By: Mark Glennon*

For starters, you’d hope a Nobel Prize winning economist would base his case on numbers remotely close to accurate.

But Roger Myerson isn’t even in the ballpark – he’s off by at least 200%, and perhaps 500% according to one of his Nobel colleagues.

A recent WGN story and video lay out Myerson’s defense of Illinois’ pending progressive income tax hike. Myerson is a Professor in Economics at the Harris Graduate School of Public Policy Studies. He won the Nobel Prize in economics in 2007.

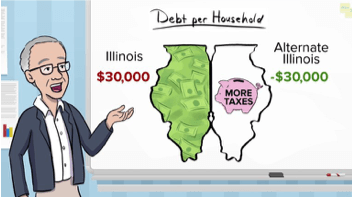

Illinois owes about $132 billion in unfunded pension debt, which is “not so bad,” he says. “Less than $30,000 per household.”

Wrong. That $132 billion is just for the five state pensions. Add on another $70 billion for local pensions and at least another $70 billion for pensioner healthcare which is entirely unfunded and constitutionally protected, and therefor part of the pension problem. That takes you to twice Myerson’s starting premise.

But that’s using the government’s numbers based on rosy, widely ridiculed assumptions. His fellow Nobel economist at the University of Chicago, Eugene Fama, said the real pension liability may be three times worse than official numbers. Apply that to all pensions, add healthcare and you’d get about $670 billion – five times worse than Myerson says.

We like to use Moody’s Analytics’ numbers, which are in the middle, and for per household liability we think you should disregard people who don’t have the means to pay anything. Chicago is the epicenter of our pension problems and its households with any real ability to pay face an average pension liability of over $400,000 at least, based on Moody’s numbers. That’s over 13 times Myerson’s per household number.

Now, let’s get to the heart of Myerson’s argument in favor of a progressive income tax, which is no less perplexing.

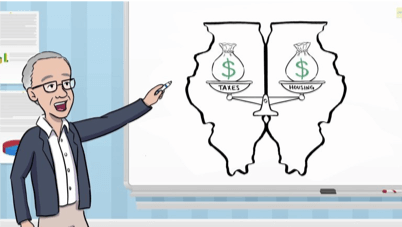

His case is based on pension obligations, taxes to pay for them and property values. He starts by saying unfunded pension are a “hidden mortgage, hidden debt that politicians didn’t tell us about because they weren’t taxing us.” True enough, but here is the rest of his case summarized:

“They say taxes are going to want to make people leave the state and they just sort of stop there, and don’t think where it’s going to go next,” Myerson says. To determine whether or not the state is better or worse off because of this unpaid obligation, you need to compare it to a hypothetical Illinois where everyone has been paying more taxes over the last 30 years.

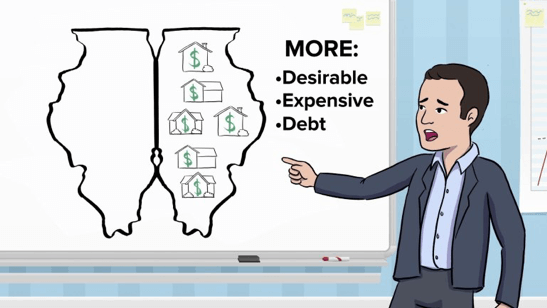

There, Myerson says, future tax bills for each household would be less, on average. But as a result, that state would have become more desirable and housing would become more expensive, so homeowners would need to take on more debt to buy a house.

“That debt, in equilibrium, as we say in economic analysis, would be of the same order of magnitude as the tax debt that you’d be escaping by moving over there [to the other Illinois],” Myerson says.

Good grief. There’s so much missing and so much wrong in that.

First, Myerson’s presupposes that higher taxes for pensions are matched something near one-for-one by reduced property values. He doesn’t back that up and it’s surely not true. Local pensions are paid primarily by property taxes, which do suppress property values. But sales taxes, fees and all the other sources of local revenue also contribute to pensions. Money is fungible. And none of the state pension and healthcare liabilities are paid by property taxes. Taxes for them still suppress property values indirectly, but surely not anything close to one-for-one.

In other words, taxes for pensions don’t equilibrate with property values nearly as closely as Myerson asserts with no foundation. They come out of, and suppress, myriad other economic activities including spending and investment, and there’s no long term value in that.

Second, some of the impact Myerson describes – lower Illinois property values – has already come to pass, and it hasn’t helped. Chicago, especially, is unquestionably cheaper because of our crisis and high taxes, and fleeing Illinoisans have already helped push prices up in other places, though probably not by much. Yet flight continues – five years straight of population decline. In other words, the balancing effect Myerson theorizes about isn’t working.

