By: Mark Glennon*

This is very bad news indeed. COGFA, the Commission on Government Forecasting and Illinois, just released its Illinois state revenue report for October and the fiscal year to date (which began July 1). Tax revenue continues to drop, despite the supposed economic recovery.

Comparing this October to last October, overall base revenues fell $304 million. Receipts from the individual income tax, corporate income tax and sales tax all declined, although transfers the state gets from the Federal government also contributed to the drop.

Comparing this fiscal year-to-date to the same period last year, base receipts are down $449 million, “reflecting growing concern with revenue performance for the first part of FY 2017,” COGFA said. Individual and corporate income tax revenue are down and sales tax revenue is flat for the year.

It’s important to note that this revenue drop is no longer attributable to expiration of Illinois’ temporary income tax. It expired at the end of 2014.

This is a particularly ugly story when combined with the analysis released today by the Illinois Policy Institute of IRS data on out-migration of the individual tax base. It shows more out-migration than in-migration of taxpayers and of total adjusted gross income, which is basically the individual tax base. And it’s the wealthier folks who are leaving while lower income folks are moving in. That’s based on 2014 data, the most recent available, and it has probably worsened since then.

The bottom line is ever increasing expenses, especially for pensions (another $1 billion increase coming up), while revenue and the tax base shrink. The state is already running deep in the red ($6 to $10 billion per year, depending on whose numbers you use), despite the harsh spending cuts already in place.

*Mark Glennon is founder of WirePoints. Opinions expressed are his own.

If you’re frustrated with Illinois’ educational results, you may want to follow the money from teachers unions. In the last four years alone, Illinois lawmakers and political candidates have taken nearly $30 million in contributions from teachers unions and their national affiliates.

If you’re frustrated with Illinois’ educational results, you may want to follow the money from teachers unions. In the last four years alone, Illinois lawmakers and political candidates have taken nearly $30 million in contributions from teachers unions and their national affiliates.

Wirepoints President Ted Dabrowski testified on April 10, 2024 to members of the House Revenue and Finance Committee at the invitation of Rep. Joe Sosnowski. Ted told lawmakers that the state’s property tax burden has become dire for countless Illinoisans.

Wirepoints President Ted Dabrowski testified on April 10, 2024 to members of the House Revenue and Finance Committee at the invitation of Rep. Joe Sosnowski. Ted told lawmakers that the state’s property tax burden has become dire for countless Illinoisans. Ted joined WLS 890’s PM Chicago Show to discuss Chicago’s worsening pension crisis, why the city’s crisis makes it such an outlier nationally, its negative impact on residents, government workers and retirees alike, and what Mayor Brandon Johnson should do about it.

