By: Ted Dabrowski and John Klingner

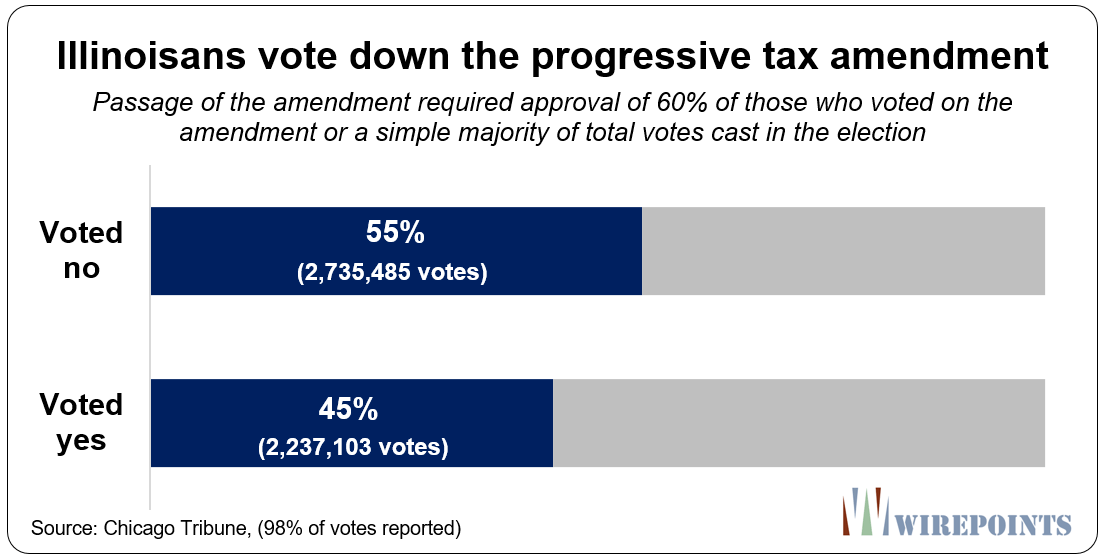

Illinoisans have voted down the progressive tax amendment 55 percent to 45 percent, soundly rejecting lawmakers’ calls for higher taxes. The amendment was set to change Illinois’ flat income tax structure to a progressive one and raise a projected $3.1 billion. Under the proposed law, Illinoisans’ highest marginal rate would have reached 7.99 percent, a 60 percent increase compared to Illinois’ current flat rate of 4.95 percent.

The failure of Illinois’ progressive tax amendment is stunning when you consider all the money, the power and the strategy that was behind it. It’s hard to dream up a more favorable setup for the amendment’s passage.

Gov. J.B. Pritzker, one of the wealthiest men in Illinois, made the progressive tax his signature proposal for fixing the state. He poured an enormous amount of political capital and spent $58 million of his own money to promote the amendment. The governor’s campaign was also assisted by the state’s powerful public sector apparatus – arguably one of the nation’s strongest – to help spread pro-tax messaging across the state. The tax had an enormous political push.

The tax itself was structured to maximize a “rich vs. poor” mentality, pitting 97% of Illinois taxpayers against a minority of just 3%. Only taxpayers with incomes above $250,000 faced higher tax rates, while all other Illinoisans were offered an incentive to tax the wealthy in the form of a small tax cut. The incentives were overwhelming.

Even the wording on the ballot was manipulative, starting with the first line. “The proposed amendment grants the State authority to impose higher income tax rates on higher income levels,” was misleading, at best. There was nothing in the amendment to stop lawmakers from imposing higher rates on everybody. The rest of the ballot language was just as bad.

Illinoisans’ fears of higher taxes were also exploited. The Pritzker administration warned a 20 percent income tax hike was in the offing if voters rejected his amendment. Threats of tax hikes on everyone were meant to ensure that the 97 percent of Illinoisans would hike taxes on the 3 percent.

Everything was aligned in favor of the amendment.

And yet, it failed.

The reason why likely boils down to one word: trust.

The reason why likely boils down to one word: trust.

