By: Ted Dabrowski and John Klingner

What the market giveth, the market taketh away.

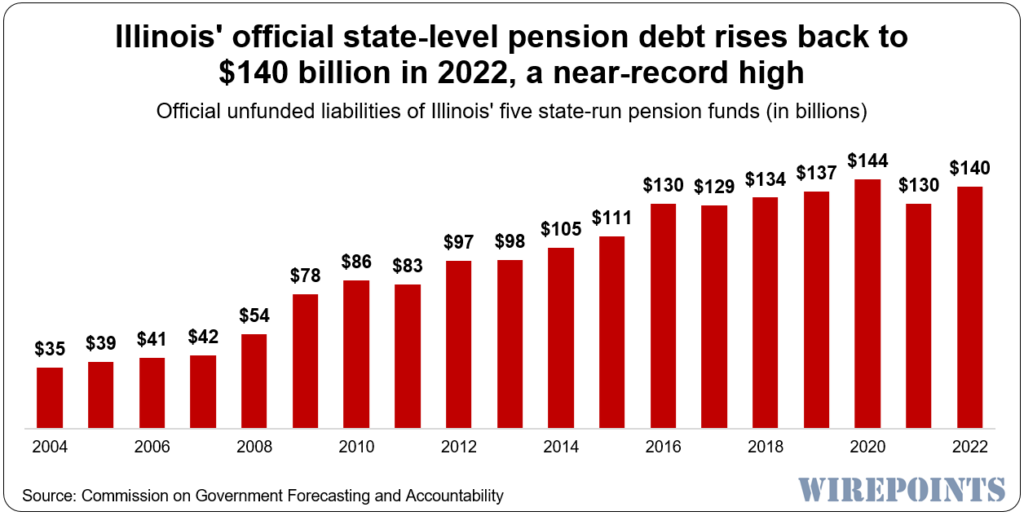

Illinois state’ pension debts jumped back to near-record high of $140 billion in 2022, largely due to the funds’ poor investment performance. Both the stocks and bond markets had negative returns, worsening the state’s unfunded liability by $10 billion.

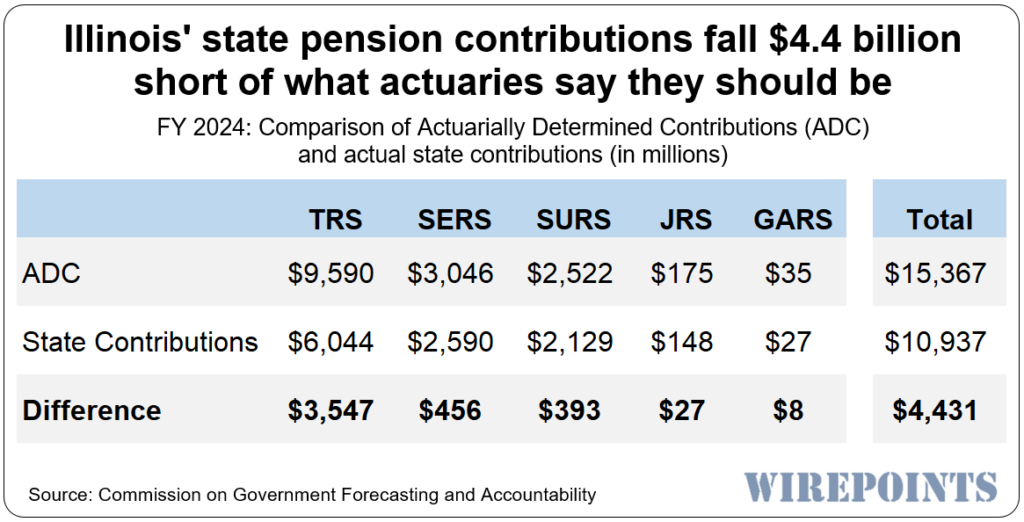

More importantly, this year’s preliminary pension report from the Commission on Government Forecasting and Accountability published the fact that Wirepoints has been harping on for years: that Illinois continues to far underpay what it should to the state’s five state-run pension funds. The latest projections for 2024 show the state will underfund the plans by $4.4 billion. More on that later.

2022’s worsening pension losses come after the previous year’s once-in-a-generation market-rally helped shrink the state’s unfunded liability to $130 billion in 2021, down from a record $144 billion a year earlier.

