By: Mark Glennon*

Step back from the trees and see the forest as you go through the “grand bargain” legislative package Springfield is considering. The details matter less than one overarching question about breaking the death spiral Illinois is in:

Will the grand bargain slow the flight of people and employers from Illinois or accelerate that exodus?

I hope you already know why that question is paramount. Nothing matters unless the exodus is stopped. State revenue is declining. The tax base is shrinking. Debt is growing. The deficit is accelerating. Employers are leaving. If the result is more flight the death spiral will quicken.

You can answer the question as well as anybody. It’s as much a matter of perception and psychology as policy and detail. And debate all you want about fairness and and merit; this is about how it would be received and perceived.

I’ll run through the elements of the grand bargain, but keep two points in in mind that aren’t apparent from the bills themselves.

First, there is indeed, as grand bargain supporters argue, much to be said for getting a budget passed — any budget, maybe even if it’s phony and unbalanced. A budget for the remainder of this fiscal year is part of the package. More money would flow quickly to starved social service agencies and others dependent on state money. I, for one, would like to see at least some of that restored. That money would come from release of at least some of the $13.2 billion now sitting unused with the Illinois Treasurer because it has not been appropriated or budgeted. It would also come from tax increases if grand bargain supporters prevail. And it’s also true that want of a budget is itself a reason why people are losing confidence in the state and fleeing.

Second, don’t think for a minute that anything close to a truly balanced budget would result even if all the new taxes in the grand bargain become law. As we and others have documented repeatedly, government budgets are nearly meaningless. Illinois’ true deficit is not the $4 to $7 billion commonly discussed in Springfield and the press but more like $13 to $15 billion and maybe more.

Here are the other 11 elements as they stood last week that, together with a budget bill, comprise the grand bargain. Keep in mind it’s all subject to revision as it is renegotiated this coming week:

- $7 billion in new borrowing that would be used to pay down part of the state’s unpaid bills, currently totaling $12 billion. Think “one credit card to another.”

- A super mortgage in favor of bondholders on state money that flows to towns and cities. We wrote about this particularly horrid bill last week, which would prioritize bondholders over the public, pensioners and other creditors.

- Illinois taxpayers assume liability for the normal cost (the annual new expense) of the Chicago teachers pension. I think many Illinoisans, including me, view this as a morally repugnant deal killer in itself because we would effectively be subsidizing the Chicago Teachers Union, which is little more than a radically left wing political operation.

- Local government consolidation. Great in concept and sweeping efforts to do it are long overdue, but this legislation would not appear to help much.

- Casino expansion. According to one expert, this legislation would “give away another 10 casino licenses worth billions of dollars on Wall Street for only $100,000 each, which is another giveaway of $3 billion to $6 billion to political insiders.”

- Procurement reforms. Nice idea but won’t do much. Whose “concession” was this, anyway, and why hasn’t it already been done?

- Pension reform. “Fake policy” for the reasons detailed here. The only way to get real pension reform, short of bankruptcy, is to amend the constitution by eliminating the pension protection clause. That might not work either but it should be tried. Where is it? And pensions will stop for legislators, but only new ones, contrary to many news reports that overlook that. Savings will be peanuts.

- Workers’ compensation reform. Large manufacturers, the key constituents who this is supposed to satisfy, say the legislation would accomplish little.

- Two-year property tax freeze. This one has been pretty much laughed off already. Big tax increases would simply be pushed to the third year, and even the first two-year freeze would be full of holes.

- Changes to school funding formula. Hard to know what to make of this or where it stands. The existing formula is impossibly complex and House Speaker Mike Madigan has called for a new study of the topic.

- Permanent tax increases. Another $5 to $7 billion of new taxes annually, probably mostly in the form of higher income tax rates and expansion of the sales tax. For some perspective, that’s at least as big as the temporary tax increase that expired two years ago and was supposed to have solved so much.

So, you decide. Will the 50% of Illinoisans who already tell pollsters they want to leave change their mind? Won’t they ask how this fixes anything? Where are the “concessions” from those who destroyed the state? More taxes, more borrowing, further deficits and little else? Fairly or not, won’t most people focus on just that last bullet point — a huge tax increase?

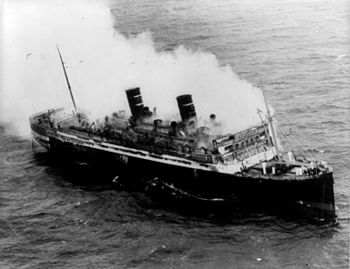

Illinois should be compared to a badly damaged ship taking on water and far from a safe harbor. Worse, an intense fire has now broken out — which is the exodus of our tax base — and extinguishing that fire should be the priority. Some of the crew needed to save the ship are abandoning it. Others are looting it. A fight goes on between two groups of officers trying to steer the ship in different directions — Governor Rauner and the majority in the General Assembly. But for now, all eyes are on the fire because, unless the loss of our tax base is reversed, everybody is doomed.

