By: Ted Dabrowski and John Klingner

Illinois Sen. Bob Martwick, an ally of Gov. J.B. Pritzker, is reportedly planning to offer a new version of a progressive tax scheme for Illinois “as soon as next month.” Martwick wants to revive a version of the governor’s scheme even though Illinoisans handily rejected the original tax amendment in Nov. 2020. The governor spent more than $50 million of his own money to try to push through the tax hike, but ultimately ended up failing 55 to 45 percent.

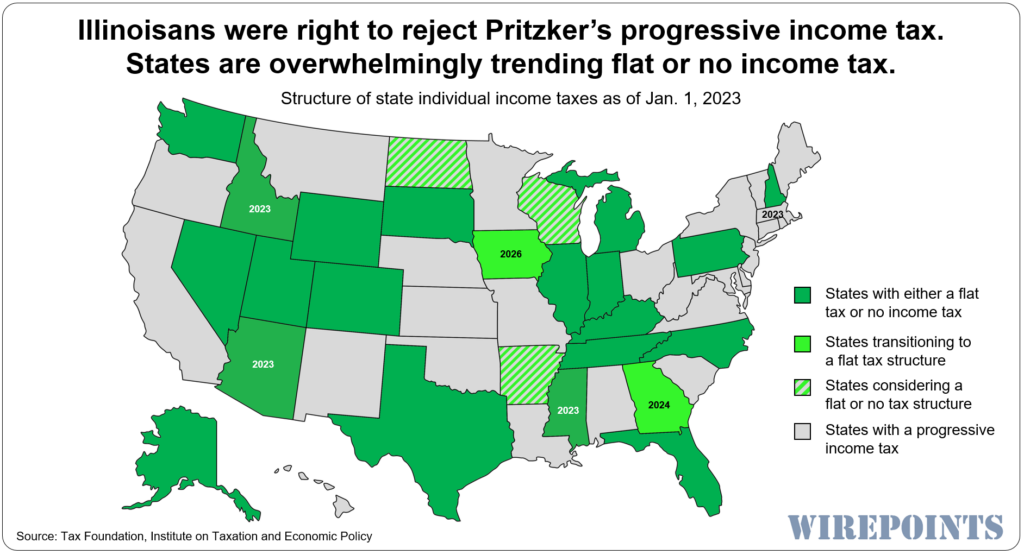

A quick scan of national reporting reveals the foolishness of any such tax hike proposal. States across the country are overwhelmingly moving towards flat and zero income tax structures, while many others are lowering rates outright. An Illinois tax hike would be moving in the exact opposite direction, further crippling the state’s economic competitiveness.

(See a Wirepoints companion piece on more tax hikes: Illinois’ newest suicide attempt: Legislation for an Illinois wealth tax will be introduced on Thursday)

This year alone, Idaho, Arizona and Mississippi all converted to a flat tax, while Georgia and Iowa are making the transition over the next two or three years, according to a Tax Foundation report. Kentucky converted to a flat tax in 2018. Tennessee went fully no-tax in 2021, and North Carolina went flat in 2014.

Only Massachusetts has gone the other way, with voters agreeing to a “millionaires surcharge” that went into effect this year. Before that, the last state to move to a progressive tax was Connecticut more than 25 years ago (1996).

Martwick’s progressive tax push also comes just one day after the Wall Street Journal reported Wisconsin’s potential move toward a flat tax. The state’s Republicans, who have near two-thirds majorities in the legislature, are working to reduce Wisconsin’s 3.54% to 7.65% progressive tax to a flat 3.25% structure.

Martwick’s progressive tax push also comes just one day after the Wall Street Journal reported Wisconsin’s potential move toward a flat tax. The state’s Republicans, who have near two-thirds majorities in the legislature, are working to reduce Wisconsin’s 3.54% to 7.65% progressive tax to a flat 3.25% structure.