A majority of Illinoisans clearly didn’t trust lawmakers – who have mismanaged this state for decades – to handle more of their tax dollars. They recognized the progressive tax for what it really was: another tax hike that would let Illinois politicians avoid structural reforms and open the door to more hikes in the future.

That realization crossed party lines: About 500,000 more Illinoisans voted against the Fair Tax than voted for Donald Trump. They crossed party lines to vote against the amendment (2,753,526 no votes and 2,255,912 for Trump.) It will be interesting to see a detailed breakdown of who voted against the tax.

Illinoisans’ rejection of the amendment will have an immediate impact on the state’s financial crisis.

The loss of $3.1 billion in expected revenues will have Gov. Pritzker and lawmakers scrambling to manage the 2021 budget, which already has an official $6 billion deficit – and billions more when the true cost of Illinois’ retirement debts is added on.

Illinois lawmakers will be more anxious than ever for a federal bailout to cover the bigger deficit. But the expected outcome of the federal elections, particularly in the Senate, makes a true no-strings-attached bailout unlikely.

With no new revenues and no guarantee of federal cash, Gov. Pritzker and the legislature will be under more pressure to actually enact reforms. However, look for them to try everything else first.

They’ll likely borrow more money from the Federal Reserve, attempt to re-amortize pension debts, or try to enact the 20 percent income tax hike Pritzker threatened during the run-up to the election.

All of that could put Illinois’ credit rating in further jeopardy. The rating agencies are already facing pressure to follow through on their warnings about downgrading Illinois. Illinois is already just one notch from junk, so any downgrade will drop it to junk status.

Voters have roundly rejected tax hikes as a way to fix Illinois’ problems.

The next step is to gather support for real solutions: Roll back state mandates so property taxes can be slashed. End strikes and forced labor arbitration at the local level to make government more affordable for ordinary Illinoisans. Consolidate overlapping and duplicative local governments to cut down on municipal bureaucracy. And most importantly, pass structural retirement reforms, starting with a constitutional amendment for pensions.

Lawmakers have failed in their attempt to hang on to the status quo. Now residents must demand real changes.

See Wirepoints’ Pension Solutions page for our comprehensive retirement plan.

A set of state lawmakers want to extend CPS’ current school closing moratorium to February 1, 2027 – the same year CPS is set to transition to a fully-elected school board. That means schools like Manley High School, with capacity for more than 1,000 students but enrollment of just 78, can’t be closed for anther three years. The school spends $45,000 per student, but just 2.4% of students read at grade level.

A set of state lawmakers want to extend CPS’ current school closing moratorium to February 1, 2027 – the same year CPS is set to transition to a fully-elected school board. That means schools like Manley High School, with capacity for more than 1,000 students but enrollment of just 78, can’t be closed for anther three years. The school spends $45,000 per student, but just 2.4% of students read at grade level.

Hopefully, all media will get the message, in Illinois, too.

Hopefully, all media will get the message, in Illinois, too. Ted joined Tom Miller of WJPF to talk about Illinois’ highest-in-the-nation property taxes, why lawmakers don’t want to touch the tax’s cost drivers, just how much Illinoisans’ tax burden has grown over the decades, why Gov. Pritzker failed to meet his promise to reform property taxes, and more.

Ted joined Tom Miller of WJPF to talk about Illinois’ highest-in-the-nation property taxes, why lawmakers don’t want to touch the tax’s cost drivers, just how much Illinoisans’ tax burden has grown over the decades, why Gov. Pritzker failed to meet his promise to reform property taxes, and more.

I guess letting many parts of City to burn to ashes backfire, is no different from a regular citizen bad credit score. Many millionaires left Illinois in droves, so I’m wondering ? who will pay the taxes.

