By: Ted Dabrowski and John Klingner

Chicago Mayor Lori Lightfoot has yet to articulate a plan for how to fix Chicago’s collapsing finances, but she’s reportedly about to “lower the boom” on taxpayers, according to the Chicago Sun-Times. The mayor is set to give a state-of-the-city speech this week to address a city budget that’s as much as $1 billion in the red.

If reports of Lightfoot’s plans are true – that she wants to increase taxes and push debts off further into the future – then it’s clear she doesn’t intend to fix Chicago’s problems. If she did, she would instead push for an amendment to the Illinois Constitution’s pension protection clause and take a hard line on contract negotiations. The city’s crisis isn’t about a one-year budget deficit. It’s about the structural issues that are doing long-term damage to Chicago and driving its residents out.

Here’s why a pension amendment and structural reforms – and not tax hikes – are Lightfoot’s only real options:

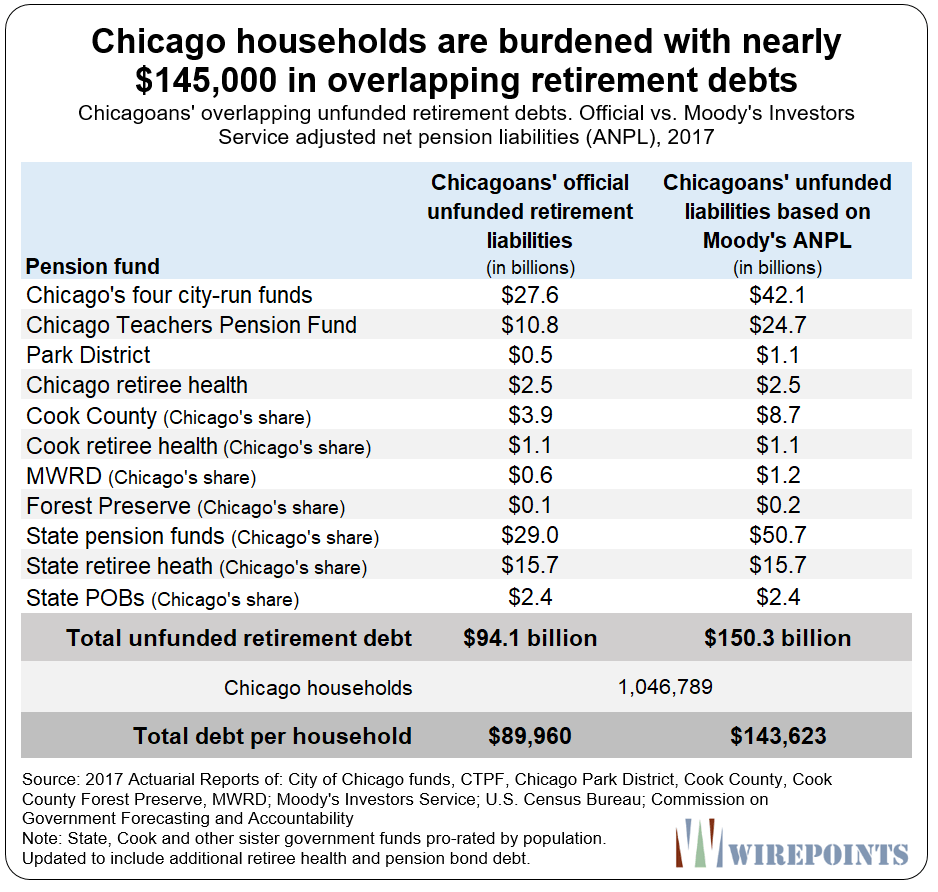

- Chicagoans are on the hook for more debts than they can ever repay. Every Chicago household is already burdened with $145,000 in overlapping retirement debts.

- Chicago is an extreme outlier fiscally. The city has the nation’s worst finances under almost every measure.

- Government-worker benefits are out of line with what Chicagoans can afford. Compensation has grown beyond what residents can pay for.

- Chicago is already shrinking. The city’s population loss has created negative consequences for the residents who remain, from growing tax burdens to falling property values.

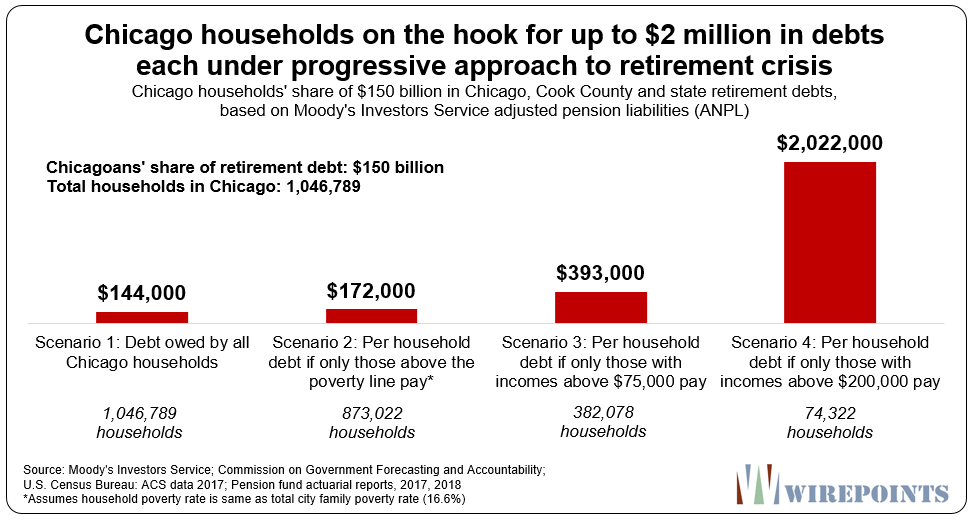

Lightfoot should realize the debt burden on Chicagoans has already reached absurd levels. A Wirepoints analysis based on Moody’s pension calculations shows Chicago households are each on the hook for $145,000 in combined local and state retirement debts. And that’s the rosy scenario. Exclude the Chicagoans that don’t have the means to help pay down those debts and that per household amount jumps to an impossible $400,000 each.

