Chicago Teachers Union contract demands are totally divorced from reality – Wirepoints

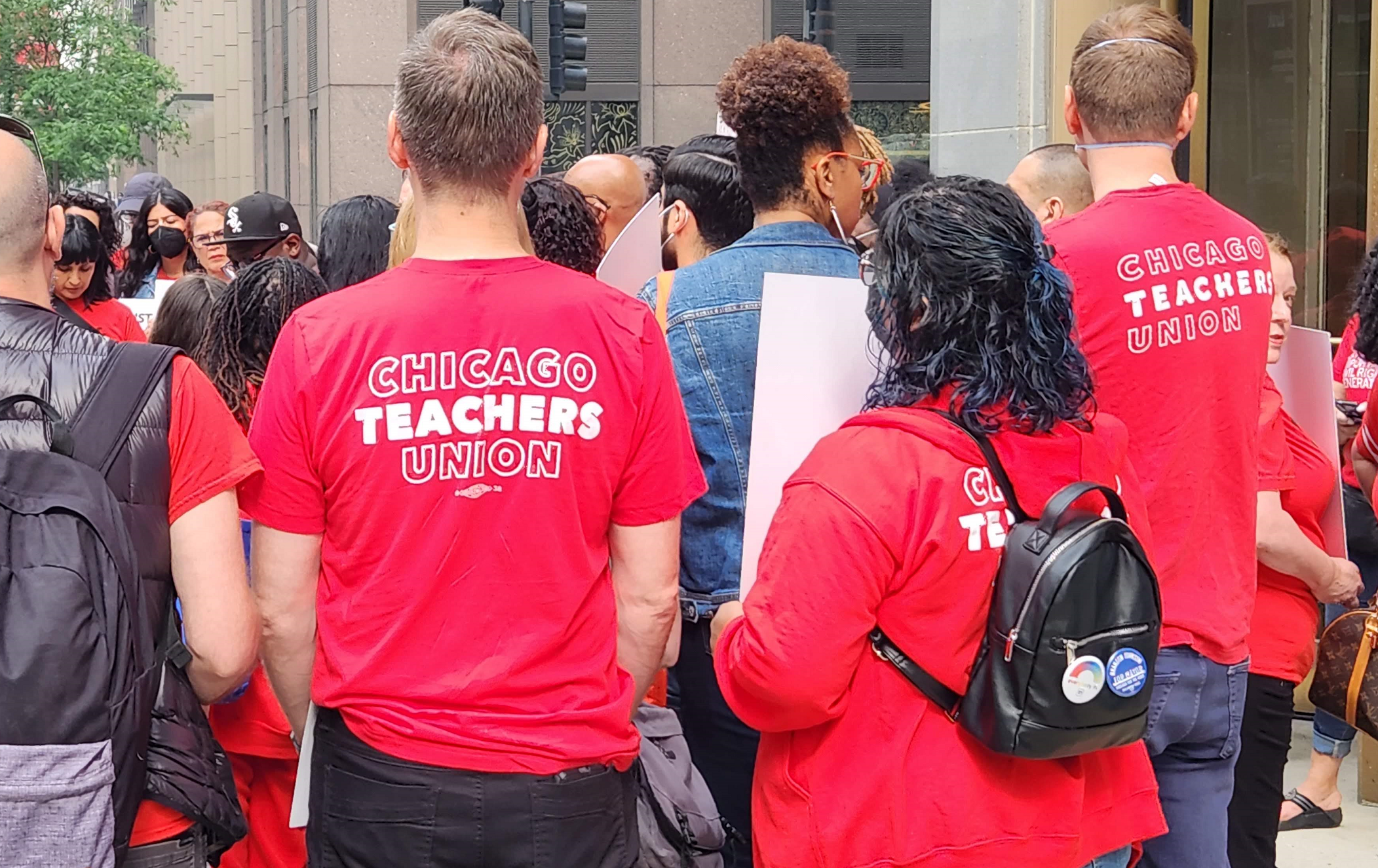

Details emerging about Chicago Teachers Union’s upcoming contract show just how divorced its demands, both extreme and expensive, are from the reality at Chicago schools. It’s not just about massive salary increases, but also about money for migrant students, climate initiatives, abortions and gender-affirming care. About blocking parental notification. Count on CTU’s demands to veer further from reality until the public finally says no.

