By: Ted Dabrowski and John Klingner

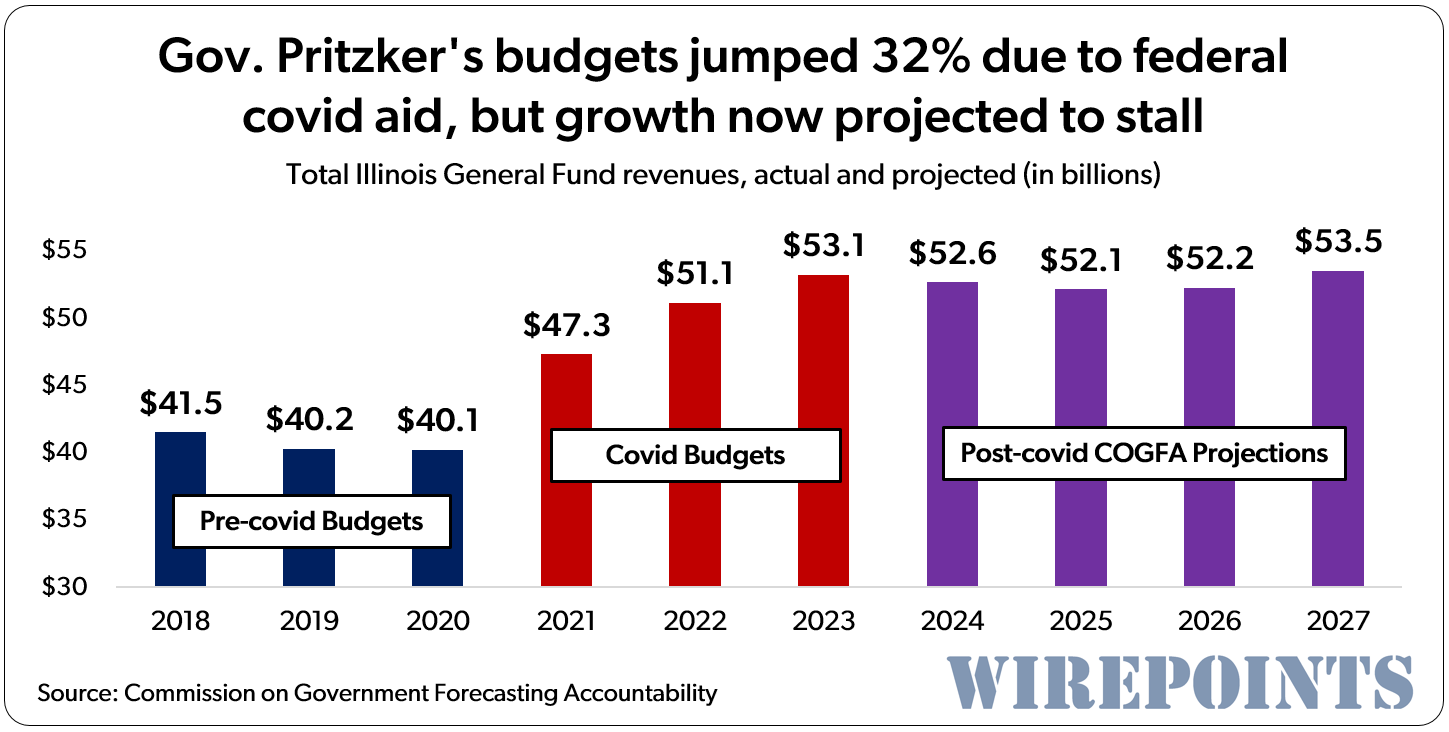

Some Illinois lawmakers continue to deny that covid aid and other federal stimulus bailed the state out of its fiscal mess, most notably, its collapsing credit rating. But a look at past and projected revenues from COGFA’s latest three-year budget projection shows just how much the bailouts blew out the state’s revenues. And now that the bailouts are over, how much harder it will be for Illinois to grow.

The Commission on Government Forecasting and Accountability, the state’s official number cruncher, projects the state’s revenue growth through 2027 will be virtually flat – and actually fall when you take inflation into account.

Those projections are in sharp contrast to the state’s 2020-2023 revenue spike, when state revenues popped to $53.1 billion in 2023 from $40.1 billion in 2020, an increase of 32% in just three years.

