Remember two years ago when politicians from both parties bragged about the new pension buyout plan? It would save over $445 million per year, they said, and they booked the savings into the 2019 budget.

We’ve told you repeatedly not to believe it, and now the evidence is coming in. The Civic Federation has now published an analysis. Actual results show savings to the state pensions of just $13 million for the fiscal year that just ended. For a little perspective, that’s less than two-tenths of one percent of what taxpayers contribute to pensions each year. And the buyout scheme “does not appear likely to meet the annual cost-reduction target over the next few years,” the Civic Federation says.

That’s only half of the bad news. Aside from the failed savings, you have to look at how the buyouts are paid for. The Civic Federation started to tackle that, too. To pay for the buyouts, taxpayers are on the hook for $300 million of bonds issued by the state at an interest cost of 5.74%. Of the $298.5 million in net proceeds, according to the Civic Federation, only about $50 million has gone towards buyouts. The remaining bond proceeds continue to cost the State interest, but have not yet resulted in any pension savings.

The fact is that the state never provided any honest analysis of true costs and benefits. There were no public hearings or evaluations by pension actuaries. That’s because the savings were fake. The fake savings were stuck into the 2019 budget in May 2018.

We weren’t the only ones to question the scheme. Reuters, The Bond Buyer and The Associated Press had skeptical stories, as did the Illinois Policy Institute, all of which we published here. Two of our favorite, honest actuaries – Mary Pat Campbell and Elizabeth Bauer, also saw through it. The “shammiest of shamtaculars,” Mary Pat called it.

Three lessons here:

First, don’t expect much from the buyout program going forward. The Civic Federation said that, and pension officials have told us the same off the record.

Second, believe nothing Illinois politicians tell you about pensions. Nothing.

Third, pension debts aren’t going away without real reforms, and that starts with a constitutional amendment that’s needed to permit real reforms.

–Mark Glennon, founder, Wirepoints.

If you’re frustrated with Illinois’ educational results, you may want to follow the money from teachers unions. In the last four years alone, Illinois lawmakers and political candidates have taken nearly $30 million in contributions from teachers unions and their national affiliates.

If you’re frustrated with Illinois’ educational results, you may want to follow the money from teachers unions. In the last four years alone, Illinois lawmakers and political candidates have taken nearly $30 million in contributions from teachers unions and their national affiliates.

Wirepoints President Ted Dabrowski testified on April 10, 2024 to members of the House Revenue and Finance Committee at the invitation of Rep. Joe Sosnowski. Ted told lawmakers that the state’s property tax burden has become dire for countless Illinoisans.

Wirepoints President Ted Dabrowski testified on April 10, 2024 to members of the House Revenue and Finance Committee at the invitation of Rep. Joe Sosnowski. Ted told lawmakers that the state’s property tax burden has become dire for countless Illinoisans. Ted joined WLS 890’s PM Chicago Show to discuss Chicago’s worsening pension crisis, why the city’s crisis makes it such an outlier nationally, its negative impact on residents, government workers and retirees alike, and what Mayor Brandon Johnson should do about it.

