By: Mark Glennon*

UPDATE 9/29/14 — See note at end of piece regarding more detailed article my Mr. Madiar.

What a sensible headline: With Illinois pensions, what’s past is prologue. Instead of dwelling on the past we have to accept it and move on to solving the problem, right?

Yet Eric Madlar, Senate President John Cullerton’s chief counsel, goes on to write about just one thing — the history of underfunding. His big discovery is that underfunding goes all the way back to 1917. Not one word about how to solve the problem except for the last line, which is that we should accept history and recognize the obligations imposed by the constitutional pension protection clause. In other words, just pay the damn pensions (including his own.)

Of course we’ve been underfunding pensions. If we hadn’t been they’d be fully funded and we’d have no crisis. We should have tried, all should agree. That way we would have seen long ago that they are unaffordable and we would have addressed them sooner.

A useful history would have discussed why they’ve been underfunded and who is responsible. There would have been plenty to write about on that but Mr. Madiar’s boss, John Cullerton, would be central to that story. He’s the one who made national headlines for claiming we have “no crisis” with Illinois pensions. He’s the public unions’ go-to guy for stopping pension reform by disguising immaterial changes as reform proposals. He’s one of the top ten Illinois Senate recipients of union cash over the last ten years. And he’s the one who’s been defending for years the the state’s fraudulent pension reporting that has understated the problem forever. Yes, fraudulent — that’s what the SEC established as a matter of law about Illinois’ false disclosures about its pensions.

If Mr. Madiar really wanted to be a historian about this, he might have looked at what Mr. Cullerton’s entire family has done since 1917 to head off the pension crisis. I don’t know, but something tells me that’s not much. They have been central to Illinois and Chicago politics almost continuously since the Chicago Fire. Chicago Aldermen, Cook County Assessor, City Council Finance Committee chair, they’ve done it all.

Old timers, remember his dad, P.J. “Parky” Cullerton? Ah, good times. Wouldn’t it be interesting to dig into what fine work he did to avoid the run up in Chicago’s pension crisis?

They’ve always been friends with unions. One Cullerton alderman was a longtime member of the International Brotherhood of Electrical Workers. Before becoming alderman, he was the city’s chief electrical inspector, a post his son later took over, according to a Tribune article about the family.

Mr. Madiar’s real point, between the lines, is that because we’ve been underfunding pensions we have some sort of resulting obligation to catch up now, and underfunding has allowed us to spend on other things. Just fund them now.

No. Even with underfunding the taxpayer contributions have been so massive that they’ve obliterated proper funding for DCFS, schools and everything else. (Their unfunded liabilities continue to worsen, which we will be writing about shortly.) We have paid in more than enough.

Mr. Madiar is surely right, however, when he says that much of his time over the past three years has been spent on pensions. That has to be true about an army of people in Springfield, all of whom are getting salaries and pensions we are paying for.

Get beyond the prologue and fix the problem.

UPDATE: The author, Mr. Madiar, contacted me, very politely I would add, and suggested I review the more detailed version of his article, which is linked here, and it has a a much lengthier history of the underfunding as he sees it.

It describes how Republican governors Thompson and Edgar contributed to the problem, which is true. Read it yourself and you be the judge, but I would say it does not provide a balanced history of Democratic responsibility, too. Even with a Democratic governor and a Democratic supermajority in the legislature, underfunding skyrocketed and continues today for the same reason it has always occurred — properly funding pensions to pay benefits as promised would be so astronomically expensive as to be fiscally and politically impossible.

*Mark Glennon is founder of WirePoints.

**************************

If you’re frustrated with Illinois’ educational results, you may want to follow the money from teachers unions. In the last four years alone, Illinois lawmakers and political candidates have taken nearly $30 million in contributions from teachers unions and their national affiliates.

If you’re frustrated with Illinois’ educational results, you may want to follow the money from teachers unions. In the last four years alone, Illinois lawmakers and political candidates have taken nearly $30 million in contributions from teachers unions and their national affiliates.

Wirepoints President Ted Dabrowski testified on April 10, 2024 to members of the House Revenue and Finance Committee at the invitation of Rep. Joe Sosnowski. Ted told lawmakers that the state’s property tax burden has become dire for countless Illinoisans.

Wirepoints President Ted Dabrowski testified on April 10, 2024 to members of the House Revenue and Finance Committee at the invitation of Rep. Joe Sosnowski. Ted told lawmakers that the state’s property tax burden has become dire for countless Illinoisans. Ted joined WLS 890’s PM Chicago Show to discuss Chicago’s worsening pension crisis, why the city’s crisis makes it such an outlier nationally, its negative impact on residents, government workers and retirees alike, and what Mayor Brandon Johnson should do about it.

