By Ted Dabrowski and John Klingner

Chicago Mayor Rahm Emanuel has floated a new plan to borrow $10 billion to plug part of the city’s nearly $30 billion dollar pension hole. It’s a horrible idea and it needs to be slapped down for two key reasons: First, it simply won’t work. You can’t borrow your way out of a debt problem.

Second, it requires Chicago to sell parts of its financial future. To make the borrowing work, the city will have to pledge future tax revenues to its bankers. And that means prioritizing bondholders over Chicagoans in case of bankruptcy.

1. Borrowing simply won’t work. Illinois already has a miserable history of borrowing through pension obligation bonds. Chicagoans and Emanuel would be wise to learn from that history by avoiding it altogether.

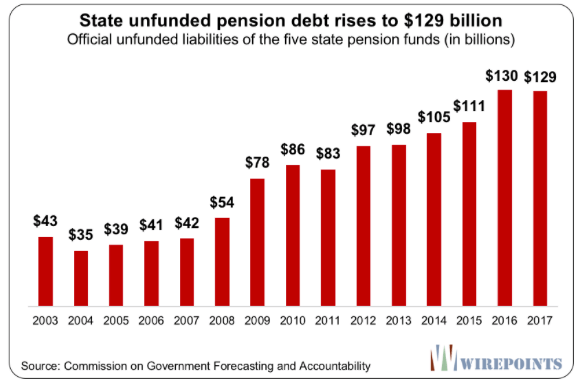

In 2003, Gov. Rod Blagojevich came up with the idea of borrowing $10 billion from the bond market so he could plug part of the state’s then $43 billion pension hole. He sold the illusion that taking on a new debt to pay down another one was the equivalent of pension reform. And everyone bought it.

The result? Fifteen years later, the state’s unfunded pension liability is at $129 billion, three times higher than what it was in 2003.

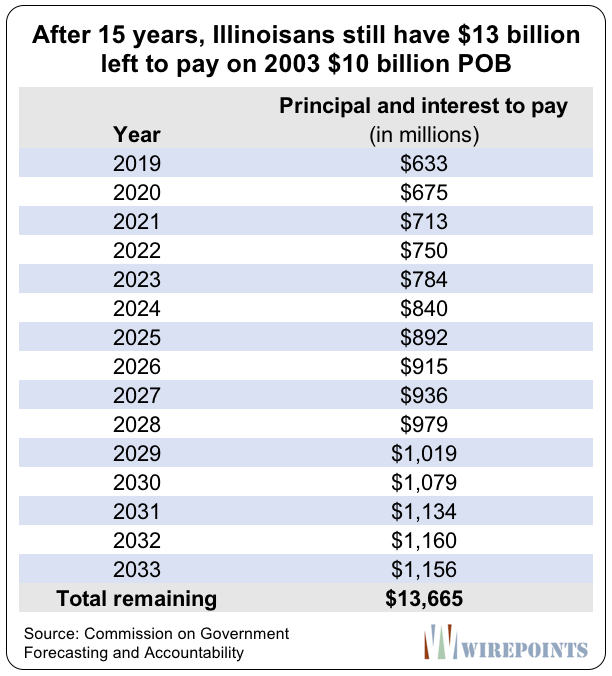

And Illinoisans will be paying off the bond borrowings until 2033 – there’s still $13.6 billion more in principal and interest left to go (COGFA, appendix N).

The idea was a disaster in many respects. It didn’t fix the pension problem. It delayed real pension reform. And, as always, arbitrage is a dangerous game to play, especially when it’s taxpayer money.

