By: Ted Dabrowski and John Klingner

Download a PDF copy of the report

Illinois just reached an alarming milestone: each Illinois household is now on the hook for, on average, $110,000 in government-worker retirement debts. That figure is the result of dividing Illinois’ $530 billion in state and local retirement shortfalls among the state’s 4.9 million households. In 2019, the burden was $90,000 per household.

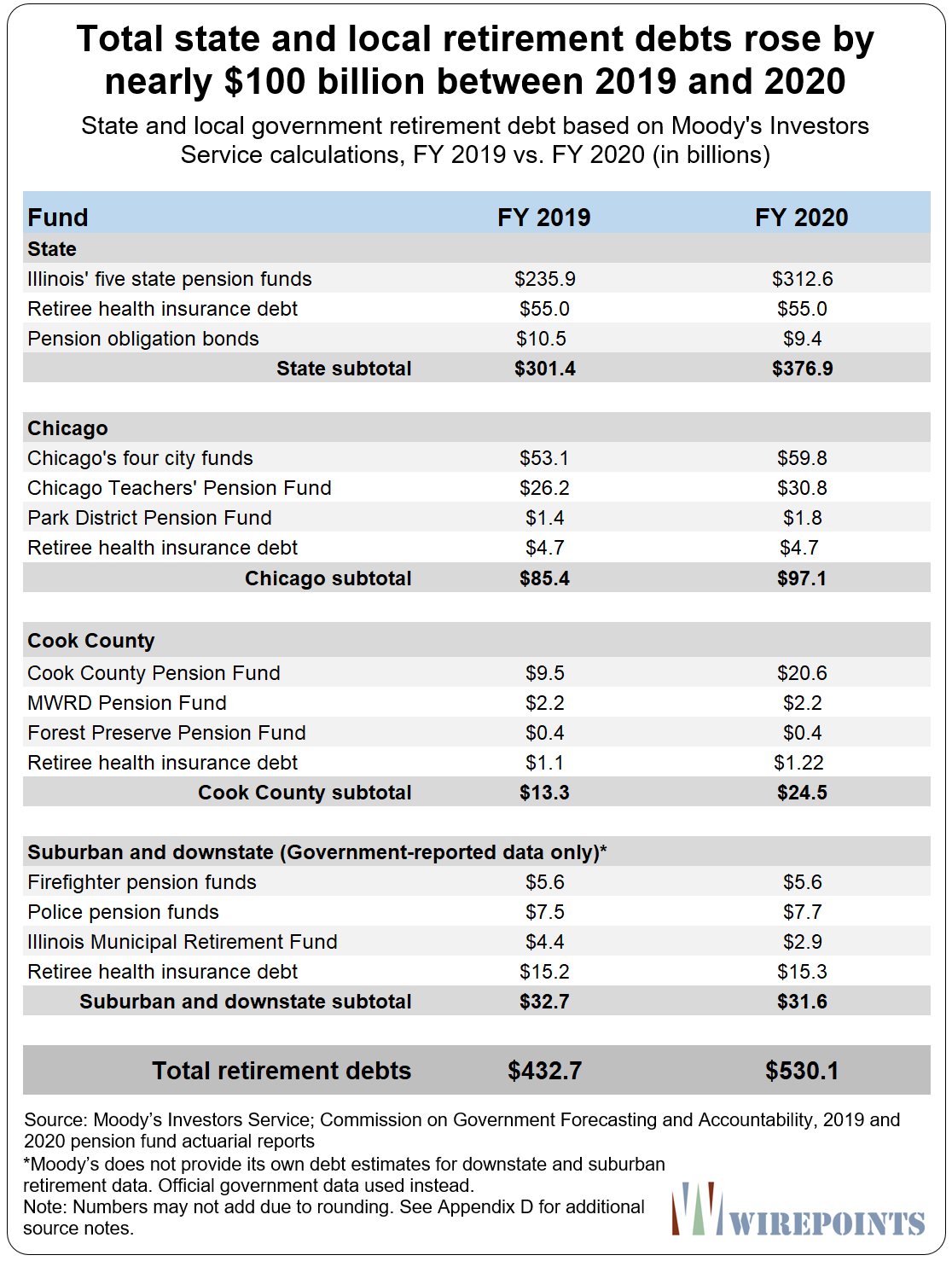

Illinois’ retirement debts increased to $530 billion in 2020, according to a Wirepoints analysis of Moody’s Investors Service debt estimates. This is the first year the credit rating agency’s estimates of Illinois’ retirement debts, made up of both pension and retiree health shortfalls at the state and local level, have broken $500 billion.

The jump in Illinois’ shortfall, up nearly $100 billion compared to 2019, was due largely to the drop in interest rates as a result of the COVID crisis. Illinois’ shortfall is expected to remain elevated in 2021 despite the market recovery. (See Appendix B.)

The growth in Illinois’ retirement debts to half-a-trillion dollars is yet another grim reminder of how lawmakers’ refusal to address the pension crisis does real harm to ordinary residents. These outsized debts have contributed directly to Illinois’ other crises, including the state’s worst-in-the-nation credit rating, the 2nd-highest property taxes and the nation’s 5th-worst decline in real home values.

The pension crisis has also contributed indirectly to a record rate of outmigration and the nation’s 2nd-largest population losses since 2010.

In addition, the growing debts point to just how much the retirement security of more than a million Illinois government workers and retirees has collapsed.

According to Pew Charitable Trusts, Illinois’ state-level pensions are just 39 percent funded, the lowest ratio in the nation.

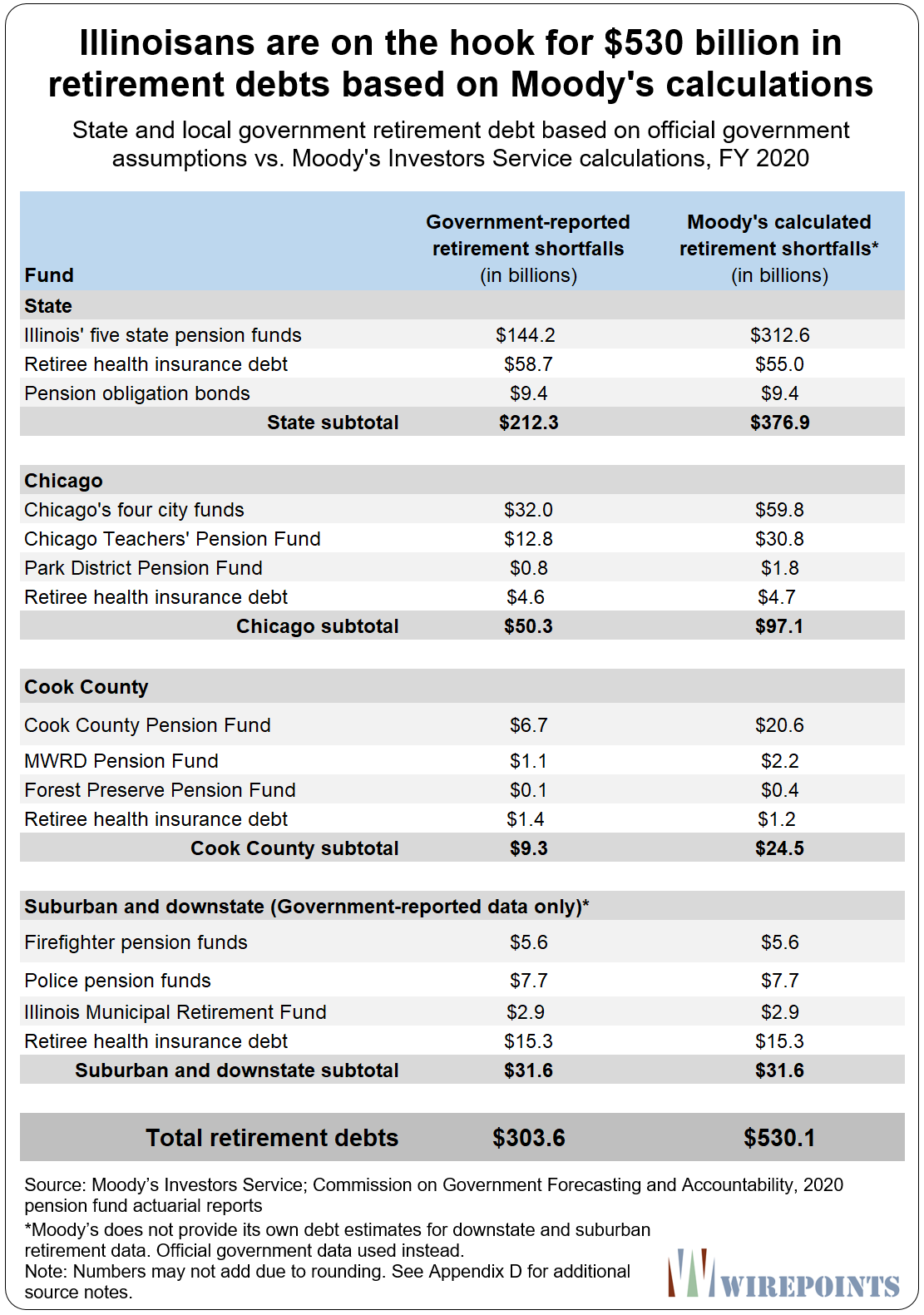

In all, Illinois’ $530 billion state and local retirement shortfall is made up of:

