By: Ted Dabrowski

Illinois is set to borrow several billion from the Federal Reserve’s Municipal Liquidity Fund (MLF) for a second time if a new U.S. stimulus package and a progressive tax hike scheme for Illinois don’t come through, according to comments from Illinois Gov. J.B. Pritzker. Illinois already borrowed $1.2 billion from the MLF earlier this year in an attempt to close some of the state’s 2020 budget shortfall.

The borrowing is significant since Illinois is the only state in the country to tap the MLF. The Fed created the MLF in April to be a “lender of last resort,” where cities, states and other government entities can go if they can’t raise money as a result of COVID-19. The governor’s comments are an admission that the normal financial markets aren’t willing to lend money to Illinois at competitive terms.

Normally, billions are raised by cities and states in the municipal bond market, where banks, insurance companies and all types of financial entities lend money directly to governments. But COVID put all that at risk, leading the Fed to step in to make sure governments had somewhere to go if the markets weren’t working.

Fortunately, despite some initial hiccups early on in the pandemic, the financial markets have worked just fine. Billions have been raised by cities and states across the country without having to tap the Fed.

The only exception so far, when it comes to city and state governments, is Illinois. The state borrowed from the MLF in June after the state failed to successfully raise $1.2 billion from the markets one month earlier. New York’s Metropolitan Transportation Authority is the only other borrower in the country to tap the MLF.

COVID-19 has brought to full view all of Illinois’ pre-pandemic problems. The increased stress is highlighting Illinois’ extreme outlier position nationally when it comes to finances, notably pension debts and the state’s unwillingness to reform. Gov. Pritzker continues to count on a federal bailout and more tax hikes to keep the state afloat, but neither will reverse the problems of overwhelming pension costs, the “nation’s least-tax-friendly-state” status and the increasing outmigration of Illinois residents. Wirepoints laid out the state’s outlier status in its recent special report linked here.

Fiscal reality kicks in

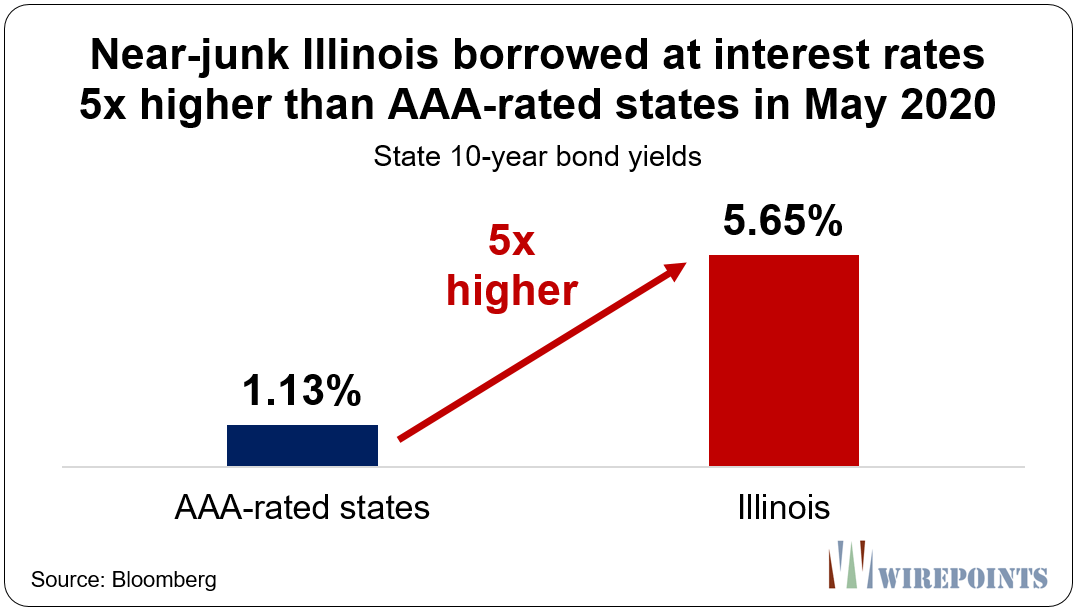

Fiscal reality began setting in for Illinois after the state was forced to pay punitive rates when it borrowed $800 million from the markets in May. Illinois’ borrowing rate then was 5.65 percent, five times higher than what well-run, AAA-rated states were paying to borrow money – around 1.1 percent.