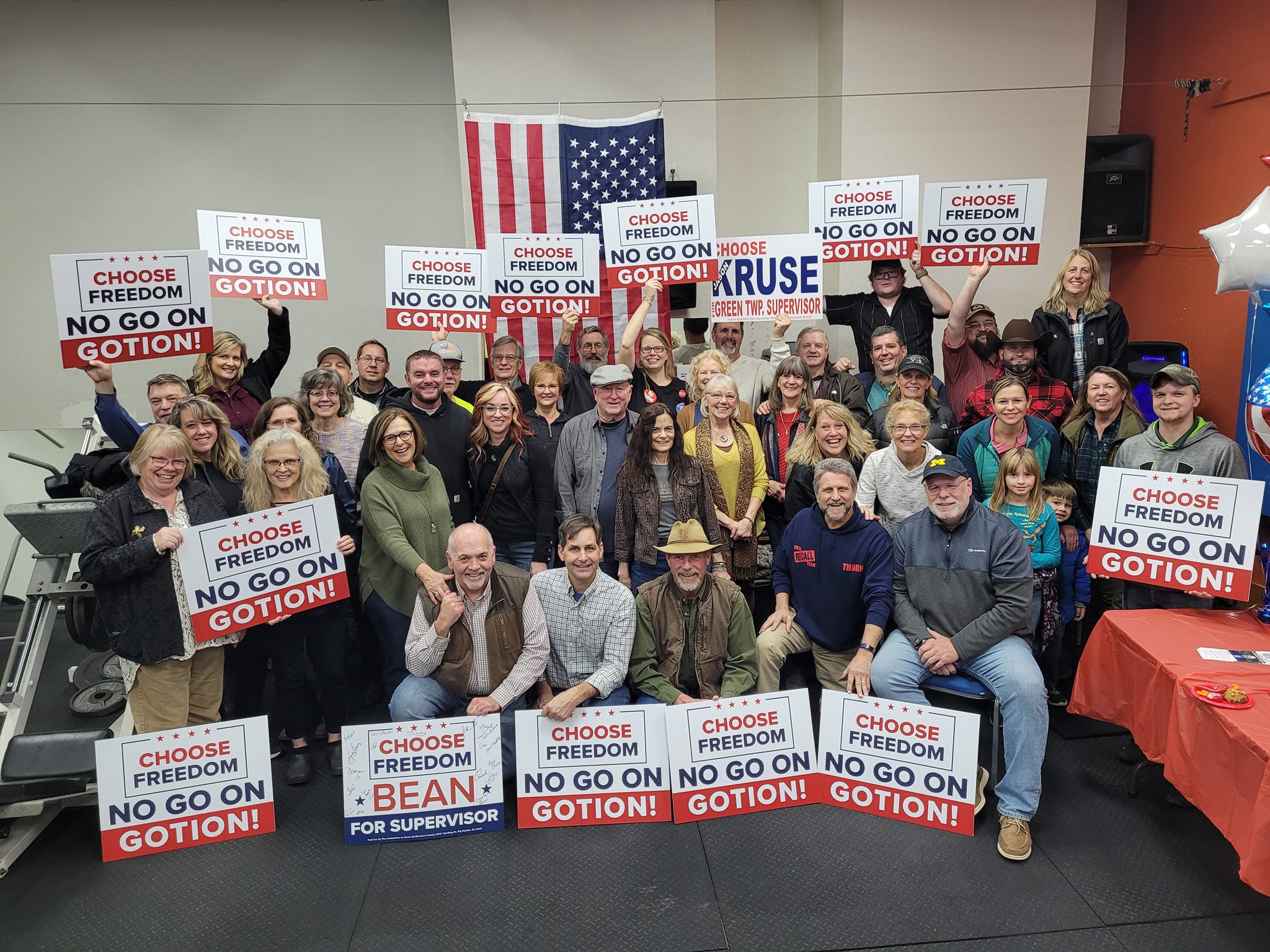

Ted joined WLS 890’s PM Chicago Show to discuss Chicago’s worsening pension crisis, why the city’s crisis makes it such an outlier nationally, its negative impact on residents, government workers and retirees alike, and what Mayor Brandon Johnson should do about it. When has any company persisted with a project in the face of stronger local, statewide and national opposition? When have taxpayers subsidized a more harebrained project?

When has any company persisted with a project in the face of stronger local, statewide and national opposition? When have taxpayers subsidized a more harebrained project?

So did anyone on this post actually offer a solution that is constitutional? As much as some don’t like Mr. Madiar’s analysis, that pesky constitution must be followed.