- Illinois’ five state-run pension funds – $313 billion

- State retiree health insurance – $55 billion

- State pension obligation bonds – $9 billion

- Chicago and Cook County pensions and retiree health – $122 billion

- Other local government pensions and retiree health – $32 billion

Illinois continues to be the nation’s extreme outlier when it comes to pension debts as measured by Moody’s. Comparing state-level pension data alone – there is no like-for-like comparison for all state and local retirement debts across the 50 states – shows Illinois’ debt swamps that of its neighbors and other big states.

Illinois continues to be the nation’s extreme outlier when it comes to pension debts as measured by Moody’s. Comparing state-level pension data alone – there is no like-for-like comparison for all state and local retirement debts across the 50 states – shows Illinois’ debt swamps that of its neighbors and other big states.

At $313 billion, Illinois’ state-level pension debt is the nation’s biggest, the 2nd-most on a per household basis, and the highest when measured as a share of state revenues and GDP. Illinois also has the nation’s highest pension costs as a share of revenues, according to Moody’s.

Record debts, no matter the source

It’s important to note that Moody’s $530 billion calculation is much higher than the official government estimates of $303 billion for Illinois’ state and local retirement debts (don’t confuse this number with Moody’s state-level-only pension debt of $313 billion). Moody’s uses lower discount rates than the state to calculate the present value of what’s owed to retirees, resulting in far larger shortfalls. In contrast, Illinois governments use far more optimistic investment rate assumptions to arrive at lower debt numbers.

The full explanation of the difference between Moody’s and the official debt calculations is covered in Appendix A, but what readers should know is that Moody’s discount rates better reflect the guaranteed pension promises that governments make to public sector workers, which taxpayers are on the hook for.

Moody’s methodology is broadly in line with the opinions of financial experts ranging from Nobel prize winners like Stanford’s Prof. William F. Sharpe and University of Chicago’s Prof. Eugene Fama, to other academics including Hoover Fellow Joshua Rauh and the late actuary Jeremy Gold.

While Wirepoints uses Moody’s debt estimates as the standard in this report, we also report the state’s official numbers for comparison purposes. Illinois’ official calculations also reached a negative milestone of their own this year: state and local retirement debts crossed the $300 billion mark in 2020. Any way you cut the numbers, retirement debts are reaching record levels in Illinois.

Illinois’ per household debts are overwhelming

Most Illinoisans can’t comprehend the meaning of $530 billion in retirement debts, but they’re increasingly feeling the burden those debts create every day.

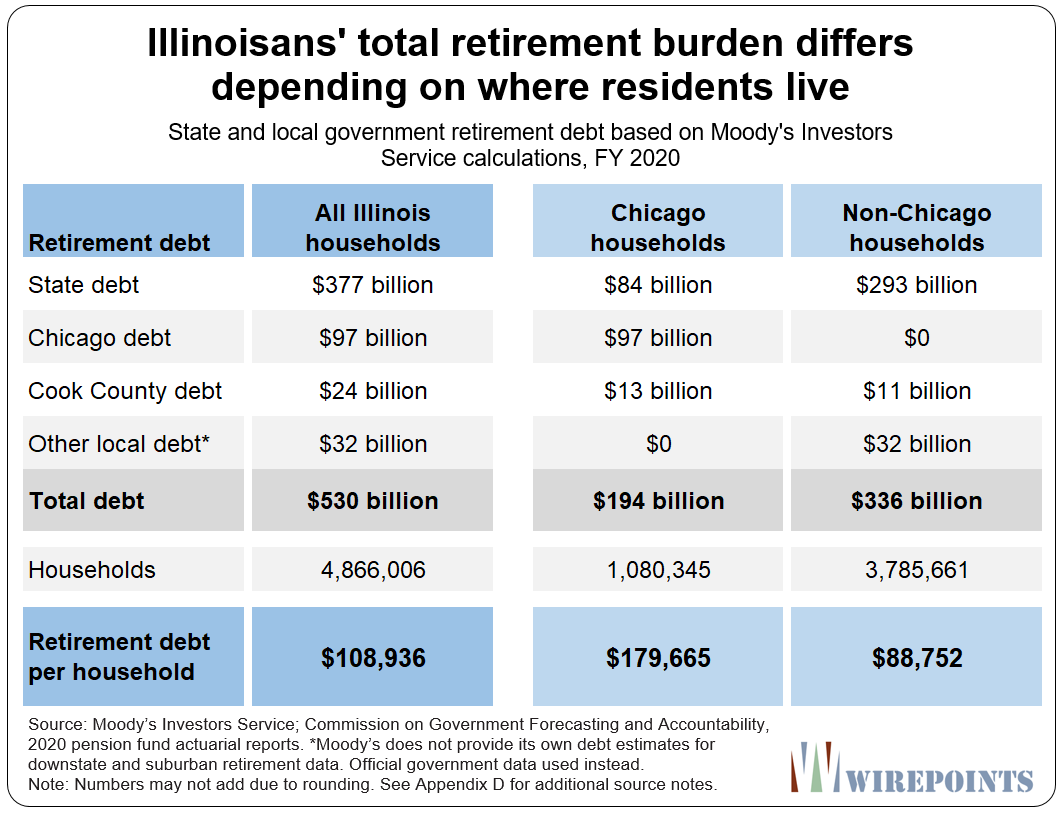

On average, each of Illinois’ 4.9 million households is on the hook for $110,000 in state and local shortfalls, based on Moody’s pension calculations ($530 billion spread over 4.9 million households).

That burden has consistently manifested itself in the higher taxes that residents have been paying, as well as in the reduced services they’ve been receiving. What’s worse, any taxes dedicated to paying down those debts over the next couple of decades won’t go toward new or improved services, but instead toward services already rendered. In other words, the future taxes needed to pay down that debt will be in addition to the taxes needed to pay for schools, transportation, healthcare and more.

The $110,000 per household is an average across the entire state, but the precise burden for Illinoisans differs depending on where they live. The debt burden on Chicago’s one million households is larger because of the city’s deeper debt crisis. There, each household is on the hook for $180,000 for their share of state and local retirement debts.

The $110,000 per household is an average across the entire state, but the precise burden for Illinoisans differs depending on where they live. The debt burden on Chicago’s one million households is larger because of the city’s deeper debt crisis. There, each household is on the hook for $180,000 for their share of state and local retirement debts.

Illinoisans living outside of Chicago, meanwhile, face an overall average burden of $90,000 per household. For comparison purposes, the burdens for Chicago and non-Chicago households, based on official state and local retirement debts, are $95,000 and $53,000, respectively.

Illinois the outlier

Illinois is the nation’s extreme outlier when it comes to retirement debts based on Moody’s calculations, particularly when just state-level pension debts are compared.

Illinois’ $313 billion shortfall in its five state-run pension funds, as of June 30, 2020, is the largest in the country, dwarfing that of its neighbors and other big states.

California, with more than triple the population of Illinois, has a state-level shortfall of $240 billion – $70 billion less than Illinois. And Texas, with more than double the population of Illinois, has a shortfall of $173 billion – $140 billion less than Illinois. Kentucky, suffering a pension crisis of its own, has a $56 billion state-level shortfall – just a fifth the size of Illinois’. The rest of Illinois’ neighbors have shortfalls valued at just $20 billion or less.