Finally, the Institute on Taxation and Economic Policy also reported that the governors of both Arkansas and North Dakota are pushing for a flat tax as well. And Indiana lawmakers, meanwhile, are considering eliminating the state’s income tax altogether.

Separately, the Manhattan Institute reported earlier this month on a number of states that are lowering rates due to solid revenues from the trillions in federal bailouts and the inflationary economy:

“This year, residents of 11 mostly Republican-leaning states are set to enjoy cuts to their individual income taxes, according to the Tax Foundation…New York is the only solidly blue state that has joined the income tax-cutting party.” Those cuts are “on top of an equal number of states that trimmed their income-tax rates in 2022.’

Increasingly uncompetitive Illinois

As we warned the last time we talked about the nation’s flat/no income tax trend, these changes mean more trouble for Illinois.

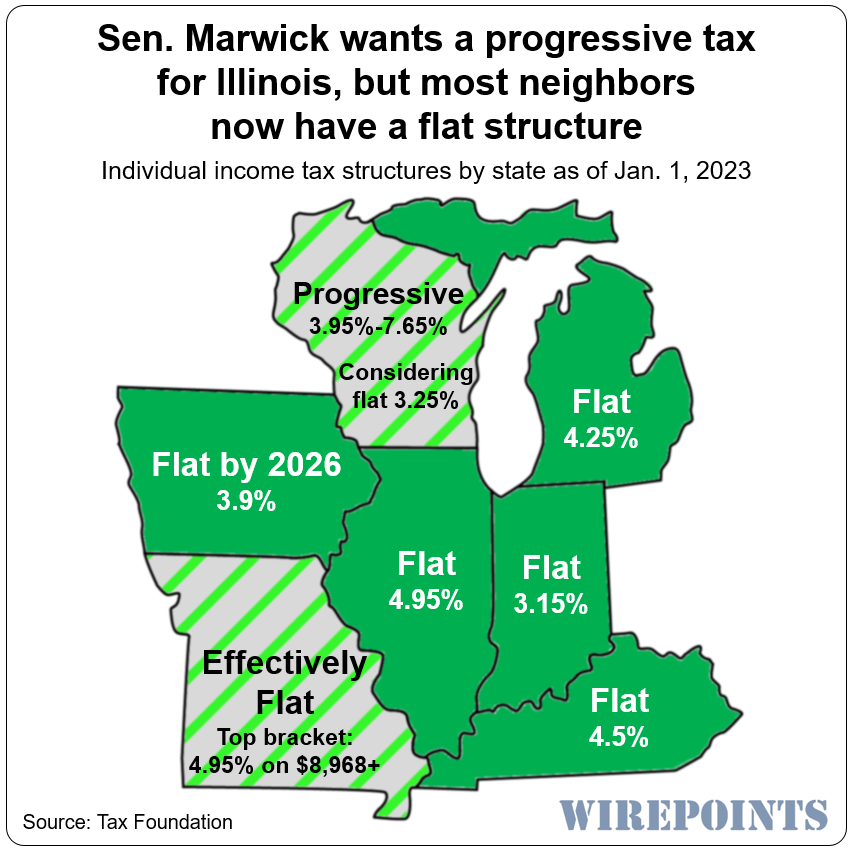

Illinois has some of the highest property, gas and sales taxes in the nation. Its 4.95% flat income tax is one of the few competitive features it has left. The more states that adopt a flat/no income structure, the more Illinois’ already-limited advantage goes away.

That’s made all the more obvious when looking at our neighbors. Kentucky went to a flat tax in 2018 and it recently cut its 5 percent rate to 4.5. Iowa will go flat by 2026. Indiana and Michigan already have flat tax rates of 3.15 percent and 4.25 percent, respectively.

And Missouri, while still progressive, continues to increase its competitiveness. The state just reduced its top marginal rate to 4.95 percent on incomes over $8,968, making it functionally identical to Illinois’ flat tax for most earners.