Details emerging about Chicago Teachers Union’s upcoming contract show just how divorced its demands, both extreme and expensive, are from the reality at Chicago schools. It’s not just about massive salary increases, but also about money for migrant students, climate initiatives, abortions and gender-affirming care. About blocking parental notification. Count on CTU’s demands to veer further from reality until the public finally says no.

Gov. JB Pritzker calls it “ethics” reform.

Gov. JB Pritzker calls it “ethics” reform. It’s rare to see city leaders in Chicago take an open, unabashed stance on the collapse of literacy. To complain is deemed as too political, too racist or too anti-public schools. So it’s refreshing to see Willie Wilson, a successful businessman and leader of the black community, call for a literacy initiative “with the goal of getting 100% of Black students reading at grade level.”

It’s rare to see city leaders in Chicago take an open, unabashed stance on the collapse of literacy. To complain is deemed as too political, too racist or too anti-public schools. So it’s refreshing to see Willie Wilson, a successful businessman and leader of the black community, call for a literacy initiative “with the goal of getting 100% of Black students reading at grade level.”

Plain and simple: Life is tough – go get a job and pay your own student loans. Nobody owes you a damn thing.

Sickening these mooches believe everyone else should pay for their largess. The FED and it’s bee ess lending policies created the massive cost increases in schools. My wife an I have paid over $350,000.00 for our University degrees and our children’s. If these scum pass this, they also owe us $350K with interest!

If you can sue Trump University for a bad product why not any other university.

In AG-speak, cancelling student debt is the equivalent of paying the hospital bill for smokers without holding the tobacco companies accountable for the damage caused by their product.

The tobacco industry was punished for marketing practices and public deception regarding the health risks that cigarettes pose to consumers. Higher education did the same thing.

In exchange for cancelling student debt, universities should be required to co-sign any all all student loans going-forward and bear the responsibility for any unpaid debt. University funding will be tied to how much debt is forgiven: the more refunds, the less state

funding received.

Put the school’s money where their mouth is and you’ll see changes overnight.

Just cancel the whole program. it in another FAILED government program.

Why hasn’t cancelation of the degree/accreditation been stipulated as a condition of loan forgiveness?

If the product (educational degree plus years of housing and beer and pizza) is being returned for a full refund, why should the buyer get to keep the product AND the refund?

Obama took the student loan program away from banks and brought it in- house to the Federal government to save money and be more equitable. Now faced with the monumental debt of unpaid loans, Bunny Biden wants to erase the debts completely and leave the middle class on the hook for whats already been lost. Voting Democratic is insane!

There’s good arguments on both sides of the student debt issue, but one thing that might be pretty bi-partisan is eliminating the interest on student loans.

Why is the government charging interest or allowing loan companies to do this on student debt?

What is the profit motive for issuance of non-collaterized loans? Why would anyone lend you anything without you paying a vig to cover their risk? The better question being the loan system just continues to perpetuate our current clownworld university system. Why not keep issuing loans, but make the universities co-signers on each loan issued. Then there is skin in the game, and the universities know they are on the hook for when their blue haired sociology graduates fail, they themselves will be having to pay for propping this failure onto society. This will prune courses, and introduce efficiency and… Read more »

The baseless assumption that student loans are “collaterized” by the debtor’s ability and willingness to repay their loans with the income resulting from their post-secondary clownworld university degrees is at the foundation of our student loan mess.

Many of these debtors and cosigners signed these loans knowing that the potential degree wasn’t going to make repaying their student loan painless, or even possible. They assumed, or were told, because, because, because – ad infinitum, ad nauseam – someone else would repay their loan for them if they found paying the loan inconvenient, in this case other taxpayers.

Agreed, moral hazard if forgiven as-is with no systemic reform. Pin forgiveness to university endowment taxation / confiscation as a protection for the tax-payer. Also, negate accreditation ability if a certain high watermark threshold of loan non-payers are occurring at a particular institution. If you are creating graduates en masse who cannot service their own loans, nor understand something as fundamental as compounding interest, then you are a nuisance to society and should be prevented from continuing. The reason our politicians only want forgiveness on the taxpayers backs is that they personally profit from the system, as-is. (ie. the right… Read more »

“Why not keep issuing loans, but make the universities co-signers on each loan issued. Then there is skin in the game, and the universities know they are on the hook…” Not a bad idea actually, maybe a high percentage they would be on the hook for. Colleges will admit people into programs with degrees that have almost no job potential, and even if they do, it’s a field that is saturated with job seekers, but few positions – gender studies comes to mind. (And tons of others) Have to find a way to make colleges take this seriously besides grabbing… Read more »

IT’S NOT DEBT CANCELLATION. It’s debt transfer. And 18 year olds are too naive and taken in by lenders, but elementary schoolers are mature enough to decide if they’re misgendered?

