By: Ted Dabrowski and John Klingner

The Commission on Government Forecasting and Accountability’s special pension report released this week shows yet again how strong markets and ever-more taxpayer funds can’t fix the flaws in the state’s politician-run pension system.

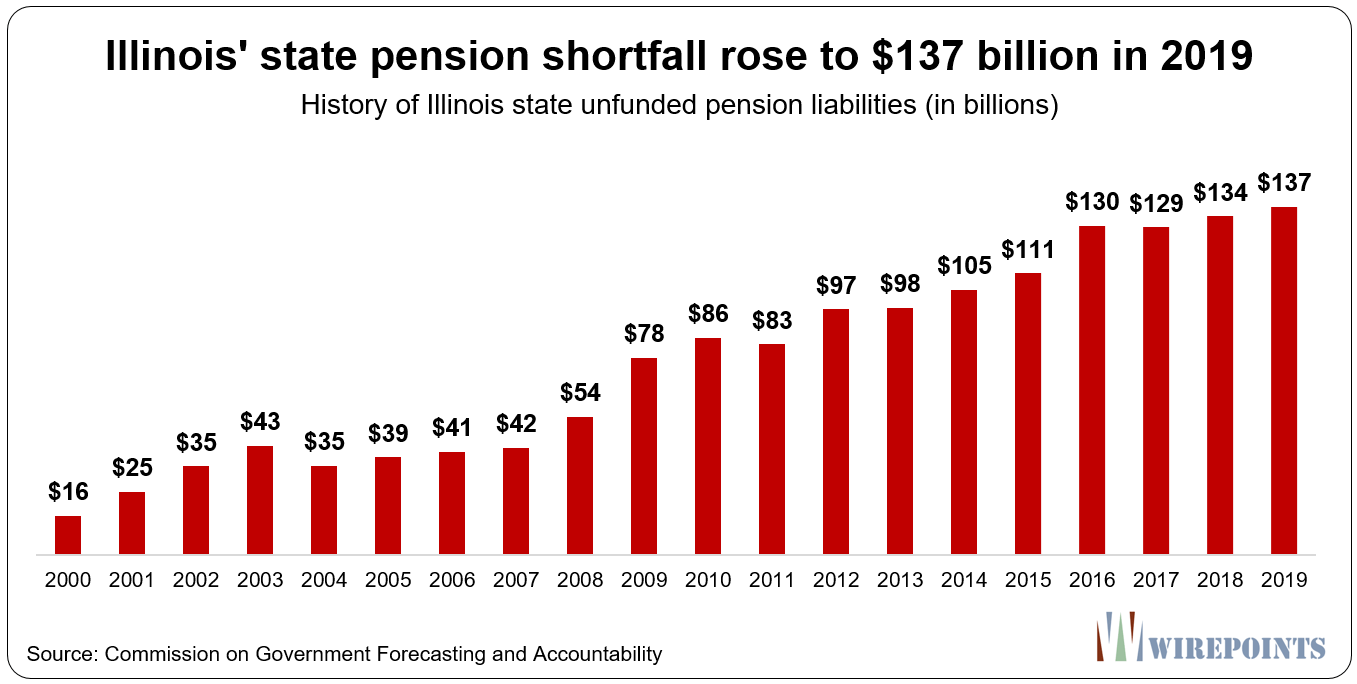

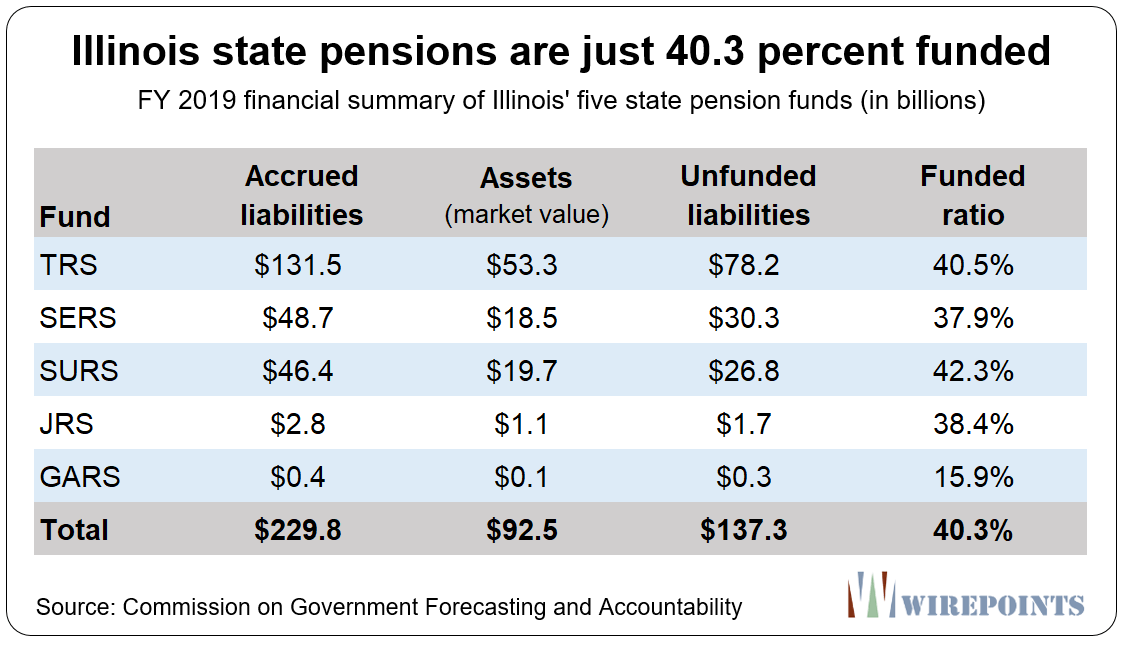

Illinois’ pension shortfall grew to a record $137 billion in 2019, up from $134 billion the year before. That increase continues a near unabated increase in pension liabilities since 2000, when the state’s shortfall was just $16 billion. Given Illinois politicians have shown no appetite to amend the constitution to reform pensions, the shortfall is likely to continue its upward trend.

