By: Mark Glennon*

The Illinois Department of Insurance has now released its 2017 Biennial Report on state and local pensions, all 671 of them. It’s the most comprehensive aggregation of pension data the state publishes.

Keep in mind these are the officially reported numbers, so they reflect the pensions’ own assumptions that are subject to heavy criticism as being overly optimistic. Financial economists say real numbers are 2X or 3X worse. Also, the numbers are mostly over a year old, at least, as explained below.

Two highlights:

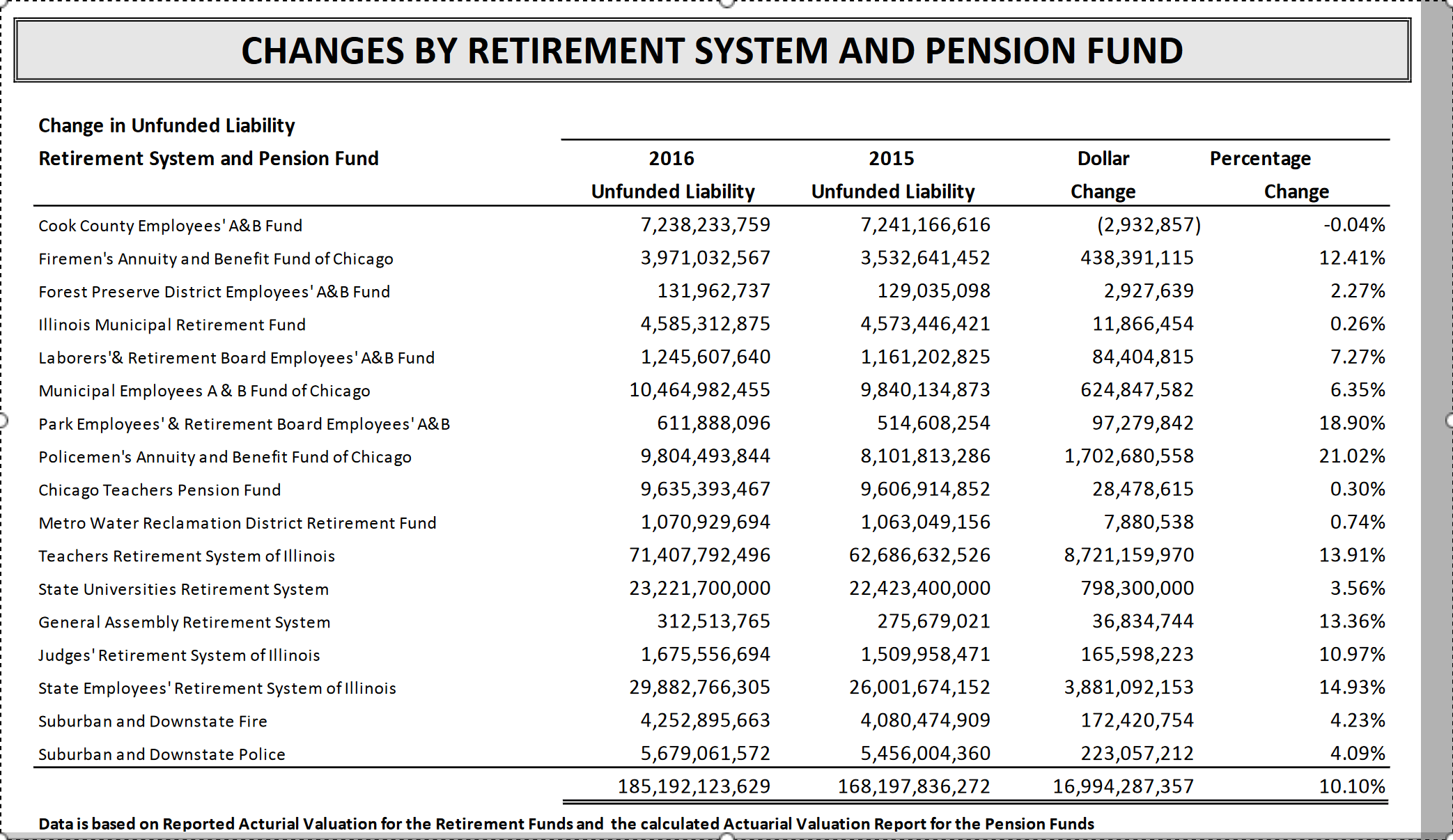

Combined, the unfunded liabilities for the 671 pensions worsened by almost $17 billion from 2015 to 2016.

