Even more evidence Illinois can thank the federal government’s covid bailouts for its budget bonanza – Wirepoints

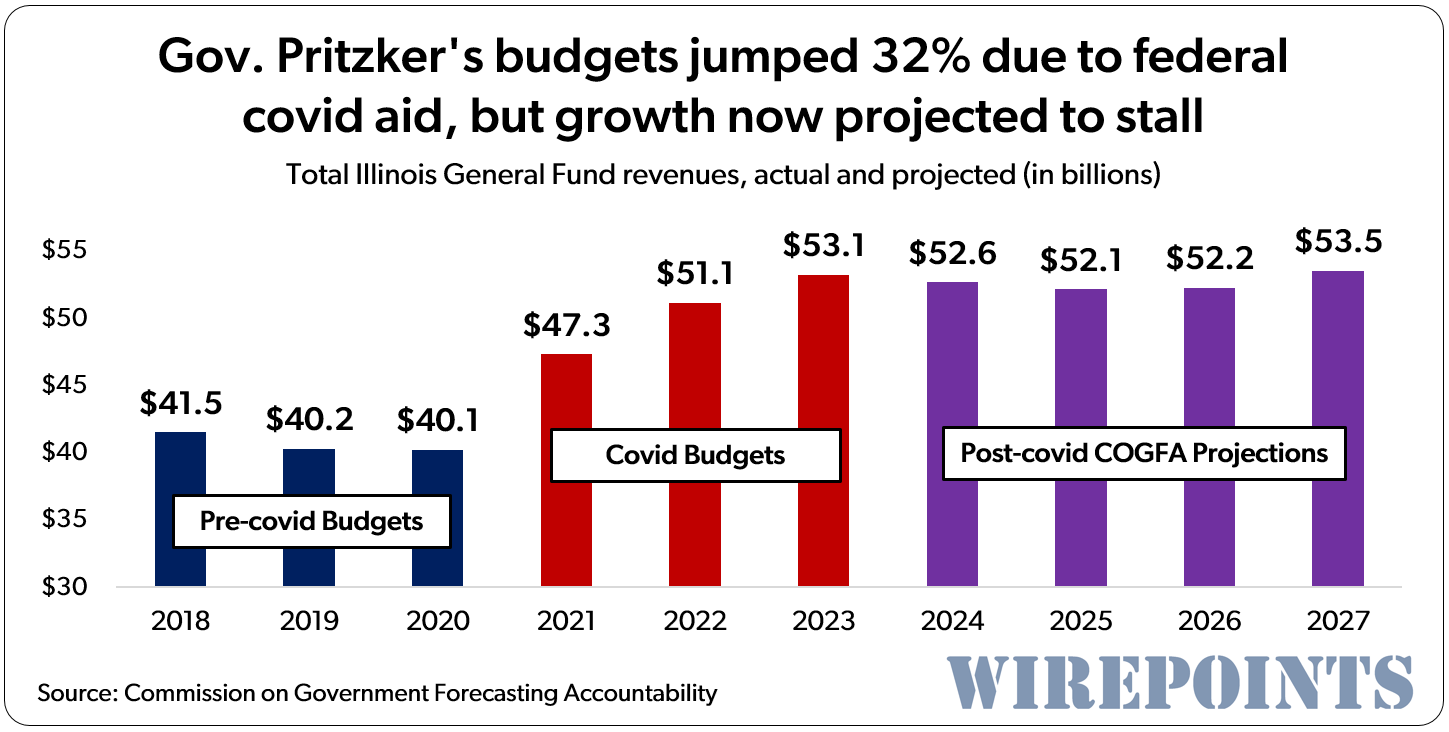

Some Illinois lawmakers continue to deny that covid aid and other federal stimulus bailed the state out of its fiscal mess. But a look at past and projected revenues from COGFA shows just how much the bailouts blew out the state’s revenues. And now that they’re over, how much harder it will be for Illinois revenues to grow.

Some Illinois lawmakers continue to deny that covid aid and other federal stimulus bailed the state out of its fiscal mess. But a look at past and projected revenues from COGFA shows just how much the bailouts blew out the state’s revenues. And now that they’re over, how much harder it will be for Illinois revenues to grow.

Election integrity – both real and perceived – is essential to government’s legitimacy and stability. Illinois, like the rest of the nation, better fix its problems now.

Election integrity – both real and perceived – is essential to government’s legitimacy and stability. Illinois, like the rest of the nation, better fix its problems now. Ted joined Dan and Amy to talk about Chicago’s latest bond offering, why Chicago’s dismal home value growth is due to poor policies, the next $70 million to be spent on migrants, the 9% salary hikes demanded by the CTU, and why Illinois lawmakers voting to stop Chicago’s selective enrollment schools from being closed is hypocritical.