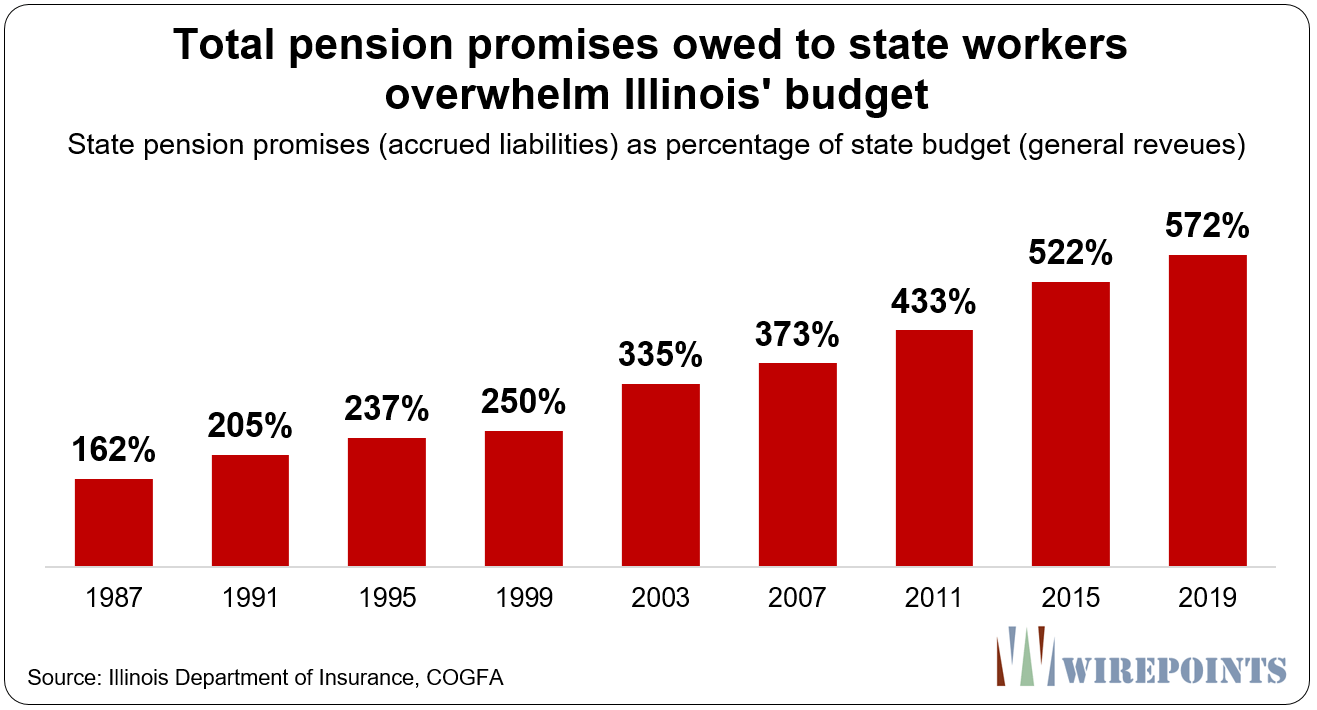

A lack of reform has taken a real toll on taxpayers and the ability of the state to meet its obligations to teachers, state workers, university employees, judges and lawmakers. The state’s accrued liabilities – the sum of the state’s yet-to-be-paid obligations to pensioners and active workers – has grown so quickly that they have overwhelmed the state’s finances.

That stress becomes quickly evident when those total pension obligations are compared to the state’s available tax revenues over time. Wirepoints covered that in our report Illinois state pensions: Overpromised, not underfunded.

In 1987, obligations to members of the five state-run pension funds was $18 billion, or 1.6 times more than the state’s then-general fund budget of $11 billion.

Today, the state’s obligations total $229 billion, or 5.7 times the state’s budget of $40 billion.

That growth in pension obligations has dwarfed the ability of state taxpayers to fund them.

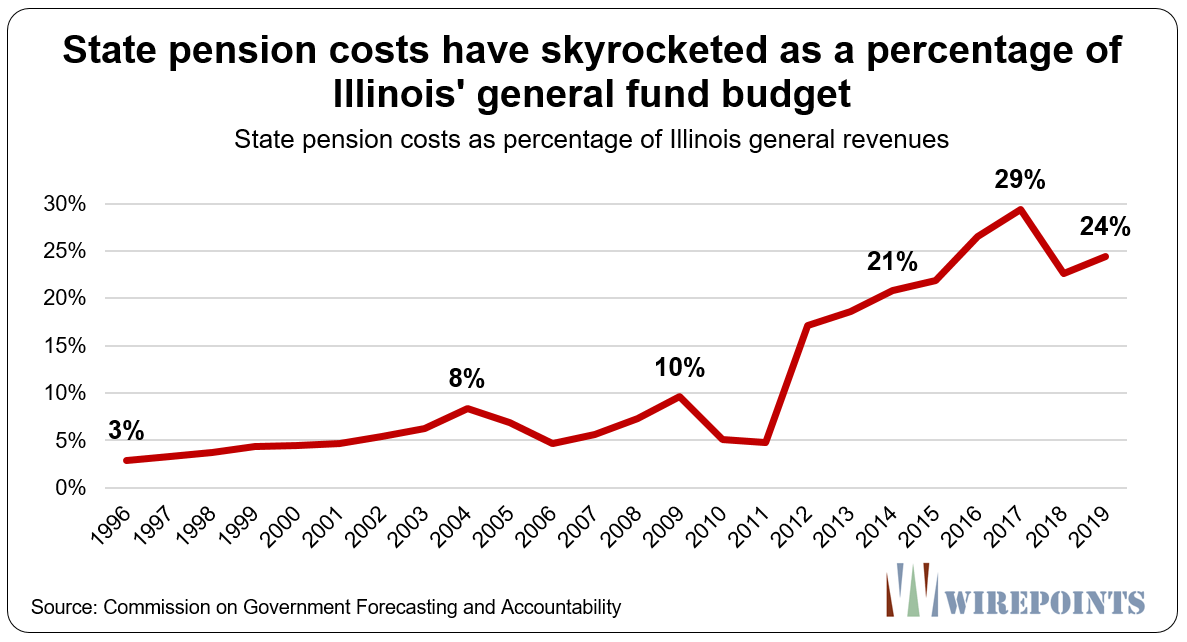

The lack of reform has also forced Illinoisans to contribute a record $10.1 billion in 2019 to pay for state pensions and the debt service on pension obligation bonds. Retirement costs now consume more than a quarter of the budget. No other state in the nation spends that much of their budget on pensions.

