$30 million over four years: How teachers unions influence Illinois politicians. – Wirepoints

If you’re frustrated with Illinois’ educational results, you may want to follow the money from teachers unions. In the last four years alone, Illinois lawmakers and political candidates have taken nearly $30 million in contributions from teachers unions and their national affiliates.

If you’re frustrated with Illinois’ educational results, you may want to follow the money from teachers unions. In the last four years alone, Illinois lawmakers and political candidates have taken nearly $30 million in contributions from teachers unions and their national affiliates.

Wirepoints President Ted Dabrowski testified on April 10, 2024 to members of the House Revenue and Finance Committee at the invitation of Rep. Joe Sosnowski. Ted told lawmakers that the state’s property tax burden has become dire for countless Illinoisans.

Wirepoints President Ted Dabrowski testified on April 10, 2024 to members of the House Revenue and Finance Committee at the invitation of Rep. Joe Sosnowski. Ted told lawmakers that the state’s property tax burden has become dire for countless Illinoisans. Ted joined WLS 890’s PM Chicago Show to discuss Chicago’s worsening pension crisis, why the city’s crisis makes it such an outlier nationally, its negative impact on residents, government workers and retirees alike, and what Mayor Brandon Johnson should do about it.

Ted joined WLS 890’s PM Chicago Show to discuss Chicago’s worsening pension crisis, why the city’s crisis makes it such an outlier nationally, its negative impact on residents, government workers and retirees alike, and what Mayor Brandon Johnson should do about it. When has any company persisted with a project in the face of stronger local, statewide and national opposition? When have taxpayers subsidized a more harebrained project?

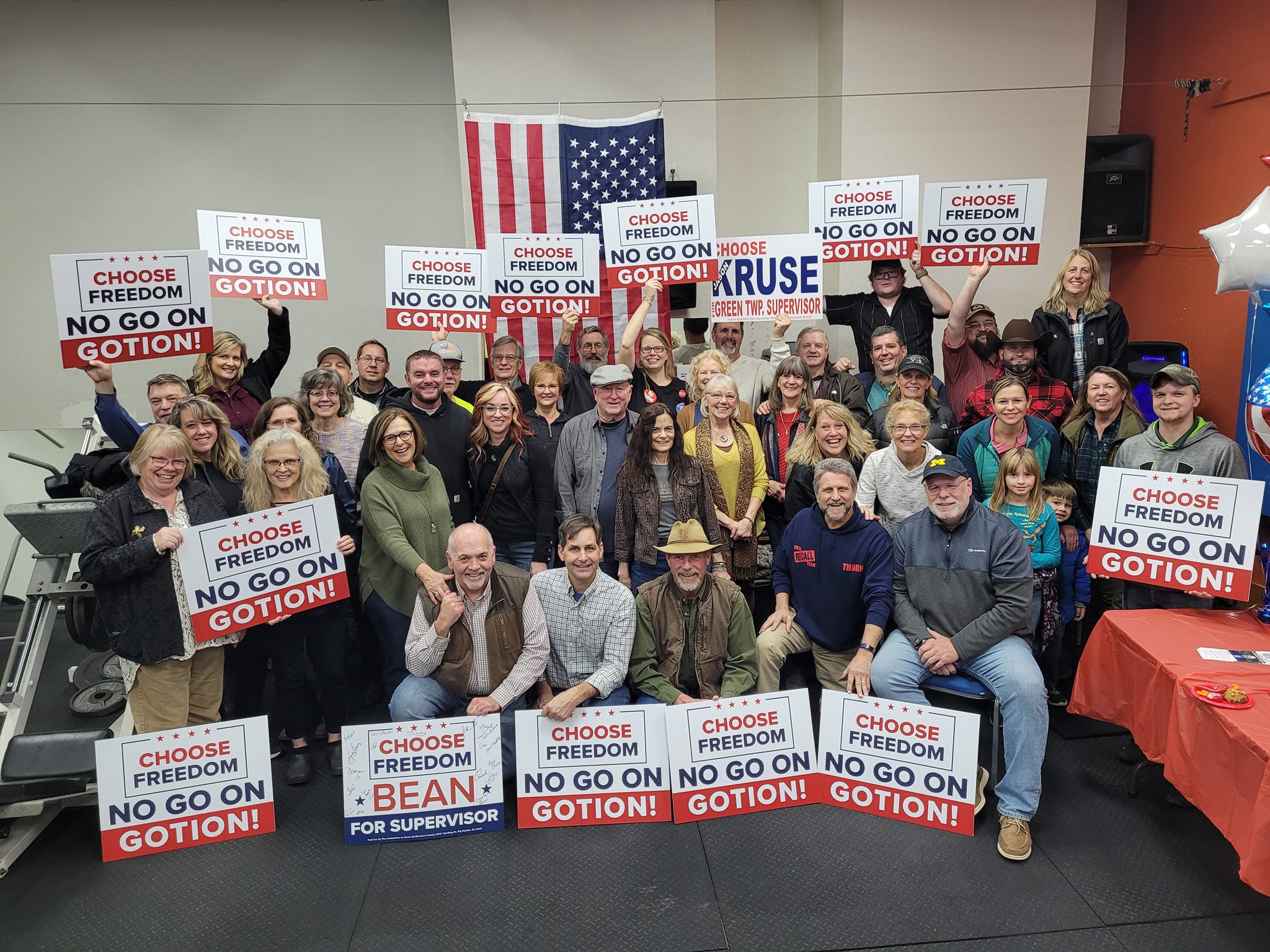

When has any company persisted with a project in the face of stronger local, statewide and national opposition? When have taxpayers subsidized a more harebrained project?

Mike, good question why we don’t have a new report. Last one dated as of 12/31/13 and it’s in particularly incoherent form. Gotta hide that ball while giving a pay increase.

I thought the county was negotiating for an increase in the employee pension contribution percentage? Or does the ILSC ruling mean you cannot raise the pension contribution rate because that counts as “diminished or impaired”?

Hard to determine what “additional 1 percent toward health care” amounts to with no context given. How much do they pay today?

I believe you are referring to Preckwinkle’s pension reform proposal that would provide for both reduced benefits and increased employee contributions. I think it’s clear that’s DOA because of the Supreme Court ruling.

The additional healthcare contribution in this, which is different, is probably OK because it’s part of a larger pay increase and presumably will be agreed to by the union.

The Cook County Pension Fund (CCPF) was 56% funded as of 2013. 2014 figures have not yet been released but should be shortly, aren’t they usually released by now? Either freeze raises until the pension is fully funded, or cut pension benefits, do something. Instead it’s have the cake and eat it too mentality. Reforms are never substantial enough or fair to the taxpayer. There is a Tier II for CCPF for those employes beginning their career January 1, 2011 or after, but reforms were not very substantial. http://www.cookcountypension.com/retiree_benefits/tier_2_retirement_annuity1.aspx CCPF is more officially known as County Employees’ and Officers’ Annuity… Read more »