By: Ted Dabrowski*

A lethal combination of rising property taxes and stagnant incomes has forced many Illinoisans to rethink their relationship with their state. More than a million net residents have already fled the state since 2000 – and you can’t blame others for thinking about joining them.

Property taxes have become punitive in a great number of areas in Illinois. We’ve written about how these taxes have destroyed the equity people have in their homes in the south suburbs of Chicago. In other cases, high property taxes are squeezing seniors out of their homes.

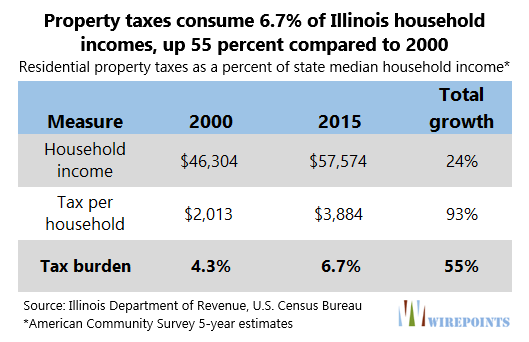

The reality for too many Illinoisans is that incomes have been stagnant for years – and falling when you consider the impact of inflation. Median household incomes since 2000 have increased by just 24 percent, far short of the 38 percent inflation that occurred during the same time period.

All the while, property tax bills across the state have been rising at an unsustainable pace. In fact, since the year 2000, Illinois property tax bills have grown nearly four times faster than household incomes have.

According to data from the Illinois Department of Revenue, taxes per household have nearly doubled across the state, up 93 percent since 2000. In comparison, household incomes have grown just 24 percent.

That means more and more of Illinoisans’ hard earned incomes are going toward property taxes and less are going toward groceries, college savings, and retirements.

In 2015, 6.7 percent of household incomes went toward property taxes, up from 4.3 percent in 2000. On average that’s nearly $1,900 more per household.

Property taxes, County by county

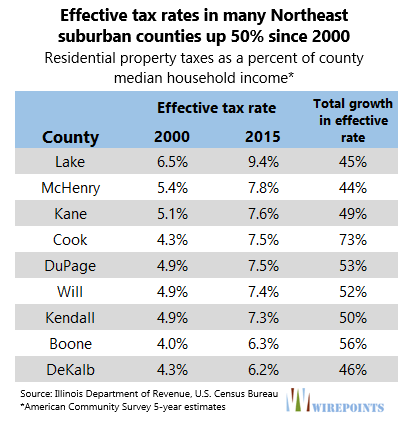

Residents of Lake County pay the highest effective rate in Illinois when measured as a percentage of household incomes. In 2000, Lake County residents paid 6.5 percent of their household incomes toward property taxes.

By 2015, that number had jumped to 9.4 percent. The average Lake County property tax bill is now over $7,300 per household.

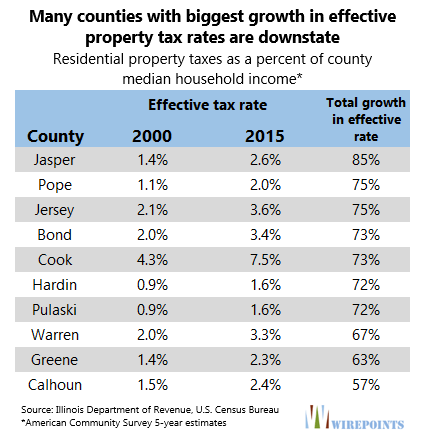

Overall, the collar counties pay the highest effective tax rates in the state. But it’s not just the Chicago suburbs that are taking a hit. Taxpayers statewide have seen their bills rise, too.

In fact, the four counties with the the biggest growth in their tax burdens, in percentage terms, are all downstate. Jasper County residents have seen their effective tax rates jump 85 percent since 2000. Residents in Pope County, have seen their rates go up by 75 percent. And the same goes for residents in Jersey county. Bond County residents are next with a 73 percent growth.

Paying more property taxes than anyone else

People have to scrape more and more of their money to pay for Illinois’ nearly 7,000 units of local government – the most in the nation – and the executive-style pay and ballooning pension payouts of the administrators who staff them.

