By: Mark Glennon*

Illinois Attorney General Kwame Raoul this week urged President Biden to fully cancel federal student loan debt owed by every federal student loan borrower in the country.

All $1.7 trillion of it. For everybody, rich or poor. No questions asked.

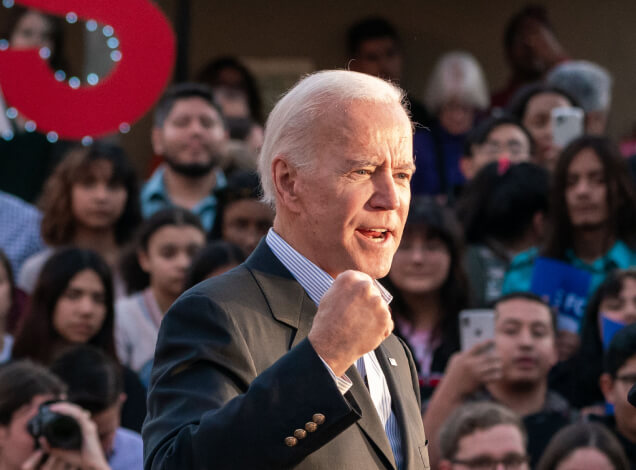

And who created the student loan mess? Both parties bear blame, but a central villain was none other than the guy Raoul wants to forgive the debt – Joe Biden.

Raoul’s press release on the matter is here, along with a letter he signed to Biden where he made the request along with seven other progressive state attorneys general.

Start with the simple but undeniable unfairness of Raoul’s proposal, though there’s much more to cover than unfairness:

• What about parents who sacrificed to pay for college instead of borrowing?

• What about students who chose to work and earn more during school instead of borrowing?

• What about graduates who delayed spending or having a family so they could repay their loans?

• What about graduates who passed over lower paying jobs that they might have found easier or more rewarding, choosing more demanding jobs with better pay to cover loan repayment?

Those questions are entirely rhetorical because there is no reasonable answer to the abject unfairness of favoring those who have sacrificed over those who have not.

Compounding the unfairness, those who sacrificed would be made to pay the tab for those who haven’t — $1.7 trillion worth. It’s not really debt forgiveness at all. It’s a transfer of debt from student borrowers to federal taxpayers. The loss to the federal government would end up as yet another addition to the federal deficit, which taxpayers eventually must face.

Raoul claims in his letter that his proposal would “be one of the most impactful racial and economic justice initiatives in recent memory.” Widespread cancelation of student loan debt, he says, “is not merely a matter of economic justice, but of racial justice as well.”

That’s wrong on both counts. Loan cancellation would be regressive, and particularly so if student debt is cancelled in full, with no cap on amount or income. The windfall from Raoul’s proposal would go mostly to those who are already well off.

Student debt is in fact “overwhelmingly owed by higher-income, better-off Americans, so that’s who gets the money under a widespread student loan forgiveness plan,” according to Adam Looney, a senior fellow at the left-leaning Brookings Institution and student debt specialist. “If you look at who has student loans,” he told CBS, “it largely reflects who goes to college and graduate school in the U.S., and college and graduate school are overwhelmingly composed of people who are from upper middle class or high-income families.”

Maya MacGuineas, president of the Committee for a Responsible Federal Budget, a nonpartisan public policy advocacy group, says forgiving college debt would disproportionately benefit higher educated people. “The poorest people in the country don’t actually have student debt,” she says.

Limiting the amount of debt forgiveness and imposing income limits would make the forgiveness less regressive, but not by much. A recent study by the Federal Reserve Bank of New York found that even if you capped the forgiveness at $50,000 per borrower, low-income neighborhoods receive roughly 25 percent of debt forgiveness while high-income neighborhoods receive around 30 percent of forgiveness.

And even if you capped the forgiveness at $10,000, 67 percent would go to majority white neighborhoods, the study says. None of that apparently matters to Raoul. He wants to forgive all federal student debt regardless of income, which would be still more regressive and less helpful proportionately to minorities.

More inflation is another likely consequence of forgiving $1.7 trillion of debt. “On the margin, this would put more money into households that get the relief. And those households are more likely than not to use that additional cushion in their monthly budget to either purchase more things or purchase more services,” an analyst with investment bank Raymond James told CBS. “So if you had to put it in one bucket or another, it’s more in the bucket of contributing versus not contributing to inflation.”