In contrast, Illinois taxpayers in 2009 paid just $3.2 billion toward pensions, or 10 percent of the budget.

Taxpayer contributions to pay for pensions have grown by about 13 percent annually since 2009, more than four times the rate of inflation.

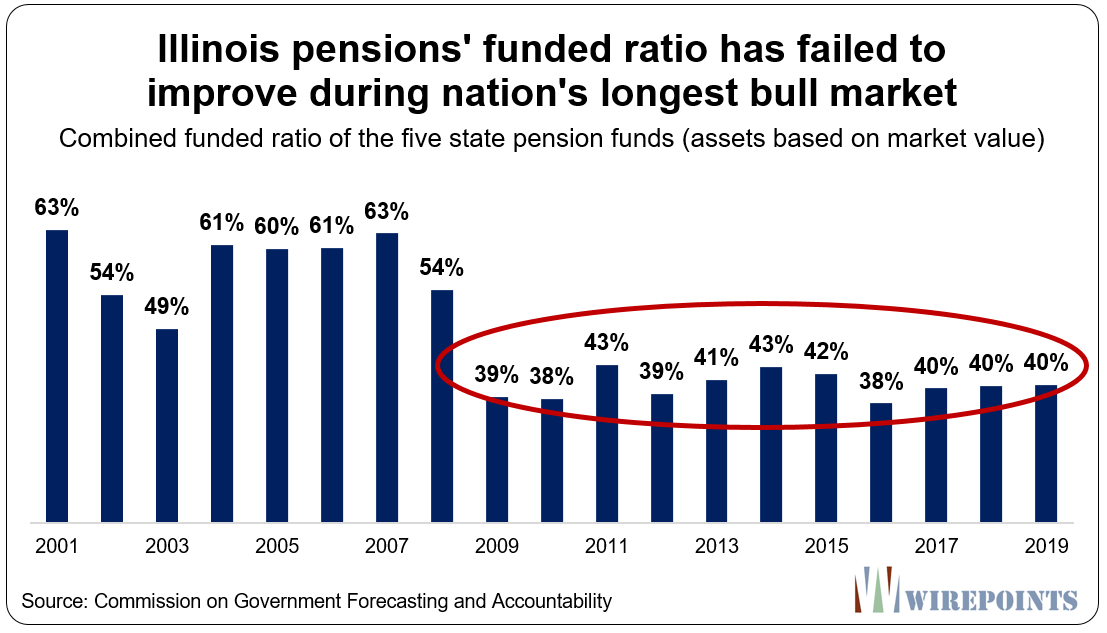

What’s most damning about the current pension system is that the nation’s longest-ever bull market (along with billions in additional state contributions) has done nothing to improve the nation’s worst pension crisis. The funded ratio for the state’s five plans has stayed virtually flat – at 40 percent – since 2009, even though markets are now almost four times higher compared to their lows of the Great Recession.

Illinois has the nation’s third-worst funded rate for pensions in the nation, according to Pew Charitable Trusts.

