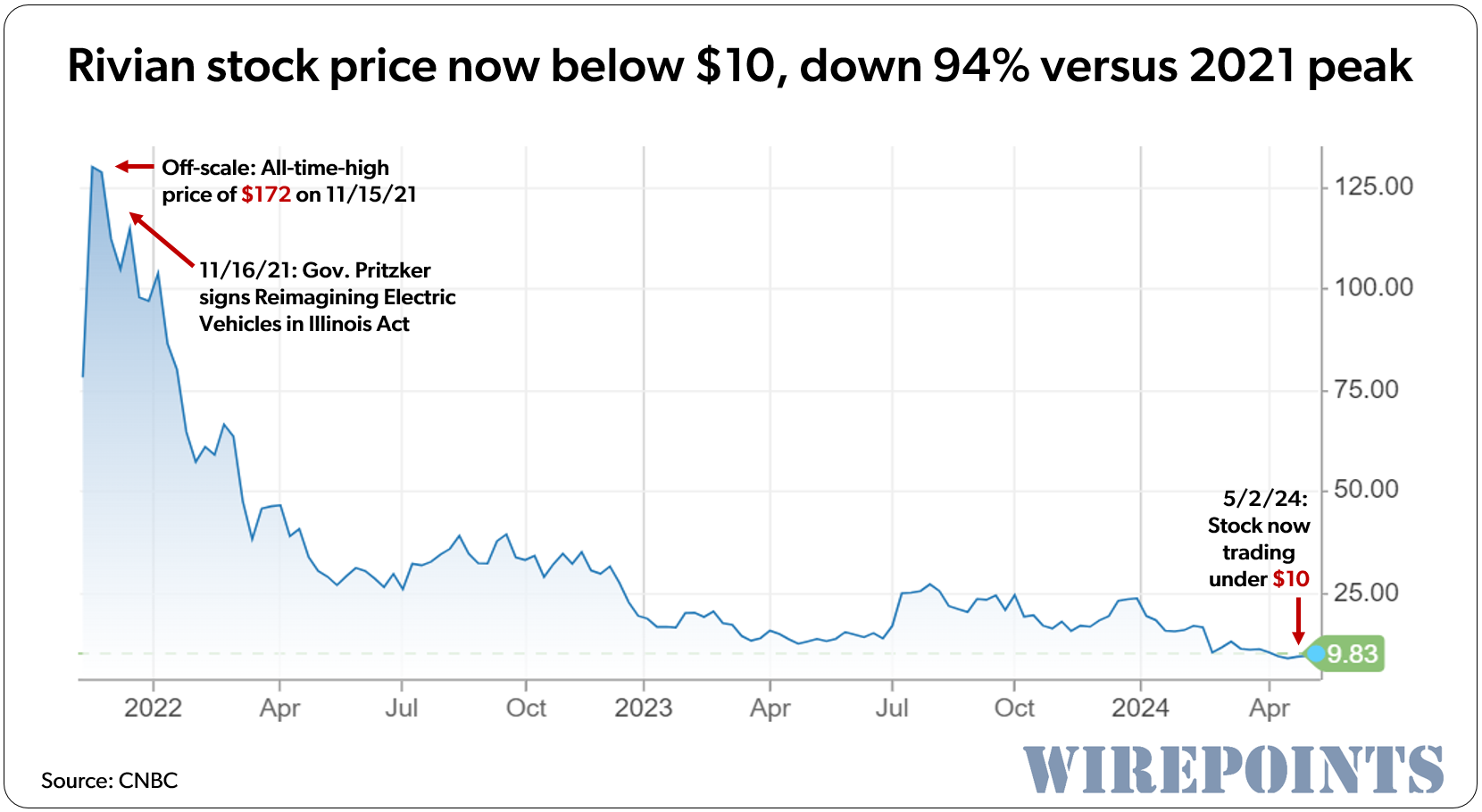

Pritzker doubles down with $827 million of taxpayer money for expansion by troubled electric vehicle maker, Rivian – Wirepoints

At $1.5 million per job, the new incentive package from the state is at least 15 times the norm. For this much money, the state could have just handed out a million bucks to 827 people, instead of creating 550 jobs.

At $1.5 million per job, the new incentive package from the state is at least 15 times the norm. For this much money, the state could have just handed out a million bucks to 827 people, instead of creating 550 jobs.