And Missouri, while still progressive, continues to increase its competitiveness. The state just reduced its top marginal rate to 4.95 percent on incomes over $8,968, making it functionally identical to Illinois’ flat tax for most earners.

That leaves Wisconsin as Illinois’ only neighbor with a truly progressive income tax. And as mentioned above, that could change soon.

Free money running out

Gov. Pritzker originally pitched the progressive tax as a way to raise the billions in revenue that all his spending programs required. He even threatened Illinois’ middle class with a hike to the flat tax if voters didn’t approve the progressive tax amendment.

The amendment was rejected, but Pritzker was saved from having to follow through on his threat by the federal pandemic spending that gave Illinois’ public and private sectors nearly $200 billion in bailout money.

Fast forward to today and Gov. Pritzker is pitching across the country – in his New Hampshire stump speech, at his 2nd inauguration, etc. – that he and his administration deserve credit for “balancing the budget,” paying down Illinois’ bills and the state’s first credit upgrades in 20 years.

But if everything is going great and he’s fixed things, then why is Pritzker, through a proxy, floating the idea that Illinois needs a progressive tax hike? The answer is simple: The impact of the federal Covid money will soon run out and all of Illinois’ unsolved problems, including the nation’s worst pension crisis, are sure to resurface. Add to that the additional spending programs of the last few years and lawmakers are going to desperately want new revenues to keep their political machine going.

Read more from Wirepoints:

- Illinois’ progressive tax amendment fails

- Illinois has been bleeding its wealthiest residents for years. Now it’s Ken Griffin’s turn to leave.

- About Gov. Pritzker’s “$1 Trillion” GDP brag

- Four more states move to a flat tax.

- Thirty years of pain: Illinoisans suffer as property tax bills grow far faster than household incomes, home values

- 20 facts every Illinoisan should know about the progressive tax amendment

Ted joined Scott Slocum to talk about the huge potential cost to taxpayers for the Bear’s proposed new stadium, why the economics of publicly-funded sporting arenas don’t work, what the latest criminal justice statistics tell us about the SAFE-T Act’s impact so far, the latest developments on Chicago’s ongoing migrant crisis, and more.

Ted joined Scott Slocum to talk about the huge potential cost to taxpayers for the Bear’s proposed new stadium, why the economics of publicly-funded sporting arenas don’t work, what the latest criminal justice statistics tell us about the SAFE-T Act’s impact so far, the latest developments on Chicago’s ongoing migrant crisis, and more. We’re supposed to worry that climate change itself is to blame for Illinois’ failing climate policy, but far bigger problems are obvious.

We’re supposed to worry that climate change itself is to blame for Illinois’ failing climate policy, but far bigger problems are obvious. Traumatizing robberies and violent crime continue to go up in Chicago this year, hitting a six-year high compared to the same time last year. It’s crime in neighborhoods perceived as safe, sometimes taking place in broad daylight, that’s driving the increased fear among Chicagoans and suburbanites.

Traumatizing robberies and violent crime continue to go up in Chicago this year, hitting a six-year high compared to the same time last year. It’s crime in neighborhoods perceived as safe, sometimes taking place in broad daylight, that’s driving the increased fear among Chicagoans and suburbanites. Ted was on The Chicago Way with John Kass and Jeff Carlin to discuss the proposed $5 billion lakefront stadium project proposed by the Chicago Bears & Mayor Brandon Johnson, why Chicago is struggling compared to other metro areas across the country, why the city might or might not go the way of Detroit, and more.

Ted was on The Chicago Way with John Kass and Jeff Carlin to discuss the proposed $5 billion lakefront stadium project proposed by the Chicago Bears & Mayor Brandon Johnson, why Chicago is struggling compared to other metro areas across the country, why the city might or might not go the way of Detroit, and more.

the bastards never have enough money.

Even if they could print the money, they still wouldn’t have enough.