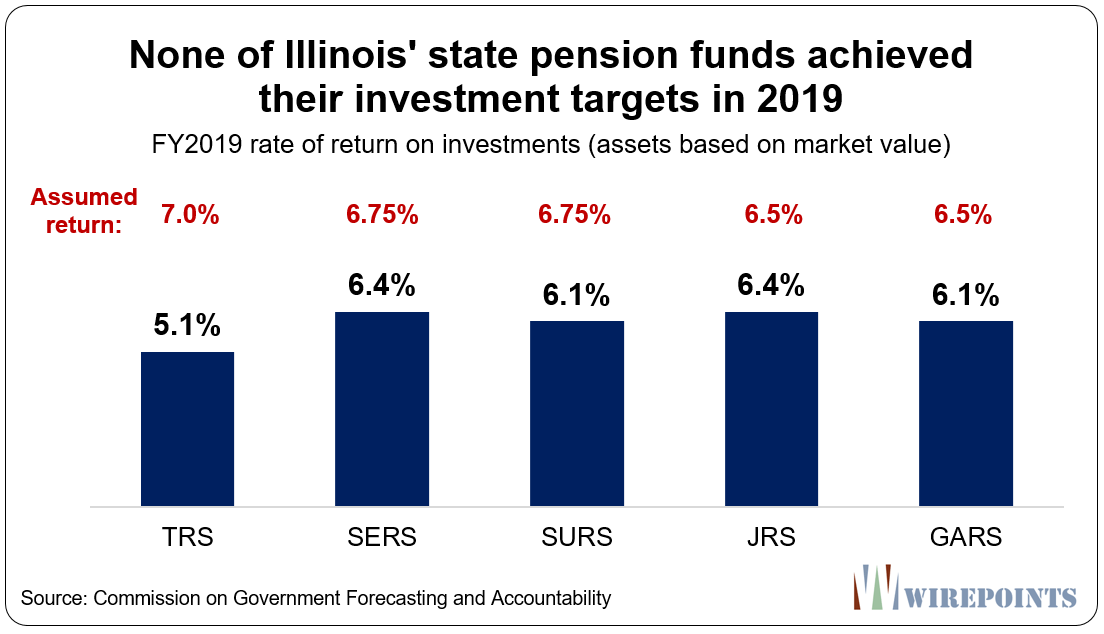

Contributing to this year’s failure was the pension systems inability to meet their investment goals in 2019. The Teachers Retirement Fund’s investments performed the worst, achieving a return of 5 percent compared to the fund’s assumed 7 percent return. And the State Universities’ Retirement System only managed a 6.1 percent return versus a target of 6.75 percent.

