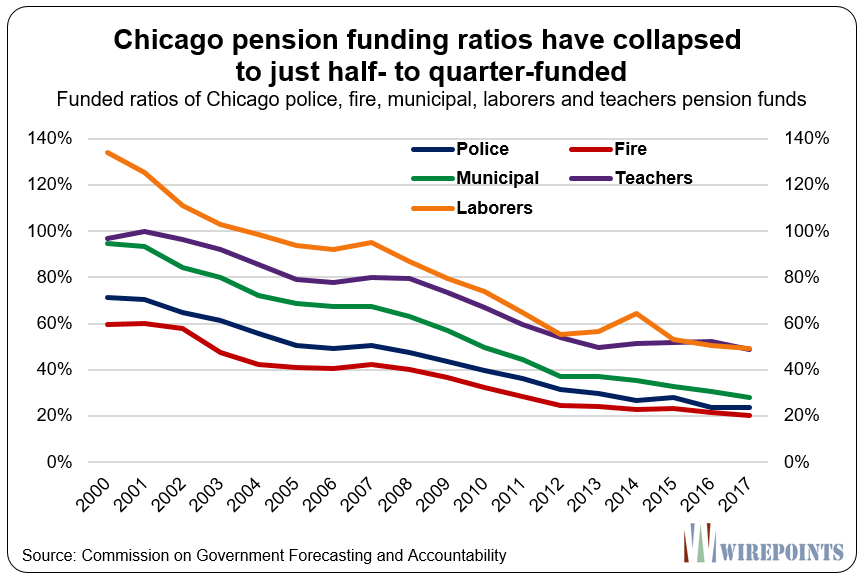

The city’s pension funding levels have collapsed since 2000 and are now among the nation’s worst. The Chicago fire pension plan has just 20 percent of the funds it needs today to meet its future obligations. The Chicago police fund is not far behind. It is just 24 percent funded. And the city’s municipal pension plan is just 28 percent funded. All of those funds in any private sector setting would be deemed insolvent and bankrupted immediately. The graphic below captures the dramatic collapse of Chicago pensions since 2000.

To analyze how bad things have gotten, let’s consider just one of the funds – the Chicago police pension fund.

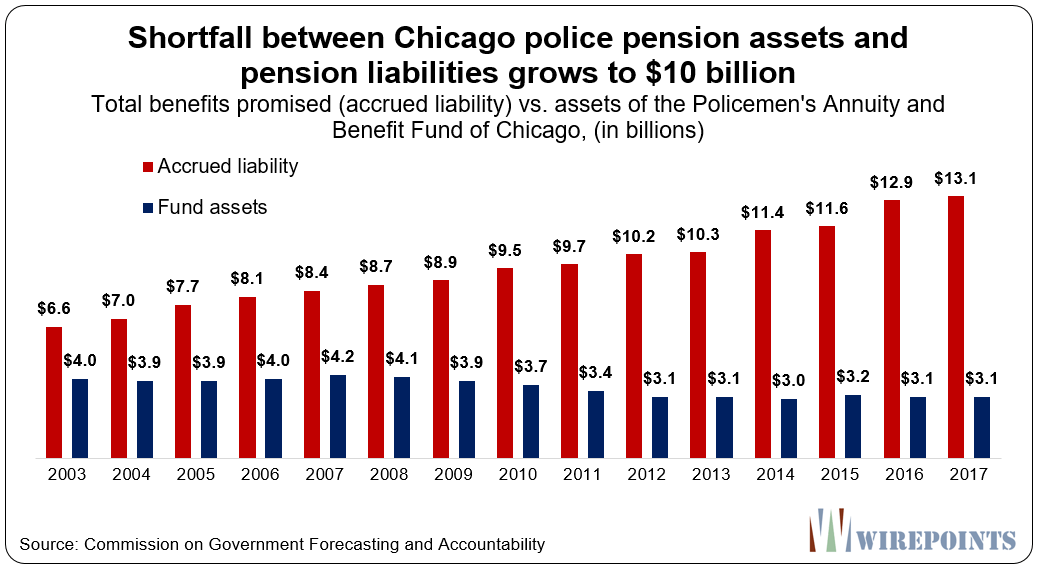

The police fund now owes some $13.1 billion in already-earned benefits to active workers and retirees. Those total promises have grown at 5 percent yearly since 2003, a rate that’s more than twice the pace of inflation. In contrast, the asset base continues to shrink, dropping by more than 20 percent over the same period.

The official shortfall now stands at $10 billion and the funding ratio is at 24 percent ($3.1 billion divided by $13.1 billion).

The danger for the fund has risen as stock market swings have gotten larger. Moody’s estimates in its report that pension funds with calendar fiscal-year ends, like those in Chicago, posted investment losses for the 2018 year. Based on what Moody’s call its composite portfolio, funds like Chicago may have lost “as much as 6 percent” of their portfolio, or nearly $190 million for the year.