Even though half of Chicagoans’ retirement debt comes from Cook County and the state, the full burden is still Lightfoot’s problem. If city residents leave because their combined tax bills are too big, Chicago loses.

The trouble for the mayor is that she’s repeatedly promised the unions she won’t reform their pensions. Lightfoot doesn’t support changing the pension protection clause, even for benefits that have yet to be earned. And that puts her at odds with the painful reality Chicagoans face every day.

The mayor is taking a big risk if she embraces yet another round of tax hikes and can-kicks. The city’s vicious cycle of higher taxes and more flight will worsen. That’s all the more dangerous considering the inevitability of a recession in the next few years.

The truth is Chicago is simply too indebted and Chicagoans too overtaxed for Lightfoot to demand anything less than a pension amendment from Springfield and structural reforms from city hall.

1. Chicagoans are on the hook for more debts than they can ever repay

Chicagoans are on the hook for over $70 billion in city and Chicago Public Schools retirement debts. But that’s only a fraction of the total burden they face. Chicago residents are also responsible for their share of Cook County and state retirement debts, too.

When you add it all up, Chicagoans owe $150 billion in total retirement debts, based on Moody’s most recent pension data. Split that evenly across the city’s one million-plus households and that comes to nearly $145,000 per household.

That’s already a massive amount, but if Lightfoot and other politicians want to try a more “progressive” solution to paying off that debt, the per household debt numbers jump even higher.

For example, if politicians demand that only households with incomes of $75,000 or more pay down the debts, the burden on those households would total an impossible $393,000 each.

And if politicians tried a progressive scheme that targeted only those households earning $200,000 or more? The burden per household would come to an impossible $2 million each.

Some wealthy residents would flee, making the burden more unbearable for those who remain.

2. Chicago is an extreme outlier fiscally

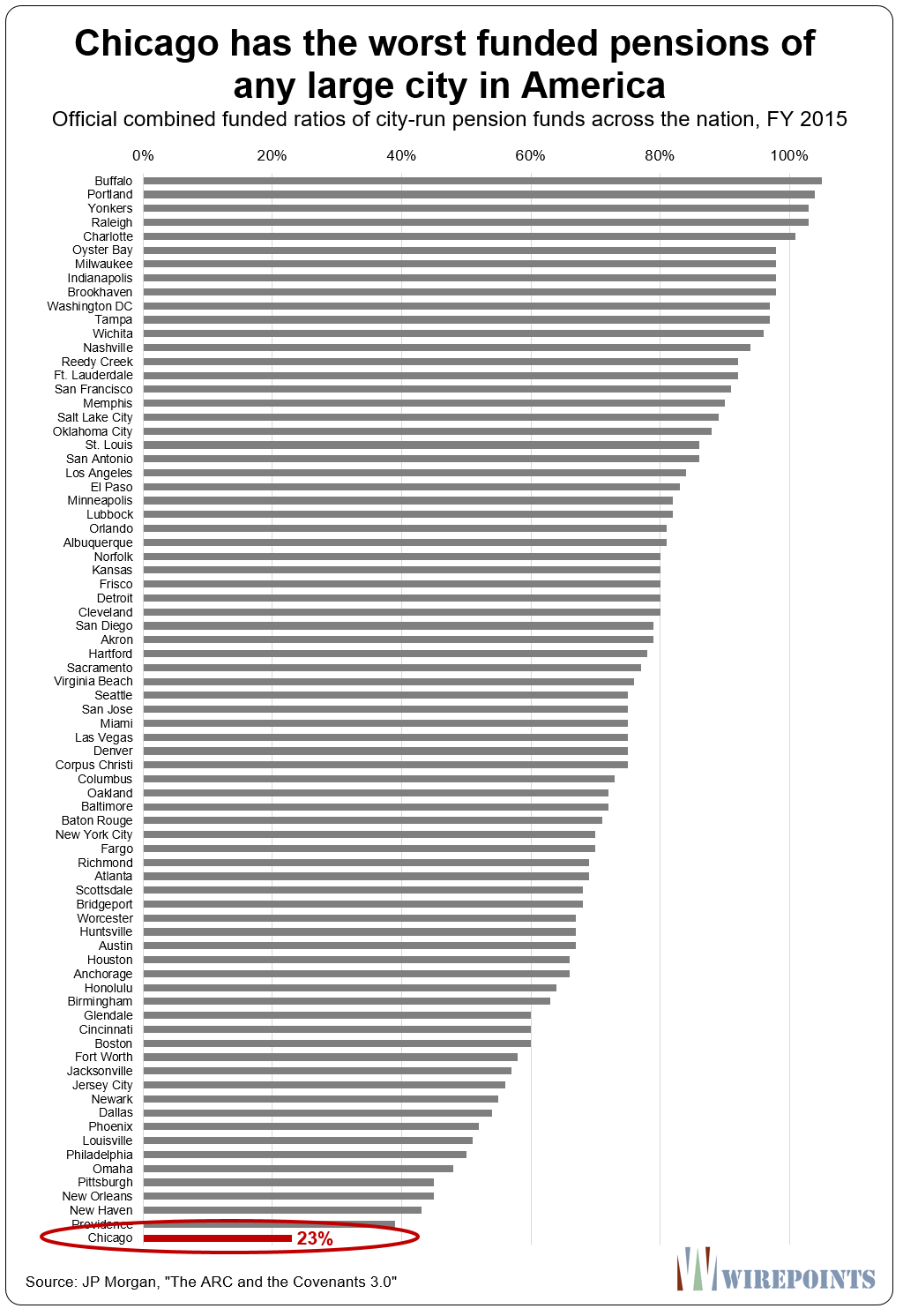

Cities across the nation are dealing with deep pension problems, but Chicago is in a class of its own. The Windy City has the nation’s worst pension crisis under almost every measure.

J.P. Morgan compiled funding ratios for the country’s major cities and found Chicago pensions, at just 23 percent, were the nation’s worst-funded. They’re effectively insolvent.