Finally, it should bother an attorney general, in particular, that he is asking Biden to do something that’s probably illegal. Where does one man get the authority to wipe out $1.7 trillion of debt owed to the nation? Probably nowhere, according to a top lawyer in former President Barack Obama’s Education Department. As recently reported by the Wall Street Journal, that lawyer wrote that “If the issue is litigated, the more persuasive analyses tend to support the conclusion that the Executive Branch likely does not have the unilateral authority to engage in mass student debt cancellation.”

******************

Student loan debt is unquestionably a severe burden on many individuals and a drag on the entire economy. How did we get here? Government is largely to blame for the problem that government is now being asked to solve.

Both parties share in that blame, but President Biden himself is the leading culprit. The full story is told nicely by two left-leaning sources, The Guardian and The Intercept. Both publication’s columns cover the full history well, which is fairly long, but the key mistake came in 2005 when the Bankruptcy Code was amended to make student loans non-dischargeable. That vastly reduced any discipline in how much would be lent out and to whom, and it’s on the bankruptcy matter that Biden’s role was key.

Both parties share in that blame, but President Biden himself is the leading culprit. The full story is told nicely by two left-leaning sources, The Guardian and The Intercept. Both publication’s columns cover the full history well, which is fairly long, but the key mistake came in 2005 when the Bankruptcy Code was amended to make student loans non-dischargeable. That vastly reduced any discipline in how much would be lent out and to whom, and it’s on the bankruptcy matter that Biden’s role was key.

From The Guardian:

The Republican-led bill tightened the bankruptcy code, unleashing a huge giveaway to lenders at the expense of indebted student borrowers. At the time it faced vociferous opposition from 25 Democrats in the US Senate. But it passed anyway, with 18 Democratic senators breaking ranks and casting their vote in favor of the bill. Of those 18, one politician stood out as an especially enthusiastic champion of the credit companies who, as it happens, had given him hundreds of thousands of dollars in campaign contributions – Joe Biden.

And from The Intercept:

Biden was one of the most enthusiastic supporters of the disastrous 2005 bankruptcy bill that made it nearly impossible for borrowers to reduce their student loan debt…. Biden came back to the legislation under the Bush administration; it passed the Senate in 2005 on a 74-25 vote, with most Democratic lawmakers voting against it…. George W. Bush signed it into law, and private student loan debt skyrocketed in the wake of its passage. The total amount of private student loan debt more than doubled between 2005 and 2011, growing from $55.9 billion to $140.2 billion….

The spike in student lending that followed from making the loans immune to bankruptcy in turn sparked other problems. For-profit colleges, some of which were predatory, ran up the bills as best they could. Traditional colleges and universities added suffocating levels of bloat, bureaucracy and silly new majors with no career future, and that continues on with no consequences.

Give credit where credit is due. The leading opponent of making student loans bankruptcy-proof was Sen. Elizabeth Warren, who lost what was a direct fight with Biden.

Maybe there’s somebody else who is wise to Biden’s role. Vice President Kamala Harris is now reported to be “increasingly wary of becoming part of the public face of the administration’s response,” Politico recently reported. She declined to participate in a Biden Administration video about pausing repayment obligations, sparking a bit of an uproar.

Who knows, but maybe Harris knows the backstory on the student loan crisis and Biden’s role in it. Maybe, just maybe, she figures that history will start to be told more often. If so, she is wise to stay away.

*Mark Glennon is founder of Wirepoints.

Read more from Wirepoints:

- Parents, keep an eye on your school’s sex ed curriculum. It may be more extreme than you think.

- Supporters of Amendment 1 should get their story straight. Latest double-talk is about workplace safety.

- Chief Executive Magazine ranks Illinois third-worst state for doing business, yet Illinois politicians think businesses will move here because of…“equity!”

- Chicago car thefts spike sharply in 2022, up 100% along lakefront compared to 2019

- Close the revolving door for high-risk offenders in Cook County

- Two ‘Compelled Speech’ Matters Beg For Litigation In Illinois

Chicago Public Schools is failing its students in almost every way. What can be done to save the educational futures of Chicago’s children? Join Wirepoints’ Ted Dabrowski as he participates in an education roundtable discussion hosted by Seeking Educational Excellence (SEE).

Chicago Public Schools is failing its students in almost every way. What can be done to save the educational futures of Chicago’s children? Join Wirepoints’ Ted Dabrowski as he participates in an education roundtable discussion hosted by Seeking Educational Excellence (SEE). If you’re frustrated with Illinois’ educational results, you may want to follow the money from teachers unions. In the last four years alone, Illinois lawmakers and political candidates have taken nearly $30 million in contributions from teachers unions and their national affiliates.

