$30 million over four years: How teachers unions influence Illinois politicians. – Wirepoints

If you’re frustrated with Illinois’ educational results, you may want to follow the money from teachers unions. In the last four years alone, Illinois lawmakers and political candidates have taken nearly $30 million in contributions from teachers unions and their national affiliates.

If you’re frustrated with Illinois’ educational results, you may want to follow the money from teachers unions. In the last four years alone, Illinois lawmakers and political candidates have taken nearly $30 million in contributions from teachers unions and their national affiliates.

Wirepoints President Ted Dabrowski testified on April 10, 2024 to members of the House Revenue and Finance Committee at the invitation of Rep. Joe Sosnowski. Ted told lawmakers that the state’s property tax burden has become dire for countless Illinoisans.

Wirepoints President Ted Dabrowski testified on April 10, 2024 to members of the House Revenue and Finance Committee at the invitation of Rep. Joe Sosnowski. Ted told lawmakers that the state’s property tax burden has become dire for countless Illinoisans. Ted joined WLS 890’s PM Chicago Show to discuss Chicago’s worsening pension crisis, why the city’s crisis makes it such an outlier nationally, its negative impact on residents, government workers and retirees alike, and what Mayor Brandon Johnson should do about it.

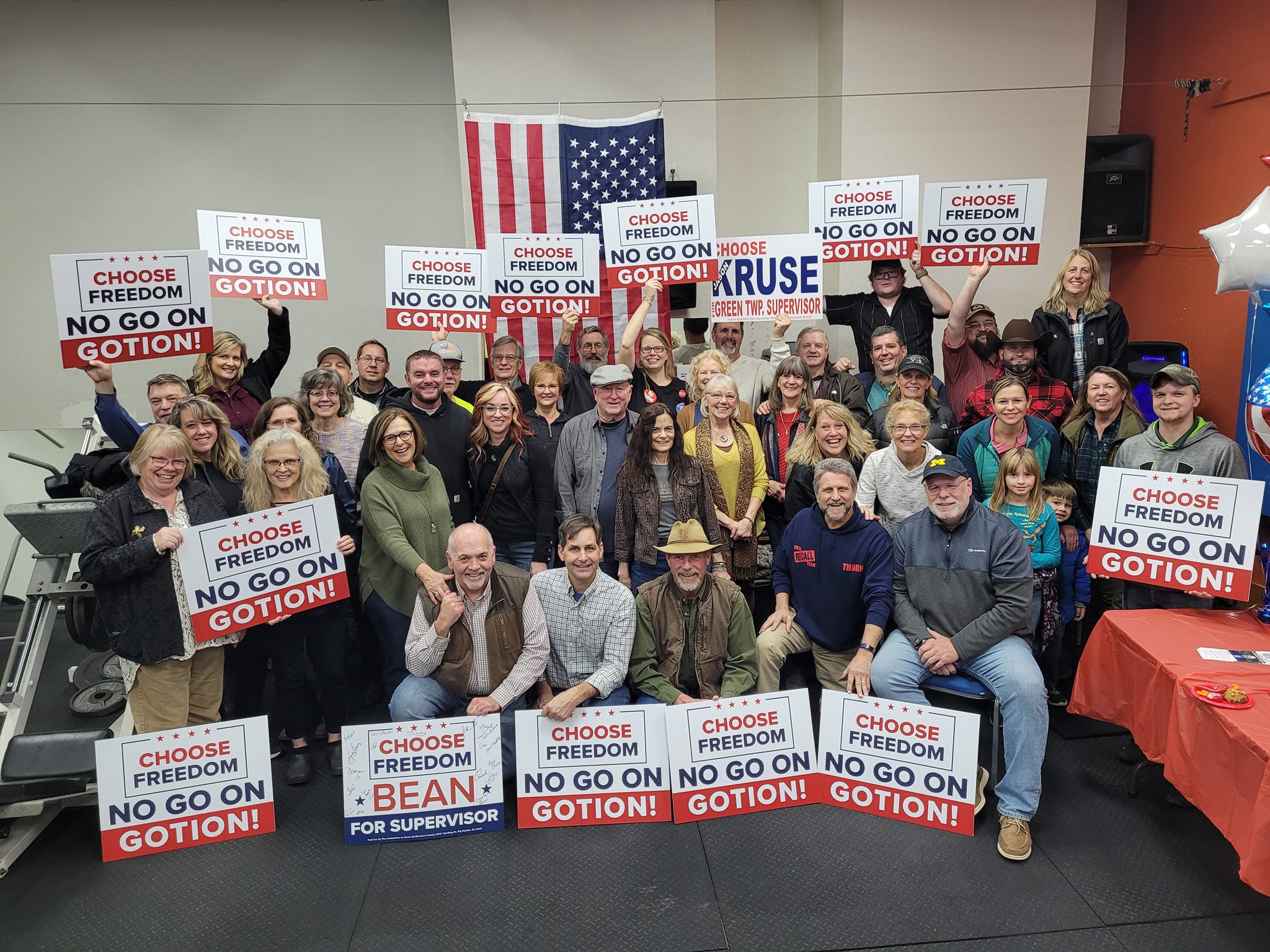

Ted joined WLS 890’s PM Chicago Show to discuss Chicago’s worsening pension crisis, why the city’s crisis makes it such an outlier nationally, its negative impact on residents, government workers and retirees alike, and what Mayor Brandon Johnson should do about it. When has any company persisted with a project in the face of stronger local, statewide and national opposition? When have taxpayers subsidized a more harebrained project?

When has any company persisted with a project in the face of stronger local, statewide and national opposition? When have taxpayers subsidized a more harebrained project?

Mark- Who will be ultimately be held responsible for Harvey’s mismanagement and misappropriation of taxpayers money? The taxpayers of course! I don’t understand how the courts could hold taxpayers liable when if fact when they paid their property taxes pension costs are in and within the property tax bills. A copy of your check is your receipt of property tax payment in full. Municipalities do not allow partial payment of tax bills and if you do your payment will come back. I see that as municipal Theft by Deception!

“Who will ultimately be responsible?” That’s really the question with no answer. The state won’t bail them out because dozens and dozens more are coming. The police and fire pensions will become tragedies. Yes, taxpayers will pick up some cost through safety net programs, but the municipalities themselves are going into an abyss never explored before.