Illinois retirement costs have been consuming for years around a quarter of the state’s budget – the biggest budget burden in the country – and yet debts consistently rise no matter how much money residents pay in.

Illinois retirement costs have been consuming for years around a quarter of the state’s budget – the biggest budget burden in the country – and yet debts consistently rise no matter how much money residents pay in.

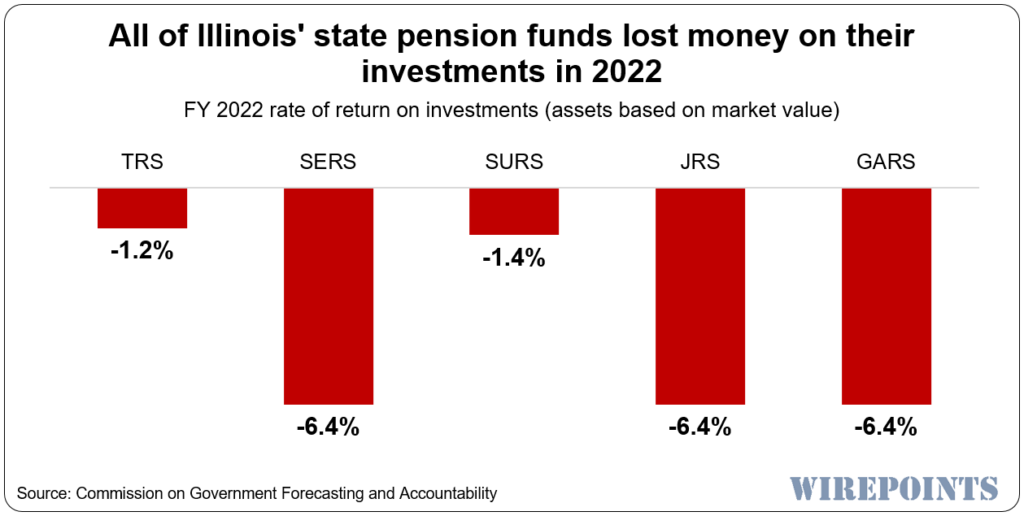

This year the markets played an outsized role in the decline of the state’s five state-run funds. The Teachers Retirement System lost 1.2 percent, the State University Retirement System lost 1.4 percent and the State Employees, Judges and Lawmakers systems all lost 6.4 percent on their investments.

That’s in contrast to their actuarially assumed returns of 6.5 to 7 percent yearly.

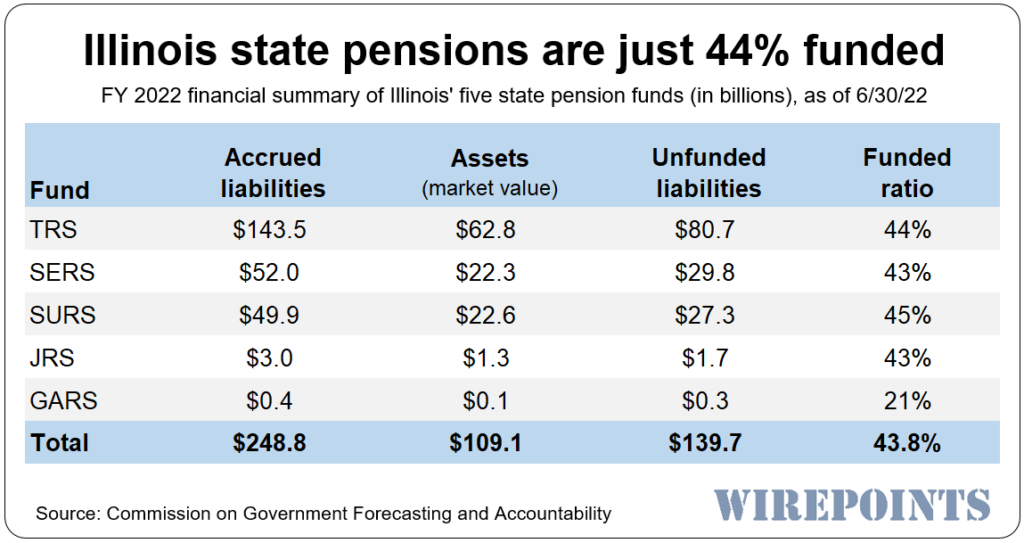

Illinoisans are now on the hook for $140 billion in unfunded state pension debts. That shortfall exists because the five pension funds should have $249 billion in their investment accounts today to ensure they can meet their future obligations, and yet they have only $109 billion. Hence the $140 billion shortfall.

