Moody’s Investors’ Service has released a new report showing Illinois’ pension shortfall for 2019 fell to $230 billion, a reflection of better stock market returns in 2018. The shortfall is down from $241 billion reported the previous year.

However, that decline will be short lived.

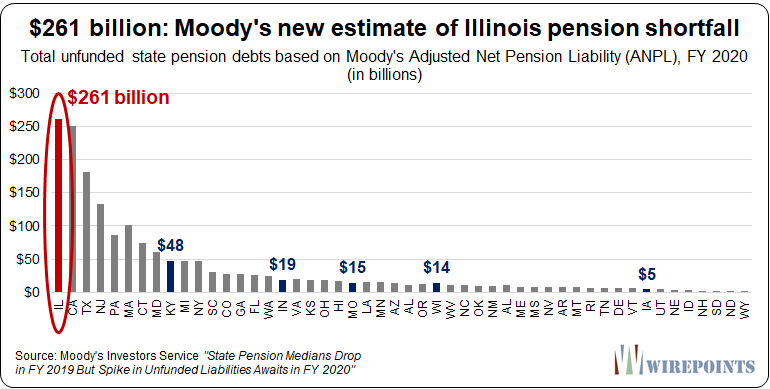

In that same report, Moody’s estimates the shortfall in Illinois’ five state-run pension funds will jump to $261 billion in 2020. The rating agency, in “Medians – Pension and OPEB liabilities fell in fiscal 2019 ahead of jump in 2020,” says a drop in interest rates and lower investment returns will worsen Illinois’ shortfall.

Moody’s estimation for all 50 states makes Illinois’ $261 billion shortfall the worst in the country.

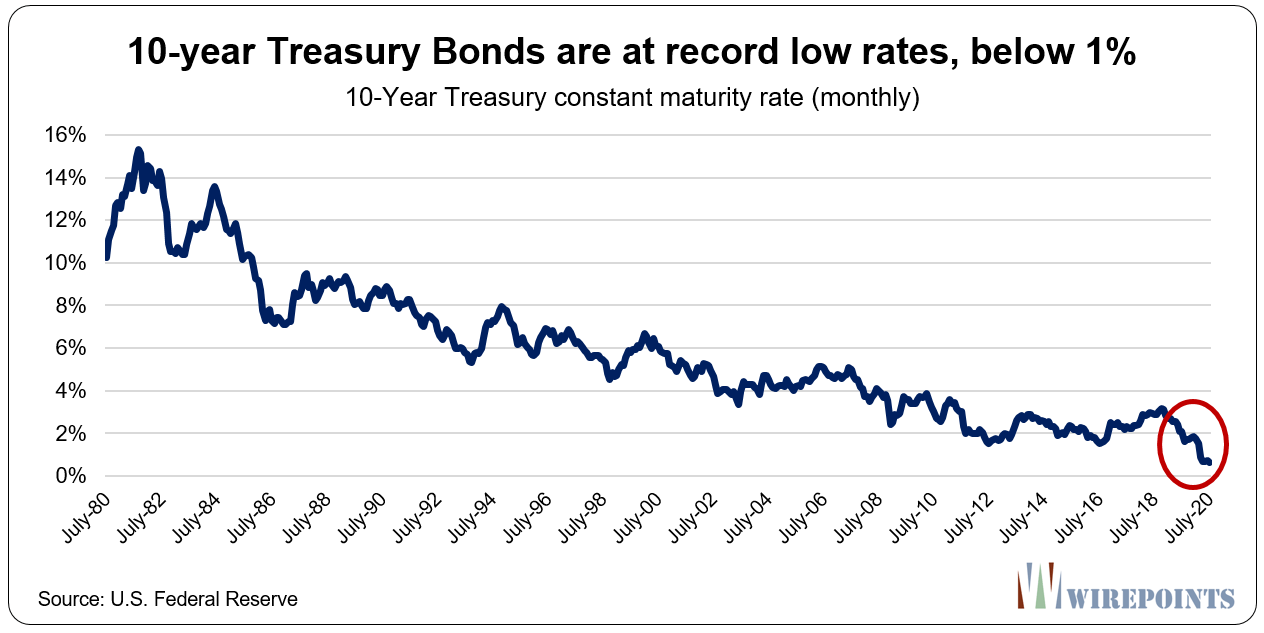

The $261 billion differs markedly from the official state reports, which calculates Illinois’ shortfall at $137 billion. The difference is driven by differing investment return expectations between the financial markets and the state. The state assumes the pension funds will continue to earn an average of nearly 7 percent a year, while Moody’s has lowered its investment return assumptions to nearly 3.5 percent yearly.