On the Library of Economics and Liberty website, Economist David R Henderson wrote an article about the failed State of Illinois November 3, 2020 referendum to convert the state income tax from a flat rate to an adjustable rate.

http://www.econlib.org/state-income-tax-rates-over-time

Trust? Seriously? In politics no one trusts anyone. THere is no such thing as TRUSTING DEMO__RATS

Pritzker is a weak leader as the governor of our once great state. Pritzker has the opportunity to lead in the most accountable way ever and yet he doesn’t. He had 2 paths that he could take, as the Billionaire with a Democratic House & Senate. 1) The path of a far left Socialist, hire more, raises to everyone, tax more and demand a federal bailout so the rest of the country, the fiscally accountable, can pay for it. 2) The path of a business man/entrepreneur who understands business survival and fiscal responsibility. The path that includes downsizing of government… Read more »

Pigster a business man? Born into massive wealth, born with a silver spoon, oops, ladel in his mouth, Northwestern Law School donation from his famiy guaranteed a degree and had very little to do with any of the family business. Blimpo couldn’t run a shoe stand much less the state. He was begging Blago for an appointment to some position of authority showing his true colors. But, being a wealthy dumbocrat, managed to buy the Gov nomination and that pretty much guaranteed a win against Rauner who had been hand tied by Madigan and the veto proof house and senate.… Read more »

Pritzker is no businessman. The very first job that he has ever held in his life started in 2018 as Governor. I seriously doubt if he himself passed the Bar Exam; likely a paid test taker did it for him. All that Pritzker has EVER done in his life is spend his Grandfather’s money.

Pritzker, and Democrats in general, are such cry babies when they don’t get their way. These people have the mindset and maturity level of little children and should be treated accordingly

Some great whines over at CapitolFax today

Ya and I bet Oswego Willy is having a ball.

Those people are nuts

Your namesake was real happy when JB dropped $50 million to fund the Say Yes campaign. He’s not happy now. Posting jibberish like a crazy person. Pretty funny.

I would sure like to find out who this idiot Oswego Willy is, pritzker can you invest 50 million to find out for me.

If voters thought the lawmakers mismanaged the state (which is blindingly obvious), why did they vote them back in?

Yep,everyone complains but keeps voting in the tax and spend Pritzkers of the world,i think its kinda funny,leftist libs and all the people who keep voting the same way,well,here ya go losers!!

Democraps in Cook/County/Chicago are responsible for every failure in Illinois, that’s why.

voter Fraud, duh!

Pritzker thought he had the trust of the people while ComEd executives are being charged with bribery of state officials. It seems the Illinois voter is FINALLY getting it.

and not trusting an Illinois politician’s promise also boils down to one word: SANITY

Test

I am just glad the 55% are smart enough to see the real issues.

Illinois has failed for decades u der Democrat leadership, these people have no management skills, spending a dollar on a quarter earned will not work. Doing the same things and expect different result.. that’s beyond stupid and incompetent.

To the people that voted against higher taxes, yet voted for Biden-I beg of you-don’t move out of Illinois.

Thank you Mr Ken Griffin for all the support you gave the No Vote.

My friends and family were very impressed with the no of robocalls and leaflets received by the No Vote.

It seems he put his money where his mouth was! Democrats are flummoxed when they run into honest people who do what’s right. The very idea seems alien to the ratscum Democrats!

Nice work, Ken.

“Trust” absolutely. Trust us, the tollroads will be free once it’s paid off in a couple of years, the latest 1978, Trust us, the lotto take will go to fund schools. Maybe so, but taxpayer money yearly doing just that for years was then diverted to … umm, other state needs. The same will happen with the gambling machines, money for roads, yes, but the current revenue stream for roads will be detoured to some politicians special needs or wallet. No trust here, never will.

Don’t forget how all the pot $$$ are going to be a huge positive for well being of Illinois. The list of failure is epic in Illinois.

Reading some of the recaps from the Fair Tax team on what went wrong, one word comes to mind: hubris. These people truly believe they are the smartest people in the room. They were consistently dismissive of any dissenting arguments against them. Rather than address the systemic faults of the Fair Tax, they ignored them. And they were overly confident in their messaging. They rode that “97% get a tax cut” horse hard and straight into the ground. And it failed, not due to their faults, but only because we rubes were fooled by one evil billionaire. I think their… Read more »

Nixit – Capitol Fax comments collectively reveal quite a bit. By and large, the commenters fail to comprehend how anyone with any intelligence could have voted any other way but to “soak the rich”. I consistently ask progressives (and asking on Capitol Fax gets me censored) as to whether tax increases are exogenous to economic productivity. I never quite seem to obtain an answer, as if it is a “little” people question. I expect not to get one with the progressive crowd.