It’s a massive penalty that ordinary Illinoisans are being forced to pay through higher taxes or cuts in core government services. The penalty reflects the continued collapse in the state’s finances. Unpaid bills of more than $8 billion, $261 billion in state pension debts, and the legislature’s unwillingness to pass any reforms has destroyed confidence in Illinois’ ability to manage its finances. Gov. Pritzker refuses to pursue pension reform, calling any attempts a “fantasy.”

It’s a massive penalty that ordinary Illinoisans are being forced to pay through higher taxes or cuts in core government services. The penalty reflects the continued collapse in the state’s finances. Unpaid bills of more than $8 billion, $261 billion in state pension debts, and the legislature’s unwillingness to pass any reforms has destroyed confidence in Illinois’ ability to manage its finances. Gov. Pritzker refuses to pursue pension reform, calling any attempts a “fantasy.”

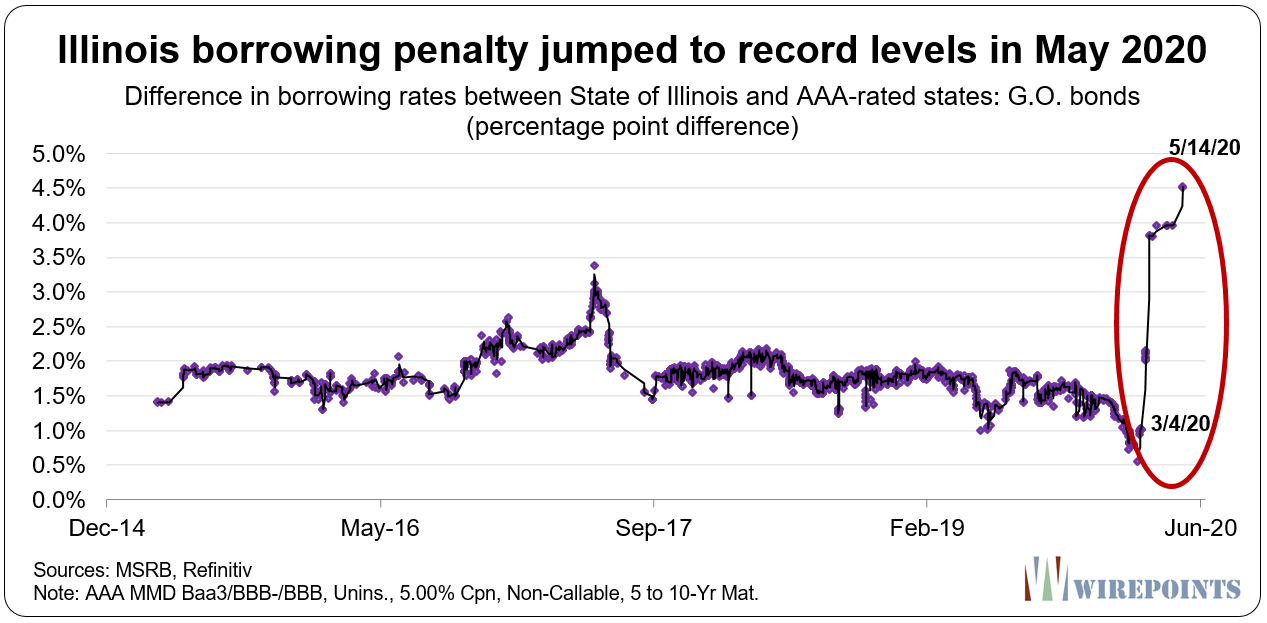

As the below graphic shows, Illinois’ borrowing “penalty” – what the state pays over and above what well-run states pay to borrow – spiked to 4.50 percentage points at the time of the $800 million borrowing in May. That means Illinois’ debt was effectively trading like junk bonds, even though the state was still rated one notch better than junk by all three rating agencies.

