By: Ted Dabrowski and John Klingner

Illinois’ wouldn’t be the fiscal and economic outlier it is today if it didn’t lose so many people to other states. Illinois is consistently one of the nation’s biggest losers of people and their incomes according to the IRS, and this most recent year is no exception.

Illinois’ chronic outflow of residents has cost the state at least $25 billion in lost income and sales tax revenues over the last 20 years, including about $4 billion in 2020 alone.

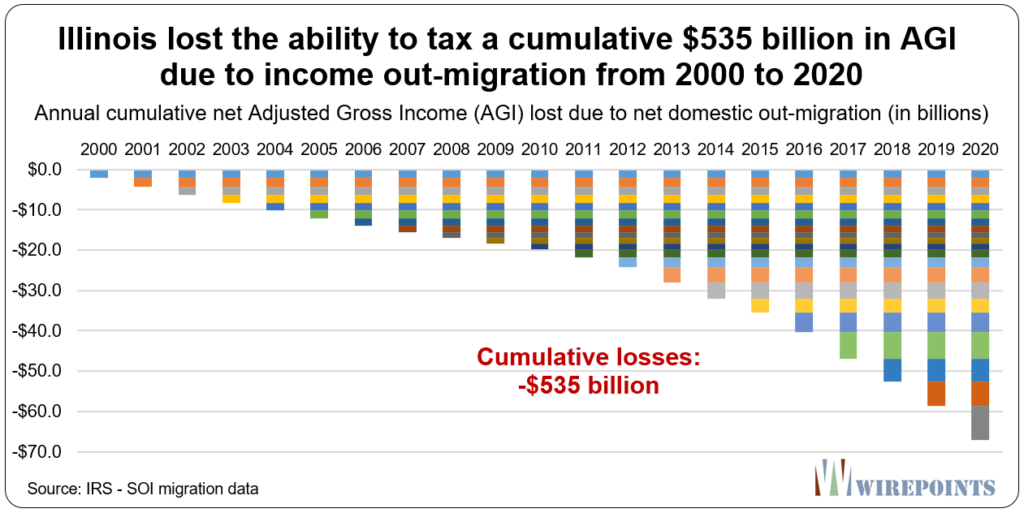

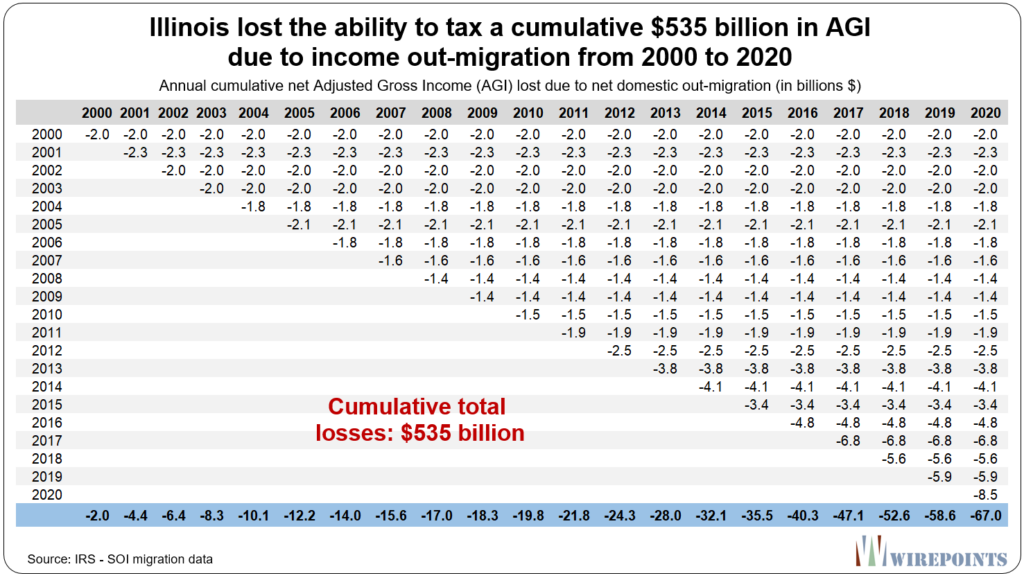

Those losses are based on IRS numbers that detail Illinois’ net loss of taxpayers and their incomes due to out-migration. When Wirepoints summed up Illinois’ losses in Adjusted Gross Income (AGI) since 2000, we found the state had lost a cumulative $535 billion in AGI that it could have taxed over the entire reported 2000-2020 period.

