If they have an excuse for this, none is apparent, and we can’t think of one.

Eight days ago Governor Pritzker released his proposed rates for a new progressive income tax, including his estimate of additional revenue to expect — $3.4 billion.

But he provided no support for that revenue claim, which we and others immediately said looked very suspicious. We’re still waiting. Pritzker has long said a progressive income tax is the key to solving our fiscal crisis and funding other promises he made.

The Civic Federation took a close look and said it “has not been able to replicate the $3.4 billion number and the Governor’s Office has not yet provided information about the methodology used to arrive at the figure.” The Illinois Policy Institute has been particularly critical. In response to their FOIA request for the administration’s basis for its projection, the administration said it needed more time.

Our own back-of-the-envelope calculation indicated a lower estimate than Pritzker’s, too. We didn’t make a more serious effort or share ours because we have only 2016 information on stratification of Illinois income groups to work off. That’s the latest we could get from our own FOIA requests, from the Rauner Administration as well. That, too, is inexcusable – more current data should be publicly posted.

I expect the administration eventually will show reasoning based on estimates of 2021 income stratification – optimistic ones that nobody has. That’s the first year a progressive tax could legally be levied. That might partially explain why nobody can confirm their numbers. However, I also suspect they did not dynamically score their estimate. That is, they did not adjust down to reflect how tax increases affect behavior, resulting in lower taxable income.

We’ll see, but it’s pretty clear what’s going on: The Pritzker Administration is backward solving to come up with justification for its projection. That’s no way to do it. They should have initially made the calculation objectively, which would have made it immediately available to share with the public.

Aside from that matter of process and transparency, it doesn’t matter much what the right number turns out to be. Even Pritzker’s $3.4 billion solves little. It would barely dent the true budget hole Illinois faces, as we wrote earlier.

UPDATE: Subsequent to writing this, the governors office released further details of its calculations, linked here.

–Mark Glennon is founder of Wirepoints.

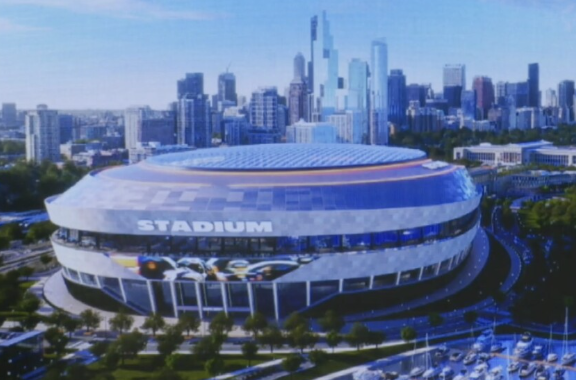

Ted joined Scott Slocum to talk about the huge potential cost to taxpayers for the Bear’s proposed new stadium, why the economics of publicly-funded sporting arenas don’t work, what the latest criminal justice statistics tell us about the SAFE-T Act’s impact so far, the latest developments on Chicago’s ongoing migrant crisis, and more.

Ted joined Scott Slocum to talk about the huge potential cost to taxpayers for the Bear’s proposed new stadium, why the economics of publicly-funded sporting arenas don’t work, what the latest criminal justice statistics tell us about the SAFE-T Act’s impact so far, the latest developments on Chicago’s ongoing migrant crisis, and more. We’re supposed to worry that climate change itself is to blame for Illinois’ failing climate policy, but far bigger problems are obvious.

We’re supposed to worry that climate change itself is to blame for Illinois’ failing climate policy, but far bigger problems are obvious. Traumatizing robberies and violent crime continue to go up in Chicago this year, hitting a six-year high compared to the same time last year. It’s crime in neighborhoods perceived as safe, sometimes taking place in broad daylight, that’s driving the increased fear among Chicagoans and suburbanites.

Traumatizing robberies and violent crime continue to go up in Chicago this year, hitting a six-year high compared to the same time last year. It’s crime in neighborhoods perceived as safe, sometimes taking place in broad daylight, that’s driving the increased fear among Chicagoans and suburbanites. Ted was on The Chicago Way with John Kass and Jeff Carlin to discuss the proposed $5 billion lakefront stadium project proposed by the Chicago Bears & Mayor Brandon Johnson, why Chicago is struggling compared to other metro areas across the country, why the city might or might not go the way of Detroit, and more.

Ted was on The Chicago Way with John Kass and Jeff Carlin to discuss the proposed $5 billion lakefront stadium project proposed by the Chicago Bears & Mayor Brandon Johnson, why Chicago is struggling compared to other metro areas across the country, why the city might or might not go the way of Detroit, and more.

Wow, I never thought that I, of all people, would be providing you with more ammunition, but intellectual honesty compels me to do so. The main problem with the projections provided by the Governor’s office is not the absence of dynamic scoring; instead, the biggest issue is an implicit reliance on overly optimistic stock market returns. Here is the key statement from the linked document: “To reach the 2021 projection, the team used data from the 2016 tax year, the most recent year for which complete data is available. They assumed filers’ income for 2021 would have grown at the… Read more »

He admits the plan will not raise enough revenue. Overestimating revenues is precisely our problem with the plan. It means tax hikes for more taxpayers (the middle class) than initially promised. The plan is a bridge to higher taxes. It is sold as a tax cut for 97% and everyone knows it s a lie.

I consistently ask progressives if they believe tax increases are exogenous to economic productivity; they respond with a blank stare or change the subject. I would be shocked if the Pritzker administration would ever dynamically score any tax.

But they are happy to claim tax policy does change behavior if it’s for one of their progressive policies like the plastic bag tax, taxes on carbon emissions, etc.