Growing property tax burdens make this state unlivable for too many Illinoisans – Wirepoints joins Tom Miller of WJPF Carbondale

Ted joined Tom Miller of WJPF to talk about Illinois’ highest-in-the-nation property taxes, why lawmakers don’t want to touch the tax’s cost drivers, just how much Illinoisans’ tax burden has grown over the decades, why Gov. Pritzker failed to meet his promise to reform property taxes, and more.

Ted joined Tom Miller of WJPF to talk about Illinois’ highest-in-the-nation property taxes, why lawmakers don’t want to touch the tax’s cost drivers, just how much Illinoisans’ tax burden has grown over the decades, why Gov. Pritzker failed to meet his promise to reform property taxes, and more.

We must focus on cutting the cost drivers of Illinois property taxes if we’re ever going to deliver relief to taxpayers – Wirepoints testifies to the IL House Revenue and Finance Committee 4.10.24

Wirepoints President Ted Dabrowski testified on April 10, 2024 to members of the House Revenue and Finance Committee at the invitation of Rep. Joe Sosnowski. Ted told lawmakers that the state’s property tax burden has become dire for countless Illinoisans.

Wirepoints President Ted Dabrowski testified on April 10, 2024 to members of the House Revenue and Finance Committee at the invitation of Rep. Joe Sosnowski. Ted told lawmakers that the state’s property tax burden has become dire for countless Illinoisans.

Illinois property tax woes continue: ATTOM says Illinoisans pay nation’s highest rate – Wirepoints

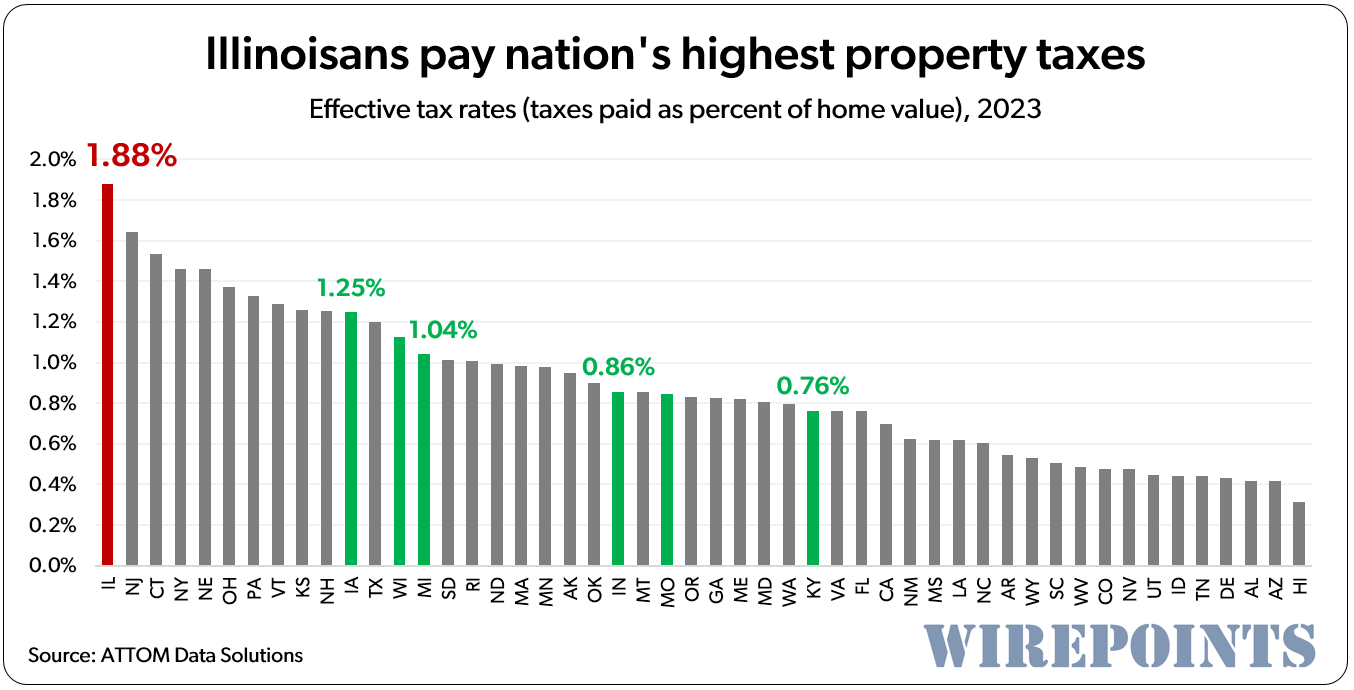

Another tax study, another loss for Illinois taxpayers. Illinois again has the highest effective property tax rate in the nation. Not only that, five of the top 10 metro areas with the highest property tax rates in the nation are in Illinois: Rockford, Champaign-Urbana, Peoria, Springfield, and Chicago.

Another tax study, another loss for Illinois taxpayers. Illinois again has the highest effective property tax rate in the nation. Not only that, five of the top 10 metro areas with the highest property tax rates in the nation are in Illinois: Rockford, Champaign-Urbana, Peoria, Springfield, and Chicago.