In this piece, we explain what two decades of fleeing residents mean in terms of cumulative income that has fled Illinois. That $535 billion in missing AGI represents not only $25 billion in forgone state tax revenues, but incalculable losses in entrepreneurship and economic activity, too.

The losses pile up on each other year after year

To fully comprehend the negative impact of losing people, you must first understand the impact of Illinois’ income out-migration over the past 20 years.

Here’s the key: The negative impact is not just how much AGI was lost in the current year. Instead, to capture the full impact in that year, you have to add up the AGI that was lost in every previous year as well.

In filing year 2000, the first year of data analyzed by Wirepoints, Illinois lost $6.6 billion in AGI due to the out-migration of 237,000 residents the previous year. In contrast, the state gained from other states just 175,000 people with a collective income of $4.6 billion.

On net, Illinois lost the ability to tax $2.0 billion of AGI in 2000.

But that’s worse than it appears. Not only was that $2 billion not there to be taxed in 2000, it was still gone in 2001 and 2002 and 2003…all the way through 2020.

In 2001, the same thing happened again. The state netted a loss of another $2.3 billion in AGI. That $2.3 billion, just like the previous year’s $2 billion, also wasn’t available to be taxed, this time in 2001 and beyond.

Illinois suffered that same situation through 2020, with the state averaging net losses of $3.2 billion in income every year – losses that built on themselves over the two decades. In 2020, the most recent reported year, Illinois lost a record net $6.5 billion in AGI.

That’s the real problem with Illinois’ chronic outflows. One year’s loss doesn’t just affect the tax base the year the income is lost, it also impacts all subsequent years. The losses pile up on top of each other, year after year.

And when a state loses incomes to other states for 21 years straight, the numbers get big. Illinois has lost a cumulative $535 billion in AGI that it could have taxed over the entire 2000-2020 period.

That $535 billion number is hard for anyone to wrap their head around, so let’s consider the impact of out-migration just on 2020.

In total, Illinois was down $67 billion in Adjusted Gross Income that year. The AGI losses were made up of the $2 billion that’s been missing since 2000, the $2.3 billion from 2001…all the way to the $8.5 billion gone in 2020.

If that $67 billion in AGI had never left the state – said another way, if Illinois had simply broken even over the 20 years – Illinois would have had about $2.5 billion in additional income tax revenues in 2020. That’s based on a 4.95 percent tax rate after taking deductions and retirement income into account.**

Illinois also missed out on sales tax revenues. The spending of that AGI would have generated another $1.3 billion when applying the existing ratio between the state’s total AGI and state sales tax revenues.***

Of course, the spending of that AGI would have generated a host of other tax revenues for the state as well, in the form of gas taxes, license fees, etc. Add it all up and the lost AGI cost the state at least $4 billion in lost revenues.

The same exercise in 2019 shows the accumulated lost AGI of $58 billion would have brought in $2.2 billion in income tax revenues and $1.2 billion in sales tax revenues.

Rinse and repeat going all the way back to 2000. Illinois has lost out on at least $25 billion in additional tax revenues since the turn of the millennium due to people leaving.

Reversing the flow

More than anything, those lost revenues represent the fundamental crisis this state faces because of chronic out-migration. Illinois is stuck in a vicious downward spiral it can’t hope to escape from without fundamentally changing how it governs.

Structural property tax reform, reductions in pension debt, slashing units of local government – the state needs to do all these things if it wants to convince Illinoisans to stay and persuade other Americans to move in.

************************************

*The IRS 2019-2020 Migration Data refers to tax returns that were submitted to the IRS in calendar years 2019 and 2020, which corresponds to tax returns, and income that was earned, for in 2018 and 2019, respectively.

