By: Ted Dabrowski and John Klingner

We may never know why Rahm Emanuel decided to drop out of the Chicago mayoral race. But the media is certainly giving him a pass. They say he simply dropped out for fear of losing. But there’s a far more likely reason than that.

Emanuel is smart, and the smart reason for leaving is glaring: He doesn’t want to risk becoming “mayor bankruptcy.” Chicago is a ticking time bomb and Emanuel is jumping ship just in case it goes off.

Don’t dismiss that scenario too quickly. Despite his lofty intentions when he first took office, Emanuel has failed miserably to reform the city’s finances. Now the risk of insolvency is rising.

Chicago’s financials are dire and the city has no plan and no reserves to survive an inevitable recession. In fact, the city has barely kept its head above the water despite a decade of national economic growth. Chicago Public Schools was already at the brink of bankruptcy just one year ago.

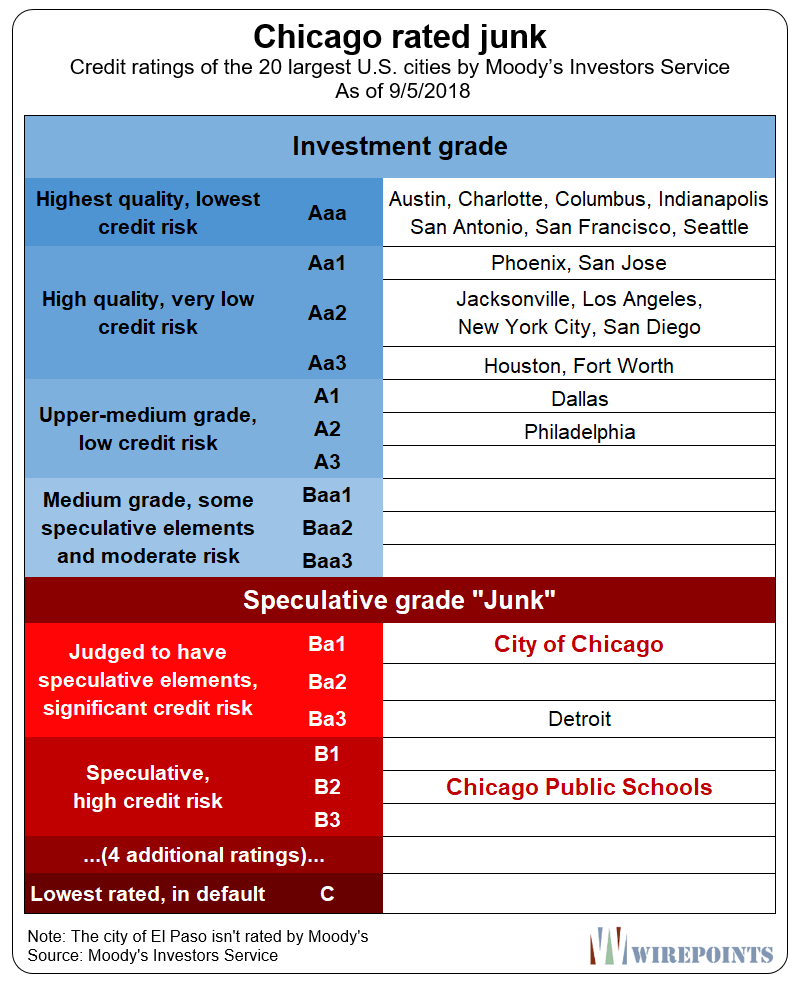

Rahm knows the risks of collapse are rising. He’s passed property tax hikes, emptied the reserves and employed every budget trick he can to make the numbers “better.” He’s even sold off public assets – the city’s future sales tax revenues – to “shore up” the city’s finances, and yet Chicago is still junk rated by Moody’s.

CPS is in even deeper junk territory – far lower than even Detroit. And that’s after the state poured more money in as the result of a new funding formula.

