By: Ted Dabrowski and John Klingner

The potential of Chicago entering a “doom loop” – that’s when “workers don’t return, offices remain empty, restaurants shutter, transit agencies go bankrupt, tax bases plummet, public services disappear” – is finally getting the attention it deserves. San Francisco is the canary in the coal mine, but Chicago has issues of its own, which we’ve written about here and here.

One part of the “doom loop” deserves special notice: the coming massive shift in property tax burdens from commercial to residential owners in Chicago. Only about half of Chicago’s office building space is occupied compared to just three years ago before the pandemic, according to swipe-card company Kastle Systems. Empty buildings means lower commercial property values and that, in turn, means lower property tax revenues for the city.

Take the ugly case where commercial property values fall 50 percent and stay there for a few years, in line with Kastle’s estimated drop in occupancy (we detail our caveats below). Everything else equal, Chicago (the city and Chicago Public Schools) would be short some $670 million in annual tax revenues from those properties. And since Chicago officials are notorious for never cutting spending, count on them to hike taxes on residential properties to make up the tax revenue shortfall.

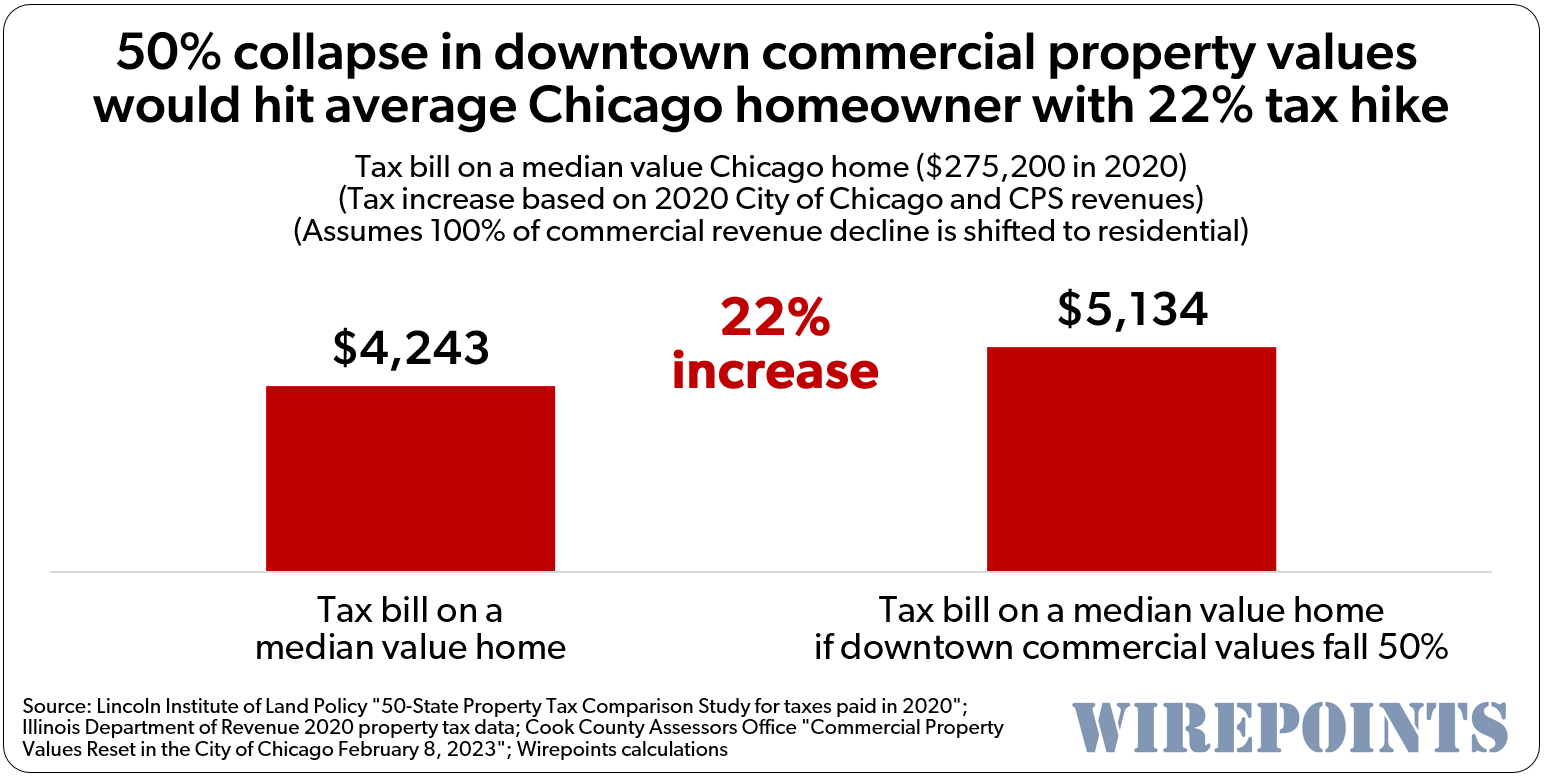

The median residential home owner would see a property tax hike of 22 percent, or $891, under that scenario. Chicago’s median household paid $4,243 in property taxes in 2020 on a home valued at $275,000, according to the Lincoln Institute of Land Policy. That would jump to $5,134 based on the above assumptions.

Wirepoints’ analysis contains the following caveats:

Wirepoints’ analysis contains the following caveats:

- How much and for how long Chicago’s office market remains impacted by work from home (WFH) and other factors such as crime is highly uncertain. A recent analysis published in NBER calculates NYC office values will be 39 percent lower in 2029 than in 2019 as a result of WFH. It also found NYC office valuations could be down by 59.6% in 2029 if the work-from-home ‘state’ lasts a full decade.

- The impact on the residential sector depends on how much of any commercial revenue shortfalls are shifted to residential properties. A full shift to homeowners may not be practically or politically feasible. Instead, other forms of tax hikes could be targeted, as could deep service cuts.