**Wirepoints calculated $4 billion in additional income tax revenue through the following: Of the $67 billion in missing Adjusted Gross Income, an estimated $3 billion in standard exemptions was removed from the total. To adjust for the fact that Illinois does not tax retirement income, Wirepoints cut another $13 billion (20 percent) from the $67 billion. That 20 percent is derived from the IRS migration data that shows an average of 20 percent of AGI lost to out-migration each year due to Illinoisans 65 and older leaving. The remaining $50 billion was multiplied by the state income tax rate (4.95%) to arrive at $2.5 billion in income tax revenues

***Wirepoints calculated that the average share of state sales tax revenues to total Illinois AGI between 2012 and 2020 was nearly 2 percent. So, adding $67 billion in AGI would result in $1.3 billion in additional sales tax revenues in 2020.

Read more from Wirepoints:

- New 2020 IRS migration data reveals Florida is the biggest winner, New York is the biggest loser, in the competition for people and their wealth

- The Covid bailouts can paper over Illinois’ fiscal mess, but they can’t hide Illinois’ GDP, employment and population failures

- Illinois needs a multiyear restructuring plan to stop residents from fleeing

Hopefully, all media will get the message, in Illinois, too.

Hopefully, all media will get the message, in Illinois, too. Ted joined Tom Miller of WJPF to talk about Illinois’ highest-in-the-nation property taxes, why lawmakers don’t want to touch the tax’s cost drivers, just how much Illinoisans’ tax burden has grown over the decades, why Gov. Pritzker failed to meet his promise to reform property taxes, and more.

Ted joined Tom Miller of WJPF to talk about Illinois’ highest-in-the-nation property taxes, why lawmakers don’t want to touch the tax’s cost drivers, just how much Illinoisans’ tax burden has grown over the decades, why Gov. Pritzker failed to meet his promise to reform property taxes, and more.

Ted joined Dan and Amy to talk about the free speech controversy brewing in Wilmette due to the city’s refusal to fly a religious freedom flag, the city’s left-wing excesses and the growing culture war, the latest money spent on the illegal immigrant crisis, and more.

Ted joined Dan and Amy to talk about the free speech controversy brewing in Wilmette due to the city’s refusal to fly a religious freedom flag, the city’s left-wing excesses and the growing culture war, the latest money spent on the illegal immigrant crisis, and more.

Are these figures adjusted for inflation? I assume so, but it’s not clear. Also, they don’t capture the natural increase in AGI that working age people experience as their careers mature. There are also economic multiplier effects of losing spending to other states and compounding effects of losing so much consistently for so many years. The overall implications of such long-term low growth and outmigration are mindbogglingly large.

I finally washed my hands of the whole affair and reluctantly moved 5 years ago. Still have family and friends that have yet to leave. My decision was based on numbers-the bond reports. The picture they paint for the future, based on the numbers, is chilling. Chicago residents have no idea how much pain is to come due to their future having been mortgaged for short term relief. Total amount due does not decrease, but number of taxpayers obligated to pay the bills decreases. And that’s not good.

With a recession becoming more likely, the window to leave Illinois may be closing for some residents. Finding a job outside of Illinois will become increasingly difficult. Consider what happened during the last recession of 2008. Unlike other states, Illinois did not quickly bounce back. Home values didn’t recover, and jobs were permanently lost. I expect the next recession could be the knockout punch.

But, but, but, “U.S. Treasury Secretary Janet Yellen said on Thursday she did not expect the U.S. economy to tip into a recession, but growth would “absolutely” slow down and gasoline prices were unlikely to fall anytime soon.” LOL, our leadership is so completely inept, every major country in the world is staring down recessionary pressures, every one sees a recession coming from all angles, and our treasury secretary lies to our faces and says a recession is no coming. The only way we’re not getting a recession is if Yellen herself jukes the stats and like China, just issues… Read more »

Yellen knows as much about recession as she did inflation. Idiot! When I think that Biden has not even been in office for 18 months and we have more than two and a half years of this dumb, corrupt (but diverse) administration, I am frightened, very frightened. It will be a very long time before we recover. The only small hope for the immediate future is the likely possibility of Republican victories in November 2022. But, even then so many Republicans are spineless RINOs. I am near despair about our future as a nation.

I’m hoping that we as a country turn our sights on all Biden supporters and treat them like the French treated the Vichy after WW2. Traitors, collaborators, and imprison as many as possible, life without parole for these criminals.