Gov. Pritzker has increased Illinois’ dependence on the federal government since the first $1.2 billion MLF borrowing. The governor “balanced” the state’s 2021 budget by including a planned $5 billion borrowing from the Fed, with a further hope to repay that debt via another federal stimulus package.

The governor’s refusal to pursue structural reforms has not gone unnoticed by the rating agencies. Neither has the governor’s failure to pursue budget savings since the pandemic started, though the governor has finally begun talking about cuts. He recently asked his agencies to submit proposals for 5 percent cuts in 2021 and 10 percent in 2022.

That hasn’t impressed the S&P, which noted in a recent report: “The magnitude of the current budget gap and reliance on one-time measures make us question Illinois’ ability to achieve structural balance in a reasonable time. Even if Illinois receives federal aid in fiscal 2021, we expect that it will face challenging budget gaps beyond the current fiscal year.”

The rating agency’s analysis reads like it is setting the stage for downgrading Illinois to junk: “With the need for additional borrowing, an elevated bill backlog, and lingering substantial structural imbalance, Illinois could exhibit further characteristics of a non-investment-grade issuer.”

Illinois is like the financial basket case down the street whose credit score is so poor he has to borrow at crazy rates from payday lenders. The solution isn’t to keep doing the same things over and over. Instead, it’s to cut up the credit cards, change the bad spending habits and restructure the massive debts.

Read more about Illinois’ fiscal mismanagement:

- Moody’s warns Illinois again, state running out of options

- Moody’s new estimate of Illinois pension shortfall increases to $261 billion

- Pritzker’s Upside-Down Message On Budget Cuts And Federal Help

- Solving Illinois’ Pension Problem | Part 1: Illinois is the Nation’s Extreme Outlier

- Solving Illinois’ Pension Problem | Part 2: Pensions – Overpromised & Overgenerous

- Wirepoints’ Pension Solutions page

A set of state lawmakers want to extend CPS’ current school closing moratorium to February 1, 2027 – the same year CPS is set to transition to a fully-elected school board. That means schools like Manley High School, with capacity for more than 1,000 students but enrollment of just 78, can’t be closed for anther three years. The school spends $45,000 per student, but just 2.4% of students read at grade level.

A set of state lawmakers want to extend CPS’ current school closing moratorium to February 1, 2027 – the same year CPS is set to transition to a fully-elected school board. That means schools like Manley High School, with capacity for more than 1,000 students but enrollment of just 78, can’t be closed for anther three years. The school spends $45,000 per student, but just 2.4% of students read at grade level.

Hopefully, all media will get the message, in Illinois, too.

Hopefully, all media will get the message, in Illinois, too. Ted joined Tom Miller of WJPF to talk about Illinois’ highest-in-the-nation property taxes, why lawmakers don’t want to touch the tax’s cost drivers, just how much Illinoisans’ tax burden has grown over the decades, why Gov. Pritzker failed to meet his promise to reform property taxes, and more.

Ted joined Tom Miller of WJPF to talk about Illinois’ highest-in-the-nation property taxes, why lawmakers don’t want to touch the tax’s cost drivers, just how much Illinoisans’ tax burden has grown over the decades, why Gov. Pritzker failed to meet his promise to reform property taxes, and more.

YOU NEED QUALITY VISITORS for your: wirepoints.org

My name is Quinn Stansberry, and I’m a Web Traffic Specialist. I can get:

– visitors from search engines

– visitors from social media

– visitors from any country you want

– very low bounce rate & long visit duration

CLAIM YOUR 24 HOURS FREE TEST => https://bit.ly/3nnmM4I

IL is in financial distress and on the verge of bankruptcy….hiking taxes yet another time, will only fuel the exodus and lead to even more tax losses…..we need reform now, pension, income tax, land tax, gerrymandering reform …IL is truly the land of bankruptcy and corruption.