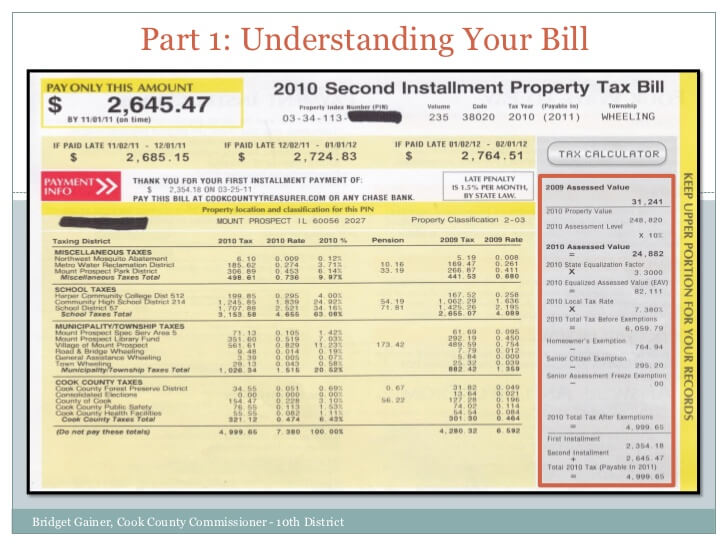

Property tax bills come due: Cook County residents will repeat last year’s sticker shock – Wirepoints

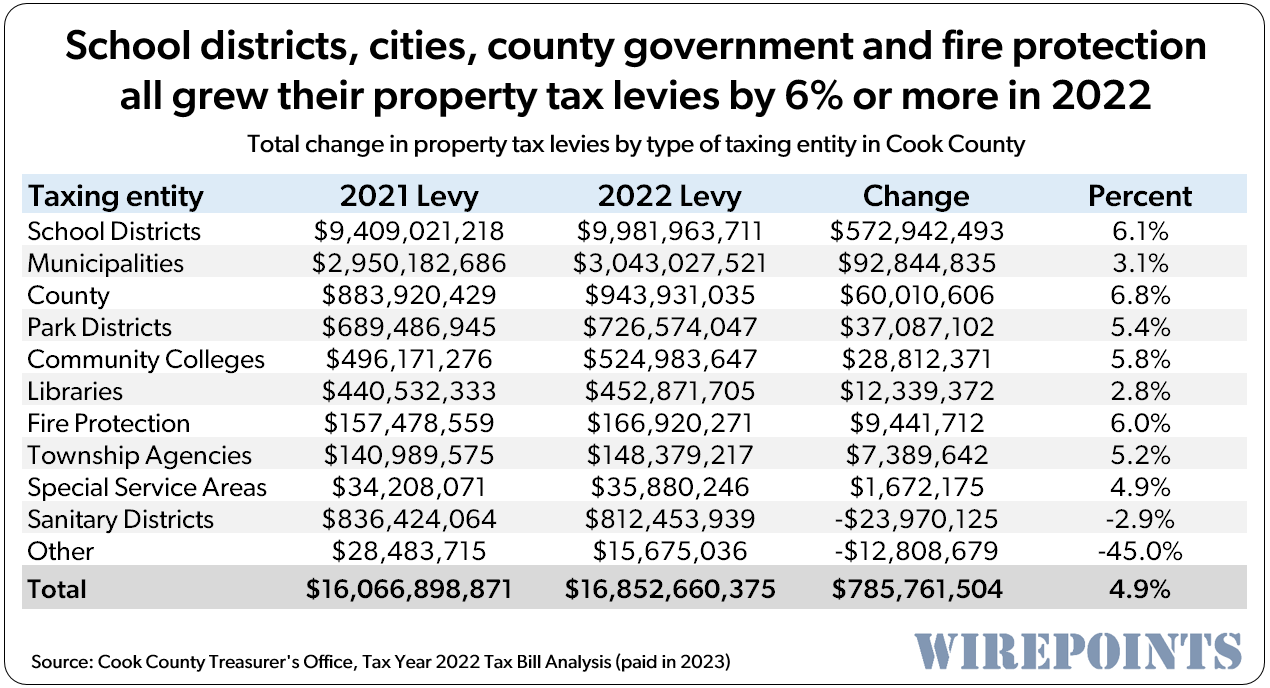

Elk Grove Village property tax bills grew 24% in 2023. Des Plaines’ jumped 29%. Northlake, 37%. And homeowners in Melrose Park experienced a near 50% increase. Residents across the Northwest suburbs were hit with the largest tax hike in 30 years – a consequence of Cook County’s revaluation of property values. Overall, Cook County homeowners were hit with a 7.2% increase in their FY 2022 taxes (paid in 2023), the biggest hike in 16 years.

Elk Grove Village property tax bills grew 24% in 2023. Des Plaines’ jumped 29%. Northlake, 37%. And homeowners in Melrose Park experienced a near 50% increase. Residents across the Northwest suburbs were hit with the largest tax hike in 30 years – a consequence of Cook County’s revaluation of property values. Overall, Cook County homeowners were hit with a 7.2% increase in their FY 2022 taxes (paid in 2023), the biggest hike in 16 years.