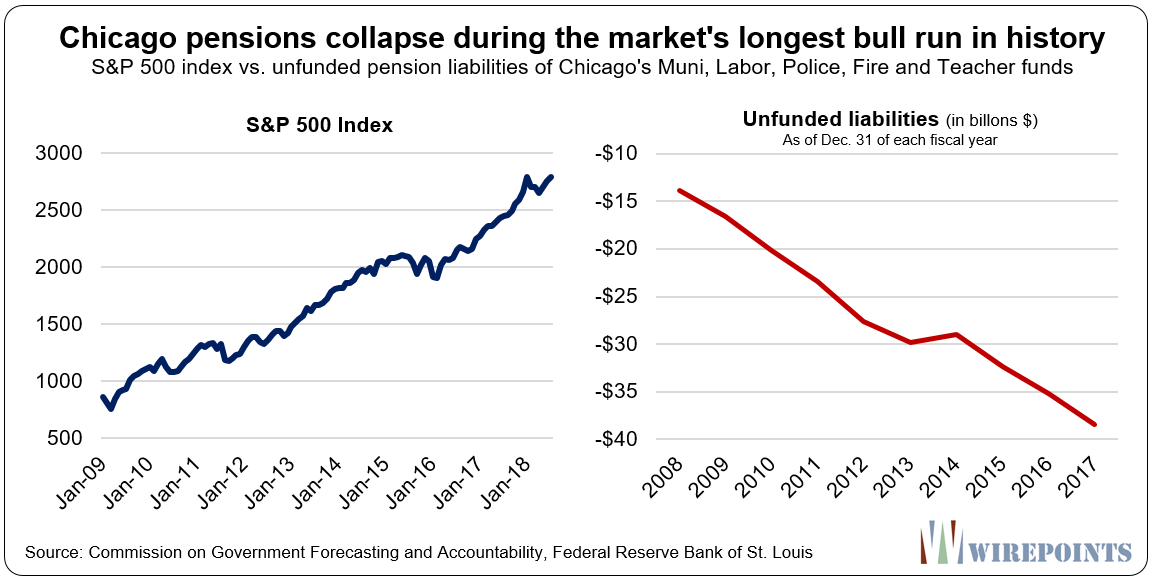

Rahm has to know city finances will crumble when the nation’s economic rally ends. He only needs to look at how the city’s pension funds have done with the market’s winds at their back. The S&P was up more than three times from 2009 through 2017, and yet the city’s unfunded liabilities increased 2.75 times over the same period, largely the result of poor funding policies.

When the stock market rally started, the city’s unfunded liabilities, including those at CPS, were less than $17 billion. Today, they are at $38 billion. And those numbers are based on the official statistics – the rosy scenario. The pension shortfall is much larger – Moody’s pegs it at $67 billion – when more conservative investment return assumptions are used.

