By: Mark Glennon*

We now have a partial view of the new up-ramp on contributions Chicago taxpayers will be required to make to the city’s four pensions. (The Chicago teachers pension is a fifth, legally separate pension. It’s funded, at least theoretically, by the Chicago school district.)

Annually required contributions are set by state law. The ramp for the last two pensions was finalized by provisions in the state budget bills passed last month over Gov. Rauner’s veto. Those provisions went mostly unnoticed, though The Civic Federation published a nice summary, linked here. Legislation changing the ramp for the other two pensions became law earlier, also over Rauner’s veto.

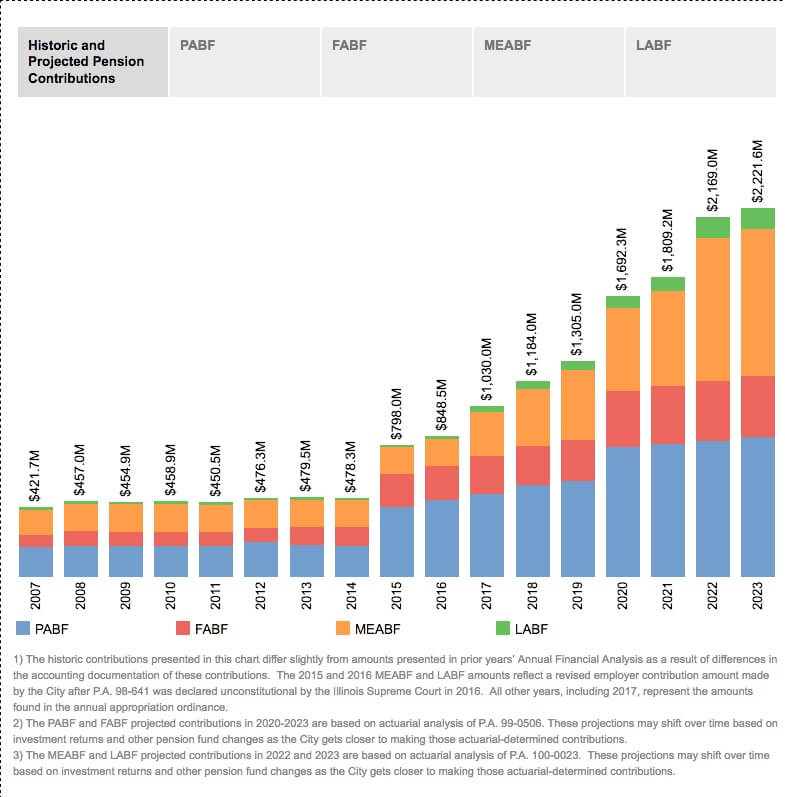

Here’s the new ramp for all four, which was released on July 31 as part of Chicago’s 2017 Annual Financial Analysis:

The amounts are initially fixed numbers. That changes in 2020 for the police and firefighter funds (PABF and FABF) and in and in 2022 for the municipal and laborers’ funds (MEABF and LABF). Then, required contributions will be annually-calculated “ARC” amounts – the contribution the pension actuary says are enough to get the pensions to 90% funding in 40 years.

In other words, the ramp is a can-kick. It means the city will continue to fund the pensions inadequately but make it up later.

Does later ever come? When the time comes to pay up, just go back to Springfield for an extension, or take a pension holiday, or borrow to make the contribution. We saw that with the “Edgar Ramp” implemented during former Gov. Jim Edgar’s term. In the meantime, unfunded liabilities compound. Today, they total $35.8 billion for the city’s four funds. They are only 21% funded in aggregate.

So, will Chicago fund the pensions as required by the ramp? Would it? Can it?

Some tax and fee increases are already in place to help cover the next few years. However, as The Bond Buyer put it, “Details on how the city will meet a big jump in pension payments in the coming years, when actuarially based contributions kick in, remained elusive…. When asked after his address on future funding sources for pensions, Emanuel didn’t offer details, simply saying the city would adhere to the ‘more balanced’ approach that he’s favored since taking office.”

The Civic Federation said, “the magnitude of the increase in funding that will be necessary in FY2023 when the City begins to fund at an actuarially-calculated level is currently unknown and no plan for funding that increase has been made public.”

The numbers we have on future contributions aren’t very good, either; that chart above is all we have. It would be especially nice to see a longer term projection of required contributions and the impact on unfunded liabilities during the interim. The numbers are also subject to the usual reasons for cynicism about pension reporting. For example, the funding goal of 90% is nothing more than assuming away part of the problem up front, and the the projections are based on those highly controversial assumptions about returns on pension assets.