When measured on a per household basis, Illinois’ state-level pension debt totals more than $64,200. That’s the nation’s 2nd-largest burden, behind only Connecticut’s $65,400 per household. Illinoisans’ state-level household burden is four times larger than the national average of $15,600, and compared to residents in neighboring Iowa and Wisconsin, Illinoisans’ burdens are 18 to 20 times larger. Iowa and Wisconsin’s per household burdens are $3,500 and $3,200, respectively.

When measured on a per household basis, Illinois’ state-level pension debt totals more than $64,200. That’s the nation’s 2nd-largest burden, behind only Connecticut’s $65,400 per household. Illinoisans’ state-level household burden is four times larger than the national average of $15,600, and compared to residents in neighboring Iowa and Wisconsin, Illinoisans’ burdens are 18 to 20 times larger. Iowa and Wisconsin’s per household burdens are $3,500 and $3,200, respectively.

Please note the 50-state economic and financial comparisons for June 30, 2020 are not yet available from Moody’s. The following 50-state comparisons are based on state-level pension debts as of June 30, 2019. Illinois’ shortfall totaled $236 billion that year.

Please note the 50-state economic and financial comparisons for June 30, 2020 are not yet available from Moody’s. The following 50-state comparisons are based on state-level pension debts as of June 30, 2019. Illinois’ shortfall totaled $236 billion that year.

Illinois’ state-level pension debt also makes the state an extreme outlier when measured against other economic and financial metrics.

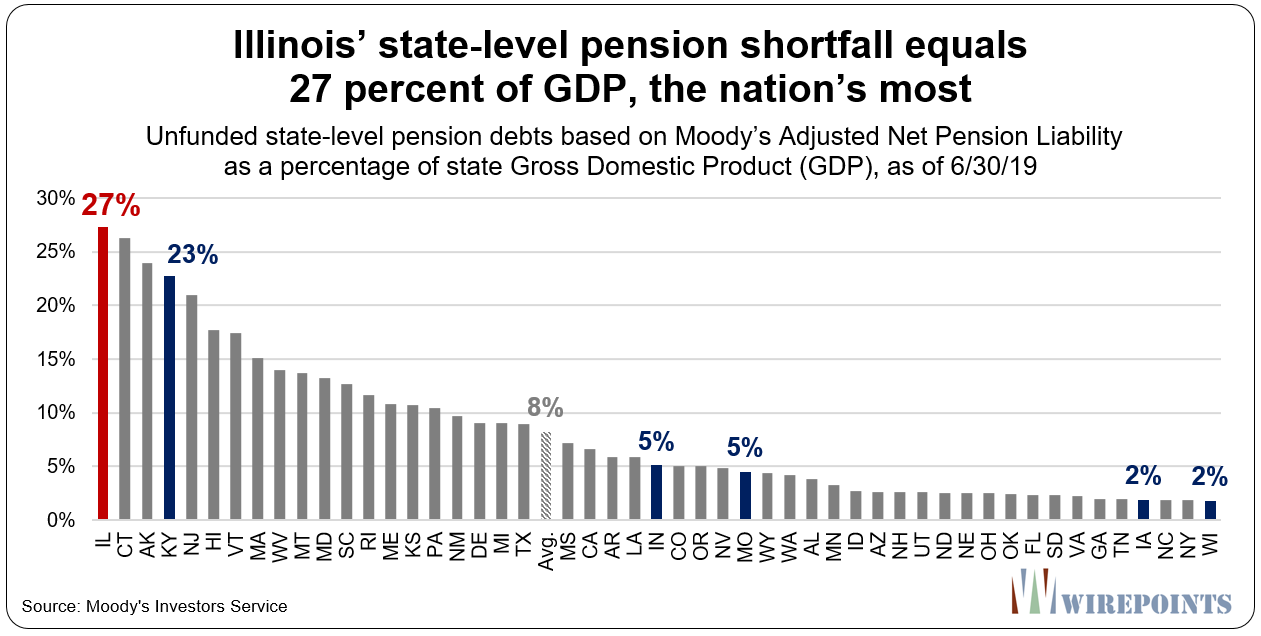

Illinois’ state level-debts are equivalent to 27 percent of the state’s annual GDP. In most of Illinois’ neighboring states, the debt is equal to just 2 to 6 percent of GDP. Indiana’s debt is at 5 percent, while Iowa and Wisconsin’s debt are both equal to less than 2 percent. Only Kentucky, which is struggling with a pension crisis of its own, comes close to Illinois with debts equal to 23 percent of GDP.

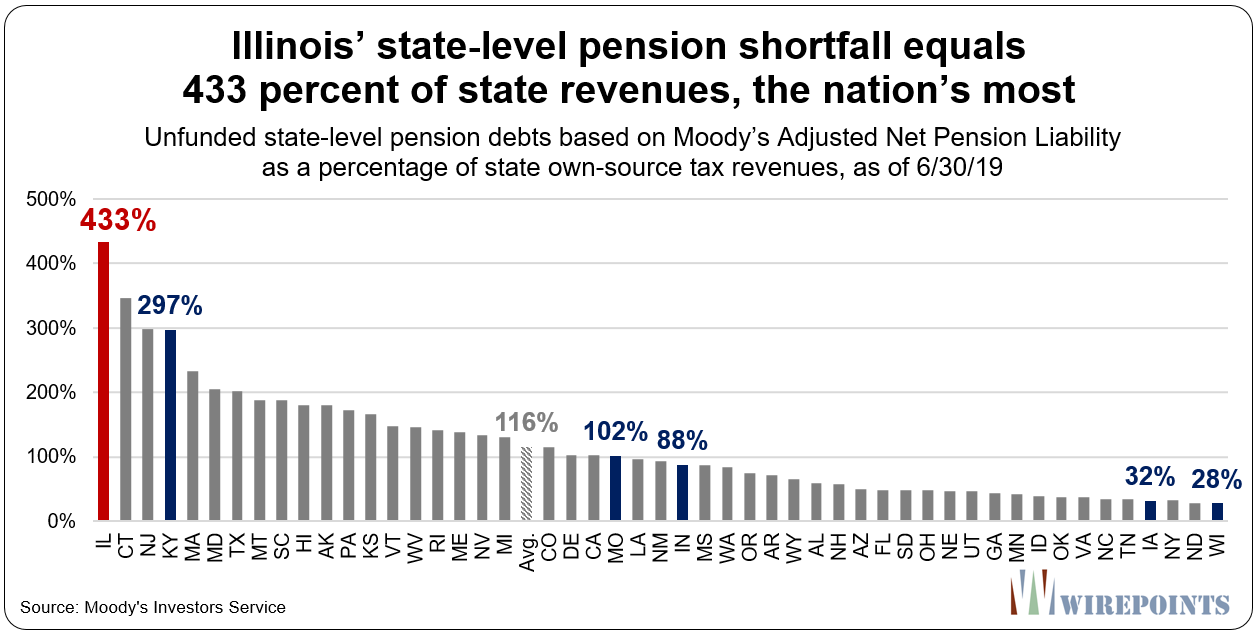

Illinois’ debts are also the nation’s-most when compared to state revenues. State-level pension debts are equal to 433 percent of Illinois’ own-source tax revenues, which is nearly four times the national average of 116 percent, and 15 times higher compared to Wisconsin’s 28 percent of revenues.

Illinois’ debts are also the nation’s-most when compared to state revenues. State-level pension debts are equal to 433 percent of Illinois’ own-source tax revenues, which is nearly four times the national average of 116 percent, and 15 times higher compared to Wisconsin’s 28 percent of revenues.