If you’re frustrated with Illinois’ educational results, you may want to follow the money from teachers unions. In the last four years alone, Illinois lawmakers and political candidates have taken nearly $30 million in contributions from teachers unions and their national affiliates.

Wirepoints President Ted Dabrowski testified on April 10, 2024 to members of the House Revenue and Finance Committee at the invitation of Rep. Joe Sosnowski. Ted told lawmakers that the state’s property tax burden has become dire for countless Illinoisans.

Wirepoints President Ted Dabrowski testified on April 10, 2024 to members of the House Revenue and Finance Committee at the invitation of Rep. Joe Sosnowski. Ted told lawmakers that the state’s property tax burden has become dire for countless Illinoisans.

“Follow your dreams…not!” One of the largest serial offenders in the education mafia is the Berklee College of Music. Using their recent annual fees and costs, I estimate that a four-year music degree from this institution will cost the student upwards of $285,057. This does not account for travel costs to/from Boston or incidentals, this is pure school direct costs. A graduate from their program will enter the workforce as a trained musician. The average amount that a gigging musician will gross in 2022 is about $100 per show (yes, even as part of those touring bands playing stadium shows,… Read more »

Here are some thoughts: Require financial competency by junior year in high school verified by standardized testing – include in that training what a contract is and what binding means. Require colleges to provide current and verifiable placement and wage data for each degree they offer and share that with high school students considering their school. Get the federal government out of the student loan business and have professional underwriters determine the viability of loaning based on the major and student Allow refinancing of student loans at current borrowing interest rates DO NOT forgive student loans. It’s patently unfair to… Read more »

Crime and corruption are the only things this clown should be concerned with.

It’s not their money, the politicians, its ours, the taxpayers. Why are we letting them give our money away? It’s because of the idiotic voters in places like Chicago/Cook County who continue to unflinchingly vote for democrats. Those voters like high taxes, like giveaways, like being sheep and are totally aware of their dependence on being led by a nose ring to insure that the elected ones make their life decisions.

Here’s the problem: We haven’t properly communicated the true social value of some of these majors. While your Gender Studies or Art History degree may not generate monetary wealth, you’ll be a hit at all the social events you deem important to your perceived wealth: fundraisers, arthouse auctions, fashion shows, awards banquets. You can’t put a price on holding your own on the social circuit, can you? Take me: I know little to nothing in the world of Literature. But your dissertation on Keats will impress everyone at the gala. Meanwhile, I sit there uncomfortably bored while you delight everyone.… Read more »

Keats? Hahahaaa Dead white men are no longer required reading in college because of the decolonization of curriculum…It’s all Kimberle Crenshaw and Imbraihm X. Kendy these days:

The essay that started it all:

White Privilege: Unpacking the Invisible Knapsack by Peggy McIntosh

https://psychology.umbc.edu/files/2016/10/White-Privilege_McIntosh-1989.pdf

The above is a fun read if you want to imagine an insane batsheet crazy middle aged self-hating racist harpie screaming about white privilege….

A handsome woman.

If you hated you genitals

I read this PDF and it brings up many valid points that are worth discussing. It still is flawed in so many ways. I think at the heart of Marxism is the collective and the central planning that it usually entails. This requires much brutality driven by the regime who will make enemies of the state disappear. Millions of human beings were murdered because of this system. The government is the father figure. Central to this is the destruction of the family and faith. Remember, the Soviet Union and now China did not allow the church to be at the… Read more »

How would you like to be the dad that just got finished paying off their kids loan? Will he be reimbursed? Or is it better to be a deadbeat and wait until you get bailed out? Also imagine you are a HS kid going directly into being a plumber, handyman, etc. after HS. Why shouldn’t the govt buy that young man a truck and materials to pursue their post HS goals?

We have to vote and get every other person who is disenfranchised and pissed off about the insane socialist agenda of the Biden administration to vote as well. Straight red in November.

Our daughter got a master’s degree in business. Because of her skills, abilities and degree she has been working ever since graduation. She also has a preexisting illness she deals with and runs a non profit program. She doubled up on payments so she could pay the debt off by January 2021. We helped her find a good interest rate but didn’t pay her debt, she worked and she paid. She is single, purchased a home this year, and pays all her own taxes. Is she going to have to pay for all the others who didn’t pay or is… Read more »

First of all, congrats to your daughter. We need more people like her in society today. Second, Kwame has put absolutely zero thought into this issue, just like everything else he does. He cares not one bit about you or your family. He is pandering to a base he hope will reelect him for the rest of his life.

