By: Ted Dabrowski and John Klingner

Warren Buffett says he wouldn’t relocate a business to a state like Illinois. He doesn’t want to get stuck paying for its pension crisis. He recently told CNBC:

“In the public sector, you know, it’s a disaster…If I were relocating into some state that had a huge unfunded pension plan, I’m walking into liabilities…And those are big numbers, really big numbers…And when you see what they would have to do – I say to myself, “Why do I wanna build a plant there that has to sit there for 30 or 40 years?”

He’s right.

Already, more than a quarter of the state’s budget is consumed by retirement costs, largely the result of overpromised benefits. Illinois can’t handle it. The state has racked up billions in unpaid bills, multi-year operating deficits and credit downgrades. It’s now just one notch above junk, according to Moody’s.

But the problem is worse than it appears. The state’s ballooning retirement promises are actually far bigger than Illinois bureaucrats say they are. When the state’s debt costs are more properly and honestly accounted for, Illinois ends up beyond crisis levels. It would take nearly half of Illinois’ $38 billion budget to pay the true costs of the state’s retirements.

Simply put, Illinois is insolvent under most realistic financial measures.

Official reporting only tells half the story

The state’s official reports grossly understate Illinois’ fiscal crisis, but it’s a good place to start.

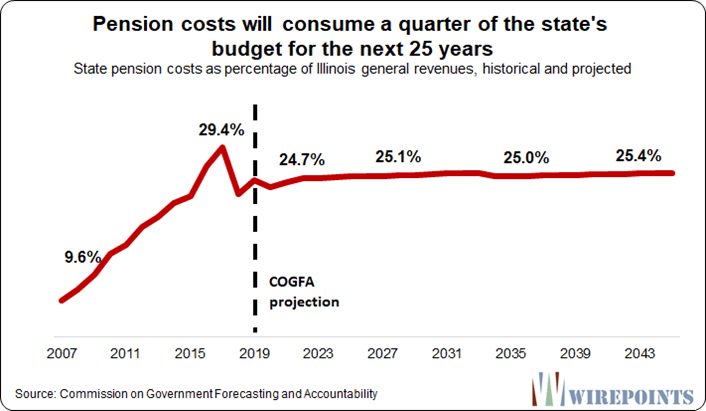

Illinois actual contributions to its state-worker retirement debts consume over 25 percent of the state budget. No other state in the country dedicates that much of its budget, making Illinois the national outlier when it comes to retirement debts.

And according to official state numbers, that burden won’t get better any time soon.

Pension costs alone will consume a full quarter of Illinoisans’ tax dollars for the next 25 years (See Appendix 1). That fact alone is enough to make Illinois increasingly unlivable for the majority of working and middle-income Illinoisans.

Not only does the state have an official $134 billion shortfall, but it also has a $73 billion debt for retiree health insurance benefits, none of which has been pre-funded. Add to that a $10 billion pension obligation bond that doesn’t mature until 2033 and the state’s official retirement debts end up totaling more than $210 billion.

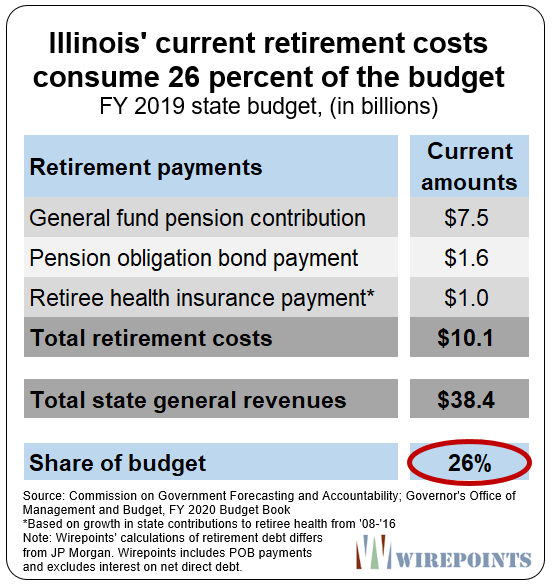

The yearly statutory payments for those obligations are more than $10 billion annually, or about 26 percent of the 2019 budget.