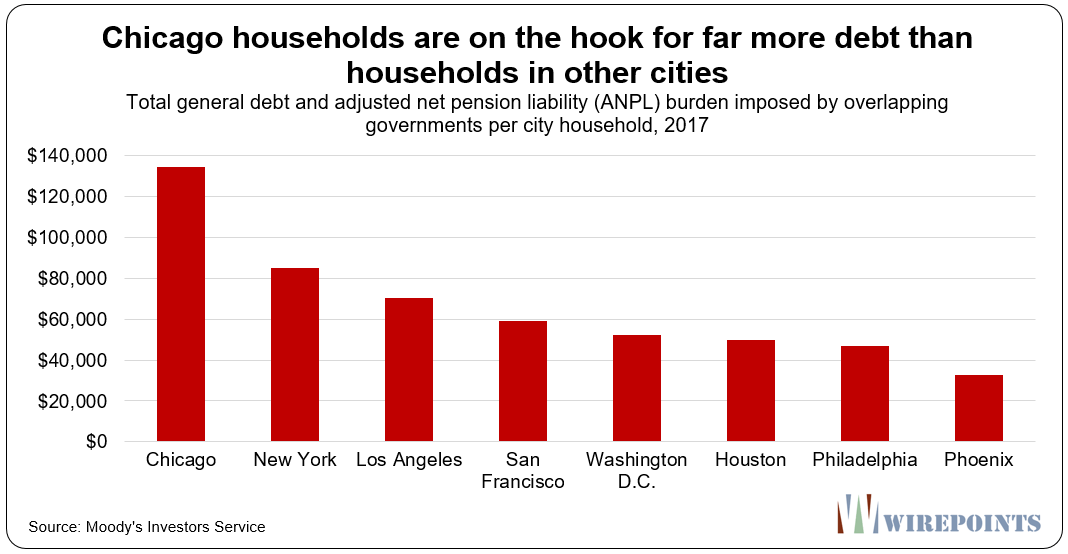

An even more pertinent city-to-city comparison is the total debt burden residents are on the hook for – not just from their own cities, but from other overlapping local governments and their state, too.

Moody’s published those numbers last year and found Chicagoans are in real trouble.

Every single Chicago household is on the hook for nearly than $140,000 in city, state and other local debts, compared to just over $85,000 in New York and $70,000 in L.A.

Meanwhile, households in Houston, Philadelphia and Phoenix all face burdens lower than $50,000 each.

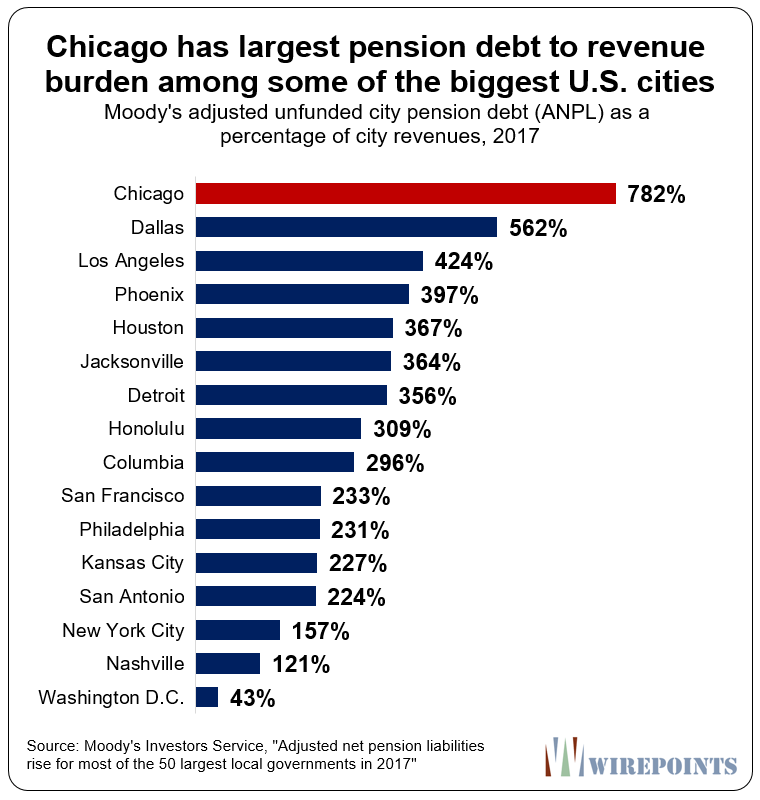

Chicago is also an outlier when it comes to the city’s capacity to pay for the debts it has accumulated. According to Moody’s assumptions, Chicago’s pension debts are nearly eight times the size of its annual revenues.

That’s much larger than any other major city Moody’s analyzed. Dallas is also considered to have one of the worst pension crises in the nation, and yet its revenue burden is 40 percent smaller than Chicago’s.