They worry about the “stress and mental fatigue on borrowers” but no mention of the stress the rest of us are facing thanks to Bidenflation. We’re suffering too and the last thing we need is to be forced to pay for these deadbeats.

Sure thing .. cancel the student loans, but only once IL pension obligations are cancelled.

Nothing but presentation of chits, like a free turkey from the alderman, to gather potential votes for team D.

‘The American republic will endure until the day Congress discovers it can bribe the public with the public’s money’ – Alexis De Tocqueville

It appears that thinking, bill-paying, contract respecting people aren’t the demographic Mr. Raoul is courting.

Neighbor majored in art history. Couldn’t find a job. Doubled down and got master’s degree. Still no job. What about those who major in gender studies, media studies? Colleges encourage students to major in obscure fields with few or limited payback because they can always get student loans. Student loans should go only to fields such as accounting, HR, fields where there is a need and payoff. Most of the blame goes to colleges, especially those that have huge endowments (Stanford, Ivy League) that could be used to lower tuitions.

Typo? Illinois political class, and their public union pals, are “systemically flawed” in my view. …and of course, ordinary Illinois non-public union taxpayers pay the price.

Free money does little. People need to pay their debts, including student loans. Sorry there is a real world out there….adults can’t play “pretend”.

Agreed. The state taxpayers need to pay their bills, including pension debt. It’s time to raise taxes and start paying the debt and stop playing “pretend”. Sorry, this is the real world.

Students know what their debts are.

I signed on the dotted line to pay for my student loans. I am forced to pay a pension ‘contract’ by virtue of living in IL. Where’s my signature agreeing to pay these grifters and pilferers pension contracts?

Where’s your signature for paying the rest of IL state bills as well? Your remark is immaterial.

You agreed to pay property taxes when you purchased your home. You agree to pay income taxes when decide to live and work in Illinois. That’s how taxes work. Sorry, there is a real world out there…adults can’t play pretend.

You’re free to move to another state but if you stay you are agreeing to these costs each and every day. Now pay your bills.

Well, PPF, my informed hope is that Illinois’ pestilential bankruptcy of finances and governance eventually becomes so bad that the stakeholders – taxpayers, guvmn’t employees, guvmnt-employee unions, payday-loan bond agencies, the Feds, bond-holders and elected officials all agree that the only solution is everyone – everyone – getting a haircut. Until then, you’re right – the only thing that can fix Illinois’ pension mess is more money from already overtaxed taxpayers. My guess is that pitchforks-n-torches will come out before you solve your problem with just their money, and that all of the grand-high-n-mighty (including guvmn’t employees and their unions)… Read more »

Maybe so. What’s popular has a huge sway in politics. Then, what’s right in the moral sense, on the other hand, generally is arguable. Which should we want more–what’s more popular or what’s morally right? That’s above my pay grade.

It is correct that we agreed to pay the property taxes when we purchased our homes. When we first signed the papers there is a fixed amount on the mortgage (principal and interest) unless an ARM was used so we know the amount every month is the same but not with what we owe on taxes. That figure changes yearly. But how many people are aware at closing about the breakdown of the property tax bill? All someone gets is the previous years bill if you bought an existing bill and the previous owner can have a homeowners/senior exemption/senior freeze/veterans… Read more »

I agree with you Freddy that houses shouldn’t be treated as ATM machines. Illinois would be better off getting taxes from other areas rather than homes. Until that happens, property taxes will continue to be a large expense for home owners. So where should taxes be increased to provide property tax relief?