Half the budget

Illinois’ true retirement costs, however, are far worse than what the official numbers say. When the state’s rosy assumptions are pushed aside and more rigorous, federal (GASB) guidelines are used, the state’s required contributions jump.

To start with, most market-based groups calculate a much higher pension debt for Illinois, using discount rates of 4 to 6 percent. Moody’s, for example, uses a rate much closer to that used by corporations. Their calculation puts Illinois’ pension debt at $234 billion – $100 billion more than the official debt.

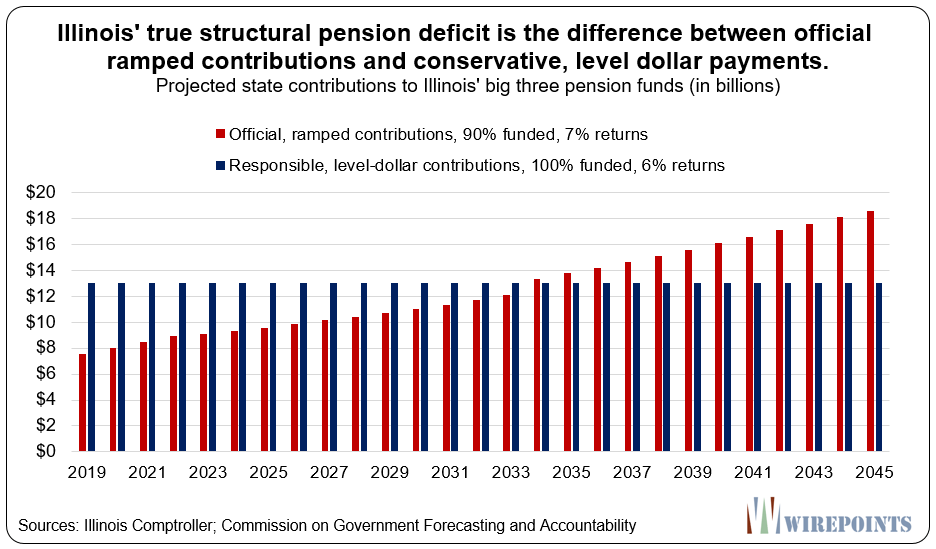

Wirepoints calculated Illinois’ true yearly pension costs based on the following assumptions:

- 100 percent funded plans by 2045;

- Level, equal-dollar yearly contributions instead of the current ramp schedule; and,

- More realistic investment returns: 6 percent instead of the 7 percent the funds currently assume (See Appendix 2).

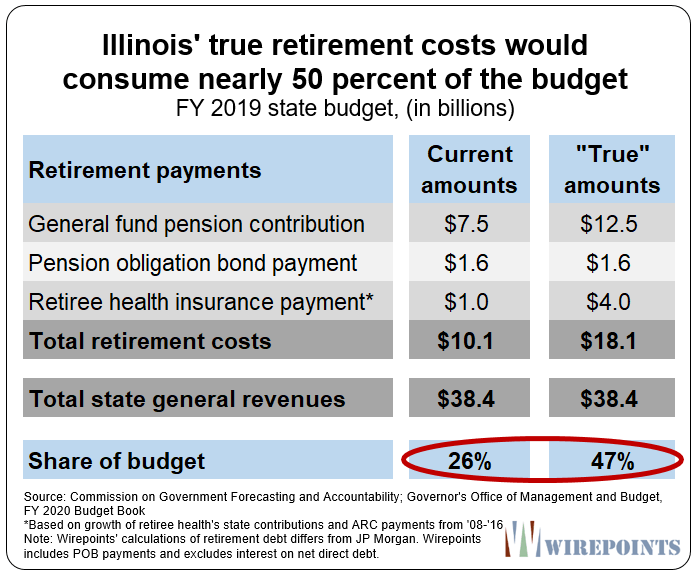

Paying for pensions properly adds another $5 billion to the state’s current general fund pension contribution – a $12.5 billion payment in all.