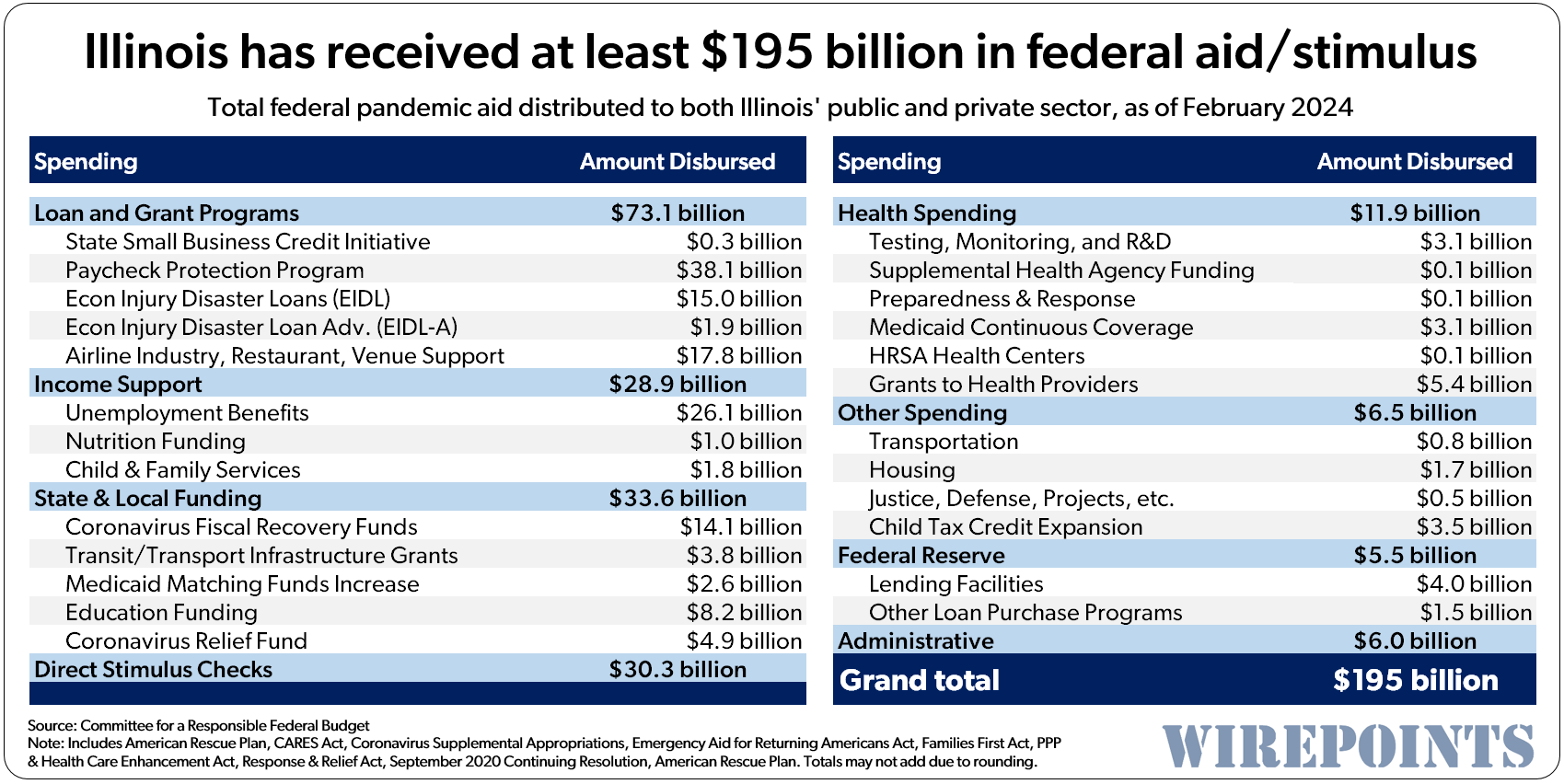

Most, if not all, of that revenue growth can be attributed to the nearly $200 billion in funds the feds doled out to Illinois’ public and private sectors during covid. The federal government’s direct grants to the state as well as its individual and business stimulus checks – which pumped up income and sales taxes for the state – both played a role, as we detailed here, here and here.

More than $70 billion was given in loans and grants to businesses. Illinoisans got $30 billion in stimulus checks. State and local governments received more than $30 billion. Billions more went to health care and a host of other programs.