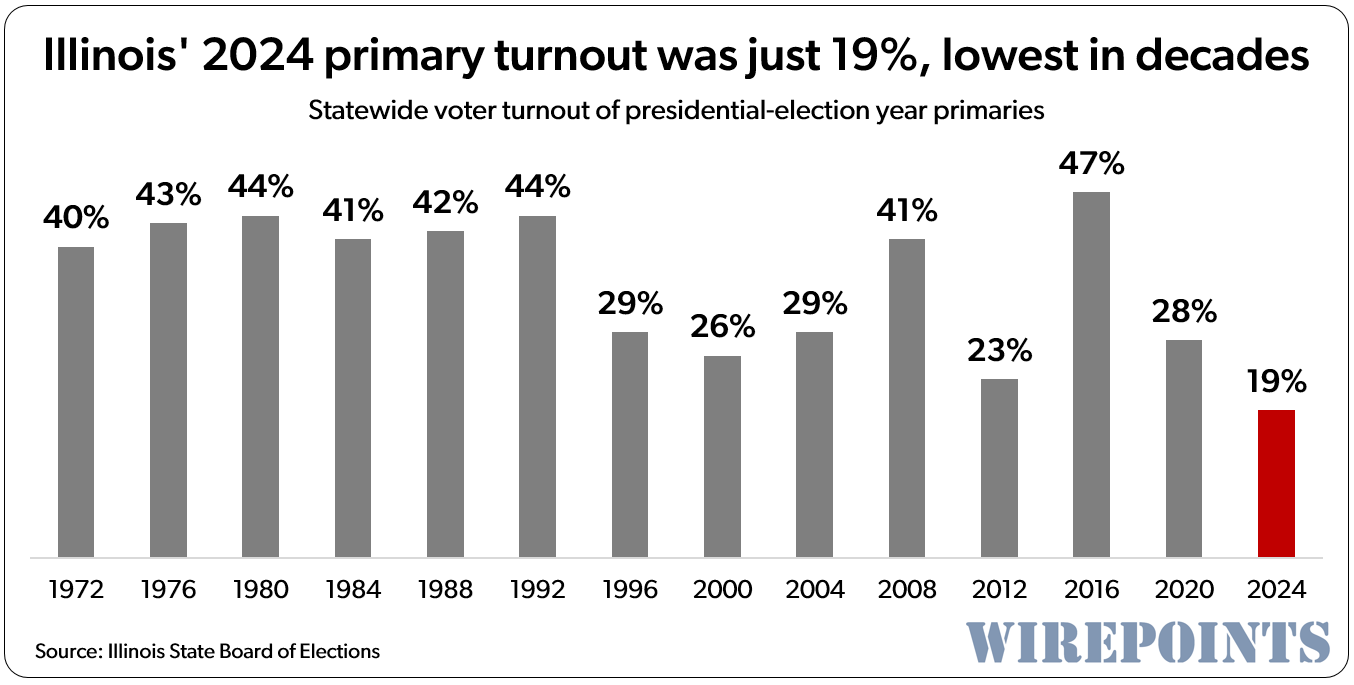

Ted joined Dan and Amy to talk about Chicago’s latest bond offering, why Chicago’s dismal home value growth is due to poor policies, the next $70 million to be spent on migrants, the 9% salary hikes demanded by the CTU, and why Illinois lawmakers voting to stop Chicago’s selective enrollment schools from being closed is hypocritical. Illinois just suffered the lowest presidential primary turnout since 1960, according to the Illinois State Board of Elections. Blame voter apathy on a lack of competitive elections. On gerrymandering. On the concern people have, thinking their votes don’t matter. It’s likely a little bit of each.

Illinois just suffered the lowest presidential primary turnout since 1960, according to the Illinois State Board of Elections. Blame voter apathy on a lack of competitive elections. On gerrymandering. On the concern people have, thinking their votes don’t matter. It’s likely a little bit of each.

its called a shake down. But at least when the mafia is collecting you get some protection and muscle for your fee. What do these businesses get in return for this payment?

Well, they get motivated to only have 49 employees. They get motivated to relocated outside the city limits if they start to build the business.

A friendly reminder that the previous Employer Expense Tax (Head Tax) exempted not-for-profit and educational organizations, meaning CTU was exempt from paying it. I’m guessing this iteration is no different. This twist of exempting employees from specific neighborhoods is a pending administrative nightmare. How would a McDonald’s franchise be treated? Is a single franchise restaurant exempt if it employs less than 50 people or subject to the tax as they are all McDonald’s employees? Then again, I’d wager many of those employees would come from these exempt neighborhoods, which raises the question why a large multi-national corp offering minimum wage… Read more »