The aggregate funded ratio dropped to 57.6% in 2016 from 57.4% in 2015.

Some pensions have calendar fiscal years and some do not, so the year-over-year comparisons are somewhat inconsistent. Some numbers are quite old since some pensions have already completed their 2017 fiscal year and those numbers would not be reflected.

Keep in mind when you hear reporters and politicians talk about “balanced budgets” that these losses, in the form of growing unfunded pension liabilities, are not included. The lion’s share of our financial crises, in other words, does not appear in government budget accounting.

It’s safe to assume that the downward trend that has been consistent since 2000 has continued, which would make more current numbers still worse. For example, the City of Chicago now reports that it’s four pensions are only 21% funded in aggregate, but this report shows them roughly 35% funded.

Still, the report is useful and important because it’s the only apples-to-apples report we get on all our pensions.

You can find further specific data on any particular pension in the 908-page report, linked here.

Here is one of the key charts from the report:

–Mark Glennon is founder of Wirepoints. Opinions expressed are his own.

A set of state lawmakers want to extend CPS’ current school closing moratorium to February 1, 2027 – the same year CPS is set to transition to a fully-elected school board. That means schools like Manley High School, with capacity for more than 1,000 students but enrollment of just 78, can’t be closed for anther three years. The school spends $45,000 per student, but just 2.4% of students read at grade level.

A set of state lawmakers want to extend CPS’ current school closing moratorium to February 1, 2027 – the same year CPS is set to transition to a fully-elected school board. That means schools like Manley High School, with capacity for more than 1,000 students but enrollment of just 78, can’t be closed for anther three years. The school spends $45,000 per student, but just 2.4% of students read at grade level.

Hopefully, all media will get the message, in Illinois, too.

Hopefully, all media will get the message, in Illinois, too. Ted joined Tom Miller of WJPF to talk about Illinois’ highest-in-the-nation property taxes, why lawmakers don’t want to touch the tax’s cost drivers, just how much Illinoisans’ tax burden has grown over the decades, why Gov. Pritzker failed to meet his promise to reform property taxes, and more.

Ted joined Tom Miller of WJPF to talk about Illinois’ highest-in-the-nation property taxes, why lawmakers don’t want to touch the tax’s cost drivers, just how much Illinoisans’ tax burden has grown over the decades, why Gov. Pritzker failed to meet his promise to reform property taxes, and more.

You know why this money is never included in the total debt figures? Because they don’t intend to pay it out, and they never did. It was just a hook to get the maroons to vote for them.

An excellent article. Thumbs up to Meep who is one of the few people whom seems to have financial acumen to understand the ramifications of IL various pensions. There is no logical out for Illinois. Moving to a 401K style plan and SS would be a good measure to mitigate future problems but does nothing to address the problems induced by the inflexible promised benefits. The killer to the pensions is the 3% annual kicker that exceeds the likely inflation rate. As of this date Buffet, Bogle, and Vanguard are all forecasting muted return of roughly 3% real, 1.5% nominal… Read more »

The only rational thing to do is declare bankruptcy right now, restructure obligations, and get a fresh start. The crooked mafia crime family of Democrats in Illinois will go down the Scorched Earth strategy making everything really bad in the end.