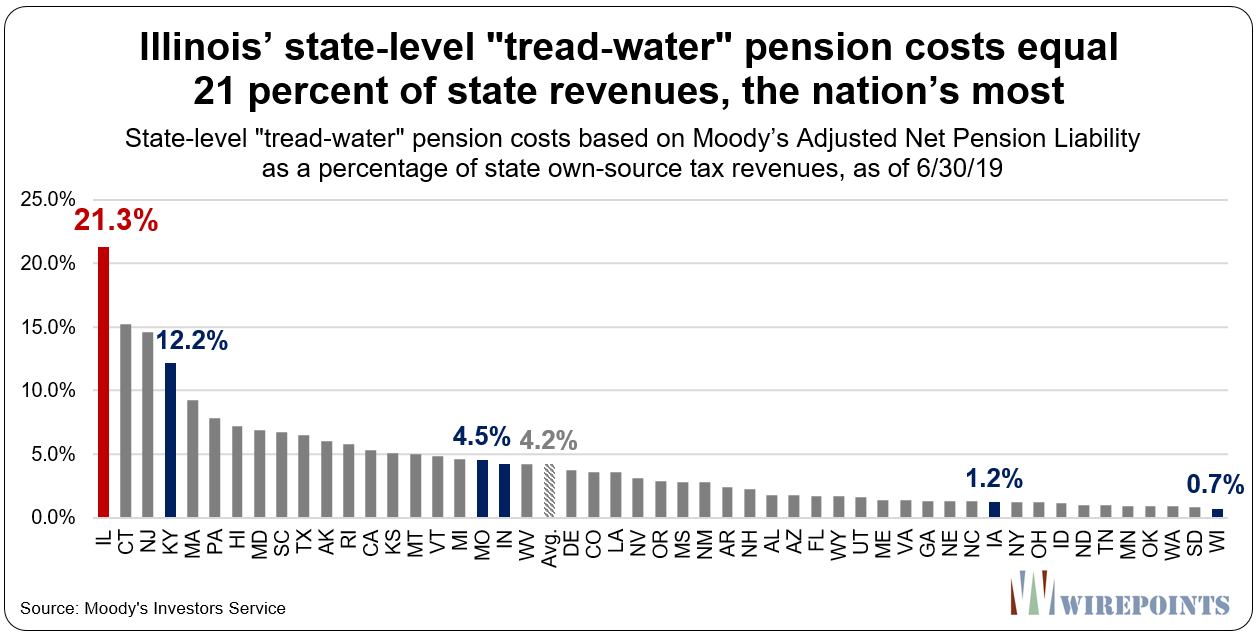

Illinois also has, by far, the highest pension costs as a percentage of state revenues. Moody’s says Illinois’ “tread water” pension cost – the annual state contribution required to ensure the state’s pension shortfall doesn’t grow from one year to the next – equals 21 percent of Illinois’ own-source tax revenues.

Illinois also has, by far, the highest pension costs as a percentage of state revenues. Moody’s says Illinois’ “tread water” pension cost – the annual state contribution required to ensure the state’s pension shortfall doesn’t grow from one year to the next – equals 21 percent of Illinois’ own-source tax revenues.

No other state comes close to that amount. Connecticut’s tread water cost equals 15 percent of revenues, the national average is just 4 percent, and all of Illinois’ neighbors’ costs, except Kentucky, equal just 5 percent or less of revenues.

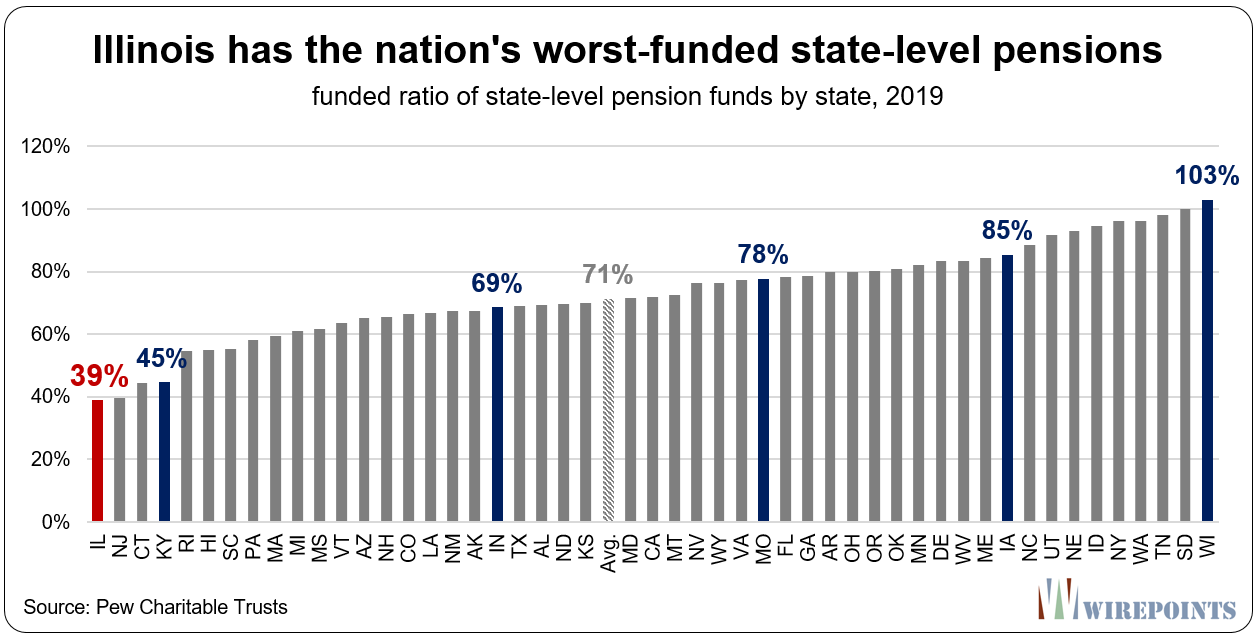

Illinois is also the nation’s extreme outlier when it comes to retirement security for state workers. Illinois state-level pensions were only 39 percent funded in 2019, according to official data collected by the Pew Charitable Trusts. A funded ratio of 60 percent or below is often seen as a “point of no return” for pension funds.

Illinois is also the nation’s extreme outlier when it comes to retirement security for state workers. Illinois state-level pensions were only 39 percent funded in 2019, according to official data collected by the Pew Charitable Trusts. A funded ratio of 60 percent or below is often seen as a “point of no return” for pension funds.

In contrast, most of Illinois’ neighbors are far better funded. Indiana’s funded ratio is 69 percent, 30 percentage points higher than Illinois, Iowa’s is 85 percent, and Wisconsin has the healthiest pensions in the nation with a funding ratio of 103 percent.

The need for structural reform

Lawmakers have done nothing since their failed reform efforts in 2013 to try and stem the growth in Illinois’ debt. That year, a majority of Democratic lawmakers and Gov. Pat Quinn agreed that pension reform was essential to fixing the state’s dire financial problems.

Then-Attorney General Lisa Madigan cited the conclusions previously reached by the General Assembly when she defended the reforms in front of Illinois’ Supreme Court:

“Having considered other changes that would not involve changes to the retirement system, the General Assembly has determined that the fiscal problems facing the state and its retirement systems cannot be solved without making some changes to the structure of the retirement systems.”

Today, most politicians won’t even discuss the possibility of reform, while others declare reform a “fantasy.”

But the reasons for structural changes are even more valid today than they were in 2013. The situation for Illinoisans has only gotten worse: state-level pension debts alone have risen by more than 60 percent, hundreds of local public safety funds have fallen closer to insolvency, Illinois’ tax burden remains one of the nation’s highest, and the state’s credit rating was at the brink of junk just a few months ago.

The hard truth is that Illinois’ crisis will only worsen over time. As the state’s retirement debts continue to grow, more and more Illinoisans will be motivated to leave the state’s debts behind while fewer migrants will be willing to move in and assume the pension burden. A growing debt burden on an ever-shrinking population will only hasten Illinois’ downward spiral.

Pension reform is inevitable. The question is whether Illinois’ legislature will address the crisis now, while Illinois still has assets and dynamism left, or delay until this state is a shadow of its former self. It’s a question of whether those reforms will happen in a controlled, organized fashion, or under the duress of fiscal and political chaos. And it’s a question of whether lawmakers will enact true structural reforms or pass more can-kicks as they have in the past.

Wirepoints’ Pension Solutions

The first step towards any reform effort is acknowledging that Illinois has a problem. That’s the purpose of this report – to bring attention to an overwhelming crisis that’s being ignored. Only once that crisis has been recognized and properly diagnosed can real solutions be discussed.

That said, Wirepoints has developed a baseline reform plan that can help fix the pension crisis. For more information about Illinois’ pension crisis and how it can be solved, see Wirepoints’ Pension Solutions.

To view Wirepoints’ detailed, actuarially-scored baseline retirement restructuring plan, read Wirepoints’ Special Report: Solving Illinois’ Pension Problem: Why It’s Legal, Why It’s Necessary, and What It Looks Like.

For a breakdown of the state’s official debts and their trend over the past two decades, visit Wirepoints’ Illinois Pension Facts.

And for a deeper analysis of Illinois’ local pension crisis, see Wirepoints’ Special Report: Communities in crisis: More than half of Illinois cities get “F” grades for local pensions.