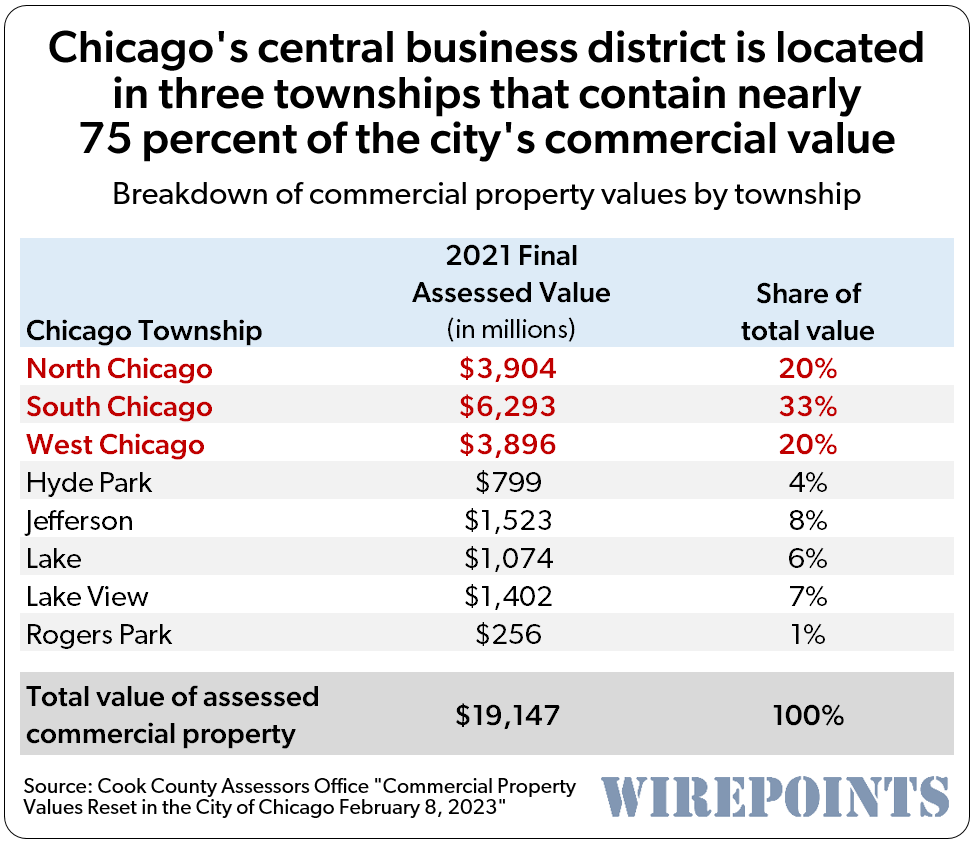

- The city’s commercial landscape varies widely across the city. For our analysis, we’ve assumed that only the three townships (North Chicago, South Chicago and West Chicago) that contain a portion of the downtown, referred to by the Cook County Assessor as the “central business district,” will suffer a 50 percent drop in commercial property values.

- For simplicity’s sake, we assume that any drop in office occupancy will result in a proportional drop in downtown commercial values and, hence, property tax revenues for the city. A less drastic 30 percent drop in Chicago commercial values would result in a $405 million loss in commercial tax revenues. A full shift in the burden to residential properties would result in a 13 percent tax hike.

- Again for simplicity, Wirepoints used 2020 Illinois Department of Revenue data for the City of Chicago and Chicago Public Schools to calculate the potential tax increase on homeowners. The vast majority of property taxes Chicagoans pay are imposed by the city and CPS.

An empty Loop means higher taxes on Chicago homeowners

Wirepoints has already documented the emptying out of Chicago’s prime commercial spaces. For more detail, check out:

- Back-to-office trend fades, worsening potential ‘doom loop’ for downtowns like Chicago’s

- Chicago’s Empty Downtown Offices Are a Frightening Problem for all Chicagoans

In short, about 80% of Chicago’s downtown office space is currently leased. But with actual occupancy running at about 50 percent of what it was in March 2020, tenants are unlikely to re-up for as much space as they have under their current lease. Chicago’s commercial values will, barring a renewed optimism in big cities, drop significantly once that fact filters through the city’s property market and tax assessment process.

The actual decline in commercial value is impossible to know right now, but we can estimate the tax impact on residents if we assume Chicago’s downtown suffers a decline in value equal to Kastle Systems’ occupancy data.

Chicago’s central business district is located in Chicago’s North Chicago, South Chicago, and West Chicago Townships. Those three areas combined contain nearly 75 percent of all commercial property value in the city.