Moody’s expectations are more realistic than the state’s and track the collapse in interest rates in recent decades. Ten-year US Treasury rates have fallen from 14 percent in the early 1980’s down to below 1 percent today (0.72 percent). Those low rates are dramatically hitting the pension funds’ ability to earn interest income from bond-related investments.

Illinois’ shortfalls will be even larger when Moody’s finally releases its 2021 estimates, which will capture the impact of COVID-19 on the interest rate and financial markets. Wirepoints estimated earlier this year that Illinois’ unfunded liability may reach $300 billion under today’s volatile conditions.

Without pension reform, this won’t end well for Illinoisans.

To learn more about pensions:

- Illinoisans need pension reform, not tax hikes

- Solving Illinois’ Pension Problem | Part 1: Illinois is the Nation’s Extreme Outlier

- Solving Illinois’ Pension Problem | Part 2: Illinois Pensions – Overpromised & Overgenerous

A set of state lawmakers want to extend CPS’ current school closing moratorium to February 1, 2027 – the same year CPS is set to transition to a fully-elected school board. That means schools like Manley High School, with capacity for more than 1,000 students but enrollment of just 78, can’t be closed for anther three years. The school spends $45,000 per student, but just 2.4% of students read at grade level.

A set of state lawmakers want to extend CPS’ current school closing moratorium to February 1, 2027 – the same year CPS is set to transition to a fully-elected school board. That means schools like Manley High School, with capacity for more than 1,000 students but enrollment of just 78, can’t be closed for anther three years. The school spends $45,000 per student, but just 2.4% of students read at grade level.

Hopefully, all media will get the message, in Illinois, too.

Hopefully, all media will get the message, in Illinois, too. Ted joined Tom Miller of WJPF to talk about Illinois’ highest-in-the-nation property taxes, why lawmakers don’t want to touch the tax’s cost drivers, just how much Illinoisans’ tax burden has grown over the decades, why Gov. Pritzker failed to meet his promise to reform property taxes, and more.

Ted joined Tom Miller of WJPF to talk about Illinois’ highest-in-the-nation property taxes, why lawmakers don’t want to touch the tax’s cost drivers, just how much Illinoisans’ tax burden has grown over the decades, why Gov. Pritzker failed to meet his promise to reform property taxes, and more.

The State of Illinois should put a lien on every piece of property for $100,000 to make sure the pension debt is covered by the people who incurred the debt.

The state of Illinois has about 1 trillion in real estate. They could add a 25% tax to each property payable over the next 30 years and get the money they need. When property values decline they keep the original 25% assessment. If someone tries to sell the property it’s payable all at once. Taxpayers can flee but property can’t. Don’t you worry PT, Illinois has many tools to get the money they need. In the meantime they don’t need to resort to such heavy handed tactics. They will increase income taxes, start taxing retirement income, start a service tax,… Read more »

And IL will still be broke

It is quite obvious to anyone with a brain or not biased (which eliminates many public union workers and their spouses) that these pensions are 100% doomed as they are now, and soon. They will either have to be bailed out or state bankruptcy allowance will have to happen. The gravy train is about to run off the tracks and explode. It’s over.

Pensions are protected. States can not go bankrupt.

Sky is the limit when it comes to taxes.

Pay up or leave if you do not like it.

Gun rights are protected by the constitution and they shit all over that. Pensions will be shit on when the political winds change. Probably coming in 2021

I agree with this. Ex Illini below might be technically correct, but if “Illinois survives” as a wasteland of violence and dependent voters with lower standard of living and destitute economic activity … did it really “survive”? LOL, again this is where language is important. The useful tool of the left is lying/confusing language and manipulating others with buzzwords, since most can’t think for themselves or are just plain lazy. Sad, but true.