Appendix A. Moody’s vs. official debt estimates

Moody’s estimates of Illinois’ debts are larger than official government numbers due to differing actuarial assumptions. The biggest driver of that difference is Moody’s use of a lower discount rate to calculate the present value of future pension benefits owed. A lower discount rate means bigger debts. For the fiscal year ending June 30, 2020, Moody’s used a 2.7 percent discount rate based on AA-rated corporate bonds. The rate is part of the FTSE Pension Liability Index used by Moody’s across the country.

The rationale for using lower, risk-free rates is simple: since governments have guaranteed a certain amount of pension benefits to government workers, then governments should lock in rates that can achieve those benefits without putting taxpayers at risk. That’s why groups like Moody’s use Treasury or near-Treasury rates to determine the size of government pension debts.

That methodology is broadly supported by financial experts ranging from Nobel prize winners like Stanford’s Prof. William F. Sharpe and University of Chicago’s Prof. Eugene Fama to other academics including Hoover Fellow Joshua Rauh and the late actuary Jeremy Gold.

In contrast, governments like Illinois use higher discount rates to calculate the value of their pension debts. Illinois uses rates close to 7 percent, which results in a lower pension burden compared to Moody’s calculations.

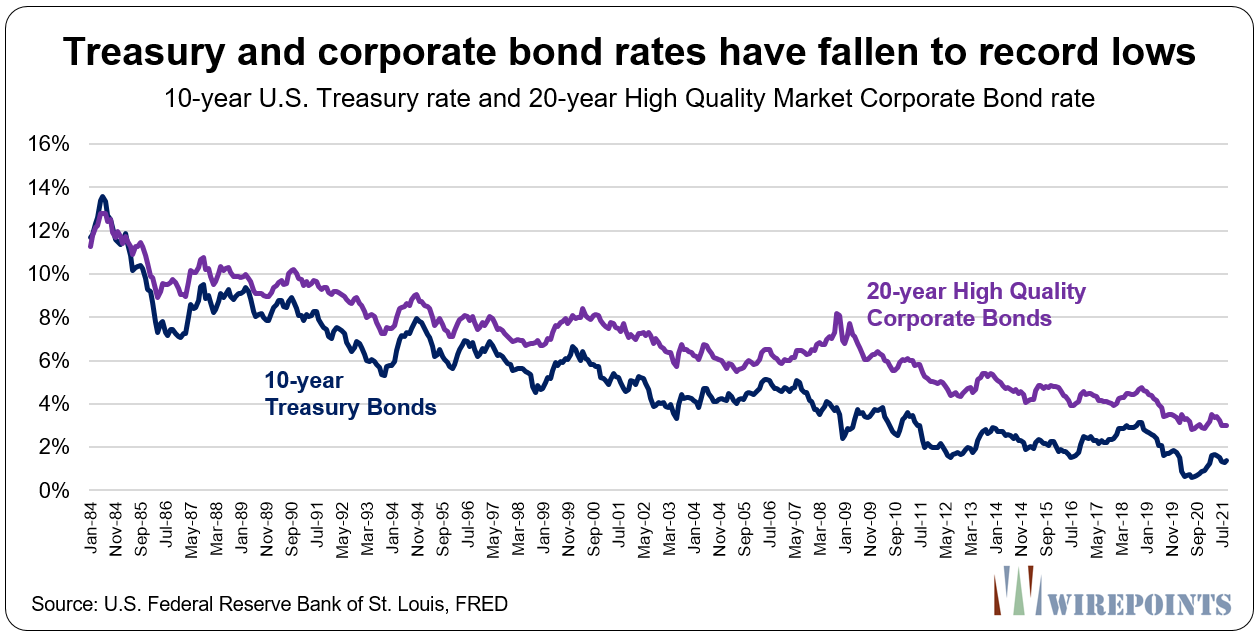

Higher discount rates may have been appropriate in the past when bond rates were far higher, but long-term yields have collapsed over the past four decades.

The 10-year Treasury rate has fallen below 2 percent and high quality corporate bonds are at about 3 percent. Using 7 percent rates no longer makes sense when the 10-year U.S. Treasury rate is under 2 percent.

Pension funds are reportedly taking on more risk to achieve their assumed returns, in part due to those low risk-free rates. Since they can no longer count on bonds, pension funds are increasingly investing in riskier assets including real estate and private equity, as recently reported in the Wall Street Journal and by the Reason Foundation. That, of course, puts taxpayers at more and more risk.

Pension funds are reportedly taking on more risk to achieve their assumed returns, in part due to those low risk-free rates. Since they can no longer count on bonds, pension funds are increasingly investing in riskier assets including real estate and private equity, as recently reported in the Wall Street Journal and by the Reason Foundation. That, of course, puts taxpayers at more and more risk.

A final note to critics that dismiss Moody’s debt calculations as too conservative: The agency’s measurement of pension debts matters because it is one of three major agencies that rates the state’s credit worthiness, which helps determine the state’s cost of borrowing, investor appetite for Illinois bonds, and the state’s overall financial reputation.

Illinois was recently upgraded to Baa2 – just two notches above junk – by Moody’s in the wake of the federal government’s unprecedented pandemic stimulus. And the City of Chicago and Chicago Public Schools are both junk-rated by Moody’s, Ba1 and Ba3,

respectively.

Appendix B. Total debts, 2020 vs. 2019

Total state and local retirement debts rose by nearly $100 billion between 2019 and 2020, growing from $432 billion to $530 billion.

The growth in debt was driven largely by falling interest rates. The FTSE Pension Liability Index, which Moody’s uses to value government retirement liabilities, fell to 2.70 percent as of June 30, 2020, down from 3.51 percent the prior year.

Illinois’ total unfunded liabilities will likely decline slightly in 2021 due to better market returns and the FTSE Pension Liability Index rising to 2.84 percent as of June 30, 2021.