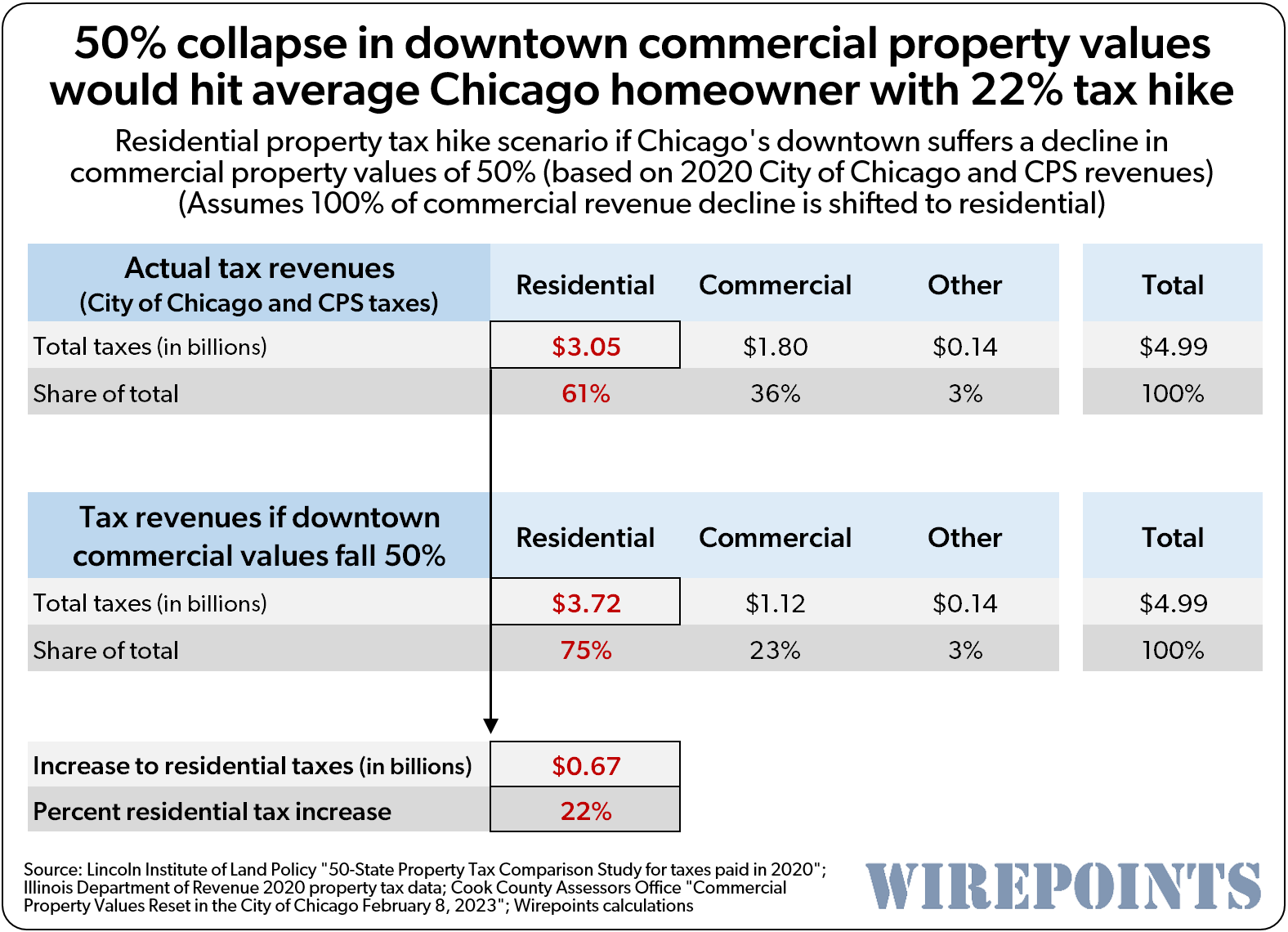

If the central business district suffers a 50 percent decline, total commercial property taxes paid to the city of Chicago and CPS would fall by $680 million – to just over $1.1 billion from $1.8 billion.

If the central business district suffers a 50 percent decline, total commercial property taxes paid to the city of Chicago and CPS would fall by $680 million – to just over $1.1 billion from $1.8 billion.

That means homeowners will experience a $680 million tax hike because they’ll be forced to make up whatever taxes commercial properties don’t pay. (Industrial and other properties only pay 3 percent of the total levy, so we exclude them for simplicity’s sake.)

In total, that means a 22 percent hike on residential properties, with the levy growing to $3.7 billion from $3.1 billion.

That shift also means residential owners will be responsible for paying 75 percent of city and school district property taxes in Chicago, up from 61 percent in 2020.

San Francisco’s collapsed real-estate market, out-of-control crime, store closings, population losses and business relocations is an example of the doom-loop in action. The WSJ article “Fire Sale: $300 Million San Francisco Office Tower, Mostly Empty. Open to Offers” is emblematic of the city’s dire state.

Before the pandemic, San Francisco’s California Street was home to some of the world’s most valuable commercial real estate. The corridor runs through the heart of the city’s financial district and is lined with offices for banks and other companies that help fuel the global tech economy.

One building, a 22-story glass and stone tower at 350 California Street, was worth around $300 million in 2019, according to office broker estimates. That building now is for sale, with bids due soon. They are expected to come in at about $60 million, commercial real-estate brokers say. That’s an 80% decline in value in just four years.

This is how dire things have become in San Francisco, an extreme form of a challenge nationwide. Nearly every large U.S. city is struggling, to some degree, with reduced office-worker turnout since the pandemic spurred remote work. No market was hit harder than San Francisco, for reasons including its high costs, reliance on a tech industry quick to embrace hybrid work, and quality-of-life issues such as crime and homelessness.

Nobody is claiming Chicago is as far along, but the Windy City is beset by many of the same crises:

- Rising crime: Chicago’s pursuit of ‘criminal justice reform’ an utter failure: Windy City homicides top nation for 11th year in a row with crime still rising.

- Closing stores: Walmart’s flight from Chicago: ‘Corporate racism?’ Or crime, taxes and dysfunction?

- Empty trains: The CTA ran near-empty trains and buses during the pandemic – and it’s still struggling to fill them. Now it wants higher taxes on Chicagoans to pay for that mismanagement.

- Fleeing businesses: Illinois has been bleeding its wealthiest residents for years. Now it’s Ken Griffin’s turn to leave.

- Broken finances: ‘Magic happens’: The illusion behind Lightfoot’s 2023 Chicago budget

- Dysfunctional government: More cops on Chicago’s streets won’t help until criminals are prosecuted and sentenced

There’s not much new mayor Brandon Johnson can do directly to dramatically reduce the impact from work-from-home, but failing to address the problems above, or worse exacerbate them, ensures the city’s commercial sector will continue to struggle and homeowners will get hit with tax increases they simply can’t afford. The doom loop will continue.

Ted was on The Chicago Way with John Kass and Jeff Carlin to discuss the proposed $5 billion lakefront stadium project proposed by the Chicago Bears & Mayor Brandon Johnson, why Chicago is struggling compared to other metro areas across the country, why the city might or might not go the way of Detroit, and more.

