By: Mark Glennon*

It seems simple enough that we should have figured out how to get it long ago — an economy where people trade services and goods among each other rapidly enough and at high enough value that each individual can live in dignity. Yet, in Illinois and much of the world, that remains elusive, and it’s that central failure that’s key to the downward spiral of the middle class and sustained poverty.

There’s no need to review the facts about unemployment and low wages. Particularly in Illinois, those who claim we are coming back are asking us to refuse to believe what we see with our own eyes.

Labor Day is a “tribute to the contributions workers have made to the strength, prosperity, and well-being of our country,” as the U.S. Department of Labor puts it. That tribute is made by also using the day to remember how badly workers have been served by the economy we have, and to look for solutions.

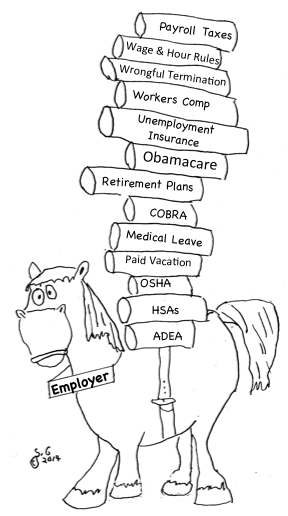

We won’t agree about those solutions, but there’s one general principle to build on that should have a consensus: Job-giving has become a huge pain in the neck. Administrative costs, bureaucracy, and litigation risk have piled so high that the equation for would-be employers has become pretty simple, employees = trouble.

It’s no surprise that business software has been a hot sector for years. The real value of most of it is allowing companies to use fewer employees. The darlings of the investment world are ventures that can “scale,” which is usually a euphemism for growing without having to hire more people. Complexity has become overwhelming. One major Chicago law firm that regularly sends out employment law bulletins often uses the title, “The Wage & Hour Nightmare Continues.” Even lawyers pull out their hair trying to keep track of it.

A rational system might reward job-giving, but we’ve decided to make employers the beasts of burden carrying the costs of administering a wide range of social goals. Believe in those goals if you want, but ask whether it’s wise to make employers responsible for achieving them.

It’s not just the Affordable Care Act, though that’s the whopper, imposing tens of millions of hours of compliance work on employers. It’s also wage and hour law complexity, retirement plans, health savings accounts, payroll taxes, COBRA and all the other things that have made human resources a specialized and huge profession — over 500,000 HR managers in America.

Some of this is fine in concept, like 401(k) plans, and some of it is rightly imposed on employers, like worker safety obligations. But the question is why job-givers should get stuck with as much of it as they have.

Illinois appears ready to pile more on. In response to the legitimate concern that workers aren’t saving enough for retirement, Springfield is now considering legislation creating “Secure Choice Savings Plans” that would make employers liable for automatically deducting three percent from paychecks to be turned over to a state-run account.

Perhaps worst of all, few employer-sponsored programs benefit those who may need them the most, independent contractors and part-timers, whose numbers have been exploding. They have few portable benefits. We’re stuck in a 1950s mindset where most everybody could find a good job with a large company.

Those days are gone, and it’s not like we couldn’t have seen it coming. Ross Perot, quirky as he was as a presidential candidate, had a plain-talking economist as his running mate — Pat Choate. 28 years ago Choate wrote The High Flex Society, a book in which he suggested preparing for exactly what has come to pass — an economy in which workers must be highly flexible — frequently changing jobs, learning new skills, and working in multiple roles. He called for dropping the employer-based benefits system in favor of a simpler, portable one. He was ignored, wrongly. We cling to a low flex model that presumes an economy that no longer exists.

Celebrate the contributions of workers this Labor Day, but also say to yourself, “this isn’t working.” Employers and workers are not trading services for money at nearly the pace that’s needed for workers to live in dignity and, one way or another, change had better come.

*Mark Glennon is founder of WirePoints (and credit to my son who drew the horse).

A set of state lawmakers want to extend CPS’ current school closing moratorium to February 1, 2027 – the same year CPS is set to transition to a fully-elected school board. That means schools like Manley High School, with capacity for more than 1,000 students but enrollment of just 78, can’t be closed for anther three years. The school spends $45,000 per student, but just 2.4% of students read at grade level.

A set of state lawmakers want to extend CPS’ current school closing moratorium to February 1, 2027 – the same year CPS is set to transition to a fully-elected school board. That means schools like Manley High School, with capacity for more than 1,000 students but enrollment of just 78, can’t be closed for anther three years. The school spends $45,000 per student, but just 2.4% of students read at grade level. Hopefully, all media will get the message, in Illinois, too.

Hopefully, all media will get the message, in Illinois, too. Ted joined Tom Miller of WJPF to talk about Illinois’ highest-in-the-nation property taxes, why lawmakers don’t want to touch the tax’s cost drivers, just how much Illinoisans’ tax burden has grown over the decades, why Gov. Pritzker failed to meet his promise to reform property taxes, and more.

Ted joined Tom Miller of WJPF to talk about Illinois’ highest-in-the-nation property taxes, why lawmakers don’t want to touch the tax’s cost drivers, just how much Illinoisans’ tax burden has grown over the decades, why Gov. Pritzker failed to meet his promise to reform property taxes, and more.

“In response to the legitimate concern that workers aren’t saving enough for retirement, Springfield is now considering legislation creating ‘Secure Choice Savings Plans’ that would make employers liable for automatically deducting three percent from paychecks to be turned over to a state-run account.”

A state run account.

What a joke.

The state has done such a great job with pensions, let’s give them more retirement money and create more patronage jobs.

Remember that the IRA option is always available to workers not covered by a 401k plan. A law that would make it necessary for employees to opt out of 401k participation, as advocated by Richard Thaler and Cass Sunstein in their book Nudge (2008), would be superior to mandatory participation in an Illinois run retirement plan, where pension funded ratios are often under 50%.