Ted joined Jeff Daly to discuss the university student protests erupting across the nation on the Israel/Palestine conflict, why it’s so dangerous for society if the media abandons facts in favor of narratives, why that allows government to spin away the problems like crime and financial crises, why it causes the voting public to become apathetic, and more.

Ted joined Jeff Daly to discuss the university student protests erupting across the nation on the Israel/Palestine conflict, why it’s so dangerous for society if the media abandons facts in favor of narratives, why that allows government to spin away the problems like crime and financial crises, why it causes the voting public to become apathetic, and more. When you hear the complaints from Illinois politicians, remember the hypocrisy: 40,000 bused to Chicago, but 161,562 allowed to fly directly to Florida.

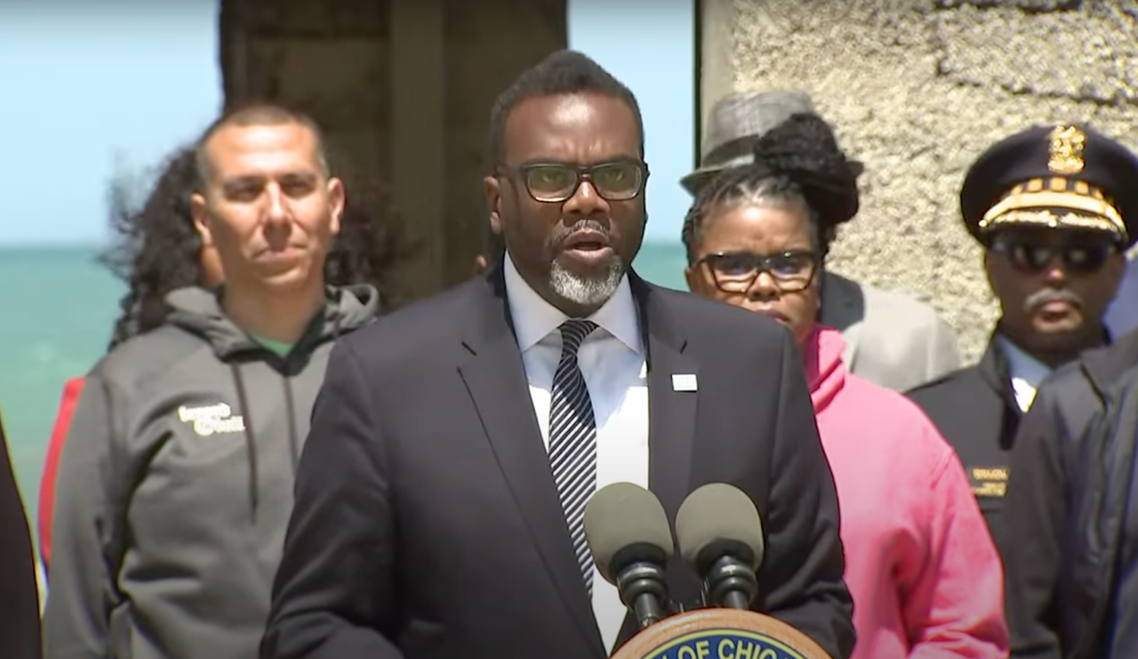

When you hear the complaints from Illinois politicians, remember the hypocrisy: 40,000 bused to Chicago, but 161,562 allowed to fly directly to Florida. Nearly one year ago, Chicagoans cheered Mayor Lori Lightfoot’s removal from office. In her place was Brandon Johnson, who promised a more inclusive approach to building a “better, stronger, safer Chicago.” It hasn’t turned out that way. Today, there’s little disagreement that Mayor Johnson has disappointed on most key issues. On crime. On policing. On migrants. On education. On governance. Even on foreign affairs.

Nearly one year ago, Chicagoans cheered Mayor Lori Lightfoot’s removal from office. In her place was Brandon Johnson, who promised a more inclusive approach to building a “better, stronger, safer Chicago.” It hasn’t turned out that way. Today, there’s little disagreement that Mayor Johnson has disappointed on most key issues. On crime. On policing. On migrants. On education. On governance. Even on foreign affairs. Ted joined Dan and Amy to talk about the problems and costs of the Chicago Bears’ proposed new stadium, why its unlikely to happen in its current form, why the ongoing wave of violent crimes makes residents scared of the city, and why the funeral of slain police officer Luis Huesca matters to Mayor Johnson’s reputation.

Ted joined Dan and Amy to talk about the problems and costs of the Chicago Bears’ proposed new stadium, why its unlikely to happen in its current form, why the ongoing wave of violent crimes makes residents scared of the city, and why the funeral of slain police officer Luis Huesca matters to Mayor Johnson’s reputation.