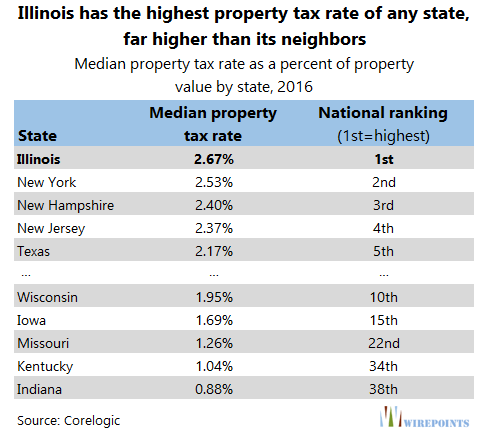

It’s not surprising then, that Illinoisans pay the highest property taxes in the nation when measured by another metric: percentage of home values.

In 2016, Illinoisans paid property taxes on average worth 2.67 percent of their home value, the highest rate in the country and far higher than that of their neighbors.

In fact, property tax rates as a percentage of property value in Illinois are already three times higher than in Indiana and two times higher than in Missouri.

Not only is it too expensive to live in Illinois, but it’s simply become too easy for Illinoisans to lower their tax bills by moving right across the border.

And if federal tax reform occurs, expect the rage against property taxes to deepen as it further exposes Illinois’ excessive property tax burdens.

You’d think with such a mess, spending reforms – from collective bargaining reforms to state mandate relief to 401(k)s to municipal bankruptcy protection – would be the linchpin of the legislature’s efforts.

Instead, all we’ve gotten is Rep. Michelle Mussman’s fake property tax freeze.

*Ted Dabrowski is President of Wirepoints.

A set of state lawmakers want to extend CPS’ current school closing moratorium to February 1, 2027 – the same year CPS is set to transition to a fully-elected school board. That means schools like Manley High School, with capacity for more than 1,000 students but enrollment of just 78, can’t be closed for anther three years. The school spends $45,000 per student, but just 2.4% of students read at grade level.

A set of state lawmakers want to extend CPS’ current school closing moratorium to February 1, 2027 – the same year CPS is set to transition to a fully-elected school board. That means schools like Manley High School, with capacity for more than 1,000 students but enrollment of just 78, can’t be closed for anther three years. The school spends $45,000 per student, but just 2.4% of students read at grade level.

Hopefully, all media will get the message, in Illinois, too.

Hopefully, all media will get the message, in Illinois, too. Ted joined Tom Miller of WJPF to talk about Illinois’ highest-in-the-nation property taxes, why lawmakers don’t want to touch the tax’s cost drivers, just how much Illinoisans’ tax burden has grown over the decades, why Gov. Pritzker failed to meet his promise to reform property taxes, and more.

Ted joined Tom Miller of WJPF to talk about Illinois’ highest-in-the-nation property taxes, why lawmakers don’t want to touch the tax’s cost drivers, just how much Illinoisans’ tax burden has grown over the decades, why Gov. Pritzker failed to meet his promise to reform property taxes, and more.

We’ve been told for decades that our property taxes are high because our income tax rates are too low. But I can guarantee you an income tax hike or progressive tax structure will never translate into a corresponding property tax reduction for everyone. How do I know? In the Park Ridge examples below, the property tax rate is 3% of value, which is preposterous by anyone’s standards. But there are villages across the Chicagoland area that are double that. Those villages are typically on the poor end of the scale, meaning they already get most of their school funding from… Read more »

Holy Cow……just looked on Zillow at “wealthy” houses in Flossmoor….right next to my hometown Park Forest. Big beautiful houses are for sale in Flossmoor for just $400k. Same-size house I live in, in Maryland sell for $800k. I thought my $12k taxes were huge — but the Flossmoor $400k home has taxes of $21,500 and tripled since ’00. What are the local legislators smoking, to do that to homeowners — that’s cruel and unusual fiscal punishment !

Totally unbelievable about taxes in IL, which is why I left. Just got done comparing some houses on Zillow, in Nashville and Park Ridge. House with assessed value of 485,000 in Nashville has tax of 5476. 492.5K In Park Ridge tax of 14,786. Nashville 837,600 tax of 9456. Park Ridge 879.9K, taxes 26329. These are all assessed values, not asking prices. (Or, to put it in perspective there’s one in Nashville with an assessed value of 2.7 million that pays 26.5K in taxes like the 880K in Park Ridge.) And no state income tax in TN.

Tennessee also gets $4 from the federal govt. for every $1 contributed on a yearly basis.Essentially IL.,N.J.,Ca.,NY. are carrying the country

Essentially Naperville, Tinley Park, Schaumburg, Winnetka are carrying the state.

See, shows how smart they are.

I don’t believe any of those stats for a second ! Where’d you read it, NewYorkTimes ?

This is a really good tip especially to those fresh to the blogosphere.

Brief but very precise info… Thanks for sharing this one.

A must read article!