By: Mark Glennon*

Last week, Chicago released its Annual Financial Analysis and held a major conference for the municipal bond community. It’s basically a time for the city to put its best foot forward and convince the financial community to buy city bonds at low interest rates.

Nothing wrong with that, in concept. In fact, it’s one time city taxpayers might well hope Mayor Rahm Emanuel earns his reputation for being, well, less than candid, and convinces the financial community things are looking up.

Nothing wrong with that, in concept. In fact, it’s one time city taxpayers might well hope Mayor Rahm Emanuel earns his reputation for being, well, less than candid, and convinces the financial community things are looking up.

The problem, however, is that the spin for bond buyers also gets widely reported to voters as if it’s meaningful, positive news for everybody else.

In truth, the financial community has very different interests than service recipients and taxpayers. Bondholders and rating agencies care mostly about whether bonds will default in just the next few years. They love higher taxes, and deteriorating services mean little because the consequences, such as flight from the city, don’t show up for years. In other words, the bond crowd cares mostly about near term liquidity problems. Insolvency down the road is the taxpayers’ problem. And the bond industry wants fees from more borrowing transactions.

Worse, by painting an increasingly better picture, Chicago appears to be readying some of the same kinds of financial recklessness that created its crisis. The snow job, in other words, is being used to make the public think it’s Christmas and time to hit up Santa for some goodies.

Let’s go through the key points made and not made by the city at its conference and in its analysis.

Chicago’s claims it cut its budget gap to just $114 million, “an 82% reduction since the Mayor took office.”

In fact, annual financial analyses mean nothing.

Budget gaps shown in the annual analyses are just the city’s word about how it expects cash expenditures to compare to revenue, but they say nothing about stuffing losses into more debt, which is where the problem is.

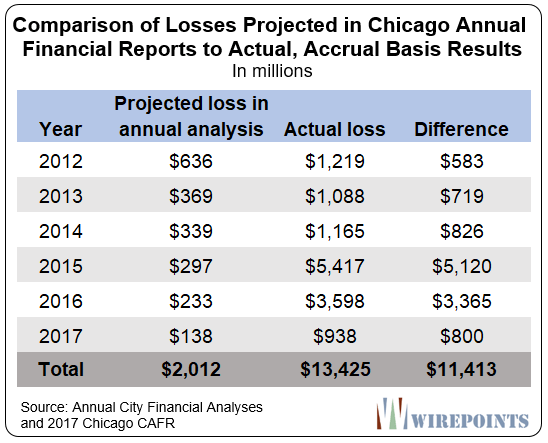

Look no further than a comparison of the budget gaps shown in past annual analyses to actual results shown in the city’s audited, accrual basis financial statements:

What the chart above shows is that the projections understated actual losses by over $11 billion in total since 2012. The municipal bond community may not care about all that debt growing on an accrual basis, but Chicagoans should.

And the chart shows there has been no improvement. Those particularly huge losses in 2015 and 2016 stemmed largely from a change in pension accounting standards and assumptions. But those accounting changes were reversed in 2017, with no rational basis, which we’ll discuss below. Without that accounting trick, last year’s loss would have been well over a billion dollars, which is above-trend (ignoring 2015 and 2016).

The only thing that has improved are the city’s predictions.

Chicago says it has City implemented balanced funding solutions for all four pension funds, putting them on the road to solvency.

In fact, little has changed beyond a plan for gradually higher taxpayer contributions.

-The hole is still deepening rapidly.

This year, Chicago taxpayers are putting about $1.2 billion into city pensions. However, it would take over $2.3 billion just to keep the pension hole from growing further. And the city should be contributing at least another $1 billion to reduce the principal amount of its pension shortfall. That’s the primary reason why “Chicago’s financial decline accelerated last year,” as Truth in Accounting’s headline put it.

-But Chicago will soon pay more towards pensions, supposedly.