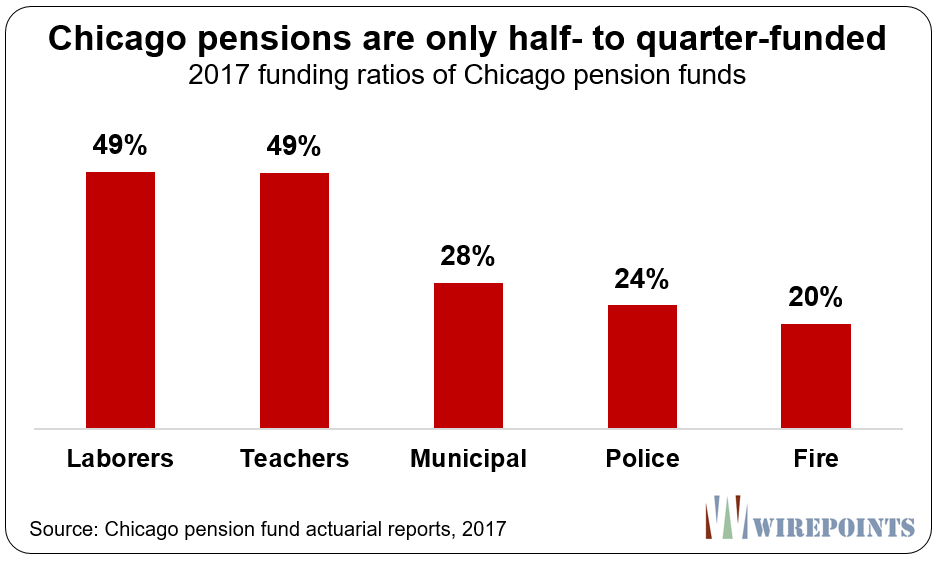

What will happen when the markets reverse? Three of the pension funds are now just one serious stock-market correction away from insolvency – if they’re not already there. The police and fire funds are officially less than 25 percent funded, while the municipal fund has just 28 percent of the funds it needs. The city’s best-funded plans – the Laborers and Teachers plans – are less than 50 percent funded.

Crumbling cash flows for city, residents

The probability of a full meltdown when the next recession comes has increased. Reports on the city’s finances show that’s especially true when Chicago is compared to its peer cities.

The debt burden is overwhelming to both Chicagoans and the city itself.

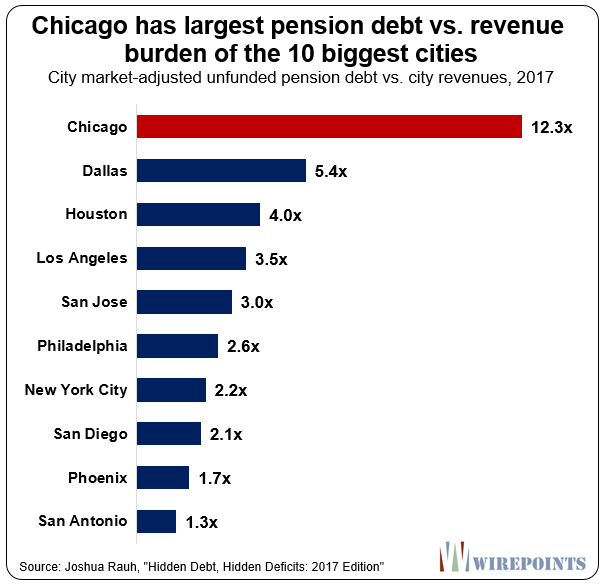

According to Joshua Rauh of the Hoover Institution, the city of Chicago’s pension debts, using market-based assumptions, are now 12 times the size of its annual revenues.

That’s much larger than any other major city in the nation. Dallas’ pension crisis is deemed one of the worst in the nation, and yet its burden is less than half of Chicago’s.

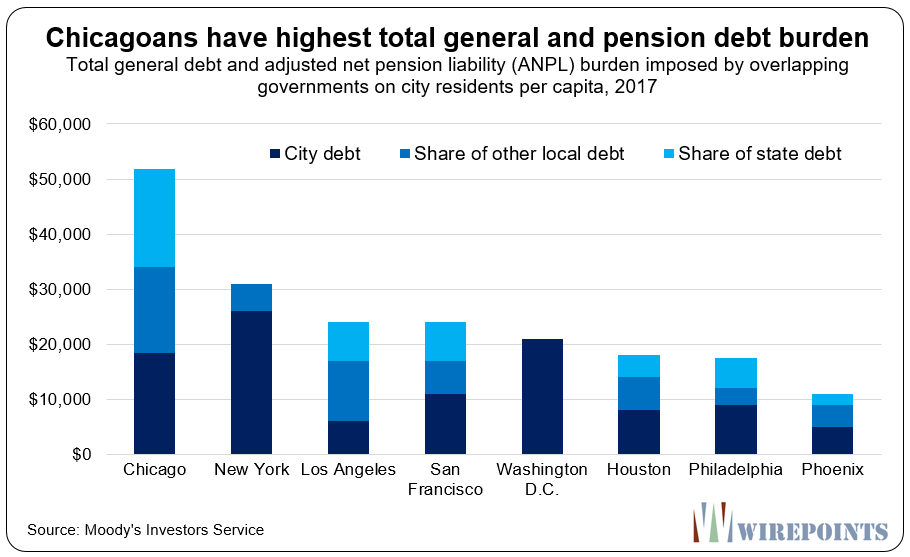

An even more pertinent comparison is the debt burden taxpayers face. Moody’s published those numbers recently and Chicagoans are in real trouble.