Make taxation theft again.

from yesterdays Crain article/ per lord Martwick——“Either way, the proposal must guarantee property tax relief in the way the Fair Tax didn’t, Martwick said. “When you look at people leaving the state, the vast majority are middle class people,” with high taxes on their homes a prime reason. To be successful a new graduated income tax plan must provide property tax relief and deal with the pension problem, he said.” So, is this hinting that in 2nd go around for “Fair Tax” the machine is going to throw chump taxpayer/ home owners a bone and now Fair Tax will somehow cover… Read more »

They threw that bone last time. Under the Fair Tax, the property tax credit was increased from 5 to 6 percent. How generous!

Despite the knowledge some here will not agree but how about this? Tax farmers on the fair market value of their ground like it used to be for years. When they sell they want full market value for the ground so why should they get a break? Maybe if they had to pay like the rest of us they wouldn’t be so quick to vote for the taxation proponents. Each and every day corporate farms get bigger and more profitable and are quite well off when one considers the value of their ground. What’s fair is fair and they are… Read more »

from yesterdays Crains article/ per lord Martwick——“Either way, the proposal must guarantee property tax relief in the way the Fair Tax didn’t, Martwick said. “When you look at people leaving the state, the vast majority are middle class people,” with high taxes on their homes a prime reason. To be successful a new graduated income tax plan must provide property tax relief and deal with the pension problem, he said.” So, is this hinting that in 2nd go around for “Fair Tax” the machine is going to throw chump taxpayer/ home owners a bone and now Fair Tax will somehow cover… Read more »

Tax Pension money, after all they are the ones responsible for this nightmare.

Maybe they will just tax private pensions and 401k/IRA withdrawals? Wouldn’t that be something.

Private Pensions are a thing of the past. They bankrupted every company that tried to keep them. Only Government greedy A$$ holes think it is okay to steal from the unborn children. Pensions have destroyed the quality of life for the average family in Illinois. They are fleeing at increasing numbers, that tells the story. They are voting with their feet.

PPF your comment is the same in every article in regards to pensions vs. 401K. Now we know who all the red down votes are

How are my comments the same when discussing pensions vs. 401k? I’m curious because it’s not something I typically comment about. When people bring up taxing pensions, my comments revolve around how it would be fair if done but I also remind people that if they tax pensions then they will also tax private pensions and 401k/IRA withdrawals.

Personally it makes no difference to me if public employees were no longer offered pensions and instead offered 401k type savings plans. You just can’t change it for existing employees.

I’m not against a graduated income tax, per se. I could give two damns if a millionaire has a higher state income tax rate than me. I don’t think their rate should be usurious. I’m against a progressive income tax is because of one thing: bracket creep. Once there is one bracket to separate the “rich” from everyone else, there will be new brackets defining the “new rich.” Politicians will keep redefining what rich is so they can back into their ever-increasing budgets. I’m already paying for everyone else, I’m not willing to pay more for everyone else. For me… Read more »

Amen. Guarantees come in many forms. While they’re in the mood of amending the constitution, let’s guarantee fewer taxing bodies, term limits, real balanced budgets, school choice. You want more money, you sacrifice like the rest of us.

No wonder why people are leaving Illinois. I’m next.

No surprise here. Emboldened by passage of the Safe-T Act and changing the Constitution with the NO Right to Work Act, Illinois so called Progressives are sadly on a roll.

Taxing pensions is on the table, make no mistake. You voted for this.

It should be. Why should two retired pensioners with combined pensions into six figures not get taxed while some working schlub making 30k pay? Because they are on a fixed income? Pretty sure they are getting by better than the minimum wage guy.

Because the retired pensioners were members of the ruling political class and the working schlub is not.

“Why should two retired pensioners with combined pensions into six figures not get taxed while some working schlub making 30k pay?”

Then you should support taxing pensions and 401k withdrawals. It’s only fair after all.

Any retirement/insurance account in which you already paid taxes on should be exempt from income tax. That includes social security. Everything else should be on the table.