So true, the progressives have no answer. They don’t seem to grasp that their “soak the rich” schemes require the consent of their proposed victims. Hubris indeed!

The capfax crowd likes the smell of their own wind. They could be a case study in any entry level psych class. The one idiot posts 20% of the comments, but he blows kisses to Miller so it’s all good.

Credit the working people who are still here in Illinois – They have gotten good at spotting a ‘bait and switch’

Yes, the bs adds claiming average folks would get a tax break was another of the lowest cheep tricks…when in fact the tax break offered would amount to a minascual amount equal to cost of a fast food meal for average tax payer in exchange for signing away all your protections for future tax rate hikes…no differnt than ‘selling trinkets to the Indians’. Shameless usery that nobody on progressive left was concerned about.

The 97% would have gotten a decrease in their taxes of under $100.00. WOW!

Poor lil JB didnt get his way,he’s probably stuffing his face with cheeseburgers and donuts to make himself feel better!

Once again our enlightened overlords are crying about the rubes voting against their own interests. When will “the smartest people in the room” ever learn WE DON’T TRUST YOU! We were told Covid would go away if we just followed your rules. We were told rioting and looting is OK because “it’s just property”. We were told shoplifting less than $1000 won’t be prosecuted.

I’d just like to say that I wrote a pretty good comment on wttw’s chicago tonight detailing why gouging “the wealthy” is wrong, hurts everyone and why it’s driven by envy only to have it removed multiple times. If anyone doubts media censorship/left bias, I don’t know how you can be helped. The wealthy already pay most of the taxes. Let’s say IL taxes at 5% across the board. At 30K a year, an individual pays 1,500. At 300K, a person pays 15,000. 3 million is 150,000 a year in taxes. What progressives want is theft where a person making… Read more »

If the fat pig in Springfield thinks he should be paying higher taxes he’s free to do so. It will be very interesting to see if he voluntarily pays taxes at the higher rate his Blank Check Amendment was proposing or if he continues to cheat the people out of what he owes

The sewer-level depths (literally) Pudgy himself goes to avoid taxes is already known.

Glad his plan to flush the regular folks of IL is itself down the toilet.

Fat boy should have donated the $60 million he spent to address the budget issues.

Operation Plan B (whatever that may be) will be implemented soon. It ain’t gonna be pretty. Many increases in existing and new taxes in the pipeline are sure to follow that do not need voter approval.

How about eliminating one man of a four man shovel leaning, I mean road crew? Why do they need 4 guys riding around on a truck to fix a pothole, one sits in the truck monitoring the truck flashing warning lights while smoking a 12 inch stogy, one fills the hole by dumping a shovel full of asphalt then shoe patting in around, the other two are leaning on shovels or brooms, lookin pretty.

Thats correct,and in the process keep chasing away the people that actually work and pay taxes and at the same time the welfare sucking leaches keep increasing,not gonna work this way much longer-bye bye illinois!!

Well if the R’s do hold the Senate, the federal bailout ain’t happening. Over to you Mike : where’s the $money$ gonna come from??

Might want to see what McConnell actually has to say about that now that the election is over.

https://www.forbes.com/sites/sarahhansen/2020/11/04/mcconnell-changes-his-tune-on-stimulus-we-need-to-do-it-before-the-end-of-the-year/?sh=11d8c6146e41

https://finance.yahoo.com/news/mcconnell-promises-covid-19-stimulus-214553619.html

McConnell knew that he couldn’t agree to it before the election but starting Monday he will start negotiating with Nancy to get this thing done. According to him it is job one. He also admits that GOP will need to offer concessions around city and state bailout money.