Illinoisans are now on the hook for $140 billion in unfunded state pension debts. That shortfall exists because the five pension funds should have $249 billion in their investment accounts today to ensure they can meet their future obligations, and yet they have only $109 billion. Hence the $140 billion shortfall.

That leaves the state’s overall unfunded ratio at 43.8 percent, one of the worst in the country. Equable ranked Illinois 49th in the country for its funded ratio, with only Kentucky doing worse.

In an apparent first, COGFA actually published the difference between what the state should be paying into the pension funds (Actuarially Determined Contribution) and what it’s actually paying.

That’s one particular truth we’ve been trying to shed light on for years. Illinois has been underpaying pensions by about $3 billion a year and underpaying retiree health costs – another one of the state’s under-reported shortfalls – by anywhere from $1 to $3 billion a year.

The state statutory requirements for pensions require a payment of $10.9 billion in FY 2024, but the actuaries calculate it should be paying in $15.4 billion. That’s a funding gap of $4.4 billion.

That gap has a lot of implications that we’ll detail in future work. But for now, here’s what matters:

That gap has a lot of implications that we’ll detail in future work. But for now, here’s what matters:

- It disproves Gov. Pritzker’s annual claim that Illinois’ budget is balanced.

- It discredits Comptroller Mendoza’s claim that all the state’s bills are paid off.

- It explains why Illinois’ pension debt continues to grow year after year.

- And it explains why the crisis always gets worse despite the squeeze that Illinoisans have been under for more than two decades.

We’ve warned for years that Illinois has overpromised – and continues to overpromise – retirement benefits. The numbers above are the consequences of that mistake.

Read more from Wirepoints:

- Illinois Pensions – Overpromised & Overgenerous

- Illinois governor disregards state actuaries to claim “balanced” budget

- Illinois owes $68 billion in health benefits to government retirees.

- Why Your Pension Is Doomed – WSJ

- Solving Illinois’ Pension Problem: Why It’s Legal, Why It’s Necessary, and What It Looks Like

- Illinois pension shortfall surpasses $500 billion, average debt burden now $110,000 per household

- Wirepoints’ Pension Solutions Page

A set of state lawmakers want to extend CPS’ current school closing moratorium to February 1, 2027 – the same year CPS is set to transition to a fully-elected school board. That means schools like Manley High School, with capacity for more than 1,000 students but enrollment of just 78, can’t be closed for anther three years. The school spends $45,000 per student, but just 2.4% of students read at grade level.

A set of state lawmakers want to extend CPS’ current school closing moratorium to February 1, 2027 – the same year CPS is set to transition to a fully-elected school board. That means schools like Manley High School, with capacity for more than 1,000 students but enrollment of just 78, can’t be closed for anther three years. The school spends $45,000 per student, but just 2.4% of students read at grade level.

Hopefully, all media will get the message, in Illinois, too.

Hopefully, all media will get the message, in Illinois, too. Ted joined Tom Miller of WJPF to talk about Illinois’ highest-in-the-nation property taxes, why lawmakers don’t want to touch the tax’s cost drivers, just how much Illinoisans’ tax burden has grown over the decades, why Gov. Pritzker failed to meet his promise to reform property taxes, and more.

Ted joined Tom Miller of WJPF to talk about Illinois’ highest-in-the-nation property taxes, why lawmakers don’t want to touch the tax’s cost drivers, just how much Illinoisans’ tax burden has grown over the decades, why Gov. Pritzker failed to meet his promise to reform property taxes, and more.

How about the fund managers, who tend to be Democratic Party family insiders as a source of losses? The sun Times story on the subject a few years ago was illuminating. Only the fees did not depreciate. The paper did not look into who owned the real estate investments those pensions bought. Three dimension chess of a sort?

Isn’t this just the kind of thing that got Jeff Skilling that big-time vacation at Club Fed?

Why don’t these fiscal responsibility laws apply to ALL government officials as well?

While they would have taken the payoffs anyway, at least we could now lock them up without having to worry about some kind of legislative governmental immunity theory standing in the way.

PPF this is the result of Greedy Government workers like yourself, job well done.