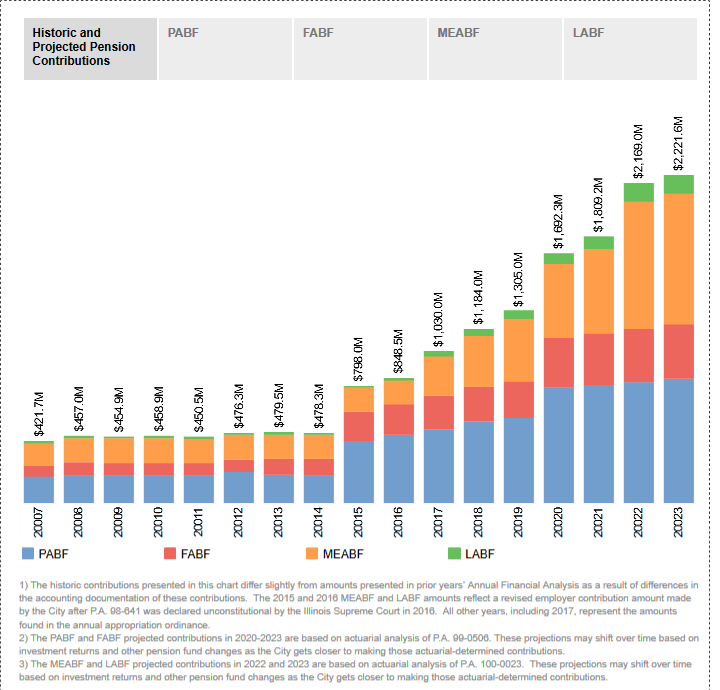

What’s new, over the last couple years, is a tougher ramp on required city pension contributions, which is set by state government. For the near term, the ramp looks like this, taken from the Annual Financial Analysis:

Taxpayer contributions will go up from $1.2 billion this year to $2.3 billion in five years.

Chicago says it now has dedicated revenue sources to cover the increases, but that’s hardly true. Yes, part of the initial jump will be covered by higher property taxes, a water-sewer charge and an emergency 9-1-1 fee, but a hole remains, and “the city is not showing its hand on how it will fully cover the higher payments,” as The Bond Buyer wrote.

How big that hole will be is actually guesswork, and even the guesswork provided by the city shows unfunded liabilities persisting. Under the new ramp, the city’s pension funding ratio doesn’t hit 30% until 2029 and a 50% ratio isn’t reached until 2047. The unfunded liability will continue to grow until 2034. (The full projection is on page 89 of the analysis.)

The next recession, which is inevitable, will blow up even that projection. The State of Illinois and many towns and cities are in the same boat on that. They simply aren’t in a position to handle the next recession.

-Chicago nevertheless claims it has already made major progress on its pensions.

The total unfunded pension liability for the city’s four pensions dropped last year from $35 billion to $28 billion, as the city reports its numbers.

Think, for a moment, about how absurd the accounting trick is that allowed the city to make that claim. Because a steeper up-ramp in taxpayer contributions is now in place, say the accountants, two of the city’s pensions can assume their investments will return 7% per year, instead of about 4% as previously assumed. That assumption change alone “improved” the city’s pension funding status by over $7.7 billion, claim the city’s accountants.

Heck, if that’s sensible, why not have the state make the ramp much tougher, requiring the city to pay up in full in just a few years? Then, you could make further assumption changes that would all but wipe out any notion there’s a problem. The contribution ramps are routinely busted anyway, so why not promise the moon?

That accounting trick is discussed in a Forbes article linked here by pension actuary Elizabeth Bauer. We wrote in detail about it here.

Other matters the city did not address.

Aside from pensions, The Bond Buyer noted three items that could worsen Chicago’s budget gap: 1) The cost of police reform measures under a consent decree announced last week by Emanuel and Illinois Attorney General Lisa Madigan is not yet known as the deal is not yet final; 2) negotiations are also still in progress on labor contracts that could drive up personnel costs in 2019; and 3) judgments and legal claims, budgeted at $45 million, have cost Chicago more than $70 million so far this year. Police misconduct judgements are a recurring, major problem.

And there’s a terrifying one nobody has written about yet: potential lawsuits stemming from alleged rapes and sexual assaults at CPS. The Chicago Tribune recently uncovered chilling allegations that would seem to raise the prospect of multiple, huge claims based on negligence, lack of oversight and other legal theories. “When students summoned the courage to disclose abuse, teachers and principals failed to alert child welfare investigators or police despite the state’s mandated reporter law,” says the Tribune.

That liability would be faced primarily by the school district, which is a separate entity from the city, but their financial plights clearly overlap.

What the city says it did accomplish.

According to the city, it also accomplished the following. These all may be true, but they just doesn’t change the bottom line numbers.

- Strategic energy and utility purchasing, consolidation of office spaces, and elimination of duplicative department functions, which provide year-over-year savings and also streamlines city government;

- Significant healthcare savings in order to keep costs relatively stable since 2012;

- Transition of multiple city services – garbage collection and graffiti removal – to a grid system, boosting service and saving money; and

- Work with our partners in labor to implement reforms such as the more flexible general laborers title, competitive bidding and apprenticeship programs.

- Stopping the use of one-time revenues to balance the budget;

- Converting all the city’s taxpayer-backed variable rate debt to fixed rate debt and terminating the corresponding swap; and

- Working to eliminate the need for the practice of “scoop and toss” by 2019, for which we took the first step in the 2016 budget by increasing available resources to make the city’s debt service payments.