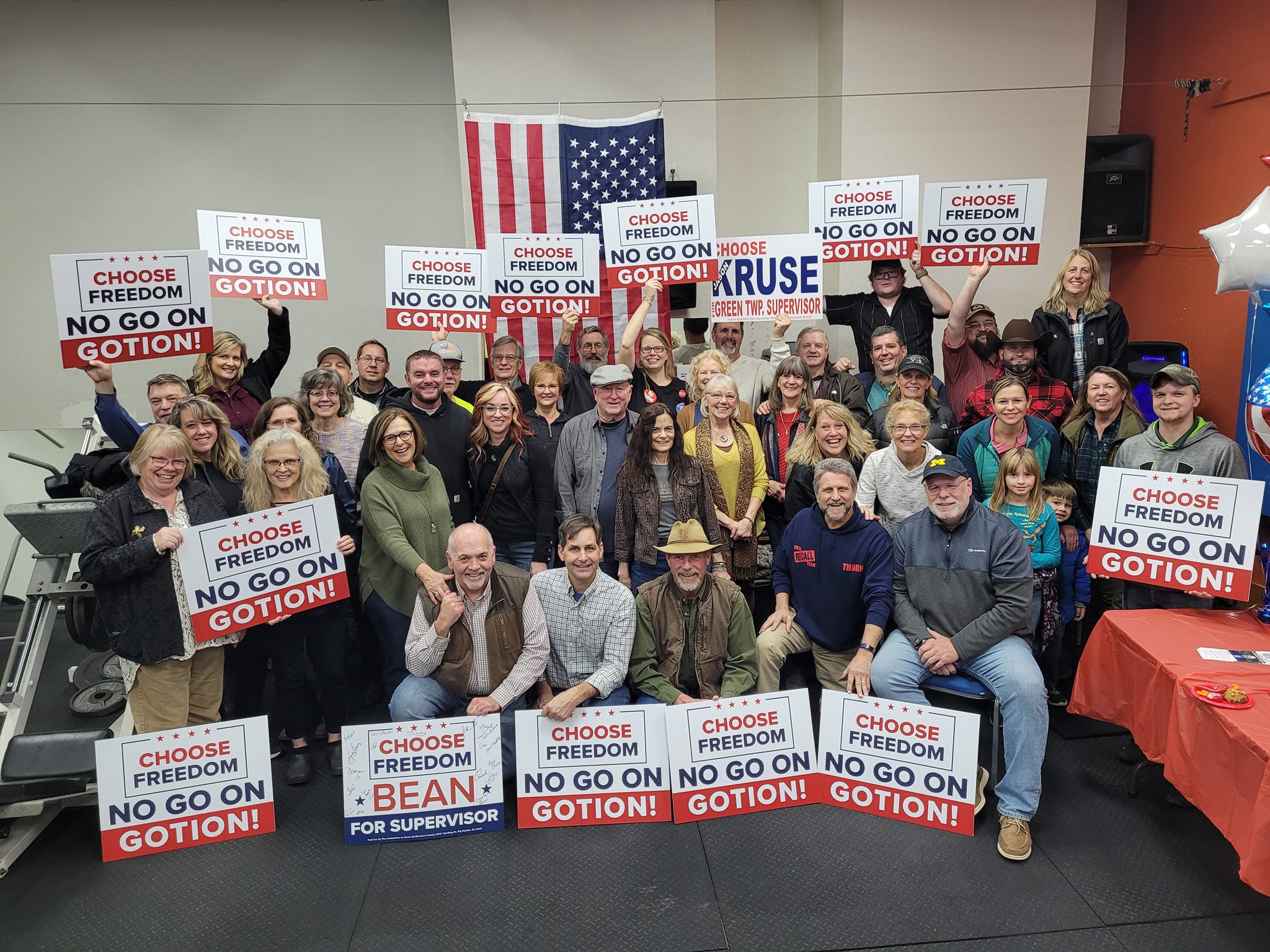

Ted joined WLS 890’s PM Chicago Show to discuss Chicago’s worsening pension crisis, why the city’s crisis makes it such an outlier nationally, its negative impact on residents, government workers and retirees alike, and what Mayor Brandon Johnson should do about it. When has any company persisted with a project in the face of stronger local, statewide and national opposition? When have taxpayers subsidized a more harebrained project?

When has any company persisted with a project in the face of stronger local, statewide and national opposition? When have taxpayers subsidized a more harebrained project?

The bankruptcy of government employers and the failure of their pension systems are likely events which are as well understood by public officials and public employees as by your readers. Unfortunately for the State and it’s taxpayers, I think the officials (supported by active and retired public employees) are acting in their self-interest by generating as much current income as possible to have a savings cushion when the system collapses and to have the largest possible benefit accruals to negotiate the highest possible bankruptcy settlement. We have passed the time when these “deciders” are considering any future but their own.

Yes, I think they have played their hand superbly, too — from their own purely selfish perspective. Loot the pot for all you can before some kind of equitable resolution is unavoidable. Their litigation strategy and whole approach to pensions has been played perfectly from that perspective — and it’s still working.

AND they are willing to exercise their power — that they were never supposed to have — to shut down transportation, education, public safety, health care and lots of other things that voters regard as necessities. It’s likely to end badly but not necessarily soon.

FDR – “The very nature and purposes of Government make it impossible for administrative officials to represent fully or to bind the employer in mutual discussions with Government employee organizations”.

What’s the likelihood the politicians will take a critical and honest look at revenues and expenditures and identify a reasonable mixture of taxes and reductions in expenditures? I’m betting an 8% State Income rate and no meaningful reforms…

There is no reasonable mixture of taxes and reductions available that would balance the budget. The tax increase would have to be so massive that a stampede out would ensue, further eroding the tax base and eventually backfiring. Illinois is in denial about that reality.

The tax increase would have to be so massive that a stampede out would ensue, further eroding the tax base and eventually backfiring

Hasn’t that stamped already begun? http://stump.marypat.org/ showed some interesting stats a few months back….

http://stump.marypat.org/article/541/public-pensions-raining-on-chicago-s-parade

Yes, exactly. There’s no doubt now that we are past the top of the curve, where further tax increases result in lower tax yield (though that effect takes a few years to show up).