Study Shows People Are Leaving Illinois In Droves | Chicago, IL Patch

Collecting money that is owed is not the problem. it’s the result of the state not funding the pensions. They have been well aware of the costs the entire time and so have the voters. Instead the voters want to pretend it will just go away. Also, if this is people leaving in droves then Illinois will be just fine. Lots of tax revenue coming in and plenty more taxes left to collect. Taxpayers have been negligent ensuring that pensions are funded so it’s only natural that taxpayers need to start paying more. Studies show pensions are underfunded. The only… Read more »

The ONLY FIX is to get out of Dodge ASAP. No major private sector can afford pensions, the ones that kept them went out of business. The greed of the cops, teachers and firemen is not going away anytime soon.

How dare teachers, police, and firefighters expect to collect their contractual pension promise. The nerve of them.

If the state wants to get rid of pensions then the state should implement that for new employees. The state just needs to pay out to all the existing pensioners and already hired employees. No stealing retiree assets. Stop being so greedy because you don’t want income taxes to rise to 6.25%. If you can’t afford it or you don’t want to pay you are free to move out. Either way, pensioners are getting paid.

As I have pointed out before, YOU and your fellow government union workers are the ones who have funded, supported, and voted for the very politicians who refuse to fund your pensions. You really think they have the guts to raise taxes for your pensions when they have so many other pet projects to fund, like reparations and guaranteed incomes? Don’t blame the taxpayers, look in the mirror who you supported.

Yes you have provided false talking points in the past and this comment continues that tradition. Who did I vote for? It’s amazing that you think you know. Who did most of the teachers vote for? Police union members? These unions don’t always support the same candidate so not sure how you think unions supported this. The FOP just supported Bailey. Pretty sure the teachers union didn’t. Pension underfunding can be boiled down to two things. Some, including this site, claim pension benefits are too generous. Others, including actuaries and this site as well as anyone that understands basic math,… Read more »

Yes, but Democrats have been FAR more responsible than Republicans because they have controlled the legislature for 44 of the last 46 years. Say what you want about that but it’s the truth.

You need governors to sign off on legislation as well. Thompson and Edgar own that. Democrats tried to cut pensions in 2012 while Republicans didn’t do anything. I’m not blaming just Republicans even though they have clearly done the most damage. Republicans also put the amendment in the constitution. You can try to blame Democrats all you want but the facts don’t show that. Also, neither party has been for funding these pensions. Which is why I responded to Wally’s ridiculous comment. Let’s just look at this last election. Did Bailey commit to funding pensions with actuarial payments? The voters… Read more »

Also, from 1969 through 2002, Republicans held the governors mansion all but 4 years. 2 of those 4 years Republicans held both the house and senate. During that span of time Republicans held the executive office while the amendment was added to the constitution in 1970(also sponsored by Republicans), offered guaranteed 3% compounding in 1989, and implemented the Edgar pension ramp in the mid 90’s. Republicans were active participants in this entire process and were driving the ship. While at the helm, pensions became more generous while funding the pensions even less. What did the voters do after the Edgar… Read more »

If we are over committed and voters won’t approve tax increase bankruptcy or its Puerto Rican alternative is the answer.

The only option that is allowed in your statement are tax increases. PR alternative doesn’t work for a state. Bankruptcy not allowed.

Also, voters don’t need to approve tax increases. Just as in the past, they will happen whether voters like them or not.

Nor was bankruptcy allowed for Puerto Rico, which is why they took the end run. Understood that states may not file for federal bankruptcy protection which is why P.R. was mentioned. Voters must approve graduated tax which was what I was getting at. Generally, tax increases don’t actually solve the problems unless the tax collector can get into the pockets of upper income “folks.” You know, “folks” aren’t limited to plebians. Most school superintendents started out as “folks.” The basic problem that you have described multiple times is that pension systems were not adequately funded. This was primarily due to… Read more »

I am sure you, and some other union members, may vote for the best candidate. The majority do go with union leadership. But I’m talking about the $$$. The FOP may have supported Bailey, but how much $$$? The $$$ buy TV ads, flyers, signs, campaign workers, etc. Look what Soros money has bought. And the teachers union is already lining up $$$ for their candidate. Chuy is lining up $$$, Vallas not so much. For 40 years, Madigan has controlled the $$$ and spent it where needed. And he went along with the desires of those who gave him… Read more »

And the issue is not how generous the pensions are. It’s the inability to modify or change the pensions with changing economic situations. And the lack of will to change the IL constitution. When I started my practice, I had a pension plan. After three years, I could not raise my fees high enough to keep up with the necessary contributions even though I was the chief beneficiary. So, we went to 401ks. Why isn’t that part of the solution?