The democrats have a name for people like her, sucker.

Yeah, a sucker with a job who actually wants to work and be a productive member of society.

To the democrats her having a job and being productive put her in a position that does not fit their agenda. Democrats want takers not earners as they need their base to be dependent on them, be led, be lectured, belittled and plied with the everything is free ideology.

In this state, if she’s in this state, she is a sucker, for sure.

If mass loan forgiveness goes through, I don’t see any sense in continuing the same loan program. At some point there has to be losers, other than the taxpayers at large, otherwise economically bad government programs will continue.

There really is no answer to the unfairness. Disadvantages to those who sacrificed will never be made up to those people. That’s the progressive social justice way.

Raoul is another one of those progressives talking out of both sides of his mouth.

If this goes through all Illinois colleges need to be free of tuition payments, no hourly class rates, no dorm charges, free books, free everything. College professors will be happy to work for free, right? Nobody pays anything to get a degree. Great idea!

Here are a few interviews from CSPAN this morning. Viewers calls/questions are worth listening to or just read the transcript. Some callers have over $300K in debt due to increasing interest payments. I believe one caller was 80 and still has loan debt. Many callers say interest on loans is the problem with some rates at 13%.

https://www.c-span.org/video/?519976-4/washington-journal-jared-bass-discusses-student-loan-forgiveness-efforts

https://www.c-span.org/video/?519976-3/washington-journal-lindsey-burke-discusses-student-loan-forgiveness-efforts

Student loan debt is a major problem. First, schools are ridiculously expensive and its hard to fault people for wanting to go to college to better their life. College tuition has increased at many times the rate of inflation for decades. The boomer generation more or less paid its way through college through working. But that’s impossible to do now – what 19 year old can afford to $50k a year on a pay-as-you-go basis? Now, loans have become an unforgiving debt & interest trap for people. Borrowers who have a bad year income wise, or get laid off, and… Read more »

It is extremely difficult to discharge student loans in bankruptcy. Many hurdles to jump over. Suzy Orman was talking about this years ago and she says that parents should not co-sign since they are then liable even if the child passes away.

https://www.edvisors.com/student-loans/private-student-loans/can-you-file-bankruptcy-on-student-loans/

But why is this debt forgiveness, in particular, beneficial, to society? What differentiates this from forgiving a mortgage, or a car, or any other of the products available to the public? All free up resources to be used elsewhere if forgiven. In your CSPAN clip, the loan this person was offered had a higher rate each time, to offset their risk in taking on the loan. This infers to me that these are private loans. The risk the lender is taking on has to be quantified, and the further from origination, the riskier the debt becomes. If a person has… Read more »

I’m against forgiveness in general but the student loan problem is pretty big, and it’s a drag on 1) household formation 2) new business start ups 3) savings and likely most importantly, 4) having children which our society desparately needs during this baby bust. It wasn’t that long ago that a college students would take on minimal loans and work his/her way through college. These days that same degree costs exponentially more. And that debt is difficult to pay back. I borrowed a lot of student loans and I paid it back but it was difficult, very difficult. Took serious… Read more »

Sure, I was in the same boat. Paid over 14 years and had kids very late. I have worked since 1983 in the same predicament as yourself, being originally a southwest-sider, meaning no silver spoon or recourse available. I am all for bankruptcy, as that’s a personal hit to the parties involved. However, it seems 1 of these parties is now the taxpayer. Restructure the debt so the actual holder is not USGov, rather the originating institution, ie the universities. Then let the parties bankrupt away, it’ll clear the field of the bad actors, both sides. The endowments are perverse… Read more »

exactly, they need to change the law, I probably should have made that a little clearer that it’s nearly impossible to bankrupt student loans.

Does this mean that all those people didn’t think they were going to pay interest on their mortgage, car payment, or credit cards either? If you sign the paperwork you pay the bill. All I can say is don’t buy a car or house if you don’t want to pay interest or you’ll be in bankruptcy court. There will be no bail out. You didn’t learn that in college?

for all intents and purposes, there is no bankruptcy for student loans, not yet at least, and if congress were serious about student loan reform, this would be the first step of many to take. Instead, Joe Biden is making empty promises he knows won’t withstand any challenge in court. Joe can’t forgive student loans by executive order it needs an act of congress and that’s really unpopular for the 2/3rds of the country that doesn’t have student loans. He’s been talking student loan forgiveness since the campaign trail but has done nothing. Because he’s flat out lying to voters.