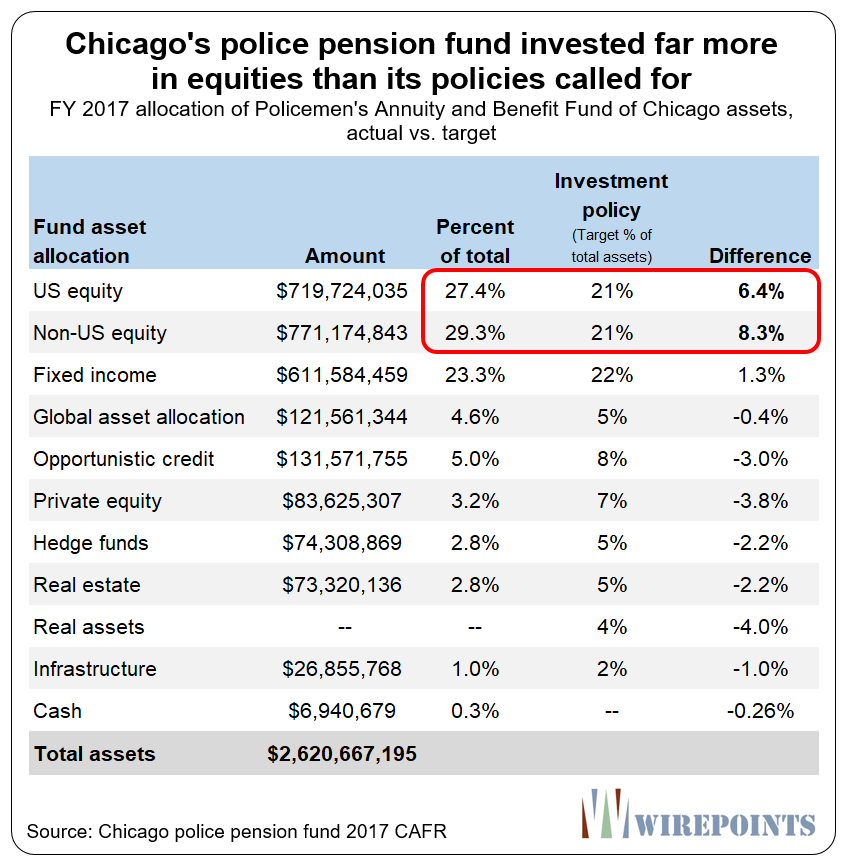

The real results could be better or worse for the police fund. We won’t know until final FY 2018 results are released. But the plan’s 2017 financial reports show the fund was running far higher equity investment risks than its policy typically called for.

The plans’ policy calls for no more than 42 percent of the total portfolio to be invested in U.S. and non-U.S. equities. At the time of the 2017 report, however, the fund had 57 percent of its assets invested in those equities, 15 percentage points more than prescribed by policy. The fund was certainly more exposed to the stock market at the time than it was supposed to be.

Which brings us back to Moody’s concerns. Assume that the police fund did lose 6 percent on its investments, or about $187 million, in 2018. Add that loss to the fact that the fund paid out more in benefits and fees, $773 million, than it took in in total contributions, $663 million. In total, the fund’s assets could be down by as much as $300 million, or nearly 10 percent.

Chicago’s police fund can’t afford a drop like that. Expect that to play into Moody’s assessment of Chicago’s pension funds.

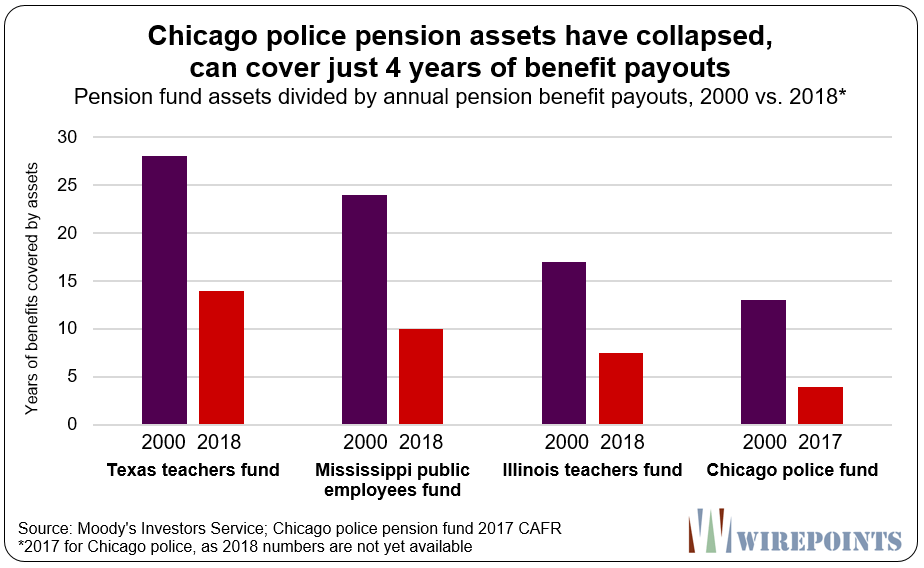

The ratings agency also calculated just how long a fund’s assets would last if no net new money came into the fund. It’s another way to compare different plans, or to see how things in one fund have changed over time.