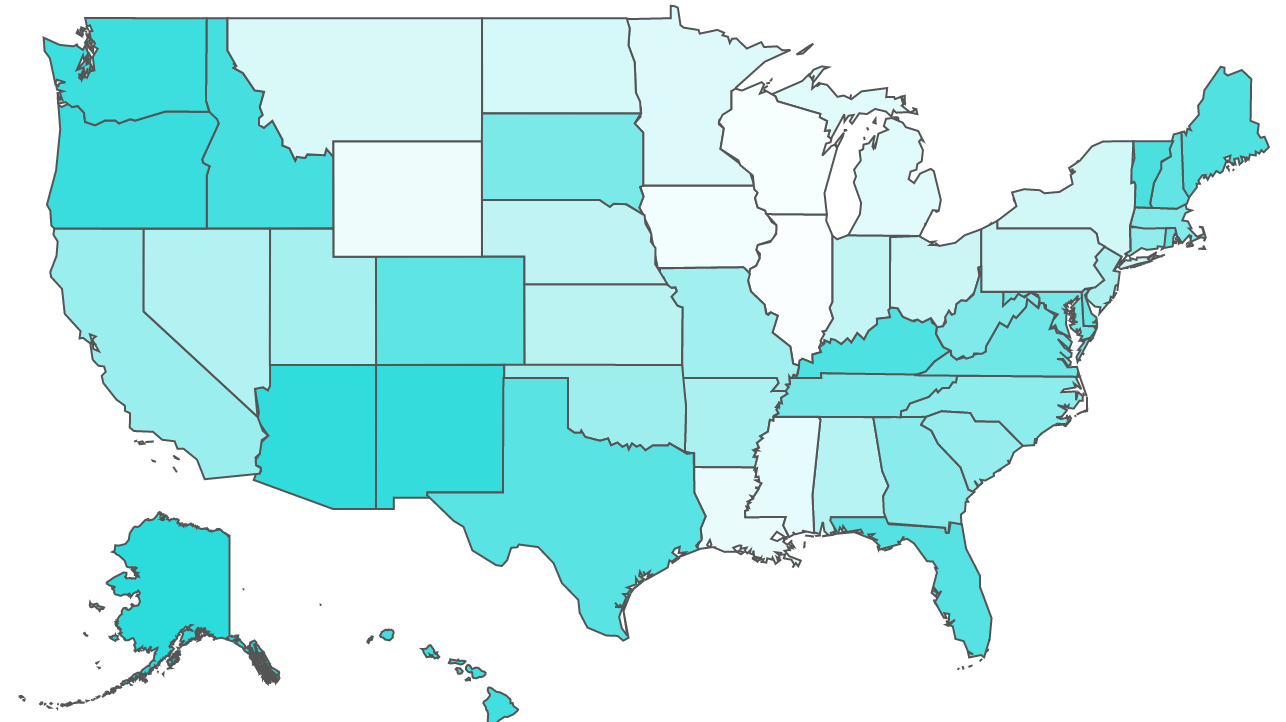

Illinois tax rates out-of-sync with those in neighboring states, most of the nation – Wirepoints