This is just crazy. I scrimped and saved, took cheap vacations, while my peers bought new SUVs every year, and went on expensive vacations. I paid for my kids college education. My peers got loans. Now they get off paying the loans. How is this fair to those of us who sucked it up for our kids, and either paid for or helped pay for their college education? And what about people who chose poorly, and picked degrees with no demand? Why should my taxes be used to pay off their loans? How is this equitable and fair to everyone?… Read more »

I agree. I learned that by at least my first year of college. I worked during the summers f through my last two years of elementary school and high school to save for college. Most of my friends did none of that, and a few there and elsewhere got financial help that I didn’t get. I paid for most of my college degree with my parents paying from some of it as well. My peers that I mentioned didn’t. I got the message; I had been a sucker.

Make sure you, and every member of your family votes. That’s all you can do.

Democrats are trying to inspire youthful democrats to show up to the polls in Nov. That’s all that this is.

As I read what George has to say it makes me wonder if this is a Saul Alinsky thing. He always said the best way to grow socialism in this country was to pit people against one another. This issue certainly does that. I hope that’s not what the Democrats are doing.

On a more fundamental level, this is a bailout of the upper class by the middle and lower class. Assume a person decides to forego college (no interest, financial consideration, other calling) and pursue a life in the trades, or the more muscular professions. They responsibly learn their skill, and diligently build a business. Why then are they, who already have decided to forgo college, now being asked, or rather told, to bail out those who decided to go the college path, and assume their cost, with nothing more than societal platitudes in return? If their business hits dire financial… Read more »

https://www.congress.gov/bill/117th-congress/house-bill/899/text

Very well said, very well indeed. My husband and I paid for as much of our children’s college education as we could—made a bit harder by the fact that we were also paying for the four of them to go to private schools. But, they worked. My God, how they worked. Caddying and waiting tables every summer from the age of 13 on. And they saved. Indeed, they saved. And they studied and were rewarded with generous scholarships from the universities they chose to attend. National Merit Scholars and Illinois State scholars all. All of them went on to get… Read more »

Buyer returns product for full refund. Seller takes back product. Product is University credentials: a degree. If Buyer seeks refund, Buyer should return Degree credentials and all rights to represent himself as BA, BS, MBA etc.. Another commenter made great suggestion that the Seller of the product (University) for which Buyer (freeloader-status-seeking student) seeks full refund should be a full or partial guarantor (instead of bamboozled taxpayers). There are over $50 billion tax-deferred dollars in 20 Ivy League endowment funds, which pay for elite meals/travel/lodging/Jeff Epstein Island junkets/other perqs in addition to earning billions in non-taxable profits annually. This could… Read more »

The funds have way more than $50B more like $1Trillion by 2048

https://www.forbes.com/sites/adamandrzejewski/2021/10/31/ballooning-ivy-league-endowment-forecasted-to-top-1-trillion-by-2048/?sh=71c871db3a37

So true. I was inarticulately referencing Harvard’s $53bil endowment as an example.

The problem is, like many in America, third-party-payment cut-outs. Student loans are debts to a third party payer.

Much like healthcare, where buyers (patients) are not allowed to pay sellers (docs/nurses) directly, accountability is obfuscated.

If buyers of college degrees (students) had to pay (or arrange financing directly from) sellers (colleges), then financial accountability would be a different matter. Bad actor sellers and deadbeat buyers could be held accountable by the other party to the transaction.

You buy a product (cigarettes; college education) under false pretenses (health and addictive risks; marketability of your degree post-graduation) and are saddled with life-altering complications (health issues; student debt). How do you solve the problem?

Does forgiving the hospital bills for cancer treatments address the root cause of the problem if the cancer wards continue to fill with users of highly-addictive tobacco products? Nope. All you get is a never-ending line of young people today filling the cancer wards of tomorrow.

Attorney Generals are supposed to go after the source of the problem. When a product is fraudulent, deceptive, and causes harm, you go after the manufacturer. In this case, the source of the fraud and deception are the institutions of higher education.

This is welfare in reverse.

Middle income non-college grads paying for the loans taken out by upper income deadbeats.

In addition to all the reasons Mark outlined as to why this policy is so bad and so unfair, why, why, why would we encourage a whole generation to learn they can borrow and not have to pay it back? This is such a moral hazard, not to mention throwing contract law out on its ear.

