By: Ted Dabrowski and John Klingner

To see how easy it is to mislead Illinoisans about the potential impact of progressive tax schemes, just look at a recent Capitol Fax post.

There, Rich Miller reposted a tweet that leaves unsuspecting readers thinking Minnesota’s progressive tax structure would be favorable to individual “middle-income” Illinoisans.

But it’s just not true. It’s another myth of the Minnesota “miracle.”

Most, if not all, individual middle income Illinoisans would pay more in taxes if Illinois were to implement Minnesota’s progressive tax regime. How many middle-income Illinoisans would be negatively affected depends, but only slightly, on where middle incomes begin.

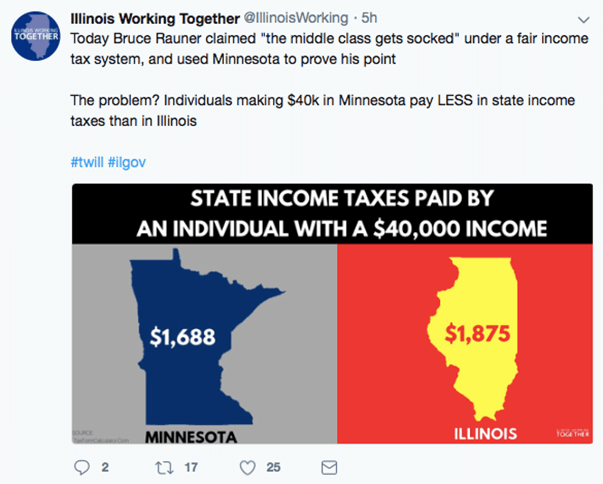

The tweet Miller posted was from Illinois Working Together. The tweet’s purpose was to counter a Gov. Rauner claim in which he used Minnesota to prove that “the middle income gets socked” under a “fair” income tax system. To make its counterclaim, the anti-Rauner coalition’s tweet shows that a Minnesotan pays nearly $200 less in taxes on a $40,000 income than an Illinoisan does. That much is true.

But by cherry picking the one income level provided by Illinois Working Together, Miller is misleading his readers. Looking at that tweet alone would lead most readers to infer that Minnesota’s middle-income individuals pay lower taxes. Here is the tweet he published:

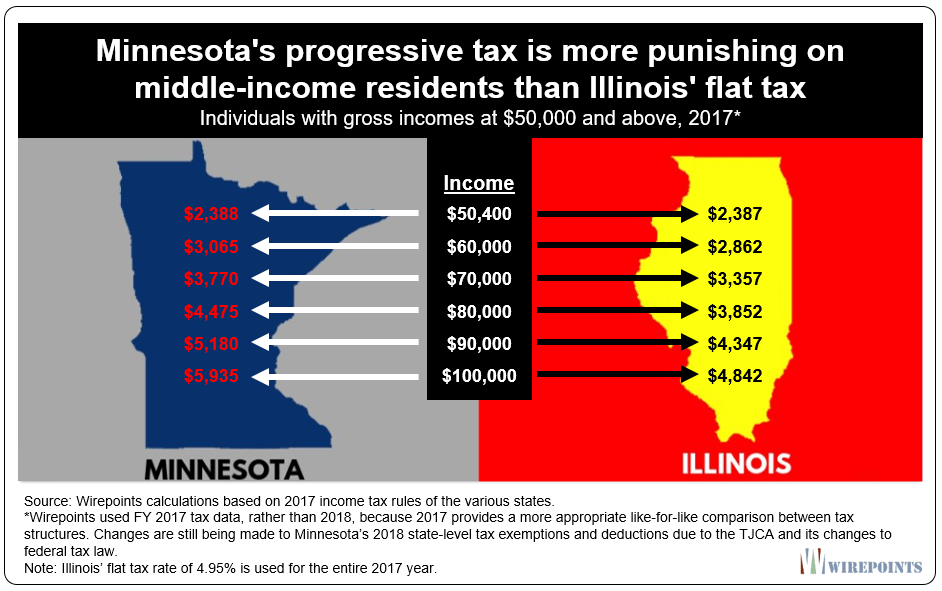

The truth about what a Minnesota progressive tax scheme would do to individual middle-income Illinoisans is shown below. A Minnesotan making $50,400 or more pays more in taxes under the progressive scheme than an Illinoisan making the same amount under the flat tax.

Graphic amended 9/24/18. See note at end of piece.