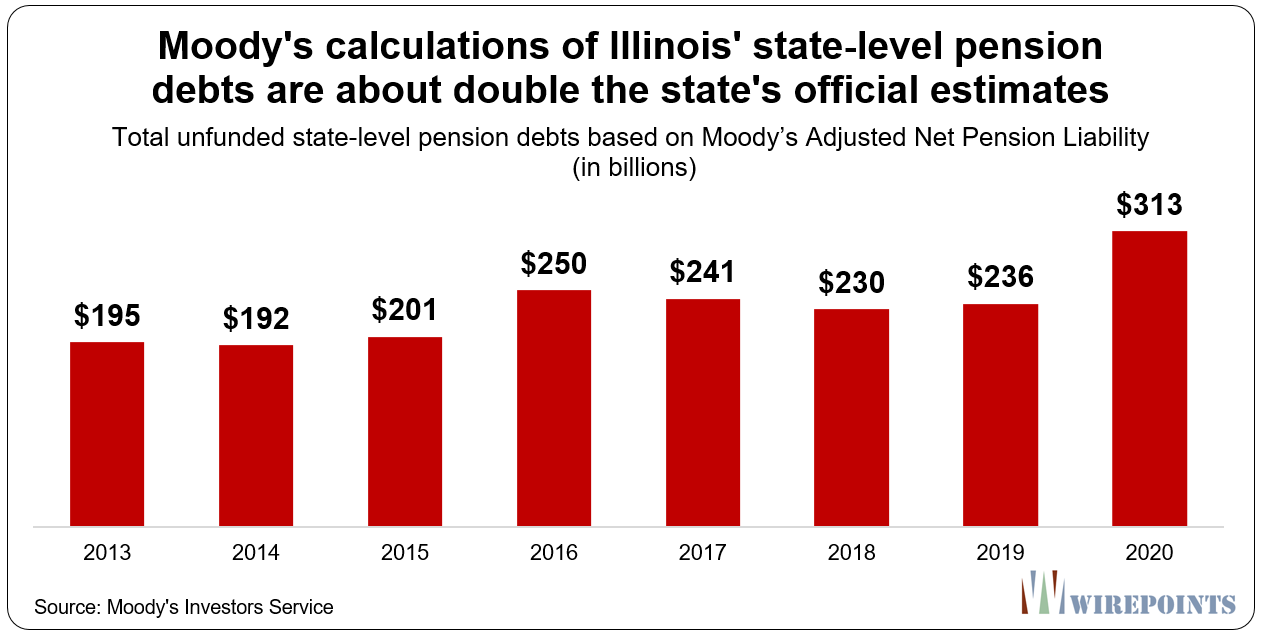

Appendix C. History of state-level unfunded liabilities

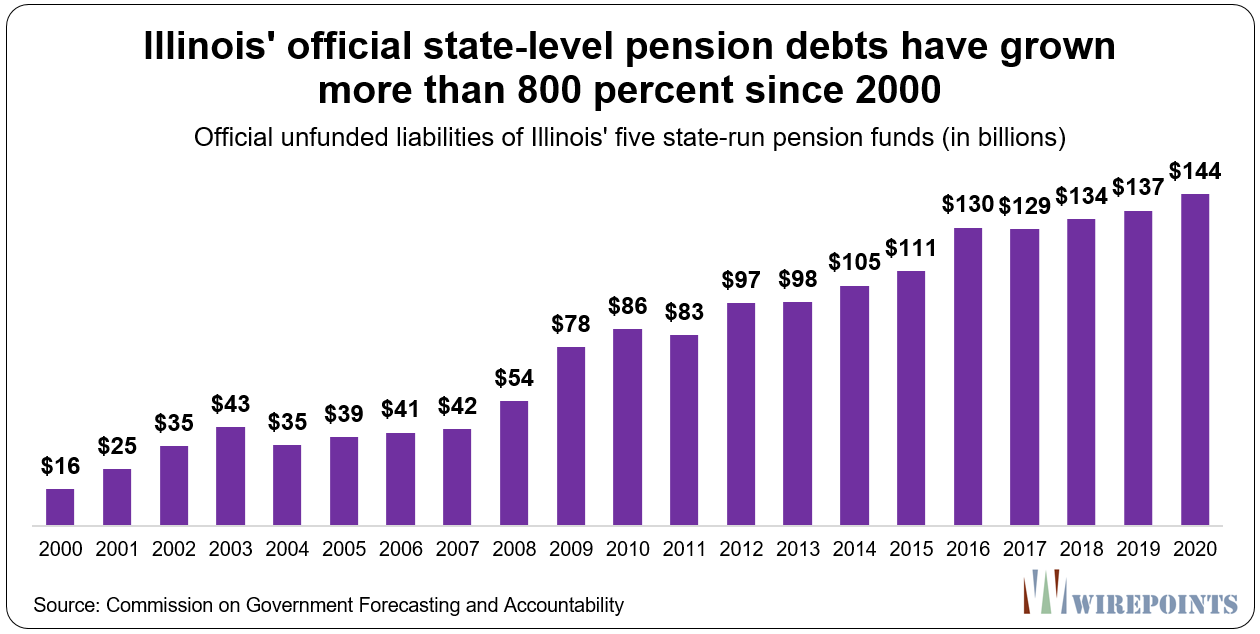

Illinois’ official state-level pension debts have risen by $128 billion since the year 2000, growing from $16 billion to more than $144 billion. That’s an increase of more than 800 percent over the period.

Moody’s calculation of Illinois’ state-level pension debt has consistently ranged between 70 to 100 percent larger than the state’s official numbers. Moody’s estimates of state debt grew from $195 billion in 2013 – the oldest data available from the credit rating agency – to $313 billion in 2020. That’s an increase of $118 billion, or 60 percent, over the 7-year period.

Moody’s calculation of Illinois’ state-level pension debt has consistently ranged between 70 to 100 percent larger than the state’s official numbers. Moody’s estimates of state debt grew from $195 billion in 2013 – the oldest data available from the credit rating agency – to $313 billion in 2020. That’s an increase of $118 billion, or 60 percent, over the 7-year period.

Appendix D. Source notes

Wirepoints’ compilation of Illinois’ state and local retirement debts was derived from the following sources. Please note that Wirepoints used data from the most recent fiscal year available when FY 2020 data was not available.

Official data

State-level pensions and retiree health:

- FY 2020 pension data was retrieved from the Commission on Government Forecasting and Accountability (COGFA) report “July 2021 Financial Condition of the Illinois State Retirement Systems.”

- FY 2020 retiree health data was retrieved from the “FY 2019 GASB 74 & 75 Actuarial Valuations” of the State Employees Group Insurance Program, Teachers’ Retirement Insurance Program, and College Insurance Program. The state’s share of teacher and college health debt is included in the state retiree health calculation.

Chicago pensions and retiree health:

- FY 2020 pension data was retrieved from the individual FY 2020 actuarial reports of the Chicago police, firefighters, laborers, municipal, teachers and park pension funds.

- FY 2020 retiree health data was retrieved from the FY 2020 Comprehensive Annual Financial Reports of the City of Chicago and Chicago Public Schools.

Cook County pensions and retiree health:

- FY 2020 pension data was retrieved from the individual FY 2020 actuarial reports of the Cook County, Cook County Forest Preserve, and Metropolitan Water Reclamation District pension funds.

- FY 2020 retiree health data was retrieved from the FY 2020 Comprehensive Annual Financial Reports of Cook County and the Metropolitan Water Reclamation District.

Downstate and suburban pensions and retiree health:

- FY 2020 pension data for Illinois’ downstate and suburban public safety funds and the Illinois Municipal Retirement Fund was retrieved from the Illinois Department of Insurance’s “2021 Biennial Report.”

- FY 2019 retiree health data was retrieved from the Illinois Comptroller’s “Local Government Warehouse” Fiscal Year 2019 Financial Database. FY 2019 data was largely used due to the low number of retiree health entries in the FY 2020 database. Local governments’ share of teacher and college health debt is included in the local retiree health calculation.

Moody’s data

State-level pensions and retiree health:

- FY 2020 pension data was retrieved from a 9/30/21 report “Medians – Pension and OPEB liabilities up ahead of decline in 2022.”

- FY 2019 retiree health data was retrieved from a 9/30/21 report “Medians – Pension and OPEB liabilities up ahead of decline in 2022.”

Chicago pensions and retiree health:

- FY 2020 pension data for Chicago police, firefighters, laborers, municipal, teachers and park pension funds was received via a request to Moody’s Investors Service. FY 2019 Chicago Park District pension data was retrieved from a 7/27/21 “Credit Opinion” report.

- FY 2019 retiree health data was retrieved for the City of Chicago from a 7/27/21 “Credit Opinion” report. FY 2019 retiree health data was retrieved for Chicago Public Schools from a 3/12/21 “Credit Opinion” report. FY 2019 retiree health data was retrieved for Chicago Park Dist. from a 7/27/21 “Credit Opinion” report.

Cook County pensions and retiree health:

- FY 2020 pension data for Cook County received via a request to Moody’s Investors Service. FY 2018 Metropolitan Water Reclamation District pension data retrieved from a 6/19/20 “Credit Opinion” report.

- FY 2018 retiree health data for Cook County was retrieved from a 12/17/20 report “Pensions still driving liability growth of 50 largest governments as interest rates fall.” FY 2019 retiree health data for the Metropolitan Water Reclamation District was retrieved from a 6/19/20 “Credit Opinion” report.

Downstate and suburban pensions and retiree health:

- Moody’s does not calculate ANPL pension data for Illinois’ downstate and suburban public safety funds or the Illinois Municipal Retirement Fund. The funds’ official debts were used in Wirepoints’ calculations instead.

- Moody’s does not calculate NOL retiree health data for Illinois’ other local governments. Official debts were used in Wirepoints’ calculations instead.

Note for Appendix B: Some Moody’s data for FY 2019/FY 2020 was not available. Wirepoints used data from the most recent fiscal year when the appropriate year’s data was not available.

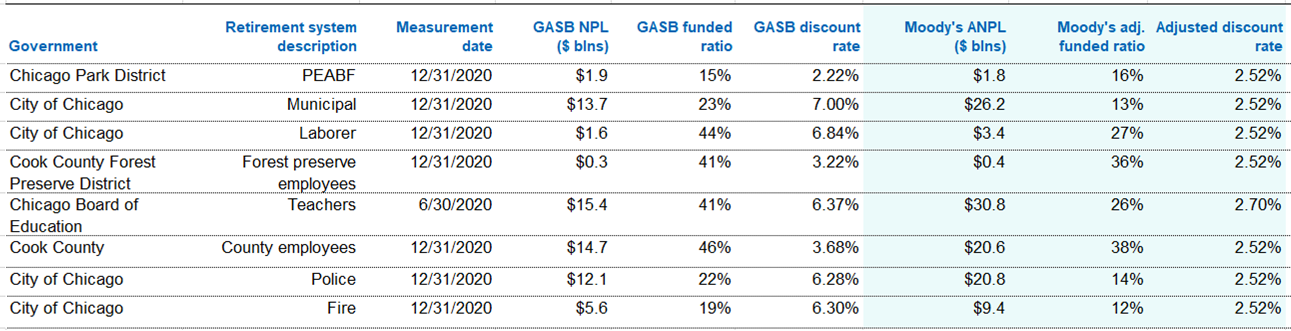

Wirepoints received the below table from Moody’s in response to a request for 2020 data for Chicago-area governments. Moody’s ANPL data was used in this report.

