Chicago Teachers Union contract demands are totally divorced from reality – Wirepoints

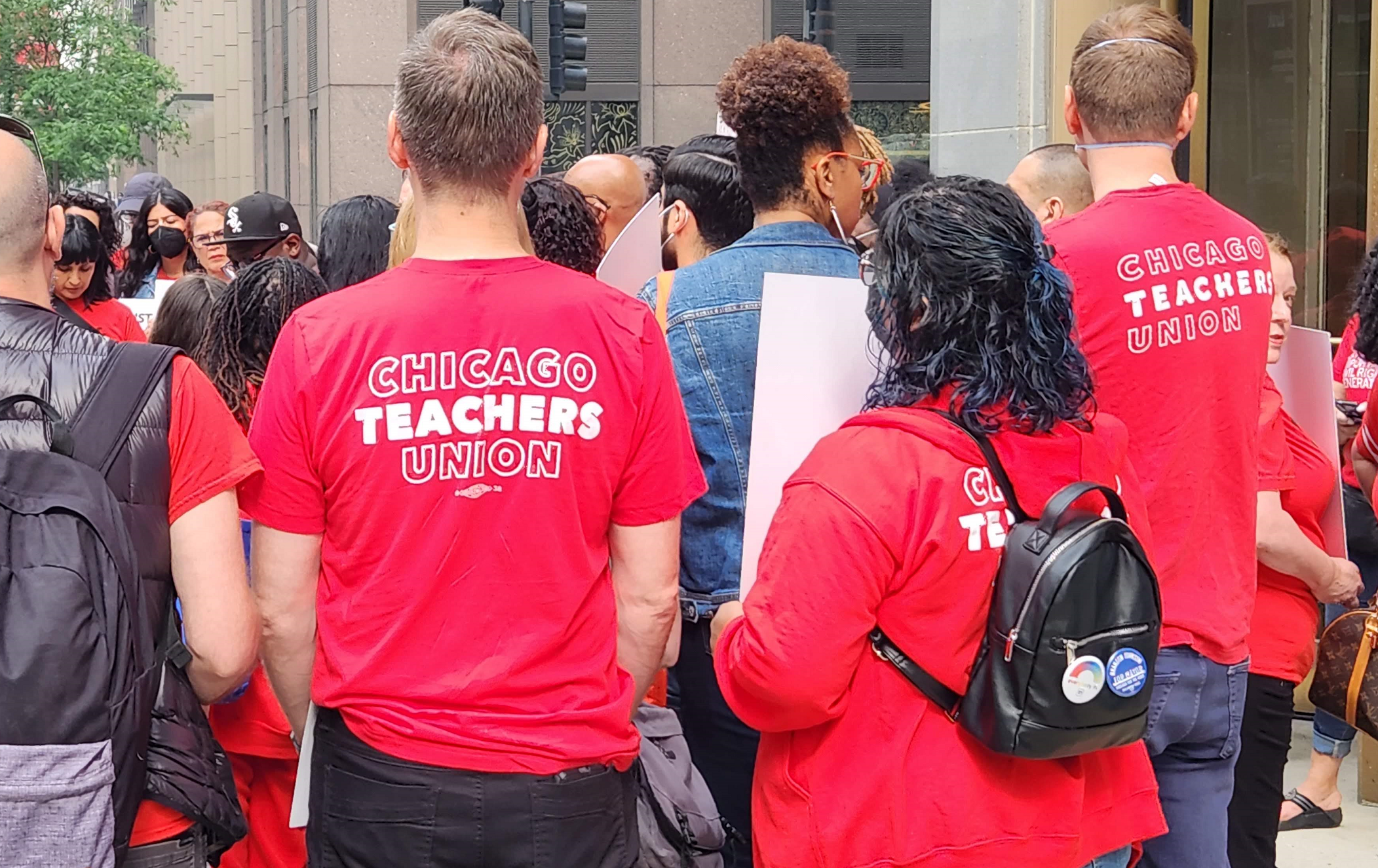

Details emerging about Chicago Teachers Union’s upcoming contract show just how divorced its demands, both extreme and expensive, are from the reality at Chicago schools. It’s not just about massive salary increases, but also about money for migrant students, climate initiatives, abortions and gender-affirming care. About blocking parental notification. Count on CTU’s demands to veer further from reality until the public finally says no.