It’s worse than what they say

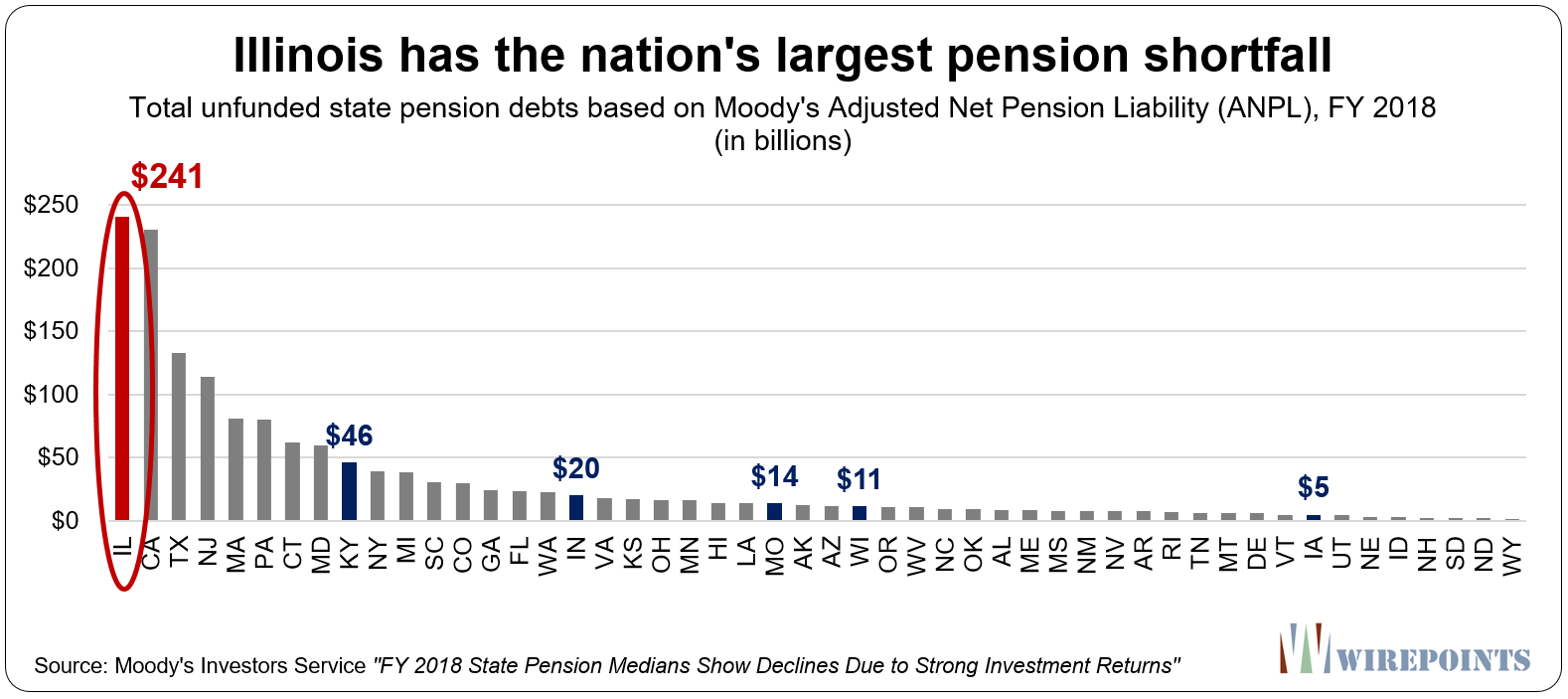

The state’s unfunded liabilities are now at a record $137 billion, nearly three times higher than when the Great Recession started in 2007. But the official numbers are far lower than what Moody’s Investors Service says Illinois’ true shortfall is.

Using more realistic investment assumptions, Moody’s calculates the shortfall for the five state-run funds at $241 billion. That’s the biggest pension shortfall in the nation.

What Moody’s says matters since it currently rates Illinois’ credit risk at just one notch above junk. Illinois has the worst credit rating of any state in the country, according to the agency. On top of that, Moody Analytics, a sister company, also recently found Illinois to be the nation’s second-least prepared state for a recession.

That’s particularly troublesome considering Illinois has another $121 billion in local retirement shortfalls, according to Moody’s, and $73 billion in retiree health debts, too.

Stark warning

Collectively, Illinois’ five pension systems have just 40.2 percent of the funds they need today to be able to meet their obligations in the future, up slightly from 39.8 percent the year before. The university employee fund, SURS, is the best funded of the five, at 42.3 percent, but its funded ratio fell by nearly 2 percentage points this year.

Most notable is the funding ratio for the state lawmaker pensions. Embarrassingly, it’s just 15.9 percent funded.

Wirepoints has remarked several times in the past about the stark warning the state’s pension trend shows: if retirement shortfalls in Illinois continue to grow during a period of remarkable stock market returns, imagine how those funds will fare when the next recession inevitably hits.

Politicians can continue to ignore the crisis, but ordinary residents are seeing their tax bills go up to pay for pensions – both at the state and local level. Just this week, Howmuch.net released a report highlighting the fact that Illinoisans now pay the nation’s highest combined state and local taxes.