“And the issue is not how generous the pensions are. It’s the inability to modify or change the pensions with changing economic situations.” That’s because they are contracts and not gratuities. “So, we went to 401ks. Why isn’t that part of the solution?” Because you can’t go back and change the contract for existing employees. You could try to and do that for new employees but the tier 2 employees are actually paying more into the system than they are getting out of it. You can’t shrink their pension benefits any more without violating safe harbor regulations. Telling people that… Read more »

“The Dems have had super majorities for a decade, what have they done for pensions?” The Dems did not have super majority when Gov Thompson started the 3% compounding. In fact, 48% of the senate was Republican. This was done with bipartisan support. When Edgar did the pension ramp he had a Republican majority in both the house and senate. While it’s rare for Republicans to hold all the power in Illinois, when they did this is what they provided. “But for the last ten years, the debt is growing geometrically, first 10% of the state budget, then 15%, then… Read more »

PPF: Take care that you don’t run out of spleen. When do you sleep? We are beginning to worry about your health.

Sincerely,

I sleep great. I post during the day and not in the middle of the night. You can’t even get facts right when implementing personal attacks. It’s like your goal is to make sure you have no credibility. Well done.

Also, you don’t need a spleen to live so all good. Not sure why I would run out of it?

Hate to repeat myself but “Who” exactly shorted the pension system? The politician in office at the time.That’s who. You made payments into the pension system or some or all of it was pension pickup by the taxpayers depending on your position. So you and I thru mostly property taxes made our annual contributions to the pensions. After it left our hands it went into the abyss called Springfield. The politicians did not make the required payments so that should be between the state employees and the politicians. They and only they should be held accountable not the taxpayers and… Read more »

Freddy, You paid the taxes you were required to pay. That doesn’t mean you were paying enough for the state to meet its obligations. The state needed and needs more money than they have been collecting. Now this isn’t your fault. You’ve paid your taxes in full. If you decide to leave the state then you owe nothing more. However, the state needs more tax revenue and if you decide to stay then they will need to collect more taxes. “You and I and all others paid but the money was misappropriated to something else.” When politicians spend the money… Read more »

Illinois has the second highest taxes in the country. If that is not enough and you want more, you can (I am making a hand gesture) yourself.

No young highly educated person will ever move to Illinois. Just makes no economic sense. Why pay for huge debt that you have nothing to do with? There is going to be a huge brain drain and that will be a big problem in the future. Best of luck PPF, Illinois is in a DEBT Death Spiral.

About twelve or fifteen years I had two neighbors who were high school teachers (Orland Park/Tinley Park area) who gleefully talked about having received their “twenty and twenty” which was 20% raises each of the two years preceding their retirement.

While I realize that the practice has since been discontinued, taxpayers from Galena to Cairo will be bearing the burden of thousands of those spiked pensions for decades.

This is, of course, indicative of blatant disregard/disrespect for taxpayers. I am so glad to be out of there.

My local school district had that same 2×20 retirement deal in the early/mid 2000s. I think it was for the elementary school district only. Big money waste because they ended up replacing those Tier 1 teachers with other Tier 1 teachers. But, yeah, it totally distorts the pension.

The teachers I mentioned truly believed it was a Win/Win: it enticed higher paid teachers to retire and replaced them with much lower paid rookies. So it was a win for both the local school district and the teachers whose pensions increased by 44%. It wasn’t a good deal for the rest of the state taxpayers for the next 30 or so years.

PPF shouldn’t make us furious. He is just telling us how it is, with a bit of tail-twisting. What should make us furious is the system itself. The Full Monty. It’s all hanging out there for everyone to see. And ultiimately it’s the voters’ fault. Voters don’t understand this. Many live from hand to mouth or catch whatever news they get from the Main Stream which either doesn’t understand pensions or economics either, or is simply carrying water for the politicians. There are other places like this: Detroit, Seattle, Philidelphia, New Jersey et al where bailouts are the order of… Read more »

Nothing sparks comments and debate like IL pensions. Well, except maybe global warming and IL property taxes.

