By: Mark Glennon*

William Isaac knows insolvency when he sees it, and how to deal with it. As Chairman of the Federal Deposit Insurance Corporation from 1981 to 1985, he was on the forefront of the banking crisis at the time. He founded The Secura Group, a leading consulting firm in financial regulation, and is a respected voice in the world of finance.

Bankruptcy, not just for Chicago, but for Illinois as well, he says.

“The city and the state should act now to restructure their liabilities and put the fiscal mess behind them. This can be accomplished by utilizing Chapter 9 and other tools Congress just gave Puerto Rico,” wrote Isaac in an opinion piece published Thursday in The Bond Buyer.

Tax increases and spending cuts won’t work, he wrote:

In the short run tax increases can partly bridge the deficits, but even this benefit will prove pyrrhic. Recent tax increases have already made the state and the city less competitive venues. As for expenditures, there’s still fat that can be cut from the budget, but it’s difficult to see this making more than a dent.

Why is his opinion a watershed? He’s the first major financial figure to outright call for bankruptcy. Others have said to start thinking about it or that it might be needed eventually — for Chicago. Pass the needed federal legislation now, says Isaac. Federal legislation would be needed to allow a whole state to file for bankruptcy. “Once a financial mess of the first order is at hand, as is the case with Chicago and Illinois, it can be far better to act decisively by restructuring rather than prolonging the pain.”

He’s not speaking to shame Illinois Democrats, avoid tax increases or hurt unions. Isaac is a Democrat himself and was appointed to the FDIC by President Carter.

Isaac also suggests using the authorization for bankruptcy as a hammer to first attempt a negotiated restructuring. That, actually, should go without saying. It’s a requirement for eligibility under the Bankruptcy Code. Isaac specifically suggests something like the PROMESA legislation recently enacted for Puerto Rico, which puts a hold on creditor collection pending attempts to negotiate.

Nobody in the Illinois press has reported Isaac’s assessment. Read his article, then read it again. It’s a pretty good summary of what we “boo-birds” and alarmists, as the “sky isn’t falling” crowd in the Illinois press and General Assembly call us, have been saying for years. We’ve said here that bankruptcy is inevitable for Chicago. We retain hope that Illinois can avoid it, but time is running out.

*Mark Glennon is founder of WirePoints. Opinions expressed are his own.

Ted was on The Chicago Way with John Kass and Jeff Carlin to discuss the proposed $5 billion lakefront stadium project proposed by the Chicago Bears & Mayor Brandon Johnson, why Chicago is struggling compared to other metro areas across the country, why the city might or might not go the way of Detroit, and more.

