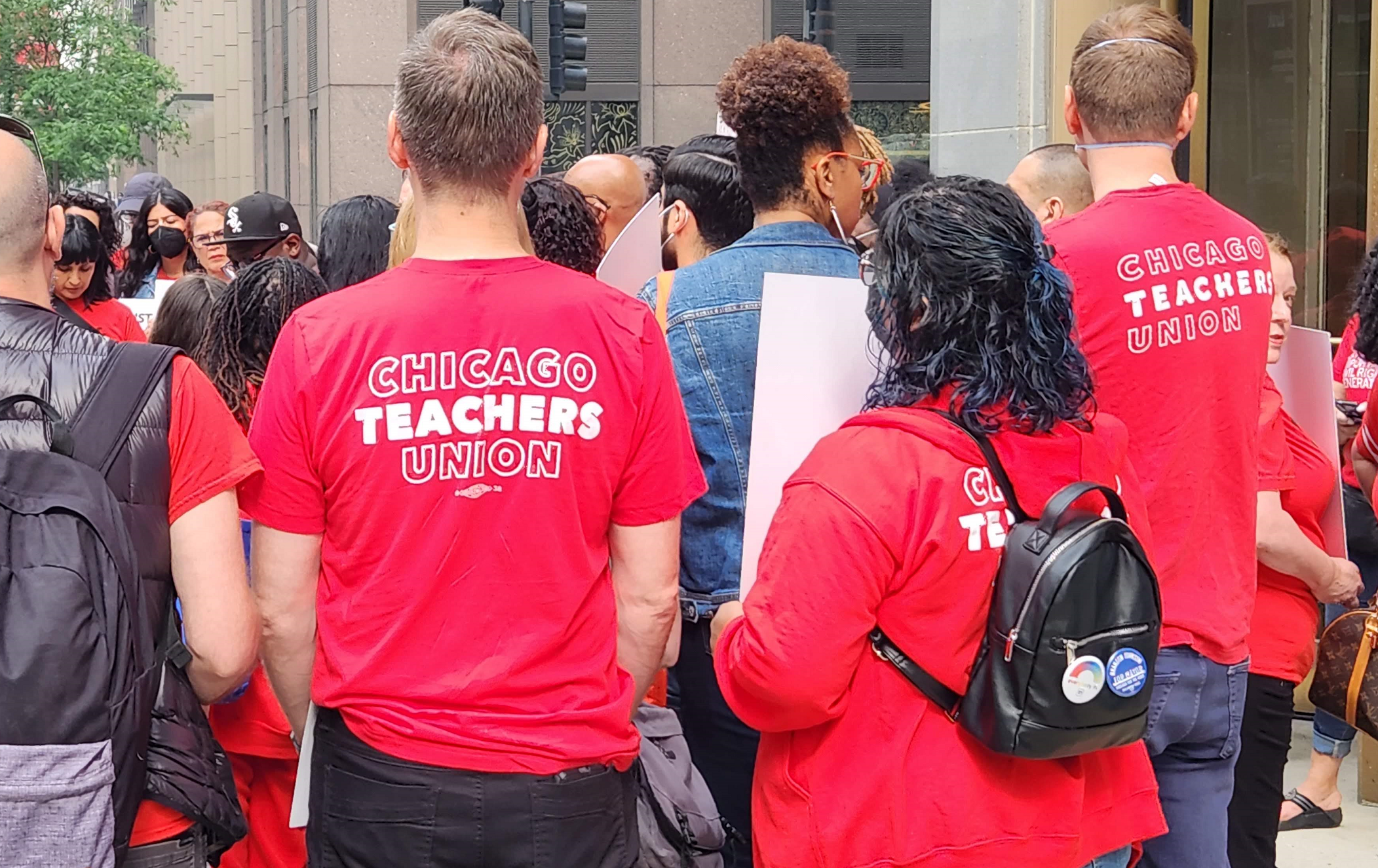

Chicago Teachers Union contract demands are totally divorced from reality – Wirepoints

Details emerging about Chicago Teachers Union’s upcoming contract show just how divorced its demands, both extreme and expensive, are from the reality at Chicago schools. It’s not just about massive salary increases, but also about money for migrant students, climate initiatives, abortions and gender-affirming care. About blocking parental notification. Count on CTU’s demands to veer further from reality until the public finally says no.