Certainly, as Wirepoints has written before, there was little the state did during those years to cause the state’s revenues to grow at their breakneck pace. No pension reforms, no economic reforms, not even any multi-billion dollar tax hikes (though the state did hike taxes on corporations by $650 million in 2021).

Also, keep in mind that the federal government continues to stimulate Illinois and the rest of the national economy with massive deficits. The federal deficit has spiked from less than a trillion dollars in 2019, the last year before covid, to $1.7 trillion over the past twelve months, and is continuing at about that pace. That is unsustainable.

The subsequent direct and indirect revenue windfall of all that support has allowed Illinois to pay off its billions in unpaid bills and receive several credit upgrades – all positive developments that Gov. J.B. Pritzker has been happy to tout.

But what the governor has never admitted is that the federal government’s unprecedented spending brought the state back from the financial brink. In fact, the governor has often denied the bailout’s role, like he did in his 2022 budget address: “Let me set the record straight for you — our state budget surpluses would exist even without the money we received from the federal government.”

But now, if COGFA’s projections hold true, the years of no-effort revenue growth are over. Covid money is ending and it’s widely agreed that federal deficits cannot continue at today’s pace. No more federal dollars means the state will have to rely on its own economy and business climate to grow the budget.

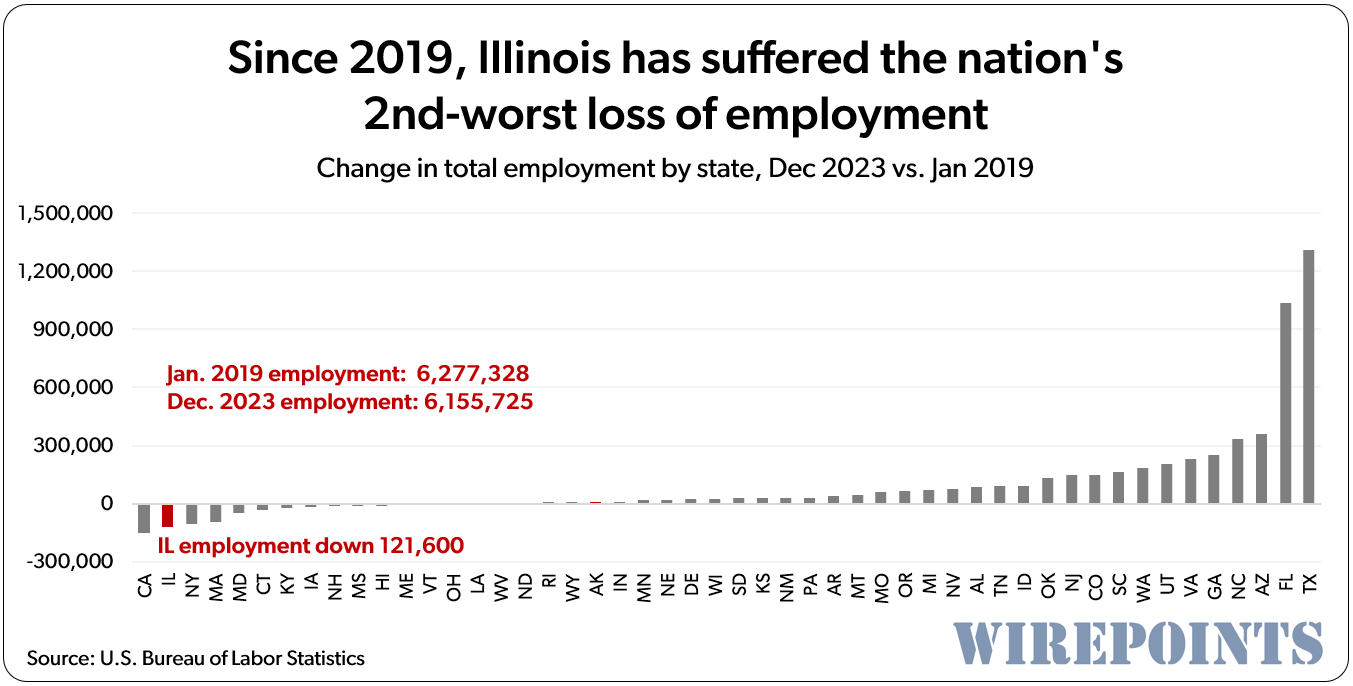

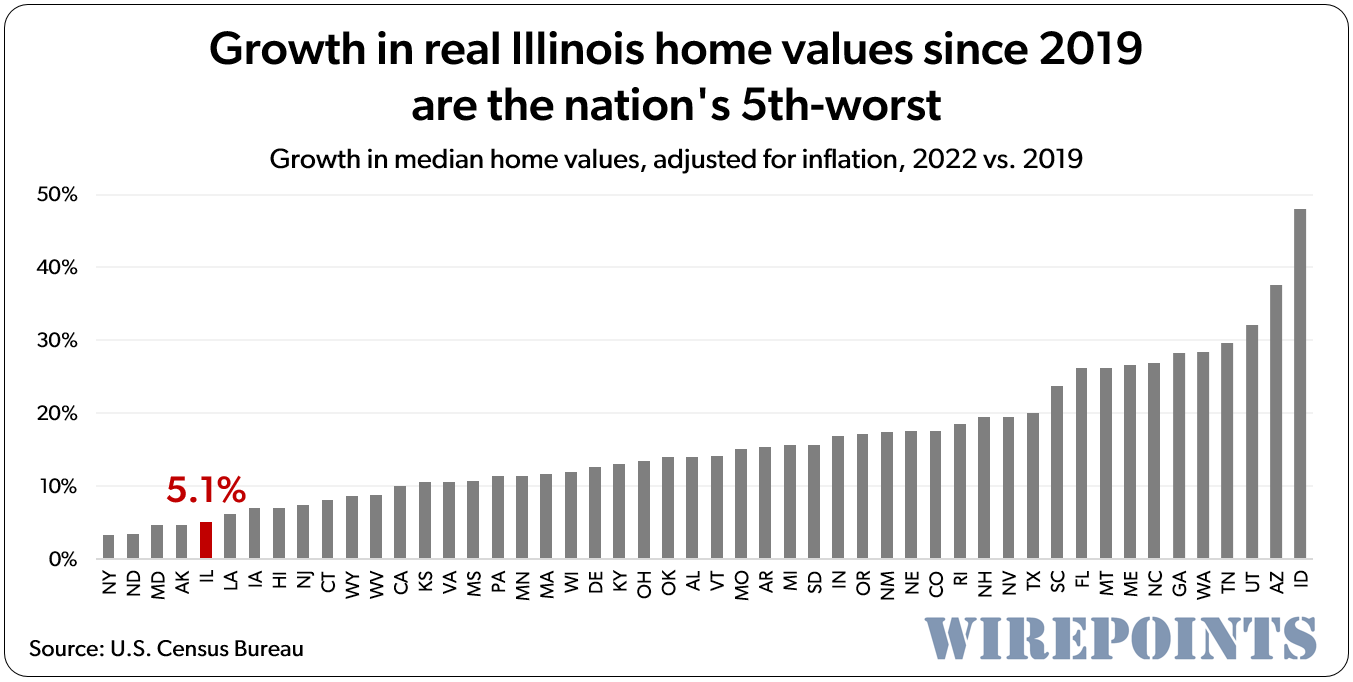

That’s a problem, because Illinois’ economy is an outlier on most metrics that matter – from jobs to GDP to home values. That’s certainly been the case since the governor took office. Since 2019, Illinois has suffered the nation’s 2nd-worst employment growth; the country’s 8th-worst real GDP growth; and the nation’s 5th-worst home value growth.

Competitive disadvantage

Meanwhile, other states have used their federal help to improve their competitive advantage over Illinois. Between 2021 and 2023, 23 states, most buoyed by bailouts they didn’t even need, reduced their income taxes and/or other major taxes, and the list is growing.

That’s really Illinois’ issue. It used an unprecedented bailout to get its own balance sheet out of the red while most other states delivered relief to their residents.

Now with revenues finally slowing, count on Illinois’ competitive disadvantages to become more obvious in the coming years.

Appendix

Read more from Wirepoints:

- Four more Illinois factories close or lay off workers

- Illinois’ long slide in manufacturing jobs continues

- Illinois tax rates out-of-sync with those in neighboring states, most of the nation

- New ranking shows worsened business tax climate for Illinois

- Reality check: $200 billion in federal bailouts hasn’t rescued Illinois from the bottom of the barrel

At $1.5 million per job, the new incentive package from the state is at least 15 times the norm. For this much money, the state could have just handed out a million bucks to 827 people, instead of creating 550 jobs.