“Essentially, all securities ‘owned’ by the public in custodial accounts, pension plans and investment funds are now encumbered as collateral underpinning the derivatives complex, which is so large—an order of magnitude greater than the entire global economy—that there is not enough of anything in the world to back it.” – David Webb “Over the past few years, the world’s largest financial institutions, those often referred to as “too big to fail,” have been quietly preparing for a potential global financial crisis. One of the ways in which they have done this is by lobbying legislators to change the way collateral… Read more »

Obviously every public sector unions been lobbying behind the scenes to change Tier 2 or even get rid of it and return to Tier 1 for ages. But, especially if your a CTU union spouting social justice EQUITY every 2 seconds and your somehow fighting for poor B&B folks 24/7, can you spout that schtick and at same time support a Tier 2 pension enhancement /shell bill for your members that doesn’t even bother to tell the chump taxpayer, who you claim to champion, what it’s going to cost or what’s in it until it’s passed at last minute as… Read more »

Five years ago (in 2019!!!) – when researching pensions was a mere hobby, I contacted TRS about potential Tier 2 enhancements and safe harbor rules (see my original email far below). Here was their response. Not only was I ahead of my time, but I took a far more analytical and forward-thinking approach than the people employed by the pension system. Dear Mr. Binotti: Thank you for your recent email to Teachers’ Retirement System. I am the communications director and your message has been forwarded to me for a response. TRS has not studied the impact of potential… Read more »

“Yes, there are concerns about future Tier 2 members not meeting the “safe harbor” provisions of the Social Security act, but the legislative fix to this problem does not include raising Tier 2 benefits.” Yet, in the same paragraph. “The “fix” to this problem is to tie the Tier 2 wage base to each year’s full rate of inflation so it proportionally matches the Social Security wage base. By doing that, Tier 2 benefits would never fall out of the safe harbor. You don’t have to touch benefits to accomplish this.” Wouldn’t this raise benefits? Or is Dave stating that… Read more »

and of course ZERO coverage in legacy press…. absolutely, face plant, morally pathetic

So I see once again unhappiness with the pension situation. Yet today we see that apparently the taxpayers will be throwing money at a stadium for the Bears, a tax credit for homes is on the stove being cooked up and of course yesterday’s reports on the millions that are going to be tossed towards the illegal migrants. Money money everywhere it seems so why the unhappiness for paying for the pensions? The low voting attendance at the most recent election shows that the Illinois voters are just happy the way things are right now and I know that we… Read more »

Pay or leave is the only option for a taxpayer.

“Love it or leave it” is an old saying.

The Illinois taxpayer was put on earth to be taken advantage of.

Tier 2 cuts were too drastic to the point that they knew it would eventually violate safe harbor rules. The cost of correcting this mistake should be determined but either way tier 2 benefits will be getting increased. The days of screwing over tier 2 members are about to end.

Obviously you didn’t bother to read the article. As usual you feel unbound by any fiscal issues with your demands for unearned largess.

I read the article as well as many articles on this subject. “Tier 1 is the original plan, and Tier 2 is for workers who started after Jan. 1, 2011. They must work longer and get smaller benefits, but the federal government mandates benefits at least equal Social Security and Tier 2 may be close to running afoul of those “Safe Harbor” laws.” Tier 2 cuts were so drastic that they are close to providing less benefits compared to social security. That’s a no no. lol As usual, I believe you can’t violate the laws to suit your purpose just… Read more »

You’ve become comical in your posts. Why not just recycle them, its all the same drivel.

You never refute any facts in my comments. I guess that means you can’t.

More lies…you can’t live on S&S…Nothing changes until the Illinois constitution is amended.

You must not understand about safe harbor. Also, what’s S&S?

You wouldn’t know… you never paid a dime into Social Security…I understand…

You can’t live on S&S…I don’t understand why I’m paying for your pinion…STOP THE THEFT!

You have no idea how much I’ve paid into SS. My guess is, far more than you ever did. What the heck does S&S stand for? Is that “Social and Security”? lol

STOP YOUR IGNORANCE!

Had we responsible legislators, they’d ask for an analysis of the cost of just increasing benefits sufficient to achieve safe harbor. That’s the baseline that must be accomplished, assuming survival of the federal government. If further enhancements are to be considered, estimates of those costs also are needed.

Isn’t there some legal principle that insane people cannot commit to a contract? Wouldn’t that apply to a legislature that changes benefits without an estimate of cost?