Details emerging about Chicago Teachers Union’s upcoming contract show just how divorced its demands, both extreme and expensive, are from the reality at Chicago schools. It’s not just about massive salary increases, but also about money for migrant students, climate initiatives, abortions and gender-affirming care. About blocking parental notification. Count on CTU’s demands to veer further from reality until the public finally says no.

Gov. JB Pritzker calls it “ethics” reform.

Gov. JB Pritzker calls it “ethics” reform. It’s rare to see city leaders in Chicago take an open, unabashed stance on the collapse of literacy. To complain is deemed as too political, too racist or too anti-public schools. So it’s refreshing to see Willie Wilson, a successful businessman and leader of the black community, call for a literacy initiative “with the goal of getting 100% of Black students reading at grade level.”

It’s rare to see city leaders in Chicago take an open, unabashed stance on the collapse of literacy. To complain is deemed as too political, too racist or too anti-public schools. So it’s refreshing to see Willie Wilson, a successful businessman and leader of the black community, call for a literacy initiative “with the goal of getting 100% of Black students reading at grade level.”

Here’s an article about the pensions unfunded liabilities. No state is 100% funded. If correct the liabilities are over $8T. California and Illinois lead the pack while Wisconsin is 56% funded.

https://www.naturalnews.com/2022-06-14-bidenflation-collapses-economy-unfunded-state-pension-bomb-ready-to-explode.html

Yes, I think that’s easy to believe. People in IL are right to be aggravated about IL having such a mind-blowingly large public employee pension debt obligation. When the ILSC overturned the pension reform proposal in 2015 they did so by saying in part that governments always can find places and and have authority to put taxpayer money elsewhere despite the clear obligation to fund those public pensions. So, while we have the “pension clause” in the IL Constitution it has no teeth in practice. So, blame the public pensioners as people will do, but the funding of IL government… Read more »

Thanks. With a $8T pension underfunding/supply chain issues/crime/almost runaway inflation/stock market almost into bear territory/climate change/fires/ heat waves/Covid/war and threats of war it seems like Biblical prophecy coming true sooner than later. All these coming together is almost a perfect recipe for disaster happening in a very short time. How we get out of this will be doable but should be addressed from multiple fronts.

What makes this downturn extremely unusual is that it’s in both stocks and bonds, pensions’ two biggest asset categories. Bond funds are down 10-20 percent YTD.

Saw this on Twitter:

One big difference between then and now was that interest rates were not at artificial lows thanks to the Federal Reserve’s actions for assorted reasons. Interest rates are generally two components; 1 a return to the lenders for use of their capital and 2 the going rate of inflation. Rates are and have been nowhere where they should be for a long time and as we all know sooner or later the markets return to normal. Stocks, houses and bonds have and are stimulated by the Federal Reserve’s various actions to hold rates far below what they should be. As… Read more »

No one thought they’d burn through their COVID relief checks this quickly due to inflation. Now it look like we’re gonna burn through last year’s 25% pension investment gains in just one year.

Love the back and forth. I thought our Governor just stated the financial state of IL. was solid. Don’t we believe him. Sorry folks I do not!!

So, if the coming recession lasts for several years, how will the pensions be paid ? You cant get blood out of a turnip.

Illinois is full of bloody turnips.

The potholes on your street cannot be fixed because a pensioner is taking a fancy cruise next month; the playground equipment at your school is dilapidated and dangerous because a pensioner just purchased an RV; the pool in your community is closed because a pensioner needs to purchase a new sexi-truck; the dorms at your state college are 70 years old because a pensioner just built a pool in their back yard; our IL state parks are in disrepair because a pensioner just took a trip to Italy. Yet, there is still areas of the state that have not yet… Read more »

It’s their money so they can spend it any way they choose. Don’t hate on pensioners because they have a solid retirement plan. The state is broke because they didn’t set the money aside and the voters were complicit in their ignorant financial planning. Better raise taxes if you want those services/upgrades you describe.

Don’t hate on pensioners because they have a solid retirement plan.

Talk about whistling past the grave yard, hahahah

“Talk about whistling past the grave yard, hahahah”

Remember that while you write your property tax check. hahahah.

You’re my bitch debtsor. Just keep on paying me. Prime steaks and high end wine.

The mask drops, revealing what we have always known was behind it.