Illinois has yet to hit a point of tax increases causing total tax revenue to decline. Sure people are leaving but total tax revenue continues to climb. Until hiking taxes leads to an actual decline in revenue the increases will continue. Not a moment earlier.

Where do people get the idea that the Detroit pensioners are doing fine with 95% of their pensions? They also lost their COLA’s and 95% of their health care benefits.

https://www.detroitnews.com/story/news/local/detroit-city/2018/07/18/detroit-bankruptcy-retirees-reaction/783828002/

This is actually the key fix – suspend health care benefits. Those were always BS, going up year after year. Never really truly part of the benefits “promised.”

so why is Illinois gona use $32 million to build road improvements and a new interchange at HOUBOLT rd and I-80 for this HOUBOLT bridge in joliet? IDOT and the state have to do the rd improvements and the new interchange I-80 from Route 6. at a cost of more than $32 million last heard. all for that HOUBOLT BRIDGE that centerpoint wants yet the state is not gona collect 1 penny from it centerpoint gets to get all the money from what we have heard. so that’s BULL!!! they need to forget that HOUBOLT bridge rd improvements. centerpoint is… Read more »

I’ve lived in Illinois on my life. State is run by crooked politicians up and down I’m part of a union it’s made a decent living for me and my family but it’s also corn the exact fabric of this great state. Every Governor Ira mayor is crooked all the politicians everybody’s got to hand out now ComEd and Madigan have something going everybody’s got to hand out state is just the taxes are unbelievable the shootings are rampant protests everywhere disgusting Rauner was put into office and he was ousted after his four years why because he tried to… Read more »

Bankrupting IL has been the montra of the Democrats in IL for centuries…SPEND SPEND SPEND never cutting Programs, or renegotiating contracts, pensions and benefits – making things better for Illinoisans. Tax and Spend on steroids…..Rauner tried but reckless in his criticism couldn’t do what was right, gotta walk before you run. Madigan and Co….don’t care they are way to powerful and do nothing to fix the problems

Why would a state with a balanced budget need to borrow money?

No, he balanced the budget by including the $5B being borrowed as revenue…otherwise, it would have had a $5B shortfall. I’m not sure what IL laws are but most state/local governments mandate that the budget is balanced. This is a programming trick I’ve seen done at the state and local levels (giving themselves a credit in their budget to offset a debit (expenditure)) to make the budget look balanced but in reality they’re relying on something to offset the shortfall.

It’s actually really dirty and pretty prominent practice. If you question their budget process, you’ll be pushed out.

JB had thrown money away, now wants the residents to foot the bill for his inadequatcy to manage the state. Hundreds of businesses are moving out to neighboring states where they are allowed to work under more normal rules. Let the state go under!!! Maybe that will get him out of office.

Let this corrupt state go bankrupt

I have noticed at school referendums the team line “what about the children” seems to be quite powerful at getting the votes out. How interesting the “what about the children” seems to be forgotten when the State borrows to buy goodies that the children will have to pay for in their future.

Quite interesting to say the least.

How fast can you leave Illinois the Socialist state?

Not fast enough

The only cure for Illinois is NO MONEY available from anywhere.

There is no point in loaning money to an insolvent entity, this is the expression: “throwing good money after bad”.

Illinois is an embarrassment to the whole country.

Nothing is worse than the greed of Illinois public employees, nothing.

The golden goose is dead and they are still beating it.

Hope they do not get any money to squander on pensions.

pennies on the dollar. See Detroit. If the Unions truly cared for their workers and themselves they would be doing something to salvage what they have.