The Truth Hurts makes a great point. I continue to be amazed at people who seem to follow the current issues and still think we are living in the American in which we were raised. This is not your father’s Democratic Party. They don’t care about “losing red state Democrats”. They’re trying to steal a presidential election! You think they can steal congressional seats? Even if they couldn’t, they sacrificed their majority once for obamacare which Deep State Roberts blessed and is here permanently. And speaking of the Deep State what makes you think Republicans like McConnell aren’t Deep State?… Read more »

I don’t care what Forbes is trying to imply – a bailout for Illinois and Chicago ain’t happening. Covid money, yes. Bailout, no. Also, Pelosi wanted all kind of kooky stuff beyond the bailout request, like national ballot harvesting and removal of electoral college.

The reason why likely boils down to one word: Madigan

Does anyone else think that creep looks like a 420 pound sack of dirty laundry? I thought the Chicago Cubs were cursed, it turns out to be the whole State! There is no way out of the mess these corrupt and stupid Democrats have put us in. Illinois is doomed. Get on with researching how a sovereign bankruptcy could work. Stiff the bondholders who lent you money. Face the reality of the horror created by Democrats. There is no way out. Kicking the can won’t work anymore.

He looks like a 420 pound sack of laundry that is $58 million poorer

Don’t worry. Pritzker and FBI madigan will pass a massive tax increase to punish the Illinois Voters. I’d guess a jump from to 12%. That will show the peasants for daring to defy King Mike and Duke Pritzker. Then when the same perverted “amendment” is on the ballot in 2022, the peasants will say “uncle” and agree to removing all constitutional income taxation guardrails and the Democrats will finally get what they want: Chicago Income tax, Cook County income tax, township income tax, rental income tax, interest income tax, etc.

While I don’t think they move to 12% I do agree with your framework for 2022. First JB will need to inflict some pain with cuts. Not just any cuts either. Cuts that tend to impact republican areas of the state. The suburbs don’t really get much money from the state so central and southern Illinois will feel the pain. If Republican GA members in those areas don’t back a tax increase he will keep the cuts permanent. The cuts will be directed to maximize the pain to make the tax increase to 6% while also looking for bipartisan cover.… Read more »

TTH, should your predictions come to pass then residents need to take an introspective look at themselves and decide if they want to stay in Illinois bad enough to endure that.

I know of a retired principle and spouse who both retired 13 years ago at the ripe old age of 57. Their combined pensions total a QUARTER OF A MILLION DOLLARS A YEAR.

How much more taxes do residents want to shoulder to support that level of greed?

Greed? I don’t think the retired teachers are greedy – though they are beneficiaries of the corrupt policy of unions contributing to politicians.

Politicians are supposed to represent their constituents at union negotiations. Huh? The pols end up ‘negotiating’ with their benefactors – how can that work to taxpayer’s benefit?

Nope, it can’t.

Retired teachers are at the forefront of greed in this state.

Who are the people holding kids education hostage every time they want an out of line pay raise? It’s not their political benefactors. It’s the teachers themselves.

And then when you cave and give them what they want they turn around and teach your children to hate you and your country.

Give me a break with the teacher defense. The patriotic teacher is the exception in this era.

I have to agree with you on this matter. Years ago there was a movement to lower the voting age and drinking age to 18 following the logic that 18 year old’s were being sent to Vietnam, getting married and or worked full time jobs in the USA’s industrial economy. Subsequently as time went on the drinking age was returned to the 21 year rule but the voting age remained at 18. This means many high school students can vote. I have conversed with many of them who have an assortment of positions yet have had no experiences in the… Read more »

There was a retired teacher in our neighborhood who rode around on his bike taking note of those with Trump yard signs or flying the flag – these people are socialist creeps.

I know someone in state government. The prog tax is dead for at least a decade. Most people don’t care about cuts, so that isn’t going to do much. It lost so badly they won’t be trying it again for a long time. At this point it will either be a bailout or changes to law to allow state bankruptcy. That is all that is left. This has become an emergency situation Illinois cannot fix on its own as taxes cannot go much higher in a high tax state people are already leaving, and cuts, legally, can only go so… Read more »

So what is Pritzker going to cut downstate? Prisons? The UIUC? I think those are all his union supporters.

Chop the Illinois State Police, right now they are chasing mask violations and threatening small businesses that are defying Jumbo’s edicts. Get ISP on the highways where they belong.