That’s partly because there’s a staggering downside to lower property values. Subpar home appreciation has cost Illinoisans a quarter trillion dollars over ten years. That’s how much more their homes would be worth if they had appreciated at the national average, as we reported here. The negative wealth effect and other damage caused by that loss is massive.

Third, the $270 billion of unfunded retiree obligations are yet-to-be-assessed as taxes. Does Myerson really think that looming bill, whether it’s a mortgage on Illinois properties or something else, doesn’t scare people away? I emphasize “yet-to-be-assessed” because Illinois and most of its municipalities are still far from taxing what would be needed just to tread water on its pensions. He apparently thinks Illinoisans needn’t worry about higher taxes because they will be offset by hammering home prices lower. Some consolation.

To stabilize our pensions and begin covering the unfunded debt, unthinkably high tax increases would be needed. Remember that proposal from Chicago Federal Bank economists? They suggested a special, statewide, property tax dedicated solely to pensions. That tax would have to be one percent of true value and last for 30 years just to cover the state pensions. It would have to be double that to cover pensioner healthcare liability and local pensions.

Fourth, and most importantly, Myerson’s hypothetical state is incomplete and disconnected from the true alternatives taxpayers face. In actuality, most other states have less generous pension benefits and most have been cutting them, which Illinois courts prohibit.

Take Wisconsin as a clear example. It has been taxing sufficiently to cover future pension outlays, yet their total tax burden is no worse than ours. Residents there face no “hidden mortgage” for pensions because they are fully funded. Property and other costs aren’t higher than in Illinois. And they have better roads, better schools and better services for most everything else. You can see results along the Wisconsin border, which is dotted with former Illinois companies.

Myerson, in other words, presents an entirely unrealistic and meaningless choice between Illinois and his theoretical Illinois. The real choice is between Illinois and states with better services, lower costs, lower taxes and lower unlevied taxes for pensions.

Let’s make this simpler and put this into context. What would Myerson say to Warren Buffet? He told CNBC, clearly referring to Illinois, “If I were relocating into some state that had a huge unfunded pension plan, I’m walking into liabilities…. I’ll be here for the life of the pension plan and they will come after corporations, they’ll come after individuals. They’re going to have to raise a lot of money.”

What would Myerson say to the countless people and employers that have fled or are planning to flee partly because of high taxes?

His answer to all of them would be that they got it wrong because they didn’t think of the comparison to a hypothetical Illinois where higher taxes had fully funded our pensions.

Wouldn’t you love to see the looks on their faces if Myerson told them that?

*Mark Glennon is founder of Wirepoints.

If you’re frustrated with Illinois’ educational results, you may want to follow the money from teachers unions. In the last four years alone, Illinois lawmakers and political candidates have taken nearly $30 million in contributions from teachers unions and their national affiliates.

If you’re frustrated with Illinois’ educational results, you may want to follow the money from teachers unions. In the last four years alone, Illinois lawmakers and political candidates have taken nearly $30 million in contributions from teachers unions and their national affiliates.

Wirepoints President Ted Dabrowski testified on April 10, 2024 to members of the House Revenue and Finance Committee at the invitation of Rep. Joe Sosnowski. Ted told lawmakers that the state’s property tax burden has become dire for countless Illinoisans.

Wirepoints President Ted Dabrowski testified on April 10, 2024 to members of the House Revenue and Finance Committee at the invitation of Rep. Joe Sosnowski. Ted told lawmakers that the state’s property tax burden has become dire for countless Illinoisans. Ted joined WLS 890’s PM Chicago Show to discuss Chicago’s worsening pension crisis, why the city’s crisis makes it such an outlier nationally, its negative impact on residents, government workers and retirees alike, and what Mayor Brandon Johnson should do about it.