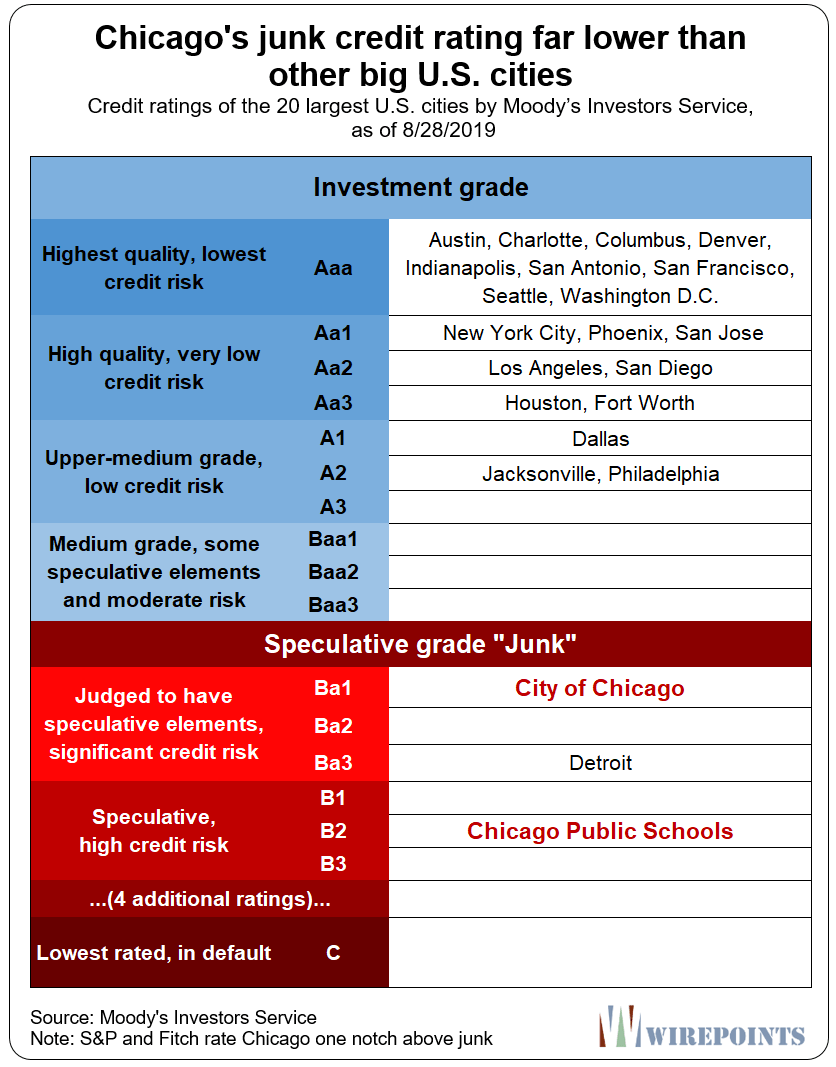

Chicago’s outlier status among U.S. cities is perhaps best summed up in one statistic: its credit rating. Chicago is the only major city in the nation besides Detroit to be rated “junk” by Moody’s (S&P and Fitch rate Chicago one notch above junk). Chicago Public Schools’ rating is even worse off. At five notches into junk territory, it’s lower than Detroit’s.

3. Government-worker benefits are out of line with what Chicagoans can afford

The city’s public sector unions have leveraged their power over the years to create a benefit structure that is no longer affordable for the ordinary Chicagoan.

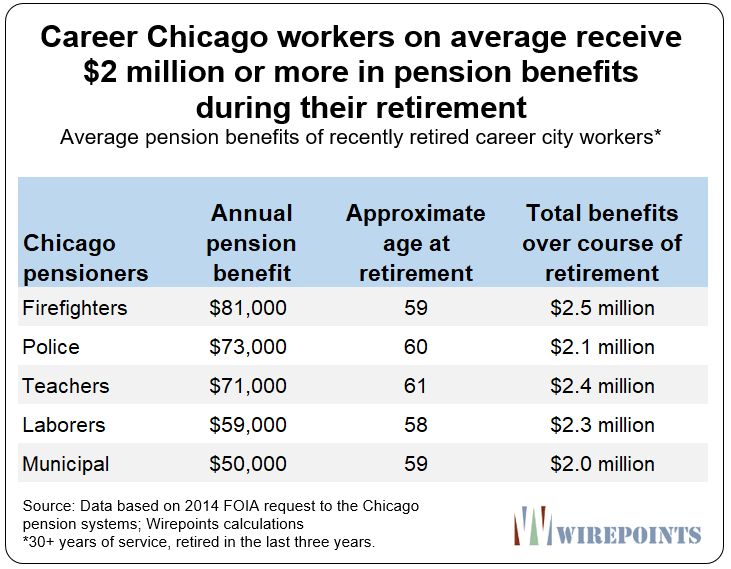

City workers have multi-year government contracts with guaranteed raises. They have pay scales based on years of service, not merit. Salaries are often spiked. Many workers retire in their late 50s, usually with full benefits. Lifetime pensions for career workers now exceed $2 million, far more than the ordinary Chicagoan will ever have when he retires. Teachers even have most of their required pension contributions “picked-up” by taxpayers. That, alone, costs Chicagoans over $100 million a year.

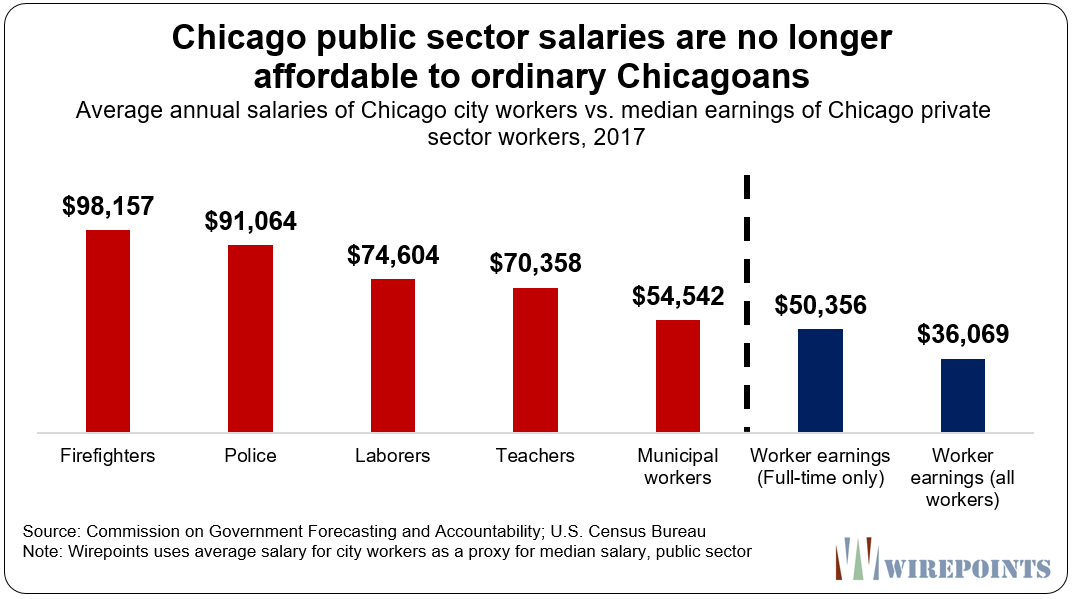

All those benefits have made government worker compensation unaffordable to the residents who pay for them. That’s particularly problematic since a fifth of Chicagoans are in poverty and nearly half of all households earn less than $50,000 annually. Private sector median earnings in Chicago were just $36,000 in 2017, while full-time workers earned $50,000.