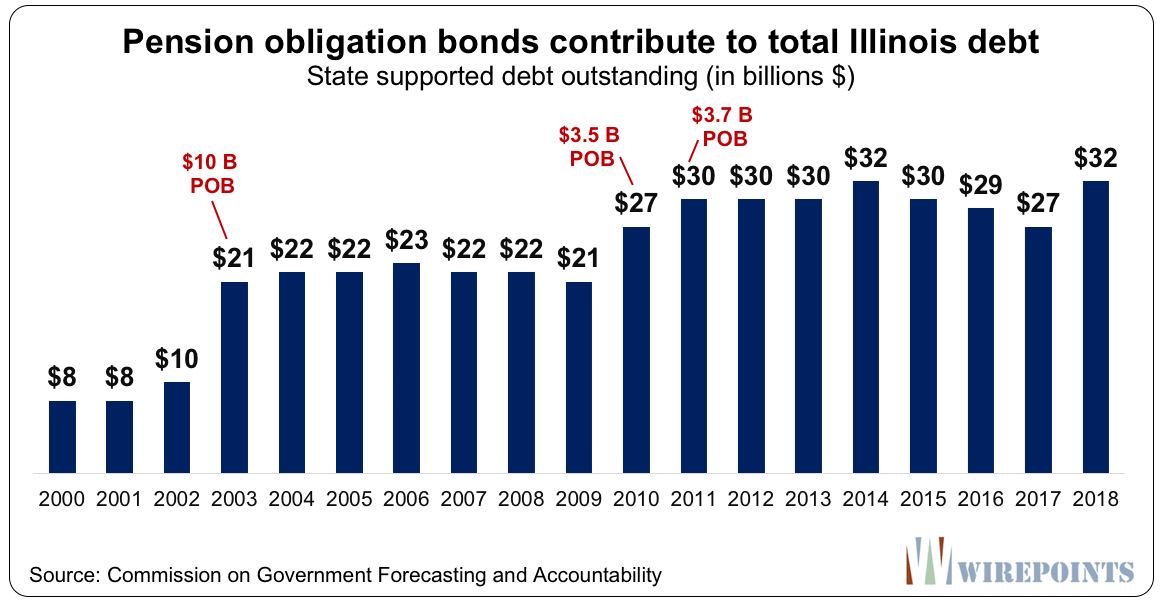

What’s worse, the borrowing didn’t end with Blagojevich. Gov. Pat Quinn copy-catted the idea by issuing $3.46 billion and $3.7 billion of POBs in FY 2009 and FY 2010, respectively.

That’s had a real impact on Illinois’ overall debt burden – excluding pensions – since 2000.

In fact, Illinois politicians are so addicted to debt that they’ve even considered an impossibly massive POB. Illinois Rep. Robert Martwick (D–Chicago) proposed $107 billion in pension borrowing earlier this year. It was met with wide criticism, including from Wirepoints, for good reason.

The bottom line is governments can’t borrow their way out of a debt problem. That’s easy to see in the state’s growing pension shortfalls year after year.

Which makes Emanuel’s proposal all the more absurd. He wants to pull a page from the Blago playbook to resuscitate the city of Chicago’s nearly bankrupt pension plans. His CFO Carole Brown formally floated the idea of a $10 billion pension obligation bond recently with a group of investors, as reported by Reuters and the Bond Buyer.

But it’s easy to see why a politician like Emanuel might try something like this. The city’s finances are temporarily off the edge of a fiscal cliff – Moody’s recently removed a negative watch from the city’s credit rating – so Emanuel has wiggle room to try and paper over his fiscal and political challenges.

By borrowing the money and putting it into pensions, making them nearly 50 percent funded, he’s hoping to change the required jump in city contributions that’s coming in a few years. If nothing is done, city contributions next year will be $1.2 billion and then jump to $2.1 billion in 2023.

The city will obviously have to pay down the cost of the POB over time. But through the securitization scheme described below, Rahm would hope to negotiate a funding plan that defers repayment of the bond for as long as possible.

But borrowing doesn’t solve Chicago’s structural pension problem. Chicago’s costs will skyrocket again when the city is forced to more honestly calculate its pension promises. A more conservative assessment by Moody’s Investors Services in its July 13, 2018 Credit Opinion puts the FY 2017 unfunded liability for the city’s four pension funds at $42.1 billion – nearly $14 billion more than the funds’ official numbers. That increase is not even contemplated in future pension contributions.

2. It requires Chicago to pledge financial assets. The borrowing plan is even more insidious than that. To induce bond investors to lend money cheaply – the city is junk rated by Moody’s – Emanuel and team are willing to pledge more and more of the city’s future revenue streams to bondholders. That kind of deal prioritizes bankers over everyone else, including city residents, over who gets those funding streams.

According to Reuters, “Brown said she would look to the most-cost effective financing model, noting the current model was Chicago’s Sales Tax Securitization Corp, which has been able to issue higher-rated debt by giving investors a statutory lien on the city’s share of state sale taxes.”