And since Minnesota’s plan is progressive (see Appendix), the higher the income, the more Minnesota’s tax structure punishes its residents’ wallets. Illinois doesn’t have that problem under its flat tax system.

What this proves is, regardless of what one considers the “top” income for middle-income individuals, Minnesota’s progressive tax structure would punish Illinois’ middle-income workers.

The only thing left for debate is whether an income of $40,000 to $50,000 is middle-income for an individual in Illinois. In Chicago, definitely not. But in Cairo, Illinois, it might be.

Regardless, the majority of Illinois middle-income individuals would take a hit under Minnesota’s tax structure.

That’s something Miller might want to add to any of his posts on progressive taxes.

————–

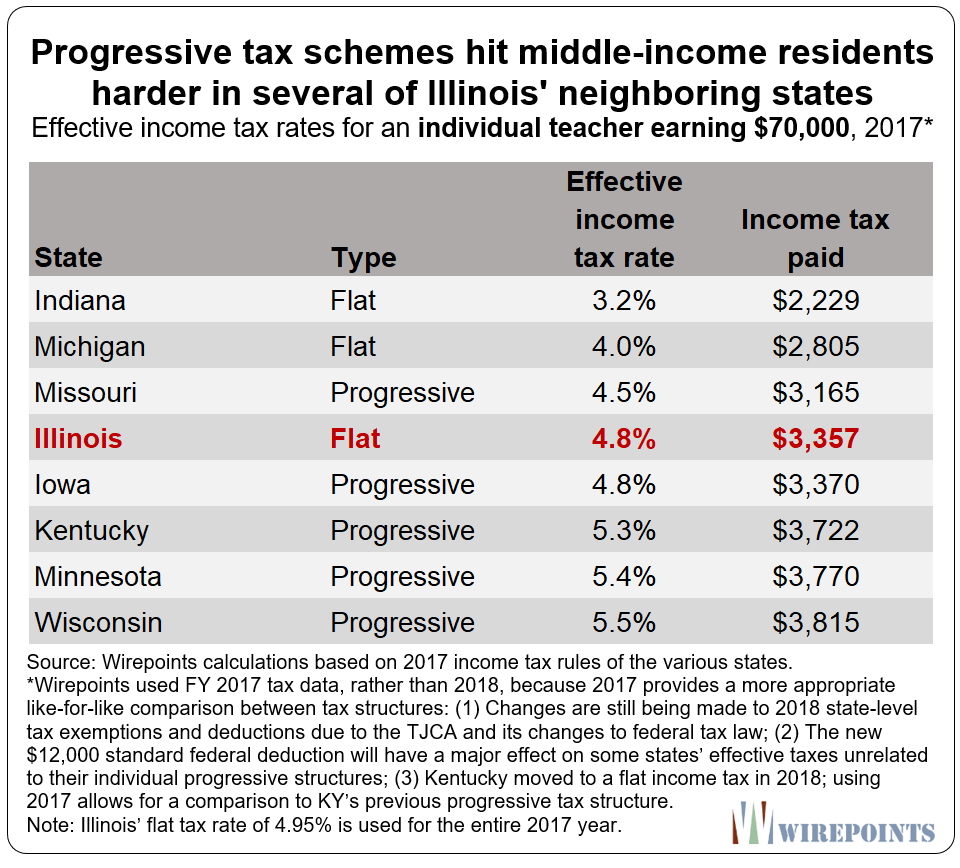

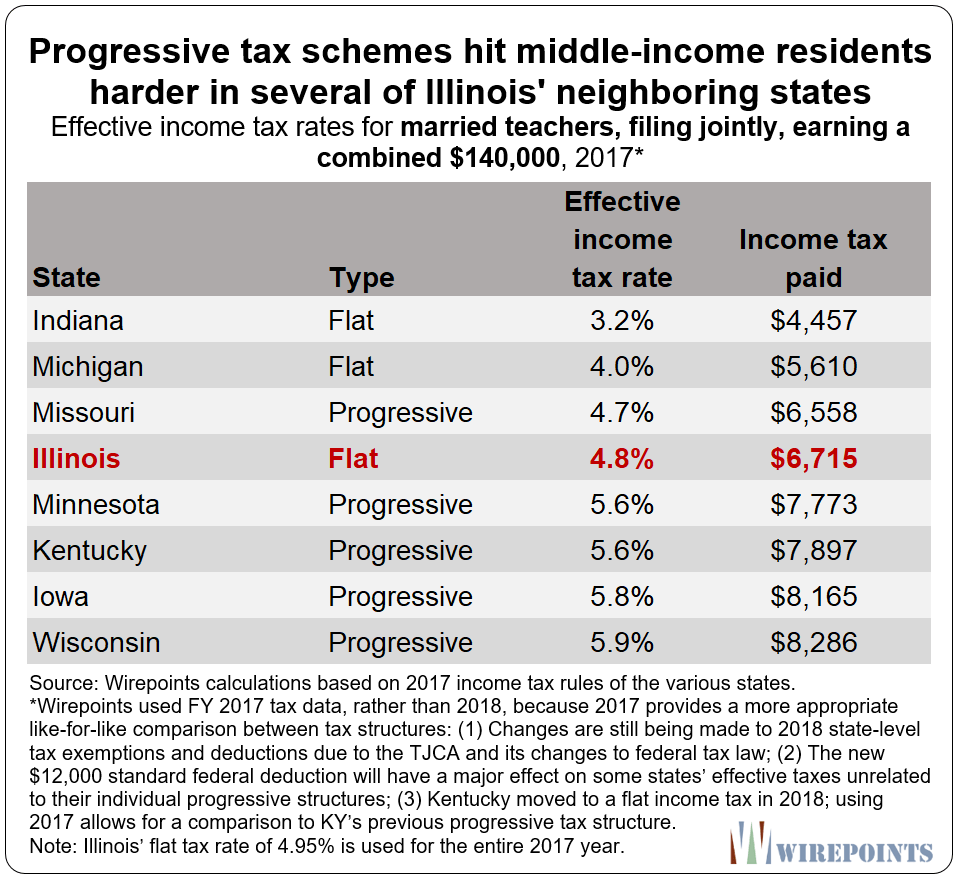

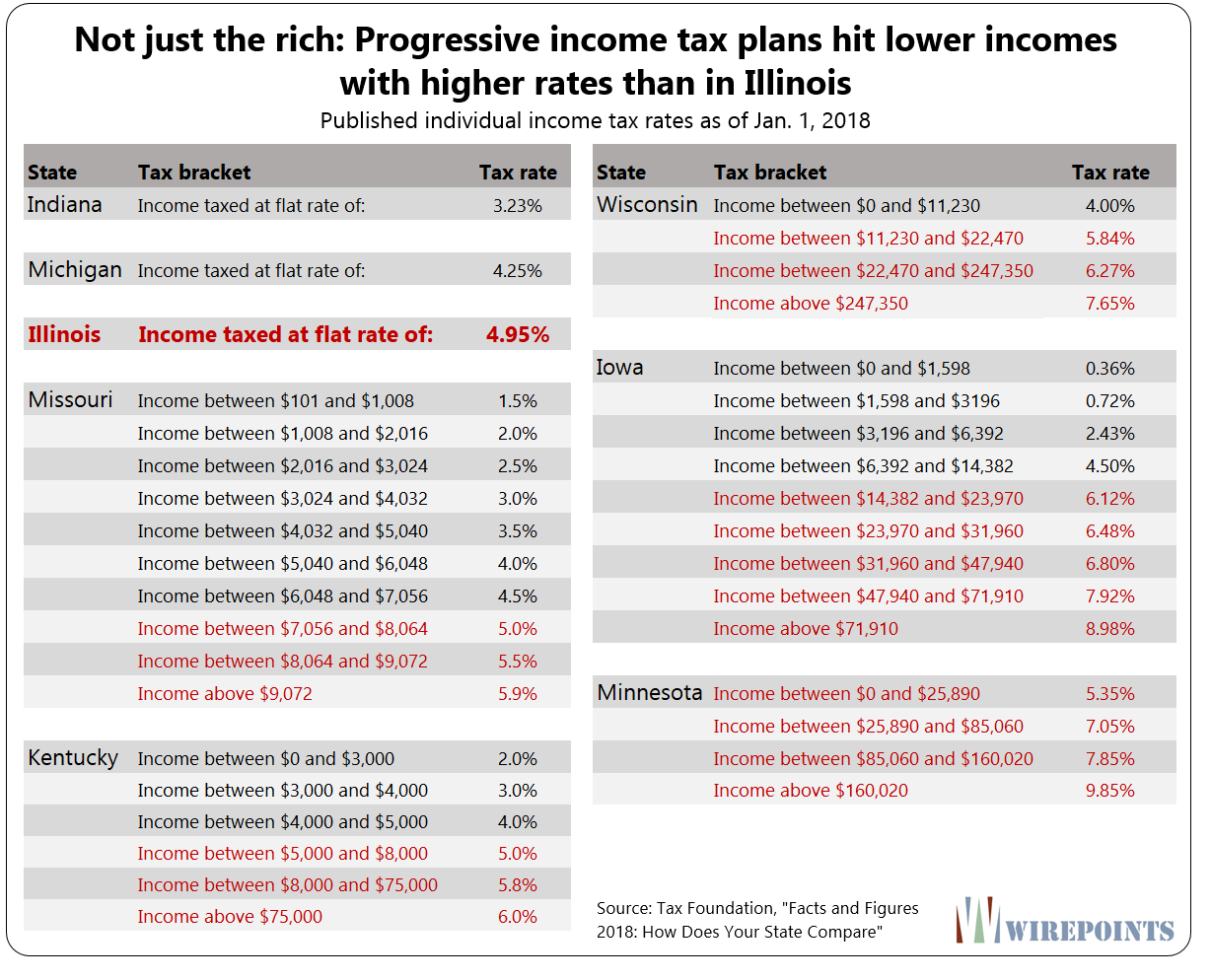

Appendix: It’s just not Minnesota’s structure that would be bad news for middle-income Illinoisans. They would pay more under most progressive-tax plans of neighboring states.

Graphics amended 9/24/18. See note at end of piece.

Note on amended graphics: Wirepoints changed its state-to-state income tax comparison to FY 2017 from FY 2018 because 2017 provides a more appropriate like-for-like comparison between tax structures because: (1) Changes are still being made to 2018 state-level tax exemptions and deductions due to the TJCA and its changes to federal tax law; (2) Kentucky moved to a flat income tax in 2018; using 2017 allows for a comparison to KY’s previous progressive tax structure.