Democrats suggested doing this to Trump supporters, but considering that Biden’s coup made things 1000x worse, the day of reckoning is coming, and Biden supporters better repent, loudly and publicly, because political retribution and political revenge is coming, with impeachments, criminal charges, imprisonment, banishment from society.

Republicans will take back congress next election. The real question will be what happens in the election 2 years after that. I predict it won’t be Biden or Trump. (I don’t think either will run.)

You mean like the indictments issued for Hillary Clinton, James Clapper, John Brennan, Adam Schiff, et al? Won’t happen. The swamp protects its own. If Trump couldn’t (or wouldn’t) drain it, nobody will.

We can dream, right?

Illinois will not recover from another recession. Most states will recover. Currently, some have a surplus due to fed covid relief. The last I checked, my state has a small surplus per household while Illinois has over $50,000 of debt.

If the recession hits hard, all of Illinois should have a junk rating in a couple of years.

Sadly you might be correct. The endless lockdowns and condition and health of the state and the city are at great risk. I think the best advice I can offer is having one person in your family plant a flag somewhere out of state or country. I think independent business people, entrepreneurs, digital nomads, may have already made this move. You can see the out of state plates on the North Shore everywhere now. These are not just senior retirees. So for everyone else who this doesn’t apply to here is what we did: 1. One person moves for a… Read more »

Good advice.

FYI: reddest state within an eight-hour drive of Chicago is Tennessee

The sky is falling. The sky is falling. You people are scared of your own shadow.

I do save for my retirement and I do have an advisor and I said to him “I’m going to get screwed they are just take my money for all the other people that don’t save for retirement” His response…. Just be glad your the one they are taking it from and not the people they are trying to get it for. This is how I equate the states pension, hey folks I can leave if there ain’t no money, there ain’t no money, if you got a public pension you WILL be screwed.

It might get to that point but changing the State of Illinois constitution will be very difficult because of who runs Springfield. Your assumptions put Illinois in receivership much like what happened when Detroit went under. Those in power and control could not allow this to happen because they would be destroying their own retirement along with their retired former co-workers. The unions and politicians were very smart when they colluded with Republican administrations to get this passed in the dead of night when no one was looking.

Wirepoints is doing a great job of getting these statistics out there, their work even being picked up in some national news outlets. Unfortunately, it is being totally ignored by local media, such as the Trib, Sun Times, Daily Herald, TV, etc. Of course, no politician like Pritzker will touch it. He just brags about delaying the gas tax and BS statistics that show a rosy picture. And how many residents really realize the impact of these numbers? Those who do are leaving and taking more AGI with them. We left in 2021 and took a good chunk of AGI.

I have mixed feelings about that. On the one hand, we of course think they should be citing our research more often. On the other, it means we continue to pick up readers that they lose. That’s a reflection not only of the control of the wokesters over the newsrooms but their stupidity as a business matter. Our work has been cited approvingly and often, as you say, by top national sources. Adding to the silliness of it all, we send many hundreds of thousands of page views to them through the links on the left two-thirds of our cite.… Read more »

These are economic and education numbers, neutral, having nothing to do with Trump, MAGA, LGBTQ, Fox, white supremacy, etc. The IL wokesters should be very concerned with these number, as you say, they indicate IL future collapse, along with pension debt.

Thank you, Mark and Ted and Matt and John and everyone else at Wirepoints! You do outstanding work ! Every single day !

I hope every reader out there recommends Wirepoints to everyone they know. You are all so appreciated.

Screw the legacy media. They mean nothing. They have no relevance and their influence is disappearing into obscurity. One of Trump’s many flaws was that he tried to gain acceptance and favor from the legacy media. He really wanted NYT, WaPo, NBC to really like him. He gave Bob Woodward unprecedented access to the White House and gave him multiple interviews. Communist Bob Woodward, the FBI plant in the legacy media, who got all his Watergate info from …the FBI…What was Trump thinking? DeSantis, in an interview with Tucker, said that he doesn’t care to give interviews to legacy media… Read more »

Hey Mark,the local news doesnt focus on these topics because its WAAAY more important to talk about racist statues,hair discrimination,and how the lgbtqs,or whatevever they call themselves,are being oppressed and discriminated against

“The losses pile up on each other year after year“

The worst years are still to come for Illinois.