Except for the state approved establishment media.

Don’t forget the pensions are based on the compensation done on local levels. The contracts are made behind closed doors and without public or even any political input. Then it is passed to the state level where appropriations are not met. The school districts followed by the universities are the largest drivers of pension debt since they are not making the pension payments to retirees. Could you find the detailed article from the Chicago Tribune from a number of years ago? The article was titled “Taxpayers socked Twice” Pensions and Penalties. There were at least two separate articles with one… Read more »

None of the WP’s analysis really matters other than to size up the forthcoming bailout from Biden and establishment Republicans in yet another pork-fest spending bill. Who cares about inflation? No one in D.C.

Long live the Edgar ramp! Illinois doesn’t now and never did have enough money to fund all these pensions no matter how they lie, steal or cheat to get it. The money just isn’t there so those planning to collect those pensions should make other plans. Pritzker put a lot of money into his re election pot why doesn’t he put a lot of money into the pension pot? Come on JB you got it why don’t you help out? Come on Public Union sector members you know he’s got it why aren’t you asking him to personally support you?

Right now, pensions are not taxed. That should be changed ASAP.

The very greedy people who have caused the problem refuse to help solve it. Greed is good for some and bad for most others. PPF and the leaches of the private sector family income are going to have to help out like they should. It is time the contribute like an honest working man does.

I agree that we should tax retirement income. There is no reason that someone making 200k in retirement pays zero income tax to the state while the poor working guy making 50k supporting a family of 4 pays $2500. The state could collect around $2 billion per year which covers about 45% of the shortfall.

Just keep in mind that you will need to tax ALL retirement income. Both public and private pensions, social security welfare checks, and 401k/IRA withdrawals. No more free lunch for all the takers.

PPF I have always thought everyone should be treated equal. It is the greedy worthless government worker who on want to collect and not pay their fair share.

People are fleeing the state thanks to the likes of people like you. The only people moving in are being bused in from Texas. Best of luck collecting the tax money you are going to need to finance your GREED.

Public employees are also taxpayers. All retirees in Illinois are exempt from income taxes. They pay their fair share. Get over it.

Wrong, their pension plans have surpassed that of the private sector average when they do not actually “produce” anything. How do you square with that??

Technically, the state could exempt social security from taxation (recipients already paid income taxes on those wages) and then tax all other retirement income equally. Moot point as they don’t have the guts to tax retirement income at all.

I believe 1099R money was taxed as earned by Illinois while the retiree was working. 1099 SSA deposits were also taxed by Illinois but not by immediately by the IRS. Social Security is means tested and you cannot move elsewhere to avoid its payment. Means testing of retirement income in Illinois would only increase the outflow of those who give some thought to their financial well being.

Don’t even bring it up you know they won’t tax public pension income. Don’t give them any ideas. They are already dangerous as it is.

If income set aside for retirement has previously been taxed it should not be again. The public pensions money has not so yes it should get whacked.

Most retirement income has not been taxed. 401k Money? Nope. SS? Nope. You paid a tax but the money they send you is not yours. It’s merely welfare payments. Does someone that pay double the SS tax get double benefits? No, because it’s not an investment but just welfare payments.

IL pensions are legal PONZI schemes. Basic math teaches you this. Just have an honest conversation with an IL teacher. I have and they were shocked at the results. I dont blame the teachers, most are very nice and are doing an honest job for fair pay and most would be willing to compromise but there is greed and power at stake and for the likes of PPF and Union bigwigs the chance to become wealthy lest the state and future generations be damned. I got mine now F/U is their motto and the private sector loses. Unless R’s get… Read more »

What? Social Security has indeed been taxed: 6.2% of gross wages. My 401k, OTOH, has not.

You mean self-employed? They shouldn’t get double because 1/2 of that is the employer portion. That they happen to be the employer is moot.

If the state ever gets around to taxing retirement income (again, moot point), there should most definitely not be one overall exemption on all retirement income because not all retirement income is the same.