Illinois lawmakers must reform pensions, cut retirement debts and roll back collective bargaining laws, or Illinoisans will continue to flee from the taxes imposed to “fix” the crisis.

Read more about Illinois’ worst-in-nation pension crisis:

- US stock markets up 200%, yet Illinois pension hole deepens 75%

- New 2019 pension reports: Illinois’ shortfall worsens to record $137 billion, pension costs exceed $10 billion for the first time

- Moody’s new report shows Illinois is nation’s extreme outlier when it comes to pension debts

- “Wealthy” Chicago households on the hook for up to $2 million in debt each under progressive approach to pension crisis

- Why Chicago’s Lightfoot should push for a pension amendment, not tax hikes

A set of state lawmakers want to extend CPS’ current school closing moratorium to February 1, 2027 – the same year CPS is set to transition to a fully-elected school board. That means schools like Manley High School, with capacity for more than 1,000 students but enrollment of just 78, can’t be closed for anther three years. The school spends $45,000 per student, but just 2.4% of students read at grade level.

A set of state lawmakers want to extend CPS’ current school closing moratorium to February 1, 2027 – the same year CPS is set to transition to a fully-elected school board. That means schools like Manley High School, with capacity for more than 1,000 students but enrollment of just 78, can’t be closed for anther three years. The school spends $45,000 per student, but just 2.4% of students read at grade level.

Hopefully, all media will get the message, in Illinois, too.

Hopefully, all media will get the message, in Illinois, too. Ted joined Tom Miller of WJPF to talk about Illinois’ highest-in-the-nation property taxes, why lawmakers don’t want to touch the tax’s cost drivers, just how much Illinoisans’ tax burden has grown over the decades, why Gov. Pritzker failed to meet his promise to reform property taxes, and more.

