See how the property taxes in your county have grown:

- Appendix A – Property taxes by highest effective tax rate, 2017

- Appendix B – Property taxes by percentage growth, 2000 vs. 2017

By: Ted Dabrowski and John Klingner

A lethal combination of rising property taxes and stagnant incomes has forced many Illinoisans to rethink their relationship with their state. More than 1.5 million net residents have already fled the state since 2000 – and you can’t blame others for thinking about joining them.

Property taxes have become punitive in Illinois. We’ve written about how these taxes have destroyed the equity in people’s homes across the state. Many families have done the math, and whether they’re in the struggling south suburbs of Chicago or the affluent North Shore, they’ve decided to leave Illinois behind.

The traditional method for measuring the burden of property taxes is to look at a household’s property tax bill and compare it to a home’s value. Under this method, Illinoisans pay the highest property taxes in the nation. At 2.7 percent, Illinoisans pay far more than residents in neighboring states – twice more than those in Missouri and three times more than residents in Indiana.

\That fact is outrageous on its own.

But to really understand the pain that these taxes inflict on Illinoisans, it’s important to compare property tax bills to household incomes. After all, those bills are paid straight from people’s earnings.

The unfortunate reality is that Illinois incomes have been stagnant for years – and falling when you consider the impact of inflation.

Between 2000 and 2017, Illinois median household incomes increased just 34 percent, far short of inflation. In contrast, household property tax bills are up 105 percent, according to Illinois Department of Revenue data.

The net result: Property tax bills per household have grown three times faster than household incomes since 2000.

That means more of Illinoisans’ hard-earned incomes are going toward property taxes and less towards groceries, college tuition, and retirement savings. In 2017, 6.73 percent of household incomes went toward property taxes, up from 4.3 percent in 2000.

That’s a 55 percent increase in the effective tax rate.

Property taxes, county by county

Residents of Lake County pay the highest property taxes in Illinois when measured as a percentage of household incomes. In 2000, Lake County residents paid 6.5 percent of their household incomes toward property taxes. Today, residents pay 9.1 percent. That’s a 40 percent increase. The average Lake County property tax bill is now over $7,500 per household.

Meanwhile the residents of the other collar counties and Cook pay more than 7 percent of their incomes to property taxes, with average bills ranging from $4,500 to $6,200 a year.

Overall, the collar counties pay the highest taxes as a percent of income in the state. But it’s not just the Chicago suburbs that are taking a hit. Taxpayers statewide have seen their taxes rise.

In fact, most of the counties that have had the biggest tax growth, in percentage terms, are found downstate. Hardin County residents, though they pay low rates, have seen them jump 97 percent since 2000. Residents in Pulaski County, have seen their rates go up by 78 percent.

Cook County comes next at 75 percent, but after that it’s all deep downstate again: Calhoun (70 percent), Greene (66 percent), Jersey (65 percent), and Pope County (62 percent).

Taxes too high

Any way you cut it, Illinoisans are being punished by property taxes.

That’s prompted some, including new Gov. J.B. Pritzker, to propose a reduction in property taxes by increasing income taxes.

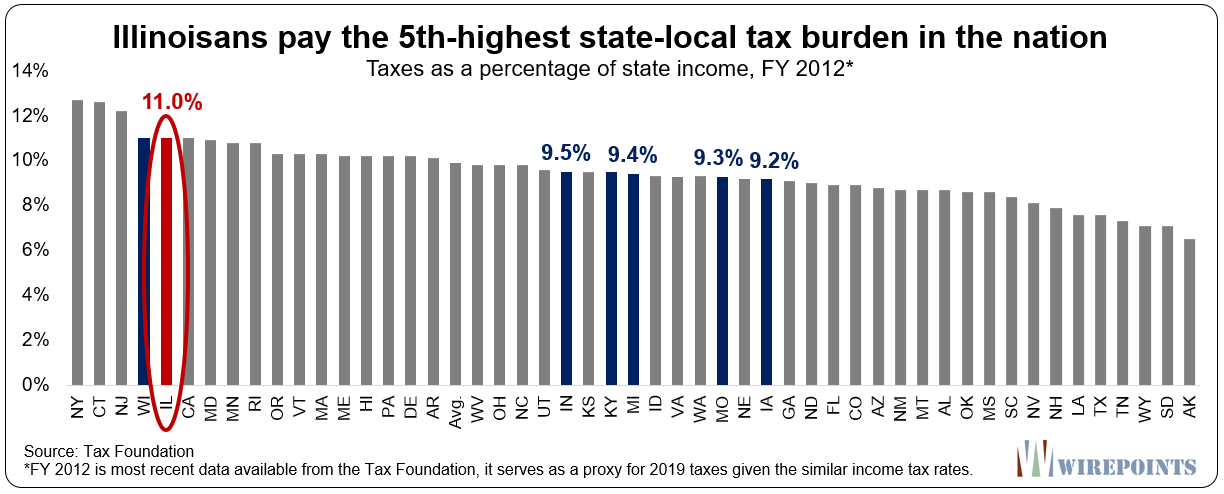

But that would do Illinoisans no good. Illinoisans already pay the nation’s 5th-highest rates when you lump all state and local taxes together.