“What? Social Security has indeed been taxed: 6.2% of gross wages. My 401k, OTOH, has not.” You paid a tax but you didn’t pay into an investment. The money you receive in benefits has not been taxed. Even if you put that money into a separate account, the first year and half in retirement would be a return on that money and then the rest of the money would be “investment” income or employer contributions. Most of this would not have been taxed. “You mean self-employed? They shouldn’t get double because 1/2 of that is the employer portion. That they… Read more »

That’s a short-sighted solution. Outmigration would increase. Retirees, public and non-public, are not obligated to live in Illinois. Pension costs will continue to increase dramatically.

Good luck getting that passed in Illinois

Biden by executive order redirected $36B from the pork-fest ‘American Rescue Plan’, which establishment Republicans supported, to corrupted private union pension plans. See the secret handwriting on the wall?

This was approved by congress. Multi-employer pension plans were allowed to apply for aid from the American Rescue Plan. It wasn’t “redirected” as this was one of the purposes of that massive spending bill.

“Approved by the swamp” Please revise.

The coming year will finally be the one that everyone here has been waiting for … the system breaks. It’s too bad most of you didn’t leave IL yet.

Wrong! As long as taxpayers exist in Illinois, their taxes can be raised. At some point the population decreases enough so the math won’t work, but that is still years away. Until then, it’s going to get ugly for those that stick it out.

Years until what? The math has not worked for 20+ years already!

It is not “IF” it will fail, it is “When” it will fail.

The system is DOA.

No Pension should be more than twice the maximum amount of Social Security. Payout ages should be the same. No one collects before age 62 discounted for early retirement. Full retirement age should be exactly the same as SS. If they do not like it they can go to work anywhere they choose to. They won’t as Government workers is an oxymoron. It should be illegal to steal money from unborn generations. Anyone with the price of a tank of gas should leave ASAP for their family’s economic life. The lust for money from the cops, teachers and firemen has… Read more »

If it makes you feel any better only the people ages 60-90 will have made out like bandits. The 50+ year old retirees, or the idiots who didn’t take the money already, will have scammer remorse when the system implodes in 2023-24. Yes, they might get paid but it’ll be with massively devalued dollars and that will still likely happen AFTER a haircut.

One can only hope you are right. My guess is taxes will continue up, up, and away. Services will be cut, cut and more cut. This is a cancer and will be a slow agonizing death for the taxpayers.

As long as there is like $4T in residential real estate that can be appropriated via property tax increases (aka “equity”), on behalf of the Illinois political class I would like to say “no problem”.

Their other great hope is a Democratic presidential administration will bail them out (at the expense of more fiscally responsible) red states.

That already happened. Now inflation makes it impossible for it to happen again without huge loss in purchasing power, but that’s the plan if you haven’t looked into it.

Pigs get fatter hogs get slaughtered.

Pigs get “fed” Hogs get slaughtered.

Don’t be a piggy. Pay more taxes now or get slaughtered later.

On a very long term basis eventually the taxpaying non government Illinoisans’ will have moved out leaving Governmental employees that will have to pay higher taxes upon themselves on an equal amount that supports their pensions. That will be a fun time to watch from the outside meaning not living in Illinois.

Makes me smile when I think of how many tax increases on a regular basis these pension collectors are going to have to endure and how much those tax increases will eat into their pensions payouts. Retired or not, it makes no difference, eventually everybody will pay more. KARMA.

Makes me smile when I think of all those monthly pension checks. An extra large smile when that 3% yearly increase comes each and every year. Direct deposit in a zero income tax/low property tax state is also pretty awesome.

There’s a certain blogger out there that has been crying for a couple years now that their state pension isn’t keeping up with inflation. Previously, that same person was extolling the virtues of 3% compounded COLA during the low inflation years saying, “But it’s an average over time!” Over time, they’re probably way ahead, but what have you done for me lately?

I’m reading and listening to so many interviews and articles that are saying the pension losses could be much higher because while equities and bonds have taken gigantic losses so far and undoubtedly more to come in 23 what pension funds are doing is switching their investments to private market (private equity, venture capital, etc) unregulated by SEC where nobody knows what the value or losses are. Thus in essance masking over even bigger over all losses Pension funds now are at an all time highs for % of funds invested in private markets. What % of pension funds does… Read more »

I wonder what percentage of Illinois residents are capable of understanding the data/graphs presented in this article. Given the horrific performance of Illinois public schools, I’m guessing less than half the population could understand the graphs. Perhaps that gets to the core problem with Illinois, and why it is a hopeless situation. The population is so poorly educated that it simply can’t comprehend all the issues/problems.