If you want to protect low income seniors, let retirees exempt the first $25k on taxable retirement income. For every $1 above that, they lose $1 exemption until they hit $50k.

Most SS recipients get their contributions back within 3.5 years. The rest is employer match and earned interest. So most SS is income that has yet to be taxed.

I think you are on the right track with the first 25k exemption if it’s ever taxed. While the exemption amount may be different I could definitely see a retirement tax for amount above a certain threshold.

Irrelevant. Pay taxes now or pay taxes later. In the case of social security, I pay taxes now. I would gladly exchange that for paying taxes when I collect.

Or move to Florida where there is NO State Income Tax.

You cannot see the hand gesture I am making for you.

You have foolishly walked into a bear trap – the article states they want a ‘mark to market’ tax. So it’s not based on your annual draw, but the total value of the pensions. For IL’s pension multi-millionaires, it will be a sizable tax.

The market value of the pension is close to zero because the funds are severely underfunded!

Taxing pensions means taxing ALL retirement income.

Retirees are the fastest growing segment of the population. Completely exempting all their retirement income is foolish.

The poor schlub who trudges into work 5x/week making $60,000 pays income taxes while the retiree with a $60,000 pension who rolls out of bed and strolls to the local diner in sweats pays nothing?

What’s funny is all these young groups that backed the fair tax totally ignored one of the main reasons why taxes go up. If they awaken, look out, retirees.

Can we just tax at 100% and speed this process up already? Bye earners, hello dependents! Illinois as the WEF wants it. You will own nothing. Including your government.

“Who is John Galt?”

If I were Martwick, I would create one new bracket for millionaires and nothing else. Forget that 3% benchmark. Just go for $1M and higher and be done with it.

Of course, the Crains article mentions no specifics. But they’re going to run into the same issue as before with change-averse retirees who have have plenty of experience not paying any income taxes under a flat tax.

With every passing day, every IL headline, every piece of proposed legislation, makes me so grateful for having left IL. My new state has cut income taxes with the ultimate goal of eliminating them entirely. The influx of new residents and small and large businesses has led to a $2 billion surplus. Yet, IL politicians are blind to what successful states are doing and do the opposite. No mercy for those who stay behind and vote for those fools.

They are not blind; this is what they want, as others like debtsor have pointed out.

What better way to get super-legislative and executive power in perpetuity than to simply chase the Unwanted out of your state?

I can’t think of any.

Martwick in my view is a clear and present danger to non public union taxpayers in IL. All efforts need to be exerted to have him voted out of office.

IL Republican Party: You need to be a viable alternative. Less maga wacko. Given national level republican wacko, also plan on drafting asap a “contract with IL voters” to document what you will and will not do. Cause trust in that wacko extremist group is very low right now. Or else disband and join Kinzinger’s America first party?

Please tell me… what policy positions make someone a “maga wacko?”

Kinzinger is an absolute joke with a mental illness. Please stop.

It’s often difficult for me to be polite in these comments. It was so obvious to me three years ago that Illinois was “all in” on the ultra-liberal socialist agenda. Now resting comfortably in my new state, I have to wonder, “Why isn’t everyone else back in Illinois racing to leave? Does the typical Illinois resident have no ethical code? Are they blind to reality? How can they just accept the constant lies coming from their leaders? How can they just accept their income being stolen by the state? What kind of people just take more and more abuse every… Read more »

Some of us are temporarily stuck here caring for family. After that, adios.

Some have family obligations keeping them here. But after that, adios is right.

Why isn’t everyone else back in Illinois racing to leave – Some of us have very high income in relation to our living expense. My mortgage payment is $1,400 including taxes and insurance. That’s for a 3 bedroom house in a DuPage suburb. Is a house in Illinois a good investment, no it isn’t. I look at it as super low rent that allows me to invest money elsewhere. Even so my equity is three times what I put into it. While the socialist policies really piss me off I have a very good job and I’m not going to… Read more »