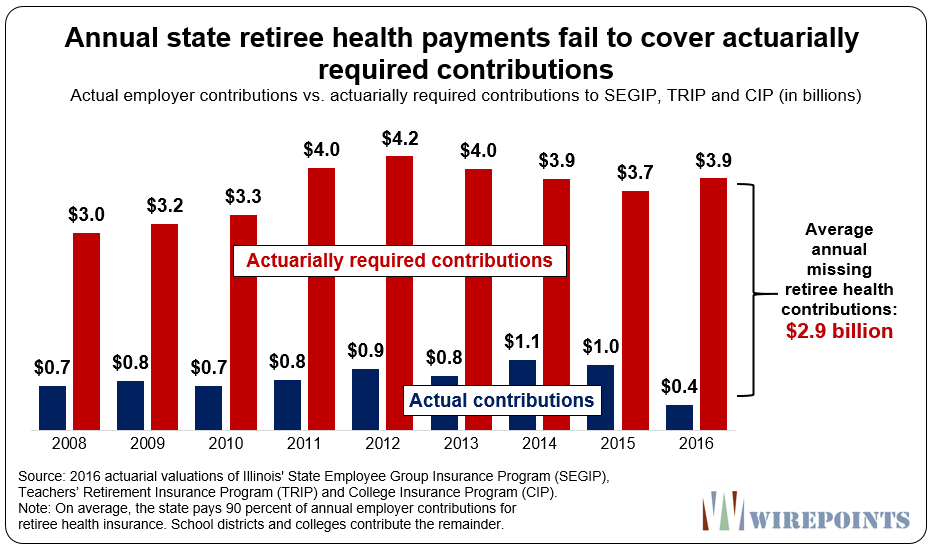

Wirepoints also analyzed what how much more it would cost the state annually if it contributed the actuarially required payments to its retiree health obligations – instead of the minimum pay-as-you-go contributions it makes today. That would require an additional $3 billion annually – creating a true annual payment of $4 billion. (See Appendix 3.)

Add up all the retirement costs and Illinois should be paying $18 billion dollars today – nearly 50 percent of Illinois’ $38 billion budget.

Paying almost 50 percent of the budget into public sector retirements is an impossibility. Diverting that much would slash the monies needed to fund Illinois’ core services and create chaos in an already dysfunctional state.

But that’s Illinois’ fiscal reality. It’s an insolvent state that can’t pay its bills.

Even if politicians were to hike taxes to raise $10 billion in new revenue, the state’s true retirement costs would still eat up over 37 percent of the budget ($18.1 billion in true retirement costs divided by a $48.4 billion budget).

JP Morgan: Illinois is the nation’s outlier

JP Morgan recently analyzed retirement costs in 2017 on a state-by-state basis, and anyway you look at it, Illinois was the outlier nationally. Morgan calculated what states currently pay toward their retirement debts, as well as what they should be paying to ensure their plans are actuarially sound. The bank added up contributions to pensions, retiree health insurance and interest on direct debt.