There may be a debate about how much public sector workers should earn, but the fact remains that salaries set the base for pensions – the most unaffordable part of city worker compensation. When salaries are high, pensions become unaffordable more quickly.

That’s particularly true because Chicago’s Tier 1 pension rules allow long-time city workers to retire in their 50s with a maximum of 75 to 80 percent of their final average salary. Chicago municipal workers, laborers and teachers also receive compounded 3 percent cost-of-living adjustments that double their annual pension benefits after 25 years in retirement.

Career workers are now retiring, on average, with $2 to $2.5 million in lifetime pension benefits. (Tier 2 has changed the rules, but it will take years before its full impact is felt.) A private sector worker would need at least $1.5 to $1.8 million saved at retirement to lock in the same amount of benefits. Most Chicagoans will never save that amount of money.

The driver behind the escalation in compensation is multi-year contracts that include guaranteed raises. Chicago’s police, fire, municipal and other unions recently came to the end of 10-year contracts that locked-in raises between 21 and 26 percent over the period. That’s pushed up pension debts even higher.

And expect the pension situation to get worse if the Chicago Teachers Union accepts Lightfoot’s proposed contract terms. Lightfoot has already capitulated and offered a five-year contract and a 16% salary increase. That will cost Chicago residents $351 million, according to WTTW.

Between that raise and regular increases based on years of service, the average teacher would see their salary grow 24% over the life of the five-year deal.

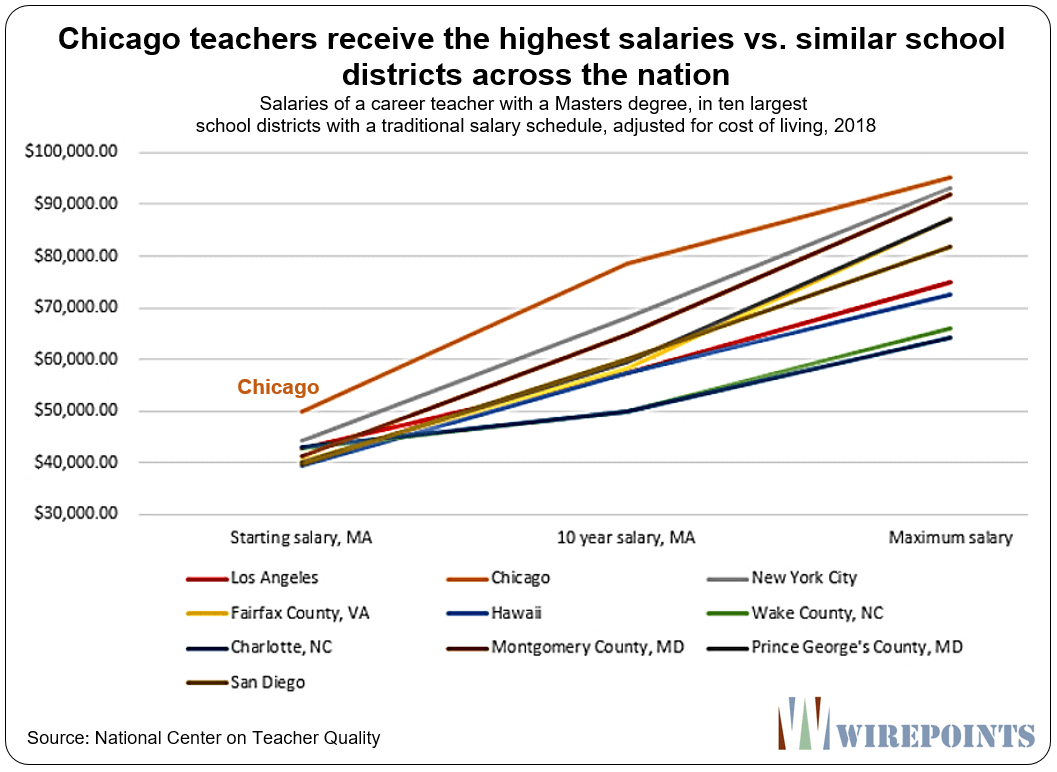

Raises like that have helped catapult Chicago teachers to some of the nation’s highest paid educators when compared to the largest school districts with traditional salary schedules (adjusted for cost-of-living). That’s according to data from the National Center on Teacher Quality.

For example, a Chicago teacher with a master’s degree receives $80,000 a year after ten years of work. In contrast, an equivalent teacher in New York City makes $70,000 and a Los Angeles teacher makes $60,000.

4. Chicago is already shrinking

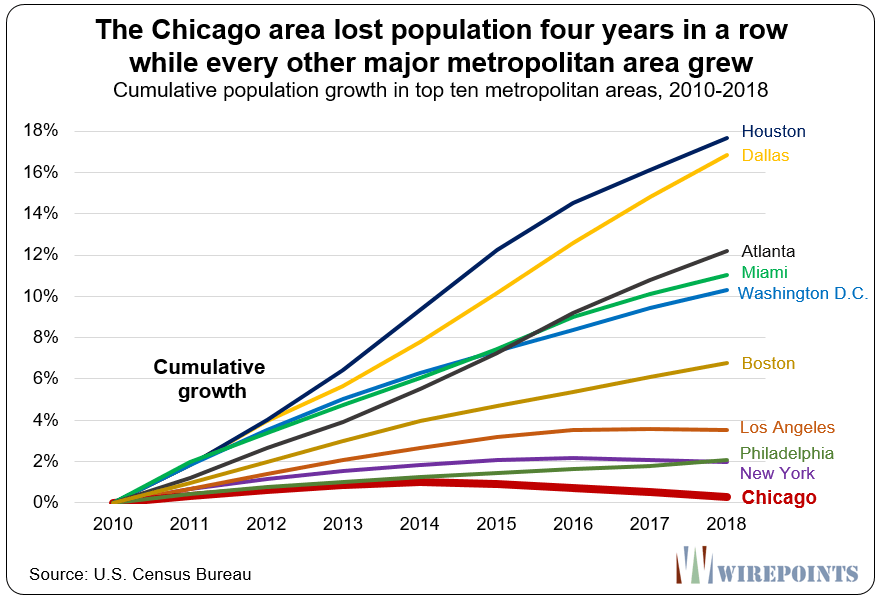

Chicago is experiencing a drain of people not felt by the other major cities across the nation. Its population has fallen four years in a row, the only top-ten city to shrink like that.