Ted joined Tom Miller of WJPF to talk about Illinois’ highest-in-the-nation property taxes, why lawmakers don’t want to touch the tax’s cost drivers, just how much Illinoisans’ tax burden has grown over the decades, why Gov. Pritzker failed to meet his promise to reform property taxes, and more.

The best day of your life is the day you move out of Illinois. A U-Haul will solve the problem. Call a mover today and start a better life for you and your family. Illinois is DOA, no hope. Even the cops, firemen and teachers with the HUGE PENSIONS are running out of Illinois.

Last man standing will be a dead man. 83 Degrees and Sunny in South Florida, NO state income taxes. Freeze you a$$ off in poverty or start a great new life.

pretending to care about social services is a flat out lie and your hypocrisy is exposed just by opening up another part of your web site. Using this issue to pit the working class against each other is the familiar refrain on used by Wirepoints. YAWN!!!

Stop spreading lies, Kennedy.

Pensioners with million dollar lifetime payouts are not the working class. They’re the 2nd Estate, the administrative class. The rest of us with piddly 401k’s and meager social security payouts are the working class.

Few things irk you folks on the left like a challenge to your claim to a monopoly on policies good for the poor. Sorry, Kennedy, the public doesn’t buy it any longer. The evidence is in. Especially in Illinois, the policies we criticize here have been particularly catastrophic for the poor and working class and plunged the entire state into insolvency. Wear your supposed compassion on your sleeve all you want. Say we just want to throw granny over the cliff all day long. It won’t work. Results matter.

Welfare (AKA social services) is provided by professionals whose occupations would evaporate if poverty was reduced. This is why all welfare systems turn humans into either slaves or pets. It really is that simple. It is an economic axiom that whatever it is you chase with money, more of it will be supplied. When you throw a lot of money at cars, car production rises. Ditto beer, or red sweaters. But no one notices the same applies to poor people, uneducated people, etc. The more that is “spent” to “fix” these problems, it’s almost by magic that there’s MORE PEOPLE… Read more »

Astonished: This is very well stated. However it has many counterparts in think-tanks, universities, pilot projects and consulting firms in tall buildings within 50 miles of the east and west coasts. Perhaps some of this will abate now that charitable deductions gain less traction on peoples’ tax returns. Academic scientists whom I know well have shared their grant-writing techniques with me: whatever you want funded, twist the proposal so that it contributes to knowledge about this year’s fashionable ailment — AIDS, breast cancer, hair loss. The World Bank has a skyscraper-full of PhDs out finding wrongs to write-up … then… Read more »

Working class? You mean gov sector workers who pay 100k lifetime into a pension and then proceeds to take out 2.1 million beginning under 60 years old? Some of which get health insurance too, or go off to get a second pension by working a few years in a different department? That working class? Sounds more like a freeloading class than a working class.

Is there a chart that shows ARC vs actual state contributions for all the state pension systems?

Such a report would increase transparency. But state government prefers to be opaque.

COGFA should produce a variance report to show the projected funding ratio next to the actual results. Showing the variance wpuld increase transparency

Few teachers realize just how tenuous is the likelihood of collecting their TRS-promised pension. I look at the charts comparing the AAI (a lump sum early payout that gives up the 3% compounding escalator) to the original pension and I wonder: How on Earth will any of this be paid in 2025, 2035 or 2045? The damned state is broke! They’re “losing money on every retiree, but plan to make it up on volume!” Everywhere I look I see utterly unsustainable trends, yet I said the same thing literally 25 years ago and those unsustainable trends remain…at least for now.… Read more »

“Wirepoints has remarked several times in the past about the stark warning the state’s pension trend shows: if retirement shortfalls in Illinois continue to grow during a period of remarkable stock market returns, imagine how those funds will fare when the next recession inevitably hits.” The can will be kicked until it can’t be. The determining factor is the herd’s willingness to believe fairy tales (AKA the value of debt.) Pensions are a debt…a promise of a future cash flow. Like the veritable OCEAN of IOU’s issued by governments, businesses and individuals across the planet, it all grew during a… Read more »