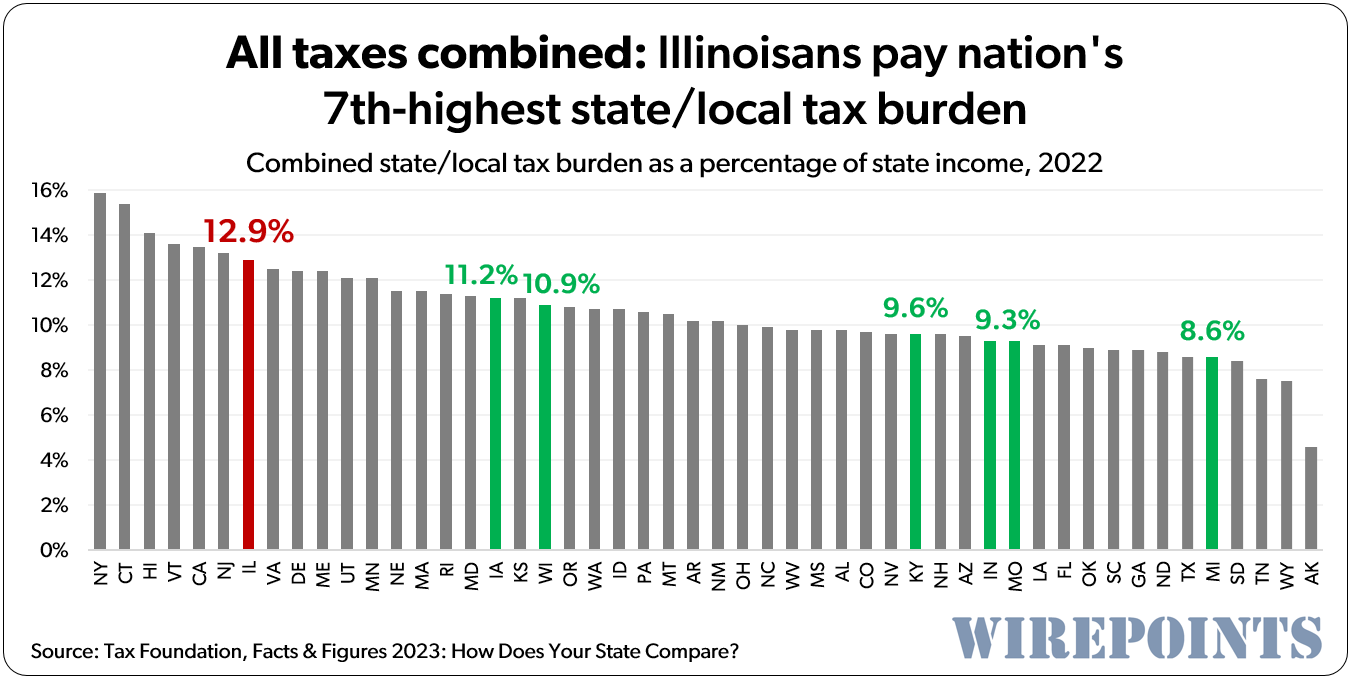

There are many factors that motivate people to move out of Illinois, but taxes often rank highest on the list. For good reason. Illinoisans pay the nation’s 2nd-highest property taxes. The 2nd-highest gas taxes. The 8th-highest sales tax rates. Overall, Illinoisans pay the nation’s 7th-highest combined state and local taxes.

There are many factors that motivate people to move out of Illinois, but taxes often rank highest on the list. For good reason. Illinoisans pay the nation’s 2nd-highest property taxes. The 2nd-highest gas taxes. The 8th-highest sales tax rates. Overall, Illinoisans pay the nation’s 7th-highest combined state and local taxes.