The Chicago MSA lost 66,000 people between 2014 and 2018. Those recent loses are part of a broader trend. Chicago saw its population drop by over 200,000 people from 2000 to 2010.

A shrinking population means the city’s massive debts are constantly falling on a smaller number of taxpayers. And so are the city’s taxes.

Chicagoans were hit with over $860 million in tax hikes over Mayor Rahm Emanuel’s tenure, including:

- A $543 million property-tax hike in 2015, the single largest in the city’s history.

- A separate $250 million property-tax hike by CPS to pay for pensions in 2016.

- Numerous fee hikes on garbage collection, utilities, permits and more.

- New taxes on ride sharing, online entertainment, e-cigarettes and more.

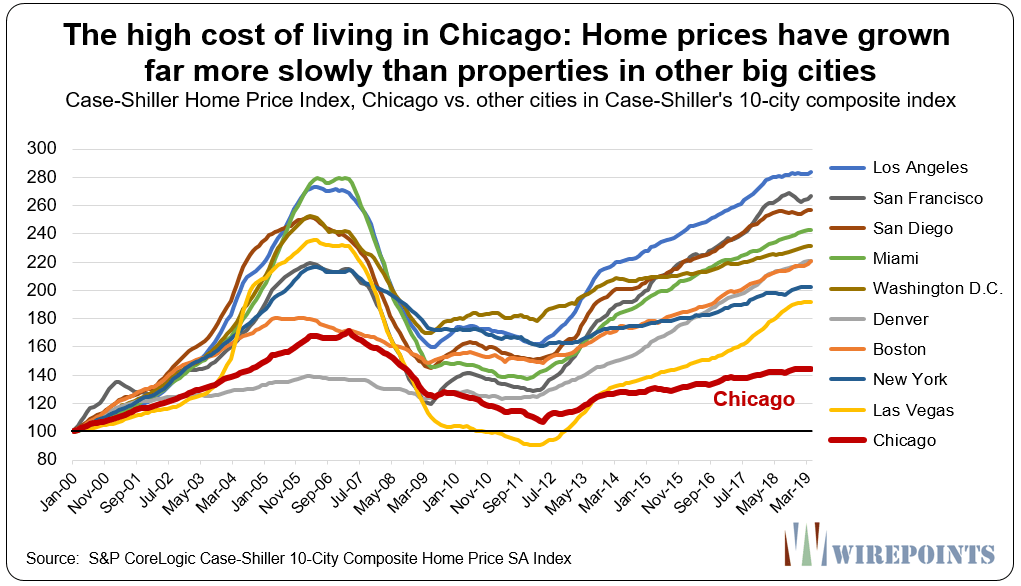

The slew of new taxes and declining population has undoubtedly had a negative effect on the city’s property values. Chicago home prices have fallen in real terms since 2000, leaving the city in last place when compared to other big cities that make up the Case-Shiller 10-City Composite Home Price Index.

Home prices in the Chicago have grown just 44 percent since 2000. By comparison, inflation was up 46 percent over the same time period.

Meanwhile, home prices in Los Angeles grew four times that of Chicago’s, or 181 percent. And prices in Miami, up 143 percent, and Washington D.C., up 130 percent, have grown three times more than those in Chicago.

That’s a double punch to every homeowner in the city. The value of residents’ own retirement nest-eggs are stagnating at the same time the public sector retirement debt they’re on the hook for has grown to an all-time high.

What Mayor Lightfoot should do

Lightfoot has inherited a financial mess as deep as any in the nation. She can be the agent of change, no matter how politically difficult that may be, or she can follow her predecessors in hiking taxes and passing can-kicks. The direction she takes is up to her.

The facts, however, are indisputable. There is no fixing Chicago without a significant reduction in its structural debts. And that means a pension amendment and subsequent pension reforms, along with holding the line on contracts.

It’s true Lightfoot is dependent on Springfield to get anything with pensions done. But if she wants to fix Chicago, she’s going to need to be the champion for an amendment.

A set of state lawmakers want to extend CPS’ current school closing moratorium to February 1, 2027 – the same year CPS is set to transition to a fully-elected school board. That means schools like Manley High School, with capacity for more than 1,000 students but enrollment of just 78, can’t be closed for anther three years. The school spends $45,000 per student, but just 2.4% of students read at grade level.

A set of state lawmakers want to extend CPS’ current school closing moratorium to February 1, 2027 – the same year CPS is set to transition to a fully-elected school board. That means schools like Manley High School, with capacity for more than 1,000 students but enrollment of just 78, can’t be closed for anther three years. The school spends $45,000 per student, but just 2.4% of students read at grade level.

Hopefully, all media will get the message, in Illinois, too.

Hopefully, all media will get the message, in Illinois, too. Ted joined Tom Miller of WJPF to talk about Illinois’ highest-in-the-nation property taxes, why lawmakers don’t want to touch the tax’s cost drivers, just how much Illinoisans’ tax burden has grown over the decades, why Gov. Pritzker failed to meet his promise to reform property taxes, and more.

Ted joined Tom Miller of WJPF to talk about Illinois’ highest-in-the-nation property taxes, why lawmakers don’t want to touch the tax’s cost drivers, just how much Illinoisans’ tax burden has grown over the decades, why Gov. Pritzker failed to meet his promise to reform property taxes, and more.

I still say that the taxpayers in Chicago and Illinois fully funded the pensions thru out the decades but the much of the money was “Diverted” to higher salaries/platinum healthcare/political pet projects/pension management fees regardless of returns/pension holidays/spiking etc. That said I think chances are slim to reduce or eliminate the 3% compounding. What may have a slim chance is to eliminate end of career advancements-salary spikes and total pension pickups by the taxpayers that are so prevalent especially in school districts and base pensions on AVERAGE career earnings even with spiking would be calculated over the entire working career… Read more »

Democrat legislators love their govt ees so much, overpay them and vastly over-benefit them, they really couldn’t care less about the financial health of the private-sector taxpayers. Seems to be an evil form of socialism. And they lie thru their teeth to keep it going. The NYT falsely started the lie that Trump’s taxcut was for the rich 1%ers. It was just the opposite, it was squarely aimed at middle income earners. I proved it quite simply.

