By: Ted Dabrowski and John Klingner

Illinois’ finances aren’t just decaying at the top, they’re falling apart everywhere. The state’s one-size-fits-all pension laws and overly generous benefits have left many cities suffocating under impossible pension debts as their populations shrink, tax burdens jump and resident incomes stagnate.

Without an amendment to the Illinois Constitution’s pension protection clause – and subsequent pension reforms – expect many cities to head toward insolvency.

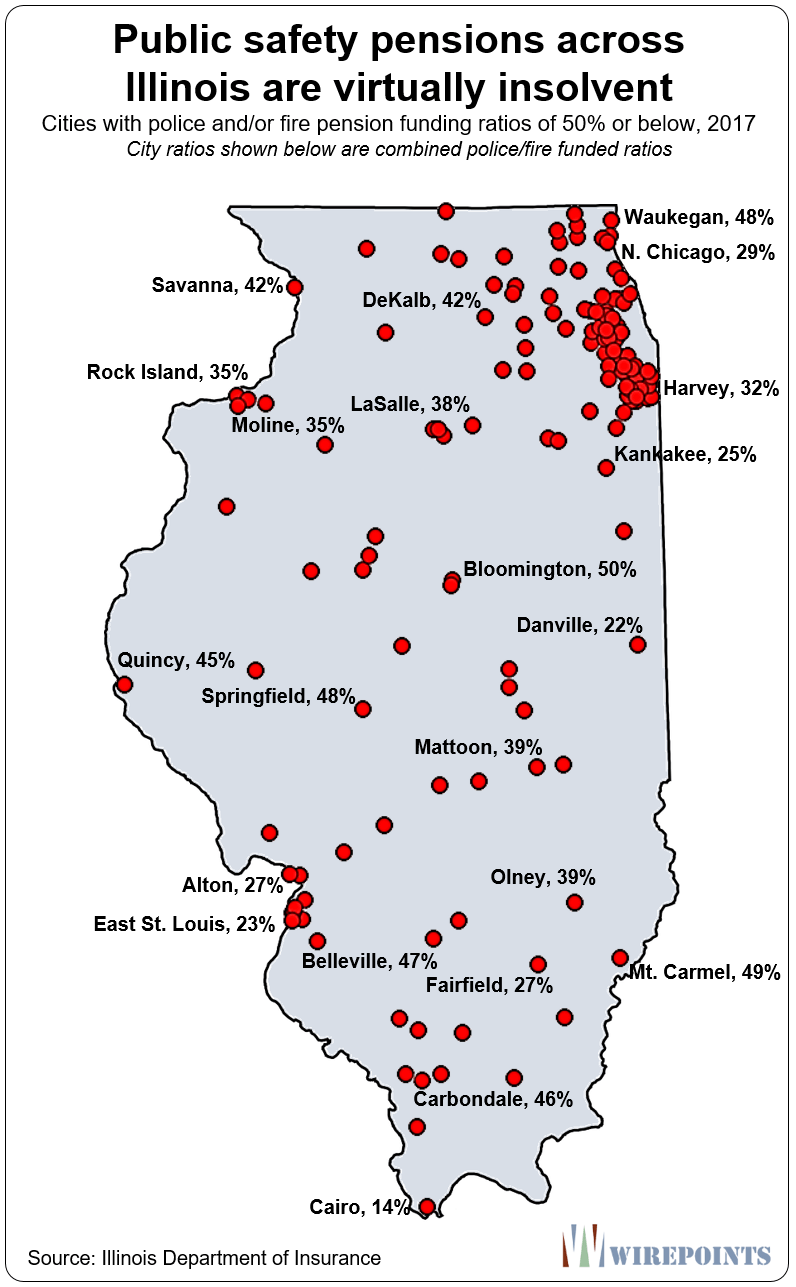

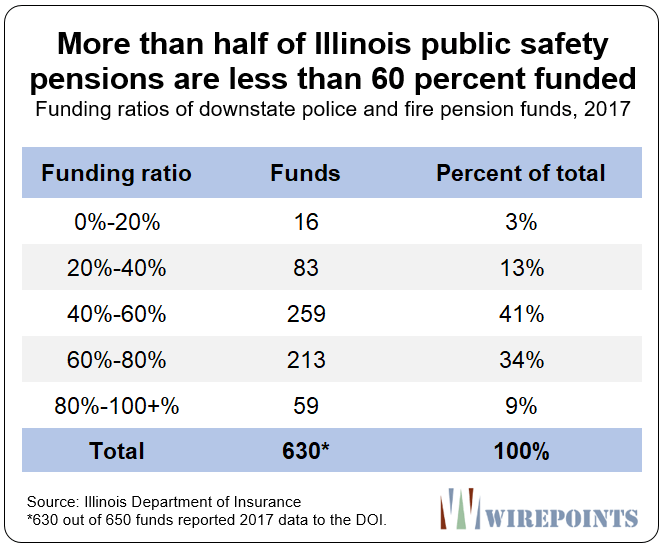

The map below shows just how wide and deep the crisis is. Of the 630 downstate police and fire pension funds that reported data to the Illinois Department of Insurance in 2017, 57 percent had funded ratios lower than 60 percent. And nearly 100 funds had funded ratios below 40 percent.

What’s worse, the downstate pension decline has occurred during one of the nation’s longest-ever bull runs. If Illinois public safety pensions are doing this poorly in a great economy, imagine their struggles during an eventual downturn.

False, and true, solutions

Illinois cities – from Kankakee to Danville to Alton – need pension fixes before costs bankrupt them. And while state politicians have effectively quashed any chance for reforms now, that shouldn’t stop city officials from demanding real changes.

Real changes don’t mean pension fund consolidations or tax hikes. Consolidation may reduce administrative costs and increase investment returns, but it’ll do nothing to reduce the pension shortfalls. Not only that, but there’s the risk lawmakers will try to bail out cities by taking over or socializing all downstate pension debt.

Illinoisans should also beware the talk of a “statewide” solution for the pension crisis. For politicians, a statewide “solution” isn’t about passing reforms, it’s about taxing everyone in Illinois. Chicago Fed economists have already suggested enacting a statewide 1 percent property tax – on top of the nation’s highest rates Illinoisans already pay – to pay for the crisis.