Pritzker’s Illinois: Nation’s worst state to own a home – Wirepoints

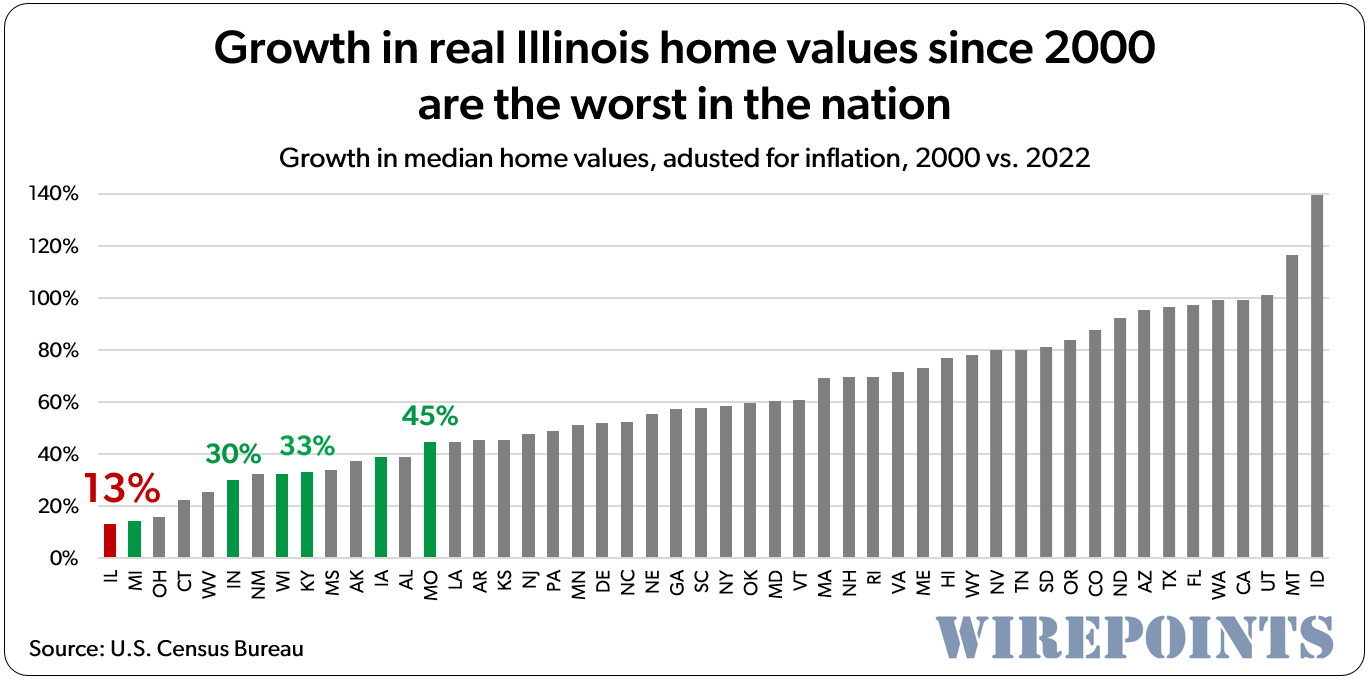

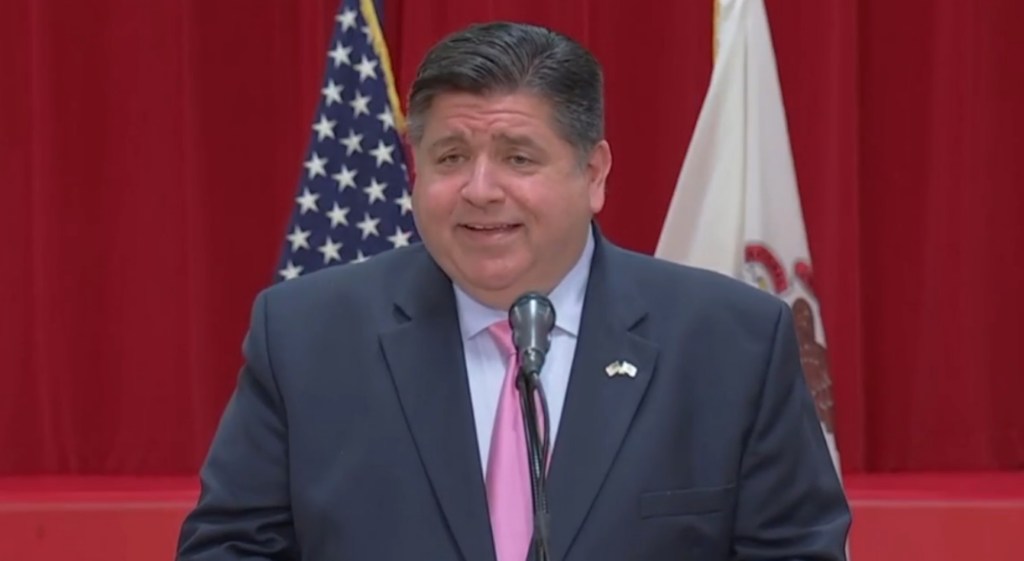

Gov. J.B. Pritzker promised to cut property taxes in 2020, part of his State of the State speech. Nearly four years on and he’s done nothing for homeowners. In fact the pain has only gotten worse. Illinois falls dead last nationally when it comes to home value appreciation since 2000 – worse even than Michigan.

Gov. J.B. Pritzker promised to cut property taxes in 2020, part of his State of the State speech. Nearly four years on and he’s done nothing for homeowners. In fact the pain has only gotten worse. Illinois falls dead last nationally when it comes to home value appreciation since 2000 – worse even than Michigan.

Johnson approves progressive ‘mansion tax’: Hits Chicagoans, businesses when they’re down – Wirepoints

Mayor Brandon Johnson and city officials are determined to push through a tax hike on Chicagoans, never mind the risk of Chicago entering into a doom loop like the one San Francisco is in. Johnson’s latest plan is to raise the city’s real estate transfer tax on properties valued at $1 million and above, adding at least another $100 million burden on high-value properties.

Mayor Brandon Johnson and city officials are determined to push through a tax hike on Chicagoans, never mind the risk of Chicago entering into a doom loop like the one San Francisco is in. Johnson’s latest plan is to raise the city’s real estate transfer tax on properties valued at $1 million and above, adding at least another $100 million burden on high-value properties.