I wonder what percentage of Illinois residents comprehend the value of a billion dollars. If you offered someone 1 billion or 100 million, I’m guessing most would take the 100 million. Also, I wonder how many could make change for a dollar.

Bottom line, it is unrealistic to expect Illinois voters to address problems beyond their understanding. The math behind the pension problem, while easy/basic for some of us, is way too complex for the majority.

It’s not “no matter how much money” residents pay. You’ve identified that the state isn’t paying enough into the fund.

A better sentence, “Debts consistently rise because the state doesn’t pay enough. They need to start funding pensions with actuarial payments if they want the debt to start to go down”

Yes, but the politicians also need to get elected to remain in power. To pay your overpromised benefits in full, taxes would need to rise so high that the incumbents would be voted out. The hole in the boat is too big, it’s just a matter of time….

BTW.. Mark will be proud of you for being the first to comment.

The article clearly states the pension funds are shorted $4.4 billion. My estimate has been in the $5 Billion area. Raising income taxes from 4.95% to 6.25% would bring in the necessary money. If the incumbents get voted out then the people of Illinois don’t want a balanced budget. Like I’ve been saying all along, the voters are responsible for this mess. Either they demand a balanced budget with more taxes and cuts elsewhere or they are complicit in racking up debt. I wonder how many politicians were voted out when they raised the tax rate from 3 to 4.95%?… Read more »

PPF, if all public employees put in the time/effort and understood their numbers like you we could solve the pension problem quickly.. we would only need half the public employees as we have now.. you could have your cake and eat it too!!!

It’s not a public employee problem. It’s a taxpayer problem. The taxpayers are not demanding a balanced budget and as such the bills are piling up.

I predict retirement income will be taxed as the state becomes ever more greedy and financially desperate. The forthcoming recession will severely impair the state, but the Feds this time won’t be able to save Illinois from itself. Indiana taxes retirement income and its economy and state coffers are in far better shape than Illinois. With a super majority in the General Assembly, the IL Democrats aren’t at risk of losing power, so this economic downturn will be the catalyst. But when they do it, the exodus will accelerate. Retirees are far more mobile than any other age cohort.

When elections are stolen, like probably every one in illinois then it is not what “we” voted for is it?

Elections weren’t stolen. If they were, the fair tax amendment would have passed. The people of Illinois have voted for these politicians and are getting exactly what they deserve. But you keep playing make believe on made up elections.

Yo, they aren’t hacking the dominion machines. Some races are easier to cheat in than others. Havesters were on the ground collecting ballots from nursing homes and homeless shelters during the height of the pandemic without the benefit of JB’s $170,000,000 ground game. My guess is that the D establishment thought they had the Fair Tax in the bag but came up just a little short due to overwhelming voter rejection. Just like how six years earlier, Quinn lost the D vote gathering machine didn’t activate. They were never going to let this happen again. But this time around, JB… Read more »

Blah Blah Blah. You have no proof of fraud. Just more sour grapes. You think fraud exists but yet you still plan on voting. You think Democrats have learned their lesson and will never lose again but yet you still plan on voting. All lies. There is no fraud. Voters just think different than you.

The voters responsible for this mess are the ones who voted for this unworkable system in 1970. Today’s voters were handed an insurmountable problem, and wrapped up in a straitjacket by the public sector unions.

The voters in 1970. The voters in 1986 that elected Big Jim Thompson who gave pensions 3% compounding each and every year. The voters in the 90’s that Elected Jim Edgar who gave us the infamous pension ramp. The voters in the 2000’s that gave us Blago who didn’t like making pension payments. The voters of 8 years ago that gave us Rauner who didn’t think the state needed a budget. How about the voters of 2022 that gave us Amendment 1. The voters both current and past are responsible. Maybe we should also blame our founding fathers that put… Read more »

Not all of us will be paying more. Speaking of ramps, the exits are busy and will remain that way. Putting Illinois’ fiscal and social disasters in our rear view mirrors . . . Come follow us, but leave your woke, liberal ideology behind.

They do not have enough to fund the bloated day to day, hence the underfunding. You do not seem intelligent enough to understand the gravity of the situation.

I agree they don’t have enough. That’s why I’ve stated many times on this site that more taxes are needed. You can pay now or pay even more later. I understand the situation perfectly.