Years ago if I’m not mistaken we had a personal property tax that was abolished. If it’s not an outrageous a small tax would help. States that have that tax have a little lower property tax. Also like Indiana a county income tax of 1 to 1.5% in exchange (not addition to) for a lower property tax. What would then happen is property values should go up which would increase taxable value but it would take hopefully just a few years to compensate. I brought this up with my local state rep a while back and he said it could… Read more »

I appreciate your comment Freddy and you have been honest with your desire to lower property taxes and replace them with something that more closely ties to ones ability to pay. The challenge that you noted is very real…who would sponsor such a bill? Would voters actually trust that these new taxes would result in a direct reduction to property taxes? You can hope that cutting property taxes causes home prices to rise and ultimate revenue to remain the same but that’s not realistic. Colorado home prices didn’t just increase because property taxes were lower. The state would need other… Read more »

I agree that who would sponsor a bill like that plus would taxpayers trust that the new taxes would not be in addition to but replacing or at the least reducing. It would have to sponsored in a bi partisan manner and promoted to homeowners as a distribution of tax revenue away from the primary source which is property. This way people still have a choice of smaller taxes on a variety of items instead of a persons largest asset. Of course there would be a hard cap on those taxes especially county income tax and if more revenue is… Read more »

A few years back I was discussing property tax increases with a college-educated millennial. He explained to me that he didn’t pay property taxes, the bank did.

I enlightened him and he was shocked that HE actually had to foot the tax bill, not the bank.

He had an art degree.

i can sell my home. I can’t sell my debt to you the pensioner which I never agreed to pay outrageously in the first place

When you sell your home Aaron you are also selling the debt to the new buyer. If you want to own property then you need to pay property taxes. You agree to it each year you own your home. You agree to pay income taxes when you live in Illinois. Your determination of what is outrageous is irrelevant. The only thing left for you to do is pay up.

Lol. I sold and moved to Oklahoma. Good luck collecting.

That’s cool Aaron. We will just collect it from the new homeowner. Enjoy Oklahoma.

For me, Oklahoma doesn’t save me much money. Sure the property taxes are less but the income taxes in retirement are about 15k more per year. Everyone must choose their own path.

Barba tenus sapientes with respect to this PPF character.

Standard rhetorical attack, each and everytime.

Read Rothbard.

Thanks for the new phrase!

If we’re handing out refunds on fraudulent products, which cancelling student debt essentially is, why would I fund the retirement of the people producing fraudulent products?

Full pension elimination for any professor or administrator associated with teaching a student whose student debt is cancelled. Since they are the source of the purposely harmful and deceitful practices that required a refund, they bear the responsibility.

Why not cancel all property tax bills and while they are at it we should get a refund from previous taxes paid for the the so called services that most of us never used. The only services that everyone needs sooner or later is police and fire/911/roads. The rest like school taxes should apply only if you have kids in school. I just spoke to some of my neighbors about the tax bills we received and they asked why do we as seniors still have to pay school taxes since we will never need it anymore. I’m sure there are… Read more »

What a hoot! While Sleepy Joe and his handlers are furiously back-peddling on their campaign student-loan forgiveness promises because the Dem’s Joe-N-Jane Sixpack constituency is unhappy, a bunch of lame “My State’s a Dumpster Fire” AG’s write Joe a letter telling him that they think swinging 100% the other direction is a good idea. The more Dem’s talk about having taxpayers who didn’t make a bad student-loan decision pay for the loans of people whose $100K degree in Lower Slobovian Basket Weaving Appreciation didn’t turn into a six figure job, the more resentment Dem’s create. My feeling is that when… Read more »

This entire issue is beyond ridiculous. Are we at the point where there is no personal accountability at all? Using Kwame’s “enormity of debt” logic, will we cancel all mortgage debt next? While those that want to cancel student debt like to mention the 43 million Americans with student debt, that leaves 290 million Americans without it, many of whom either didn’t go to college or paid off their debt. Wonder how they’ll feel about footing the bill for the deadbeats. For how many is this an issue of “can’t pay” vs “don’t want to pay”?. The gimme free stuff… Read more »

Great. College debt wiped away. What about the debt of the students who start school in the Fall of ’22? They have to pay full price while the guy who graduated in Spring of ’21 gets it for free? Why hasn’t congress passed this bill yet? Where is the D bill from the D house and D senate with D FJB as president to wipe away loans? The solution to college debt is out there. It’s called bankruptcy. If you make too little money to pay back your loans 7 years of out college, you get bankruptcy and a fresh… Read more »

Illinois AG Raoul Wants Poor, Non-College Grads, To Pay The Student Loans Of College Educated Deadbeats