Shifting them around won’t help when the total tax bill is too high to begin with. What Illinoisans need is tax cut, not a tax shift. But not the type of “cut” that allows politicians to continue spending, borrowing and piling up unpaid bills in some other way.

Instead, Illinois needs real reforms that bring the structural cost of government down: a pension clause amendment, less restrictive collective bargaining laws and a dramatic reduction in local governments, to name a few.

Read more about Wirepoint’s solutions:

- Illinois constitutional pension amendment is long overdue

- Emanuel’s call for a constitutional amendment shouldn’t be narrowly construed

- Springfield fiddles while Illinois cities burn

- Admin over kids: 7 ways Illinois’ education bureaucracy siphons money from classrooms

See how the property taxes in your county have grown:

If you’re frustrated with Illinois’ educational results, you may want to follow the money from teachers unions. In the last four years alone, Illinois lawmakers and political candidates have taken nearly $30 million in contributions from teachers unions and their national affiliates.

If you’re frustrated with Illinois’ educational results, you may want to follow the money from teachers unions. In the last four years alone, Illinois lawmakers and political candidates have taken nearly $30 million in contributions from teachers unions and their national affiliates.

Wirepoints President Ted Dabrowski testified on April 10, 2024 to members of the House Revenue and Finance Committee at the invitation of Rep. Joe Sosnowski. Ted told lawmakers that the state’s property tax burden has become dire for countless Illinoisans.

Wirepoints President Ted Dabrowski testified on April 10, 2024 to members of the House Revenue and Finance Committee at the invitation of Rep. Joe Sosnowski. Ted told lawmakers that the state’s property tax burden has become dire for countless Illinoisans. Ted joined WLS 890’s PM Chicago Show to discuss Chicago’s worsening pension crisis, why the city’s crisis makes it such an outlier nationally, its negative impact on residents, government workers and retirees alike, and what Mayor Brandon Johnson should do about it.

Ted joined WLS 890’s PM Chicago Show to discuss Chicago’s worsening pension crisis, why the city’s crisis makes it such an outlier nationally, its negative impact on residents, government workers and retirees alike, and what Mayor Brandon Johnson should do about it. When has any company persisted with a project in the face of stronger local, statewide and national opposition? When have taxpayers subsidized a more harebrained project?