A set of state lawmakers want to extend CPS’ current school closing moratorium to February 1, 2027 – the same year CPS is set to transition to a fully-elected school board. That means schools like Manley High School, with capacity for more than 1,000 students but enrollment of just 78, can’t be closed for anther three years. The school spends $45,000 per student, but just 2.4% of students read at grade level.

A set of state lawmakers want to extend CPS’ current school closing moratorium to February 1, 2027 – the same year CPS is set to transition to a fully-elected school board. That means schools like Manley High School, with capacity for more than 1,000 students but enrollment of just 78, can’t be closed for anther three years. The school spends $45,000 per student, but just 2.4% of students read at grade level.

Hopefully, all media will get the message, in Illinois, too.

Hopefully, all media will get the message, in Illinois, too. Ted joined Tom Miller of WJPF to talk about Illinois’ highest-in-the-nation property taxes, why lawmakers don’t want to touch the tax’s cost drivers, just how much Illinoisans’ tax burden has grown over the decades, why Gov. Pritzker failed to meet his promise to reform property taxes, and more.

Ted joined Tom Miller of WJPF to talk about Illinois’ highest-in-the-nation property taxes, why lawmakers don’t want to touch the tax’s cost drivers, just how much Illinoisans’ tax burden has grown over the decades, why Gov. Pritzker failed to meet his promise to reform property taxes, and more.

70 percent of pension assets are typically invested in equity (stocks) or equity-like assets, not bonds. Historically, and I mean by this over 100+ years, stocks have outperformed bonds by roughly 4-5% on an annual basis on average, not only in the US but in other countries as well. This is referred to as the equity premium in the academic literature. Whether Moody’s low discount rates, based on bond yields, are more appropriate than the official discount rates depends crucially on the reason the equity premium exists in the first place. If the reason for the historical equity premium is… Read more »

Just to be clear, the public pension system in IL is not unsustainable due to underfunding, it is unsustainable due to the purposeful corruption of the union/political class in IL. The cries of “underfunding” is actually “The Big Lie” — all the unions have left to continue the illusion that it was ever fair to taxpayers to implement a pension system that returned 20-1 on each dollar future pensioners contributed.

The pension system in IL was designed in the 1970’s to be insolvent in that the dollars required to keep it solvent over even a 40 year projection were pipe dreams- totally unsustainable, as the system eventually requires up to 50% of all tax revenue to stay afloat. It is nothing more than a Ponzi scheme in which taxpayers are the marks and unions/politicians are the criminals. It doesn’t help that those we depended on to keep IL out of this state bankruptcy problem are all first in line to collect on the scheme(can you say MADIGAN). One way out… Read more »

So in summary, the public employee unions, and especially the teacher’s unions, have a stranglehold on the state of Illinois. Unlike most parasites, they have not evolved a symbiotic relationship so as not to kill the host. They show no sign of letting up; the grip is getting ever tighter and they revel in it. We will only survive if we find a way to overcome them. And then learn from the experience and never believe them again.

This article looks eerily like the Illinois situation. This is from 2016. https://www.bakersfield.com/news/how-a-pension-deal-went-wrong-and-cost-california-taxpayers-billions/article_ed5d5e80-3122-5414-81c0-d4faf0c8f5e0.html In the article it states that Gov Pete Wilson took $1.6B from Calpers to balance the budget. How many of our former governors “borrowed or took” money from the pension allocations to try to balance the budget? What was the total amount and was it repaid? If they did that it considered misappropriations of funds or more blatantly theft by deception to the pensioners and taxpayers. Those billions “diverted” over the years if it is true here in Illinois have lost untold amount of $$$ from investment… Read more »

“IF it is true.” You’ve got to be kidding! Its been true for literally many, many decades in that actuarial contributions have NEVER been made to the various IL public employee pension funds. Then, some fifteen years ago we had a couple of “pension holiday” years where literallly no pension contributions were made at all under Gov. Rod. How can any of that be interpreted in any other way than resulting in theft? The courts have made it clear that public employees and retirees have no rights as to the level of the pension systems’ funding and only have a… Read more »

We continue to short pensions even during the years where we meet the statutory payments. Everyone involved knows we are shorting the actuarial contribution payments by 5-6 billion per year and then when the pension debt increases everyone acts shocked. It’s the Illinois way. If voters are really upset about this debt increasing then they need to push lawmakers to make the required actuarial contributions. Of course that would require an increase in taxes and people don’t vote for that. Instead they vote for politicians that lie to them. It’s not their fault, they are merely giving the voters what… Read more »

More than 80% of Illinois taxpayers will receive NO benefit from the higher taxes you recommend. So why would people vote for the taxes you propose?

If pension funds run low enough then pension payments will come right off the top. Pensions will be paid first. Then tax increases will be required to meet other obligations. Raise taxes now to actuarially fund pensions or raise taxes even more in the future to cover other funding. Either way taxes will go up. Since taxpayers would rather pay more in the future that is exactly what they will get. Enjoy!

You didn’t answer my question

Welcome back James and PPF. We discuss a lot of topics on this site, but I never see you unless the topic is pensions or teaching. Seems like self-interest is the driving force…

Unlike some here I realize I’m not an expert needing to weigh forth on nearly every topic posted. I’d advise such posters to look up the term Dunning Kruger Effect. There are video postings on YouTube.com as well. If its a psychological disease-of-sorts nearly everyone can succumb to it at times. “A man’s gotta know his limitations.” (said Clint Eaatwood as “Dirty Harry”)

Since few of us are experts in anything, I guess that means thinking and expressing ideas are a sign of psychological disease. Got it.

If you’re a hammer everything else looks like a nail. Got it.

👍👍

Prozac, I tend to make comments about pensions because it’s the largest issue facing Illinois and people still don’t understand the problem. Most people are under the impression that if the pension funds run dry then the pensioners are screwed rather than the taxpayers. They are wrong and I will continue to point out this falsehood. Also, I have followed this site for years and most of the issues they cover are around pensions, education and taxes. Click on the policy link at the top of the page if you don’t believe me. Since COVID appeared, many articles and people… Read more »

By now, most people understand the state is broke and doesn’t pay its bills. They may not be familiar with the complexities of the pension crisis but they understand the bill will soon come due. And most of them understand that they will no longer be living in IL when that day comes. So it’s not really their problem. It becomes the problems of the illegals, the pension grifters, the moochers, the government workers…and those too dumb or poor to remain, and they don’t have any money to pay for the pensions anyway. I know the pension problem isn’t going… Read more »

Everyone says they will move but most people don’t. Family ties and other emotional reasons leave people in this state. Taxes have gone up about 70% in the last 10 years but population remains about the same. It’s a rounding error. As you’ve noted on other threads debtsor, the price of real estate is rising much faster in other prime markets while Illinois is stagnant. Sure our property taxes are higher but the overall cost to living in a home balances out with our depressed values. This also makes it more difficult for people to just up and move. People… Read more »

You’re missing the nuance of the ’rounding error’. The natives are leaving. The counties populated by natives are hollowing out. The natives are leaving Chicago too but are being offset by poorer foreign born residents. This is most evident in the CPS and Chicago ward maps as latino populations grow. IL is not Syria. It won’t be millions of families walking or floating to the EU border. But it’s one family at a time, one college student at a time, one retiree at a time. Eventually the flood of immigrants will dry up when they learn about high taxes and… Read more »

Right. PPF is an in denial, biased dope whose pension is doomed. Ted and Mark have both said the pensions are doomed, including in the article above. Math always wins, and the math says there are no realistic taxes or cuts that can be made now to save the pensions as is. TRS even admitted that if the pension funds go insolvent they won’t be able to be paid. PPF deserves the ditch he will be living in soon. I know math will win, and I can’t wait. Enjoy!!!! No more comments for me, as arguing with fools is a… Read more »