Elizabeth Warren doesn’t deserve props. Though she battled Biden over this issue, a couple years ago, when confronted by a father who paid for his child’s education asking if he would be repaid, she said “Of course not.”

https://www.savingforcollege.com/article/elizabeth-warren-confronted-over-student-loan-proposal-by-father-who-saved-for-college

I too am loath to saying anything nice about Warren given the radical she has become. But early in her career in the 1980s she was a legit bankruptcy law scholar at the U of Texas. I was practicing law there at the time, followed her work and respected it.

Her research claiming that medical bills were the primary driver of bankruptcy was flawed and many consumer bankruptcy attorneys disagreed with her findings. At the time, she seemed to be pushing an agenda for socialized medicine in the years before Obamacare was finally passed. It’s almost always credit cards and personal loans that push the average person into bankruptcy. A charge here or there for gas or food over time and suddenly the minimum payments become to much to pay and the person eventually goes bankrupt.

Warren is a self serving piece of garbage. She can’t speak without screaming like a banshee. Her history is well documented. I wish Ted Kennedy was still around to give Liz and Bernie a ride.

And of course zero talk about reducing the crazy cost of college at U of I. I believe U of I is one of the highest total cost state universities vrs neighboring states.

Nothing but cheap pandering by a member of the Democratic party who are destined to get slaughtered in the mid-term elections.

The Federal Govt has been charging high rates for these long-term load, around 8% when home loans were at 4%. That is part of the problem. Instead of canceling the debt, cancel the interest which is a tremendous savings to the borrows. That way everyone wins. But gee, that is too logical for US politiicans.

Logic?-common sense?-our politicians?-hah,nice try

What is the profit motive for issuance of non-collaterized loans? Why would anyone lend you anything without you paying a vig to cover their risk? The better question being the loan system just continues to perpetuate our current clownworld university system. Why not keep issuing loans, but make the universities co-signers on each loan issued. Then there is skin in the game, and the universities know they are on the hook for when their blue haired sociology graduates fail, they themselves will be having to pay for propping this failure onto society. This will prune courses, and introduce efficiency and… Read more »

No we’re getting somewhere…. Align incentives!

Interest rates are a function of the index + a risk premium that is a function of the risk of default and loss of principal…. Can’t just cancel that either…. That whole signed a contract thingy…

Interest rates are no longer even a function of the index or risk because in most cases now the Fed itself is the only buyer of the bonds. The Fed sets the price. My mortgage is in 2’s issued during a 5 or 6% rate environment. No private buyers of that MBS – the fed was the only buyer. With funny money. We live in a messed up environment.

Kwame, take your moronic ideas and insert them.. Well, we all know…. It is wrong and likely illegal to support the abrogation of contracts that were entered into willfully by both parties.

Adulting is hard – but, part and parcel with the freedom our country tries to afford is the responsibility to make and own one’s decisions…..

What kind of society would we be creating if we allow and reward the idea of “no consequences”? Well, we know the answer…. One need look no further than Chicago and our legal system (San Fran, etc.) to see the impact….

Excellent article, as to how we got here.

Now, once again, we have Illinois -Chicago (#1-2 in overall tax burden; #1-2 in political corruption; #51, behind Puerto Rico; rampant “catch and release” crime; and “owned by the public unions”), portraying themselves as geniuses who deserve to guide the country at the national level (ie cancel trillions of student debt). Recommend to the country that you dismiss the musing of Illinois-Chicago politicians, given their track records.

Politicians, particularly Democratic Illinois politicians, can pretty much say or write anything, no matter how silly, hypocritical or baseless, without fear of being held accountable in any meaningful way. Governor Tax Cheat’s trumpeting of Fitch’s guvm’t payday-loan bond agency’s decision to inflate their Illinois credit rating to recruit more investors into purchasing high interest rate Illinois bonds is a case in point. “Remain calm, all is well. Vote for me.” Sadly, in Illinois, election after election, this works. One wonders if it is even possible for an Illinois politician to say something so outrageous that a public outcry actually causes… Read more »

The outcry has happened once before goodgulf,DONT you DARE raise taxes on soda pop Toni Preckwinkle,other than that,I guess anything goes for the dem politicians in this state

“Politicians, particularly Democratic Illinois politicians, can pretty much say or write anything, no matter how silly, hypocritical or baseless, without fear of being held accountable in any meaningful way.”

Never saw it expressed more succinctly – Bravo! MSM and the loss of true reporters is the culprit.

Better known as Rauol the Fool. Just another radical policy to lead us into serfdom.

Thank you Mark for highlighting this. I like to know who my destructors are.