PPF doesn’t deal with the problem that raising taxes is not a solution. First, taxes have to be raised on the population that can actually pay appreciable taxes. Easy to talk about taxing the so called rich but their numbers are decreasing in Illinois. The defeat of the income tax amendment reflects how difficult this task is because even in a very blue state people have little trust in how government manages money. Second, if tax increases get passed, good luck with the budget. Every recent tax increase has been accompanied by growth in the pension deficit. The political crowd… Read more »

Yes. I was referring to his characterization:

“You’re my bitch debtsor. Just keep on paying me. Prime steaks and high end wine.”

All the talk of contracts and constitutional amendments is just a cover for the naked desire to control those of us they consider to be their serfs. PPF finally said exactly what he means.

Well, we all are the pensioners’ bitches while we live in this state. Until we leave. We each have to weigh the pluses and minuses of why we stay here.

This site captures so many people that hate the state but even in this cohort most people stay and continue to pay taxes. The state continues to vote in the same politicians and are getting exactly what they deserve. You love paying me money each and every month. Quit complaining and embrace your destiny.

Ironically, I’m bleeding this golden goose dry, making as much money as I can, and spending it out of state, until such time that I am unable to make as much money, then I’ll leave and stiff the rest of you all with the bill!

And someone else will then try to milk the state dry until they leave. Those people will of course pay taxes as well. Illinois will continue to survive and be just fine. I’ll keep cashing checks!!!

The losers will of course continue to complain. Such is life.

Willowglen and others are delusional to think taxes won’t continue to rise. The state owes the money and they will pay. Either cut services or raise taxes. Either way pensioners are getting paid first. Maybe some day pensioners will receive a small cut around 5% but until then they will continue to increase their pension checks 3% per year. Pay your bills and stop trying to steal from retirees.

And don’t forget how IL politicians have banned investments in “bad” industries such as fossil fuels, tobacco, etc. in favor of “green” investments. How is that working out?

Only the beginning

Geez. What a surprise. Wirepoints and others have been saying for years that the Democrats’ BS on pension reforms is all fluff. When the first downturn hits it will be disaster. Well here we are. Wait till the various pensions funds make their requests to the Legislature in January for their annual funding handout. It will be a choker. “Billions ” will be the operative word.

I don’t begin to know why this was even published. Is there even one reader out there who doesn’t implicitly realize that all investments ebb and flow? Some years show positive results and others the reverse. It has ever been that way. Do we need a news article to tell us the obvious? Duh!

So, James, what do you think about public employee unions that tout and shill on behalf of Illinois politicians who divert our tax dollars that should be going to guvmn’t employee pensions so that they can promise “other stuff to other people” in return for their votes. How about giving me one, just one, example of a statement by someone from SEIU, AFSCME or CTU that publicly withdraws the union’s endorsement from ANY Illinois Democrat because the union has (correctly) concluded that Springfield’s paying for fraud-plagued public aid, crumbling roads-n-bridges and inadequate public safety with money that they’ve also promised… Read more »

Always a fan of The Music Man – great reference. You had me singing along!

But, not a fan of the Gov and his mishandling of just about everything.

Your comments are irrelevant to my posting and so much so I stopped reading two sentences into it. From your general tone it appears you can give your own version of my take on it without my bothering to do so, I’m quite sure.

“….so I stopped reading two sentences into it.” Oh, how typically “progressive” – how “Illinois Democrat” I really enjoy reading your comments on those (not infrequent) occasions when you make yourself the poster-child for the “thinking” that’s created the sad financial and governance failures which afflict our state. Certainly spared you from answering either of the (only) two very basic questions I asked you to discuss in my response. Both of which, of course, were entirely relevant to your obfuscating post, wherein you tried to misdirect the conversation away from Illinois’ pestilentially underfunded public employee pensions by claiming that because… Read more »

Blah, blah, blah, black sheep. Keep working yourself into a lather.

What, me worry? My public pension is guaranteed to only go up.

Only the lowly taxpayers need to worry about investment returns.

When does worrying do any good when it comes to stock market results? They rise and fall periodically, and just when you think when it will do such things chances are it will fool you. As to the rest I no maka da rules!

The point of the comment, James, is that the material decline in the value of assets, and therefore the bump up in unfunded liability, has a direct impact on the budget request each of the pension funds make. That is the request to the Legislature for how much that particular pension fund gets in the budget each year. The total of those higher requests, added to the fact that the State won’t be getting any handouts from the federal government again, means the budget is going to be in a shambles.

Sure, that’s the way it works. Sometimes the relationship is positive for the state’s financial status and sometimes its negative. What else is new under the Sun?

Bend over and pay up Illinois.