There’s a short answer to what Illinois should be doing, ideally, to address its crisis. Everything ever mentioned — dozens of things large and small we’ve written about or linked to on this sight that would reform the state’s operation and improve its climate for employers and taxpayers. I can think of no proposal made by anybody that’s too drastic given the scope of our problems. If a tax increase is unavoidable for solving the near term budget crisis, it should be presented as a temporary bridge to reforms that will take years to have an impact.

The General Assembly will have none of that, which is why Governor Rauner should be thinking about that sinking, burning ship analogy. He doesn’t control the whole ship, but he still has access to its public address system. He should use it to lay out both a short and long term vision to discourage more from jumping ship. Maybe he should be clear that we’ll go down unless he gets full control of the ship, which is to say he must get a new legislature in two years.

But he can’t ignore what his passengers see — that the ship is listing and on fire. It’s time to fight his way back up to the bridge and use the microphone:

This is the captain speaking. Here’s our current situation…. Here’s where I must have your help… Here’s how we’ll get this ship safely home….

*Mark Glennon is founder of Wirepoints. Opinions expressed are his own.

A set of state lawmakers want to extend CPS’ current school closing moratorium to February 1, 2027 – the same year CPS is set to transition to a fully-elected school board. That means schools like Manley High School, with capacity for more than 1,000 students but enrollment of just 78, can’t be closed for anther three years. The school spends $45,000 per student, but just 2.4% of students read at grade level.

A set of state lawmakers want to extend CPS’ current school closing moratorium to February 1, 2027 – the same year CPS is set to transition to a fully-elected school board. That means schools like Manley High School, with capacity for more than 1,000 students but enrollment of just 78, can’t be closed for anther three years. The school spends $45,000 per student, but just 2.4% of students read at grade level.

Hopefully, all media will get the message, in Illinois, too.

Hopefully, all media will get the message, in Illinois, too. Ted joined Tom Miller of WJPF to talk about Illinois’ highest-in-the-nation property taxes, why lawmakers don’t want to touch the tax’s cost drivers, just how much Illinoisans’ tax burden has grown over the decades, why Gov. Pritzker failed to meet his promise to reform property taxes, and more.

Ted joined Tom Miller of WJPF to talk about Illinois’ highest-in-the-nation property taxes, why lawmakers don’t want to touch the tax’s cost drivers, just how much Illinoisans’ tax burden has grown over the decades, why Gov. Pritzker failed to meet his promise to reform property taxes, and more.

One of the worst parts of the grand bargain is that Illinois is now attempting to manufacture laws that will essentially make their junk bonds “risk free”. Wow risk free junk bonds, that’s a lot like “free college”. By guaranteeing payment to bond holders over taxpayers in the event of default to make loaning to Illinois more palatable. The state is basically creating an FDIC equivalent for its crappy bonds and using the taxpayers as the underwriters. Fist we got shafted by law in the Illinois constitution, now we can get shafted by a government distorted bond market, by law.

Madigan’s Refusal Reform: Blame Rauner and Defeat Him November 6, 2018.

– Madigan and His Patronage Army More Organized & Experienced Than Rauner’s Rangers.

– Power Over Policy.

People of Illinois; Go to illinoispolicyinstitute.org and read the balance the budget info! Very enlightening! Everything mentioned in those articles needs to be implemented ASAP; not the feces and excrement in the “Grand Bargain” ! Then call the “prostitutes” in the General Assembly; who only care about themselves and get in their FACES; real hard. Also; Why don’t we just model the policies put in place by other successful states with strong economies?

Please look at Census Bureau numbers. The Illinois population decline did not begin until after Rauner was elected and the state had no budget. Even if you are correct in stating that the true annual budget shortfall is 13-15 billion, which I think is a wild exaggeration but whatever, isn’t closing 5-7 billion of that better than doing nothing at all? Guess what: courts can and will order tax increases at some point if politicians fail to do so, as the ruling in Kansas yesterday illustrates.

People didn’t just up and leave as soon as Rauner arrived and the budget stalemated. It takes years to relocate — find a new job, sell home, etc. so blaming Rauner just doesn’t fly. The $13-15B estimate is hardly a wild exaggeration. U of I economists and Jim Nowlan came up with the same number. The link in the story is to an earlier one with those sources. It’s not hard to calculate. Look at the current run rate of cash loss (about $8B per year) and add the things that aren’t in that number such as the underfunding of… Read more »

You’ve made this simplistic observation before. Illinois’ bigger problem is its fastest growing demographic consists of elderly people whose retirement income isn’t taxed. Just 5 years ago, there was a 12 percentage point differential between people under 18 versus over 65. That’s down to 8.8 now. That doesn’t bode well. You don’t need to leave Illinois to negatively impact state revenue, just retire. But honestly, I would expect a slightly deeper dive into the numbers and more insightful remarks from a professor. You’re cherry-picking of dates and spouting numbers with little to no context is lazy work, even for a… Read more »

I guess that’s what happens when the free money quits coming in.

You got me when the intense fire broke out on the badly damaged ship.