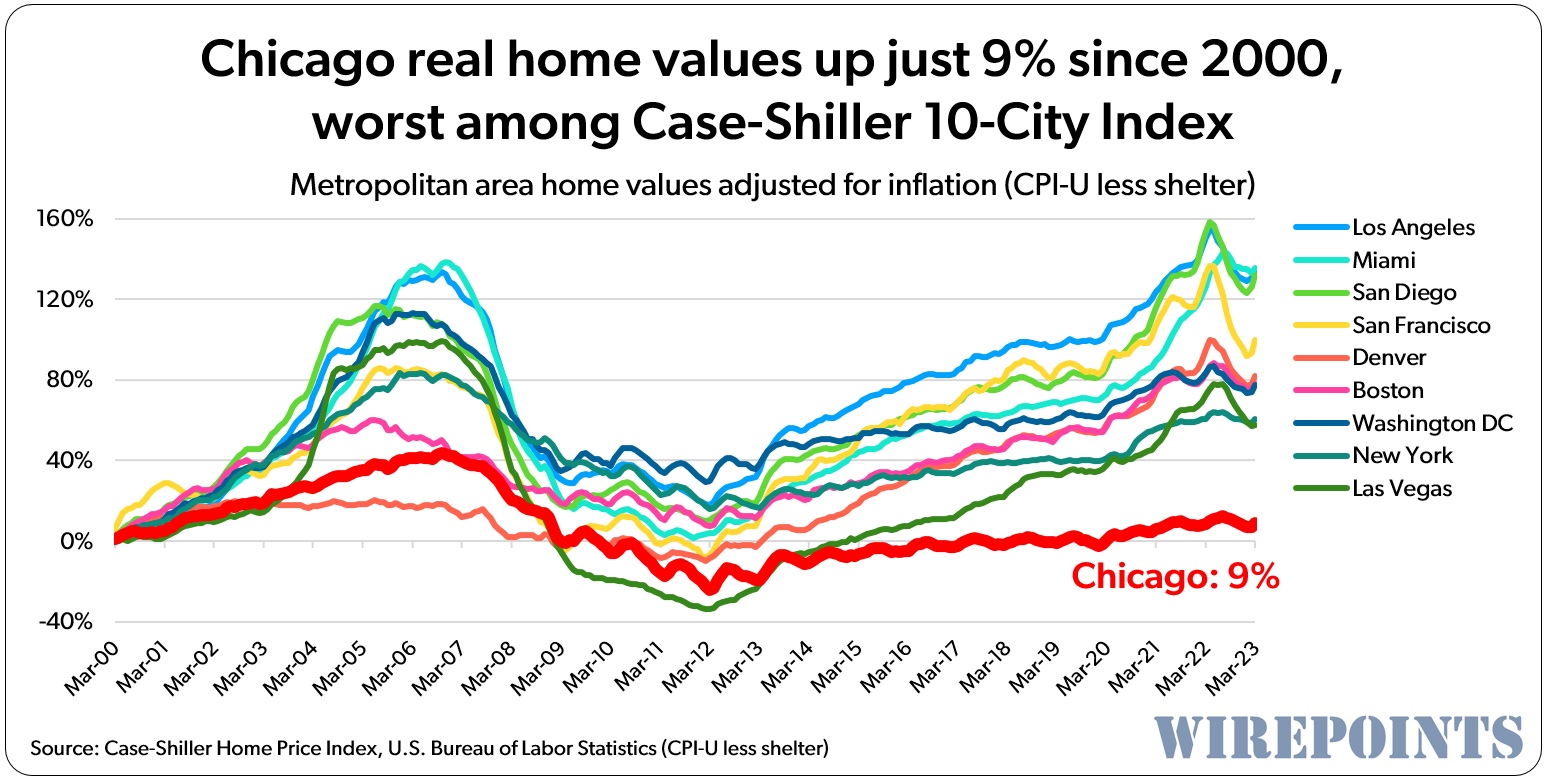

Good, recent price news for Chicago area homeowners but gloom over longer term – Wirepoints

Recent Chicagoland price increases continue, though the longer term shows a different story.

Recent Chicagoland price increases continue, though the longer term shows a different story.

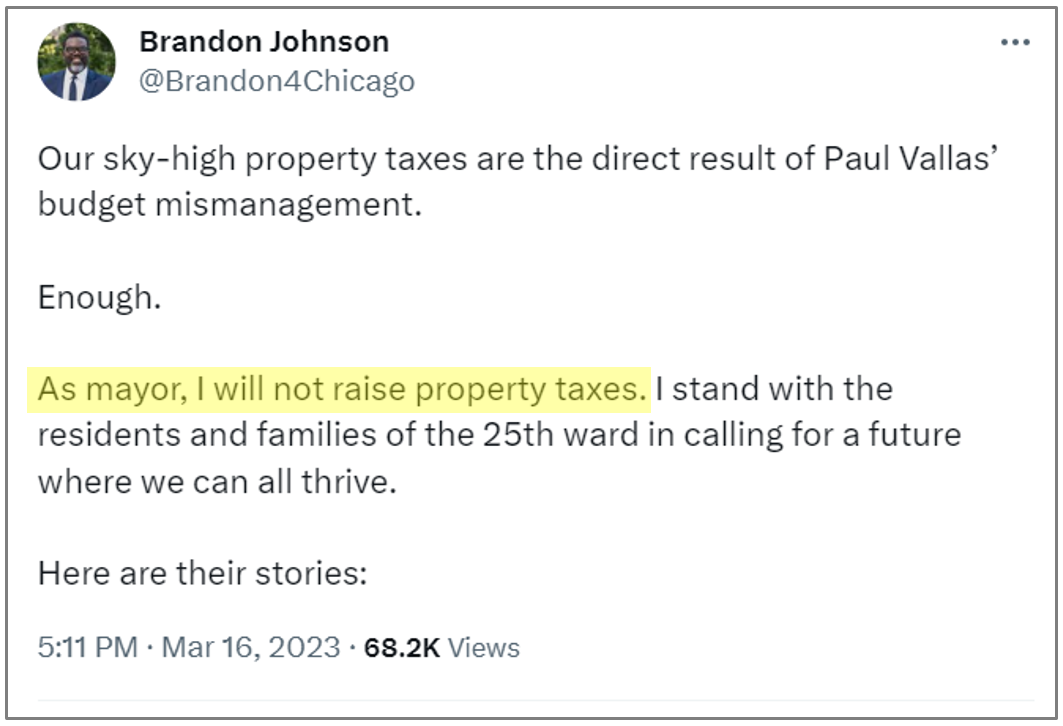

So much for Chicago Mayor Johnson’s promise of no property tax hikes (Part 1) – Wirepoints

“As mayor, I will not raise property taxes.“ That was a key message Brandon Johnson made during his run for Chicago mayor. Now less than two months since he assumed power, the Chicago Public Schools board is set to hike property taxes by 5 percent and there’s no pushback whatsoever from Mayor Johnson.