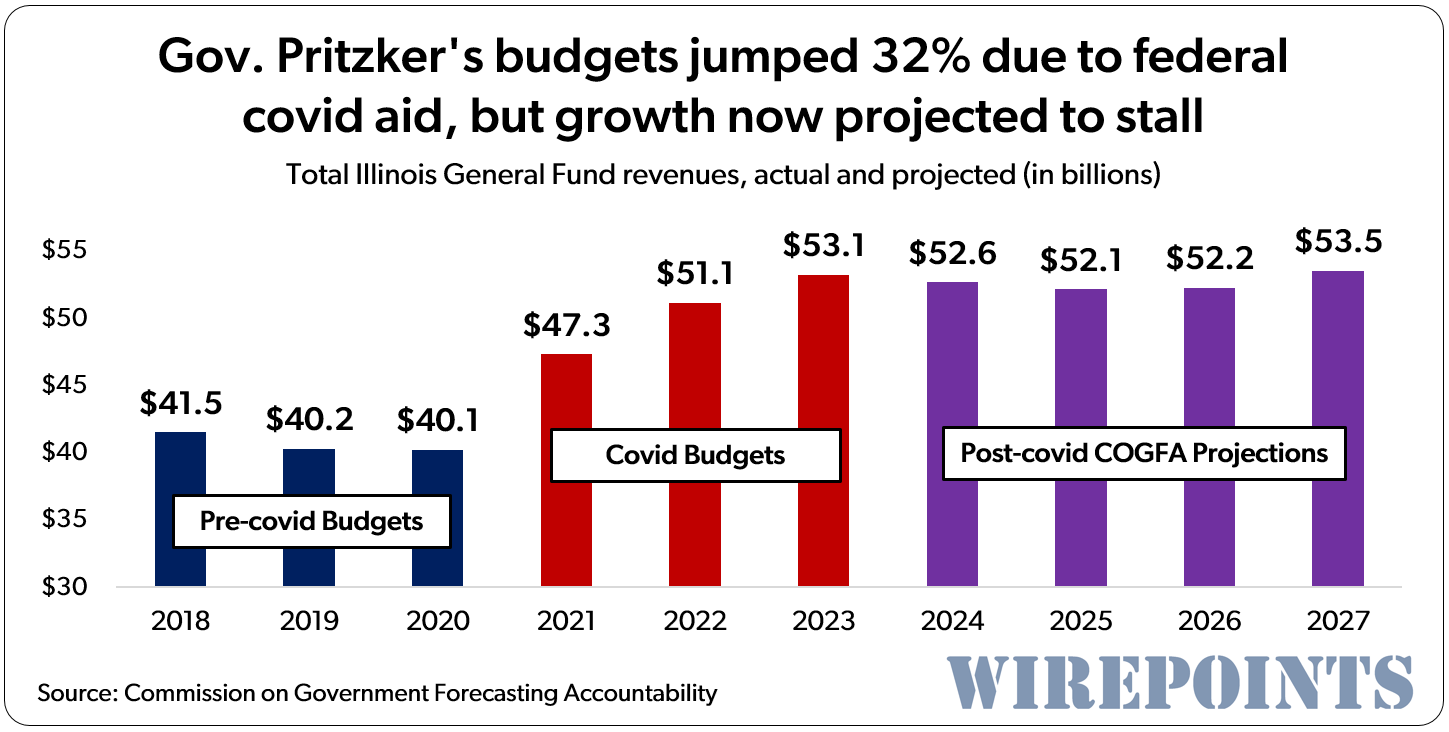

Ted was on The Chicago Way with John Kass and Jeff Carlin to discuss the proposed $5 billion lakefront stadium project proposed by the Chicago Bears & Mayor Brandon Johnson, why Chicago is struggling compared to other metro areas across the country, why the city might or might not go the way of Detroit, and more. Some Illinois lawmakers continue to deny that covid aid and other federal stimulus bailed the state out of its fiscal mess. But a look at past and projected revenues from COGFA shows just how much the bailouts blew out the state’s revenues. And now that they’re over, how much harder it will be for Illinois revenues to grow.

Some Illinois lawmakers continue to deny that covid aid and other federal stimulus bailed the state out of its fiscal mess. But a look at past and projected revenues from COGFA shows just how much the bailouts blew out the state’s revenues. And now that they’re over, how much harder it will be for Illinois revenues to grow. Election integrity – both real and perceived – is essential to government’s legitimacy and stability. Illinois, like the rest of the nation, better fix its problems now.