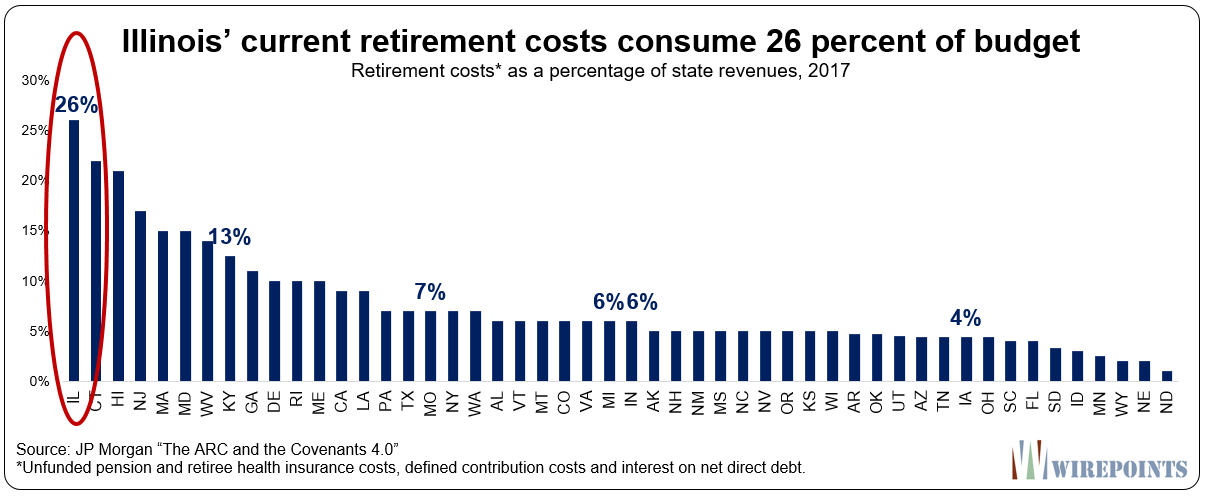

JP Morgan found that over 26 percent of Illinois’ budget currently goes toward public-sector retirements. That was far more than other states with major pension crises, including Connecticut and New Jersey.

By comparison, retirements only consumed 6 percent of Indiana’s budget and 4 percent of Iowa’s. That’s a big reason why those states have triple-A credit ratings while Illinois teeters just one notch above junk.

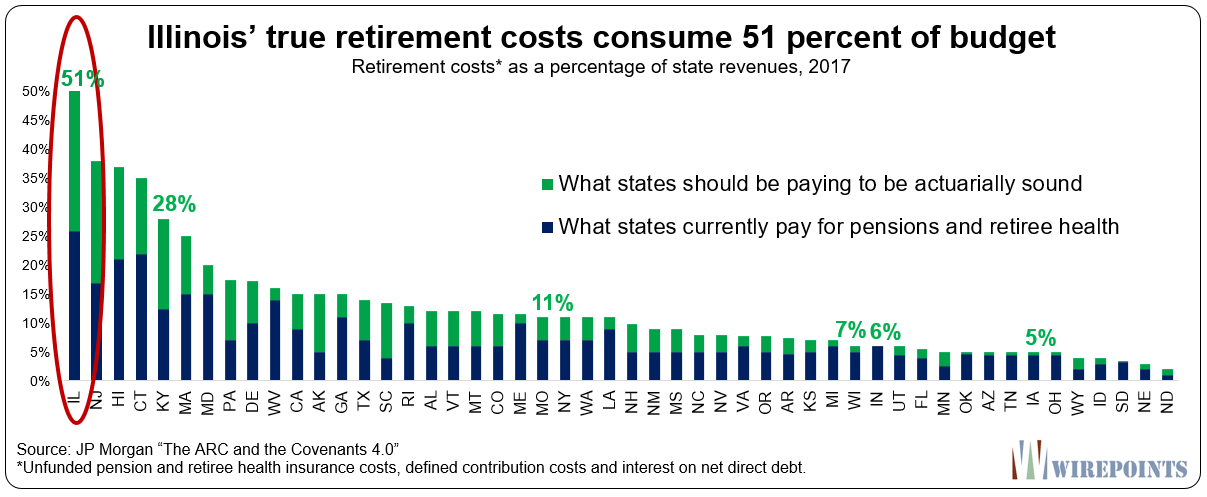

Illinois’ outlier status is even more stark when JP Morgan measured the true costs of state retirements. Over 50 percent of Illinoisans’ tax dollars would go to pay for pensions, retiree health and interest.

Iowa’s true retirement costs, in contrast, are just 5 percent of its budget. Wisconsin’s, 7 percent. Indiana and Missouri’s, 6 percent and 11 percent, respectively.

Even Kentucky, mired in its own pension debacle, is far better off than Illinois is.

More taxes can’t fix this

Illinois politicians are running out of options. Their usual tricks of more debt and reamortizations won’t work with Illinois teetering on junk status. That’s why they’re so desperate for what they call a tax hike on the rich. They’re selling Gov. J.B. Pritzker’s $3.2 billion progressive tax hike as the panacea for all of Illinois’ ills.

But the reality is the state has no way to pay for all the promises lawmakers have made. The state is currently shorting its retirement plans by at least $8 billion annually. It’s currently running a $3.2 billion operating deficit. And it has a stack of nearly $6 billion in unpaid bills.

No amount of tax hikes can fix the structural problems of runaway benefits.

