By: Mark Glennon and John Klingner

To countless politicians and critics nationally and locally, it was perhaps the most vile thing Congress ever produced.

- The “worst bill in the history of the United States Congress,” said House Speaker Nancy Pelosi.

- “The American plutocracy gets its immoral tax bill,” wrote Jesse Jackson in the Chicago Sun-Times.

- “Sheer greed, an effort by the…. ‘malefactors of great wealth’ to escape more of their obligations to the society,” wrote the St. Louis Post-Dispatch.

It was TCJA, the 2017 Tax Cuts and Jobs Act, and its alleged sin was a massive give-away to the rich at the expense of the poor and middle class.

When the bill was passed in 2017 we said to hold off on that judgement. “One thing for sure,” we wrote, “is that wildly hysterical opponents have convinced the middle class they’ll be getting a tax increase, and that’s nonsense.”

It turns out that may have been understatement.

For the first time, we have the actual results instead of estimates and assertions. In 2018, the first year for which we have hard numbers on TCJA’s effect, the wealthiest Americans paid a greater portion of the burden than they did before.

For the first time, we have the actual results instead of estimates and assertions. In 2018, the first year for which we have hard numbers on TCJA’s effect, the wealthiest Americans paid a greater portion of the burden than they did before.

There’s more. TCJA, according to separate research, lopped a full trillion dollars off the value of high-end homes, not middle-class homes, which was part of a trade-off that accrued to the benefit of the country as a whole.

Here are the details:

The IRS publishes data on which income groups paid how much about two years after each year’s filing deadline. Those numbers for 2018 recently came out and were analyzed by the NTPU, the National Taxpayers Union Foundation. Their conclusions:

As a result of the TCJA, the share of federal income taxes paid increased for the top 1 percent from 38.5 percent in 2017 to 40.1 percent in 2018…. On top of this, the share of income taxes paid by the top 5 percent, top 10 percent, top 25 percent, and top 50 percent all increased. The bottom 50 percent of taxpayers saw their share of federal individual income taxes drop from 3.1 percent to 2.9 percent.

Their full report is here.

How can that be? TCJA cut rates for high earners and some supposed experts said at the time that the result would be a windfall for the rich.

The answer is due in part to lower rates for everybody, a higher standard deduction and additional provisions designed to ease burdens low-income earners such as the increased child tax credit, all of which were in TCJA.

But there’s clearly another reason why higher earners didn’t get a windfall, one that became immediately obvious to anybody paying high property taxes in states like Illinois. For high earners, TCJA slashed the SALT deduction – deductions for state and local income tax, sales tax, and property taxes, essentially capping them at $10,000. With a higher standard deduction protecting low and moderate incomes, that cap only hit big earners.

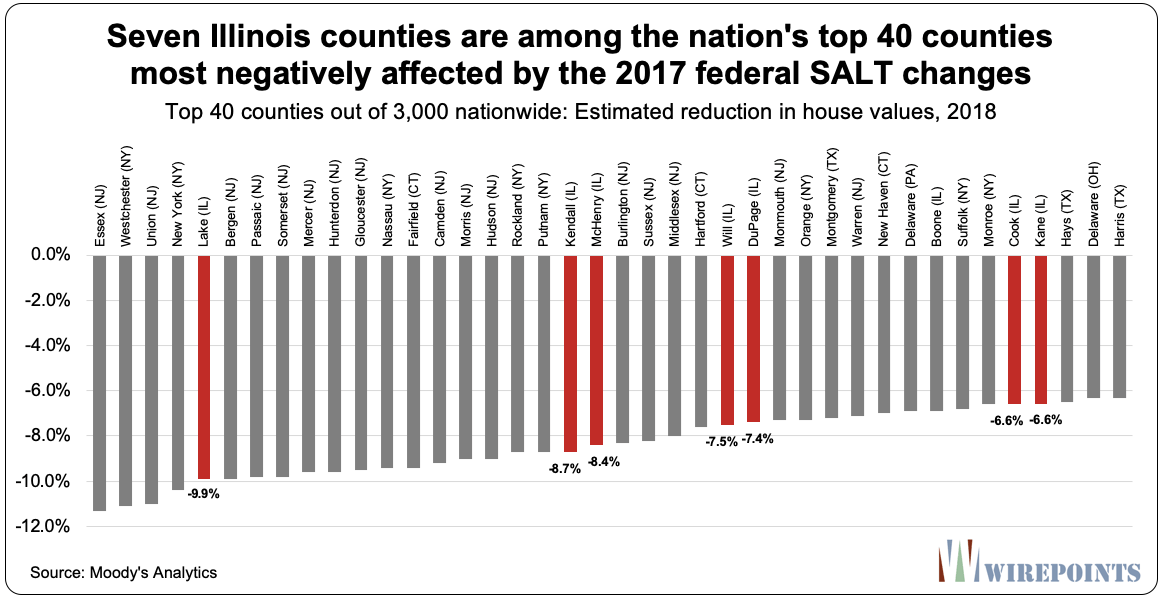

And it’s for that reason that the impact of TCJA goes far beyond NTPU’s study. High property taxes and reduced deductibility depress home prices. Moody’s Analytics quantified that effect in research last year.