What’s next?

The city repeatedly acknowledges it still has work to do, but here’s what it is actually considering and doing.

First, the city floated the idea of pension obligation bonds for roughly $10 billion — borrowing to pay off pension debt, in other words. One credit card to another. Pension obligation bonds are widely criticized. I asked Bill Bergman at Truth in Accounting for his reaction to Chicago’s idea: “Pension obligation proposals like this are a symptom that Chicago is grasping for straws. They effectively double down on leverage and investment risk, and carve out senior places for new creditors and pensioners relative to the rest of us,” he said. Our own article on the idea is linked here.

Making the idea worse, Chicago is considering pension obligation bonds that use the dangerous, new “securitization” scheme we’ve written about often. That’s where the city sells off ownership of future revenue to secure its borrowing. The purpose is to make sure bondholders get paid ahead of everybody else upon bankruptcy. It’s like selling off body parts to bondholders.

Second, the school district is preparing for a binge. As we wrote earlier, it wants to spend nearly 20 percent more than it did last year, increase its number of school administrators handsomely, and increase its debt by as much as $1 billion – on top of the massive debts it already has — all as student enrollment declines.

The district is a separate entity from the city, but Chicago’s financial crisis has to be seen on a consolidated basis. Ultimately, the same tax base is on the hook. For Chicagoans, that includes not just the city and schools but the Chicago Park District and their share of problems at Cook County, The Cook County Forest Preserve, the Metropolitan Water District and the state, all of which are insolvent, mostly because of pensions.

*****************

A nice show for the municipal bond community is fine in concept, as we said at the outset. But what the city needs — and what bond buyers, too, ultimately will want — is a showstopper: a shock-and-awe, catalog-length plan containing pretty much every reform that’s been suggested, implemented immediately, not just for the city but for the state and most of its municipalities.

*Mark Glennon is founder and Executive Editor of Wirepoints.

Ted joined Scott Slocum to talk about the huge potential cost to taxpayers for the Bear’s proposed new stadium, why the economics of publicly-funded sporting arenas don’t work, what the latest criminal justice statistics tell us about the SAFE-T Act’s impact so far, the latest developments on Chicago’s ongoing migrant crisis, and more.

Ted joined Scott Slocum to talk about the huge potential cost to taxpayers for the Bear’s proposed new stadium, why the economics of publicly-funded sporting arenas don’t work, what the latest criminal justice statistics tell us about the SAFE-T Act’s impact so far, the latest developments on Chicago’s ongoing migrant crisis, and more. We’re supposed to worry that climate change itself is to blame for Illinois’ failing climate policy, but far bigger problems are obvious.

We’re supposed to worry that climate change itself is to blame for Illinois’ failing climate policy, but far bigger problems are obvious. Traumatizing robberies and violent crime continue to go up in Chicago this year, hitting a six-year high compared to the same time last year. It’s crime in neighborhoods perceived as safe, sometimes taking place in broad daylight, that’s driving the increased fear among Chicagoans and suburbanites.

Traumatizing robberies and violent crime continue to go up in Chicago this year, hitting a six-year high compared to the same time last year. It’s crime in neighborhoods perceived as safe, sometimes taking place in broad daylight, that’s driving the increased fear among Chicagoans and suburbanites. Ted was on The Chicago Way with John Kass and Jeff Carlin to discuss the proposed $5 billion lakefront stadium project proposed by the Chicago Bears & Mayor Brandon Johnson, why Chicago is struggling compared to other metro areas across the country, why the city might or might not go the way of Detroit, and more.

Ted was on The Chicago Way with John Kass and Jeff Carlin to discuss the proposed $5 billion lakefront stadium project proposed by the Chicago Bears & Mayor Brandon Johnson, why Chicago is struggling compared to other metro areas across the country, why the city might or might not go the way of Detroit, and more.

Summarizing the first chart.

The City of Chicago projected a loss of $138M – $636M in each of its annual budgets from 2012 – 2017 (never a balanced budget).

Actual losses in each year ranged from $938M – $5.4B.

Actual losses exceeded projected losses in each year, ranging from $583M – $5.1B.

For the period 2012 – 2017, the total projected losses were $2.0B, the total actual losses were $13.4B, and thus actual losses exceeded projected losses by $11.4B.

Mayor Rahm Emanuel assumed office May 16, 2011.

mark–wish you could get crain’s to publish this one. fantastic!

I wonder if part of the appeal of POB’s is that the debt gets lumped into all the other bonded debt instead of being called out specifically (like pensions). I couldn’t tell you how much bonded debt my hometown/county/state has accumulated, but I can tell you what their pension liabilities are.