By: Mark Glennon*

Bloomberg today reported that Chicago’s unfunded pension liability jumped by a staggering $11.5 billion. For a little perspective, keep in mind that the total unfunded liability for Chicago’s four pensions as commonly reported has been only about $20 billion.

Shocked? You shouldn’t be. We wrote two years ago that this is one of the “insane implications of keeping two sets of books.” Get used to it. That $11.5 billion increase was for just one of Chicago’s four pensions. Similar bad news will be coming out in Chicago and across the state for many other pensions.

As Bloomberg pointed out, the $11.5 billion increase for MEABF (Chicago’s Municipal pension) resulted from court invalidation of Chicago’s pension reform attempt and changes in accounting rules. However, a look at the new actuarial report for that pension indicates that $8.7 billion of it resulted, apparently, from those new accounting rules. (I say, “apparently,” because the change seems to be reflected in a line item called “change of assumptions” in page 93 of the report — a report that’s obfuscated, as usual.) That’s the part that will be repeated often. Chicago’s three other pensions have not yet posted new actuary reports for the year ended 12/31/15. Many other pensions in Illinois have not yet reported their new numbers.

The big question now, which we flagged two years ago, is whether the bond market will start focusing on numbers based on the new accounting rules. The new rules are much tougher, chiefly because they require much lower discount rates on unfunded liabilities. Numbers will also continue to be reported in the old way, using assumptions set by politically appointed trustees, which pols will attempt to hide behind.

If the bond market focuses on the new numbers, borrowing costs may leap, or worse. One economics prof we quoted two years ago said, “Places like Chicago…will be effectively unable to borrow in traditional bond markets.” Ouch.

Maybe Illinois reporters will finally start questioning the low numbers spoon fed to them by politicians and pensions. Interestingly, Bloomberg ignored numbers using the old accounting method contained in the actuarial report. That will be the trend; it’s just a question of when. The simple truth is that reality ultimately invalidates phony assumptions made in any projection. In this case, the Governmental Accounting Standards Board realized it could not, with a straight face, continue to report pensions the old way, so it made improvements. That was predictable and inevitable.

Regardless, it will be hard to hide from the new numbers. Bloomberg and maybe a few others will make the new accounting known. Kudos to them for being on top of this. They wrote about it before we did two years ago.

Brace yourself for more bad news.

UPDATE 5/20/16: LABF, Chicago’s Laborer’s fund, has now posted its actuarial report for the year ended 12/31/15. It’s a smaller fund. It shows its “Net Pension Liability” under the new accounting rules increasing by 3X, from $774,812,844 to $2,473,958,691.

New reports for Chicago’s police and fire pensions are not posted yet. Betting they’ll go up on a Friday evening or over Memorial Day weekend.

And an MEABF union trustee Tweeted this about the jump in that pension’s liability: “Easy now with the sky is falling. Ray Charles saw this coming with GASB. It’s not a surprise. Makes for a good headline though.” Nothing to see here, folks. Move along.

*Mark Glennon is founder of WirePoints. Opinions expressed are his own.

If you’re frustrated with Illinois’ educational results, you may want to follow the money from teachers unions. In the last four years alone, Illinois lawmakers and political candidates have taken nearly $30 million in contributions from teachers unions and their national affiliates.

If you’re frustrated with Illinois’ educational results, you may want to follow the money from teachers unions. In the last four years alone, Illinois lawmakers and political candidates have taken nearly $30 million in contributions from teachers unions and their national affiliates.

Wirepoints President Ted Dabrowski testified on April 10, 2024 to members of the House Revenue and Finance Committee at the invitation of Rep. Joe Sosnowski. Ted told lawmakers that the state’s property tax burden has become dire for countless Illinoisans.

Wirepoints President Ted Dabrowski testified on April 10, 2024 to members of the House Revenue and Finance Committee at the invitation of Rep. Joe Sosnowski. Ted told lawmakers that the state’s property tax burden has become dire for countless Illinoisans. Ted joined WLS 890’s PM Chicago Show to discuss Chicago’s worsening pension crisis, why the city’s crisis makes it such an outlier nationally, its negative impact on residents, government workers and retirees alike, and what Mayor Brandon Johnson should do about it.