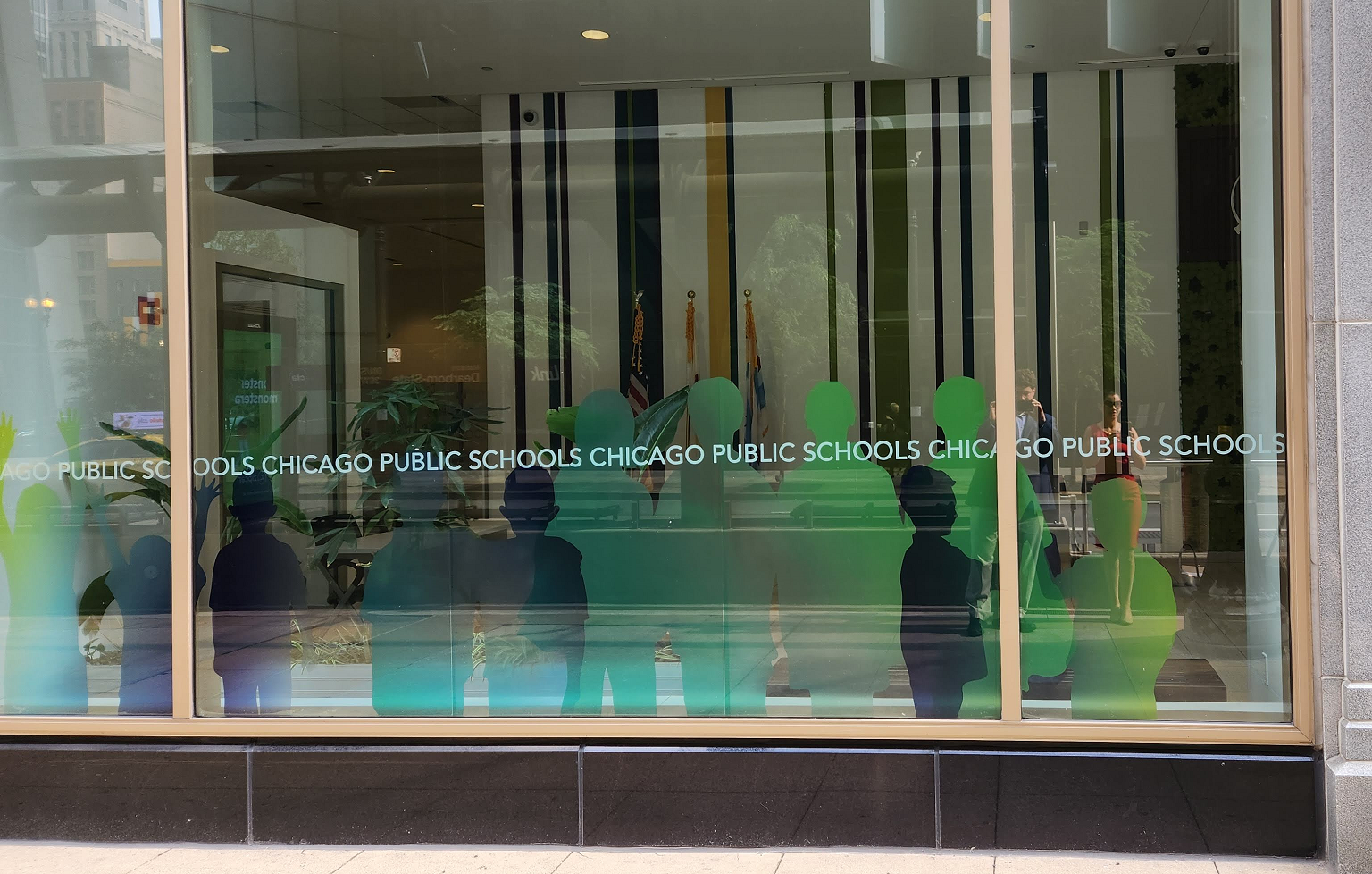

Election integrity – both real and perceived – is essential to government’s legitimacy and stability. Illinois, like the rest of the nation, better fix its problems now. Ted joined Dan and Amy to talk about Chicago’s latest bond offering, why Chicago’s dismal home value growth is due to poor policies, the next $70 million to be spent on migrants, the 9% salary hikes demanded by the CTU, and why Illinois lawmakers voting to stop Chicago’s selective enrollment schools from being closed is hypocritical.

Ted joined Dan and Amy to talk about Chicago’s latest bond offering, why Chicago’s dismal home value growth is due to poor policies, the next $70 million to be spent on migrants, the 9% salary hikes demanded by the CTU, and why Illinois lawmakers voting to stop Chicago’s selective enrollment schools from being closed is hypocritical.

Federal legislation would be needed to allow a whole state to file for bankruptcy.

BK is not needed for IL. States are sovereign, they need NO approval from the Federal Government to: 1) stop paying their debts; 2) to re-structure their debts; or 3) to repudiate their debts. The state can use any or all of the three options and there is no recourse by anyone to stop it. A subdivision like Chicago is a different story, they would need legislation to file a Chapter 9.

Rex – Understood that Federal legislation would be needed for IL — the article says that. But I don’t know what makes you think the state can repudiate its debts. The statutes for the state pensions say the state is liable on the underlying pensions. For Chicago, the statutes said otherwise, but the court said Chicago would be liable anyway because of the pension protection clause. You don’t think IL courts would interpret the pension protection clause (and the statutes, in the case of the state) as a waiver of its sovereign immunity?

I think when the continuing appropriation provisions were added, there was an express statutory waiver of sovereign immunity and an authorization for mandamus. Public pension folks seem to have taken a lesson from bond lawyers. My question is whether continuing appropriations get more protection than annual appropriations if the state runs out of money? Let’s say you have 5 billion of continuing appropriations, 10 billion of annual appropriations and 8 billion of revenues. (Add zeros as necessary)

At least for general obligation bonds, they have a statutory and contractual payment priority. Bonds would get paid first if it came to that.

I read this article last week, and one statement caused me concern about how informed Mr. Isaac is in his analysis. Here is the statement that caused my concern: “The elephant in the room is, of course, the pension liabilities, but the unions have already been cooperative in reforming the pension plans, so there might not be a lot more benefit to squeeze from this area.” What, if any, reforms have occurred and where did the unions agree with those reforms? Maybe some minor changes with the city worker plans, but I thought even some of those changes did not… Read more »

You are exactly right. He erred on that. Unions have made no material concessions on pensions. The only exception is the Tier 2 reforms for new workers only, which chopped the ladder off for new hires after 2010, forcing them to subsidize Tier 1s and leaving Tier 2s with an inadequate plan.

Wishful thinking, but what is the political possibility of congress passing any kind of legislation allowing state bankruptcy if Clinton is elected, (which as an independent I think is inevitable) and strong possibility of dems taking senate, and Clinton selecting SC judges? Especially considering all the states like Ill, California, NJ, etc that are hopelessly in debit are democratic. Maybe some kind of legislation for debit restructuring- a giant kick-the-can. And a ton of fed handouts to school dist, police depts, state univs and state transportation projects–in the form of a new giant stimulus spending package–that’s what will sell. does… Read more »

Eventually, I think chances are high, but the real question is WHAT ELSE the legislation would say. That’s where the mother of all battles will be. We’ve written about it before. The muni bond industry will try to stick things in protecting their positions. Public unions will try to prioritize pensions and protect labor contracts from being rejected. I fear state taxpayers will not be organized as well as either of those groups. Clinton and Trump haven’t said anything, to my knowledge. Nobody in Congress has really taken this on yet.