A set of state lawmakers want to extend CPS’ current school closing moratorium to February 1, 2027 – the same year CPS is set to transition to a fully-elected school board. That means schools like Manley High School, with capacity for more than 1,000 students but enrollment of just 78, can’t be closed for anther three years. The school spends $45,000 per student, but just 2.4% of students read at grade level.

A set of state lawmakers want to extend CPS’ current school closing moratorium to February 1, 2027 – the same year CPS is set to transition to a fully-elected school board. That means schools like Manley High School, with capacity for more than 1,000 students but enrollment of just 78, can’t be closed for anther three years. The school spends $45,000 per student, but just 2.4% of students read at grade level.

Hopefully, all media will get the message, in Illinois, too.

Hopefully, all media will get the message, in Illinois, too. Ted joined Tom Miller of WJPF to talk about Illinois’ highest-in-the-nation property taxes, why lawmakers don’t want to touch the tax’s cost drivers, just how much Illinoisans’ tax burden has grown over the decades, why Gov. Pritzker failed to meet his promise to reform property taxes, and more.

Ted joined Tom Miller of WJPF to talk about Illinois’ highest-in-the-nation property taxes, why lawmakers don’t want to touch the tax’s cost drivers, just how much Illinoisans’ tax burden has grown over the decades, why Gov. Pritzker failed to meet his promise to reform property taxes, and more.

Governments are ran by Satan himself. Get rid of them all

How does that change for married filing jointly?

The median household income in IL is about $60K.

Also it would be helpful if the $40k figure was added to the WP chart, so people can more easily understand that those earning $40k and below would benefit if MN’s adjustable income tax was implemented in IL in the scenario described in the article.

Rich Miller’s blog seemingly is populated by a lot of State of Illinois employees based upon the comments section and a posting once showing the various Illinois Departments and Agencies that have a subscription to the service.

Naturally we can expect a tax hike from that group of individuals…it supports anything that assures Illinois public employees of having one of the highest pay grades in the nation

Your taxable income is lower in Minnesota because it’s derived from Line 43 (after itemized deductions) on you 1040 whereas Illinois’ taxable income is Line 37 (AGI), so I’m guessing the new federal tax laws will increase your tax liability in Minnesota. At $40,000, you’d save $190 in taxes in Minnesota. That’s fine as every dollar counts. But how many school districts are trying to pass referenda that are advertised as “only” being some small percentage of your home value (like $70 per $100,000 of home value)? How come paying $210 extra in property taxes on your $300,000 home is… Read more »

The $70 per $100 home value is typically deceptive, as referendum bond debt service is rarely flat over the term of the bond.

Deception by omission or not adequately explaining is the norm not the exception during bond referendums.