“As mayor, I will not raise property taxes.“ That was a key message Brandon Johnson made during his run for Chicago mayor. Now less than two months since he assumed power, the Chicago Public Schools board is set to hike property taxes by 5 percent and there’s no pushback whatsoever from Mayor Johnson.

Dear Illinois leaders, please explain the state’s dead last ranking on racial equality – Wirepoints

This time it’s for Illinois’ political leadership to answer. Tell us, why have your “equity” policies failed so miserably?

This time it’s for Illinois’ political leadership to answer. Tell us, why have your “equity” policies failed so miserably?

Illinoisans aren’t better off under Gov. Pritzker’s budgets, economy – Wirepoints

The real measure of success isn’t what the governor says it is, but rather how the state’s residents are faring under his leadership. And that, by most measures, has been a failure. Fewer people are employed today than when Pritzker took office. Illinois’ economic growth is stagnant, at best. Tax burdens are higher than ever. And residents are fleeing in record numbers.

The real measure of success isn’t what the governor says it is, but rather how the state’s residents are faring under his leadership. And that, by most measures, has been a failure. Fewer people are employed today than when Pritzker took office. Illinois’ economic growth is stagnant, at best. Tax burdens are higher than ever. And residents are fleeing in record numbers.

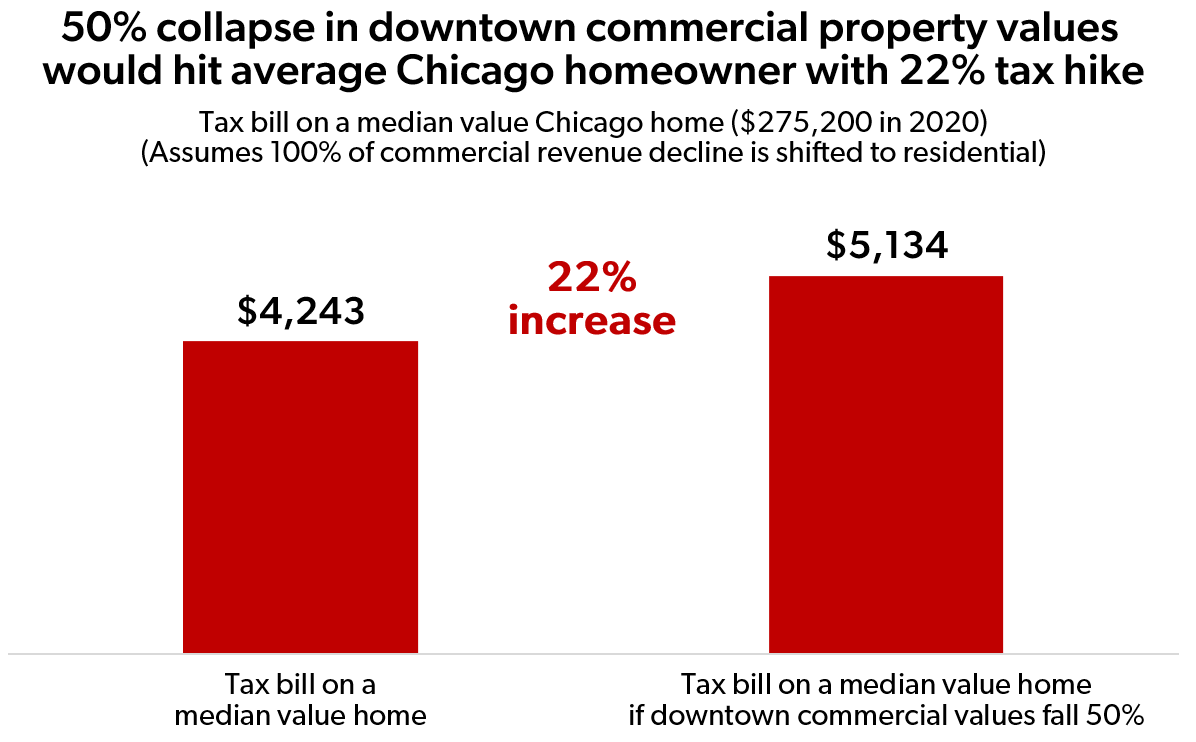

Chicago’s commercial ‘doom-loop’ could result in a property tax hike on homeowners as large as 22% – Wirepoints

The potential of Chicago entering a “doom loop” is finally getting the attention it deserves, but one part deserves special notice: the coming massive shift in property tax burdens from commercial to residential owners in Chicago.

The potential of Chicago entering a “doom loop” is finally getting the attention it deserves, but one part deserves special notice: the coming massive shift in property tax burdens from commercial to residential owners in Chicago.

13 Illinois counties among the top 50 property markets nationwide most ‘at-risk’ of a downturn – Wirepoints Quickpoint

Illinois is home to 13 of the nation’s 50 housing markets that are most-at-risk of a downturn according to a new report by ATTOM Data Solutions. The Chicagoland area is, collectively, among the most “vulnerable to decline” property markets in the nation.