That means Chicago has already pledged some of its future sales tax revenues to bondholders. Next up could be local government shared revenues, personal property replacement taxes or motor fuel taxes. As Wirepoints’ Mark Glennon likes to say, Chicago is selling off body parts to generate funding. If bankruptcy comes, there’ll be far less left to fund city services for residents. The bankers will have priority over city revenues, not Chicago residents. And Chicago could find itself in an “assetless bankruptcy.”

Rather than restructuring and scaling back spending, Emanuel is taking risk with everyone’s money with a POB, including those dependent on core government services

Timely?

It’s easy to see why Emanuel might be so attracted to the idea of borrowing to fund pensions.

If the city successfully issues bonds, Rahm will be able to say he “fixed” the city’s pension crisis. In the short term, he won’t have raise taxes on residents or try to pass actual pension reforms that anger the city’s unions.

That helps his reelection chances. And if he does it right, he might remove a lot of pressure from his entire next term, assuming he wins.

But in the long run, nothing he’s doing solves the underlying risk of insolvency for Chicago. Chicagoans still face the same amount of debt, pensions remain unreformed, and every risk that existed before still remains.

Emanuel’s game only kicks the can down the road…and the can keeps getting bigger and bigger.

A set of state lawmakers want to extend CPS’ current school closing moratorium to February 1, 2027 – the same year CPS is set to transition to a fully-elected school board. That means schools like Manley High School, with capacity for more than 1,000 students but enrollment of just 78, can’t be closed for anther three years. The school spends $45,000 per student, but just 2.4% of students read at grade level.

A set of state lawmakers want to extend CPS’ current school closing moratorium to February 1, 2027 – the same year CPS is set to transition to a fully-elected school board. That means schools like Manley High School, with capacity for more than 1,000 students but enrollment of just 78, can’t be closed for anther three years. The school spends $45,000 per student, but just 2.4% of students read at grade level.

Hopefully, all media will get the message, in Illinois, too.

Hopefully, all media will get the message, in Illinois, too. Ted joined Tom Miller of WJPF to talk about Illinois’ highest-in-the-nation property taxes, why lawmakers don’t want to touch the tax’s cost drivers, just how much Illinoisans’ tax burden has grown over the decades, why Gov. Pritzker failed to meet his promise to reform property taxes, and more.

Ted joined Tom Miller of WJPF to talk about Illinois’ highest-in-the-nation property taxes, why lawmakers don’t want to touch the tax’s cost drivers, just how much Illinoisans’ tax burden has grown over the decades, why Gov. Pritzker failed to meet his promise to reform property taxes, and more.

Typical “kick the can down the road” political ploy or put another way make it a problem for some future Mayor. Democrats couldn’t balance a budget if their life depended on it. Furthermore, they do not want to balance budgets, they want to keep using other people’s money to push their socialist agenda by taxing us more and more until we are all dependent on the Federal and State governments for everything. Then they can tell us what to do, what we can and cannot say, and make us all slaves to their needs.

There’s an interesting you-tube vid “Madoff family secrets, stephanie’s story”. Stephanie is the wife of Mark Madoff. She says Mark asked his father about the family business and Bernie said “just do your job, and I’ll do mine”. In the Richard Dreyfuss movie Mark goes up to the forbidden floor of the office to see what’s going on and doesn’t see much more than people printing client statements. In the case of Illinois, hundreds of people must have an idea what’s going on and know it’s going to blow up but decide to do nothing. Is it mass delusion or… Read more »

Part of that I can answer specifically. Ted and I know, and regularly talk to, current and former members of the muni bond community — bankers, underwriters, credit raters, lawyers and more. For those currently working, the answer is easy. If they speak up their careers are over, perhaps not just in muni finance but anywhere in finance in Chicago, and perhaps beyond. Retired members of that crowd are still reluctant to talk because they’d be hurting their friends and former colleagues so badly, perhaps even implicating them in legal disputes. But rest assured most of them know. It’s all… Read more »

I think the politicians are also hoping they’re out of office when it all blows up.