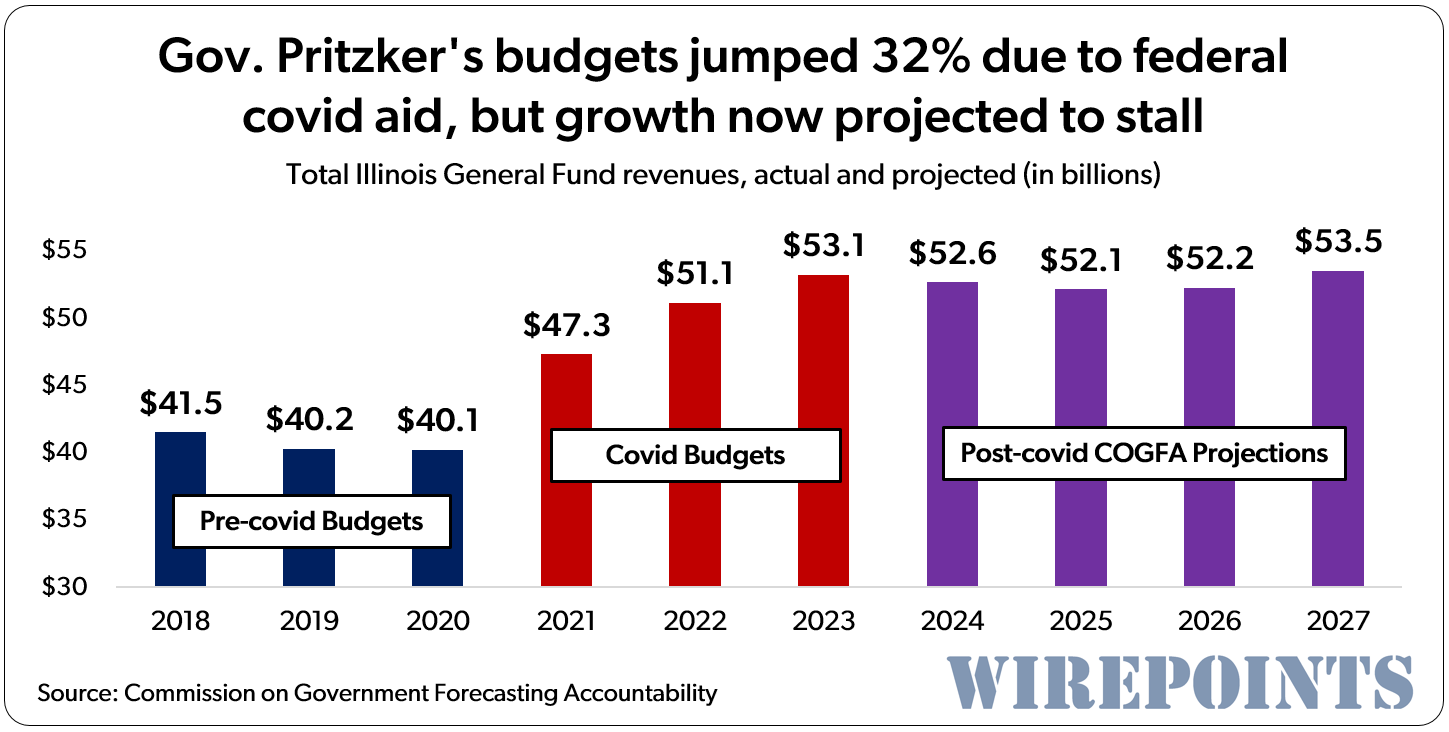

Ted was on The Chicago Way with John Kass and Jeff Carlin to discuss the proposed $5 billion lakefront stadium project proposed by the Chicago Bears & Mayor Brandon Johnson, why Chicago is struggling compared to other metro areas across the country, why the city might or might not go the way of Detroit, and more. Some Illinois lawmakers continue to deny that covid aid and other federal stimulus bailed the state out of its fiscal mess. But a look at past and projected revenues from COGFA shows just how much the bailouts blew out the state’s revenues. And now that they’re over, how much harder it will be for Illinois revenues to grow.

Some Illinois lawmakers continue to deny that covid aid and other federal stimulus bailed the state out of its fiscal mess. But a look at past and projected revenues from COGFA shows just how much the bailouts blew out the state’s revenues. And now that they’re over, how much harder it will be for Illinois revenues to grow. Election integrity – both real and perceived – is essential to government’s legitimacy and stability. Illinois, like the rest of the nation, better fix its problems now.

Election integrity – both real and perceived – is essential to government’s legitimacy and stability. Illinois, like the rest of the nation, better fix its problems now. Ted joined Dan and Amy to talk about Chicago’s latest bond offering, why Chicago’s dismal home value growth is due to poor policies, the next $70 million to be spent on migrants, the 9% salary hikes demanded by the CTU, and why Illinois lawmakers voting to stop Chicago’s selective enrollment schools from being closed is hypocritical.

Ted joined Dan and Amy to talk about Chicago’s latest bond offering, why Chicago’s dismal home value growth is due to poor policies, the next $70 million to be spent on migrants, the 9% salary hikes demanded by the CTU, and why Illinois lawmakers voting to stop Chicago’s selective enrollment schools from being closed is hypocritical.

The article mentions the shame of Chicago as if we are the only city dealing with this

The entire nations commercial real estate market is tanking itself, more from the financials than the lack of interest in leasing, though that as well

We as a industry have to make a great rethink re what commercial real estate is now, and what we can do creatively with what we have

The larger Democrat cities are objectively faring the worst. We don’t have many examples of repurposing office towers that makes financial sense. Often, the buildings are best off abandoned especially if crime prevents people from coming into the vicinity to occupy the building. Obviously, Detroit, but closer to home, the Spivy Building in East St. Louis IL was a 12 story skyscraper that was eventually abandoned as a ruin. Never repurposed, never even demolished. I reckon many downtown and suburban office parks will be torn down and will just be empty lots for decades.

Chicago bungalows are relatively low tax compared to the burbs. So Chicago has some wiggle room and an excuse that they should be taxing at suburban rates anyway. Whatever happens the population of Chicago is numb and won’t care. As long as they have their porn, lottery, couch, sitcoms, weed, cell phones attached to their hand 24/7, etc. people just don’t care.

Take look at property values in the 60625 zip code (Lincoln Square). New construction on north Washtenaw or west Carmen homes are $1.375M.

I’ll say it again, office buildings are obsolete. But there is a win win possible. A sanctuary city like Chicago is just chomping at the bit to take care of illegal immigrants. All they have to do is get Washington to fund the remodeling of these buildings into public housing. Win win, Chicago gets its much wanted immigrants, the buildings get utilized, and the money rains down from Washington. What could possibly go wrong with this plan?

Why even bother remodeling? Just let them move in with a wink and a nod towards existing housing codes. Brandon could issue an emergency executive order temporarily waiving building codes for emergency migrant housing. Lori used executive orders to completely shut down the city for two years, and an executive order to prevent purebloods from eating at restaurants or going into stores, why can’t Brandon waive building and zoning codes?

Spot on Debtsor. If Chicago can thumb it’s nose at Federal Immigration Law what’s a building code amongst their base?

Here’s something to think about BJ.

Let’s say you do just that and there’s a high rise AM fire in one of these “formerly”office buildings with a catastrophic loss of life — think 9/11. That will be on you.

Building Code enforcement is both a big money-maker for City Hall, as well as job-security for union labor required to perform electrical, plumbing, carpentry, painting/drywall, and other trades. Difficult to employ non-union labor in downtown Chicago, union officials monitor construction activity, and building inspectors are quick to discover major non-permitted renovation occurring in downtown high-rises.

Realistically, the elevators will stop functioning within days or weeks, so only the first several floors will be occupied. Healthier, younger miscreants will use the upper floors for nefarious activities. As for the fire, it won’t be long before the buildings are stripped down and sold off to their bare concrete interior, so a fire would not be as catastrophic as a carpeted office building full of paper and particle board desks. Bad, yes, but not 9/11 bad. And there will only be several floors to evacuate via stairwells, few overweight and unhealthy residents will be willing to walk up… Read more »

In South Africa, vacant office high-rise buildings did in fact become defacto squatter homes, sharing communal toilet-rooms (until plumbing failed), often without electricity or functional elevators. Look it up.

It’s no simple remodel to convert a high-rise office building into high-rise multi-family housing. It’s expensive renovation construction. Two communal toilet-rooms per floor in these older “C-class LaSalle Street office buildings; residential units require at least one full bathroom’s worth of plumbing (plus kitchen plumbing), and housing standards likely to require 2nd bathroom for any 2 bedrm+ units. Need separately-metered electrical, probably water too; plus new operable double-glazed windows with screens must be installed, to replace old fixed-glazing inoperable single-glaze windows, to meet fresh-air ventilation.

Lets not forget the taxes now needed for the illegal immigrants health care. What taxes will be increased or what new taxes will be imposed?