Thanks for replying. On a side note do you know how many public union retirees and currently working there are. My best guess is 400-600K but not sure. That would be about 5-6% of the total population of 12.4 million. They are owed approx 250 billion in lifetime benefits. That means 94% of the remaining population are responsible. How is it that the majority (94%) have little or anything to say? My retirement prospects are constantly being Impaired or Diminished. My choices are “Stay and Pay” or move. The Illinois constitution states we have the right to “Protection of Property”.… Read more »

On the flip side, judges in some other pension cases may feel compelled to rule for pension reform. They know that pension reform means more money for the court system. Jerry Brown seems confident that pensions will be cut.

If you told the whole story, it would be one of corruption, undocumented spending, and over $10 million in bond money disappearing. And the politicians of Harvey canceling a pension tax. Failure to make any form of pension payments $0, nothing, even though pension payments were itemized in the budget. Additional bonding is not on Harvey’s horizon. No reputable bonding agency is willing to take the chance. It would have been nice to include Harvey’s miserable bond rating. It’s not a matter of the poor city, it’s a matter of not meeting a fiduciary responsibility while raping the treasury for… Read more »

In Harvey’s case, that’s largely true, and we’ve carried all those stories. But the bigger point of the piece is the general implications for the other hundreds of municipalities whose pensions are bleeding down towards zero.

once again, if the state bailed out cps/ctu pensions and chi home owners then if i was a harvey home owner or pol, i’d be going to the state and demanding an equal state pension bailout deal? along with all the other zillions of underwater munic pensions.

Exactly right. Article on that coming soon.

maybe this makes no sense, but ultimately it’s the state that’s on the hook for guaranteeing municipal pensions, because its the state “shall not be diminished’ line in constitution that guarantees harvey pensions not the township or tax payer/prop owners of harvey. so, if was ives- because shes the only one running for gov that didn’t support the school funding/bailout deal, she could come out and say if elected she would file suit on behalf of all the municipality home owners that the state would have to pick up all the municipal pensions just like the state did for cps/chicago… Read more »

Mark- As I understand it if pensions can not be diminished or impaired that means they can’t be taxed under state rules but they are taxed under federal rules. Doesn’t federal taxes diminish or impair pensions. On that same note could the pensioners CONTRIBUTIONS be what can not be diminished or impaired (think principal in your bank account ) but lifetime returns on benefits could be impaired. Just trying to look at it from a different angle .Many people have around $100K in contributions but could collect over $1-2 million in benefits not including healthcare.

The courts would let you tax or not tax all retirement income but not let you target just pensions. IL taxes none of it currently. The courts also would not let you jack up the employee contribution rate, except for new hires as to whom you can do what you want.