Every single Chicagoan is on the hook for more than $50,000 in debts, compared to just over $30,000 in New York and $25,000 in L.A. Residents in Houston, Philadelphia and Phoenix all face burdens lower than $20,000 each.

Those per capita numbers, however, understate the true burden some Chicagoans will actually face. More than a quarter of the city is at or near poverty, meaning they won’t be able to pay much toward the city’s debts. That pushes the burden towards middle and upper income residents.

And if the proponents of progressive taxes get their way – Ald. Ricardo Munoz is pushing for a progressive city income tax on those making more than $120,000 – the burden will fall on a much smaller segment of the Chicago population, say some 10 percent. In that case, the burden would equal some $500,000 on those targeted by the progressive tax.

All this matters because, as we’ve reported in the past, Chicago has already raised all kinds of taxes to fund its pensions and close its budget holes. Taxes are up by more than $1 billion since 2015.

The pressure for more tax hikes, absent any pension reform or concessions by the unions, will only increase as required pension contributions jump. Payments to the city’s funds are planned to rise by more than $1 billion in five years – nearly a doubling – and the city has no free cash-flow to cover them.

What’s worse for Emanuel is that most taxpayers have figured out that most of the tax increases are being poured into old pension debt. Little, if any, is going to fund new services.

That’s not good when you consider Chicago has been shrinking for decades.

Hail Mary

Those poor results are what recently led Emanuel to push for a borrowing “solution” that many have called a desperate and irresponsible can kick. Emanuel wants the state to borrow $10 billion and to pour that money into the city’s pension funds, with repayments of the bonds flung into the far, far future. The overall scheme is nothing more than a plan to gamble with taxpayer funds.

Worse yet, he wants to use the city’s securitization scheme to entice skeptical bankers to accept the bond deal. That will require the city to sell even more of its future revenues – the public’s assets – and put future services at risk.

In the end, Emanuel is hoping the influx of cash into the pension funds will bring down the city’s required contributions going forward. It’s all in an attempt to push a pension crash and tax hikes as far into the future as he can in order to protect his legacy. Never mind how bad all this will be for Chicago.

What’s next

You can’t help but wonder if Emanuel is stepping down because he can’t get the $10 billion pension bond deal done. The likelihood of the deal has dropped as more people realize what a kick-the-can plan it is.

And without the scheme, the risk of a meltdown is real. That’s a risk Rahm is unwilling to stick around for. He doesn’t want to be the mayor that begs for a bailout, especially since he has ambitions for higher office.

Emanuel will soon hand over the time bomb that is Chicago finances to his successor. Will that new mayor tackle the big and unpopular reforms by taking on the unions, special interests and crony businesses to bring the cost of Chicago government in line with what residents can afford? Or will their solution just be more tax hikes that destroy the city’s tax base?

Chicagoans better hope, and vote, for the former. The bomb is ticking.

A set of state lawmakers want to extend CPS’ current school closing moratorium to February 1, 2027 – the same year CPS is set to transition to a fully-elected school board. That means schools like Manley High School, with capacity for more than 1,000 students but enrollment of just 78, can’t be closed for anther three years. The school spends $45,000 per student, but just 2.4% of students read at grade level.

A set of state lawmakers want to extend CPS’ current school closing moratorium to February 1, 2027 – the same year CPS is set to transition to a fully-elected school board. That means schools like Manley High School, with capacity for more than 1,000 students but enrollment of just 78, can’t be closed for anther three years. The school spends $45,000 per student, but just 2.4% of students read at grade level.

Hopefully, all media will get the message, in Illinois, too.

Hopefully, all media will get the message, in Illinois, too. Ted joined Tom Miller of WJPF to talk about Illinois’ highest-in-the-nation property taxes, why lawmakers don’t want to touch the tax’s cost drivers, just how much Illinoisans’ tax burden has grown over the decades, why Gov. Pritzker failed to meet his promise to reform property taxes, and more.