Yes, all too many are self interested to point where they cannot speak freely. These frauds happen in plain sight for those who care to look. Enron? Their off balance sheet transactions were an open secret. Madoff? A tens of billions of dollars fund with a solo practice accountant? For reasons of independence and acumen, only the Big 4 could attest to that size of a business. Plus it was well known that Madoff cleated his own trades. These frauds were not the product of dark hidden secrets. What strikes me as mind blowing is that the Illinois numbers and… Read more »

On you-tube there are clips of “Chasing Madoff”. Watch “Markopolos: I gift wrapped and delivered the largest Ponzi scheme in history to the SEC >” People from the SEC reportedly showed up at the Madoff building for an audit. They flipped through the books and Bernie was “cool as a cucumber”. They said, okay it looks fine, and then left.

WOW, great article Ted and John !!!!!!!!!! Isn’t it amazing the Democrats in charge will do just about ANYTHING to avoid mentioning changing the state constitution to permit pension reductions? It’s almost as if they think that’s the worst option of all the bad options they’ve considered.

If they had any sense, and any pity for the private sector taxpayers, they’d realize it’s the BEST, BAD idea ! (from the movie Argo, when rescue ideas were discussed)

“Pensions are a promise”

I was made promises too. I was promised that if I paid $x in property and other taxes that would satisfy my obligation for public employee pensions. Now I’m being told I must pay x again, or 5x, or 10x or whatever? Not happening. I paid my share already. Maybe the public employees should have been more involved in their retirement instead of being spectators who blindly trusted their union and government.

In the end, what the courts say won’t mean spit. If nobody sticks around to pay their taxes, the union pensions can’t be paid. Leaving seems to be the only option and it’s becoming more popular.

But when people leave, they sell their house. Or worse case they walk and the bank forecloses and takes possession. Either way, taxes still get paid, just by someone else.

Why are taxpayers always on the hook for the mismanagement of pensions and lifetime healthcare that benefits only a select few public workers as a percentage of total population ? Why don’t people band together and form a Taxpayers Bill of Rights or taxpayers unions. Instead we are being picked clean one by one like vultures circling to get the very little equity we have left in our homes and ultimately losing them to excessive taxes. When did taxpayers vote for this. I do not recall seeing this on any ballot like “Do you support paying public employees pension and… Read more »

Wow, that’s very well spoken! Unfortunately, because there’s never enough of an orchestrated effort to try to change this craziness, the only alternative is to relocate which, as Mark G pointed out, isn’t feasible for many categories of residents. It’s so very despicable what the politicians are doing: digging a deeper hole with more borrowing at the expense of the taxpayer. Another related problem is that there are way too many residents who either are unaware of what’s occurring or are in denial that there’s any serious problem that can’t be remedied with a few tweaks. Incredibly, as I have… Read more »

The bottom line is that government has created a class of elites, public employees, that is entitled to a solid gold risk-free retirement. Unlike us unwashed masses, they are free from risk. We taxpayers bear the risk instead and politicians have promised public employees limitless amounts of our money so they can live like kings without any worries

Amen brother. This is the issue, the public sector has no skin in the regulatory economy they rule over. They are exempt from the reality they force on the masses.

I left Chicago a long time ago. At this point, anyone still living there deserves no sympathy. If you choose to put your head in the sand and ignore the obvious facts, you deserve what you get. I can’t wait until everyone refuses to lend the city any more money and it all falls part. Fewer police, teachers, firefighters, more potholes, less frequent garbage pickup, more rats, and later and later pension checks. It will be a shining example of a liberal sanctuary city for the whole nation. It should be fun for the rest of us to watch when… Read more »

With this kind of contract, they are basically creating a new class of bond. A bond that pays out junk yields yet is guaranteed protection from bankruptcy and guaranteed funding by handing over revenue streams. Essentially letting the money flow straight from taxpayer to lender right? Investors will flock to an investment like this. At the root of it all Moody’s is still eneableing it. They won’t come up with a new method of rating these bonds, so rates will remain high yield attracting more investors due to the protections and returns. This is the worst kind of lending from… Read more »

It is just like the movie The Big Short where the rating agency lady says if they don’t give an “A” rating, the client will just go down the street to another ratings agency until they get it. No different. Chicago will find an agency to give them that “A” rating until the very end.

Exactly like that. That’s why Moody’s is not part of the ratings game for Chicago right now. They were kicked out (they’ll work their way back in) when they were more realistic about Chicago’s situation (and put them in junk).

And it’s why Kroll (who?) is in there now with friendlier ratings. But they’ll run out of raters if they keep up the pace.