The only solution that can protect both taxpayers and retirees is structural pension reform and bankruptcy for cities that aren’t yet too far gone. For others, like Harvey, Illinois, it’s probably too late.

Municipal leaders across Illinois need to demand the following if they want their cities to survive Illinois’ collective crisis:

- An amendment to the constitution so pensions can be reformed and worker retirement security saved;

- The ability to convert pensions to defined contribution plans for workers going forward;

- A freeze on COLAs (while protecting small pensioners) until pension plans return to health, and;

- Collective bargaining reforms so officials can hold the line on new contracts.

And if they get none of the above, they should demand from Springfield the option of invoking municipal bankruptcy. Otherwise, cities will remain trapped in a downward spiral – unable to reform and unable to reorganize.

Read more about Illinois’ downstate pension crisis:

Ted joined Tom Miller of WJPF to talk about Illinois’ highest-in-the-nation property taxes, why lawmakers don’t want to touch the tax’s cost drivers, just how much Illinoisans’ tax burden has grown over the decades, why Gov. Pritzker failed to meet his promise to reform property taxes, and more.

Ted joined Tom Miller of WJPF to talk about Illinois’ highest-in-the-nation property taxes, why lawmakers don’t want to touch the tax’s cost drivers, just how much Illinoisans’ tax burden has grown over the decades, why Gov. Pritzker failed to meet his promise to reform property taxes, and more.

Ted joined Dan and Amy to talk about the free speech controversy brewing in Wilmette due to the city’s refusal to fly a religious freedom flag, the city’s left-wing excesses and the growing culture war, the latest money spent on the illegal immigrant crisis, and more.