Great article. Chicago will be having to go bankrupt very soon. It is inevitable, as with other cities and towns in Illinois.

Mark/Ted – I started seeing that the number for a private sector worker to earn a similar amount of money in retirement is $1.5M in the bank (HAH!!). I think it would also be interesting to start breaking down the actual amount of time worked, specifically for teachers vs. a comparable private sector worker to showcase the difference for the average IL resident. Below is my real life example, which doesn’t even include the age of retirement and OPEB’s… just straight up day to day comparison of private vs. public unfairness. One of the arguments I often get in with… Read more »

Well said. Meanwhile, our students lag behind the rest of the world due to government curriculum meddling and all that standardized testing idiocy.

I have no problems paying teachers $98,000 a year. It’s just that we should be paying for only half as many teachers at that price. Same goes for administrators.

The govt pensions are also protected in a divorce proceeding, unlike 401k earnings during the marriage. These guys had some great lawyers to protect those damn pensions, all the way up to the constitution.

One needs to file a QILDRO (Qualified Illinois Domestic Relations Order) which the courts will enforce to obtain their share of their spouses Illinois government pension.

The final 5(?) yrs average pay determines the pension which also skyrockets the value of the pension at retmt.

Hostil–st recently had articale about city worker absentee days and says it was over 4 times private sector!! But it goes way beyond that especially for teachers–theyre taking all there sick days/vacation days on top of all the other ways you can get paid and still claim days off, (like family med leave act days). I keep emailing s karp education writer at wttw to do an articale on how many days subs cover for techers at cps and $ cost. Or the city could simply publish # of days (and catagories from vacation to fmla days) for all depts… Read more »

And of course the biggest scam on tax payers,,if your a city worker you can get paid for taking all your vacation/sick days, fmla days, and on and on,,and turn around and work a ton of ot or work for a couple hrs on a holliday and make $ time& half $. And then the union reps can zoom around on news media claiming theyre understafted. And the news media gobbles it up, especially for cps

FMLA days are unpaid.

NB, as to your comments about the higher-than-usual rate of absenteeism for CPS teachers my guess is that you likely have no family members or close friends as teachers in that system. If you did you’d start to “feel their pain.” It’s an understatement to say that a great many (maybe a majority) feel they are fighting a lonely, unappreciated battle in the routine duties of doing their job. The whole COS system is subjected to continual criticism almost from every quarter, and the odds of feeling successful on a routine basis are really small. In short, the end result… Read more »

All the city or state has to do is release the data on # of days work, # of days worked ot, etc.. for all departments from cops to teachers to streets & san…sorry you feel so victimized..and sorry i dont put people on pedestals

Don’t underestimate the power of putting people on a pedestal. It’s a very powerful positive-performance reinforcer when done right. The problem, though, is much deeper in that the public at large has no real appreciation for the strength of the societal forces acting against the accepted yardsticks for measuring educational progress. The roadblocks to achieving success often seem insurmountable to those who are so easily criticized despite their best efforts individually. That whole aura leads to a sense of psychological defeat when encountered for years on end.

If it’s so bad, why do it? Maybe because the compensation is higher than anywhere else?

Perhaps, Mike, but there’s some other obvious reasons as well. First, by the time one decides to try another career path maybe 8-15 years into it his/her age at that time suggests a new start will be hard financially when the expenses of family lilfe must be met are are likely growing. Age discrimination is a known factor when seeking new employment, after all. To make matters worse, there is no vesting of a teacher pension until maybe 8 years of employment, although that’s a guess on my part. Therefore, the pension to be eventually collected will be pitifully small… Read more »

The minimum years of service (vesting) for the Teachers Retirement System of IL (TRS IL) & the Chicago Teachers Pension Fund (CTPF) is 5 years at age 62 for Tier I and 10 years at age 67 for Tier II. Tier II is those who began their career on or after January 1, 2011. There’s various other options but let’s go with that. The accrual rate (amount of final average salary earned per year of service) is 2.2%. Let’s say they taught 15 years. 15 years teaching x .022 = .33. Multiple .33 x final average salary to get starting… Read more »

Mike, you’ve given a good analysis of the rules and possible outcomes for public school teachersI in IL. But, your next-to-last sentence fails a bit. If one starts drawing a pension close to his last year of employment all is well in terms of the examples you showed, but sometimes a person stops his employment multiple decades before applying for a pension. The rub there is that there is no reconstitution of salaries received all those years ago to account for inflation meantime; Social Security does that, Consequently the pensions in your examples need to be reduced in terms of… Read more »

You totally ignore that in the majority of school districts in Illinois, the teachers and administrators contribute little or nothing to the pension fund. That’s because the Board makes that contribution on behalf of the teachers / administrators. In the case of CTFP, the teachers contribute only 2% to the pension fund, explained in this WTTW article. https://news.wttw.com/2018/01/16/chicago-teacher-pension-payday-top-earners-2017 The result is an outstanding return on investment. The teachers / administrators will counter that was a perk negotiated during collective bargaining in lieu of a salary hike. Counter that by looking at the salary schedule, stipends, any other pensionable income, and… Read more »

james has gotten a “healthy” head start on legal pot . Gov Tubby says keep smoking away and maybe you can smoke $300B worth of taxes to save that crater of a state and pay your beloved teachers that have failed the students on every scholastic metric.

IL Politicians love their serfs dumb, dependent and doped up . The perfect storm to lie, cheat and steal and people keep voting for this nonsense so you get what you deserve. Smart ones are leaving and leaving fast

James– i’ve experienced in my time and my kids a lot of great & not so great teacher– just like any other profession. In my own job field, in the constriction industry, i’ve been hired, fired, promoted, demoted so many times and at so many companies i couldnt keep count…never had a jessy sharkey type putting me up on a pedistal….do recall when my kids were at cps the crazy # of days they had subs…if you feel so secure in your victimization then i assume you would have no problem with having cps release data on # of days… Read more »

Mike, I wholeheartedly agree that public employee absentee days when reported both as a percentage of work days and as a group statistic ought to be public knowledge. There are numerous reasons for it, and those reasons shouldn’t be swept from public view. Maybe that would lead to public salary efficiencies you’d like and working environment upgrades I’d like. Skipping either of those improvements is putting a bandaid on the problem instead of dealing with its root causes.