They have asked for an analysis. It’s just not released yet.

looks like they’re expanding Tier 2 benefits way beyond “safe harbor” for whatever they pass or whatever ends up in “shell bill”? Are you OK with state passing these bills without even finishing the actuarial reports, (presenting the bill to public)?

I would prefer they know what the costs will be before voting. I also would prefer if they didn’t pass “pension reform” laws that violated our constitution as they did about 10 years ago. I would also have preferred they had done the analysis that tier 2 would violate SS safe harbor rules but instead they passed the law anyway without thinking it all the way through. Unfortunately our legislators don’t always perform their duties to my liking. Now that tier 2 will need changes, it doesn’t surprise me that the enhancements are greater than necessary. That’s the politics of… Read more »

How does creating a new tier of benefits for employees not yet hired violate the state constitution?

I was referencing the 2013 pension reform in the second sentence as an example. I then referenced the 2010 reform as an example of passing a law that would violate safe harbor. Sorry for the confusion.

and of course, without actuarial cost estimate, what will be new tax revenue source to pay for theses TIER 2 benefit enhancements is completely unknown? Where will this leave municipal governments? especially the ones that state has currently intercepted their tax revenue to pay existing pensions , like south CC burbs, harvey, etc? !!!EQUITY!!!

Tier 2 also has to pay into the plan that supports the benefits of the Tier 1 folks. I believe if i were in Tier 2 that would seriously disappoint me but that’s how Madigan et al set that band aid up. However it worked well for Madigan when he was in office meaning all in all, to me, Tier 2 was just another gift from Madigan that keeps on giving.

“Tier 2 also has to pay into the plan that supports the benefits of the Tier 1 folks” Yes, it’s all the same funds and tier 2 is paying more than necessary to help the state cover their debt. They are helping out the state and not tier 1 members. It doesn’t matter to tier 1 members as the state itself is the backer of all these pension funds. The amount available in each individual pension fund is really just a report card as to how much money we have pre-paid for pensions. The state is ultimately responsible so it… Read more »

Maybe tier 2 members should just move. Isn’t that the solution for everything?

It is one possible solution. They could also change careers. They also can ask their legislative leaders to improve their pension. It seems they are going with that option.

Yes yes I see your point but the Tier 2 people I speak to say that the are paying for Tier 1 people and I see their point as well as yours. Yes you are correct it is the State’s liability but they say we are being made to pay extra to support Tier 1 and they do. This would make quite a discussion during a night of drinking and we could then move on to the chicken and the egg dilemma.

I would feel that way as well but what they are really doing is saving the state and other taxpayers money. Tier 1 is getting their money either way.

Maybe you can explain this to me. The benefits must be equal to SS but not less but it also does not say more than just equal. Here is the average SS benefit by age which is approx $2,200 per month. https://money.usnews.com/money/retirement/social-security/articles/average-social-security-benefit-by-age How many teachers have made the same Maximum income to get the equivalent SS monthly payment which for taxable wages is now at $168,600? So at age 62 they would get $2,710 per month at FRA it is $3,822 and at age 70 it is $4,873. Most in the school districts make far less than $168K this year… Read more »

It’s not about just equal payouts. You need to remember that tier 2 pensioners are paying 9 percent towards pensions while people that contribute to SS are only adding 6.2 percent. If you go to the top of this thread and read Nick’s communication with Dave Urbanek, you will notice that one of the “what if” scenarios he asked about was reducing tier 2 contributions from employees to 6 percent or whatever is necessary to meet safe harbor. While I don’t believe you can move contributions below 7.5 percent, I assumed his point was that by reducing employee contributions we… Read more »

Folks already know how this ends – Pritzker and Democrats will do what the unions want, fiscal responsibility be damned.

Inexcusable. They have the number. Not hard for actuaries to calculate this.

This is another effort to hang onto the union

Vote and build on it. Pritzker doesn’t care how Much it costs us he will continue to raise taxes needed to cover it.

We now need to recall Pritzker and somehow

Get a decent politician as gov for us.

Actuaries should be able to tell us right now what the costs would be if we converted everyone in Tier 2 to Tier 1. Those formulas are already in place.

They are not talking about converting them all to tier 1. The retirement age with 35 years of experience would be 62. Currently tier 1 members can retire as early as 55 with 35 years. It’s going to cost us more than current tier 2 costs but not as much as tier 1.

With that said, they know roughly how much this is going to cost.