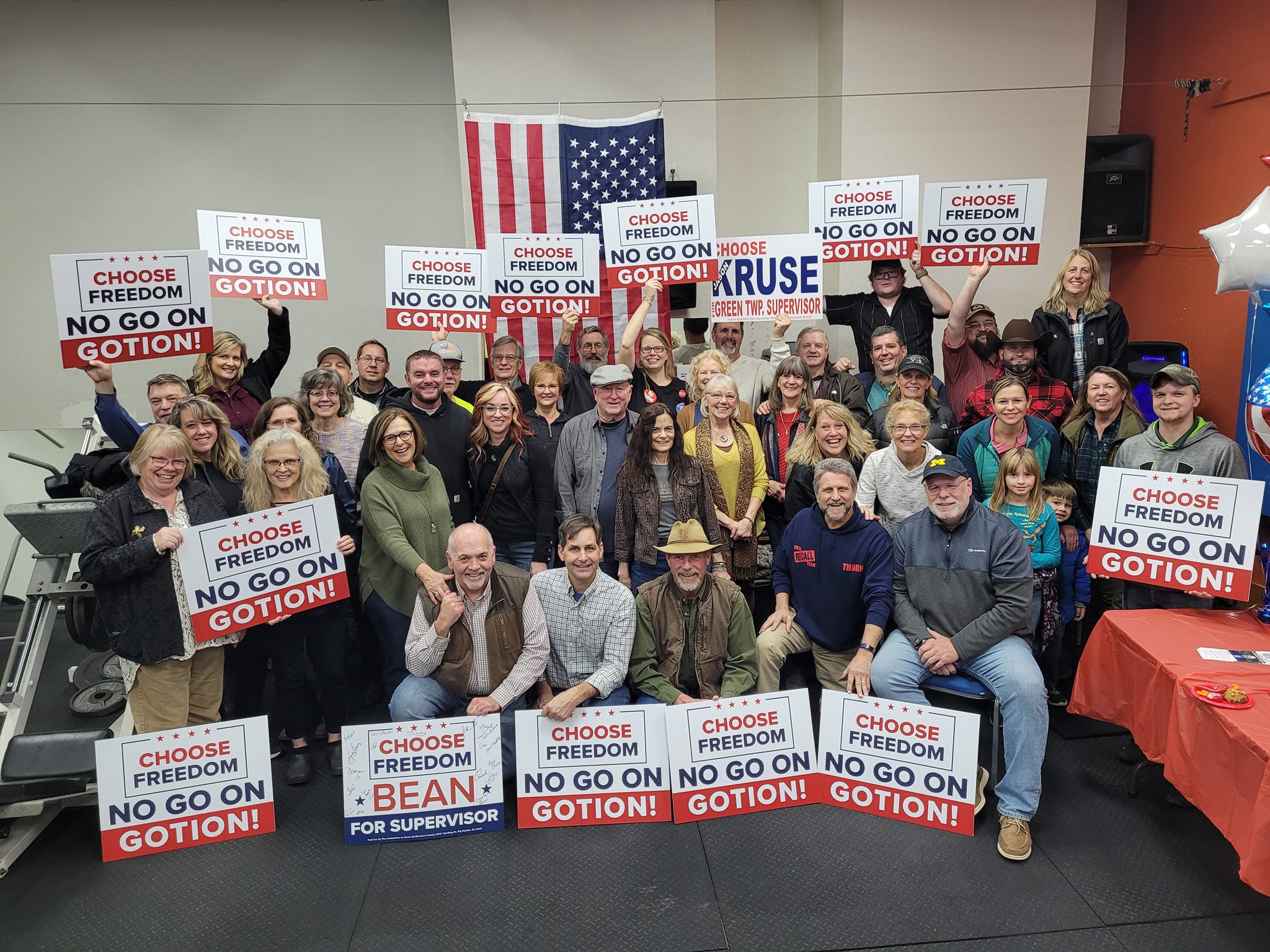

When has any company persisted with a project in the face of stronger local, statewide and national opposition? When have taxpayers subsidized a more harebrained project?

Keep voting for freebies, outrages pensions, etc. and expect lower taxes does not work. You pay what you voted for. I left IL years ago and never regretted it.

Our homes and properties are only ATM machines for all the taxing bodies. Their reasoning is the more expensive your property is the more they can tax you even though you get the exact same services as a home that is half your value but at a higher cost to you. Why does the school or any other tax cost you double on a $500K home vs $250K? Many seniors can not afford their taxes anymore. Last I checked there is no net worth tax in Illinois yet the largest asset many have are their homes What if this were… Read more »

Where do I find data about other Illinois counties not listed here?

Mr. Underfoot, we’ve added county-by-county data for your review, sorted by the largest effective tax rates and the largest percentage changes in rates since 2000. Here is a link to the first one: https://wirepoints.com/wp-content/uploads/2019/01/Appendix-A-Residential-property-taxes-as-a-percent-of-household-income-by-county-ranked-by-highest-effective-tax-rate-2017.pdf

Thank you for your prompt reply!!

Public unions all get regular raises

Step increases

Even public union retirees get a 3% raise every year

The working class , that is what the article describes

What article are you referring to?

The above article describes how high taxes are going up.

Everybody’s got an uncle, sister, brother, mother who is either a teacher, cop, township official, city clerk, government contractor — you name it. So they keep voting for the gravy train to continue. Until it can’t. Meanwhile, those who don’t have a relative lovin’ their guberment are screwed. Zombie state.

And Illinois’s largest Industry is……….GOVERNMENT!

A tax cut is not enough. We need process reform to prevent them from gaming us in the future. Who cares if they cut or cap the RATE when they can just subjectively inflate your assessed value to whatever the hell they want? And process reform can’t happen without a crackdown on corruption. This why I am forced to rent…biding my time until either true reform or inevitable collapse. But I’ll probably leave the state before either of those two events occur, because of…you know…the weather…

Hank, you are spot on. The reforms need to come through a pension clause amendment and way-less restrictive collective bargaining laws. Our bargaining laws are the fourth-most restrictive in the country.

Reform also comes in dramatically reducing the number of governments we have – the most in the nation. It also means bringing prevailing wages for public construction jobs in line with market wages.

And there’s plenty more…