I hate the egregious pensions this state has granted to public employees, but there will be no bankruptcy. Under the tier 2 pension system, the gravy train for new public employees stopped. Existing employees get to ride the train, but Father Time is undefeated. They’ll all be dead at some point, even Devil Madigan. That is the plan the state will put forward. It will take decades, but the pension debt will be paid. Yes, taxes will go higher during the next 20 years, but ultimately the state will survive.

There is another problem. The Tier 2 pension is illegal as it does not minimally meet the upper limit of Social Security. LOL, they have another problem with the Ponzi — they fixed a portion of that to try to make Tier 1 more solvent, but they even got caught on cheating the internal Ponzi Tier 2 back end! LOL!

And going MUCH Higher.

The Sky is the limit.

Get out while you still can.

Illegal Ponzi Scheme

Yet Moody’s refuses to rate Illinois’ bonds as junk allowing the current situation to continue on.

Completely bankrupt…the Democrats did this to ILLINOIS..FILE BANKRUPTCY BEFORE FURTHER DAMAGE HAPPENS TO THIS STATE.

Illinois sucks because of the Pension Greed.

The 2020 Miami Report released this summer states that an average of 950 people move to Florida every day and a majority come from high-taxed areas like New York, Boston, California and Chicago, according to the New York Times.

Florida residents pay no state income or estate tax and receive a homestead exemption of up to $50,000 on a primary resident and a three percent annual cap on home assessments.

Florida is great but not for long. I moved there 27 years ago and it had a wealth tax under democratic leadership. Jeb Bush became governor and abolished it. Florida became a red state but as more people come to Florida to escape insane taxation, they still bring their politics with them and elect democrats who have the same ideals as the states they are leaving. Florida is now a purple state and soon will be blue because of the massive migration from New England. I wonder what these people are thinking.

Don’t forget everyone from Illinois to

When you move out of Illinois do not tell anyone where you came from, it is an embarrassment. They will think you are mentally challenged to have lived there.

Actual number of $300 billion maybe low. It is growing like cancer and can not be stopped. Give Illinois one last KISS GOOD BYE, there is NO HOPE for Illinois. DOA, a goner 100% for sure. The Greed of the Cops, Teachers and Firemen have DESTROYED Illinois for Generations to come. Taxes will DOUBLE every 5 years for as far as the eye can see. Get out while you can still sell your property. All the pension money is heading to Florida to live in Luxury Homes on the poor honest hard working taxpayers. They are laughing all the way… Read more »

I doubt these numbers include the healthcare cost associated with these pensions… LOL. The numbers are so big that it is someone else problem.

These updates on the escalating Illinois pension debt remind me of the fable about the frog is hot water.

Bottom line; do not own property in Illinois. I know the Wirepoints team is trying to stay and fight these battles but it’s a lost cause. This is the bluest state in the country and is run by and for the public sector unions. I’m getting closer and closer to leaving. Franklin, TN sounds pretty great right now.

The liberal media/politicians/and voters will never accept Wirepoint solutions. Tennessee is a fiscally responsible conservative state. Good choice.

Anywhere is a better place. Illinois has been destroyed, the quicker you get out the sooner your life will be better. Best day of your life is the day you move.

Getting rid of herpes will be easier than getting rid of Illinois property.

if this “UNFAIR” tax passes, I will refuse to pay 8% income tax and $1,000/month in land taxes to live here. It will push me over the edge, I will move to Florida. I am done. Hopefully it will not pass. If it does, look for the flood gates to open up, and IL will make less moneyin taxes actually due to all the out migration. Bank on it. I am done with the high taxes, lies, high corruption, perpetual Democrat control of everything, and hostile environment to hard working citizens.

Either way, the IL taxpayer will lose. If the progressive tax doesn’t pass, the flat tax rate will once again increase; this time, to six percent (or 5.95 percent, because that doesn’t sound as bad) or more. Then, in a relatively short time, they’ll find out that’s not enough to generate the revenue they need, and they’ll raise it again. IL is in a severe downward spiral that worsens every day. In other words, if anyone thinks they’ll be spared if the progressive tax doesn’t pass, they’re wrong. So, you have runaway state income tax rates and runaway property tax… Read more »