Until Illinois’ retirement debts are brought under control through structural reforms, starting with a constitutional amendment for pensions, politicians will continue to throw even more tax dollars into the collapsing mess that is Illinois finances.

No wonder Warren Buffett stays away.

Read more about how pensions wreck Illinois’ budget:

- Moody’s vs. Illinois politicians: $100 billion difference in pension debts

- There’s No Legal Reason Not To Pursue An Illinois Constitutional Amendment

- Overpromising has crippled public pensions: A 50-state survey

- Illinois’ other debt disaster: $73 billion in unfunded state retiree health benefits

- Pritzker’s progressive tax push: A guide for the ordinary Illinoisan

Appendix 1

Appendix 2

Appendix 3

A set of state lawmakers want to extend CPS’ current school closing moratorium to February 1, 2027 – the same year CPS is set to transition to a fully-elected school board. That means schools like Manley High School, with capacity for more than 1,000 students but enrollment of just 78, can’t be closed for anther three years. The school spends $45,000 per student, but just 2.4% of students read at grade level.

A set of state lawmakers want to extend CPS’ current school closing moratorium to February 1, 2027 – the same year CPS is set to transition to a fully-elected school board. That means schools like Manley High School, with capacity for more than 1,000 students but enrollment of just 78, can’t be closed for anther three years. The school spends $45,000 per student, but just 2.4% of students read at grade level.

Hopefully, all media will get the message, in Illinois, too.

Hopefully, all media will get the message, in Illinois, too. Ted joined Tom Miller of WJPF to talk about Illinois’ highest-in-the-nation property taxes, why lawmakers don’t want to touch the tax’s cost drivers, just how much Illinoisans’ tax burden has grown over the decades, why Gov. Pritzker failed to meet his promise to reform property taxes, and more.

Ted joined Tom Miller of WJPF to talk about Illinois’ highest-in-the-nation property taxes, why lawmakers don’t want to touch the tax’s cost drivers, just how much Illinoisans’ tax burden has grown over the decades, why Gov. Pritzker failed to meet his promise to reform property taxes, and more.

We are screwed it’s time to move

Only people worse than Ill politicians are the ones who keep voting them in!

Well Warren by the fed,s own numbers the U S A. Is insolvent. All so. Over 200 pensions world wide are underfunded. Let that sink in

Either you trust them to make good on the promise or don’t:-$

This article blames runaway benefits but mentions nothing about the fact the previous governors and the general assemblies (Republican and Democratic controlled) choose to skip past payments which is what created the hole Illinois is in (if those weren’t skipped then there would be significantly more invested resouces). Benefits were already corrected with the Tier II changes. It also doesn’t help that the state workforce has significantly less workers than the past which reduces employee contributions to the fund to support retired workes.

@Arm

It’s a moot point. The article is saying WHY we are screwed and by how much, its obvious HOW we got here…The issue is, how do we move forward. Screw the current private sector workers for past policy mistakes? Amend the constitution to re-neg on benefits?

I don’t hear anyone in the public unions offering to compromise so my vote is for the latter. If T1 union members were offered 10% colas, they still would have taken it and would still be crying about “a pwomise is a pwomise”.

Correct Hank. Also, I find it impossible to be sympathetic towards the unions based on their behavior over the years and their cozy (you scratch my back, I’ll scratch yours) relationship with the Dems. I felt like I was forced to leave Illinois and wouldn’t mind some payback by seeing those pension promises turn to dust.

The pensions have been overpromised with pension benefits growing 600 times faster than income. The problems have nothing to do with skipped payments. Pension obligation bonds were purchased and now repayment must be made. Public employees need a 401K plan just like private sector workers.

The reality is scary, but to me the thing that this article and similar ones don’t address is the impact of slashing pension promises or salaries- the brain drain. I know, ” but people are leaving Illinois already,” and that’s true, but it can definitely be exacerbated. I’m a public teacher with a master’s (and graduate school debt) who has been pretty successful in the classroom based on my reviews. I’m not alone, despite the chaos, Illinois schools have been pretty successful. A large part of that is promises that were made. I simply can’t afford to live here if… Read more »

Sorry AlexW, but the Illinois public sector can’t protect you much longer from reality. The private sector can’t afford to pay the Illinois public sector bills/promises. It’s that simple. If you’re as talented as you say, you should be able to find employment in another state like so many other former Illinois resident/taxpayers.