I emailed this question to wirepoints, but perhaps no one got it. This Forbes article is saying 2028 will be the turning point. So, there shouldn’t be any additional increases until after that, correct? “Its annual contributions are calculated based on an objective of reaching 90% funding in the year 2045, yet because it attains this target in part due to the effect of lower-benefit Tier 2 workers comprising an increasing share of the workforce, its contributions are not yet sufficient to begin reducing that debt, which is forecast to climb to a peak of $145.9 billion in 2028 before… Read more »

Douglas, you can find those answers laid out in detail on page 13 of the new Cogfa report: http://cgfa.ilga.gov/Upload/1119SpecialPensionBriefing.pdf. Under the current payment ramp, and IF all assumptions hold up, the unfunded liabilities would top out in 2028, as the chart shows. But note that scheduled state contributions have to continue to rise and rise.

Looks like they’re now predicting 2026 to be the year where unfunded liabilities start to decrease. Seems pretty aggressive, considering what we know today.

“What Moody’s says matters since it currently rates Illinois’ credit risk at just one notch above junk”

No what Moody’s says does not matter, Moody’s is part of the problem. How long have we had to hear this mantra, time after time, opportunity after opportunity comes and goes and Moody’s hand stays pat playing with the pickle in their pocket. It became apparent Moody’s will not pull the trigger and the debt will continue to mount, hence why we left the state. The fox is clearly guarding the hen house.

Ha! I stand corrected. I should have said “what Moody’s says matters MUCH MORE than what the government says!!” Moody’s puts the state unfunded liability at nearly $240 B, the government says its $137 B.

And Moody’s never overstates anything, they exist to collect fees and will do all they can not to hurt their revenue by killing deals and offerings. When was the last time Moody’s protected investors? They don’t, only get honest after the crash is obvious.

A class action lawsuit against Moody’s is in order. They continue to prop up a giant ponzi scheme, who’s kicking the can? Moody’s. They no longer rate objectively, they rate the very thing they manipulate and create. That is the market they make year after year selling taxpayers down the river. The greater the taxpayers misery, the better the ratings. The madness doesn’t end until blood sucking investors in Moody’s backed products begin to see it as kryptonite. Right now investors are making a killing profiting on our labor and wealth.

Illinois is a financial time bomb a that can’t be disarmed. The real question is what will happen after the bomb explodes. Will Wirepoints help lead Illinois back to fiscal sanity? To their credit, I believe they will try. To their dismay, I believe they will fail. Illinois has a liberal, progressive heart. It thinks and reasons with it’s heart. Wirepoints does the same with it’s brain. Showing graphs, charts and other data to a heart is pointless. It can’t understand. It won’t understand. The heart will always place a higher value on a picture of a struggling drug addict,… Read more »

IL is a perfect illustration of competing “factions” leading to a tragedy of the commons.

“Need” is limitless. The ability to produce what is needed is finite. The intersection of this is collective delusion.

I would dispute the ‘can’t be disarmed’ I would give you won’t be disarmed, because the gov’t won’t do either: 1. All the hard things necessary to balance without doing #2. 2. The one easy thing that could balance it. #2 is a progressive surtax on pension payments some level(s). The power to tax is immense and broad. Put a sufficient surtax on any amounts paid over $10k a month, or $5k a month, or whatever level is necessary to make the pension system balance would fix it. And it would do it without hurting the workers getting by with… Read more »

State can’t tax income of those who don’t live in Illinois. I think it’s also true that cities and counties (etc.) can’t tax income of those who don’t live or work within municipal boundaries. It is, however, an eminently sensible idea! I think it’s a better idea to have pension trust fiduciaries begin to reduce payments to pension millionaires in order to protect pensions of those still actively working and pensions of those who are younger where the fund is likely to run dry. Pensions are trusts and trustees can petition for court supervision and courts can marshal available assets… Read more »

The state pension unfunded liabilities grew 756% from 2000 to 2019, from $16B to $137B.

That’s the TRS, SERS, SURS, GARS, and JRS pension funds.

As a reminder, a frequent quote is the state has not balanced its budget since 2001.

For visual variety, how about inverting one of the negative bar charts.

Put the X axis at the top, and draw the bars downward.

Since red means negative, and negative goes down.

The legacy of Michael Madigan and John Cullerton is massive debt and financial mismanagement.