Thanks Mark . It is difficult to tell politicians much of anything. I have to learn what language they are speaking. They are proof that aliens came here from another planet. To nixit the biggest portion of my property tax bill are the school districts so pension pickup is quite a sum. My home in Rockford I pay $7,000 on a 153K value with no end in sight. Many home values here are close to the same value that they were in 1991. 28% are underwater and our crime rate is the highest in Illinois. So you see why I… Read more »

Good grief. 4.6% property tax rate. The only comfort I can offer is that a number of Chicago suburbs are higher. That’s confiscation and suicidal for any community.

Thank you for the info I will check it out. I went to a local town hall meeting by Sen Steve Stadleman and this same analogy was brought up. People asked the senator where did the money go and he said “It was DIVERTED” to where he did not know. We have pension pickup here in Rockford so when I pay my taxes the pension portion is included for that year so my obligation should be fulfilled yet the taxpayer is on the hook even though the money was diverted (stolen or borrowed). The taxpayers are also on the hook… Read more »

Fred- If you see Stadleman again tell him he is full of it. Nothing that went into the pensions was diverted elsewhere. And you are right that healthcare is entirely unfunded, pay-as-you-go, making it a primary reason why the numbers are insurmountable

Fred, your school district’s pension pick-up is only the employEE portion of the pension contribution, not the employER. You pay for the pick-up in your property taxes. Your state income tax dollars are supposed to pay the employer portion, aka the “diverted” portion of the equation.

Taxpayers are not on the hook, they can leave eventually. The Pension funds go broke or the municipality.

All everyone hears is the phrase unfunded liability. What are the assets in the funds now. TRS has about $60 billion today? That’s what should matter now. What are the total unfunded liabilities of everyone’s mortgage over the entire 30 year period in Illinois. If you get a mortgage do you need all the money- mortgage-interest-taxes-insurance upfront. NO! How about all your living expenses for 30 years upfront. You just need the monthly obligation. The $60 billion is enough for many years. Look into management fees of the funds with no guarantee of returns as a place to start trimming… Read more »

Oh dear lord, not the fallacious mortgage analogy. Try this on for size: your credit card balance. Because, you know, that’s for paying for past operational costs. Not for financing a capital asset (aka a house). Oh, look, we paid for only 20% of our past operational costs in this one category (pensions). And we’re gonna only accrue more each year! Look how responsible we’re being! Sure, we’ll pay off the whole balance… maybe… look, we can make the interest payments, ok, maybe not interest payments, but we can keep paying, all right! What’s the problem? more on that here:… Read more »

Fred, I really hope you and everybody who looks at it that way take the time to think it through. You will understand how wrong that viewpoint is. Start with Mary Pat’s comment (Meep) and her link. She’s an actuary, but you don’t need to be one to understand this.

Fred, to a point mortgage example can be helpful in explaining the funding challenges that pubic plans face. But this comparison comes up short because unlike a mortgage, the pension liabilities continue to grow each year. Since you mentioned the TRS plan, I went to p. 830 of the report and learned that the pension liability (the total liability, not just the unfunded portion) grew from $90.0 billion at 6/30/12 to $118.6 billion on 6/30/16, a 7.1% compound annual growth rate. I also learned that the benefits paid each year exceeded the contributions from the members and the tax payers,… Read more »

If I can continue the flawed mortgage analogy, pension debt is like continuing to make a mortgage payment on a house you no longer live in and couldn’t afford to begin with.

And this was reported using “government math”. It’s likely then that the pension unfunded liabilities actually increased by an amount that exceeds the entire state budget. How much longer can this go on?

Any pension fund with a fiscal year end of 6/30 would’ve taken a big hit in 2016 with the Brexit crash that occurred on 6/27/16. I’d like to know how the state pension funds with FYE of 6/30 performed for fiscal year 2017. It would be interesting to see how much the unfunded liability changed during a bull run post-Brexit and Trump.

The onslaught continues unabated. Crickets from the Dems.

Lots of GOP crickets, too. Somebody needs to get on this, though it’s far too late to avoid the bloodbath coming.