Here are a couple:. First, amending the constitution is politically impossible now, but the need to do that will soon be apparent to all. Second, just stop funding the pensions, which the constitution does not prohibit. Set up an alternative plan and begin funding that one, or at least threaten to. Tell the unions they can either make real reforms to the old plan or they will go broke. If the old ones are not fixed, give pensioners the option to cash out of the old, broke pension and go into the new one. A third possibility is put the… Read more »

Here’s the short portion of Mr. Madiar’s 44 page paper that discusses pension underfunding causes other than the State shorting it’s annual contribution to the pension funds. ****START QUOTE**** “Indeed, in June 2013, the Commission on Government Forecasting and Accountability (“COGFA”), testified before the First Conference Committee to Public Act 98-0599 and detailed the factors that caused the $87 billion growth in unfunded pension liabilities between fiscal years 1985 and 2012. [134] COGFA’s analysis revealed that 47% of that growth (or $41.2 billion) came from the State not paying what it should have to the pension systems. [135] Stock market… Read more »

There is one person whom has written about the impact of benefit hikes. Bill Zettler in Illinois Pension Scam compared 1970 Teachers Retirement System of Illinois (TRS) benefit levels to 2011 levels. He chose TRS because it’s the largest public sector pension fund in Illinois. That’s only 1 of the 18 pension funds in the Illinois Pension Code. And that only goes back to 1970, not 1917. So if you think someone has actually analyzed this going back to 1917, much less 1970, you are wrong. Mr. Madiar has set the benchmark of 1917 for underfunding. Mr. Madiar should talk… Read more »

Here’s a quote from Mr. Madiar’s article. “In short, pension benefit increases and employee salary increases were not the main reasons why the State’s five pension systems are so underfunded.” Where’s his proof? Did he go back to 1917 to make that calculation? If so, show us the history and math. If not, why not. Because he clearly states there has been discussion of underfunded pensions since 1917. Here’s what legislators and Governors and the one sentence added to the Illinois State constitution at the Constitutional Convention in 1970 have done. They consistently and repeatedly hiked the benefits of underfunded… Read more »

A few typo’s, I obviously meant early 1900’s date that Mr. Madiar used, not the early 1800’s.

No matter what Mr. Madiar, Mr. Cullerton, Mr. Madigan, Mr. Quinn, and all of the legislators and Governors say, they cannot escape they fact they used the legislative process to hike underfunded pensions. Where’s that report, Mr. Madair. Where is the list off all the House Bills, Senate Bills, and Public Acts that hikes pensions going back to the early 1800’s date you used? If the pensions had been underfunded so long, why where the pensions first not fully funded, THEN enact any benefit hikes? There’s the story. And given it’s a $100 BILLION + problem, it should be a… Read more »

The normal cost of SURS to the state is about 12% of payroll. This is what we would be paying if there had not been underfunding in the past 100 years. However, because of the underfunding, the state must now contribute over 30% of payroll to make up for it. So let me ask this simple question: is an employer contribution towards retirement of 12% of salary too high? Even if the employer does not participate in Social Security and does not pay the employer portion of the 6.2% payroll tax that every private employer must pay? The reality is… Read more »

Andy- The normal cost is calculated using the phony assumptions written about so often. They include an assumed rate of return that is far too high and that no reputable financial economist says is reasonable. Even the state auditor and its own actuary criticized the assumed return used by SURS which went into that 12%. Last year’s Nobel Prize winner in Economics says correcting that assumption alone would TRIPLE Illinois’ pension problem. Pensioners are asking for guarantied lifetime returns, which should require lower, fixed income -like return assumptions, yet pretending that contributions will earn a stock market -like, unguarantied rate… Read more »

Mark, To expect the State of Illinois to keep its promises to employees is impossible? Perhaps the State of Illinois could make a modest start by keeping the tax hike, charging sales tax of services as most states do, and collect income taxes on retirement money as most states do. These modest changes plus a longer ramp up to full funding would go a long way to making the impossible possible without the State of Illinois unconstitutionally cheating its employees. Additional more drastic steps might be needed, if so the sooner the state starts the easier these will be. O.… Read more »

Well-said. I’m sure the authors / supporters of this site will not agree, but the Center for Tax and Budget Accountability demonstrates that pensions, as structured, are indeed affordable for Illinois. The accumulated debt is the issue, caused mostly by underfunding in the past, which amazingly did stop under Quinn, the reformer. Any sensible person could look at the debt and recognize the answer – reamortize it.

CTBA’s notion of “reamortization” is another term for kicking the can down the road — just pushing it off until later. It’s not clear we could properly fund even the Normal Cost (the benefits earned for the current year), which is why Quinn couldn’t even do that with the tax increase in place. But you are right that the accrued unfunded liability is the biggest problem. Nobody has even suggested a solution for that, especially for the worst off municipalities.

Thank you for giving contrary opinions here. We welcome them.

Can’t agree on reamortization when the issue is a very long term liability. How many home owners would be renters if they had not been able to refinance? It’s the typical solution. Also, CTBA has long supported a total overhaul of the Illinois tax code, which has no ability to keep up with the costs of government – including schools, welfare, public health, etc. We are still following an early 20th century model based on manufacturing when our economy has moved to a service base. IL is far behind its neighbord in taxing services, which even Rauner recognizes as a… Read more »