Not sure what you think the unions can do to fix the current pension debt. They do not have any ability to negotiate a reduction. Even if they did have that power, Detroit pensioners received 95.5 pennies on the dollar. Why would the unions come to the table to negotiate? Are you suggesting that if they do that now the cut will be less dramatic than Detroit? Do the bondholders not care either? Is Fidelity not wise? If pensioners are cut don’t you think bondholders will lose out as well. Pensioners are owed money just as bondholders yet no one… Read more »

There will be shared sacrifices. Don’t worry if you only end up with 95% of your pension, you’ll be okay.

The main point is not curtailing existing pension, it’s to close the plan for future pensioners. Existing would be grandfathered in.

First Ulysses, I don’t have a pension. I do think pensioners will be all right though. I also believe your statement that there will be shared sacrifices and the burden won’t fall on pensioners alone. That will upset many readers of this site. Many want pensioners to suffer for choosing to work as a teacher, firefighter or police officer. Second, they have already curtailed pensions with the tier 2 pensions. Those are about the same value as SS benefits and it’s not realistic to cut those any further. The financial problems remain for the existing tier 1 pensioners. Also, if… Read more »

Not to Worry, Tier 1 people will die off in another 50 years, so just raise taxes on the next 2 or 3 generations to 15% of their income. No big deal, current workers in the private sector can get 2 jobs and work till over age 70 or longer. It is for the state workers and they should be proud.

Anything for the state, comrade!

The Truth Hurts – I think you misunderstand the law significantly. Yes, the pensioners are owed money just as with the bondholders. But surely you recognize that pensioners, unlike bondholders, are unsecured and therefore subordinate to bondholders and other secured creditors. And I would not take comfort in the Detroit proceedings. The benefits granted to Detroit pensioners were nowhere near as bountiful as Illinois pensioners, and there will be real pressure to materially diminish Illinois pensioners benefits in any insolvency or like proceeding. Now, the union will hold on to the very end, as you suggest, but it is in… Read more »

You seem to be misinformed into thinking that the union has any power to negotiate away pensioners benefits. They don’t. It’s not that I’m saying the union will continue to fight it as much as I’m saying they don’t have that power. Show me where I’m wrong. I’ve never once said that city pensioners are protected in a bankruptcy. I’ve pointed out Detroit to show that even in a bankruptcy pensioners did not take the hair cut that so many on here wish. Pensioners are people that vote. A bankruptcy in the city of Chicago would be political as much… Read more »

You have the answers, go to Springfield.

Why do you waste time and energy sprinkling these knowledge nuggets on this website?

Go effect change.

But something is off, in all your posts ‘thou doth protest too much, methinks’

Finally, taxes will be raised.

But, as Thomas Sowell observed, rates can be set sky high, but who will stay around to pay them, especially if basic services are barely met?

What then?

To quote Thomas Sowell (Discrimination and Disparities): All that the government can do in reality is change the tax rate. How much tax revenue that will produce depends on how people react. There have been some times when higher tax rates have produced lower tax revenues, and some other times when lower tax rate have produced higher tax revenues. In the 1920s, for example, the tax rate on the highest incomes was reduced from 73 percent to 24 percent– and the income tax revenue rose substantially — especially tax revenues received from people in the highest income brackets. In terms… Read more »

The truth hurts – I am not misinformed. The union in Arizona compromised just for the reasons I stated. There is a distinction between the unions motivations and what they are capable of doing. More to the point, what do you suggest to fix the enormous financial gap in Illinois, particularly Chicago? Passage of the Fair Tax will scarcely help. And the bond market could freeze the City out in a heartbeat. It is in the union’s interest to take a realistic and informed stance.