Illinois is home to 13 of the nation’s 50 housing markets that are most-at-risk of a downturn according to a new report by ATTOM Data Solutions. The Chicagoland area is, collectively, among the most “vulnerable to decline” property markets in the nation.

Gov. Pritzker deserves no credit for his ‘taxpayer relief’ plan – Wirepoints

Just in time for the elections, Illinois Gov. J.B. Pritzker is set to send out income and property tax rebate checks as part of his $1.8 billion “taxpayer relief” plan. The problem is, none of what the governor is offering is real relief for struggling Illinoisans. Instead, it’s just Pritzker giving back a few hundred dollars after stripping Illinoisans of thousands.

Just in time for the elections, Illinois Gov. J.B. Pritzker is set to send out income and property tax rebate checks as part of his $1.8 billion “taxpayer relief” plan. The problem is, none of what the governor is offering is real relief for struggling Illinoisans. Instead, it’s just Pritzker giving back a few hundred dollars after stripping Illinoisans of thousands.

False advertising of Illinois’ new ‘property tax relief’ bill – Wirepoints Quickpoint

Gov. JB Pritzker on Friday signed a new bill providing property tax relief for senior, veteran and disabled homeowners. What nobody said is that those reductions for some mean increases for others. It’s just a matter of shuffling the property tax burden.

Gov. JB Pritzker on Friday signed a new bill providing property tax relief for senior, veteran and disabled homeowners. What nobody said is that those reductions for some mean increases for others. It’s just a matter of shuffling the property tax burden.

Thirty years of pain: Illinoisans suffer as property tax bills grow far faster than household incomes, home values – Wirepoints Special Report

Any way you cut them, the residential property taxes Illinoisans pay are punitive. As a share of household incomes, they’re up more than 60 percent compared to three decades ago. As a percentage of home values, Illinois property taxes are now the highest in the country. And as for their impact on house prices, property taxes have contributed to Illinois suffering the nation’s third-worst growth in home values over the

Any way you cut them, the residential property taxes Illinoisans pay are punitive. As a share of household incomes, they’re up more than 60 percent compared to three decades ago. As a percentage of home values, Illinois property taxes are now the highest in the country. And as for their impact on house prices, property taxes have contributed to Illinois suffering the nation’s third-worst growth in home values over the

It’s not just Illinois homeowners that suffer: Businesses pay some of the nation’s highest property taxes too – Wirepoints

We recently wrote about how Illinoisans are burdened by the nation’s highest effective property taxes. Residents aren’t alone. Chicago imposes the 2nd-highest commercial property taxes in the nation. Aurora, Illinois, the state’s second largest city, imposes the nation’s 6th-highest tax rate.

We recently wrote about how Illinoisans are burdened by the nation’s highest effective property taxes. Residents aren’t alone. Chicago imposes the 2nd-highest commercial property taxes in the nation. Aurora, Illinois, the state’s second largest city, imposes the nation’s 6th-highest tax rate.

Slew of bills signed by Gov. Pritzker helps propel Illinois property taxes to nations’ highest – Wirepoints

It’s not surprising that Illinois has retaken the top spot for nation’s highest effective property taxes. According to ATTOM, a leading curator of real estate data nationwide for land and property data, Illinois’ effective tax rate was 1.86% in 2021, followed by New Jersey at 1.73%.

It’s not surprising that Illinois has retaken the top spot for nation’s highest effective property taxes. According to ATTOM, a leading curator of real estate data nationwide for land and property data, Illinois’ effective tax rate was 1.86% in 2021, followed by New Jersey at 1.73%.

If inflation is hitting you hard now, wait till it finds its way into your property tax bill – Wirepoints

Count on Illinois property tax bills – already the nation’s second highest – to jump as teacher salaries rise. You can bet teachers unions will soon extract as much as they can from local school officials in contract negotiations, all in the name of inflation. Contracts in more than 240 Illinois school districts are set to expire in 2022.

Count on Illinois property tax bills – already the nation’s second highest – to jump as teacher salaries rise. You can bet teachers unions will soon extract as much as they can from local school officials in contract negotiations, all in the name of inflation. Contracts in more than 240 Illinois school districts are set to expire in 2022.

Illinois’ Pritzker promised to lower property taxes. He’s only made them worse. – Wirepoints

Not only has Gov. Pritzker failed to address property taxes, he’s made Illinoisans’ property tax burden even worse. Under Pritzker’s leadership, the legislature has passed a slew of laws that will only increase property tax bills.

Not only has Gov. Pritzker failed to address property taxes, he’s made Illinoisans’ property tax burden even worse. Under Pritzker’s leadership, the legislature has passed a slew of laws that will only increase property tax bills.

When will Illinois voters teach politicians the lesson from New Jersey on property taxes? – Wirepoints Quickpoint

Illinois and New Jersey consistently rank neck-and-neck for the highest property tax rates in the nation. When will Illinois voters send as strong a message as New Jersey voters sent?