PFF understands that math always wins and that the pensions cannot and will not be paid. But it’s a long road to get there. And the road always leads to hollowed out cities like Cairo, Waukegan, Rockford, Elgin, East St. Louis, and so on….. Again, use streetview on your favorite online map service to see the once productive but now completely hollow cities littering the Illinois landscape. It’s more than just ‘rust belt decline’. Our surrounding states have far greater small town prosperity than IL. I”ve seen it with my own eyes over the last 20 years driving the midwest… Read more »

Pensions Paid First – your inquiries don’t push far enough. First, what in fact will happen when, let’s say, the Chicago police fund goes on a pay as you go status? Initially, it will be paid but not for long. The only prompt effective lever is an increase in property taxes, which will happen as well, but it won’t take many leaving (because the real money is in the top 10 percent of the population) to cause a real crisis. And further, contributions to other funds will not be made; it will be a mess of gigantic proportions. The domino… Read more »

Willowglen, IL has been undergoing a massive demographic and cultural transition for nearly 30 years. Our non-flagship colleges are awful because our high schools produce nearly illiterate graduates. It’s difficult to maintain decent 2nd tier state colleges when two-thirds of our high schools have average SAT scores literally in the gutter and don’t want to go to college. The top scoring kids have all the options and the lowest scoring have none. This contributes to the pension problems and the hollowing out I talk about above. These high school graduates stay in the state (for now) and will not earn… Read more »

I think you are correct as to demographic trends. Although far from being scholars, and both PE majors to boot, my parents were competent and literate coming from ISU. They were competent enough to raise two sons who graduated from the best schools in the nation, undergrad and grad, with honors.And frankly athletics always took top priority for financial reasons. Certainly anecdotal, but reflective of my parents generation. My athletic rivals in Illinois by and large went in state to schools like ISU and Southern and Eastern Illinois, successful in athletics and in academics. Many were from the southern suburbs,… Read more »

Your parents were two generations ago and my own college experience was about one generation ago. Times have changed very much so and high school today is barely recognizable to even what you and I experienced. For goodness sakes, the principal of my local high school uses pronouns in his email signatures to parents and the community.

I’ve been known to kid on occasion but in this case was the money borrowed that was to be appropriated to pensions to be paid back at a later date not necessarily with cash but with “enhanced” benefits or the promise of not addressing the pension crisis. Think of it no reforms whatsoever have been made. None. That in itself is a form of payback all legal of course. If any reforms were made don’t you think the unions and pensioners would have a fit and demand that the (diverted ) money be paid back? Not making any cuts or… Read more »

Let’s just agree that politics is an oft-confusing, shifty business fraught with all kinds of motivations from numerous players. The end result generally is some kind of compromise wherein most are at least minimally agreeable while simultaneously agitated that more couldn’t have gone their way. Outsiders complain continuously no matter the result while insiders surely know how morally mushy the whole process has become to get there. That’s how democracy works in the good ol’ USA.

The really hateful and inhumane activity will be the end game of this obvious bust-out/buy-up. Those architects of this crisis with access to family banks can obtain hyper-leveraged loans, opaque to any regulatory scrutiny. Unlimited amounts of borrowing at Fed window at zero or near-zero rates will be awarded to the few insiders able to access these massive funds, and given the political insider’s privilege to be ‘in the room where it happens, the room where it happens, the room where it happens’. That is: the politicians who created and profited by policies which destroyed Illinois property values will then… Read more »

Not an expert about this but a few things may be missing. #1 If these figures are based on actuarial tables life expectancy has been lowered by a few years so the money owed may be less. #2 Investment returns if higher will lower that amount but if investments falter the amount owed will be higher. #3 More bailouts from the feds. #4 Inflation or maybe worse hyperinflation. We are not immune to that. No vaccine for idiots running this country or state. Remember Zimbabwe? $100 Trillion Notes. The coins were worth more than the currency due to their metal… Read more »

Concerning the life expectancy comment, it looks like you were misguided by a CDC misrepresentation of recent life expectancy trends.. Life expectancy in the US (again an interesting flavor of exceptionalism) had reached some kind of plateau before covid and the 2020-1 covid editions have resulted in a very unusual level of excess deaths and excess of years of life lost. The CDC reported that the 2020 year has resulted in a significant decrease in life expectancy (about 1 year) and a similar outcome is expected in 2021 but this interpretation is based on a period-life-expectancy assumption whereby the new… Read more »

Balanced budgets result in $300B or $500B in Illinois state and local pension and retiree healthcare Ponzi scheme debt.

That sounds bigger than Bernie Madoff which was $65B.

Disturbing level of debt, more than a lot of countries in world. Question: why then did Moody’s recently upgrade the debt ratings? Until the rating agencies have the political will to rate it what it is: junk debt and insolvent the music will keep playing.

Why? $180 billion in bailout money from the Feds…and now more on the way. If bondholders weren’t more secure after that, they never will be….https://wirepoints.org/illinois-gets-its-first-credit-upgrade-in-20-years-it-took-138-billion-in-federal-relief-for-it-to-happen-wirepoints/

The lion share of that money went to the private sector. It is odd that Moodys would upgrade based on one time, non recurring bail outs when they gave reprieve on their rating during Covid because it was an extraordinary event. Can’t have it both ways. If they didn’t downgrade then I don’t ever see them doing it. There is a structural imbalance with the budget. Those pension deficits are ran up on that backs of everyday Illinoisans.

Well,im doing my part to help the public sector pensioners,right after reading this article i promptly dropped a check in the mail for $ 110,000 dollars,that will satisfy what I owe to the public sector workers-you’re welcome!!

Smart move. Paid it off before even more interest accumulates and debt-collectors come a-callin’. Maybe the state will offer an amnesty program so I can just cut them a $60K check and I’m off the hook.

lol!-I just hope they dont try to cash my check for,mmm,i ll just say ,”a little while”

No worries. They have your house as collateral.

Homes are depreciating assets with high carrying costs. The state of IL can keep it!

Yeah, no big deal, same old same old. Moodys, the great enabler, will write these analysis just to cover their butts, then turn around and keep the ratings above junk, just where the market wants it get those yields. The market knows that Illinois is in trouble, but they also know that the politicians here will literally enslave the population and even seize assets to pay the bonds. Bond-wise you might call Illinois a slave-secured bond market, a rock solid investment because our slave handlers in Springfield will tax the crap out of us at the mere thought of reducing… Read more »

It’s $110,000 per household but equity demands certain zip codes pay more, and others pay none at all….

Yep. Once you means-test the debt – say, apply it only to households with $75,000 or more in income, households that comprise maybe one-third of all taxpayers – you’re left with a large mortgage on top of your large mortgage. Except you only get to live in one of them.

And there will be an equitable pension exit tax assessed on every homeowner leaving the state….

When politicians talk about equity they have always meant YOUR HOME’S EQUITY hahahha you didn’t earn that equity, it came off the backs from others who had no home equity at all… your home equity in Orland Park was stolen from Back of the Yards, some how that happened, even if it doesn’t make sense, it doesn’t matter…

I’m checking my zip code now to see if I am eligible for the “give back benefit” like Joe Namath and Jimmie “JJ” Walker.

Dino-mite. I only see those commercials about 50 times per day!

But but but…..It’ FREEEEEEE!

yea,those ignorant commercials irk the crap outta me

Pritzker is running for re-election, so what is he proposing to fix the problem?

Too worried about gender, pronouns, and “equity”.

As long as a large asteroid hits the middle of the state we’ll be fine. That’s how the dinosaurs solved their pension crisis.

Unfortunately some of our politicians especially in Washington had dinosaurs as pets( little Rex and Bronto) but they are still collecting pensions.

These numbers are so staggeringly high that almost no one can comprehend them– not the average citizen or the average public official. So you know what the response will be from all levels of government– ignore them, just as they have done in the past. Even a large federal bail out can’t solve the problem now.

A very informative article by Wirepoints. The facts set forth are as disturbing as can be. But the $110,000 per household figure understates the problem. How many households have the wherewithal to make any progress towards the debt? 25 percent of the 4.9M? A guess, to be sure, but likely getting close to the mark. Out migration of the top 10 percent of households will bring on catastrophe. The only real strategy in the minds of the politicians who run the state is a fed bailout. That is the only way forward for them – certainly a tough thing to… Read more »