Rats are so passe in Chicago. The coypu, a sort of super rat, has now shown up in Chicago.

Mike, most IL voters obviously deserve what they will get, but I do cringe when I hear blanket statements about everybody in IL deserving what’s coming. For starters, there are kids, and those who are here fighting. But there are many more who simply can’t leave, from little guys to big guys: franchise owners, family farm owners, car repair guys who built up reputations for honesty over many years, professionals in partnerships that are hard to undo, beauticians with loyal clienteles, folks with a specialty and a unique employment contract that would be hard to replicate. The list goes on… Read more »

I do see your point Mark. Some (like me for instance) didn’t deserve to be surrounded by such horrible state and city management. I voted, and my team almost always lost. I finally got the message that I was in the permanent minority and left. Everyone has a choice, it’s just tougher for some. People in other cities/states will have no sympathy when Chicago and Illinois fall apart. They will say, “You got what you deserved.” When the day comes and Chicago/Illinois begs for federal bailouts, I will vote against any politician that wishes to help. I’ll feel a little… Read more »

Some of those Mark describes are likely to be renters rather than owners and those that aren’t renting can sell their homes, take their licks, and remain in the area. That doesn’t work for business owners with real estate or hands-on service providers. For accountants and lawyers, much can now be accomplished on-line from outside Illinois. Those with movable wealth can try to park it elsewhere, although wealth taxes at the state and federal levels may not be far off. Sales taxes – WILL go up everywhere where they don’t have graduated income taxes. State bankruptcy with BIG benefit haircuts… Read more »

Many public-pension millionaires already exist in IL, and many more are being created as time goes on. The next time you hit a pothole and need to get your car repaired, at least you’ll know where your tax payments aren’t going.

Trump is the best thing that could have happened for those with pensions. Their funds are partially invested in the stock markets which has done great under Trump. Too bad even this great economy can’t stop Chicago’s and Illinois eventual economic collapse. I have to admire Alexandria Ocasio-Cortez youthful enthusiasm, even though she is so misguided and wrong about socialism. Central States manages a teamsters pension fund and is projected to be broke in 10 years. There are 3 people receiving benefits for every person adding to the fund. When Central States tried to reduce benefits now to avoid that,… Read more »

You point is semi-well taken…BUT, the issue was very obvious to anyone who paid the slightest bit of attention. I have known about this for over 25 years. I was semi-stuck here with the invalid aging parents thing but it was a choice I made. I divested myself of all my business interest in Illinois and relocated my business interests to Florida, although I still have clients here. Note, I have not recommended a single client of mine ever expand in Illinois or open a business in Illinois. FYI, I do a lot of franchise and business start-up consulting. Even… Read more »

P M, well put. I don’t know anyone that left Illinois that regretted it.

Funny thing, the most liberal, high income (> 250K) people I know, who were always taking about paying their fair share, fled across the border to WI to escape the very policies they espouse.

The problem with the voters who like government is that they don’t like paying for the government they want. Well, that’s gonna change soon when the bill for this pension mess finally needs to be paid.

It’s a way so the bond market can enjoy junk bond yields without the risk. Just legalize that inconvenient junk rating risk out of the way by contracting to screw over the future taxpayers even more. Then invest away at loan shark rates which our kids pay for. Market risk in the Chicago bond market is entirely on the citizens now. And to add insult to injury, this loans spend isn’t even for the benefit of the taxpayers, it’s for the class that elects him now living anywhere but Illinois. Of course the next insult will come when moody thinks… Read more »

rahm could get calk & cabrera to be the underwriters

essentially, wouldnt the city have to offer up are homes as collateral to securitize the $10 billion in bonds?

These horror-show tactics of politicians to screw the taxpayer should flat-out not be allowed.

What should be void as a matter of public policy is securitizing this borrowing by selling future city revenue, which is the proposal is here.

Mark, you and the others above zeroed in on the problem better than I did. I especially find thought-provoking the premise that the bond rating agencies are part of the problem, allowing this abuse to worsen over time. Of course, wirepoints.com noted that many times.

What also should be void as a matter of public policy is any type of defined benefit pension going forward – period. It is ridiculous that the public sector employees should be immunized from the economic realities they impose on the economy by the very laws and regulations they create. This is the greater principle at play. Why should one class of citizens be immunized from the realities faced by the non-privileged class?