Ted joined Dan and Amy to talk about the free speech controversy brewing in Wilmette due to the city’s refusal to fly a religious freedom flag, the city’s left-wing excesses and the growing culture war, the latest money spent on the illegal immigrant crisis, and more. Chicago Public Schools is failing its students in almost every way. What can be done to save the educational futures of Chicago’s children? Join Wirepoints’ Ted Dabrowski as he participates in an education roundtable discussion hosted by Seeking Educational Excellence (SEE).

Chicago Public Schools is failing its students in almost every way. What can be done to save the educational futures of Chicago’s children? Join Wirepoints’ Ted Dabrowski as he participates in an education roundtable discussion hosted by Seeking Educational Excellence (SEE).

Property Tax Relief Task Force (PA 101-0181).

September 23, 2019 Pension subcommittee presentation from UIC GFRC & UIS IIPF titled, “Local Pension Plans and Property Taxes.”

https://www2.illinois.gov/rev/research/taxresearch/Documents //eadn-wc01-3158345.nxedge.io/Sep%2023%20Local%20Pensions%20Subcommittee%20Presentation.pdf

https://www2.illinois.gov/rev/research/taxresearch/Pages/Property-Tax-Relief-Task-Force.aspx

According to Ald Raymond Lopez (15th ward) on WTTW’s Chicago Tonight he said to keep up with inflation which previous mayors did not do the city’s property tax levy would have to go up 100% and he would vote for it. No spending cuts were mentioned. That would put the tax rate at Rockford’s level at just over 4% of value. Political Insanity has taken over Chicago and Illinois.

Springfield and Chicago pretty much guarantee that the vote will not swing conservative anytime soon. Electing rauner was an anomaly, and a huge disappointment. Small town Illinois is hurting bad but has no numbers to change things. I’m in kankakee frequently, too many are on assistance.

Voter turnout is generally low because of apathy and disgust with the system. But if voter turnout were higher – there might be more R voters than you think out there.

I’m under the impression that the R party has for the most part given up on Illinois, and I can’t blame them. Why throw resources at a hopeless situation? Even if you win, you loose.

R has totally given up because Cook County’s voting population overwhelms the rest of the state. The Cook County machine turns out D voters consistently every statewide election despite losing population every year. It’s really pretty crazy. For example: In 2014, Cook County turnout was 50%. Overall population was 5,250,000. There were 363,000 (D) votes and 311,000 (R) votes. That’s a small margin for a supposedly Democratic stronghold. I But fast forward to 2018. Turnout was 55%, so a small increase in turnout. Overall Cook County population was down to 5,180,000 people. But JB had 539,000 (D) votes to 291,000… Read more »

call up the one who said “keep owa name out yo’ mouf'”

Would it be tin-foil of me to suggest that the reason pols are against pension reform is because there is still a mafia controlling the Chicago-metro area Unions? And that elected officials are afraid of getting whacked if they try to take any of the kool-aid away?

No.

All it took for Solis to flip AND WEAR A WIRE IN MADIGAN’S SPEAKER’S OFFICE were a few pictures of him leaving an asian massage parlor. That’s it. Do you think Tony Soprano would go state’s witness because of a few black & whites? Heck no. The days of the pols being in bed with the union mafia is long over. The unions are just political machines, very powerful machines, that only vote their self-interest to the detriment of everyone else including ‘the children’ (i.e. CTU). That’s what they fear – they fear the loss of campaign $$$ from the… Read more »

The reality is that the pensions will be paid. Pension payments will be paid first and foremost, while everything else decays. The firefighter’s pension are the potholes on your street. The cop’s pension is your city’s dilapidated city hall. The city clerk’s pension are the crumbling schools. The city manager’s pension is your park dist’s tennis courts covered with grass. The maintenance worker’s pension is the 40 year old playground equipment at the local park. And so on, and so on, and so on. It will be like this for a generation; and when that time comes, the landscape around… Read more »

Alton Illinois sold its water department to a private company…underfunded police and fireman’s pensions.

