Chicago Teachers Union contract demands are totally divorced from reality – Wirepoints

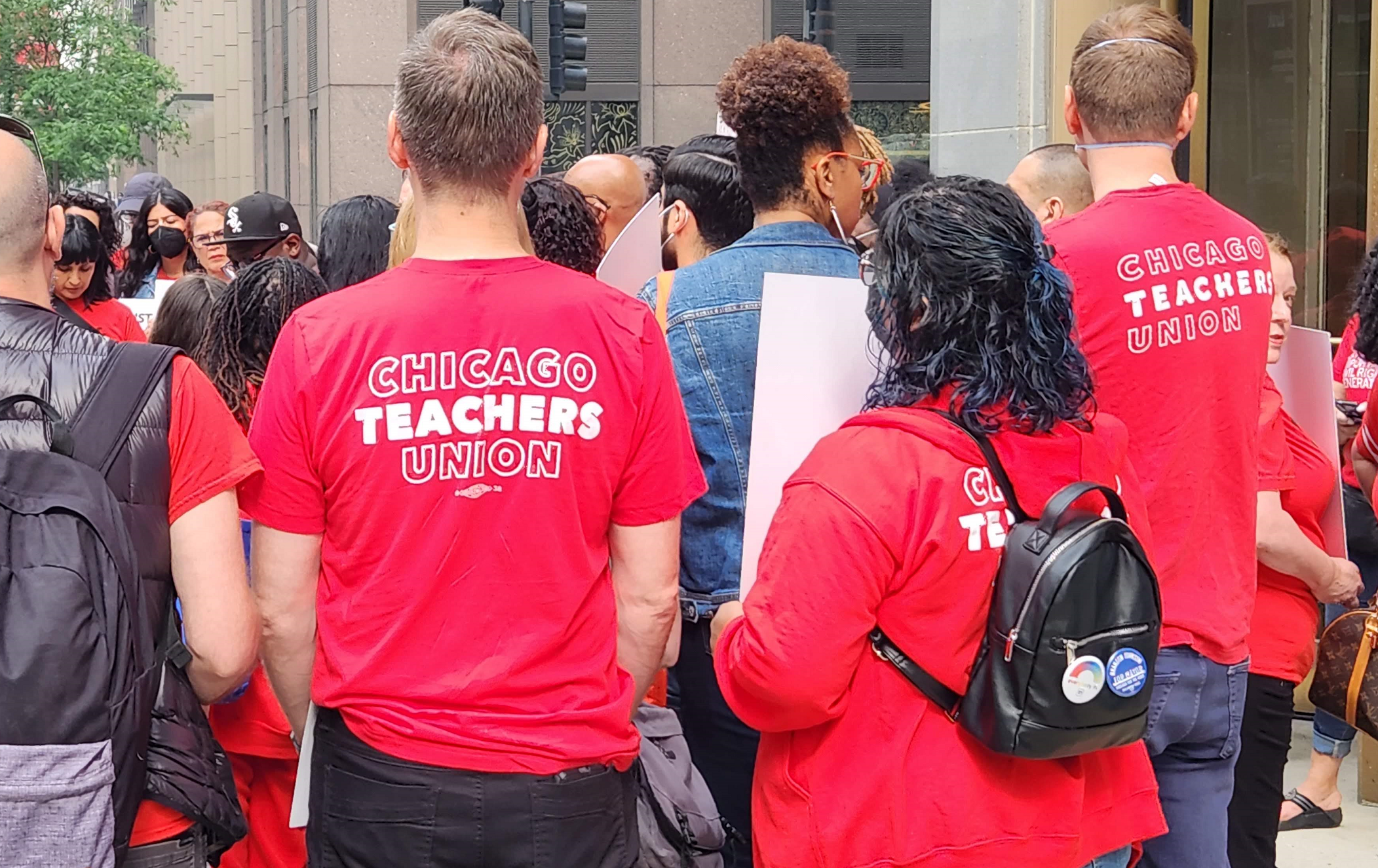

Details emerging about Chicago Teachers Union’s upcoming contract show just how divorced its demands, both extreme and expensive, are from the reality at Chicago schools. It’s not just about massive salary increases, but also about money for migrant students, climate initiatives, abortions and gender-affirming care. About blocking parental notification. Count on CTU’s demands to veer further from reality until the public finally says no.

Details emerging about Chicago Teachers Union’s upcoming contract show just how divorced its demands, both extreme and expensive, are from the reality at Chicago schools. It’s not just about massive salary increases, but also about money for migrant students, climate initiatives, abortions and gender-affirming care. About blocking parental notification. Count on CTU’s demands to veer further from reality until the public finally says no.

Gov. JB Pritzker calls it “ethics” reform.

Gov. JB Pritzker calls it “ethics” reform. It’s rare to see city leaders in Chicago take an open, unabashed stance on the collapse of literacy. To complain is deemed as too political, too racist or too anti-public schools. So it’s refreshing to see Willie Wilson, a successful businessman and leader of the black community, call for a literacy initiative “with the goal of getting 100% of Black students reading at grade level.”

It’s rare to see city leaders in Chicago take an open, unabashed stance on the collapse of literacy. To complain is deemed as too political, too racist or too anti-public schools. So it’s refreshing to see Willie Wilson, a successful businessman and leader of the black community, call for a literacy initiative “with the goal of getting 100% of Black students reading at grade level.”