Let’s see…eeenie, minee, minney…..

Taxes go to pay for pensions and as PPF tells it they must be paid, like it or not. Government services are second to pension payments.

Actually the Illinois voters said the pensions must be paid,,,PPF is just reminding us.

They said this in the early 1970’s those voters are dead by now. That is when the government employee greed just exploded and has never stopped. The only way to stop it is to run out of money.

Less TIF means even higher property taxes for those of us not on the TIF gravy train. Johnson could score some political points and find revenue by reviewing these concocted TIFs entered into over the years.

This entire analysis is incorrect. The vast majority of Chicago’s top-dollar commercial real estate is within a TIF district. Lowered valuations on those properties would only result in higher residential tax bills if the commercial properties collectively declined below the frozen amount for each TIF. In reality, a 50% decline would simply mean less TIF revenue for Chicago to use for planning.

If you’re going to do this sort of analysis, at least do it correctly.

While I do not disagree with the fact that lower RELATIVE valuations on commercial property would result in higher residential tax bills if the commercial properties declined below their frozen value, you need to cite a source that shows the “vast majority of Chicago’s top-dollar commercial real estate is within a TIF district”, otherwise your “analysis” is just a mere statement.

Look at the map here: https://webapps1.chicago.gov/ChicagoTif/

The majority of the Loop, South Loop, West Loop, and River North are within TIF districts. This includes major commercial properties like the Sears Tower, Board of Trade, all of Fulton Market, etc etc.

Let’s say Bob is correct. They are all in TIFs and pay reduced taxes. The value of the real estate tanks. Problem: Government needs money and is controlled by the unions/machine/crony capitalists. Where do they get it and how? They don’t eliminate the TIF, but they change the multiplier that they use to calculate the tax. Higher multiplier=higher tax, but still less than they would be paying since they are in a TIF. Where do they get the rest of the money they desire? The answer is homeowners. So, let’s say it’s not a 50% downturn on CRE but simply… Read more »

You are incorrect and clearly do not understand the IL prop tax system.

Changes to assessed values within a TIF have no effect on the overall composite tax rate, as long as those changes don’t drop the total assessed value for the area below the frozen amount. The biggest impact reduced CRE values in the CBD will have is reduced TIF revenue.

The equalizer is set by the state and literally does not affect individual property taxes at all, outside of exemptions.

Let’s say for arguments sake that the analysis is correct. The loss of value to TIF’s will still somehow be correlated to higher taxes for homeowners across the city. They (pols) will make it sound way worse than it is. The recipients of TIF like special interest groups or political slush funds will lose money but the overall property taxes receipts will increase due to higher taxes. At least that will be an excuse the polls will say. Nothing will be lost. Like in all 38 Ptell counties in Illinois the taxing bodies will never get less than the year… Read more »

Here’s how the election for Brandon Johnson and every other election in Chicago goes down. White upper class working people are too busy to vote. They have golf games, hair appointments, fancy lunches, whatever, they just can’t be bothered or make the time. The people on the dole make it a point to vote because they want everything to remain the same. They want to keep their affordable housing, free medical, free food, and hopefully a universal income so they don’t have to work, etc. They make sure they vote every time so that nothing is disrupted and their “unproductive… Read more »

And let’s not forget the illegal immigrant property tax that is sure to come soon. Democrats will tax anything, anywhere, anytime to make sure that they have enough money to spend. Whether you agree or disagree with their expenditures, it’s not important to them, you’re not important to them. You better get out because they’re not done yet. Either leave Chicago or bend over and pay up.

Marie, that’s not very lady like…..

What they do to taxpayers in Illinois is not very “lady like” either.

They will be getting what they voted for is how this downstater sees it. Good for them!

Your neighborhood tax increase is next.

You can be sure there will be heavy pressure from vote rich Chicago to get “help from Springfield”. That means the Illinois general assembly will vote for increased subsidies for Chicago, to be paid for, yes of course, by the suburbs and downstate.

Paid for by the suburbs. Downstate gets more money from the state than they provide in revenue. The idea that downstate pays the bills is laughable.

Who pays for the unfunded mandates imposed upon us?

We all do. You and your downstate neighbors just pay a lot less than the rest of us. On top of that deep discount you end up with more of the money sent back to your region.

Noticed you didn’t say a peep on Pritzker holding back +$4.5B to your pension fund. That’s good, for Johnson wants more from Springfield.

Just because YOU didn’t see it or hear it doesn’t mean it didn’t happen. You are wrong. You must have missed the SEVERAL comments that I’ve made about actuarial contributions vs statutory contributions. This isn’t a new thing. The money that is being shorted is a direct result of the Edgar pension ramp. It allows JB as well as prior governors to pretend they are offering up balanced budgets (because they are technically balanced per state law) instead of the structural deficit budgets that are offered up every year. Do you really think JB is the only Governor to do… Read more »

One would never support pension plans we were not allowed to vote on. They are essentially illegal taxation put together by vote hungry a-holes. We know how it went down and what we are getting for it in the way of service is the true “deplorable”

Pension expenditure needs to come into line what is actually funded then – no more magic beans by you or Democrats. Will you stop counting in the magic beans?

The ‘downstate’ gets more money than they pay argument is absolute fake news and racist propaganda spread by Democrats as an excuse to punish and humiliate The Deplorables in Illinois. Downstate, otherwise described as south of I-80 and west of 47 (maybe even west of I-39) has nearly all of the landmass of the state, so yes, state money money pays for that infrastructure. Downstate also nearly all the prisons (except Stateville), and the largest universities. Downstate also has the state capital, Springfield, which was decided in 1839. So therefore, significant money is spent Downstate to support the government, which… Read more »

our downstate school district gets comparatively little state funding meaning we deep deep into our pockets via property taxes to support our school district while Chicago is always getting more funding. It gets old after awhile

Downstate votes Republican, so the super-majority legislature takes retribution on you. They hate the deplorables, they really do. It’s hard to accept this reality, but these legislators hate you. They think you’re all backwards, racist Trump supporting rubes and you deserve as much the scorn, vengeance, humiliation and retribution as the legislature can give you. Just listen to the way these people talk about you and you understand that if these were any other country in any time in history, they’d be rounding you up into camps, forcefully resettling you, expelling you from the state, confiscating your land and property.… Read more »

That reads like your own version of political happiness to me. That’s essentially your continual drum beat here. Just substitute your moniker everywhere you’ve written “they” or “Democrats,” and I agree with that point of view.

Show me where I’m wrong.