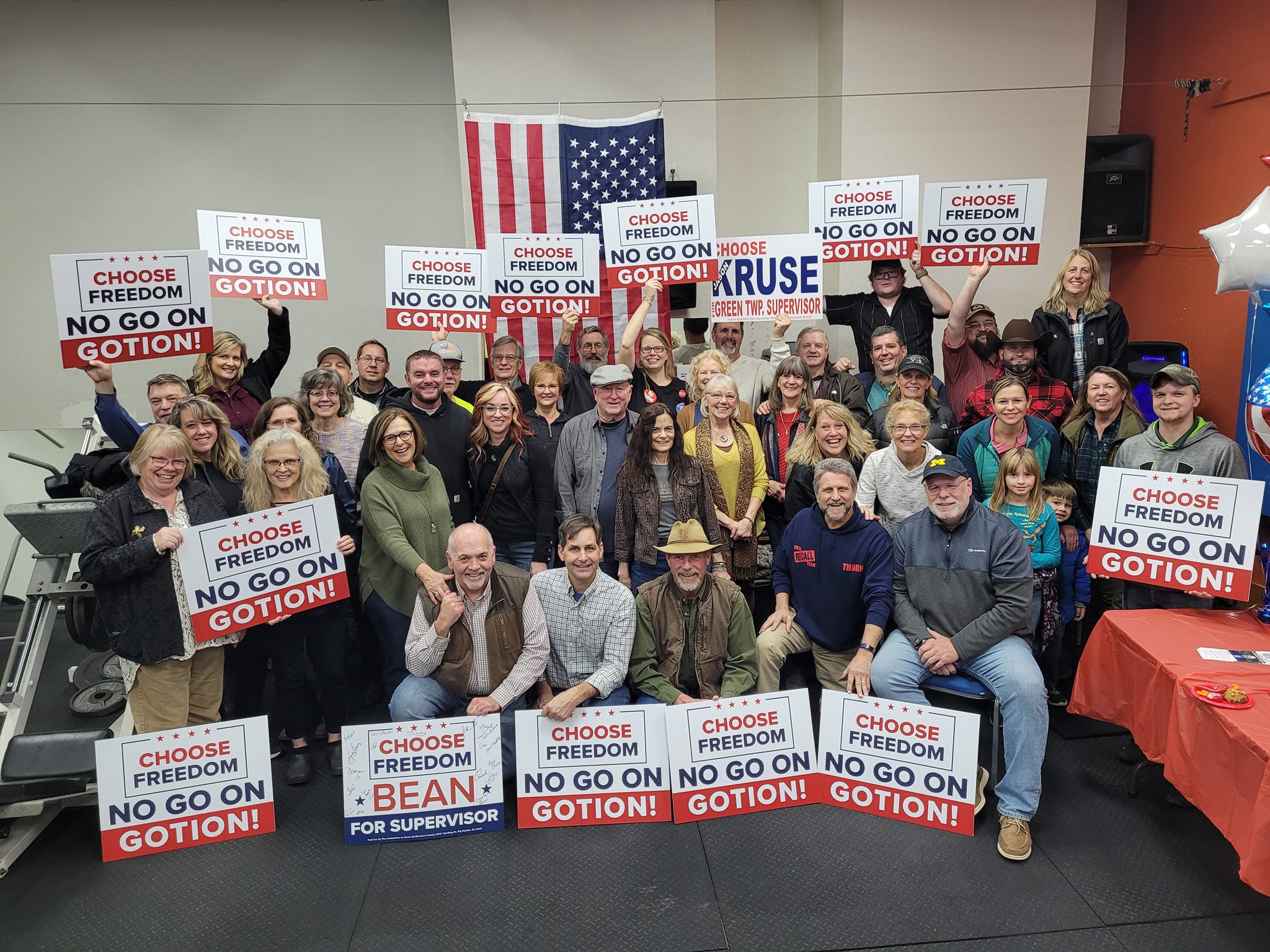

Ted joined WLS 890’s PM Chicago Show to discuss Chicago’s worsening pension crisis, why the city’s crisis makes it such an outlier nationally, its negative impact on residents, government workers and retirees alike, and what Mayor Brandon Johnson should do about it. When has any company persisted with a project in the face of stronger local, statewide and national opposition? When have taxpayers subsidized a more harebrained project?

When has any company persisted with a project in the face of stronger local, statewide and national opposition? When have taxpayers subsidized a more harebrained project?