I have to second the remarks given by The Truth Hurts when he said public unions have no authority to negotiate IL government retirees’ pension benefits. There are two reasons for saying that, but they are intertwined. First, there is no single union that represents literally all of the retirees in anyone of the five directly supported state retiree pension funds; the unions only support active workers who choose to be members. Secondly, this opinion is not simply our mutual opinion on this matter; it was literally stated by the IL Supreme Court a few years ago–perhaps in their dismissal… Read more »

The unions in Illinois are more powerful and radical than the unions in Arizona. The unions in Illinois used that power to lobby for lots of pension and retiree healthcare benefit hikes for decades while pensions and retiree healthcare were underfunded. Until it’s proven that all sources of revenues and cuts are exhausted, expect no political negotiation to reduce pension and retiree healthcare benefits, regardless if it seems to an outsider that it would be in the best interest of the unions to do so. The unions could form coalitions to negotiate pension reductions with politicians. But a court fight… Read more »

… and the air traffic controllers were fired by Reagan, yet I flew on a plane today, and 1000s of times since 1981.

The world will still exist after the pensions have run dry, and after the unions have imploded.

Since the 70’s Illinois pensions were funded in the 35-50% range. Yet since that time pensioners have continued to receive their pension payments without fail. You can go back to 1917 and find documents discussing pension insolvency in Illinois and yet pensioners continued to receive their pension payment. Illinois will still exists after they raise taxes and taxpayers continue to reach deeper in their pockets. It’s fun reminiscing. PATCO members were fired for breaking federal law and striking. Illinois public sector unions have broken no such law. With no disrespect to “The Gipper”, A TV cowboy is not going to… Read more »

As there is obvious precedent, and all the answers are squared away, we can end this discussion and shut down this site. All clear then, no further issues. How about dem White Sox? — In this now highly financialized world, unlike the era of true growth, with industrial might feeding into a destroyed world – post World Wars, with little to no competition, IL is now like a dying star. It will plod along up until iron forms in its core, and suddenly the whole affair will go Super Nova (ala JUNK bond rating). For a long time nothing, then… Read more »

Traditionally in a capital structure of any organization, once the organization is in receivership, the trade payables (suppliers, wages, etc) are subordinated to senior creditors (bondholders in this case). If anything, it will be a cat fight amongst the pension holders and the deep backlog of suppliers to the state who have yet to be paid – all unsecured creditors. It will be interesting indeed….

Also, we are talking apples and oranges here. Of course, the unions cannot likely voluntarily curtail the existing pension holders benefits. But a federal bankruptcy judge sure can. Not sure what you are arguing about.

Years ago there was talk about returning the deadbeat states to the status of territory. This would allow for the Federal Government to name a territory governor and assume policing duties with U.S. Marshals and federal judges. The This idea doesn’t sound so outlandish now.

I just got done reading this article, and Ron Paul’s “End the Fed” was the first book I seen in my bookcase as I looked up. Coincidence?

And even if Illinois gets fed bailout will they be allowed to spend it on pre-covid debt? Aparently jb & public sect unions are lobbying in dc to allow (what would Wisconsinites think?)..and meanwhile last articales I’ve read CARES ACT fed funding that supposedly only to be spent on covid related expenses mysteriously remains unspent?

We are getting the bailout now. This money we are borrowing from the Fed IS the bailout. Nobody expects Illinois to pay it back except maybe those chumps in the Republican states whose tax money is coming our way with these “loans.” Certainly not any savvy Illinois legislator. Pretty soon NY, NJ, and Cali will go to school on our experience and their upcoming loans will be forgiven by the next Democratic administration in DC. Maybe real soon. No problem NB.

I hope they do tap MLF. I suspect that will be the final straw for Moody’s and the other agencies because it shows their inability to run the state without emergency financing facilities. Then JB will have the rare distinction of leading the only U.S. state to ever have a junk credit rating. Maybe he won’t care. He’s certainly had a few portfolio companies of his go sideways too. He’s a grifter and failed leader.

No one should “Lend” Illinois money. They will not pay it back, they can not pay it back.

Illinois is as Broke as broke can get, it is broken.

Nothing but a huge Ponzi Scheme.

It should be illegal to steal from everyone they can.

Exactly! IL needs less debt, not more!!!