Specifically, Moody’s estimates that TCJA’s reduction in SALT deductions means home prices are $1 trillion lower than they would be otherwise.

That loss is almost entirely concentrated on big earners and those with expensive homes in high tax states. The middle class gets the standard deduction, which TCJA increased, or if they itemize, they don’t hit the $10,000 cap. So, the tax code changes hurt home values most in the wealthiest areas in the highest property tax states – Illinois, Connecticut, New York and New Jersey, according to Moody’s.

You can see it in Moody’s data below of the 40 hardest-hit counties below. They are all in high property tax states with relatively high incomes.

Notice that Cook County and all Chicago’s collar counties are on that list:

The point is that the savings for the general public that resulted from reduced SALT deductions were paid for heavily by the wealthy through reduced home values. TCJA was indeed progressive.

The point is that the savings for the general public that resulted from reduced SALT deductions were paid for heavily by the wealthy through reduced home values. TCJA was indeed progressive.

The bigger lesson is to beware of claims about what’s progressive and what isn’t. Politicians often don’t know or truly care about the difference.

Supposedly progressive Senators like Senators Chuck Schumer and Nancy Pelosi, for example, want to double down on the hostility to TCJA by eliminating the cap on SALT deductions. That means they are directly supporting a tax cut for the rich. Schumer said, “I want to tell you this: If I become majority leader, one of the first things I will do is we will eliminate [the cap] forever…. It will be dead, gone and buried.” Pelosi has tried to remove the cap as part of various pandemic relief proposals.

Here in Illinois, the supposed regressivity of TCJA was sometimes used to support the case for a counterbalance through the failed Fair Tax proposal, which would have allowed for progressive tax hikes at the state level. That rationale was wrong, and the Fair Tax would have been a mistake for separate reasons that we often wrote about – Illinois already has an uncompetitively high tax burden. Trying to address inequality through state tax increases where the tax base is already fleeing because of high taxes is folly.

TCJA had other pros and cons not discussed here. Personally, I thought at the time it went too far too fast because, among other reasons, the economy was red hot, so some of the economic stimulus it provided would have been better to preserve for tougher times (like now).

But it’s good to see that the hysteria about it being regressive turned out wrong, at least so far.

In the coming year, we hope to write more about how to address income and wealth inequality focusing on what truly works and what doesn’t. That’s an extraordinarily complex matter in which sorting facts from political hyperbole isn’t easy, as TCJA has shown.

Read more about the issues that impact Illinoisans and the nation as a whole:

- True inequality: In-class education at Chicago’s Catholic schools but remote learning at public schools

- New 2020 Census shows Illinois population shrinks for 7th year in a row

- Illinois Senators Durbin and Duckworth Are Among The Book Burners Happy With Big Tech Censorship

- Same old bad news in new 2020 Illinois pension report belies far worse reality

- Look Who Is Standing In The Schoolhouse Door Now: The Chicago Teachers Union

- Illinois to borrow billions from the Feds AGAIN, only state in country to tap government lending program

A set of state lawmakers want to extend CPS’ current school closing moratorium to February 1, 2027 – the same year CPS is set to transition to a fully-elected school board. That means schools like Manley High School, with capacity for more than 1,000 students but enrollment of just 78, can’t be closed for anther three years. The school spends $45,000 per student, but just 2.4% of students read at grade level.

A set of state lawmakers want to extend CPS’ current school closing moratorium to February 1, 2027 – the same year CPS is set to transition to a fully-elected school board. That means schools like Manley High School, with capacity for more than 1,000 students but enrollment of just 78, can’t be closed for anther three years. The school spends $45,000 per student, but just 2.4% of students read at grade level. Hopefully, all media will get the message, in Illinois, too.

Hopefully, all media will get the message, in Illinois, too. Ted joined Tom Miller of WJPF to talk about Illinois’ highest-in-the-nation property taxes, why lawmakers don’t want to touch the tax’s cost drivers, just how much Illinoisans’ tax burden has grown over the decades, why Gov. Pritzker failed to meet his promise to reform property taxes, and more.

Ted joined Tom Miller of WJPF to talk about Illinois’ highest-in-the-nation property taxes, why lawmakers don’t want to touch the tax’s cost drivers, just how much Illinoisans’ tax burden has grown over the decades, why Gov. Pritzker failed to meet his promise to reform property taxes, and more.