I think your looking-for-enemies mindset is wrong. People can—at least sometimes—be peruaded by logical arguments and particularly where it brings them some personal benefit. Nastiness only begets more nastiness rather than solving problems at hand. In the era of Ronald Reagan and Tip O’Neal(sp?) some three decades ago and further back people could politely disagree with another’s political point of view yet socialize amicably. Today’s version is to buy more arms to serve as self protection, spit or write vitriol and only socialize with like-minded people. Its a sad commentary on our modern era. We need to treat our fellow… Read more »

(Rolls up sleeves…) I consistently show you where you’re wrong, and you still keep this up.

I’ve got data and statistics on lots of extreme movements. It’s very rare to encounter anything more than a small fraction of political operatives that adhere to your distorted perception.

Joe Biden went to Howard University last week and called White Supremacists aka Trump supporters, the greatest threat to America today. Last year he stood on stage and called MAGA Trumpers a threat to Democracy itself and he would do whatever it takes to make sure that Democracy in America survives. JB Pritzker told me that my refusal to wear the armband, I mean useless mask, I WAS THE ENEMY. Biden told me in January 2021 that his patience was wearing thin with me for not taking a useless experimental shot, that acksully had negative efficacy and made me MORE… Read more »

FYI My most important comment of the day.

First off, you’re substituting Joe Biden for the downstate Republicans you originally mentioned to defend your argument.

You’ve also left out the fact that Howard University graduates trashed him.

You’re 0 for 1 this week so far. Actually, 0 for 2 if you count this one as a double hitter. LOL

*Edit this one could be considered a triple since, according to you, black people – paradoxically, always vote for Democrat.

https://www.tiktok.com/@kingquincyaaron2/video/7235828232858176811

Dave, you missed the structure of my comment. I started at the national level, worked my way down to state level, then to specific state reps finally to my local school district. For a several paragraph comment on a forum simply reciting back to you how Democrats feel about Republicans – using their own words – I did a pretty darn good job. As for the one guy holding up a sign about Joe Biden, that proves nothing, ’tis nothing more than a photo op. The difference between you and me and is that I am taking Democrats as face… Read more »

And I’m taking them seriously, very seriously, because they hold all the institutional power right now, and they’ve made it very clear who they plan to come down mightily upon. It’s not the urban gun owner carrying an illegal pistol…it’s you, deplorable, with your AR-15 that shoots tin cans and paper targets, they’re coming for you.

I am just waiting, debtor, for the dems to pull their ultimate “Reichstag Fire” stunt. With the Chinese virus fake panic, and the BLM/Antifa – induced 2020 “Summer of Love” mayhem, they’ve had some very effective “practice runs”…

I forgot the contrived “Russia Collusion” hoax, the “reporting” of which earned two of our most prominent “state organs” (NY Times & WaPo) Pulitzers, and consumed many millions of our tax dollars. This was something right out of “1984”, or even Joe Goebbel’s vile playbook…

Dave, for that comment I’m giving you a “down vote”. What you peg “distorted perception”, is something any normal – brained person can see by simply skimming the day’s news headlines – even at the most basic local level. At a local level here in Evanston I’ve been confronted as a “racist… hater… NIMBY…” by the leftist powers – that – be. They’d be quite happy silencing me *permanently* if they could do so…

Hi GM, there are some nuances to debtsor’s facade that I think you’ve missed. Sure, there are some mad Democrats that hate opposition. What debtsor never acknowledges is that Biden stands on a frail house of propaganda and lies. Republicans, when compared to Democrats, generally have more income, have more education, have substantial resources, and are more than capable of putting an end to this mess. Failing to acknowledge this, failing to put together and implement a plan, and constantly boasting of oppositional power is never going to get anybody anywhere. If you want to win at sportsball, you put… Read more »

Biden personally may stand on a frail house of propaganda and lies, but, the Democrat Party propping him up is as strong as ever. Democrats control the presidency, the senate, half of state governments, most urban centers, academia, the corporate board rooms, education, unions, non-profits, tech and many other political and cultural institutions, and most importantly, half of the nation’s voters. It’s a shame that conservatives lost these institutions over the years but we just wanted to drink our Bud Light’s and be left alone, while the commies took the long march through every institution. I’m sure the White Army… Read more »

100% correct, all you have to do for confirmation is head over to Crapfax. When the graduated income tax didn’t pass all that was posted was a bunch of ideas of how to punish downstate like closing prisons, parks etc. Too bad you can’t access their archives.

Downstate gets more tax revenue than Cook County. They get more tax revenue than the entire suburbs. If cuts have to be made it only stands to reason that downstate should be cut the most. Also, how could they punish downstate? Unless you believe things like universities and prisons actually benefit the economies in downstate Illinois. Downstate voters have master being tax victims of Chicago while benefitting more than any other area of the state. Their residents are low income, have a greater proportion on medicaid, and contribute very little to the overall financial revenue or growth to Illinois.

“have a greater proportion on medicaid”

love that trick there, fewer numbers on medicaid, but “greater proportion”. And whose fault is that? What legislature has consistently punished voters for voting for the wrong party?

Lol… PPP’s comment brings to mind that old saw, “figures won’t lie, but liars will figure”…

Hard to accept this reality??? Your idea of reality and mine are completely different. Have you ever tried professional writing? You could go far in the fiction section. You’ve got a great imagination!

Curious- If your downstate school gets little funding how do the test scores compare with schools that get the most funding? I believe the state minimum per pupil expenditure is approx $6,750 but not sure and yet those rural school district students still comply with the curriculum needed to graduate. I know it’s hard to compare since most likely the rural students come from 2 parent households and demographics are different from large city schools.

My school district gets great scores and we have relatively high property values to reflect it. When we need new schools though we have referendums to pay for them compare to another downstate Democrat stronghold East St Louis that seems to get plenty of new school fundings and lets not bring up Chicago

I suggest you compare property taxes paid in the suburbs compared to the rest of the state. People love to complain about the percent paid but that’s because many of those areas have such low home prices. Ultimately though in total dollars, property taxes are a bargain downstate compared to the suburbs. The suburbs get even less. We just are expected to be good citizens, have low crime and safe communities, and send our money downstate. In return we get downstate residents that act like they’re the ones spending all the money. Almost $3 for every $1 collected is sent… Read more »

Taxes are based upon the fair market value of the property meaning that while I hear you I don’t think you are making much sense. The fair market value of property is what taxes are computed on. I generally agree with much of what you post but not on this one. Incidentally I live in a very low crime safe community that is a reflection of the individuals that live here not some Chicago dictate. Hopefully you wont send your immigrant problem here to create another Democrat party ****hole. and no we do not get a lot of funding from… Read more »

“Taxes are based upon the fair market value of the property meaning that while I hear you I don’t think you are making much sense. The fair market value of property is what taxes are computed on.” Where I’m going with this RB is that the cost to have police, fire and teachers in your community is not based on the average home price. Meaning, if a 3 bed 2 bath home in Hinsdale is 800k and it’s 200k in Springfield, it may not make sense for Hinsdale to pay 4 times as much in property taxes to pay for… Read more »

Your post is too long and wordy to waste my time on. My community more than pays its own way; Chicago does not support us and please don’t send us Chicago’s problems as has happened in other communities.