James–i assume you are cps teacher. Does your union, ctu, agree w you? Cps as well as all other city department pay catagories ( from sraight time, vacation,sickdays, family med leave act days, etc) work hours would made public?, or does ctu not even think its a problem? As cutting down on ot, family med leave days, disability claims, etc is one of the few bones lightfoot is throwing us tax payers before we get socked w another gigantic tax increase on top of are $145,000 avg debt burden on are homes

I’m just an interested observer really. Its good to consider all sides of a political argument, don’t you think? What I read mostly here and elsewhere is the five-seconds-of-thought responses of the gut rather than the more reasoned responses one might hope to encounter. I have no axe to grind as to whether sick days, disability days, vacation days, etc., are reported. But, I do think there’s a need for protecting any individual’s right to privacy, so I think system-wide reporting is the way to go.

Taxpayers have the right to know how their money is spent on any given employee, which is why sick days, disability days, vacation days, pensionable income, years of service, etc. can be requested for a particular employee via a FOIA request to, for instance, a government employer or pension system.

The collective bargaining agreements, policies, and laws are regularly changed.

It’s impossible to track and comprehend what’s happening over time without the ability to drill down to the employee level.

For the management of the system you have a point, yes. But, of what value is it to the public at large other than to harass said employees? Does an employee have to then routinely justify his use of off-duty days to each and every person who should make that inquiry of him. That doesn’t smell right!

Could be wrong, tried to google, but think i was reading the gov unions already got bills past baring release of data on individual employees sick days, etc..all i was advocating for was overall release of absenteeism data by category in total for all city and state departmrnts, the info already exists..and am 100% sure gov unions would fight tooth & nail to not let happen…except for james because now he’s on are side–yes?

Guys, I read an article a few years back about this very subject. https://chicago.suntimes.com/2017/1/30/18449621/the-watchdogs-1-in-4-cps-teachers-missed-10-or-more-days-a-year The amount of sick days the average CPS teacher takes was staggering. When I was in school, I don’t remember my teacher being out sick more than 2 or 3 times (max) a year. Some never missed. They were good at their jobs and took pride in being there. The people that work in CPS are different. And also, to James’ earlier point about individual contributions not mattering, whose fault is that? Their own union ferociously pushes back on any kind of merit based recognition and… Read more »

“Democrats and socialists refuse to acknowledge that humans need motivation, and that individuals like recognition and being rewarded.”

Privilege and intersectionality explains everything. It’s racist to say that some people perform their job better than others because motivation and recognition are merely dog whistles for white supremacy and patriarchy. Reward is merely the result of privilege and must be eradicated for a progressive (regressive) pay structure. The less you work, the more you earn and are rewarded! This will do it’s part to reverse hundreds, if not thousands (or millennia) of Indo-European language speaker privilege.

Right its not your problem directly; but, its your tax dollars paid locally or at least to the state of Illinois. Feel better now?

Here is the Chicago Public Schools Employee Position Roster. https://cps.edu/About_CPS/Financial_information/Pages/EmployeePositionFiles.aspx Transparency laws exist for a reason. For example, local school boards hid, made it difficult to find, and otherwise harassed taxpayers regarding various employee compensation costs. Despite existing laws, few school districts report stipends for individual employees. One generally has to FOIA that information. The Illinois State Board of Education maintains an Employment Information System (EIS) as a result of Public Act 97-0256 for local school district teacher and administrator pay. That system does not report stipends, travel and phone stipends, extra duty pay, salary paid for time not working… Read more »

“There is no fixing Chicago without a significant reduction in its structural debts. And that means a pension amendment and subsequent pension reforms, along with holding the line on contracts.” They will not do it. Ever. The public unions are the bosses of the politicians, and the politicians value their individual power and perks over the well-being of the city and its citizens. The public unions give them that power, and the politicians will defer to the public unions all the way down to the day that the city enters bankruptcy and someone else has to run it. They will… Read more »

Chicago is bankrupt, and sooner than later they will be FORCED to allow its bankruptcy, as well as many other cities and towns across the state. The next recession at the latest. Chicago is toast in its current form.

Bravo on a superb article!

It’s kind of fun to watch socialists run out of somebody else’s money to the point where suddenly nearly every resident is a member of “the rich” to be taxed. Lightfoot is simply running a giant Ponzi, using the power of govrnmrnt to confiscate the assets of private employees to hand it over to govt employees. I am so very thankful I don’t own a home in Chicago. Lightfoot is the farthest thing from a reformer.

As usual – great analysis by the Wirepoints guys! Well done and thank you.

Do you have data on the median salary for Chicago city workers and not just the average? It would make more sense to show that since you’re using the median salary of the private sector?

Sorry, Flamingo – we only have average. But because of the way salary scales are constructed in the public sector, there’s not a big difference between average and median for police officers or teachers or city workers. Compared to the private sector, which can have super low and super high salaries, the public sector deviation is quite small.

Ted, I feel pushy in asking because you are encumbered with a lot of work (great work at that), but I am curious to discern how much borrowing capacity Lightfoot has to close the alleged $858B gap – I say alleged because the gap is likely higher. My guess is that the city’s borrowing capacity is very limited, and there are covenants in the relevant agreements that make it difficult to borrow, along with a number of existing liens which give Lightfoot no room to maneuver. I am curious because with promises to the teachers union and other progressive elements,… Read more »

Preaching to the choir here. There’s what the mayor should and what the mayor will do. You gotta keep the people that actually go out and vote happy(mainly public unions and their cronies), so the only option is to keep spending more than you can afford and piling on the debt since the bond rating agencies seem to be keeping Chicago and IL a notch above junk.

To summarize, Chicago is toast.

Look at it this way. If you move your family out of Chicago (and Illinois), you instantly save 143 grand. That’s a great deal!