I just wonder should the Democrats try and attack the SALT deduction limitations how they will explain it to their constituents in other States how they will more or less be subsidizing the State of Illinois. This makes me think that SALT might just might be here to stay and represents just another nail in Illinois’ coffin.

Hmmm The problem that ALWAYS arises whenever anyone attempts to discuss Federal /State “Statistics” is the fact that 99% of the time those “Statistics” are themselves fraudulent. Generated or rigged to create a specific outcome, like the bogus “unemployment rate”, “Interest rates”, the Daily “Gold price” any commonly consumed commodity for that matter etc., etc, as numerous admissions in open court in all these instances has proven, the government and/or corporations end up admitting that they are fictions. These fictions of course are never random. These creations are expressed created to make somebody money either directly or indirectly. The only… Read more »

As expected “politicianscpander to the middle class”

My family is one of those above average income ones with a big property tax. Let me tell you we got hit very hard with higher taxes to Uncle Sam. I am not complaining about that but I am complaining about how everybody said people like us were being so greedy. We knew this was coming but didn’t complain and still everybody said those horrible things.

This is pretty poor analysis. (A) Completely ignores the corporate tax rate impact – the SOURCE of the primary criticism of this bill. This would cause income to be returned in some ratio to (1) shareholders in the form of dividends and (2) increased wages/income to labor. The core issue is in what proportion those increases occured – would the benefit go primarily to the affluent or less affluent? (Hint: we know – buybacks were heavily criticized as COVID-induced recession hit) (B) SALT – This was a punitive change to taxation where the winning side wanted to stick it to… Read more »

“The problem was never that the poor would end up paying a higher % of total taxes, the problem was that the benefits (gains) went disproportionately to the affluent without a equal reduction in taxation (gains) that went to the less affluent.” This is quite frankly the laziest argument that is constantly dragged out by liberals. The poor don’t pay any federal income taxes. In fact, the bottom 47% don’t pay any federal income tax. Yes they pay sales taxes (supports local government) and yes they pay social security tax but that is to fund an initiative that supports them… Read more »

Well done and absolutely correct!

LOL I love how my well explained and accurate points of critical analysis are downvoted because they provide an alternative (“independent”, non-political, data and policy oriented, more accurate) perspective on the topic which doesn’t fit into the apparent (apparently revealed) agenda of the writers and more importantly audience, and the PRIMARY (/sarcasm independent, policy and data-driven /end sarcasm) response begins with an ad hominem attack calling me a liberal while ATTEMPTING to not actually say it out loud to avoid being accused of being an ad hominem. You know, and not actually addressing or critiquing my critique whatsoever. I’ve talked… Read more »

I did address your critique, as did others. It was weak. Any tax cut will disproportionately benefit tax payers. Not everyone agrees with your apparent belief that government’s job is to level outcomes. You engage in all the things you criticize others for. You presume bad faith, which is as hominem. The only reason you can think of for capping SALT deductions is to “stick it” to the other side. Analyzing the net effects of the corporate tax rate cut on all levels of income is very complex, and the article did not attempt to do so. Your “analysis” doesn’t… Read more »

“yes, putting words in my mouth, because what I said in your quote was “less affluent” which you are trying to re-brand as poor.” I did no such re-branding. Tough to lie that I’m using your words when I copy and pasted the quote directly from YOUR VERY OWN WRITING. Please save us all the mental gymnastics. You wrote it. It’s in your original post. What’s the purpose of lying when everyone can go to your post and see that you are lying. Kind of makes all your other long winded points useless when you are caught lying. Also, I… Read more »

Mr. Barendt, you are dead wrong on all that and some of it is just plain silly. You are effectively complaining about the higher tax burden the wealthy pay under TCJA. A. Corporate tax. That was not where all the controversy was, as you claim. To the contrary, the more enlightened economists on the left have long despised the corporate income tax and wanted to get rid of it entirely. TCJA’s changes in it were long overdue. It’s ultimately paid by shareholders, consumers, suppliers and employees, and it is not progressive. Yes, shareholders bear much of it they are the… Read more »

Mr. Glennon, Thanks for taking the time to respond. I appreciate the possibility that I am “dead wrong,” but do confess I wonder how productive the dialogue will be if any of this is described as “just plain silly.” Mr. Barendt, you are dead wrong on all that and some of it is just plain silly. I don’t see how you’ve established the incorrectness of any of my points, but thanks for calling my points silly instead of addressing them. You are effectively complaining about the higher tax burden the wealthy pay under TCJA. Please re-read. I’m not complaining about… Read more »

You use a lot of words but don’t make many points. I guess your gripe is that this analysis did not take into account the corporate tax rate cut. But for all your hand-waving you don’t provide any analysis to back up your assertions. You falsely accuse the author of straw man argument and then engage in it yourself: the author addressing the specific question of whether the middle class got a tax increase, as loudly and persistently claimed by Democrats. You want to claim that “everybody” agreed the bill was progressive and gave the middle class a tax cut,… Read more »

I’ve been double-taxed on my social security taxes all my working days.