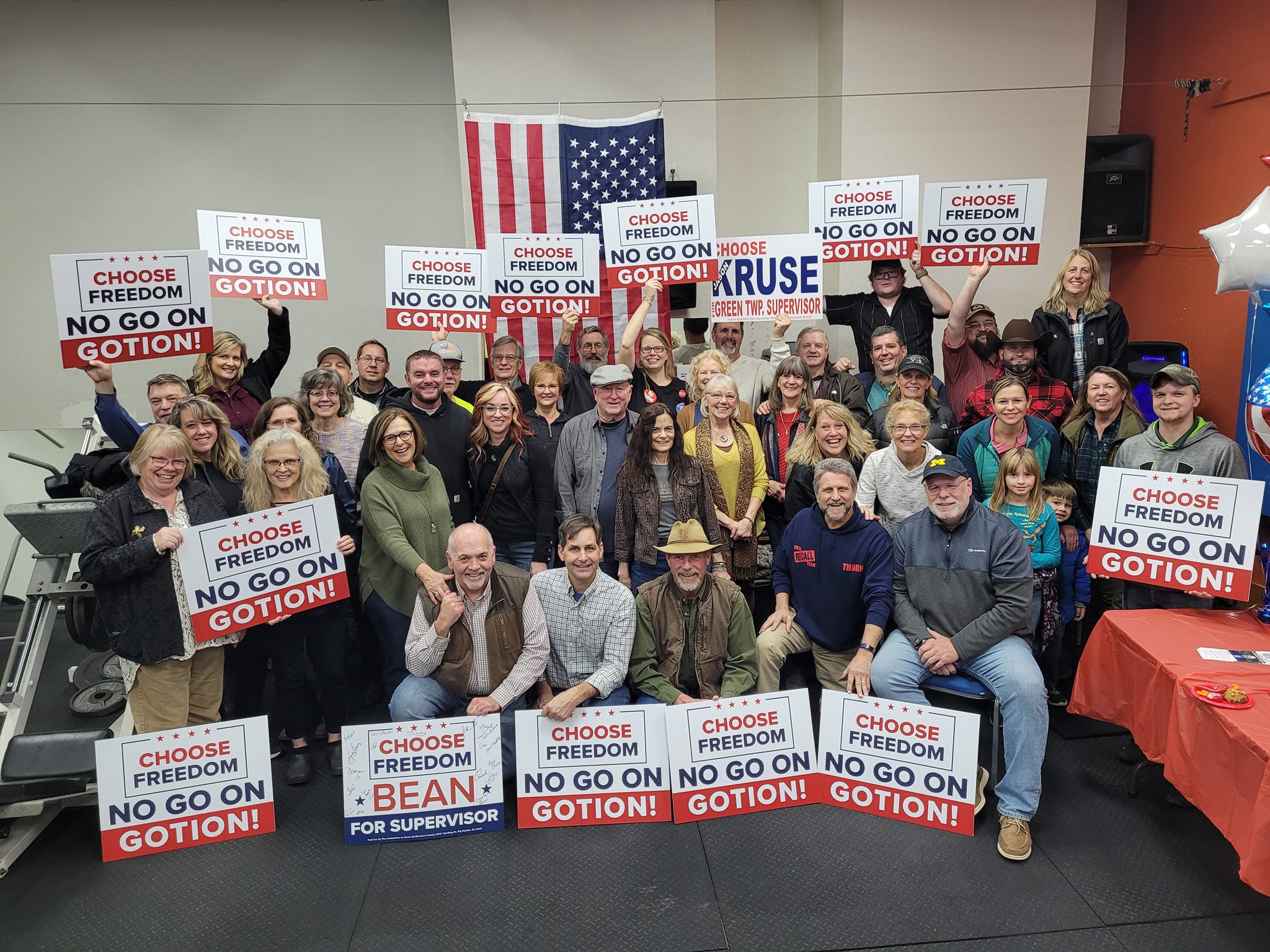

Ted joined WLS 890’s PM Chicago Show to discuss Chicago’s worsening pension crisis, why the city’s crisis makes it such an outlier nationally, its negative impact on residents, government workers and retirees alike, and what Mayor Brandon Johnson should do about it. When has any company persisted with a project in the face of stronger local, statewide and national opposition? When have taxpayers subsidized a more harebrained project?

When has any company persisted with a project in the face of stronger local, statewide and national opposition? When have taxpayers subsidized a more harebrained project?

The balance sheet of Philly School District is a brazen example of how we can’t assume honest financial reporting from schools, cities, or states. If you go to the balance sheet on p. 20 of the 2018 CAFR, observe a “deferred assets” entry of around $700 million. This is probably an Enron entry to avoid posting $700 million in losses on the income statement (from pension costs). So why is it important to avoid reporting a loss on the income statement ?? If the District reports $170 million in profits, the financial officer and the school Board can report that… Read more »

Lesson #4–watch trib, st, crain report nothing on civic fed report

Didn’t we say that this would be a net loss regardless because anyone taking the buyout wasn’t planning on living long and, as a result, the buyout would be more expensive than them claiming their normal pension benefits until death?

Yup. Overweight, smoking skydivers with cancer will be the first takers. That selection bias then invalidates the mortality tables for those who remain in they system.

An amendment alone won’t do it. The bond holders need to experience a serious default, that then exposes the raters false optimism at best or lies at worst. That single default event is the chemotherapy blast upon the cancer. The whole mechanism, the fundamental engineering of finances in Illinois and Chicago, is still simply paying debt with more debt. The debtor is a market that is offered taxpayers as collateral, raters that are in collusion, and investors that are protected by clauses that basically gave away the store already. All of this is a legal ponzi only legal by virtue… Read more »

We all knew you were right…ok.

Enough self gratification. So they have millions in funds provided by these bonds right? Is it real money that the politicians will now spend to decorate their offices? Or do they pay back the bond holders?