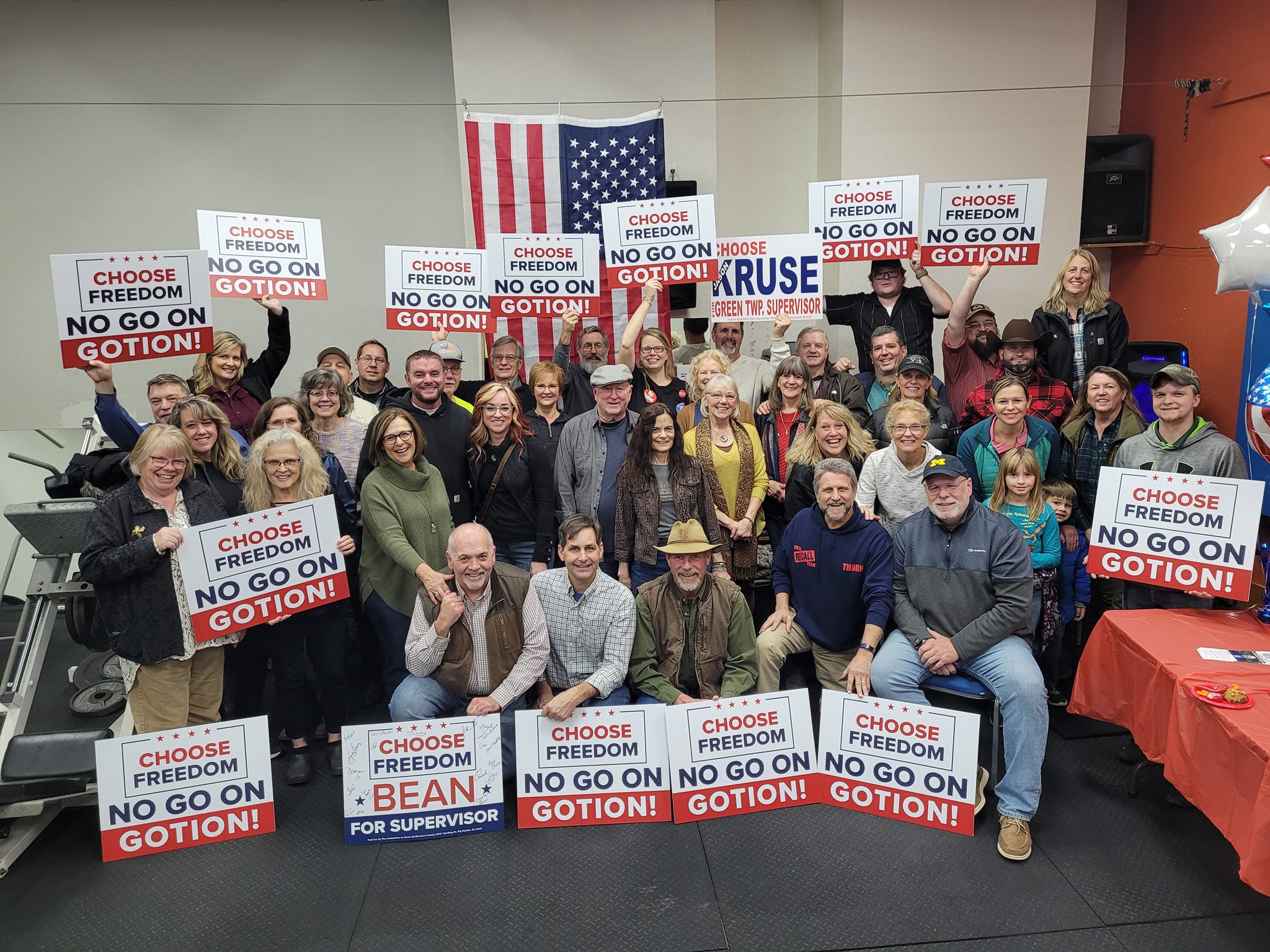

Ted joined WLS 890’s PM Chicago Show to discuss Chicago’s worsening pension crisis, why the city’s crisis makes it such an outlier nationally, its negative impact on residents, government workers and retirees alike, and what Mayor Brandon Johnson should do about it. When has any company persisted with a project in the face of stronger local, statewide and national opposition? When have taxpayers subsidized a more harebrained project?

When has any company persisted with a project in the face of stronger local, statewide and national opposition? When have taxpayers subsidized a more harebrained project?

I am absolutely astounded that a Nobel prize winning economist dismissed the significance of unfunded pensions and other liabilities in IL. People are leaving the state and the state is insolvent!!!

All illinoisans are working to take care of government employees of which politicians are included. The reason there’s no reform is because politicians would need to cut themselves out of the equation! A simple fix would be to make folks work to 65 and all would be solved!

Probably celebrate. When they sober up they will choose a new class of people to despise chase away.

If his theories are so rosy. Then why are bonds being used for operating expenses instead of for the long term assets that benefit generations, roads, parks, infrastructure and the things that attract business? How borrowed money is being spent is the best indicator of true economic health. Because borrowing actions are prioritized just to get them done, unlike general budget slush funds. He may have a lot of math behind all this, but to the layman it’s just a very elitist way of taking money from your left pocket, putting it in your right pocket, then stating you’re richer.

I see, once again, those that get the high paying teaching jobs, steal from the taxpayer, are extraordinarily lacking in knowledge. Up pops that, 1% state real estate tax again. Higher taxes build a bigger coffin. Illinois is so doomed, and disgusting. The revolt or the bolt? It will be both.

I believe Myerson forgot to.balance his equation.

If ILL/ ALT-ILL is modelled on the assumption of tax rate capitalization, then:

ALT-ILL would have the same prooerty values as ILL.,.

The $30,000 of additional taxes paid ito create ALT-ILL ( which obviated the theoretical $30,000 debt) would have been capitalized into the property as negative value as it was being paid.