Details emerging about Chicago Teachers Union’s upcoming contract show just how divorced its demands, both extreme and expensive, are from the reality at Chicago schools. It’s not just about massive salary increases, but also about money for migrant students, climate initiatives, abortions and gender-affirming care. About blocking parental notification. Count on CTU’s demands to veer further from reality until the public finally says no.

Gov. JB Pritzker calls it “ethics” reform.

Gov. JB Pritzker calls it “ethics” reform. It’s rare to see city leaders in Chicago take an open, unabashed stance on the collapse of literacy. To complain is deemed as too political, too racist or too anti-public schools. So it’s refreshing to see Willie Wilson, a successful businessman and leader of the black community, call for a literacy initiative “with the goal of getting 100% of Black students reading at grade level.”

It’s rare to see city leaders in Chicago take an open, unabashed stance on the collapse of literacy. To complain is deemed as too political, too racist or too anti-public schools. So it’s refreshing to see Willie Wilson, a successful businessman and leader of the black community, call for a literacy initiative “with the goal of getting 100% of Black students reading at grade level.”

No one can retire with this kind of property tax nonsense.

Well then, their market values (comps per RE parlance) must have increased by 100-200%

Nothing to see here……

You clearly don’t understand how property taxes work if you think property values need to rise in order for property taxes to increase. If the taxing district needs double the taxes then everyone will pay double the property taxes assuming that everyones property value remained the same. When your individual property tax assessment increases relative to others in the same area then you will also pay even more. If the taxing district needs more money then everyone must pay more regardless of the property value. The property value is only relevant for determining your share compared to your neighbors. Nothing… Read more »

PPF, I was being facetious. Granted, you harbor a self delusion that property taxes can be raised ad infinitum to keep you and your ilk in high cotton.

When taxes are raised at a rate greater than property appreciation and/or taxpayer take home pay growth it’s really a reduction in the taxpayers standard of living.

Yes, there really is a tipping point and hope you live to experience the consequences of poor governance.

Your neighbors continue to vote for more spending and more taxes. That reduction in standard of living is the result of voters. Stop acting surprised when taxes increase when this is what the voters want.

I support cutting spending. Let’s start with the largest federal welfare program, Social Security. Enough of you freeloaders complaining about taxes while you line up at the welfare trough. You could finally experience what you wish upon others.

Welfare? Really? Last time I checked I had contributed hundreds of thousands into Social Security.

No. Last time you looked you paid social security taxes and have no legal right to receive social security. You have no legal claim to social security and only receive it at by the kindness of the generous taxpayers. It’s a form of welfare plain and simple.

We’ll agree to disagree on that one, PPF.

Fair enough. I can appreciate that.

Didn’t Pritzker form a task force years ago to address property taxes? Maybe one of our local so called journalists can ask him how that’s going next time he cuts a ribbon on an overpriced capital project.

PPF says it like it is pensions will be paid by the taxpayer. More increases likely to come in the future. Only way out of it is to get out ASAP.

Where to go is the problem. The window of opportunity is behind us. Home values have increased dramatically in most parts of the country where property taxes were much lower than ours. Many people in Florida are getting massive home insurance premiums IF they can get it. Wisconsin home values have increased steadily for years now due to reasonable fiscal policies enacted. One option is to stay and fight but not as individuals but as a group. By yourself it is difficult if not impossible to fight the system. The “System” was enacted over years to insure the status quo… Read more »

You will die of old age before anything changes. Wish it was different, but it is not.

Problem is who’s gonna buy your house knowing the problem with property taxes in Illinois great you wanna leave but odds are you’re STUCK