Anyone who does not like teacher salaries should do something else for a living. Teachers should not become multi-millionaires from a public pension.

lol really?? “multi-millionaires ???” lmao

Actually Rich, although Illinois pension “multi-millionaires” would be a slight exaggeration in describing most full-career classroom teachers, when you actually run the numbers it turns out that the description is not all that far-fetched. According to https://www.illinoispolicy.org/reports/pension-solutions-reforming-retirement-age/ “More than 71 percent of TRS members retired before the age of 60. The average pension for TRS members who retired before the age of 60 with at least 35 years of service is $70,491” If you go to http://valueyourpension.com/inflation-cola-pension-calculator/ and plug in $70,491 as the starting yearly pension payout for a 60 year old female, and enter in the 3% Illinois Teachers… Read more »

No doubt the corrupt mafia Democrats will choose the “Scorched Earth Death Spiral Path” by raising taxes and kicking productive people and companies out of the state. Just don’t see the surviving another 10 years, maybe not 5 years. The only thing that gives the Democrats even a remote chance at saving Illinois is by re-electing Trump and hope the economy continues to go higher.

If Trump doesn’t get relected, Illinois may not survive 2 more years.

Hollowing out. Autocorrect.

Liberals and their garbage entitlement on display! Wake up folks, this is what liberalism/socialism looks like. It is billowing out our country and consuming the hopes of our children. All so liberal politicians can make taxpayer-funded promises to essentially buy their way into office perpetually. Downright wicked.

So disappointed with voters in this state. Thanks for reporting truth. I Moved to Chicago in 1988; I Never expected then that I’d be now planning an exit-move.?

Even worse.. if 50% of the budget is retirement related, and let’s say 50% of those retirees went to Florida, Arizona, Tennessee, sc, already. Then we are basically subsidizing those states as we mail out pension checks that don’t even get spent here. Maybe that’s why taxing retirement income in Illinois is the third rail of politics here, even for the progressives. Between the crappy weather and corruption even govt retirees want to leave, add on a retirement tax and they would truly be idiots to stay here to spend their Illinois pension checks.

My fantasy would be for a tax-payer advocacy org or property tax owners file suite to demand state & muniple debt be presented using full federal GASB standards @ minimum, on the grounds tax payer should at least have the right to know the full debt on which to asses thier payments intead of phony accounting.

Great article. I will be forwarding it to many people.

Good idea Gemini, but it’s my experience that most will ignore because they don’t believe things could have already gotten this bad without them knowing all about it. They think, “How come nobody else is talking about this disaster? I guess it’s not true or exaggerated.”

It’s really funny, isn’t it? Buffett preaches about climate change, while Berkshire Hathaway owns some of biggest carbon emitting companies on the planet. He advocates higher taxes, while admitting he wouldn’t open facilities in high tax states like IL. Hypocrisy on the left is part of their sickness.

Doug, a list of Berkshire Companies can be found here: https://en.wikipedia.org/wiki/List_of_assets_owned_by_Berkshire_Hathaway He’s pretty much been an insurance company buyer with such companies as GEICO, General Re, Wesco Financial, and others. As far as the Berkshire investment portfolio found here https://www.cnbc.com/berkshire-hathaway-portfolio/ you can see his top holding is Appile, followed by a number of banks, such as Bank of America, Wells Fargo, USB, Goldman Sachs, JP Morgan and consumer companies like Coca Cola. So I don’t see the ownership in some of the biggest carbon emitting industries. I am sure you can cherry pick some like Phillips 66, but that’s a… Read more »

Doug may be partly referring to Berkshire’s ownership of railroad stock that transports oil. Buffet has been anti pipeline. Transporting oil by rail is much more environmentally dangerous. Wells Fargo also has a railcar division that transports oil

He’s buying a petroleum company in West Texas now as well.

Tom- You forget precision cast parts.

“The Toxic 100 Air polluters index from the University of Massachusetts lists Precision Castparts as the number one air polluter in the U.S. in the August 2013 edition,[19] which the company called a flawed study.”