Ted joined Tom Miller of WJPF to talk about Illinois’ highest-in-the-nation property taxes, why lawmakers don’t want to touch the tax’s cost drivers, just how much Illinoisans’ tax burden has grown over the decades, why Gov. Pritzker failed to meet his promise to reform property taxes, and more.

Running for Mayor of Chicago, is just like trying to be the Captain of the Titanic.

Thanks to the wonderful manual

Just a reminder:

The very second you cross the Illinois state line with your moving truck, you will not owe 1 red cent on those ridiculous and obscene pensions.

Hope this helps.

Unless you get a Democrat President and House because they will open the door to a Federal bailout which you and your children will pay for.

I would laugh at this city of fools if my few remaining conservative Illinois relatives were to get out. I keep warning them, but they can’t get out…yet. They will though asap.

We don’t need a new roster of Halloween horror movies. There’s enough real financial horror in the USA.

1. States’ unfunded pension liabilities of $6 trillion.

2. Student loan debt hits $1.5 trillion. $37,000 per graduate for students who took out loans.

3. Calif has already defaulted on some pension checks (Loyalton, LA Works Consortium). And it didn’t have to file for bankruptcy.

4. USA debt of $700,000 per taxpayer.

5. It turns out that all of those earthquake proof buildings in San Francisco may not be earthquake resistant at all.

https://www.nytimes.com/interactive/2018/04/17/us/san-francisco-earthquake-seismic-gamble.html

There is NO ONE that will take on the public employee unions. NO ONE. We are looking at a slate of progressive candidates that are simply more or less…progressive. None of these people–currently in the race and “exploring” getting in–know a hoot about economics or what it’s like to run a private business. None of them have any loyalty to the business community, and almost all of them have at least one government union that they are beholden to. You are nuts if you are increasing real estate or business assets in this city and this state right now. You… Read more »

After 16 months on the market and price reductions down to $2.75 million, the nine-bedroom, 9,270-square-foot French Country-style mansion in Bannockburn owned by former Chicago Bulls guard Kirk Hinrich has found a buyer. In Bannockburn, Hinrich paid $4.4 million in 2007 for the mansion, which was built by Orren Pickell Builders in 2005. He first listed the mansion in April 2017 for $4.499 million and cut his asking price several months later to $3.9 million. Hinrich then again reduced his asking price to $3.55 million in March, and then to $2.75 million in August. If Hinrich sells the mansion at… Read more »

Charlotte – it is actually worse than you describe (I graduated from high school in that district back when people had a future from Illinois). Despite the decline in property value, you can bet his property taxes have increased since 2007 by around the same 40 percent he will lose on the sale of the property, making living in Bannockburn/Deerfield a once in a lifetime Government equity theft event. Illinois is ill prepared to sustain its upper middle class, especially with the advent of telecommuting for high skilled people. Of course, the upper middle class is really the only group… Read more »

Because I ran out of other people’s money; it’s just no fun anymore; people don’t like me anymore; my huge ego has been deflated; too many people can see through me now making it hard to run my usual lying campaign; I came to the realization that “progressivism” didn’t work… Etc. He really had no reasons left to stay.

Time to leave the city.

Or bend over, pay up, and have your personal finances ruined. A lot of homeless people on the street can tell you how that works out.

Rham is no dummy, now all you good little Republicans who think Rauner is the lesser of two evils should learn a lesson from Rahm, a vote for Rauner is simply a vote to hang the responsibility for Illinois collapse on the republican brand. Illinois is as doomed as Chicago is, the only thing a second term of Rauner is going to do is let the Democrats off the hook. Illinois is domed, but it can serve a useful purpose in showing the country what happens when you let Democrats in charge. We could see a statewide insolvency. That would… Read more »

And eventually at the local level, if there is anyone left in the state by that time. Problem is if Rauner wins when the collapse comes they will blame it on Rauner and Republicans. If Democrats control both chambers and the governors office they will own the problem.

*Rahm

Well said. That’s why I want Rauner to loose this time. It’s too late to fix this and all that’s left is to find blame when it all collapses. If there are no republicans in office, it will be difficult to blame them, although I’m sure the Dems will try.

It’s clear why a rat would flee a burning ship