ALT-ILL property values would be the same as ILL with $30,000 debt hidden mortgage.

Seems to me there’s also question of when it gets capitalized that has to be worked in — is it when the taxes are levied or when the market concludes they will be levied in the future? In reality, I think it’s somewhere in between. But it doesn’t matter much because it’s far from true that pensions get paid entirely out of property taxes. So, regardless of when when the taxes get capitalized, the whole mechanism is largely a side show.

remember the soda tax? Wasn’t that just for pensions?

The soda tax was for The Children!

You are correct, in an excruciatingly accurate model we would account for annual treasury bond yields,actual tax rates and inflation rates, run it out 30 years , then present value ILL/ALT-ILL accordingly. But at modern day low inflation rates and bond yields, approximations are accurate enough for government work, We can achieve approximate results by assumption.You can then look at comparative Case Shiller indices of home values to validate the tax rate capitalization theory Assume 100% property tax rate capitalization on an annual basis. Property tax rates are so aberrantly high in Illinois relative to all of America that every… Read more »

But don’t you agree that Dr. Myerson’s model is fatally flawed at the outset, because the very theory he used to argue ALT-ILL having higher property value was not factored into the left side of his equation!!!??? that is, if the debt (which was considered to be a fully capitalized POSITIVE property value in ALT-ILL)disappeared because of higher tax payment in ILL, the value increase due to debt would have been fully offset by the property devaluation as a result of payment of those theoretical taxes!!! It seems to me he applied the ‘tax rate capitalization ‘ factor to only… Read more »

Since he intends this to be a reason to pass the fair tax, it seems to me his thinking must go like this: Don’t worry bout higher taxes here because they will be capitalized, suppressing property values and thereby making our home mortgage payments lower, resulting in a wash. Alt-IL already paid, so its taxes will be lower, property values higher and its home mortgage payments higher. If that is his thinking, then he did include it on both sides of the equation. Of course, there are all kinds of other things wrong with that. For example, 1) Prices here… Read more »

No he STILL did not include the $30,000 of additional tax payments on the left side of equation!

I was very unsure.about my noting such a glaring mistake by a high level economics profesaor, so i checked with my friend who.is alao a high level economics profesor, and he double-checked with another colleague.

Nobody wants.to.call attention to.a mistake like this, and it was possible his model.was misinterpreted by WGN editors, and in the end who cares, right?

But it is important to note that even when “experts ” are cired, we should always check the math!

Thanks. I will think that through again. I had not seen his original essay.

I agree with all your other observations, for sure.

To be fair to Dr. Myerson, his original editorial essay seems to have been disttorted by WGN editorial

Finally, it is possible to construct a model of property value destruction ( relative to the rest of America, which offers .similar median quality social service provision in exchange for signifiicantly lower ratios.of home value and household income).

Now THAT would be a model Dr. Myerson might present that would start a meaningful discussion about real world solutions in Illinois. He could.get a TA to do that in one afternoon!

I believe that the Myerson ILL/ALT-ILL is based upon the theory that aberrant tax rates are capitalized as a negative property value, ‘property tax rate capitalization ‘ That means, in Illinois with our property tax rate aberrant high relative to all other regional domicile choices , every additional cent of tax demanded can be considered, in ratio, as annual property value depreciation. This makes sense: property tax rate is literally the ratio of ‘public spending relative to the means of the taxable community ‘. If a community cannot afford the demands of public spending, the community may be forced to… Read more »

Cliff Asness, a PhD economist from Univ of Chicago, says Krugman is a hack that has sold out. Don’t pay attention to him anymore. His work for the Nobel was great. Now, nada. Myerson won the Nobel as well but when you look at the decisions, you have to look at the inputs and structure and ignore the outcome.

Stiglitz is another Nobel economist who has whacked out.

As soon as I saw “Dumbest” and “Nobel Economist” in the headline I assumed the article was about Krugman

It’s like Calvin Coolidge said: “The world is full of educated derelicts.” The public has figured that out. Trump has capitalized on it by attacking “elites.”

Don’t piss on my leg and try to convince me that it’s raining. That was my angry reaction at reading his propaganda piece on wgn. Saying high taxes won’t make people leave is insane–it’s the only thing people can do.

The Illinois current total tax burden surpasses most, if not all other states. So what does Illinois have to show for it? Better roads? Better schools? Lower Crime? It has none of those things, plus even at todays taxing levels, the state isn’t taxing enough to meet it’s obligations. How is it that other states manage to provide a better level of public service without a state tax and also with much, much lower property taxes? Could it be that Illinois simply pays too much for everything, or it pays many more people than other states for the same amount… Read more »

$30,000 of state pension debt per household is “not so bad”? Kinda flippant, if you ask me. You know what I’d rather do with $30,000? ANYTHING ELSE.