“City Council members in Alton, Illinois, have voted to allow negotiations to go forward in selling off the city’s sanitary sewer system and water treatment plant in order to help pay for Alton’s growing pension burden.”

https://www.illinoispolicy.org/alton-in-negotiations-to-sell-off-city-sewer-system-and-water-treatment-plant-to-pay-for-pensions/

The reality is that chapter 9 bankruptcy is coming to most cities in towns in Illinois, and the pensions will get cut. A recession is on the way sooner than later, and that will be game over for this pension farce. People can only pay so much, and you have to have police, period.

Look at Waukegan, Joliet, Rockford, Elgin, Rockford, Freeport, and so on, with empty downtowns, rotting infrastructure, decaying schools and depressed land values. They’re already dozens of years ahead of everywhere else on this path. But they’re still paying the pensions. I have my doubts that insolvency is coming anytime soon. The pensions will be paid, all else be dam ed. People will leave the states, small pockets of affluence will remain. But the pensions will be paid, the bond holders will be paid, and nothing else will be paid.

I have kept track of a few mansions on Sheridan Road in Waukegan over the past ten years. I lived to the south in Lake County, but I trained often in Waukegan, where in contrast to the cream puffers in the North Shore I could develop competitive acumen at the national level with the guys in Waukegan. My heart is in the place, despite now living a socioeconomic life light years away from Waukegan today. One of the mansions – impossible to build today and selling for 700k 10 years ago, can’t even fetch 300k. (It would be worth 3… Read more »

Another recession will end this game. It can’t go on forever. No one will be left in Illinois if it did go on for much longer, and then the pensions default anyway. Moral of the story: the pensions are doomed.

I will add that Mark agrees that this all will not go on much longer. Peoria is using 100% of their property taxes for pensions now, and they are still broke. That won’t last more than a few years, and a recession will destroy all the cities you mentioned plus many more such as Peoria and Chicago.

Perhaps that’s the key point. How much despair will occur as various Illinois public entities delay, or put off the inevitable? How long will residents have to endure bigger class sizes, higher crime, declining social services, higher taxes?

How long until the liberal/socialist politicians throw in the towel?

The Liberal corrupt Mafia Union Thug Democrats will go down the “Scorched Earth Death Spiral” process until absolutely forced to by no one left to tax or voted out. They won’t be voted out since the dumb voters of Illionois are told Republicans are racists.

I’m not sure copyright laws allow me to freely copy another person’s published article on this general topic, so all I am doing here is asking people to try finding it since it’s take is quite different. I found it in today’s “Jacksonville Journal-Courier.”

“State finances

in rough shape,

but improving”

By Peter Hancock

Capitol News Illinois

James, unfortunately, that article made a monumental error. It said the state’s overall “net position” improved from -136B to -$184B. It was the reverse. They got the years reversed. The state essentially lost a stunning $50 billion according to its new annual financial statements, to which the article was referring. We will have an article up on those statements tomorrow.

OPEB reporting. I thought they also re-stated last year’s CAFR too.

Yes, that’s what we will be writing about.

Thanks for the clarification, especially since the message was so greatly different than what most say these days. I eagerly await your article-ation!

A majority of the states voters are fine with the continuation of “business as usual”. They either don’t understand or don’t agree that “business as usual” leads to financial disaster for almost everyone. So be it. The scenario for Illinois residents, which has already started, begins with residents being drained financially thru rising taxes and falling real estate value. The worst funded pensions will be unable to meet their obligations. The public unions will go to court and win, forcing the cities and state to fund pensions at the expense of essential services such as police protection. What happens next… Read more »

What a depressing, but thought provoking, article as is your response to it! I’d have to agree with all of it. Now, where did I put that suicide pill anyway?

Don’t mind you coming, but leave your bad policy ideas and welfare mentality behind.

Public unions cannot go to court over pension reduction in chapter 9 bankruptcy, so you are wrong. The pensions in all these cities and towns are going to end up being cut due to bankruptcy. It is inevitable.