The below graph shows how various funds have fared over time since 2000 and highlights the collapse in the Illinois Teachers’ Retirement System plan. In 2000, TRS had enough assets to cover about 17 years of benefit payouts. By 2018, the plan’s assets could cover just eight years of benefits.

What does it look like for the Chicago police fund? Wirepoints ran the numbers and found that in 2000, the fund’s assets could cover the next 13 years of payouts. At the end of 2017, they were just enough to cover four years.

Harbinger

Fortunately for the Chicago funds, early 2019 returns have reversed most of the market’s 2018 year end. The question is, will the stock market continue to rally, or were the market drops a harbinger of things yet to come?

Any more big losses like that and it won’t be good news for city pensioners. Or for the Chicago households that will be forced to bail out the near-insolvent funds.

Read more on Chicago’s pension crisis:

- A more likely reason Rahm Emanuel dropped out: the Chicago time bomb

- $125,000: The pension debt each Chicago household is really on the hook for

- Emanuel’s call for a constitutional amendment shouldn’t be narrowly construed

Key quotes from Moody’s report

“Unfunded pension liabilities could prove to be unaffordable for some governments in the event of another round of significant investment losses. Pension costs have risen significantly over the past decade, but most governments, including many with very high liabilities, have thus far managed to postpone material damage to their budgets and fiscal reserves through strong revenue growth and by deferring pension contributions. Market volatility potentially stands to further steepen the path of cost growth, however. Should this occur in combination with a recession, the higher costs will present a severe affordability challenge for some governments.”

“…recent market losses highlight the uphill credit challenge facing governments that rely on high-return/high-risk pension assets to cover a large portion of their pension benefit promises.”

Appendix

A set of state lawmakers want to extend CPS’ current school closing moratorium to February 1, 2027 – the same year CPS is set to transition to a fully-elected school board. That means schools like Manley High School, with capacity for more than 1,000 students but enrollment of just 78, can’t be closed for anther three years. The school spends $45,000 per student, but just 2.4% of students read at grade level.

A set of state lawmakers want to extend CPS’ current school closing moratorium to February 1, 2027 – the same year CPS is set to transition to a fully-elected school board. That means schools like Manley High School, with capacity for more than 1,000 students but enrollment of just 78, can’t be closed for anther three years. The school spends $45,000 per student, but just 2.4% of students read at grade level.

Hopefully, all media will get the message, in Illinois, too.

Hopefully, all media will get the message, in Illinois, too. Ted joined Tom Miller of WJPF to talk about Illinois’ highest-in-the-nation property taxes, why lawmakers don’t want to touch the tax’s cost drivers, just how much Illinoisans’ tax burden has grown over the decades, why Gov. Pritzker failed to meet his promise to reform property taxes, and more.

Ted joined Tom Miller of WJPF to talk about Illinois’ highest-in-the-nation property taxes, why lawmakers don’t want to touch the tax’s cost drivers, just how much Illinoisans’ tax burden has grown over the decades, why Gov. Pritzker failed to meet his promise to reform property taxes, and more.

Ted & John: Absolutely a fantastic article and the charts are so clear — frightening numbers, that’s for sure. Looking at the Investment policy target %s, it appears strategic and good, looks like the Harvard & Yale Endowment approach. Except that the ACTUAL stocks are nearly 60% ! In a big way, the investment return doesn’t matter so much, because it’s too late — assets are too small compared to Accd Liab. Cash contribs of $0.66M is already 50% of the $1.2B Payroll — imagine that, contributing 50% of Payroll to the pension plan !! (scariest fact, is that 7%… Read more »

Will the IL sports betting allow betting on a date when these plans collapse? You really need to wonder what the police union does behind closed doors with their members and retirees. Do they tell them not to worry? We have your back? Don’t worry…we have a plan? These are the guys with the guns. You’d think they’d be holding a few people hostage on the 5th floor. What happens when retirees start getting IOU’s? Do the ranks of police officers shrink…”I’m not working for promises! FU.” You have to really wonder where this sh1t show ends…

… and what’s really crazy is these liberal state pensioners are currently benefitting from and dependent on Trump continuing to lead a good economy, yet they probably despise him. I have no sympathy for those so ignorant they vote against their own self interests.

Dan: Trump’s done so much good for the economy and the media even lied saying it was a tax cut for the 1% — absolutely false. It was designed and enacted as a middle-class tax cut. Anyone whose financial life has been improved since 1/1/17, should do some research to learn the truth, and then vote accordingly next time. But 1/2 of voters will do neither.

The latest asset allocation sheet for the Police (PABF) shows assets of just 2.553 billion. Assuming this is for the 6/30/18 quarter end period, it is going to look extremely bad come fiscal year end reporting.