Chicago doesn’t support you but the suburbs clearly do. Your property taxes aren’t the only taxes. Your “community” may but the overall downstate area does not. Short and to the point.

Your suburbs don’t support me/us either

You are trying to paint with too wide a brush

Every community doesn’t fit your perceived assumptions

This conversation is over

If your community is part of downstate Illinois then the suburbs do indeed support your area. If your “community” is just your neighbors you may be right about your small enclave but overall in the downstate area you are subsidized by the suburbs.

The financials clearly show that downstate is getting more dollars sent by a wide margin that is funded primarily from the suburbs. Almost $3 for every dollar in tax revenue they contribute. The city and suburbs account for about 72% of the tax revenue collected yet somehow in your mind the downstate area is funding the rest of the state. Sure some of that money goes to universities and prisons but those items greatly benefit the downstate economy. You’re acting like that doesn’t matter. Without state government there is very little economic activity downstate. You also left off the fact… Read more »

Kudos for correctly identifying the suburbs and not Chicago. Chicago (Cook) pretty much consumes every state tax dollar it produces.

To be clear, that’s far south, not downstate. From a % perspective, that seems like a lot but in actual dollars the far south receives the least amount in disbursements from the state.

I agree that I should have been clear that the almost $3 for every $1 is for southern Illinois not “downstate”. If you look above this post you will see I made the reference correctly. For downstate it’s a $1.70. While the actual total dollars may not be much for southern Illinois (I’m not sure the amount) the actual dollars for downstate is significant. They receive more than cook county and also more than the suburbs combined (not with Cook). I get that a large chunk of that money goes to prisons and universities but it still benefits the downstate… Read more »

PFF, just spit it out: They’re all poor, deplorable Trump supporting rubes, and they are lucky the legislature even gives them any money at all, even if that money goes to unionized Democrat voting university employees and unionized Democrat prison wardens. The measly $18M they got for infrastructure is peanuts compared to the billion dollars+ the state spends on illegal immigrants.

https://www.wsiu.org/state-of-illinois/2021-04-07/dceo-announces-18-2-million-in-infrastructure-grants-for-34-rural-communities

I don’t find them deplorable rubes. I find them ridiculous that they complain about all the taxes while they are greatest beneficiary. I find it hilarious when downstate residents believe they are the ones funding the state. It reminds me of liberals pretending that rich people got rich by taking from the poor. Somehow letting high earners keep more of their money is taking from the poor. They are both comical.

I guess when you don’t identify with either political party you are able to see the ridiculous claims much easier.

These are all strawmen arguments. You can try to figure them out for yourself, but this is not an honest recitation of any of the arguments above. Close, but not accurate.

To be clear, it’s really the central section of the state that’s the big money drain. The far south simply does not generate nor receive a whole lotta state revenue. But, yeah, downstate clearly does not fund Chicago.

I would love to see these numbers by zip code, because while it’s fun to make generalizations about downstate, there are plenty of suburbs and Chicago neighborhoods leeching off their neighbors.

“But, yeah, downstate clearly does not fund Chicago.”

Thanks for being a voice of reason here. My original comment merely pointed out that downstate is not the one paying the bills. I’m always surprised when facts are inserted into the discussion it gets people so upset.

Downstate is everywhere that is not Chicago or a suburb.

It is no different in Virginia, where Fairfax County pays the lions share of taxes for the state. I always think the downstate gets too much argument is silly without context because it ignores the economies of scale disadvantage the rural areas endure – the whole state cannot be a dense urban or suburban environment. I think the focus should be on having quality public institutions throughout the state, and this is where Illinois fails in comparison to Virginia. The university system alone is so much better than Illinois, and really, given the economic engine of Chicago, there is no… Read more »

“I always think the downstate gets too much argument is silly without context because it ignores the economies of scale disadvantage the rural areas endure” Willow, I’m not arguing that downstate gets too much money. I’m simply stating that they are not the ones paying for Chicago or Cook County. The original commenter stated “to be paid by the suburbs and downstate”. Downstate does not pay for other parts of the state. Their economic survival is the direct result of government tax dollars that they receive. Their residents get mad about spending in Chicago and go out of their way… Read more »

PFF, the original commenter never said that Downstate pays for other parts of the state. He said that they don’t receive their fair share so they had to reach into their pockets to make up the difference. You pointed out that downstate gets more money back than paid in but admitted that it mostly goes to the universities and prisons. Which are Democrat institutions and are mostly filled with chicago area students and criminals. So the chicago isn’t really just funneling that money to downstate interests, its funnelling that money downstate to pay for its chicago area interests. So he… Read more »

“PFF, the original commenter never said that Downstate pays for other parts of the state.” Check again. You’ll find it’s just one more moment of you being confidently incorrect. Maybe you should read the entire thread before inserting yourself into so many conversations. Your assignment for the day is to re-read this thread and see the error of your ways. I’ll even make it easier for you and provide you with the original comment to this conversation where I responded and then you joined in. “You can be sure there will be heavy pressure from vote rich Chicago to get… Read more »

“to be paid for” Maybe English is not your first language, but he’s talking about the future tense. ‘To be’ is a really tricky verb in English. You accused him of saying, and I repeated, that “Downstate pays for other parts of the state”.‘Pays’ is the present continuous tense, meaning now, and ongoing. We know that’s not true factually, but whether they receive their fair share is an entirely different and subjective question. But he said “to be paid for.” That means future tense, he could have wrote “will be paid for” because he suggests that the IL legislature, in… Read more »

PPF – why are the state’s institutions, particularly universities, so mediocre? There’s lots of money spent. If you had asked me 50 years ago what university would have a bright and competitive future it would have been Northern Illinois University. It’s location near Chicago made it a prime institution to develop and grow. If I were a university leader then, I would have had a goal to make it into a Purdue without the Big 10 sports. It now ranks 34th in the state according to Niche (although not even really ranked) behind really poor value schools that are very… Read more »

The short answer is demographic changes. Minorities – for many reasons – choose to attend college at lower rates than whites and asians. Many suburban schools that used to be mostly white and asian thirty years ago are today nearly entirely hispanic, MENA, black. My older sibling’s large suburban high school was nearly 100% white a few decades ago and had high college attendance rates throughout the state. Today, the school is over 70% minority and has a 21% reading proficiency rate. The state doesn’t graduate enough high quality students to justify turning Northern into an elite university. Your example… Read more »

PFF would find more friends on Crap Fax, using the same lies and twisted logic they use over there to justify their oppression of downstate conservative voters that wrong vote.