Back to the question whether Chicago will honor the ramp, I’d say it’s really a matter of whether taxpayers will put up with it. On that, I think most readers are as qualified to answer as anybody.

*Mark Glennon is founder of Wirepoints. Opinions expressed are his own.

A set of state lawmakers want to extend CPS’ current school closing moratorium to February 1, 2027 – the same year CPS is set to transition to a fully-elected school board. That means schools like Manley High School, with capacity for more than 1,000 students but enrollment of just 78, can’t be closed for anther three years. The school spends $45,000 per student, but just 2.4% of students read at grade level.

A set of state lawmakers want to extend CPS’ current school closing moratorium to February 1, 2027 – the same year CPS is set to transition to a fully-elected school board. That means schools like Manley High School, with capacity for more than 1,000 students but enrollment of just 78, can’t be closed for anther three years. The school spends $45,000 per student, but just 2.4% of students read at grade level.

Hopefully, all media will get the message, in Illinois, too.

Hopefully, all media will get the message, in Illinois, too. Ted joined Tom Miller of WJPF to talk about Illinois’ highest-in-the-nation property taxes, why lawmakers don’t want to touch the tax’s cost drivers, just how much Illinoisans’ tax burden has grown over the decades, why Gov. Pritzker failed to meet his promise to reform property taxes, and more.

Ted joined Tom Miller of WJPF to talk about Illinois’ highest-in-the-nation property taxes, why lawmakers don’t want to touch the tax’s cost drivers, just how much Illinoisans’ tax burden has grown over the decades, why Gov. Pritzker failed to meet his promise to reform property taxes, and more.

As a retired Chicago Police Sergeant, I long ago accepted that the Police Pension was a Ponzi Scheme. Nobody in their right mind, could have expected the consistent returns necessary to fund it. Added to this are the Exempt members, most of whom are Exempt because they had a political sponsor, who almost instantly suck up much more than they put in. For example: Beatrice Cuello O’Donnel, retired from CPD with a pension at approximately $125,000. She is now the Vice Chancellor for Security at City Colleges of Chicago, which pays about the same as her pension. How do we… Read more »

Beatrice Cuello…that name rings a few bells:

http://www.nbcchicago.com/news/business/Drugs-Weapons-Found-on-Police-Officials-Property.html

http://articles.chicagotribune.com/2002-02-06/news/0202060215_1_police-officers-gun-police-shooting

No tax increases without……….. #1 Freeze the DB pensions for the Future service of all CURRENT workers. For Future service, 401k-style DC Plans with taxpayer contributions no greater than the average contribution that Private Sector Taxpayers typically get from their employers (3% of pay)…… plus the employer’s 6.2%-of-pay share of Social Security contributions if the worker isn’t in SS. #2 Roll-back all retroactively granted pensions changes (of ALL kinds…. formulas, provisions, etc….., noting that ANY change that creates an instantaneous increase in Plan liabilities on it’s effective date is a “retroactive” one) recognizing that they were noting but a theft… Read more »

This is what’s frustrating: This is the era of “do nothing”. Bridges continue to rust, unfunded pension liabilities keep growing, the national debt grows, schools crumble, and everybody just watches. It’s like watching paint dry. A lot of restaurants are suddenly closing so that is adding a little excitement.

if the states going to “bailout” cps pensions, why not all the other city pensions and all the other municipalities as well?

And there will be far stronger humanitarian cases for a bailout than the CPS pension. Places like Harvey will soon be looking at paying nearly nothing to their pensioners.

They shouldn’t pay them nothing, but they should pay them NO MORE then what a comparable Private Sector worker would typically get from their employer if retiring at the SAME age, with the SAME wages, and the SAME years of service.

And yes, doing so would likely cut non-safety worker pensions by 50+% and cut Safety workers pensions by 60% to 80% (because THAT’s how ludicrously generous they are today).

A “bailout” paying more would be the ultimate insult to Taxpayers.

I worked 30 years in a union factory. I get $540 a month.

They could save themselves a lot of effort by changing the X-axis to read “Current Year, CY+1, CY+2, etc” The tall bars will always be in CY+.

Pension ramps are pension scams.

They are passed by greedy irresponsible politicians who refuse to reform pensions.

Michael Madigan was the House Speaker at the time of the Edgar Ramp.

Thus it is the Madigan Edgar ramp.

Before Edgar could sign it, the bill passed the House.

Exactly. The Illinois ramp, the Chicago ramp, and the New Jersey ramp… until they actually start paying full payments, I won’t believe they will.

“Later” does come…..as financial collapse. “Later” is almost here.

The Chicago press corp….crickets…chirp, chirp…