Amen. Thank you. Well stated, and more proof. No one requires and to buy, or keep high priced or highly taxed homes, either. Buyers and debtors beware. Tpd

In addition to the middle class not getting hurt by the 2017 tax cut, overall IRS data shows that for 2018, the first year of Tax Cuts and Jobs Act, Illinois 6 District saved over $166M with every income bracket lower !! AND, the bill fueled economic activity because the IL6 increased income by over $4 billion at the same time saving on taxes.

Truth matters.

Not only this but it eliminated states with low property taxes, due to good management, from subsidizing states that have raised property taxes through the roof due to poor management. The old property tax deduction put the fed right in the middle of handing out a huge favor to states like NJ, CT, NY, IL MA, etc. At the direct expense of homeowners not having the resource of such a big property tax bill. The old way basically handed cash at tax time to those living in mismanaged states, because your property tax bill was treated like money paid against… Read more »

Mike Bloomberg contributed +$60M to Joe Biden and Democrat campaigns – His projected annual gain if the SALT caps are removed? $60M/ yr. Yes, Biden, Pelosi and Schumer want a HUGE tax cut for Billionaire’s! Notice none of this was discussed in our MSM, for it flew in the face of the Democrat election narrative of ‘Orange Man Bad!’.

This is something to bring to the attention of the socialists that like to bash Trump, both at the state and federal level. Imagine a cat fight between AOC and Pelosi when Nancy tries to remove the SALT cap which clearly only benefits the upper tier. It’s not actually news though, this was brought up when it became law and Cuomo and Murphy started howling about it.

Did Illinois ever produce a report like this? I know I paid more state taxes due to the loss of the SALT deduction. I imagine some lower income people paid less. It would be interesting to know if net collections are higher or lower after the federal tax cut. The fact that you hear nothing from Illinois tells me they’re collecting more and don’t want the taxpayers to know.

My household lost the SALT tax like everyone else, but fortunately my smaller house has (only) a $6500 tax bill, so I more than made up for those losses with the: ~increased child tax credits ~lower tax brackets ~spouse’s self-employed 20% tax reduction My AGI in in 2017 and 2018 were similar but my tax owed dropped by a full 5 figures. I’m not exaggerating, I paid $11k less in taxes in 2018 than 2017 because of the new tax law. It was a great bill for hard working middle-class and self-employed families living within their means. I’d be screwed… Read more »

Good question which, I think, is entirely separate from the TCJA and the federal changes. I am aware of no such report on IL revenue. It would be a matter of the adjustment to the tax credit you get for IL property taxes paid on your IL income tax return. (Remember that in IL that’s done through a credit, not a deduction.) That credit changed to keep up with the recent increase in IL income tax, so I am not sure there is an issue here.

A bit off the subject here but worth remembering that when Illinois taxation is computed based upon a “flat tax” there are assorted credits, deductions and additions that modify the Federal Adjusted Gross income used in computing the “flat tax” as brought out by your post. This can easily be shown by looking at the Illinois Schedule M at the following link: https://www2.illinois.gov/rev/forms/incometax/Documents/currentyear/business/miscellaneous/Schedule-M.pdf Illinois had a simple flat tax once but like so many things it has become another political myriad of adjustments for special interests, including the State’s, in true Illinois political style when determining the amount of tax… Read more »

Yes, but that Schedule M has some pretty obscure tax deductions likely not used by 98% or more of IL residents. Illinois has an artificially low exemption that’s only a fraction of the federal exemption and that 2 page schedule M is short compared to the federal deductions.

Net collections were actually lower. Don’t know about the state level, but here’s a good summary. Additional problem: The tax cuts aren’t funded yet, so the future increase in taxation to finish funding or the servicing of the debt and its claims against future taxes would need to be addressed because we can call any of this progressive or regressive.

https://www.brookings.edu/policy2020/votervital/did-the-2017-tax-cut-the-tax-cuts-and-jobs-act-pay-for-itself/

Remember the Fair Tax team didn’t know how to devise a graduated tax rate structure that lowered taxes for 97%, so they threw in a bunch of tax credits and backed their way into it. Don’t expect them to understand the Trump tax cuts.

The only way Tax and Cut should be used in Illinois is, they tax and cut your net income.

Don’t confuse them with data. Can our governor still take plumbing out of a mansion and avoid property taxes? Different kind of SALT deduction