I just caught you in a lie on this very thread. “PFF, the original commenter never said that Downstate pays for other parts of the state”. A flat out lie that anyone with the ability to read can quickly verify.

Where have I lied? Talk about twisted.

See above: “to be paid for” Maybe English is not your first language, but he’s talking about the future tense. ‘To be’ is a really tricky verb in English. You accused him of saying, and I repeated, that “Downstate pays for other parts of the state”. ‘Pays’ is the present continuous tense, meaning now, and ongoing. We know that’s not true factually, but whether they receive their fair share is an entirely different and subjective question. But he said “to be paid for.” That means future tense, he could have wrote “will be paid for” because he suggests that… Read more »

Cite a source that shows that downstate receives more money than they pay in taxes.

Are you serious? Are you really not aware of these facts? The last study I read on this was out of Southern Illinois University. Maybe they were biased against themselves.

The logical inference is that this is deliberate destruction of property values, by organisms with an endgame in mind:

1. Destroy property values through aberrant high property tax rates (cost-of-carry driving individual buyers out of competitive bidding pool).

2. Buy up all property at pennies on the dollar,using OPM-at-risk leveraged loans from family/friendly bank relationships.

3. Restructure conditions which created original problem (aberrant high property tax rates).

This probably means cramming down defined benefit entitlements-holders. This is ironic because these are the similar-but-politically-inferior organisms who empowered the politically-superior organisms to orchestrate this predictable scenario.

You’re giving these morons too much credit by insinuating they are playing the long game. The commie is usually a low IQ moron that just wants to destroy whatever is in front of his or her face. Lori looked out her window on the 5th Floor, saw too many white people and big bad corporations, and said, I’ll destroy this place, that’s equity. The virus came along and she said “It’s not fair that black/brown people should be forced to work downtown and risk catching corona, so we’ll shut down all the offices and tourist and entertainment infrastructure”. So she… Read more »

Keep in mind this comment came in July of 2021, the summer after the Summer of Love. The City had a full year to try and figure out the rampant crime problem, and the Deputy Mayor for Public Safety told BOMA, (BOMA/Chicago is a trade association that has represented the interests of the Chicago office building industry since 1902) to: “…get in your car and go to Gresham, Austin, Lawndale, Englewood, Roseland…” Because you know, there’s probably fewer than 150,000 people combined still remaining in those neighborhoods….but pre-2020, there were millions of people every week in downtown…so we don’t care… Read more »

Intelligence is subjective. I know plenty of people that have exceptional skills at one task and lack competence in another.

Poor Fritz. His dream was to shift a huge chunk of the property tax burden on those greedy commercial properties. Now the value is tanking and there is no where else to go but back to the homeowners.

The commercial real estate problem, and the potential shift in the tax burden to residential makes sense. The Chicago-based media will trumpet a 22% property tax increase as the end of the world. But it should be noted that the homeowners in Chicago vote almost in unison for the D’s, and have shown very strong support for JB and D mayors. The D’s are the ones that introduced the authoritarian lockdown policies that led to this issue. No lockdowns in many major cities in the south (many led by R’s) and no such problems there. Also, I suspect most homeowners… Read more »

My brother used to work in the Loop before he moved away years ago.

On a recent business trip downtown here, he was shocked at how deserted and creepy the Loop seemed on a weekday — like a Zombie Apocalypse.

It’s not safe, even at high noon.

A generation of homeowners have been eviscerated, having purchased urban homes for stratospheric prices over the last twenty years. But worse, the former real estate titans who’ve purchased downtown office properties, by way of massive leverage, face disaster with massive foreclosure actions. It’s been a very long time since RE has had the floor drop out of valuations. And even longer since the baby boomer landlords have discovered reality, read Price to Value.

Anyone west of Western, or even close to Western, is going to suffer immensely. It’s already being reflected in neighborhood sales and listing prices.

“Doom-loop” already arrived. Mayor’s Office (Lightfoot) program provides tax incentives for developers to convert existing LaSalle St office buildings into affordable multi-family housing. These land-use conversions have a “forever” impact on tax rolls, and awarded tax-relief will further push real tax burden on other Chicago residential-property tax-payers. Proposed new affordable housing concentration within LaSalle St corridor will also have permanent negative impact on remaining Loop office environment. both by diluting size of downtown business district, and by relocating low/moderate income households to high-density urban district unsuitable for families with middle-school and older children. Lightfoot’s people thought by mandating a ground-floor… Read more »

You mean they won’t need a Truefitt & Hill shop in the new neighborhood there?

If the expected commercial building implosion happens, that would be outstanding. That’s because the tax burden shift to the homeowners might be the thing that finally wakes up these stupid people that keep voting for Democrats. They won’t be able to sell their homes to get out without taking a bath because of the high property tax rates. So maybe, just maybe, they’ll start to think about who they vote for.

Isn’t there an old saying “you can’t fix stupid”

A 22% hike would put me at 10K per year to live in my paid off home in Bowmanville. I really don’t see how my lesser means neighbors could manage. Articles like this increase my resolve to move……I just hope I didn’t wait too long.

And if you miss a tax payment, you could lose your home to the vultures. Such a nice place, IL.

You’ve been warned countless times to leave Illinois yet you haven’t.

The suffering is 100% on you.

Absolutely right Indy!

Of course, you waited too long. I waited too long, and I moved almost 3 years ago. Also, and I’m not trying to be mean, you should have known better than anyone, having come from Detroit.

All those expensive condo’s sitting in a pile of garbage – a fool and his money….

Enjoy Chicago, you asked for it.

The only way the tax rates will go down is if the overlapping entities spend less money, and that ain’t gonna happen. If you look at historical data even in 2008-09+ revenue did not go down because the budget (levy) did not go down. Values crashed so they just raised the rates. This is direct from a city CAFR. “The County Clerk computes the annual tax rate by dividing the levy by the Tax Base and then computes the rate for each parcel of real property by aggregating the tax rates of all governmental units having jurisdiction over that particular… Read more »

Somebody’s gotta pay for that $500/ month “ guaranteed income “. Enjoy yourself, Chicago!

And Medicaid, public schools for undocumented immigrants. We don’t need any stinkin borders … we’re a proud Sanctuary City!

Since I can’t post links here..look on YouTube for Mesha Mainor Fox News. She’s a Democrat that is totally pissed at the party, and there are more like her. I pointed her to Mark’s work on underachieving schools. She’s also ticked about immigration. She sounds amazingly like a Conservative.