Illinois job growth? Government does all the hiring as private sector shrinks – Wirepoints

Job growth is good, unless it’s the government doing all the hiring. Unfortunately, that’s the situation in Illinois. The latest BLS data shows Illinois was able to eke out a gain of 17,100 jobs over the last 12 months, but only because government job gains offset the state’s private sector job losses.

Job growth is good, unless it’s the government doing all the hiring. Unfortunately, that’s the situation in Illinois. The latest BLS data shows Illinois was able to eke out a gain of 17,100 jobs over the last 12 months, but only because government job gains offset the state’s private sector job losses.

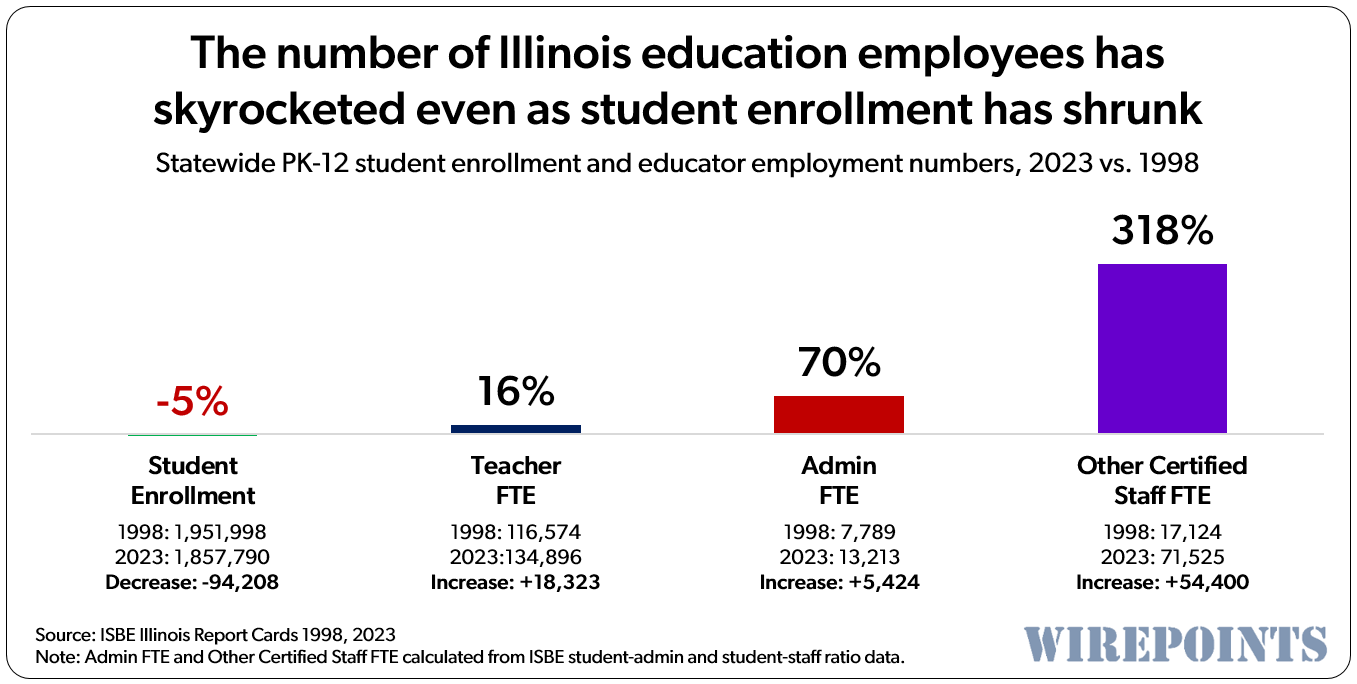

Illinois education officials continuously claim there’s a teacher shortage across the state. Yet data from the state’s own Illinois Report Card shows that hiring at schools has been booming over the last 25 years, especially when you consider that student enrollment has been shrinking at the same time.

Illinois education officials continuously claim there’s a teacher shortage across the state. Yet data from the state’s own Illinois Report Card shows that hiring at schools has been booming over the last 25 years, especially when you consider that student enrollment has been shrinking at the same time. Ted joined Dan and Amy to talk about the failures of Mayor Johnson’s first year in office, what Chicago’s future looks like, why so many CPS teachers are chronically absent, the details of Gov. Pritzker’s $827 million giveaway to Rivian, and more.

Ted joined Dan and Amy to talk about the failures of Mayor Johnson’s first year in office, what Chicago’s future looks like, why so many CPS teachers are chronically absent, the details of Gov. Pritzker’s $827 million giveaway to Rivian, and more.

We now know that anyone with assets of over $4 million would be considered “extremely wealthy” in Illinois.

this includes savings, retirement defined contribution $ along with non cash assets.

Currently the cash value of a defined benefit pension that passes to an heir is not taxable in the same way as are defined contribution assets.

Seems unfair.

Do we have an estimate of how many in the state currently reach this standard of “extremely rich?”

Reserve your UHaul today.