At $1.5 million per job, the new incentive package from the state is at least 15 times the norm. For this much money, the state could have just handed out a million bucks to 827 people, instead of creating 550 jobs. Ted joined Jeff Daly to discuss the university student protests erupting across the nation on the Israel/Palestine conflict, why it’s so dangerous for society if the media abandons facts in favor of narratives, why that allows government to spin away the problems like crime and financial crises, why it causes the voting public to become apathetic, and more.

Ted joined Jeff Daly to discuss the university student protests erupting across the nation on the Israel/Palestine conflict, why it’s so dangerous for society if the media abandons facts in favor of narratives, why that allows government to spin away the problems like crime and financial crises, why it causes the voting public to become apathetic, and more. When you hear the complaints from Illinois politicians, remember the hypocrisy: 40,000 bused to Chicago, but 161,562 allowed to fly directly to Florida.

When you hear the complaints from Illinois politicians, remember the hypocrisy: 40,000 bused to Chicago, but 161,562 allowed to fly directly to Florida. Nearly one year ago, Chicagoans cheered Mayor Lori Lightfoot’s removal from office. In her place was Brandon Johnson, who promised a more inclusive approach to building a “better, stronger, safer Chicago.” It hasn’t turned out that way. Today, there’s little disagreement that Mayor Johnson has disappointed on most key issues. On crime. On policing. On migrants. On education. On governance. Even on foreign affairs.

Nearly one year ago, Chicagoans cheered Mayor Lori Lightfoot’s removal from office. In her place was Brandon Johnson, who promised a more inclusive approach to building a “better, stronger, safer Chicago.” It hasn’t turned out that way. Today, there’s little disagreement that Mayor Johnson has disappointed on most key issues. On crime. On policing. On migrants. On education. On governance. Even on foreign affairs. Ted joined Dan and Amy to talk about the problems and costs of the Chicago Bears’ proposed new stadium, why its unlikely to happen in its current form, why the ongoing wave of violent crimes makes residents scared of the city, and why the funeral of slain police officer Luis Huesca matters to Mayor Johnson’s reputation.

Ted joined Dan and Amy to talk about the problems and costs of the Chicago Bears’ proposed new stadium, why its unlikely to happen in its current form, why the ongoing wave of violent crimes makes residents scared of the city, and why the funeral of slain police officer Luis Huesca matters to Mayor Johnson’s reputation.

Tennessee is just a one day drive from most of Illinois, and our numbers in the above graphs look good. You could jump from the bottom end of the graphs to near the top in 2024, or you can stay in Illinois and complain about it for the rest of your life. What are you waiting for?

Covid revealed much about government at all levels. Florida and other better run states had their tax $$$ filtered through Washington and flushed into places like debt ridden Illinois only to be spent foolishly. Think of the emergency hospital McCormick Place became, heavily staffed with connected people and lightly used. Think of all those Payroll Protection loans fraudulently obtained by public sector employees. All waste and the only residue is cheapened money for anyone with savings.

The Federal Government committed fiscal suicide with the trillions pumped into the economy in supposed Covid relief. Between the massive fraud, free stuff for couch dwellers and silly green initiatives, very little positive long term impact will be realized. But the need to issue more Government debt at higher interest rates isn’t going away, which will eat up a much greater percentage of the Federal budget. If you’re a saver, take advantage of those attractive rates so you at least realize some benefit.

Well we’ll need another federal bailout soon. I wonder what the disease will be this time……

It’s already starting, bird flu detected in cows milk, mooooo

This was all apart of their plan with the plandemic scam of 2020

Cue the “it’s Rauner’s fault” for when things start to turn south.

It’s always somebody else’s fault never the politicians at hand.

The Pritzker’s all profited from Covid and JB’s unwarranted lockdowns. The government class, Democrats main benefactor, continues to be rewarded with unearned largess from taxpayers. As WP has stated before, IL taxpayers are in an abusive relationship with the Democrats who control the state. It’s ALL bad, and unfixable.

To hear Pritzger bellow, he did it all by himself with the pot dispensaries, failing electric motor plants and the casino that is taking in far less than projected.