Woodstock Illinois property tax rates are now 3.55% of full fair market home value. Woodstock Il home value property tax rates have ranged between 3.5% to 4.8% of full fair market value for over a decade. For over a decade, home values in Woodstock have relentlessly fallen against home values all over Illinois and America. Woodstock Illinois Tax Code Rate: Tax Code Rate 10.657969 (That is: 10.657969% of EAV; Equalized Assessed Value= 33% of fair market value. ) That means: tax rate on full fair market value = 1/3 of tax rate on EAV. That means: 10.657969%/3=3.55% of full fair… Read more »

Question should be is Why are the taxing bodies co-owners of your property an get a percentage of your value every year to provide services which many people do not even need? They never pay us a dime for any upkeep and repairs. If your property value goes up they get more money for the exact same services as when your property value was less. They get a % regardless of value usually the same or more than the year before especially in a Ptell county. Now when you decide to sell your home all property taxes in arrears must… Read more »

The immediate answer is that there are a myriad of ways taxes can be collected. If you want property taxes to be reduced another tax rate elsewhere has to make up that deficit. Where do you want that increase to occur? Better yet, where do you think the public at large would accept a tax increase or a set of them elsewhere?

That’s the question James. So many complaints about property taxes but very few people acknowledge that taxes will need to increase elsewhere to make up for it. They don’t even offer up any realistic cuts.

Voters need to get real. The state needs more tax revenue not less. If you want property tax relief then other taxes will need to rise. It’s pretty simple.

We all have different sorts of feelings about the taxes applied to one thing versus some other thing. As for me, at the state level I’d prefer an increase in the state’s personal income tax rate if it would be comensurate with lower taxes elsewhere, but that would bring a mob of protest as well. Essentially a tax on real estate is unrelated to the owner’s ability to pay it, although it can be stated that generally a person of higher income will have higher-value real estate. But, that’s not to say the elderly and others with lower incomes aren’t… Read more »

James, be careful what you wish for. In Michigan they raised the sales tax from 4% to 6% and lowered property taxes. For a while we had “lower” property taxes. After about a decade with inflation and appreciation my property taxes exceed the prior level of property tax paid and Michigan still has the 6% sales tax.

Yes, but that’s a normal function of inflation. A decade of it takes its toll on nearly every financial aspect of one’s life. Inflation hasn’t been all that active for several years, but now we might have quite the opposite, proclamations of the fed and federal politicians notwithstanding.

PFF, “They don’t even offer up any realistic cuts.” This reminds me of the dumbest guy on the internet, Kendall County William, who suggested that every government worker was ‘essential’ and could not be furloughed or put on unemployment in the early days of the pandemic. Someone suggested, well, what about librarians? Librarians are closed, do we really need to pay librarians full salaries for not working? Zir responded that every government worker was essential and needed to be paid in full for sitting home and not working. So here we are again, there’s been many many suggestions how to… Read more »

Politicians weigh the consequences every such political decison they make based self-interest considerations, and the financial bottom-line effect is of much lesser importance, it would appear. Its been that way since the memory of man runneth not to the contrary and likely will continue. He who cuts the budget is likely cut as well in the next election cycle, and they all know it.

Name one politician who cut taxes or services and wasn’t reelected.

Blago cut the state very deep (look the DNR) and was reelected.

Some argue that Rauner didn’t cut and that’s why he lost.

Weirdly enough I haven’t kept a database on such things saying when and where each happened. My bad!

When you make rash generalizations on this site you have to expect to be questioned.

Yes, your bad for the rash generalization, not for your choice of databases.

Oh, I get it. Clearly nobody else here does likewise since we are all data driven.

Yes, everyone offers to cut things in government that they don’t care about. It’s not realistic if you can’t get politicians to support the cut. The voters ultimately want these taxes and spending levels or they would vote in different politicians. Please point out the politician that has offered any significant cuts. Even when Rauner was in office he stated that there wasn’t much to cut. He knew a tax increase needed to happen and admitted such. We are short $5 billion per year in actuarial pension payments. We need to add more revenue or cut elsewhere to get there.… Read more »

“If you want property taxes to be reduced another tax rate elsewhere has to make up that deficit.” Because it’s not possible for government services to be delivered more efficiently, or to be reduced?

Apparently not. So, we are left to assume its forever a zero-sum game. Lower one tax and increase another set of taxes. I’d like my other various personal expenses to be reduced as well, but I don’t see too many in the private sector volunteering to do that either. No, the only way is up, up and away apparently. So, why should the government think they are held to a higher standard?

We don’t own our homes – the state allows us to live in them, maintain them, and pay for them. Then they collect annual rent or they can confiscate them.

Real estate ownership is a bit of a misnomer or an outright myth.

And Winnebago county is brutal.

Agree- Many of us have a mortgage and pay rent (taxes) for the “privilege” of living in them.

These commenters want to divert the attention from specific to general: “home values will fall if you don’t pay for good schools” , “somebody has to pay for social service provision” are typical distracting general canards. The specifics on which taxpayers need to focus on specifically are: P-TAX RATES. P-TAX RATES represent ratios of cost-per-value-received. P-TAX RATES in America, with rising home values and decent happy safe prosperous family life, indicate that acceptable quality social service provision should cost 1% of full fair market home value. When rates in America are 1% and rates in Woodstock are 3.55% and the… Read more »

I know the plight of Woodstock all to well. My uncle lived just down the road from the old Deeter’s restaurant. My uncles tax was close to $12K and he sold and the new owners taxes went to $14K and eventually lost it thru foreclosure. He moved to Colorado and taxes on a home worth over $400K now are approx $1,700 with homeowners/senior and senior freeze. He buys a new car every 3 or so years with his savings (before car chip shortage).